Bangladesh Cold Chain Market

Taille du marché en milliards USD

TCAC :

%

USD

1.10 Billion

USD

2.03 Billion

2025

2033

USD

1.10 Billion

USD

2.03 Billion

2025

2033

| 2026 –2033 | |

| USD 1.10 Billion | |

| USD 2.03 Billion | |

|

|

|

|

Segmentation du marché de la chaîne du froid au Bangladesh, par composants (matériel, logiciel), par type de service (transport, entreposage et distribution, transit, autres), par type de marchandises/attribut critique (produits alimentaires, marchandises diverses, marchandises dangereuses (y compris les produits chimiques dangereux), autres), par type de température (réfrigéré, congelé), par technologie (compression de vapeur, automate programmable (PLC), surgélation rapide, systèmes cryogéniques, refroidissement par évaporation, autres technologies), par capacité de chargement (grand (32–66 L), moyen (21–29 L), petit (10–17 L), très petit (3–8 L), minuscule (0,9–2,7 L), autres), par mode d'exploitation (national, international), par type de client (B2B, commerce électronique et livraison du dernier kilomètre, B2C), par modèle commercial (transporteurs possédant leurs propres actifs, courtage et 3PL, autres), par distance (50 à 100 miles, 101 à 200 miles, 201 à 500 miles, plus de 500 miles) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché de la chaîne du froid au Bangladesh

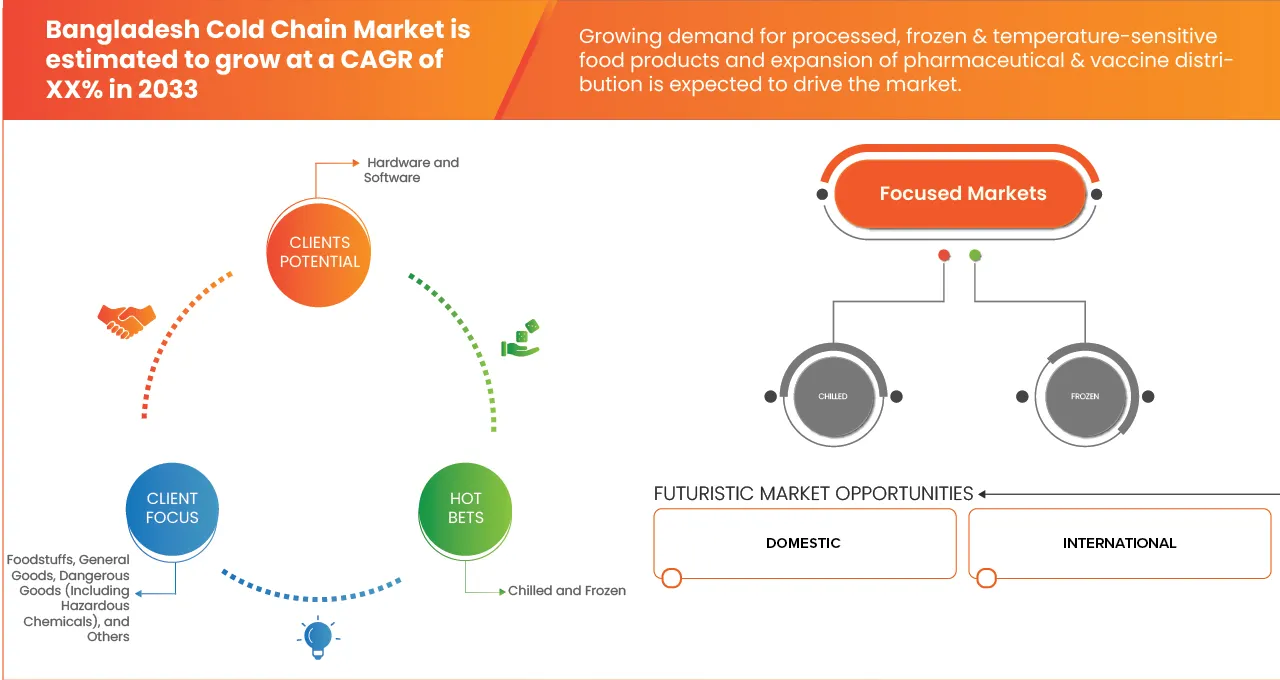

- Le marché de la chaîne du froid au Bangladesh était évalué à 1,10 milliard de dollars américains en 2025 et devrait atteindre 2,03 milliards de dollars américains d'ici 2033 , avec un TCAC de 8,1 % au cours de la période de prévision.

- Le marché est principalement tiré par le besoin croissant de logistique à température contrôlée, la demande croissante de produits alimentaires périssables et la dépendance accrue aux solutions de stockage frigorifique dans les secteurs pharmaceutique et de la santé.

- Cette croissance est soutenue par des facteurs tels que l'essor du commerce de détail organisé, le développement de l'agriculture tournée vers l'exportation, la hausse des besoins en distribution de vaccins et de produits biologiques, et la modernisation rapide des infrastructures de la chaîne du froid afin de garantir la qualité et la sécurité des produits.

