Bangladesh Fright Forwarding Market

Taille du marché en milliards USD

TCAC :

%

USD

20.21 Billion

USD

34.65 Billion

2025

2033

USD

20.21 Billion

USD

34.65 Billion

2025

2033

| 2026 –2033 | |

| USD 20.21 Billion | |

| USD 34.65 Billion | |

|

|

|

|

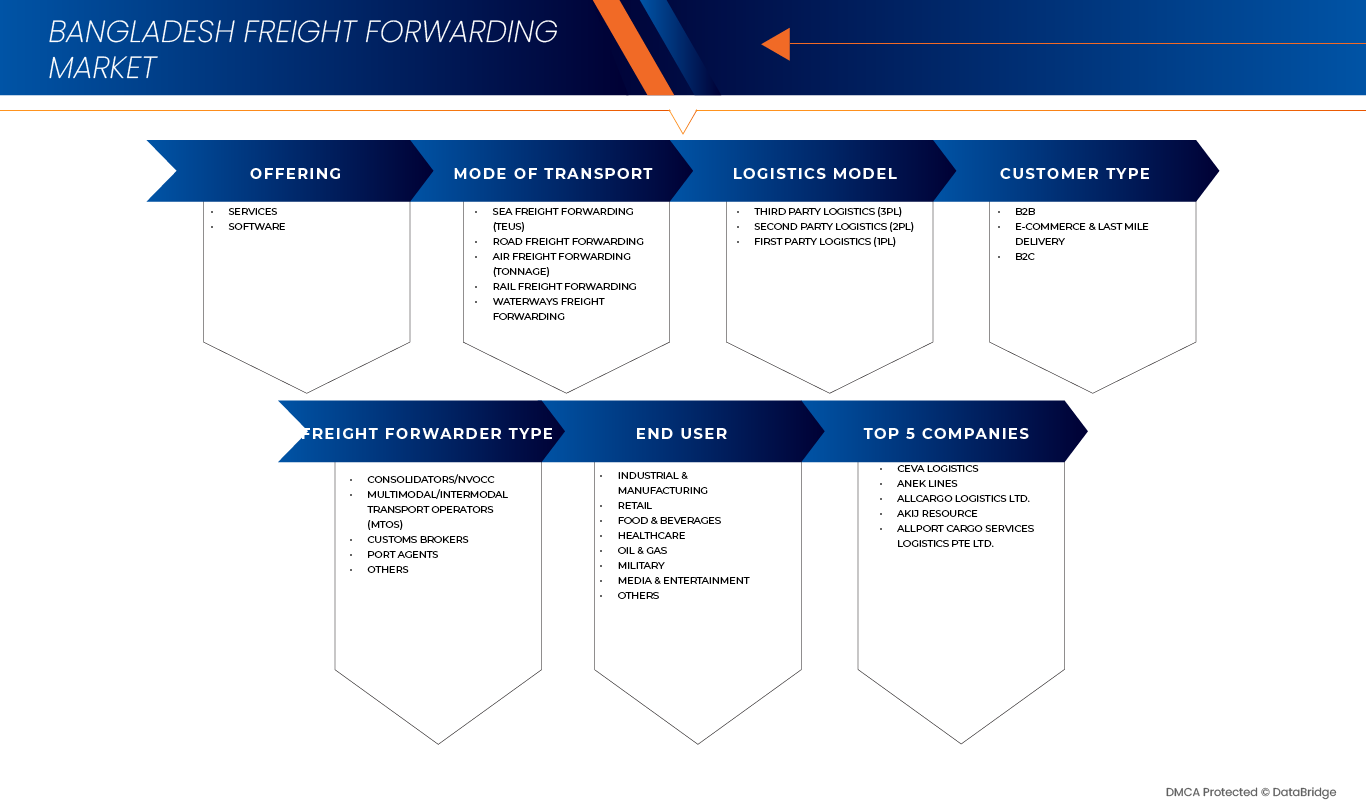

Segmentation du marché du transport de marchandises au Bangladesh : offre (services et logiciels), modes de transport (maritime (EVP), routier, aérien (tonnage), ferroviaire et fluvial), modèles logistiques (logistique tierce partie (3PL), logistique de second rang (2PL) et logistique de premier rang (1PL)), types de clients (B2B, e-commerce et livraison du dernier kilomètre, et B2C), types de transitaires (consolidateurs/NVOCC, opérateurs de transport multimodal/intermodal (MTO), courtiers en douane, agents portuaires et autres), utilisateurs finaux (industrie et production, distribution, agroalimentaire, santé, pétrole et gaz, armée, médias et divertissement, et autres) – Tendances et prévisions du secteur jusqu’en 2033

Taille du marché du transport de marchandises au Bangladesh

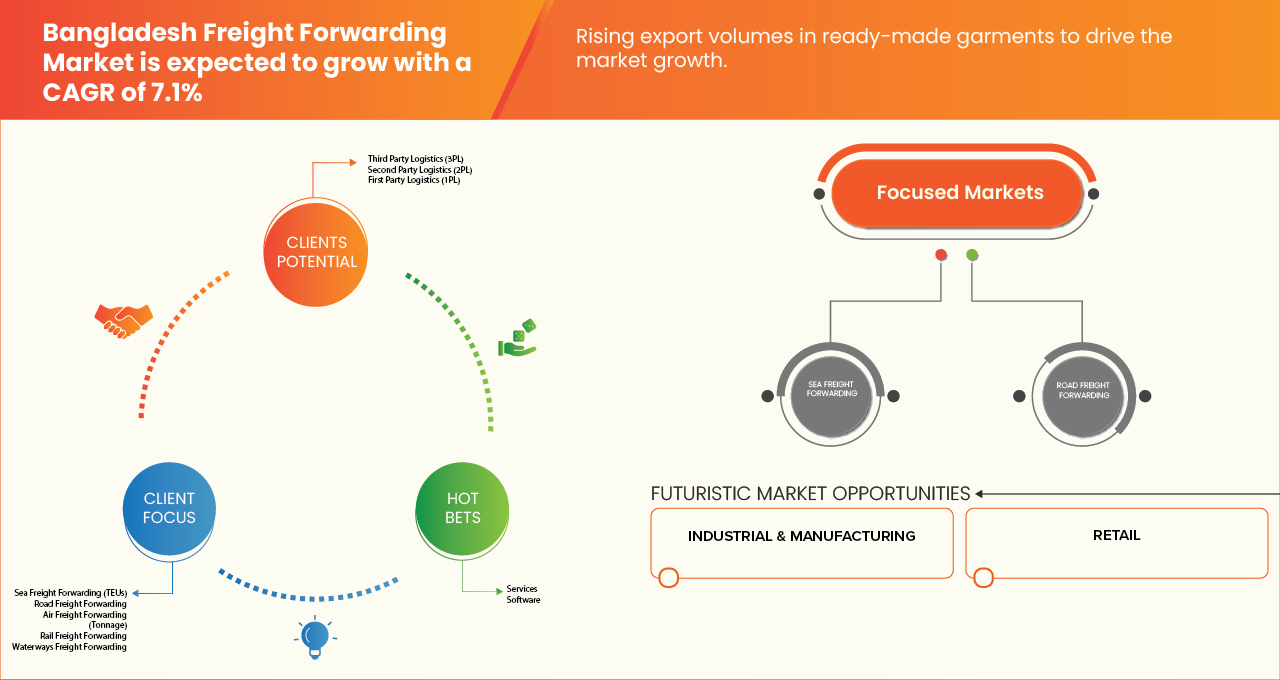

- Le marché du transport de marchandises au Bangladesh devrait atteindre 34,65 milliards de dollars américains d'ici 2033, contre 20,21 milliards de dollars américains en 2025, soit une croissance annuelle composée substantielle de 7,1 % sur la période de prévision allant de 2026 à 2033.

