Bangladesh Trucking Market

Taille du marché en milliards USD

TCAC :

%

USD

20.24 Billion

USD

51.82 Billion

2025

2033

USD

20.24 Billion

USD

51.82 Billion

2025

2033

| 2026 –2033 | |

| USD 20.24 Billion | |

| USD 51.82 Billion | |

|

|

|

|

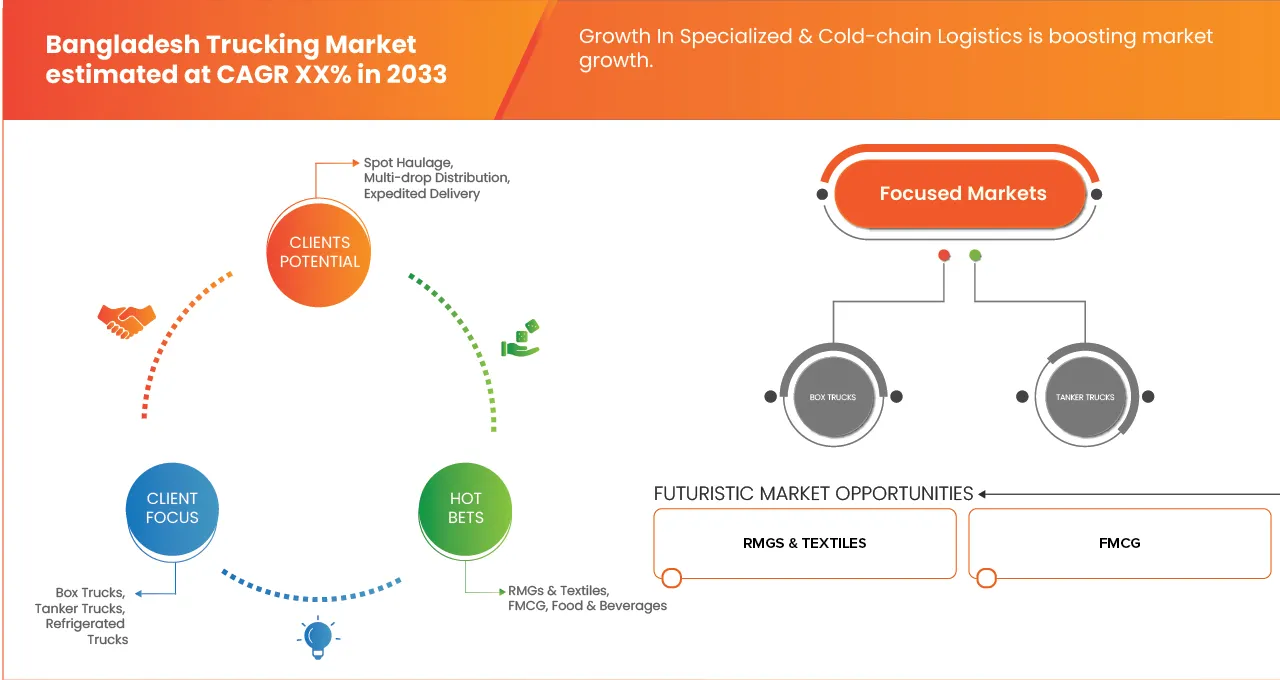

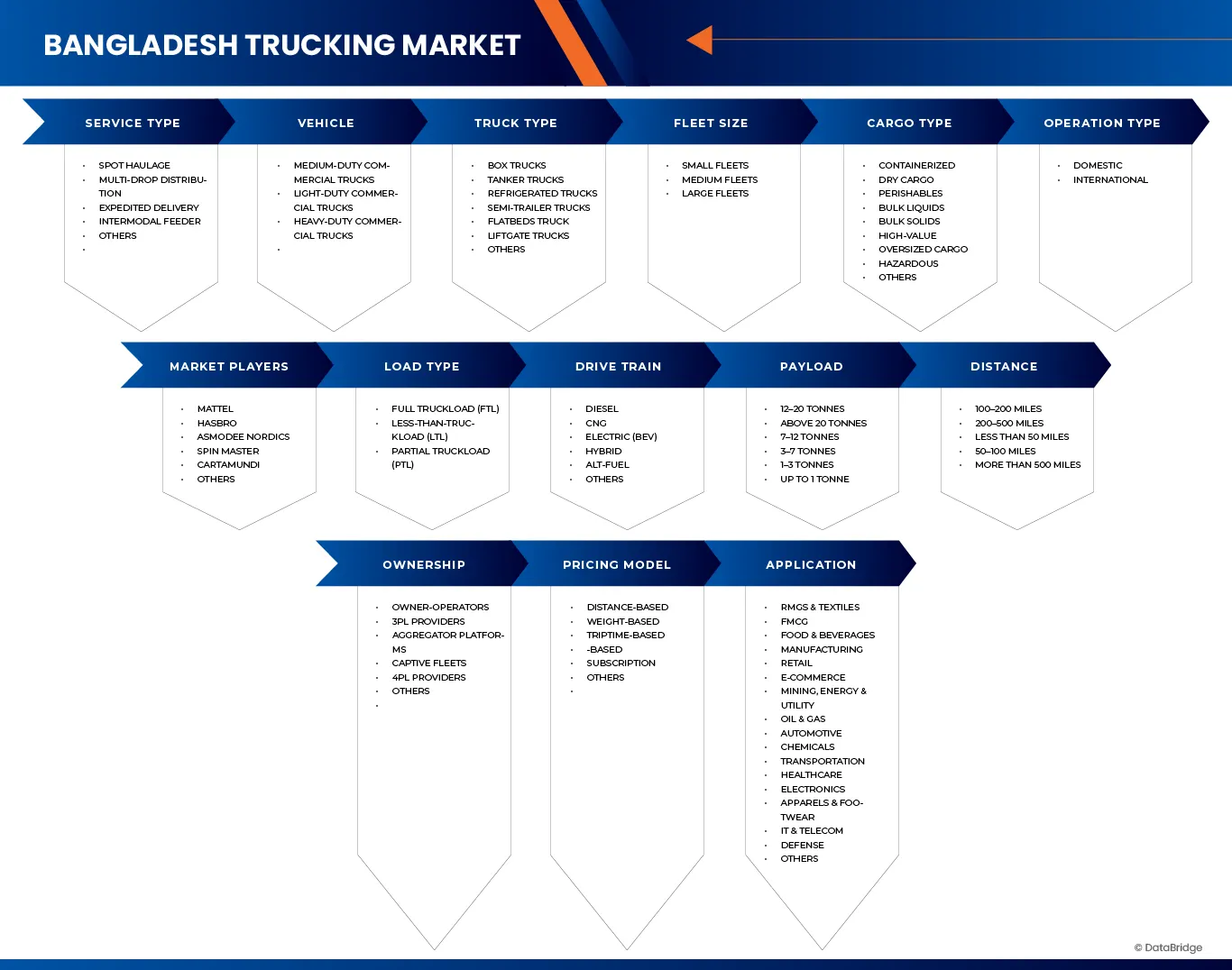

Marché du transport routier au Bangladesh, par type de service (transport ponctuel, distribution multi-points, livraison express, transport intermodal, autres), par type de véhicule (camions commerciaux moyens, camions commerciaux légers, camions commerciaux lourds), par type de camion (camions fourgons, camions-citernes, camions frigorifiques, semi-remorques, camions plateaux, camions à hayon élévateur, autres), par type de chargement (chargement complet (FTL), chargement partiel (LTL), groupe motopropulseur (diesel, GNV, électrique (BEV), hybride, carburant alternatif, autres), par charge utile (12-20 tonnes, plus de 20 tonnes, 7-12 tonnes, 3-7 tonnes, 1-3 tonnes, jusqu'à 1 tonne), par distance (100-200 miles, 200-500 miles, moins de 50 miles). 50 à 100 miles, Plus de 500 miles), Par propriétaire (propriétaires-exploitants, prestataires logistiques 3PL, plateformes d'agrégation, flottes captives, prestataires logistiques 4PL, Autres), Par taille de flotte (petites flottes, flottes moyennes, grandes flottes), Par type de cargaison (conteneurs, marchandises sèches, denrées périssables, liquides en vrac, solides en vrac, marchandises de grande valeur, cargaisons hors gabarit, matières dangereuses, Autres), Par type d'opération (national, international), Par modèle de tarification (à la distance, au poids, au trajet, au temps, par abonnement, Autres), Par application (vêtements et textiles, biens de consommation courante, alimentation et boissons, fabrication, vente au détail, commerce électronique, mines, énergie et services publics, pétrole et gaz, automobile, produits chimiques, transport, santé, électronique, vêtements et chaussures, informatique et télécommunications, défense, Autres), Par type de contrat (transport routier privé, transport routier pour compte d'autrui, transport sous contrat dédié (DCC)). Par utilisateur final (B2B (Business-to-Business), B2C (Business-to-Consumer)) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché du transport routier au Bangladesh

- Le marché du transport routier au Bangladesh était évalué à 20,24 milliards de dollars américains en 2025 et devrait atteindre 51,82 milliards de dollars américains d'ici 2033 , avec un TCAC de 6,1 % au cours de la période de prévision 2026-2033 .

- La croissance du marché du transport routier est principalement due à des coûts de main-d'œuvre compétitifs et à une main-d'œuvre abondante qui soutient la production de vêtements à grand volume.

Analyse du marché du transport routier au Bangladesh