Analyse du marché de la chaîne du froid au Bangladesh

- Le marché de la chaîne du froid au Bangladesh connaît une croissance accélérée, portée par la demande croissante de solutions logistiques fiables, économes en énergie et performantes à température contrôlée. Les systèmes de chaîne du froid offrent des avantages tels que la réduction du gaspillage de produits, une meilleure précision de la température et une capacité de stockage et de transport modulable, comparativement aux méthodes de manutention conventionnelles. Leur adoption se développe dans les secteurs de l'agroalimentaire (viande, fruits de mer, produits laitiers, fruits et légumes), de la pharmacie (vaccins, insuline, produits biologiques), des fournitures médicales et des exportations horticoles. Toutefois, le marché reste confronté à des défis liés aux coûts énergétiques, à la faible pénétration des entrepôts frigorifiques en milieu rural, aux lacunes en matière d'infrastructures et à la nécessité d'améliorer la surveillance de la température et la fiabilité opérationnelle.

- Le secteur agroalimentaire demeure un moteur de croissance essentiel, car les produits thermosensibles nécessitent un entreposage frigorifique fiable et un transport réfrigéré pour préserver leur fraîcheur et limiter les pertes. La distribution pharmaceutique connaît également une expansion rapide, portée par les vaccins, les produits biologiques et les médicaments vitaux qui exigent un contrôle rigoureux de la température. Parallèlement, la grande distribution, les plateformes de vente rapide et les marques de produits surgelés stimulent la demande en réseaux de chaîne du froid performants. De plus, les exportateurs de produits de la mer et de produits horticoles s'appuient de plus en plus sur une logistique du froid de pointe pour se conformer aux normes internationales de qualité et de sécurité, ce qui contribue à la croissance du marché.

- Les pays de la région Asie-Pacifique contribuent à façonner les pratiques du marché tandis que le Bangladesh poursuit l'intégration de normes modernes d'entreposage frigorifique. Parallèlement, des régions comme l'Europe et le Moyen-Orient constituent des destinations clés pour les exportations bangladaises de produits thermosensibles, favorisant ainsi l'adoption de protocoles de chaîne du froid harmonisés à l'échelle mondiale. Dans le même temps, les régions en développement d'Asie du Sud et d'Afrique émergent comme de nouveaux marchés, manifestant un intérêt croissant pour des systèmes d'approvisionnement en froid améliorés.

- Les principaux fournisseurs investissent dans des technologies de réfrigération avancées, des chambres froides solaires, la surveillance en temps réel de la température et des systèmes d'isolation améliorés afin d'optimiser l'efficacité énergétique et de réduire les coûts d'exploitation. Parmi les nouvelles solutions figurent des unités de stockage frigorifique modulaires, le suivi numérique des flottes de camions frigorifiques et des chambres à humidité contrôlée pour les produits spécifiques. Les installations de stockage frigorifique représentent une part importante du marché, du fait de leur utilisation généralisée dans l'agroalimentaire, l'agriculture et l'industrie pharmaceutique. Les partenariats stratégiques entre les prestataires logistiques, les entreprises agroalimentaires et les organismes gouvernementaux façonnent le développement du secteur. Alors que le Bangladesh renforce ses normes réglementaires en matière de sécurité alimentaire, de qualité à l'exportation et de conformité pharmaceutique, le maintien d'une fiabilité à long terme et l'adoption de systèmes de surveillance avancés seront essentiels à la compétitivité et à une croissance durable du marché.

- Le secteur du matériel devrait dominer le marché de la chaîne du froid au Bangladesh, représentant la plus grande part de marché (77,99 %) en 2026. Cette domination s'explique par la croissance continue des besoins en transport de marchandises à court terme et à la demande, liée à l'essor des secteurs du commerce de détail, de la construction et de l'agriculture. Les services de transport routier flexibles, avec paiement au trajet, sont privilégiés par rapport aux contrats à long terme, notamment par les PME dont les volumes d'expédition sont variables, ce qui renforce la demande en infrastructures de chaîne du froid.

Portée du rapport et segmentation du marché de la chaîne du froid au Bangladesh

|

Attributs |

Aperçu du marché de la chaîne du froid au Bangladesh |

|

Segments couverts |

|

|

Pays couverts |

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché de la chaîne du froid au Bangladesh

« Progrès en matière d’efficacité, d’expansion des capacités et d’applications émergentes »

- L'une des principales tendances du marché de la chaîne du froid au Bangladesh est l'adoption accélérée de technologies de réfrigération avancées et de systèmes de stockage modernes afin d'améliorer l'efficacité du refroidissement, d'accroître la capacité et de soutenir diverses applications dans les secteurs de la transformation alimentaire, de la pharmacie, de l'agriculture et de la distribution au détail.