- Le marché du transport de marchandises au Bangladesh connaît une forte croissance en raison de la demande mondiale croissante, notamment en provenance des marchés émergents asiatiques, stimulée par la compétitivité des coûts, la disponibilité d'une main-d'œuvre qualifiée et une infrastructure d'exportation solide.

- L'expansion du secteur est également alimentée par l'automatisation de la production, l'adoption de solutions textiles numériques et les initiatives de développement durable telles que les tissus écologiques et les processus de production économes en énergie.

- Les incitations gouvernementales, les accords commerciaux favorables et les investissements directs étrangers accélèrent la modernisation des usines et leur mise en conformité avec les normes de qualité internationales. De ce fait, le Bangladesh se positionne comme un acteur majeur du transport de marchandises.

- De plus, la hausse des investissements dans la R&D, la diversification vers le transport maritime technique et fonctionnel et le développement du transport maritime à haute valeur ajoutée renforcent la compétitivité des exportations du pays et son potentiel de marché à long terme.

Analyse du marché du transport de marchandises au Bangladesh

- Le marché du transport de marchandises au Bangladesh connaît une croissance accélérée, portée par la demande croissante de solutions logistiques fiables, économes en énergie et performantes à température contrôlée. Les systèmes de transport de marchandises offrent des avantages tels que la réduction du gaspillage de produits, une meilleure précision de la température et une capacité de stockage et de transport modulable, comparativement aux méthodes de manutention conventionnelles. Leur adoption se développe dans les secteurs de l'agroalimentaire (viande, fruits de mer, produits laitiers, fruits et légumes), de la pharmacie (vaccins, insuline, produits biologiques), des fournitures médicales et des exportations horticoles. Toutefois, le marché reste confronté à des défis liés aux coûts énergétiques, à la faible pénétration des entrepôts frigorifiques en milieu rural, aux lacunes en matière d'infrastructures et à la nécessité d'améliorer la surveillance de la température et la fiabilité opérationnelle.

- En 2026, le secteur des services devrait maintenir une forte croissance, représentant 91,60 % du marché, grâce à la hausse des commandes à l'exportation, à la demande croissante de vêtements et d'articles de mode à prix abordables, ainsi qu'aux atouts concurrentiels du Bangladesh en matière de production : faibles coûts de main-d'œuvre, forte disponibilité de la main-d'œuvre et écosystème industriel bien établi. Par ailleurs, l'adoption de l'automatisation, des outils de conception numérique et de pratiques textiles durables favorise une productivité accrue et le respect des normes internationales, renforçant ainsi la position dominante du secteur de l'habillement en 2025.

Portée du rapport et segmentation du marché du transport de marchandises au Bangladesh

|

Attributs |

Aperçu du marché du transport de marchandises au Bangladesh |

|

Segments couverts |

|

|

Pays couverts |

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également les normes réglementaires, les tarifs douaniers et leur analyse, l'analyse de la chaîne de valeur, la matrice technologique, l'analyse de la chaîne d'approvisionnement, la matrice de pénétration du marché par rapport aux perspectives de croissance, la cartographie de la pénétration et des perspectives de croissance, les opportunités de revenus et les perspectives d'avenir des nouvelles entreprises et des entreprises émergentes, les données d'importation et d'exportation, l'analyse comparative des entreprises, l'analyse des prix, le quadrant d'évaluation des entreprises et l'analyse des cinq forces de Porter. |

Tendances du marché du transport de marchandises au Bangladesh

« Transformation numérique et solutions logistiques intégrées »

- Une tendance majeure et croissante sur le marché du transport de marchandises au Bangladesh est l'adoption accrue des plateformes numériques, de l'automatisation et de la gestion logistique axée sur les données afin d'améliorer la visibilité des expéditions, la précision de la documentation et l'efficacité opérationnelle. Les transitaires délaissent progressivement les processus manuels et papier au profit de systèmes numériques intégrés pour gérer les volumes d'échanges commerciaux en hausse.

- Par exemple, les principales entreprises de transport de marchandises au Bangladesh mettent en œuvre des systèmes de gestion du fret basés sur le cloud, la documentation électronique et des solutions de suivi des cargaisons en temps réel afin de rationaliser les opérations d'import-export, notamment pour le secteur du prêt-à-porter. Ces outils numériques permettent une réservation plus rapide, une coordination douanière simplifiée et un suivi des expéditions par voie aérienne, maritime et terrestre.

- L'intégration numérique permet aux transitaires d'optimiser la planification des itinéraires, de réduire les retards de transit et d'améliorer la coordination avec les compagnies maritimes, les compagnies aériennes, les ports et les autorités douanières. Par exemple, les plateformes d'analyse de données automatisées aident les transitaires à prévoir les volumes d'expédition, à gérer la disponibilité des conteneurs et à minimiser les frais de surestaries et de détention.

- L'utilisation croissante de tableaux de bord logistiques centralisés permet aux transitaires de gérer de multiples services (entreposage, dédouanement, transport multimodal et livraison du dernier kilomètre) via une interface unique. Il en résulte un écosystème logistique plus transparent, plus efficace et davantage axé sur le client.

- Cette tendance vers des solutions logistiques intégrées et basées sur la technologie redéfinit les attentes en matière de services sur le marché du transport de marchandises au Bangladesh. Par conséquent, les acteurs locaux comme les entreprises de logistique internationales investissent dans des plateformes de fret numériques et des capacités de chaîne d'approvisionnement intégrées afin d'acquérir un avantage concurrentiel.

- La demande de services de transport de marchandises numériques connaît une croissance rapide dans les secteurs tournés vers l'exportation, notamment le textile, la pharmacie et les biens de consommation, les expéditeurs privilégiant de plus en plus la rapidité, la rentabilité, la conformité réglementaire et la visibilité en temps réel.