- L'activité croissante dans les secteurs de la fabrication, des biens de consommation courante, du textile, de la construction et de l'agriculture accroît la demande de transport routier de marchandises dans tout le pays.

- Les investissements publics dans les autoroutes, les ponts et les corridors de connectivité régionaux (par exemple, le pont Padma, les améliorations de la route Dhaka-Chattogram) favorisent des opérations de camionnage plus rapides et plus fiables.

- La congestion des centres urbains et la qualité insuffisante des réseaux routiers ruraux augmentent les temps de transit et les coûts d'exploitation.

- La demande croissante en matière de GPS, d'optimisation d'itinéraires, de logiciels de gestion de flottes et d'outils d'efficacité énergétique ouvre la voie à une transformation numérique.

- L’application incohérente des réglementations en matière de transport, des règles de surcharge et des normes d’autorisation complique les opérations.

- Le transport ponctuel devrait dominer le marché du transport routier au Bangladesh en 2026, avec une part de marché de 48,81 %. Cette domination s'explique principalement par la demande croissante de fret à court terme, alimentée par l'expansion des secteurs du commerce de détail, de la construction et de l'agriculture au Bangladesh. Les entreprises privilégient de plus en plus le transport routier flexible au trajet plutôt que les contrats à long terme, notamment les PME dont les volumes d'expédition fluctuent.

Portée du rapport et segmentation du marché du transport routier au Bangladesh

|

Attributs |

Aperçu du marché des produits de transport routier au Bangladesh |

|

Segments couverts |

|

|

Pays couverts |

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les analyses de scénarios de marché telles que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché du transport routier au Bangladesh

« Des coûts de main-d’œuvre compétitifs et une main-d’œuvre abondante soutiennent la production de vêtements en grand volume »

- Le paysage industriel du Bangladesh a connu une expansion rapide au cours de la dernière décennie, soutenue par la croissance de la production nationale, l'essor du secteur de la construction et le développement du commerce régional. Cette transformation a considérablement accru la circulation des matières premières, des biens intermédiaires et des produits finis le long des axes économiques, renforçant ainsi la demande de transport routier à l'échelle nationale. De l'acier et du ciment aux biens de consommation courante, en passant par les produits agricoles et pharmaceutiques, les industries fonctionnent désormais avec des capacités de production accrues et des délais de livraison plus courts, faisant du transport routier un élément essentiel à la continuité de la chaîne d'approvisionnement et à l'efficacité de la logistique intérieure.