- Le marché connaît une demande croissante d'unités de stockage frigorifique de grande capacité et de transport frigorifique écoénergétique, grâce à leur stabilité thermique supérieure, la réduction des pertes et leur capacité à préserver l'intégrité des produits par rapport aux méthodes de manutention traditionnelles. Cette tendance est particulièrement marquée dans la logistique des denrées périssables, la distribution de vaccins et de produits biologiques, ainsi que dans les chaînes d'approvisionnement orientées vers l'exportation, où la fiabilité et l'efficacité opérationnelle sont essentielles.

- Par exemple, en 2024, plusieurs opérateurs de la chaîne du froid au Bangladesh ont étendu leurs réseaux d'entrepôts à température contrôlée et mis en service des chambres froides à énergie solaire afin de favoriser des opérations durables et d'améliorer la desserte des marchés ruraux et urbains. De même, les entreprises de logistique intègrent de plus en plus de systèmes de surveillance de la température basés sur l'Internet des objets (IoT) pour garantir une visibilité en temps réel et la conformité des produits pharmaceutiques et alimentaires sensibles.

- Les acteurs du secteur intègrent des innovations telles que les environnements à humidité contrôlée, les matériaux d'isolation améliorés et les systèmes de gestion thermique avancés afin de répondre aux besoins croissants des filières agroalimentaires, des exportations de produits de la mer et de l'horticulture. Parallèlement, les technologies d'emballage modernisées et les solutions de suivi numérique améliorent la fiabilité du transport et réduisent les pertes tout au long des circuits de distribution.

- Avec l'expansion continue de secteurs tels que le commerce rapide, la grande distribution et la santé, la demande en solutions de chaîne du froid fiables, économes en énergie et évolutives s'intensifie. Les acteurs du marché s'alignent également sur les meilleures pratiques internationales en adoptant des fluides frigorigènes respectueux de l'environnement, en respectant les réglementations en matière de sécurité alimentaire et pharmaceutique et en améliorant la transparence de leur chaîne d'approvisionnement afin de consolider leur position sur des marchés nationaux et d'exportation en forte croissance.

Dynamique du marché de la chaîne du froid au Bangladesh

Conducteur

« Demande croissante de produits alimentaires transformés, congelés et thermosensibles »

- Le Bangladesh connaît une transformation rapide de ses habitudes alimentaires, sous l'effet de l'urbanisation, de l'évolution des modes de vie et de la hausse du pouvoir d'achat. Un nombre croissant de consommateurs, notamment dans les grandes villes comme Dhaka, Chattogram et Sylhet, délaissent les produits frais traditionnels des marchés traditionnels au profit de plats cuisinés et de repas préparés. Ce changement est favorisé par des modes de vie trépidants, une participation accrue des femmes au marché du travail et une meilleure connaissance des tendances alimentaires mondiales.

- La popularité croissante des produits surgelés de marque (tels que la volaille, les filets de poisson, les crevettes, les en-cas, les produits de boulangerie, les crèmes glacées et les produits laitiers), ainsi que l'augmentation de la production de biens thermosensibles (vaccins, produits pharmaceutiques, fruits, légumes), créent une demande soutenue pour des systèmes fiables d'entreposage frigorifique, de transport réfrigéré et de distribution à température contrôlée.

- De plus, le Bangladesh est un important exportateur de poissons et de fruits de mer, ce qui exige une logistique frigorifique de pointe pour répondre aux normes internationales strictes de qualité et de sécurité pour des marchés tels que l'UE, le Japon et le Moyen-Orient. Garantir l'intégrité de l'ensemble de la chaîne d'approvisionnement, des sites de débarquement et de transformation jusqu'aux points d'exportation, est essentiel au maintien de sa compétitivité.

- Les formats de distribution modernes, tels que les supermarchés, les plateformes de commerce rapide et les services de livraison de courses en ligne, se développent à l'échelle nationale, imposant de nouvelles exigences logistiques aux fournisseurs en matière de maintien de la chaîne du froid. Afin de réduire les pertes après récolte – actuellement élevées pour les produits périssables comme le poisson, la viande, les légumes et les produits laitiers – les producteurs et les distributeurs investissent dans des entrepôts frigorifiques, des installations de pré-refroidissement, des camions frigorifiques et des infrastructures de livraison du dernier kilomètre.