Dynamique du marché du transport de marchandises au Bangladesh

Conducteur

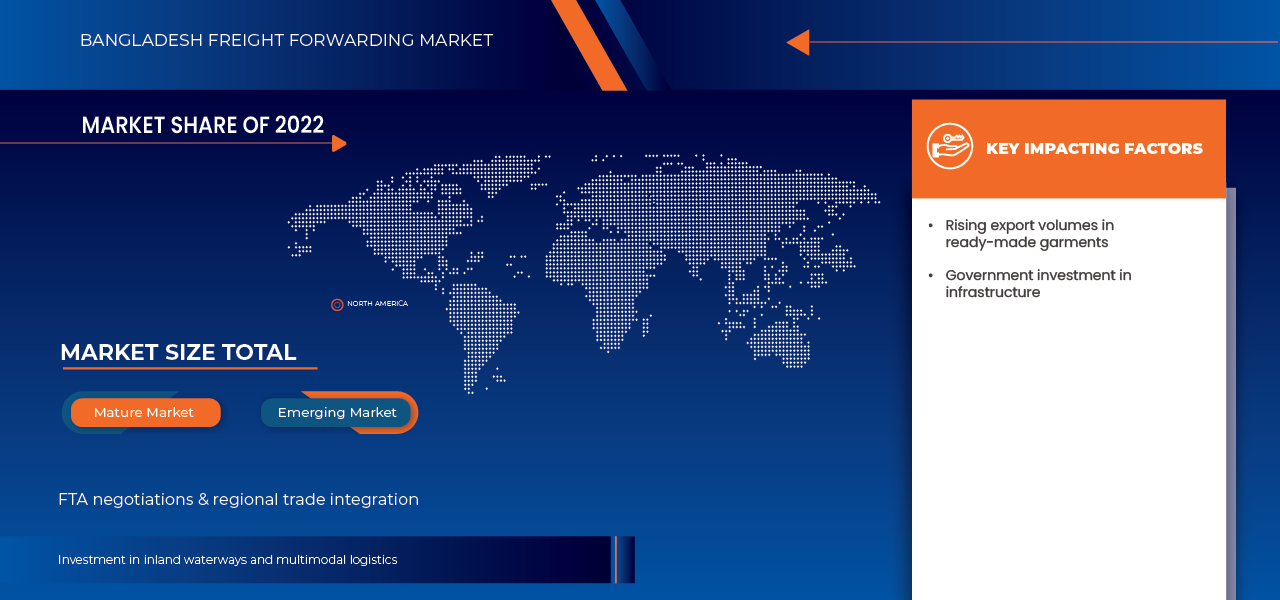

« Croissance tirée par l’expansion du commerce d’exportation et le développement des infrastructures »

- La croissance rapide de l'économie bangladaise, fortement axée sur l'exportation et tirée par l'industrie du prêt-à-porter, est un facteur majeur de la demande en services de transport de marchandises. L'augmentation des volumes d'exportation vers l'Amérique du Nord, l'Europe et l'Asie accroît sans cesse le besoin de solutions logistiques internationales et de manutention de fret efficaces.

- Par exemple, les investissements en cours dans des projets de modernisation portuaire, tels que l'agrandissement du port de Chittagong et le développement des ports en eau profonde de Payra et Matarbari, devraient considérablement améliorer la capacité de manutention des marchandises et réduire la congestion. Ces développements d'infrastructures devraient dynamiser les activités de transport de marchandises par voie maritime et multimodale.

- Avec l'augmentation des volumes du commerce international, les transitaires jouent un rôle essentiel dans la gestion des procédures douanières complexes, la conformité réglementaire et la documentation transfrontalière. Leur expertise aide les exportateurs à minimiser les retards, à réduire les coûts et à garantir une livraison ponctuelle sur les marchés mondiaux.

- De plus, les initiatives gouvernementales visant à améliorer la connectivité routière, ferroviaire et fluviale renforcent les réseaux logistiques nationaux et transfrontaliers, créant ainsi de nouvelles opportunités pour les entreprises de transport de marchandises d'offrir des solutions de transport multimodales et intégrées.

- La participation croissante des marques multinationales et des acheteurs s'approvisionnant au Bangladesh accroît la demande de services de transport de marchandises fiables, évolutifs et rapides. Ceci est particulièrement important pour les chaînes d'approvisionnement de la mode rapide qui exigent le strict respect des délais de livraison.

- L'impact combiné de la croissance des exportations, des investissements dans les infrastructures et de l'intégration croissante du commerce mondial devrait demeurer un facteur clé soutenant l'expansion soutenue du marché du transport de marchandises au Bangladesh au cours de la période prévisionnelle.

Retenue/Défi

« Congestion portuaire et retards opérationnels »

- La congestion portuaire et les retards opérationnels dans les principaux ports maritimes constituent un frein structurel majeur pour le marché du transport de marchandises au Bangladesh. Cette congestion réduit le débit portuaire, retarde l'accostage des navires et le chargement/déchargement des conteneurs, ce qui augmente les délais de transit, les frais de surestaries et de stockage, et nuit à la fiabilité du service.

- Pour les transitaires, les retards imprévisibles et l'accumulation des conteneurs complexifient la planification du transport intérieur, du dédouanement et de la livraison, compromettant ainsi la qualité de leurs services et immobilisant leur fonds de roulement dans les terminaux portuaires et les dépôts de conteneurs intérieurs. À terme, ces goulets d'étranglement persistants nuisent à la compétitivité globale du secteur de la logistique et du transport de marchandises au Bangladesh, dissuadant les clients dont le commerce est soumis à des impératifs de rapidité, tels que les exportateurs de vêtements ou les importateurs de denrées périssables.

- Les exemples précédents illustrent la persistance et le caractère systémique des congestions portuaires et des retards opérationnels dans les principaux ports d'entrée du Bangladesh, notamment à Chattogram. La surcapacité récurrente des terminaux, l'insuffisance du dédouanement des conteneurs à l'intérieur des terres, le manque de navires légers ou de capacités de transport ferroviaire et routier, ainsi que les perturbations intermittentes du personnel dans les opérations douanières et de manutention contribuent à créer un environnement de chaîne d'approvisionnement fragile et imprévisible.

- Pour le secteur du transport de marchandises, une telle instabilité compromet la fiabilité des services, fait grimper les frais de surestaries et d'entreposage, allonge les délais de traitement, immobilise le fonds de roulement et réduit la compétitivité, notamment pour les clients dont les chaînes d'approvisionnement dépendent de livraisons ponctuelles. Tant que les réformes infrastructurelles et institutionnelles n'auront pas amélioré significativement les opérations portuaires, la congestion et les retards qui en découlent continueront de freiner la croissance et l'efficacité du marché du transport de marchandises au Bangladesh.

Par exemple,

- En août 2025, le Financial Express a noté qu'environ 45 000 EVP étaient entassés dans les terminaux portuaires de Chattogram (sur une capacité d'environ 53 000 EVP), avec une douzaine de porte-conteneurs ancrés à l'extérieur attendant de trois à six jours, ce qui suggère que la surcapacité des terminaux portuaires et les retards d'accostage restent un problème récurrent.

- En mai 2025, bdnews24.com a rapporté qu'une manifestation de douaniers au port de Chattogram avait aggravé l'accumulation de conteneurs, les navires attendant jusqu'à six jours pour accoster, malgré une capacité du terminal portuaire de 53 518 EVP.