- L'industrialisation accélérée du pays est étroitement liée à l'expansion des zones économiques, des parcs industriels et des plateformes logistiques. Ces zones attirent les investissements de fabricants nationaux et étrangers, créant ainsi des pôles de production concentrés qui dépendent fortement du transport routier. Avec l'implantation continue d'usines dans des districts tels que Gazipur, Narayanganj, Chattogram, Cumilla et Rajshahi, le volume du transport de marchandises inter-districts a fortement augmenté, alimentant une demande soutenue de camions moyens et lourds. Cette évolution a également incité les transporteurs à diversifier leurs flottes et à accroître leurs capacités afin de répondre aux besoins croissants en matière de fret.

- De plus, l'amélioration des liaisons terrestres, grâce à des projets d'infrastructures majeurs comme le pont Padma, la modernisation des routes nationales et la création de nouvelles voies express, a permis un transport de marchandises plus rapide et plus fiable. La réduction des temps de trajet entre les principaux pôles industriels a permis aux fabricants d'accroître leur production et d'étendre leurs réseaux de distribution. À mesure que l'efficacité des transports s'améliore, les entreprises des secteurs de la construction, des biens de consommation et de l'agriculture ont de plus en plus recours au transport routier pour optimiser leurs chaînes d'approvisionnement, minimiser les retards et respecter les délais de livraison imposés par le marché.

- La croissance de la consommation intérieure renforce encore cette tendance. L'urbanisation rapide de villes comme Dhaka, Chattogram, Gazipur et Sylhet a entraîné une forte demande en biens de consommation courante, produits alimentaires emballés, produits électroniques et matériaux de construction. Face à cette hausse de la consommation, les détaillants et les distributeurs s'adaptent, ce qui se traduit par une augmentation substantielle de la fréquence et du volume des livraisons aux entrepôts, aux marchés de gros et aux commerces de détail. Ce développement du commerce intérieur accroît directement la charge opérationnelle du secteur du transport routier, faisant de lui l'un des principaux bénéficiaires de l'évolution de la structure économique du Bangladesh.

- In March 2024, a Bangladesh Planning Commission briefing highlighted that domestic freight movement grew steadily due to rising industrial production and expanding economic zones, leading to higher trucking utilization across major corridors.

- In August 2024, the Ministry of Industries reported that new manufacturing investments in consumer goods and construction materials significantly increased inter-district cargo demand, particularly along the Dhaka–Chattogram and Dhaka–Khulna routes.

- In January 2025, a logistics market review by the Bangladesh Freight Forwarders Association (BAFFA) noted that improved connectivity from key infrastructure projects has enhanced trucking efficiency and supported higher domestic trade volumes

- Bangladesh’s expanding industrial output and growing domestic trade are not just economic milestones—they are structural forces reshaping the country’s logistics backbone. As production scales up and distribution networks become more complex, the reliance on efficient trucking services intensifies. This sustained industrial momentum positions “Growing Domestic Trade & Industrialization” as one of the most influential drivers of growth in the Bangladesh trucking market

Bangladesh Trucking Market Dynamics

Driver

“Expansion of Road Infrastructure”

- Bangladesh’s road infrastructure has undergone significant improvement over the past decade, fundamentally enhancing the efficiency, reliability, and overall performance of the trucking sector. Major national highways, expressways, and bridge networks have been expanded or upgraded, enabling faster transit across key industrial and commercial corridors. These improvements have reduced travel times, minimized congestion, and supported the uninterrupted flow of goods—factors that collectively strengthen the country’s trucking-dependent logistics ecosystem.

- One of the most transformative developments has been the strategic modernization of national highways linking major economic hubs such as Dhaka, Chattogram, Khulna, Sylhet, and Rajshahi. As these highways become wider, smoother, and better managed, trucking operators are able to complete more trips within shorter timeframes, helping reduce operational costs and enhance delivery reliability. Such improvements also allow fleet owners to deploy more efficient route planning, increase truck utilization, and manage tighter turnaround cycles, benefiting industries with time-sensitive cargo needs.

- The completion of landmark projects such as the Padma Bridge has dramatically reshaped connectivity between the central and southwestern regions of the country. Previously dependent on lengthy ferry crossings, freight transport through the region now moves with significantly greater ease, enabling faster distribution of agricultural commodities, construction materials, and industrial goods. This improved access has also stimulated investment in new industrial zones, storage facilities, and logistics hubs in these regions, further increasing the demand for trucking services.

- In addition, ongoing construction of expressways, elevated roads, and improved feeder routes is gradually integrating remote districts with major urban markets. The modernization of regional road networks has been particularly beneficial for agro-based industries, allowing farmers and distributors to transport perishables more efficiently to processing centers and urban wholesale markets. With reduced risks of spoilage and faster market access, trucking has become a critical enabler of agricultural trade expansion.

- Government policies have also emphasized the development of economic corridors connecting industrial belts with seaports and land ports. Enhanced connectivity to Chattogram Port, Mongla Port, and the Payra Port development zone has strengthened export-oriented and import-dependent freight flows. As these ports expand capacity and introduce more logistics-friendly infrastructure, trucking operators benefit from smoother cargo-handling operations and improved road-port linkages.

- For instance,In July 2024, the Roads and Highways Department (RHD) reported that upgrades to the Dhaka–Chattogram Highway had reduced average freight transit time by nearly one-third, significantly boosting trucking throughput along the country’s busiest industrial corridor.

- In October 2024, the Ministry of Road Transport and Bridges highlighted that new expressway and regional connectivity projects under the National Integrated Infrastructure Development Plan were designed to support higher cargo mobility and reduce bottlenecks across major trade routes.