Retenue/Défi

« Coûts élevés des infrastructures et de l’énergie »

- Les coûts élevés des infrastructures et de l'énergie constituent un frein majeur à la croissance et à l'efficacité du secteur de la chaîne du froid au Bangladesh. Le développement d'un réseau moderne de chaîne du froid exige des investissements considérables dans des systèmes de réfrigération de pointe, des installations de stockage isolées et des flottes de transport à température contrôlée. Ces systèmes reposent sur des technologies sophistiquées et une alimentation électrique continue, ce qui rend leur installation et leur maintenance très coûteuses. Les fréquentes fluctuations de courant et la fiabilité aléatoire du réseau électrique contraignent les opérateurs à investir massivement dans des groupes électrogènes de secours, du carburant et des systèmes de gestion de l'énergie, augmentant ainsi leurs dépenses d'exploitation. Cette hausse des coûts empêche de nombreuses entreprises, notamment les PME, d'adopter des solutions modernes de chaîne du froid ou d'accroître leurs capacités. À l'instar des consommateurs des marchés du bien-être haut de gamme qui attendent des solutions performantes, fiables et personnalisées, les industries du Bangladesh qui dépendent des services de la chaîne du froid exigent également un contrôle de la température constant et de haute qualité. Cependant, le poids financier important limite la capacité du secteur à adopter des technologies innovantes et économes en énergie. Par conséquent, l'écosystème de la chaîne du froid se développe plus lentement, ce qui engendre des lacunes dans la préservation de la qualité pour des secteurs clés tels que l'agriculture, la pêche et l'industrie pharmaceutique. Relever ces défis liés aux coûts grâce à l'innovation technologique, à une conception efficace des installations et à des investissements stratégiques sera crucial pour construire une infrastructure de chaîne du froid robuste et compétitive au Bangladesh.

- Les coûts élevés des infrastructures et de l'énergie dans le secteur de la chaîne du froid au Bangladesh constituent un frein majeur à sa modernisation et à son expansion. Le maintien d'un stockage à température contrôlée, du transport frigorifique et de systèmes de manutention avancés exige des investissements considérables et une alimentation électrique continue, ce qui représente un défi financier important pour de nombreux opérateurs. Ces contraintes budgétaires limitent l'adoption de technologies écoénergétiques, réduisent l'efficacité opérationnelle globale et entravent la capacité des entreprises, notamment des PME, à développer leurs activités. Par conséquent, des secteurs essentiels tels que l'agriculture, la pêche et l'industrie pharmaceutique sont confrontés à des inefficacités de leur chaîne d'approvisionnement, à des pertes après récolte et à une qualité des produits compromise. Relever ces défis grâce à des investissements stratégiques, à l'innovation technologique et à des solutions écoénergétiques représente une opportunité cruciale pour renforcer l'écosystème de la chaîne du froid, améliorer la sécurité alimentaire et accroître la compétitivité du marché, permettant ainsi au Bangladesh de se doter d'une infrastructure d'approvisionnement plus résiliente et fiable pour les denrées périssables.

Étendue du marché de la chaîne du froid au Bangladesh

Le marché de la chaîne du froid au Bangladesh est divisé en dix segments notables, basés sur les composants, le type de service, le type de marchandises/attribut critique, le type de température, la technologie, la taille de la charge utile, l'exploitation, le type de client, le modèle commercial et la distance.

- Par composants

Le marché de la chaîne du froid au Bangladesh est divisé en deux segments principaux : le matériel et les logiciels. En 2026, le segment du matériel devrait dominer le marché avec une part de 77,99 % et atteindre 1 600 774,90 dollars américains d’ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,3 %, sur la période 2026-2033.

- Par type de service

Le marché de la chaîne du froid au Bangladesh est segmenté, selon le type de service, en transport, entreposage et distribution, transit et autres. En 2026, le segment du transport devrait dominer le marché avec une part de 44,61 % et atteindre 923 402,80 milliards de dollars américains d'ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,4 %, sur la période 2026-2033.

- Par type de marchandise/attribut critique

Le marché de la chaîne du froid au Bangladesh est segmenté, selon le type de marchandises et leurs attributs critiques, en produits alimentaires, marchandises générales, marchandises dangereuses (y compris les produits chimiques dangereux) et autres. En 2026, le segment des produits alimentaires devrait dominer le marché avec une part de 58,28 % et atteindre 1 211 747,34 milliards de dollars américains d'ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,5 %, sur la période 2026-2033.

- Par type de température

Selon le type de température, le marché de la chaîne du froid au Bangladesh se divise en deux segments : réfrigéré et congelé. En 2026, le segment réfrigéré devrait dominer le marché avec une part de 58,31 % et atteindre 1 201 748,33 milliards de dollars américains d’ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,3 %, sur la période de prévision 2026-2033.

- Par la technologie

Le marché de la chaîne du froid au Bangladesh est segmenté, selon la technologie utilisée, en compression de vapeur, automates programmables (PLC), surgélation rapide, systèmes cryogéniques, refroidissement par évaporation et autres. En 2026, la compression de vapeur devrait dominer le marché avec une part de 41,39 % et atteindre 868 525,87 milliards de dollars américains d'ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé (8,6 %) sur la période 2026-2033.

- Par taille de charge utile

En fonction de la capacité de charge utile, le marché de la chaîne du froid au Bangladesh est segmenté en : Grand (32–66 L), Moyen (21–29 L), Petit (10–17 L), Très petit (3–8 L), Minime (0,9–2,7 L) et Autres. En 2026, le segment Grand (32–66 L) devrait dominer le marché avec une part de marché de 33,64 % et atteindre 703 917,33 milliers de dollars américains d’ici 2033, avec le taux de croissance annuel composé (TCAC) le plus élevé de 8,6 % sur la période de prévision 2026-2033.