- En juillet 2025, le Business Standard a rapporté qu'une vingtaine de porte-conteneurs attendaient au mouillage extérieur depuis neuf jours, ce qui expliquait l'engorgement des navires par des limitations d'infrastructure (par exemple, un nombre insuffisant de portiques de levage et d'espace dans les parcs à conteneurs) plutôt que par un simple volume de marchandises.

Étendue du marché du transport de marchandises au Bangladesh

Le marché du transport de marchandises au Bangladesh est segmenté en plusieurs segments importants en fonction de l'offre, du mode de transport, du modèle logistique, du type de client, du type de transitaire et de l'utilisateur final.

- En offrant

En fonction de l'offre, le marché est segmenté en services et logiciels.

Le secteur des services devrait dominer le marché en raison de la forte dépendance du pays aux exportations, notamment celles du secteur du prêt-à-porter (transport de marchandises), qui nécessitent un soutien logistique important via des opérations de fret maritime et aérien à grande échelle. Le secteur du transport de marchandises, qui contribue largement aux recettes nationales, génère une demande considérable de services de transport efficaces pour garantir la livraison des marchandises dans les délais impartis sur les marchés internationaux. Cette dépendance au transport de marchandises souligne le rôle crucial des infrastructures de fret maritime et aérien pour soutenir la croissance des exportations et répondre aux exigences des chaînes d'approvisionnement mondiales.

- Par modèle logistique

Sur la base du modèle logistique, le marché est segmenté en logistique tierce partie (3PL), logistique de deuxième partie (2PL) et logistique de première partie (1PL).

Le segment de la logistique tierce partie (3PL) devrait dominer le marché, porté par une forte tendance à l'externalisation chez les exportateurs de fret, les entreprises de biens de consommation courante, les détaillants et les acteurs du e-commerce. Ces entreprises recherchent de plus en plus des solutions logistiques intégrées pour optimiser leurs coûts, améliorer l'efficacité de leur chaîne d'approvisionnement et se concentrer sur leurs activités principales, ce qui alimente la demande de services 3PL intégrés couvrant l'entreposage, le transport et la livraison du dernier kilomètre.

- Par mode de transport

En fonction du mode de transport, le marché est segmenté en transport maritime (EVP), transport routier, transport aérien (tonnage), transport ferroviaire et transport fluvial.

Le transport maritime de marchandises (EVP) devrait dominer le marché grâce aux importantes exportations de vêtements du pays, qui dépendent de plus en plus du transport maritime par conteneurs. Cette croissance est également soutenue par l'expansion des opérations des ports de Chattogram et de Mongla, ainsi que par l'amélioration de l'efficacité de la manutention des conteneurs, permettant des délais de traitement plus courts, une réduction de la congestion et une logistique plus fiable pour le commerce international. L'effet combiné de la demande croissante à l'exportation et de l'amélioration des infrastructures portuaires positionne le transport maritime comme le segment leader du secteur du transport de marchandises du pays.

- Par type de consommateur

En fonction du type de client, le marché est segmenté en B2B, commerce électronique et livraison du dernier kilomètre, et B2C.

Le segment B2B devrait dominer le marché, porté par une base industrielle solide, une production manufacturière destinée à l'exportation en grand volume et une demande soutenue de la part de secteurs clés tels que le transport de marchandises, le textile, l'industrie pharmaceutique, la chimie et l'électronique, qui nécessitent collectivement des solutions logistiques et de chaîne d'approvisionnement fiables à grande échelle.

- Par type de transitaire

En fonction du type de transitaire, le marché est segmenté en consolidateurs/NVOCC, opérateurs de transport multimodal/intermodal (MTO), courtiers en douane, agents portuaires et autres.

Le segment des consolidateurs/NVOCC devrait dominer, porté par l'augmentation des volumes de conteneurs et la demande croissante de services de groupage (LCL) parmi les petits et moyens exportateurs à la recherche de solutions d'expédition rentables et efficaces.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en industrie et fabrication, vente au détail, alimentation et boissons, santé, pétrole et gaz, militaire, médias et divertissement, et autres.

Le secteur industriel et manufacturier dominera le marché du transport de marchandises au Bangladesh grâce à la solide base de production du pays, fortement orientée vers l'exportation. Cette base est notamment portée par l'industrie du prêt-à-porter, qui représente la majeure partie du volume des échanges commerciaux du Bangladesh. La forte dépendance aux marchés internationaux, l'afflux continu de matières premières (tissus, machines, produits chimiques) et les importantes exportations de produits finis génèrent une demande considérable pour les services de transport maritime, aérien, routier, ferroviaire et fluvial.

Analyse du marché du transport de marchandises au Bangladesh

Le marché du transport de marchandises au Bangladesh connaît une forte croissance, alimentée par l'essor des exportations de vêtements confectionnés et l'augmentation des volumes d'échanges internationaux. La demande croissante de solutions logistiques efficaces et économiques, conjuguée à la nécessité de réduire les délais de transit, favorise l'adoption de la logistique tierce partie (3PL), des services de consolidation/NVOCC et des systèmes avancés de gestion de la chaîne d'approvisionnement. Les investissements dans les infrastructures portuaires, l'amélioration de la manutention des conteneurs dans les ports de Chattogram et de Mongla, ainsi que le développement de solutions de suivi numérique performantes contribuent à accélérer l'efficacité et la fiabilité opérationnelles. Par ailleurs, la collaboration croissante entre les transitaires, les exportateurs, les compagnies maritimes et les prestataires d'entreposage permet de proposer des solutions logistiques complètes, améliorant ainsi la qualité des services et la compétitivité sur les marchés mondiaux. L'ensemble de ces facteurs positionne le Bangladesh comme un acteur clé du transport de marchandises régional et des chaînes d'approvisionnement mondiales du secteur de l'habillement.

Part de marché du transport de marchandises au Bangladesh

Le secteur du transport de marchandises au Bangladesh est principalement dominé par des entreprises bien établies, notamment :

- CEVA Logistics (Suisse)

- Ressource AKIJ (Bangladesh)

- Allport Cargo Services Logistics Pte Ltd. (Singapour)

- ANEK Lines – Acquise par le groupe Attica (Grèce)

- Allcargo Logistics Ltd. (Inde)

- United Parcel Service of America, Inc. – UPS (États-Unis)

- Groupe AEx (Bangladesh)

- ASF Express (BD) Ltd (Bangladesh)

- Agence internationale Alif (Bangladesh)

- ALLIED SEA-AIR LOGISTICS LTD (Bangladesh)

- Réseau de distribution de fret (BD) Ltd. (Bangladesh)

- AMRA Logistics Ltd. (Bangladesh)

- Fareast Logistics BD Ltd (Bangladesh)

- RK Freight Ltd (Bangladesh)

- Services maritimes alliés (Bangladesh)

- Ambition Inc. (Bangladesh)

- APS Logistics (Bangladesh)

- Expédition 2C (Bangladesh)

- Mars Freight Bangladesh Ltd. (Bangladesh)

- Groupe de sociétés Shams (Bangladesh)

- AEx Cargo Intl. (Bangladesh)

- DSV (Danemark)

- MOL Logistics Co., Ltd. (Japon)

- FedEx (États-Unis)

Dernières évolutions du marché du transport de marchandises au Bangladesh

- En juin 2025, DHL s'est associé à Daimler Truck et hylane pour déployer 30 camions Mercedes-Benz eActros 600 entièrement électriques, selon un modèle de « transport à la demande », afin d'optimiser le transport de colis depuis les centres de tri en Allemagne. Cette collaboration soutient les objectifs de développement durable de DHL en réduisant les émissions, en améliorant l'efficacité énergétique et en intégrant une technologie de pointe pour les camions électriques dans ses opérations logistiques quotidiennes. Cette initiative renforce la transition de DHL vers des solutions de transport routier longue distance plus écologiques et plus efficaces.