- In January 2025, a logistics assessment by the Bangladesh Bridge Authority (BBA) emphasized that the Padma Bridge had increased freight movement by enabling uninterrupted truck access between Dhaka and 21 southwestern districts, directly stimulating trucking demand.

- Bangladesh’s expanding road infrastructure is not only an enabler of smoother transportation—it serves as a strategic driver of national logistics transformation. As travel efficiency improves and industrial hubs become more interconnected, reliance on trucking continues to deepen. These sustained infrastructure advancements firmly position “Expansion of Road Infrastructure” as one of the most influential drivers powering the growth of the Bangladesh trucking market.

Restraint/Challenge

« Mauvais état des routes et embouteillages »

- Le secteur du transport routier au Bangladesh continue de souffrir d'inefficacités opérationnelles dues à des infrastructures routières toujours insuffisantes et à des embouteillages chroniques sur les principaux axes de transport. Si les grands axes et les routes nationales se sont améliorés au fil des ans, une grande partie des routes secondaires et régionales demeurent étroites, accidentées ou mal entretenues. Ces conditions ralentissent considérablement le transport de marchandises, augmentent l'usure des véhicules et accroissent les coûts d'exploitation des transporteurs, ce qui nuit en définitive à la performance logistique globale et à la fiabilité des livraisons.

- Le défi est particulièrement criant dans les centres urbains et périurbains où se concentrent les activités industrielles et commerciales. Des villes comme Dhaka, Gazipur, Chattogram et Narayanganj connaissent fréquemment de graves embouteillages, dus à une forte densité de population, à la largeur limitée des routes et à une circulation mixte mêlant bus, voitures, rickshaws et véhicules non motorisés. Pour les transporteurs routiers, la circulation dans ces zones congestionnées entraîne des temps de transit imprévisibles, des temps d'attente plus longs aux points d'entrée et des retards dans les livraisons, tant à l'arrivée qu'au départ. Ces perturbations augmentent non seulement la consommation de carburant, mais réduisent également la productivité des flottes, ce qui complique le respect des engagements urgents de la chaîne d'approvisionnement pour les entreprises.

- La congestion aux principaux points de passage logistiques aggrave encore le problème. Les points d'accès autour des ports, des zones industrielles et des marchés de gros sont fréquemment congestionnés en raison du nombre limité de places de stationnement, d'une gestion du trafic inadéquate et de la forte concentration de véhicules. Ces retards peuvent allonger considérablement les temps de chargement et de déchargement, affectant ainsi l'efficacité de la chaîne d'approvisionnement des entreprises manufacturières, de distribution et d'exportation. Par conséquent, les transporteurs routiers sont souvent confrontés à une réduction du nombre de trajets quotidiens et à une augmentation de leurs coûts d'exploitation, ce qui se traduit en fin de compte par une hausse des tarifs de transport pour les utilisateurs finaux.

- Malgré les nombreux projets d'infrastructures en cours, l'écart entre la croissance du fret et l'expansion des capacités routières demeure important. Ce déséquilibre exerce une pression constante sur le transport routier, obligeant les entreprises à investir davantage dans la maintenance, les heures supplémentaires des chauffeurs et les itinéraires de secours, autant de facteurs qui réduisent leur rentabilité. Le mauvais état des routes et les embouteillages persistants constituent donc un défi structurel qui freine la modernisation de la logistique et compromet la fiabilité des transports au Bangladesh.

- Par exemple, en janvier 2024, une étude des transports réalisée par le Département d'ingénierie des collectivités locales (LGED) a mis en évidence que près d'un quart des routes régionales nécessitaient des réparations majeures, contribuant à des retards fréquents dans le transport de marchandises et à des coûts d'entretien des véhicules plus élevés pour les transporteurs routiers.

- En septembre 2024, l'Autorité de coordination des transports de Dhaka (DTCA) a signalé que les embouteillages aux heures de pointe à Dhaka et Gazipur avaient augmenté le temps de transit moyen des camions de plus de 40 %, perturbant considérablement les horaires logistiques quotidiens.

- En février 2025, une évaluation logistique réalisée par l'Autorité des transports routiers du Bangladesh (BRTA) a indiqué que l'accès limité des camions et les contraintes de largeur des routes à proximité des zones industrielles continuaient de créer des retards de livraison, réduisant ainsi l'efficacité du fret pendant les périodes de forte demande.

- Les problèmes liés à l'état des routes et aux embouteillages chroniques au Bangladesh constituent des obstacles structurels à l'efficacité du transport de marchandises. Avec l'augmentation des volumes de fret due à l'expansion industrielle et commerciale, ces problèmes continuent de limiter la fiabilité du transport routier, d'accroître les coûts opérationnels et de nuire à la performance logistique globale. Par conséquent, le « mauvais état des routes et les embouteillages » représentent l'un des principaux freins à la croissance et à l'efficacité du marché du transport routier au Bangladesh.

Le marché du camionnage au Bangladesh

Le marché du transport routier au Bangladesh est segmenté en quinze catégories principales selon le type de service, le véhicule, le type de camion, le type de chargement, la transmission, la charge utile, la distance, la propriété, la taille de la flotte, le type de cargaison, le type d'exploitation, le modèle de tarification, l'application, le type de contrat et l'utilisation finale.

- Par type de service

Le marché du transport routier au Bangladesh est segmenté, selon le type de service, en transport ponctuel, distribution multi-points, livraison express, transport intermodal et autres. En 2026, le segment du transport ponctuel devrait dominer ce marché avec une part de marché de 48,81 % et atteindre 25,77 milliards de dollars américains d'ici 2033, avec un taux de croissance annuel composé (TCAC) de 6,4 % sur la période 2026-2033.

- En véhicule

Le marché du transport routier au Bangladesh est segmenté, selon le type de véhicule, en camions commerciaux moyens, camions commerciaux légers et camions commerciaux lourds. En 2026, le segment des camions commerciaux moyens devrait dominer ce marché avec une part de 52,79 % et atteindre 27,78 milliards de dollars américains d'ici 2033, soit une croissance annuelle composée de 6,3 % sur la période 2026-2033.