- Par opération

Le marché de la chaîne du froid au Bangladesh est segmenté, selon son mode de fonctionnement, en marché intérieur et international. En 2026, le segment intérieur devrait dominer le marché avec une part de 69,67 % et atteindre 1 442 073,76 milliards de dollars américains d'ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,4 %, sur la période 2026-2033.

- Par modèle d'entreprise

Selon le modèle commercial, le marché de la chaîne du froid au Bangladesh se segmente en transporteurs possédant leurs propres actifs, courtage et logistique (3PL), et autres. En 2026, le segment des transporteurs possédant leurs propres actifs devrait dominer le marché avec une part de 61,47 % et atteindre 1 261 709,96 milliards de dollars américains d'ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,3 %, sur la période 2026-2033.

- Par distance

Le marché de la chaîne du froid au Bangladesh est segmenté en fonction de la distance : 50 à 100 miles, 101 à 200 miles, 201 à 500 miles et plus de 500 miles. En 2026, le segment des 50 à 100 miles devrait dominer le marché avec une part de 41,31 % et atteindre 856 096,62 milliards de dollars américains d’ici 2033, affichant le taux de croissance annuel composé (TCAC) le plus élevé, à 8,4 %, sur la période 2026-2033.

Les principaux acteurs du marché sont :

- Yusen Logistics Global Management Co., Ltd. (Japon)

- Transcom Limited (Bangladesh)

- Bangladesh Limited (Nippon Express Holdings) (Bangladesh)

- Bcl Cold Storage Limited (Inde)

- Entrepôt frigorifique Nabil (Bangladesh)

- MAYEKAWA MFG. CO., LTD. (Japon)

- AK Cold Storage & Engineering (Bangladesh)

- Tritech (Bangladesh)

- Groupe Empire (Bangladesh)

- Groupe NM Bangladesh (Bangladesh)

- Groupe J & Y (Bangladesh)

- SS Freight Bangladesh (Bangladesh)

- Transmove (Bangladesh)

- Groupe Younus (Bangladesh)

- Agence de transport de Nazrul (Bangladesh)

- Agence CAPTAINS GROUP (Bangladesh)

- Earnest Engineering Works Ltd. (Bangladesh)

- Groupe industriel Alhaj (Bangladesh)

- Badal et Compagnie (Bangladesh)

- DREAMCO EXPRESS PAKISTAN PVT LTD (Bangladesh)

- GROUPE DE CONVOYEURS (Bangladesh)

Dernières évolutions du marché de la chaîne du froid au Bangladesh

- En août 2025, les États-Unis ont annoncé leur soutien à l'expansion du réseau logistique à température contrôlée du Bangladesh, en mettant l'accent sur de nouvelles installations d'entreposage frigorifique et une capacité de transport réfrigéré améliorée afin de réduire les pertes alimentaires après récolte et de renforcer les chaînes d'approvisionnement agricoles.

- En juillet 2025, les exploitants d'entrepôts frigorifiques du Bangladesh ont exhorté le gouvernement à inclure les pommes de terre dans son programme national d'aide alimentaire, soulignant le rôle crucial des infrastructures de la chaîne du froid dans l'amélioration de la sécurité alimentaire et demandant des incitations politiques pour réduire les coûts d'équipement et d'exploitation.

- En juin 2025, le gouvernement, en collaboration avec des partenaires internationaux au développement, a proposé d'importants investissements dans des unités de stockage frigorifique de semences de pommes de terre et de bulbes d'oignons, dans le cadre d'un partenariat public-privé. Cette initiative vise à renforcer la chaîne du froid en milieu rural, à améliorer la conservation des semences et à soutenir une production agricole résiliente.

- En mai 2025, une évaluation nationale des capacités de stockage frigorifique a révélé que le Bangladesh disposait d'environ 2,7 millions de tonnes de capacité, soulignant un déficit important par rapport à la demande réelle. Le rapport a insisté sur la nécessité de construire des installations supplémentaires et d'améliorer le transport frigorifique afin de réduire les pertes et d'optimiser la chaîne d'approvisionnement, de la production à la commercialisation.