- En mai 2025, Kuehne+Nagel a récemment conclu un accord de fournisseur principal de services logistiques avec Evonik pour la région Asie-Pacifique (Chine, Inde, Asie du Sud-Est, etc.), gérant environ 70 000 expéditions aériennes, maritimes et routières par an dans le cadre d'une gestion intégrée des transports.

- En septembre 2022, 3i Logistics a été nommée « l'un des meilleurs fournisseurs de solutions logistiques et de chaîne d'approvisionnement durables d'Asie du Sud » dans le cadre des South Asian Business Excellence Awards 2022, reconnaissant ses performances dans la logistique de projets, le transport de marchandises, le transport et les services de chaîne d'approvisionnement dans des conditions difficiles (y compris les livraisons pendant la COVID-19).

- En mars 2023, AH Khan & Company Ltd. a franchi une étape clé de sa croissance en obtenant les certifications ISO 9001:2015 et ISO 28000:2007, reconnaissant ainsi officiellement son engagement en matière de gestion de la qualité et de sécurité de sa chaîne d'approvisionnement. La cérémonie de certification s'est tenue au Dhaka Club, témoignant de l'importance accrue accordée par l'entreprise à l'excellence opérationnelle et aux normes internationales.

- En 2024, Crown Logistics a publié des documents d'entreprise soulignant les efforts déployés pour optimiser les opérations, adopter la technologie et renforcer la qualité des services dans les domaines de l'entreposage, du groupage et de la manutention des marchandises hors gabarit, mettant ainsi l'accent sur l'amélioration continue de l'efficacité opérationnelle et de la durabilité de ses activités au Bangladesh.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUN INSIGHT

4.1 PESTEL ANALYSIS

4.2 PRICING ANALYSIS

4.2.1 KEY PRICING DRIVERS

4.2.2 CUSTOMER SEGMENTATION AND PRICE SENSITIVITY

4.2.3 VALUE-ADDED SERVICES AND PREMIUM PRICING

4.2.4 MARKET IMPLICATIONS

4.2.5 CONCLUSION

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 OVERVIEW OF BUYER PRIORITIES

4.3.2 PRICE SENSITIVITY AND SERVICE EXPECTATIONS

4.3.3 TECHNOLOGY ADOPTION AND DIGITAL PREFERENCES

4.3.4 BRAND LOYALTY AND TRUST FACTORS

4.3.5 DEMAND FOR VALUE-ADDED LOGISTICS SERVICES

4.3.6 CHANGING ENGAGEMENT AND COMMUNICATION CHANNELS

4.4 ECONOMIC ANALYSIS

4.4.1 KEY COMPONENTS OF ECONOMIC ANALYSIS

4.5 ECONOMIC ANALYSIS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 STRATEGIC GEOGRAPHIC POSITION AS A REGIONAL GATEWAY