- Par type de camion

Le marché du transport routier au Bangladesh est segmenté selon le type de camion : camions fourgons, camions-citernes, camions frigorifiques, semi-remorques, camions plateaux, camions à hayon élévateur et autres. En 2026, le segment des camions fourgons devrait dominer ce marché avec une part de 32,33 % et atteindre 17,41 milliards de dollars américains d’ici 2033, soit une croissance annuelle composée de 6,7 % sur la période 2026-2033.

- Par type de charge

Selon le type de chargement, le marché du transport routier au Bangladesh est segmenté en chargement complet (FTL), chargement partiel (LTL) et chargement partiel (PTL). En 2026, le segment du chargement complet (FTL) devrait dominer ce marché avec une part de marché de 56,49 % et atteindre 28,47 milliards de dollars américains d'ici 2033, avec un taux de croissance annuel composé (TCAC) de 5,7 % sur la période 2026-2033.

- Par train de roues

Based on Drive Train, the Bangladesh trucking market is segmented into Diesel, CNG, Electric (BEV), Hybrid, Alt‑Fuel, Others. In 2026, Standard Malt segment is expected to dominate the Bangladesh Trucking Market with 74.18% market share and is expected to reach USD 38.67 billion by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033.

- By Payload

Based on Payload, , the Bangladesh trucking market is segmented into 12–20 tonnes, Above 20 tonnes, 7–12 tonnes, 3–7 tonnes, 1–3 tonnes, Up to 1 tonne. In 2026, 12–20 tonnes segment is expected to dominate the Bangladesh Trucking Market with 25.76% market share and is expected to reach USD 13.98 billion by 2033, growing with the CAGR of 6.8% in the forecast period 2026 to 2033.

- By Distance

Based on Payload, , the Bangladesh trucking market is segmented into 100–200 miles, 200–500 miles, Less than 50 miles, 50–100 miles, More than 500 miles. In 2026, 100–200 miles segment is expected to dominate the Bangladesh Trucking Market with 28.24% market share and is expected to reach USD 15.02 billion by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- By Ownership

Based on Ownership, the Bangladesh trucking market is segmented into Owner-Operators, 3PL Providers, Aggregator Platforms, Captive Fleets, 4PL Providers, Others. In 2026, Owner-Operators segment is expected to dominate the Bangladesh Trucking Market with 45.26% market share and is expected to reach USD 23.56 billion by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033.

- By Fleet Size

Based on fleet size, the Bangladesh trucking market is segmented into Small Fleets, Medium Fleets, Large Fleets. In 2026, Small Fleets segment is expected to dominate the Bangladesh Trucking Market with 52.87% market share and is expected to reach USD 28.11 billion by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- By Cargo Type

Based on Cargo Type, the Bangladesh trucking market is segmented into Containerized, Dry Cargo, Perishables, Bulk Liquids, Bulk Solids, High-Value, Oversized Cargo, Hazardous, Others. In 2026, Containerized segment is expected to dominate the Bangladesh Trucking Market with 39.30% market share and is expected to reach USD 21.01 billion by 2033, growing with the CAGR of 6.6% in the forecast period 2026 to 2033.

- By Operation Type

Based on Operation Type, the Bangladesh trucking market is segmented into Domestic, International. In 2026, Domestic segment is expected to dominate the Bangladesh Trucking Market with 85.64% market share and is expected to reach USD 44.28 billion by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- By Pricing Model

Based on Pricing Model, the Bangladesh trucking market is segmented into Distance-Based, Weight-Based, Trip-Based, Time-Based, Subscription, Others. In 2026, Distance-Based segment is expected to dominate the Bangladesh Trucking Market with 55.10% market share and is expected to reach USD 28.45 billion by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- By Application

Based on Application, the Bangladesh trucking market is segmented into RMGs & Textiles, FMCG, Food & Beverages, Manufacturing, Retail, E-Commerce, Mining, Energy & Utility Oil & Gas, Automotive, Chemicals, Transportation, Healthcare, Electronics, Apparels & Footwear, IT & Telecom, Defense, Others. In 2026, RMGs & Textiles segment is expected to dominate the Bangladesh Trucking Market with 22.27% market share and is expected to reach USD 11.67 billion by 2033, growing with the CAGR of 6.3% in the forecast period 2026 to 2033.

- By Contract Type

Based on Contract Type, the Bangladesh trucking market is segmented into Private Fleet Trucking, For-Hire Trucking, Dedicated Contract Carriage (DCC). In 2026, Private Fleet Trucking segment is expected to dominate the Bangladesh Trucking Market with 52.87% market share and is expected to reach USD 28.09 billion by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033

- By End Use

Based on End Use, the Bangladesh trucking market is segmented into B2B (Business-to-Business), B2C (Business-to-Consumer). In 2026, B2B (Business-to-Business) segment is expected to dominate the Bangladesh Trucking Market with 85.73% market share and is expected to reach USD 28.09 billion by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033

Bangladesh Trucking Market Share

The Bangladesh Trucking Market is primarily led by well-established companies, including:

- DHL (Germany)

- Kuehne+Nagel (Switzerland)

- DSV (Denmark)

- Nippon Express Holdings (Japan)

- Pathao Ltd. (Bangladesh)

- Truck Lagbe (Bangladesh)

- Obhai Solutions Limited (Bangladesh)

- Titas Transport Agency (Bangladesh)

- Loop (Bangladesh)

- Homebound (Bangladesh)

- Reliable Logistics Service (Bangladesh)

- Fleet Freight (Bangladesh)

- A H Khan & Company Limited (Bangladesh)

- Faraji Logistics (Bangladesh)

- WAC Bangladesh Limited (Bangladesh)

Latest Developments in Bangladesh Trucking Market

- In June 2025, DHL has partnered with Daimler Truck and hylane to introduce 30 fully electric Mercedes-Benz eActros 600 trucks under a “transport-as-a-service” model to enhance parcel-center transportation in Germany. The collaboration supports DHL’s sustainability goals by reducing emissions, improving energy efficiency, and integrating advanced electric trucking technology into daily logistics operations. This initiative strengthens DHL’s shift toward greener, more efficient long-haul road transport solutions.