- En avril 2025, les acteurs privés de la chaîne du froid ont étendu leurs flottes de camions frigorifiques et leurs services logistiques intégrés afin de répondre à la demande croissante des secteurs de la grande distribution, de l'industrie pharmaceutique, des produits surgelés et des industries tournées vers l'exportation. Les analystes de marché prévoyaient une croissance soutenue du marché bangladais de la chaîne du froid, portée par la hausse de la consommation urbaine et la modernisation des chaînes d'approvisionnement.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH COLD CHAIN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND APPLICATION

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 VALUE CHAIN ANALYSIS

4.3 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES IN THE BANGLADESH COLD CHAIN MARKET

4.4 PENETRATION AND GROWTH PROSPECT MAPPING OF THE BANGLADESH COLD CHAIN MARKET

4.5 COMPANY EVALUATION QUADRANT

4.6 COMPANY COMPARATIVE ANALYSIS

4.7 COMPANY SERVICE PLATFORM MATRIX

4.8 TECHNOLOGY ANALYSIS

5 TARIFF & ITS ANALYSIS

5.1 OVERVIEW OF RELEVANT TARIFFS

5.2 TRADE POLICIES INFLUENCING THE MARKET

5.2.1 TARIFF LEVELS & IMPORT DUTIES

5.2.2 RECENT / PROSPECTIVE POLICY SHIFTS

5.3 COST IMPACT ON STAKEHOLDERS

5.3.1 FOR COLD-CHAIN OPERATORS / INVESTORS

5.3.2 FOR PRODUCERS / FARMERS / AGRO-SUPPLIERS:

5.3.3 FOR CONSUMERS & END-MARKETS (DOMESTIC + EXPORT):

5.4 SUPPLY CHAIN DISRUPTIONS

5.5 STRATEGIC RESPONSE BY OEM

6 REGULATORY STANDARDS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR PROCESSED, FROZEN & TEMPERATURE-SENSITIVE FOOD PRODUCTS

7.1.2 EXPANSION OF PHARMACEUTICAL & VACCINE DISTRIBUTIONE

7.2 RESTRIANTS

7.2.1 HIGH INFRASTRUCTURE & ENERGY COSTS

7.2.2 DEPENDENCE ON IMPORTED REFRIGERATION TECHNOLOGY

7.3 OPPORTUNITY

7.3.1 INTEGRATED 3PL COLD‑CHAIN LOGISTICS SERVICES

7.3.2 RAPID GROWTH OF E-COMMERCE, Q-COMMERCE & MODERN RETAIL

7.4 CHALLENGES

7.4.1 UNDERDEVELOPED ROAD LOGISTICS NETWORK

7.4.2 RECENT TARIFF CHANGES & POLITICAL INSTABILITY

8 BANGLADESH COLD CHAIN MARKET, BY COMPONENT.

8.1 OVERVIEW

8.2 BANGLADESH COLD CHAIN MARKET, BY COMPONENT, 2018-2033 (USD THOUSAND)

8.2.1 HARDWARE

8.2.2 SOFTWARE

8.3 BANGLADESH HARDWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1 SENSORS

8.3.2 DATA LOGGERS

8.3.3 GPS DEVICES

8.3.4 TELEMATICS & TELEMETRY DEVICES

8.3.5 NETWORKING DEVICES

8.3.6 RFID DEVICES

8.3.7 OTHERS

8.4 BANGLADESH SENSOR IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 TEMPERATURE SENSORS

8.4.2 HUMIDITY SENSORS

8.4.3 MOISTURE SENSORS

8.4.4 OTHERS

8.5 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 ON-PREMISES

8.5.2 CLOUD

8.6 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY ORGANIZATION SIZE, 2018-2033 (USD THOUSAND)

8.6.1 LARGE ORGANIZATION SIZE

8.6.2 SMALL & MEDIUM ORGANIZATION SIZE

9 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE.

9.1 OVERVIEW

9.2 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE, 2018-2033 (USD THOUSAND)

9.2.1 FOODSTUFFS

9.2.2 GENERAL GOODS

9.2.3 DANGEROUS GOODS (INCLUDING HAZARDOUS CHEMICALS)

9.2.4 OTHERS

9.3 BANGLADESH FOODSTUFFS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 REFRIGERATED TRANSPORT WITH REFRIGERATION

9.3.2 REFRIGERATED TRANSPORT WITH FREEZING

10 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE.

10.1 OVERVIEW

10.2 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2018-2033 (USD THOUSAND)

10.2.1 CHILLED

10.2.2 FROZEN

11 BANGLADESH COLD CHAIN MARKET, BY COMPONENT.

11.1 OVERVIEW

11.2 BANGLADESH COLD CHAIN MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

11.2.1 VAPOR COMPRESSION

11.2.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.2.3 BLAST FREEZING

11.2.4 CRYOGENIC SYSTEMS

11.2.5 EVAPORATIVE COOLING

11.2.6 OTHER TECHNOLOGIES

12 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE.

12.1 OVERVIEW

12.2 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE, 2018-2033 (USD THOUSAND)

12.2.1 LARGE (32–66 L)

12.2.2 MEDIUM (21–29 L)

12.2.3 SMALL (10–17 L)

12.2.4 X-SMALL (3–8 L)

12.2.5 PETITE (0.9–2.7 L)

12.2.6 OTHERS

12.3 BANGLADESH COLD CHAIN MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

13 BANGLADESH COLD CHAIN MARKET, BY OPERATION.

13.1 OVERVIEW

13.1.1 DOMESTIC

13.1.2 INTERNATIONAL

13.2 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

14 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE.