4.6.2 DEEP-SEA AND SEAPORT DEVELOPMENTS AS CATALYSTS FOR REGIONAL FLOWS

4.6.2.1 MATARBARI DEEP SEA PORT AND BAY OF BENGAL HUB POTENTIAL

4.6.2.2 CAPACITY EXPANSION AT CHATTOGRAM, MONGLA, AND PAYRA PORTS

4.6.3 INLAND CONNECTIVITY AND MULTIMODAL CORRIDOR DEVELOPMENT

4.6.3.1 DHAKA–CHATTOGRAM–MATARBARI LOGISTICS SPINE

4.6.3.2 DHIRASRAM INLAND CONTAINER DEPOT AND RAIL-BASED FREIGHT EXPANSION

4.6.3.3 INLAND WATERWAYS AND PROTOCOL TRANSIT ROUTES

4.6.4 CROSS-BORDER AND TRANSIT TRADE OPPORTUNITIES

4.6.4.1 BBIN AND SUB-REGIONAL CONNECTIVITY ADVANCEMENTS

4.6.4.2 GATEWAY POTENTIAL FOR NEPAL AND BHUTAN

4.6.5 EMERGING REGIONAL CLUSTER OPPORTUNITIES WITHIN BANGLADESH

4.6.5.1 DHAKA–GAZIPUR–NARAYANGANJ MANUFACTURING BELT

4.6.5.2 CHATTOGRAM–COX’S BAZAR–MATARBARI COASTAL CORRIDOR

4.6.5.3 SOUTHWEST EXPORT CORRIDOR VIA MONGLA AND PADMA BRIDGE

4.7 TECHNOLOGICAL ANALYSIS

4.7.1 OVERVIEW OF TECHNOLOGICAL MATURITY IN FREIGHT FORWARDING

4.7.2 CORE TRADE FACILITATION AND CUSTOMS TECHNOLOGIES

4.7.2.1 BANGLADESH SINGLE WINDOW AND PAPERLESS TRADE SYSTEMS

4.7.2.2 AUTOMATED CUSTOMS RISK MANAGEMENT

4.7.3 PORT AND TERMINAL DIGITALIZATION

4.7.3.1 PORT COMMUNITY SYSTEMS AND TERMINAL OPERATING SYSTEMS

4.7.3.2 TRANSITION TOWARD SMART PORT TECHNOLOGIES

4.7.4 DIGITALIZATION OF FREIGHT FORWARDING OPERATIONS

4.7.4.1 TRANSPORT AND WAREHOUSE MANAGEMENT SYSTEMS

4.7.4.2 ELECTRONIC DATA INTERCHANGE AND CLIENT SYSTEM INTEGRATION

4.8 EMERGING TECHNOLOGIES AND INNOVATION TRENDS

4.8.1.1 DATA ANALYTICS AND PREDICTIVE OPERATIONS

4.8.1.2 INTERNET OF THINGS (IOT) FOR TRACKING AND CONDITION MONITORING

4.8.1.3 AUTOMATION AND ROBOTICS IN PORT-CENTRIC LOGISTICS

4.8.2 TECHNOLOGY IN E-COMMERCE AND LAST-MILE LOGISTICS

4.9 KEY STRATEGIC INITIATIVES

4.9.1 INTEGRATION OF MARITIME, PORT, AND INLAND LOGISTICS SERVICES

4.9.1.1 DEVELOPMENT OF END-TO-END LOGISTICS CAPABILITIES

4.9.1.2 EXPANSION OF PORT-CENTRIC AND DRY-PORT INFRASTRUCTURE

4.9.1.3 COORDINATION OF MULTIMODAL TRANSPORT NETWORKS

4.9.2 EMPHASIS ON MODERNISATION, INNOVATION AND TECHNOLOGY ADOPTION

4.9.2.1 DEPLOYMENT OF DIGITAL LOGISTICS SYSTEMS

4.9.2.2 INTRODUCTION OF INTELLIGENT TRANSPORT AND TRACKING SOLUTIONS

4.9.3 REGIONAL POSITIONING AND HINTERLAND/TRANSSHIPMENT STRATEGY

4.9.3.1 STRATEGIC POSITIONING AS A REGIONAL GATEWAY

4.9.3.2 INVESTMENT IN MULTIMODAL AND PORT-LINKED INFRASTRUCTURE

4.9.3.3 EXPANSION INTO CROSS-BORDER AND TRANSSHIPMENT LOGISTICS

4.9.4 DIVERSIFICATION OF SERVICE PORTFOLIO — FROM BASIC FORWARDING TO VALUE-ADDED LOGISTICS

4.9.4.1 EXPANSION BEYOND TRADITIONAL FORWARDING

4.9.4.2 DEVELOPMENT OF INTEGRATED 3PL AND 4PL SOLUTIONS

4.9.5 ALIGNMENT WITH SUSTAINABILITY AND GLOBAL COMPLIANCE TRENDS

4.9.5.1 EVOLVING TOWARD GREENER LOGISTICS

4.9.5.2 PREPARING FOR INTERNATIONAL COMPLIANCE REQUIREMENTS

4.9.6 CONCLUSION

4.1 CASE STUDY ANALYSIS

4.10.1 CASE STUDY: PORT DIGITALISATION AND ITS IMPACT ON FREIGHT FORWARDING EFFICIENCY

4.10.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.10.1.2 OPERATIONAL CHALLENGES BEFORE CROSS-BORDER INTEGRATION

4.10.1.2.1 LACK OF REAL-TIME OPERATIONAL VISIBILITY

4.10.1.2.2 MANUAL DOCUMENTATION AND PHYSICAL PROCESSING

4.10.1.2.3 INEFFICIENT COORDINATION AMONG STAKEHOLDERS

4.10.1.3 DIGITALIZATION MEASURES INTRODUCED

4.10.1.3.1 DEPLOYMENT OF TERMINAL OPERATING SYSTEMS (TOS)

4.10.1.3.2 INTRODUCTION OF PORT COMMUNITY SYSTEMS (PCS)

4.10.1.3.3 ELECTRONIC GATE PASSES AND DIGITAL CARGO DOCUMENTATIONS

4.10.1.3.4 PARTIAL INTEGRATION WITH CUSTOMS AND SINGLE WINDOW PLATFORMS

4.10.1.4 IMPACT ON FREIGHT FORWARDING EFFICIENCY

4.10.1.4.1 IMPROVED PLANNING AND RESOURCE ALLOCATION

4.10.1.4.2 REDUCTION IN CONTAINER DWELL TIME

4.10.1.4.3 ENHANCED RELIABILITY FOR EXPORT SECTORS

4.10.1.4.4 LOWER OPERATING COSTS AND FEWER ADMINISTRATIVE BURDENS

4.10.1.4.5 STRONGER ALIGNMENT WITH GLOBAL SUPPLY CHAIN STANDARDS

4.10.2 CASE STUDY: CROSS-BORDER LOGISTICS AND REGIONAL MARKET INTEGRATION

4.10.2.1 BACKGROUND & STRATEGIC CONTEXT

4.10.2.2 OPERATIONAL CHALLENGES PRIOR TO CROSS-BORDER INTEGRATION

4.10.2.2.1 REGULATORY COMPLEXITY AND FRAGMENTED DOCUMENTATION

4.10.2.2.2 WEAK BORDER INFRASTRUCTURE AND LIMITED MULTIMODAL CONNECTIVITY

4.10.2.2.3 LIMITED COORDINATION AMONG AGENCIES ACROSS BORDERS

4.10.2.3 STRATEGIC INTERVENTIONS BY LOGISTICS OPERATORS

4.10.2.3.1 FORMATION OF CROSS-BORDER PARTNERSHIPS

4.10.2.3.2 DEPLOYMENT OF DEDICATED DOCUMENTATION SUPPORT TEAMS

4.10.2.3.3 ADOPTION OF MULTIMODAL ROUTING THROUGH RIVER PORTS AND ROAD CORRIDORS

4.10.2.3.4 ALIGNMENT WITH NEW TRANSIT AGREEMENTS

4.10.2.4 KEY OUTCOMES FOR FREIGHT FORWARDING OPERATIONS

4.10.2.4.1 REDUCED TRANSIT TIME AND GREATER PREDICTABILITY

4.10.2.4.2 EXPANSION OF SERVICE PORTFOLIOS

4.10.2.4.3 NEW REVENUE STREAMS AND MARKET PENETRATION

4.10.2.4.4 STRENGTHENING BANGLADESH’S ROLE AS A REGIONAL GATEWAY

4.11 SUPPLY CHAIN ANALYSIS – BANGLADESH FREIGHT FORWARDING MARKET

4.11.1 CUSTOMER BOOKING & CONTRACTING

4.11.2 DOCUMENTATION, COMPLIANCE & CUSTOMS CLEARANCE

4.11.3 INLAND TRANSPORTATION & FIRST-MILE MOVEMENT

4.11.4 PORT OPERATIONS & TERMINAL HANDLING

4.11.5 INTERNATIONAL CARRIAGE (OCEAN & AIR FREIGHT)

4.11.6 WAREHOUSING, DISTRIBUTION & VALUE-ADDED SERVICES

4.11.7 LAST-MILE DELIVERY & IMPORT DISTRIBUTION

4.11.8 DIGITALISATION & TRADE FACILITATION

4.11.9 BOTTLENECKS, RISKS & MITIGATION

5 REGULATORY

5.1 NATIONAL REGULATORY FRAMEWORK

5.2 OPERATIONAL & DOCUMENTATION REQUIREMENTS

5.3 DANGEROUS GOODS, SECURITY & SPECIAL CARGO

5.4 TRADE FACILITATION, RISK MANAGEMENT & DIGITALISATION

5.5 INSTITUTIONAL & INDUSTRY COMPLIANCE PROGRAMMES

5.6 LABOUR, PROFESSIONAL STANDARDS & FINANCIAL COMPLIANCE

5.7 REGULATORY GAPS & MARKET IMPLICATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING EXPORT VOLUMES IN READY-MADE GARMENTS