- In May 2025, Kuehne+Nagel has recently entered a lead-logistics provider agreement with Evonik across Asia-Pacific (China, India, Southeast Asia, etc.), managing ~70,000 air, sea, and road shipments annually under an integrated transport-management framework.

- In March 2023, A H Khan & Company Ltd. marked a key milestone in its growth by receiving ISO 9001:2015 and ISO 28000:2007 certifications, formally recognizing its commitment to quality management and secure supply chain operations. The certification ceremony was held at Dhaka Club, reflecting the company’s strengthened focus on operational excellence and global standards. This achievement enhances its credibility in the logistics sector and supports its vision of expanding services with greater reliability, transparency, and international competitiveness.

- In November 2024, Fox Parcel announced a complete solution for Pakistani online sellers to expand their e-commerce business in Bangladesh without needing a local business license. The company offers two main options: direct shipping from Pakistan with customs and delivery handled by Fox Parcel, or cost-effective production in India or China with import, fulfillment, and returns management services in Bangladesh. Additional support includes localized Bengali-speaking customer service, safe storage, professional packing, reliable delivery, cash-on-delivery options, and optional visa guidance for in-person meetings. With end-to-end logistics and fulfillment solutions, Fox Parcel enables online sellers, digital marketing experts, and e-commerce entrepreneurs to access the rapidly growing Bangladeshi market while minimizing costs and operational barriers.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH TRUCKING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 IMPORT & EXPORT DATA

4.2.1 STRATEGIC DEVELOPMENT

4.2.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.2.2.1 CHALLENGES

4.2.2.2 INHOUSE IMPLEMENTATION / OUTSOURCED (THIRD-PARTY) IMPLEMENTATION

4.2.3 CUSTOMER BASE

4.2.4 SERVICE POSITIONING

4.2.5 CUSTOMER FEEDBACK / RATING (B2B)

4.2.6 APPLICATION REACH

4.2.7 SERVICE PLATFORM MATRIX

4.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4 FUTURISTIC SCENARIO (2025–2040)

4.5 LIST OF PROJECTS

4.5.1 MAJOR ROAD & CORRIDOR PROJECTS

4.5.1.1 WESTERN ECONOMIC CORRIDOR & REGIONAL ENHANCEMENT (WECARE)

4.5.1.2 ACCESS PROGRAM (BANGLADESH COMPONENT) – TRADE & TRANSPORT CONNECTIVITY

4.5.1.3 RURAL CONNECTIVITY IMPROVEMENT PROJECT (RCIP)

4.5.1.4 SASEC ROAD CONNECTIVITY PROJECTS

4.5.1.5 RAMPURA–AMULIA–DEMRA (RAD) PPP TOLL ROAD

4.5.2 PORT, ICD, AND LOGISTICS INFRASTRUCTURE PROJECTS

4.5.2.1 BAY TERMINAL / BAY CONTAINER TERMINAL (CHATTOGRAM)

4.5.2.2 PATENGA CONTAINER TERMINAL (PCT)

4.5.2.3 DHIRASRAM INLAND CONTAINER DEPOT (ICD)

4.5.2.4 KHANPUR INLAND CONTAINER TERMINAL (ICT)

4.5.2.5 MULTIMODAL LOGISTICS HUBS – KAMALAPUR & DHAKA AIRPORT AREA

4.5.2.6 HALISHAHAR ICD (CHATTOGRAM)

4.5.2.7 LAND PORT & BORDER LOGISTICS UPGRADES

4.5.3 POLICY & GREEN FREIGHT–RELEVANT PROGRAMS

4.5.3.1 NATIONAL LOGISTICS POLICY INITIATIVES & ROAD MASTER PLANNING

4.5.3.2 GREEN FREIGHT PROGRAMS

4.5.3.3 MUJIB CLIMATE PROSPERITY PLAN – TRANSPORT COMPONENTS

4.5.4 DIGITAL TRUCKING, FREIGHT TECHNOLOGY & MARKET PLATFORMS

4.5.4.1 TRUCK LAGBE

4.5.4.2 OTHER DIGITAL LOGISTICS PLATFORMS

4.6 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.6.1 TECHNOLOGY-DRIVEN OPPORTUNITIES