14.1 OVERVIEW

14.2 B2B

14.3 E-COMMERCE & LAST-MILE DELIVERY

14.4 B2C

15 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL

15.1 OVERVIEW

15.2 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL, 2018-2033 (USD THOUSAND)

15.2.1 ASSET-BASED CARRIERS

15.2.2 BROKERAGE & 3PL

15.2.3 OTHERS

16 BANGLADESH COLD CHAIN MARKET, BY DISTANCE.

16.1 OVERVIEW

16.2 BANGLADESH COLD CHAIN MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

16.2.1 50 – 100 MILES

16.2.2 101 – 200 MILES

16.2.3 201 – 500 MILES

16.2.4 MORE THAN 500 MILES

16.3 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

17 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE.

17.1 OVERVIEW

17.1.1 TRANSPORTATION

17.1.2 WAREHOUSING AND DISTRIBUTION

17.1.3 FREIGHT FORWARDING

17.1.4 OTHERS

17.2 BANGLADESH TRANSPORTATION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.2.1 ROAD

17.2.2 SEA

17.2.3 RAILWAY

17.2.4 AIR

17.2.5 WATERWAYS (INLAND / RIVER TRANSPORT)

17.3 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TYPE OF CARRIER, 2018-2033 (USD THOUSAND)

17.3.1 FULL TRUCKLOAD (FTL)

17.3.2 SPECIALIZED FREIGHT

17.3.3 LESS THAN TRUCKLOAD (LTL)

17.3.4 PARTIAL TRUCKLOAD (PTL)

17.4 BANGLADESH ROAD IN COLD CHAIN MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

17.4.1 LIGHT COMMERCIAL VEHICLE (LCV)

17.4.2 MEDIUM COMMERCIAL VEHICLE (MCV)

17.4.3 HEAVY COMMERCIAL VEHICLE (HCV)

17.5 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

17.5.1 REFRIGERATED TRUCK

17.5.2 TANKER TRUCK

17.5.3 BOX TRUCKS

17.5.4 FLATBEDS TRUCK

17.6 BANGLADESH REFRIGERATED TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

17.6.1 FOOD

17.6.2 PERISHABLE GOODS

17.6.3 MEDICAL SUPPLIES

17.6.4 BEVERAGES

17.6.5 NON-PERISHABLE GOODS

17.6.6 OTHERS

17.7 BANGLADESH PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.7.1 FRUITS

17.7.2 VEGETABLES

17.7.3 SEAFOOD

17.7.4 MEAT

17.7.5 OTHERS

17.8 BANGLADESH MEDICAL SUPPLIES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.8.1 VACCINES

17.8.2 PHARMACEUTICALS

17.8.3 BLOOD BANKS

17.8.4 OTHERS

17.9 BANGLADESH BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.9.1 NON-ALCOHOLIC BEVERAGES

17.9.2 ALCOHOLIC BEVERAGES

17.1 BANGLADESH NON-ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.10.1 JUICE BASED BEVERAGES

17.10.2 CARBONATED BEVERAGES

17.10.3 TEA

17.10.4 COFFEE

17.11 BANGLADESH CARBONATED BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.11.1 SPORTS & ENERGY BEVERAGE

17.11.2 CBD INFUSED RTD BEVERAGES

17.11.3 OTHERS

17.12 BANGLADESH ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.12.1 BEER

17.12.2 SPIRITS

17.12.3 WINE

17.13 BANGLADESH NON-PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.13.1 FRUITS

17.13.2 VEGETABLES

17.13.3 SEAFOOD

17.13.4 MEAT

17.13.5 OTHERS

17.14 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.14.1 LIQUID TANKERS

17.14.2 DRY BULK TANKERS

17.15 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

17.15.1 MILK

17.15.2 JUICES (BEVERAGES)

17.15.3 CHEMICALS

17.15.4 GASES

17.15.5 FUEL

17.15.6 OTHERS

17.16 BANGLADESH GASES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.16.1 OXYGEN

17.16.2 NITROGEN (LIQUID NITROGEN)

17.16.3 LPG (LIQUEFIED PETROLEUM GAS)

17.16.4 LIQUEFIED BUTANE GAS

17.16.5 HELIUM

17.16.6 PROPANE

17.16.7 OTHERS

17.17 BANGLADESH FUEL IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.17.1 DIESEL

17.17.2 PETROL

17.18 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY CATEGORY, 2018-2033 (USD THOUSAND)

17.18.1 REFRIGERATED

17.18.2 NON-REFRIGERATED

17.19 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY ISOLATION, 2018-2033 (USD THOUSAND)

17.19.1 INSULATED

17.19.2 NON-INSULATED

17.2 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY PRESSURIZED, 2018-2033 (USD THOUSAND)

17.20.1 NON-PRESSURIZED

17.20.2 PRESSURIZED

17.21 BANGLADESH WATERWAYS (INLAND / RIVER TRANSPORT) IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.21.1 FOOD & PERISHABLES