6.1.2 GOVERNMENT INVESTMENT IN INFRASTRUCTURE

6.1.3 E-COMMERCE & RETAIL GROWTH

6.2 RESTRAINTS

6.2.1 PORT CONGESTION AND OPERATIONAL DELAYS

6.2.2 HIGH LOGISTICS COSTS

6.3 OPPORTUNITIES

6.3.1 FTA NEGOTIATIONS & REGIONAL TRADE INTEGRATION

6.3.2 INVESTMENT IN INLAND WATERWAYS AND MULTIMODAL LOGISTICS

6.4 CHALLENGES

6.4.1 FRAGMENTED FREIGHT FORWARDING MARKET

6.4.2 SKILLED WORKFORCE SHORTAGE

7 BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SERVICES

7.3 SOFTWARE

8 BANGLADESH FREIGHT FORWARDING MARKET, BY CUSTOMER TYPE

8.1 OVERVIEW

8.2 B2B

8.3 E-COMMERCE & LAST MILE DELIVERY

8.4 B2C

9 BANGLADESH FREIGHT FORWARDING MARKET, BY FREIGHT FORWARD TYPE

9.1 OVERVIEW

9.2 CONSOLIDATORS/NVOCC

9.3 MULTIMODAL/INTERMODAL TRANSPORT OPERATORS (MTOS)

9.4 CUSTOMS BROKERS

9.5 PORT AGENTS

9.6 OTHERS

10 BANGLADESH FREIGHT FORWARDING MARKET, BY LOGISTICS MODEL

10.1 OVERVIEW

10.2 THIRD PARTY LOGISTICS (3PL)

10.3 SECOND PARTY LOGISTICS (2PL)

10.4 FIRST PARTY LOGISTICS (1PL)

11 BANGLADESH FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT

11.1 OVERVIEW

11.2 SEA FREIGHT FORWARDING

11.3 ROAD FREIGHT FORWARDING

11.4 AIR FREIGHT FORWARDING

11.5 RAIL FREIGHT FORWARDING

11.6 WATERWAYS FREIGHT FORWARDING

12 BANGLADESH FREIGHT FORWARDING MARKET, BY END USER

12.1 OVERVIEW

12.2 INDUSTRIAL & MANUFACTURING

12.3 RETAIL

12.4 FOOD & BEVERAGES

12.5 HEALTHCARE

12.6 OIL & GAS

12.7 MILITARY

12.8 MEDIA & ENTERTAINMENT

12.9 OTHERS

13 BANGLADESH FREIGHT FORWARDING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: BANGLADESH

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CEVA LOGISTICS

15.1.1 COMPANY SNAPSHOT

15.1.2 SERVICE PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ANEK LINES

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 ALLCARGO LOGISTICS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 AKIJ RESOURCE

15.4.1 COMPANY SNAPSHOT

15.4.2 SERVICE PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 ALLPORT CARGO SERVICES LOGISTICS PTE LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AEX CARGO INTL.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AEX GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ALIF INTERNATIONAL AGENCY

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ALLIED MARITIME SERVICES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 ALLIED SEA-AIR LOGISTICS LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 AMBITION INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 AMRA LOGISTICS LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 APS LOGISTICS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 ASF EXPRESS (BD) LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CARGO DISTRIBUTION NETWORK (BD) LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DSV

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 FAREAST LOGISTICS BD LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 FEDEX

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MARS FREIGHT BANGLADESH LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 MARVEL FREIGHT LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MOL LOGISTICS CO., LTD.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 RK FREIGHT LTD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SHAMS GROUP OF COMPANIES

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 UNITED PARCEL SERVICE OF AMERICA, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 SERVICE PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 2C SHIPPING

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 A.H. KHAN & CO.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 BADAL & COMPANY

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 BLUE OCEAN FREIGHT SYSTEM LTD.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 CDZ GLOBAL LOGISTICS LTD.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENT

15.3 CMX (PVT.) LTD.

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENT

15.31 COMPASS GLOBAL LOGISTICS, LLC

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 CROWN LOGISTICS LTD

15.32.1 COMPANY SNAPSHOT

15.32.2 PRODUCT PORTFOLIO

15.32.3 RECENT DEVELOPMENT

15.33 DB SCHENKER

15.33.1 COMPANY SNAPSHOT

15.33.2 PRODUCT PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 DHAKA LOGISTICS NETWORK

15.34.1 COMPANY SNAPSHOT

15.34.2 PRODUCT PORTFOLIO

15.34.3 RECENT DEVELOPMENT

15.35 DHL GROUP

15.35.1 COMPANY SNAPSHOT

15.35.2 REVENUE ANALYSIS

15.35.3 PRODUCT PORTFOLIO

15.35.4 RECENT DEVELOPMENT

15.36 EAST WEST HOLDINGS LTD. (EWHL)

15.36.1 COMPANY SNAPSHOT

15.36.2 PRODUCT PORTFOLIO

15.36.3 RECENT DEVELOPMENT

15.37 FARAJI LOGISTICS

15.37.1 COMPANY SNAPSHOT

15.37.2 PRODUCT PORTFOLIO

15.37.3 RECENT DEVELOPMENT

15.38 FEEDERLOGISTICS.

15.38.1 COMPANY SNAPSHOT

15.38.2 PRODUCT PORTFOLIO

15.38.3 RECENT DEVELOPMENT

15.39 FLEET FREIGHT

15.39.1 COMPANY SNAPSHOT

15.39.2 PRODUCT PORTFOLIO

15.39.3 RECENT DEVELOPMENT

15.4 FREIGHT CONNECTION INDIA PVT. LTD.

15.40.1 COMPANY SNAPSHOT

15.40.2 PRODUCT PORTFOLIO

15.40.3 RECENT DEVELOPMENT

15.41 FREIGHTWALLA

15.41.1 COMPANY SNAPSHOT

15.41.2 PRODUCT PORTFOLIO

15.41.3 RECENT DEVELOPMENT

15.42 GAC.

15.42.1 COMPANY SNAPSHOT

15.42.2 PRODUCT PORTFOLIO

15.42.3 RECENT DEVELOPMENT

15.43 GEODIS.

15.43.1 COMPANY SNAPSHOT

15.43.2 PRODUCT PORTFOLIO

15.43.3 RECENT DEVELOPMENT

15.44 GLOBAL LOGISTICS SOLUTIONS PVT LTD.

15.44.1 COMPANY SNAPSHOT

15.44.2 PRODUCT PORTFOLIO

15.44.3 RECENT DEVELOPMENT

15.45 GREENLINE LOGISTICS.

15.45.1 COMPANY SNAPSHOT

15.45.2 PRODUCT PORTFOLIO

15.45.3 RECENT DEVELOPMENT

15.46 HUB FREIGHT BANGLADESH

15.46.1 COMPANY SNAPSHOT

15.46.2 PRODUCT PORTFOLIO

15.46.3 RECENT DEVELOPMENT

15.47 INTERTRANS GROUP

15.47.1 COMPANY SNAPSHOT

15.47.2 PRODUCT PORTFOLIO

15.47.3 RECENT DEVELOPMENT

15.48 JB LOGISTICS.

15.48.1 COMPANY SNAPSHOT

15.48.2 PRODUCT PORTFOLIO

15.48.3 RECENT DEVELOPMENT

15.49 JEBSEN & JESSEN PTE LTD.

15.49.1 COMPANY SNAPSHOT

15.49.2 PRODUCT PORTFOLIO

15.49.3 RECENT DEVELOPMENT

15.5 K & S FREIGHT SYSTEMS INC.

15.50.1 COMPANY SNAPSHOT

15.50.2 PRODUCT PORTFOLIO

15.50.3 RECENT DEVELOPMENT

15.51 KHAN BROTHER'S GROUPS.

15.51.1 COMPANY SNAPSHOT

15.51.2 PRODUCT PORTFOLIO

15.51.3 RECENT DEVELOPMENT

15.52 KHIMJI POONJA FREIGHT FORWARDERS PVT. LTD.

15.52.1 COMPANY SNAPSHOT

15.52.2 PRODUCT PORTFOLIO

15.52.3 RECENT DEVELOPMENT

15.53 KUEHNE + NAGEL

15.53.1 COMPANY SNAPSHOT

15.53.2 REVENUE ANALYSIS

15.53.3 PRODUCT PORTFOLIO

15.53.4 RECENT DEVELOPMENT

15.54 MAXPEED

15.54.1 COMPANY SNAPSHOT

15.54.2 PRODUCT PORTFOLIO

15.54.3 RECENT DEVELOPMENT

15.55 MGH

15.55.1 COMPANY SNAPSHOT

15.55.2 PRODUCT PORTFOLIO

15.55.3 RECENT DEVELOPMENT

15.56 MIR LOGISTIC.

15.56.1 COMPANY SNAPSHOT

15.56.2 PRODUCT PORTFOLIO

15.56.3 RECENT DEVELOPMENT

15.57 MULTI FREIGHT LIMITED

15.57.1 COMPANY SNAPSHOT

15.57.2 PRODUCT PORTFOLIO

15.57.3 RECENT DEVELOPMENT

15.58 NABIL GROUP OF INDUSTRIES

15.58.1 COMPANY SNAPSHOT

15.58.2 PRODUCT PORTFOLIO

15.58.3 RECENT DEVELOPMENT

15.59 NAVANA LOGISTICS LTD.

15.59.1 COMPANY SNAPSHOT

15.59.2 PRODUCT PORTFOLIO

15.59.3 RECENT DEVELOPMENT

15.6 NIPPON EXPRESS BANGLADESH LTD.

15.60.1 COMPANY SNAPSHOT

15.60.2 PRODUCT PORTFOLIO

15.60.3 RECENT DEVELOPMENT

15.61 ORIGIN SOLUTIONS LTD.

15.61.1 COMPANY SNAPSHOT

15.61.2 PRODUCT PORTFOLIO

15.61.3 RECENT DEVELOPMENT

15.62 PIONEER LOGISTICS HOLDINGS PTE LTD. .

15.62.1 COMPANY SNAPSHOT

15.62.2 PRODUCT PORTFOLIO

15.62.3 RECENT DEVELOPMENT

15.63 PRIME LOGISTICS LIMITED.

15.63.1 COMPANY SNAPSHOT

15.63.2 PRODUCT PORTFOLIO

15.63.3 RECENT DEVELOPMENT

15.64 QNS GLOBAL GROUP.

15.64.1 COMPANY SNAPSHOT

15.64.2 PRODUCT PORTFOLIO

15.64.3 RECENT DEVELOPMENT

15.65 RAJPAT SHIPPING & LOGISTICS.

15.65.1 COMPANY SNAPSHOT

15.65.2 PRODUCT PORTFOLIO

15.65.3 RECENT DEVELOPMENT

15.66 SEAWAYS FREIGHT LINKS

15.66.1 COMPANY SNAPSHOT

15.66.2 PRODUCT PORTFOLIO

15.66.3 RECENT DEVELOPMENT

15.67 SWIFT FREIGHT INTERNATIONAL LTD.

15.67.1 COMPANY SNAPSHOT

15.67.2 PRODUCT PORTFOLIO

15.67.3 RECENT DEVELOPMENT

15.68 TOWER FREIGHT LOGISTICS LIMITED (TFL)

15.68.1 COMPANY SNAPSHOT

15.68.2 PRODUCT PORTFOLIO

15.68.3 RECENT DEVELOPMENT

15.69 YOUNGONE LOGISTICS

15.69.1 COMPANY SNAPSHOT

15.69.2 PRODUCT PORTFOLIO

15.69.3 RECENT DEVELOPMENT

15.7 3I LOGISTICS GROUP

15.70.1 COMPANY SNAPSHOT

15.70.2 PRODUCT PORTFOLIO

15.70.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 MACROECONOMIC FACTORS

TABLE 2 COMPREHENSIVE ECONOMIC ANALYSIS FOR BANGLADESH FREIGHT FORWARDING MARKET

TABLE 3 BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 4 BANGLADESH FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 BANGLADESH WAREHOUSING IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 BANGLADESH VALUE-ADDED SERVICES IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH FREIGHT FORWARDING MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH FREIGHT FORWARDING MARKET, BY FREIGHT FORWARD TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH FREIGHT FORWARDING MARKET, BY LOGISTICS MODEL, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH FREIGHT FORWARDING MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH INDUSTRIAL & MANUFACTURING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH READY-MADE GARMENTS (RMGS) IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH READY-MADE GARMENTS (RMGS) IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH RETAIL IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH FOOD & BEVERAGES IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH HEALTHCARE IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH OIL & GAS IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH MILITARY IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH MEDIA & TRANSPORT IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH OTHERS IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 BANGLADESH FREIGHT FORWARDING MARKET

FIGURE 2 BANGLADESH FREIGHT FORWARDING MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH FREIGHT FORWARDING MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH FREIGHT FORWARDING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 BANGLADESH FREIGHT FORWARDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH FREIGHT FORWARDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 BANGLADESH FREIGHT FORWARDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BANGLADESH FREIGHT FORWARDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BANGLADESH FREIGHT FORWARDING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENTS COMPRISE THE BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING (2025)

FIGURE 13 BANGLADESH FREIGHT FORWARDING MARKET: SEGMENTATION

FIGURE 14 GOVERNMENT INVESTMENT IN INFRASTRUCTURE, E-COMMERCE & RETAIL IS EXPECTED TO DRIVE THE BANGLADESH FREIGHT FORWARDING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH FREIGHT FORWARDING MARKET IN 2026 AND 2033

FIGURE 16 DROC ANALYSIS

FIGURE 17 BANGLADESH FREIGHT FORWARDING MARKET: BY OFFERING, 2025

FIGURE 18 BANGLADESH FREIGHT FORWARDING MARKET: BY CUSTOMER TYPE, 2025

FIGURE 19 BANGLADESH FREIGHT FORWARDING MARKET: BY FREIGHT FORWARD TYPE, 2025

FIGURE 20 BANGLADESH FREIGHT FORWARDING MARKET: BY LOGISTICS MODEL, 2025

FIGURE 21 BANGLADESH FREIGHT FORWARDING MARKET: BY MODE OF TRANSPORT, 2025

FIGURE 22 BANGLADESH FREIGHT FORWARDING MARKET: BY END USER, 2025

FIGURE 23 BANGLADESH FREIGHT FORWARDING MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.