4.6.1.1 DIGITAL FREIGHT MARKETPLACES (LOAD-MATCHING PLATFORMS)

4.6.1.2 TELEMATICS & FLEET MANAGEMENT SOLUTIONS

4.6.1.3 ELECTRONIC TOLLING, SMART ROUTING & AUTOMATED COMPLIANCE TOOLS

4.7 LOGISTICS SERVICE EXPANSION OPPORTUNITIES

4.7.1 EXPRESS CARGO & TIME-DEFINITE TRUCKING

4.7.1.1 COLD CHAIN TRUCKING (REEFER LOGISTICS)

4.7.1.2 E-COMMERCE MIDDLE-MILE & LAST-MILE HEAVY VEHICLE DISTRIBUTION

4.7.1.3 CONTRACT LOGISTICS FOR RMG & MANUFACTURING SECTOR

4.7.2 FLEET-RELATED & ASSET-BASED OPPORTUNITIES

4.7.2.1 FLEET LEASING & TRUCK-AS-A-SERVICE (TAAS)

4.7.2.2 TRUCK REFURBISHMENT & RE-MANUFACTURING WORKSHOPS

4.7.2.3 MULTI-AXLE HEAVY TRAILER FLEET BUSINESSES

4.7.3 INFRASTRUCTURE & ECOSYSTEM OPPORTUNITIES

4.7.3.1 PRIVATE LOGISTIC PARKS / TRUCK TERMINALS / INLAND CONTAINER DEPOTS (ICDS)

4.7.3.2 ROADSIDE SERVICES & MOBILITY CENTERS

4.7.3.3 GREEN LOGISTICS SERVICES

4.7.4 INDUSTRY-SPECIFIC EMERGING OPPORTUNITIES

4.7.4.1 RETAIL & FMCG DISTRIBUTION NETWORKS OUTSOURCING

4.7.4.2 AGRICULTURE SUPPLY CHAIN MODERNIZATION

4.7.4.3 CONTAINERIZED DOMESTIC FREIGHT

4.7.5 FINANCIAL & ANCILLARY SERVICE OPPORTUNITIES

4.7.5.1 FINTECH-ENABLED TRUCKING FINANCE

4.7.5.2 INSURANCE PRODUCTS FOR TRUCKING

4.7.5.3 DIESEL & FUEL OPTIMIZATION BUSINESS

4.8 PENETRATION AND GROWTH PROSPECT MAPPING

4.9 REGIONAL MARKET OVERVIEW

4.1 TECHNOLOGY ANALYSIS

4.10.1 VEHICLE & POWERTRAIN TECHNOLOGIES

4.10.2 TELEMATICS & FLEET CONNECTIVITY

4.10.3 DRIVER & SAFETY TECHNOLOGIES

4.10.4 DIGITAL FREIGHT & LOGISTICS PLATFORMS

4.10.5 ADJACENT & ECOSYSTEM TECHNOLOGIES

4.10.6 TECHNOLOGY ADOPTION OUTLOOK

4.11 TRUCK FLEET SIZE OF MAJOR PLAYERS

4.12 USED CASES & ITS ANALYSIS

5 TARIFF REVISIONS AND THEIR IMPACT ON THE AUTOMOTIVE INDUSTRY

5.1 TARIFF STRUCTURES

5.1.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

5.1.2 UNITED STATES: AUTOMOTIVE TARIFF POLICIES

5.1.3 BANGLADESH: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

5.1.4 BANGLADESH: GOVERNMENT-IMPOSED TARIFFS ON AUTOMOTIVE COMPONENTS

5.2 IMPACT ON AUTOMAKERS

5.2.1 INCREASED PRODUCTION COSTS

5.2.2 SUPPLY CHAIN DISRUPTIONS

5.2.3 SHIFT IN MANUFACTURING FOOTPRINT

5.2.4 COMPETITIVE DISADVANTAGE

5.2.5 INCREASED INVESTMENT IN DOMESTIC PRODUCTION

5.3 IMPACT ON SUPPLIERS

5.3.1 COST PRESSURES

5.3.2 REDUCED DEMAND

5.3.3 SUPPLY CHAIN VULNERABILITY

5.4 IMPACT ON CONSUMERS

5.4.1 HIGHER VEHICLE PRICE

5.4.2 REDUCED AVAILABILITY OF OPTIONS

5.4.3 INCREASED MAINTENANCE COSTS

5.5 THE FUTURE OF AUTOMOTIVE TRADE

5.5.1 ONGOING TRADE NEGOTIATIONS

5.5.2 TECHNOLOGICAL ADVANCEMENTS

5.5.3 GEOPOLITICAL FACTORS

5.5.4 FOCUS ON DOMESTIC PRODUCTION

6 REGULATORY STANDARDS

6.1 NATIONAL REGULATORY FRAMEWORK

6.1.1 PRIMARY TRANSPORT LAWS & OVERSIGHT

6.1.2 VEHICLE FITNESS & INSPECTION

6.1.3 1DRIVER LICENSING & WORK-TIME RULES

6.1.3.1 ROAD SAFETY & SPEED REGULATIONS

6.1.4 AXLE-LOAD & OVERLOADING CONTROL

6.1.5 MANDATORY MOTOR INSURANCE

6.2 ENVIRONMENTAL & EMISSION STANDARDS

6.2.1 VEHICLE EMISSION RULES

6.2.2 FUEL QUALITY MEASURES

6.3 DANGEROUS GOODS & SPECIAL CARGO

6.3.1 HAZARDOUS GOODS TRANSPORT

6.3.2 OVERSIZE / OVERWEIGHT CARGO

6.4 TRADE & CROSS-BORDER TRUCKING REGULATIONS

6.4.1 CUSTOMS & TRANSIT REQUIREMENTS

6.4.2 ELECTRONIC DOCUMENTATION

6.5 INDUSTRY COMPLIANCE SYSTEM

6.6 LABOUR & OCCUPATIONAL SAFETY

6.7 REGULATORY GAPS & MARKET IMPLICATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION

7.1.2 EXPANSION OF ROAD INFRASTRUCTURE

7.1.3 E-COMMERCE & RETAIL GROWTH

7.2 RESTRAINTS

7.2.1 POOR ROAD CONDITIONS & TRAFFIC CONGESTION

7.2.2 FRAGMENTED & UNORGANIZED TRUCKING SECTOR

7.3 OPPORTUNITIES

7.3.1 FLEET MODERNIZATION & TELEMATICS ADOPTION

7.3.2 CROSS-BORDER TRADE EXPANSION

7.3.3 GROWTH IN SPECIALIZED & COLD-CHAIN LOGISTICS

7.4 CHALLENGES

7.4.1 REGULATORY UNCERTAINTY & COMPLIANCE ISSUES

7.4.2 SAFETY RISKS & HIGH ACCIDENT RATES

8 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE.