17.21.2 FISHERIES & SEAFOOD

17.21.3 MEDICAL SUPPLIES & VACCINES

17.21.4 OTHERS

17.22 BANGLADESH WAREHOUSING AND DISTRIBUTION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.22.1 OFF GRID

17.22.2 ON-GRID

17.23 BANGLADESH OFF GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.23.1 SOLAR CHILLERS

17.23.2 MILK COOLERS

17.23.3 SOLAR POWERED COLD BOXES

17.23.4 OTHERS

17.24 BANGLADESH ON-GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.24.1 WALK-IN COOLERS

17.24.2 WALK-IN FREEZERS

17.24.3 DEEP FREEZERS

17.24.4 ICE-LINED REFRIGERATORS (ILRS)

18 BANGLADESH COLD CHAIN MARKET

18.1 COMPANY SHARE ANALYSIS: U.S.

19 SWOT ANALYSIS

20 COMAPANY PROFILES

20.1 YUSEN LOGISTICS GLOBAL MANAGEMENT CO., LTD.

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 RECENT DEVELOPMENT

20.2 TRANSCOM LIMITED

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 RECENT DEVELOPMENT

20.3 NIPPON EXPRESS HOLDINGS

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 BCL COLD STORAGE LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 RECENT DEVELOPMENT

20.5 NABIL GROUP OF INDUSTRIES

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 AK COLD STORAGE & ENGINEERING.

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 ALHAJ GROUP OF INDUSTRIES

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 BADAL AND COMPANY

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 CAPTAINS GROUP

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 CONVEYOR GROUP

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DREAMCO EXPRESS

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 EARNEST

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 EMPIRE GROUP

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 J & Y GROUP

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 MAYEKAWA MFG. CO., LTD.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 N.M GROUP BANGLADESH

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 NAZRUL TRANSPORT

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 SS FREIGHT BANGLADESH

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 TRANSMOVE

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 TRITECH

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 YOUNUS GROUP

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 TARIFFS BY HS CODE

TABLE 3 BANGLADESH COLD CHAIN MARKET, BY COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 4 BANGLADESH HARDWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 BANGLADESH SENSOR IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY ORGANIZATION SIZE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH FOODSTUFFS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH COLD CHAIN MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH COLD CHAIN MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH COLD CHAIN MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH TRANSPORTATION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TYPE OF CARRIER, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH ROAD IN COLD CHAIN MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH REFRIGERATED TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 23 BANGLADESH PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 BANGLADESH MEDICAL SUPPLIES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 BANGLADESH BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 BANGLADESH NON-ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 BANGLADESH CARBONATED BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 BANGLADESH ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 BANGLADESH NON-PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 32 BANGLADESH GASES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 BANGLADESH FUEL IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY CATEGORY, 2018-2033 (USD THOUSAND)

TABLE 35 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY ISOLATION, 2018-2033 (USD THOUSAND)

TABLE 36 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY PRESSURIZED, 2018-2033 (USD THOUSAND)

TABLE 37 BANGLADESH WATERWAYS (INLAND / RIVER TRANSPORT) IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 BANGLADESH WAREHOUSING AND DISTRIBUTION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 BANGLADESH OFF GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 BANGLADESH ON-GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 BANGLADESH COLD CHAIN MARKET: SEGMENTATION

FIGURE 2 BANGLADESH COLD CHAIN MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH COLD CHAIN MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH COLD CHAIN MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 BANGLADESH COLD CHAIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH COLD CHAIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH COLD CHAIN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH COLD CHAIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 BANGLADESH COLD CHAIN MARKET: MARKET END USER INDUSTRY COVERAGE GRID…

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENTS COMPRISE THE BANGLADESH COLD CHAIN, BY COMPONENTS (2025)

FIGURE 13 BANGLADESH COLD CHAIN MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR PROCESSED, FROZEN & TEMPERATURE-SENSITIVE FOOD PRODUCTS EXPECTED TO DRIVE THE BANGLADESH COLD CHAIN MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH COLD CHAIN MARKET IN 2026 & 2033

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 FIGURE 1 COMPANY EVALUATION QUADRANT

FIGURE 18 DROC ANALYSIS

FIGURE 19 BANGLADESH COLD CHAIN MARKET, BY PRODUCT, 2025

FIGURE 20 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE, 2025..

FIGURE 21 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2025

FIGURE 22 BANGLADESH COLD CHAIN MARKET, BY PRODUCT, 2025

FIGURE 23 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE, 2025

FIGURE 24 BANGLADESH COLD CHAIN MARKET, BY OPERATION, 2025

FIGURE 25 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE, 2025

FIGURE 26 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL, 2025

FIGURE 27 BANGLADESH COLD CHAIN MARKET, BY DISTANCE, 2025

FIGURE 28 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE, 2025

FIGURE 29 BANGLADESH COLD CHAIN MARKET: COMPANY SHARE 2025 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.