8.1 OVERVIEW

8.2 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

8.3 SPOT HAULAGE

8.4 MULTI-DROP DISTRIBUTION

8.5 EXPEDITED DELIVERY

8.6 INTERMODAL FEEDER

8.7 OTHERS

9 BANGLADESH TRUCKING MARKET, BY VEHICLE

9.1 OVERVIEW

9.2 BANGLADESH TRUCKING MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

9.3 MEDIUM-DUTY COMMERCIAL TRUCKS

9.4 LIGHT-DUTY COMMERCIAL TRUCKS

9.5 HEAVY-DUTY COMMERCIAL TRUCKS

10 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE.

10.1 OVERVIEW

10.2 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

10.3 BOX TRUCKS

10.4 TANKER TRUCKS

10.5 REFRIGERATED TRUCKS

10.6 SEMI-TRAILER TRUCKS

10.7 FLATBEDS TRUCK

10.8 LIFTGATE TRUCKS

10.9 OTHERS

10.1 BANGLADESH BOX TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.10.1 LAST-MILE DELIVERIES (E-COMMERCE)

10.10.2 FOOD DELIVERY

10.10.3 HOME APPLIANCES & FURNITURE

10.10.4 OTHERS

10.11 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 LIQUID TANKERS

10.11.2 DRY BULK TANKERS

10.12 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.12.1 FUEL

10.12.2 CHEMICALS

10.12.3 MILK

10.12.4 JUICES

10.12.5 OTHERS

10.13 BANGLADESH FUEL IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 DIESEL

10.13.2 PETROL

10.13.3 GASES (LPG/PROPANE/BUTANE/N₂/O₂/HE)

10.14 BANGLADESH GASES IN TRUCKING, BY TYPE, 2018-2033 (USD THOUSAND)

10.14.1 LPG

10.14.2 PROPANE

10.14.3 LIQUEFIED BUTANE

10.14.4 NITROGEN

10.14.5 OXYGEN

10.14.6 HELIUM

10.15 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY PRESSURIZATION, 2018-2033 (USD THOUSAND)

10.15.1 NON-PRESSURIZED

10.15.2 PRESSURIZED

10.16 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY REFRIGERATION, 2018-2033 (USD THOUSAND)

10.16.1 NON-REFRIGERATED

10.16.2 REFRIGERATED

10.17 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY INSULATION, 2018-2033 (USD THOUSAND)

10.17.1 NON-INSULATED

10.17.2 INSULATED

10.18 BANGLADESH REFRIGERATED TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.18.1 FOOD

10.18.2 PERISHABLE GOODS

10.18.3 MEDICAL SUPPLIES

10.18.4 BEVERAGES

10.18.5 OTHERS

10.19 BANGLADESH PERISHABLE GOODS IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 MEAT

10.19.2 FRUITS

10.19.3 VEGETABLES

10.19.4 SEAFOOD

10.19.5 OTHERS

10.2 BANGLADESH MEDICAL SUPPLIES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.20.1 PHARMACEUTICALS

10.20.2 VACCINES

10.20.3 BLOOD BANKS

10.20.4 OTHERS

10.21 BANGLADESH BEVERAGES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 CARBONATED BEVERAGES

10.21.2 JUICE-BASED

10.21.3 SPORTS & ENERGY DRINKS

10.21.4 TEA

10.21.5 COFFEE

10.21.6 OTHERS

10.22 BANGLADESH FLATBEDS TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.22.1 CONSTRUCTION MATERIALS

10.22.2 MACHINERY

10.22.3 SCRAP METAL

10.22.4 CARS

10.22.5 OTHER RECYCLABLES

11 BANGLADESH TRUCKING MARKET, BY LOAD TYPE.

11.1 OVERVIEW

11.2 BANGLADESH TRUCKING MARKET, BY LOAD TYPE, 2018-2033 (USD THOUSAND)

11.3 FULL TRUCKLOAD (FTL)

11.4 LESS‑THAN‑TRUCKLOAD (LTL)

11.5 PARTIAL TRUCKLOAD (PTL)

12 BANGLADESH TRUCKING MARKET, BY DRIVE TRAIN.

12.1 OVERVIEW

12.2 BANGLADESH TRUCKING MARKET, BY DRIVE TRAIN, 2018-2033 (USD THOUSAND)

12.3 DIESEL

12.4 CNG

12.5 ELECTRIC (BEV)

12.6 HYBRID

12.7 ALT‑FUEL

12.8 OTHERS

13 BANGLADESH TRUCKING MARKET, BY PAYLOAD.

13.1 OVERVIEW

13.2 BANGLADESH TRUCKING MARKET, BY PAYLOAD, 2018-2033 (USD THOUSAND)

13.3 12–20 TONNES

13.4 ABOVE 20 TONNES

13.5 7–12 TONNES

13.6 3–7 TONNES

13.7 1–3 TONNES

13.8 UP TO 1 TONNE

14 BANGLADESH TRUCKING MARKET, BY DISTANCE.

14.1 OVERVIEW

14.2 BANGLADESH TRUCKING MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

14.3 100–200 MILES

14.4 200–500 MILES

14.5 LESS THAN 50 MILES

14.6 50–100 MILES

14.7 MORE THAN 500 MILES

15 BANGLADESH TRUCKING MARKET, BY OWNERSHIP.

15.1 OVERVIEW

15.2 BANGLADESH TRUCKING MARKET, BY OWNERSHIP, 2018-2033 (USD THOUSAND)

15.3 OWNER-OPERATORS

15.4 3PL PROVIDERS

15.5 AGGREGATOR PLATFORMS

15.6 CAPTIVE FLEETS

15.7 4PL PROVIDERS

15.8 OTHERS

16 BANGLADESH TRUCKING MARKET, BY FLEET SIZE.

16.1 OVERVIEW

16.2 BANGLADESH TRUCKING MARKET, BY FLEET SIZE, 2018-2033 (USD THOUSAND)

16.3 SMALL FLEETS

16.4 MEDIUM FLEETS

16.5 LARGE FLEETS

17 BANGLADESH TRUCKING MARKET, BY CARGO TYPE.

17.1 OVERVIEW

17.2 BANGLADESH TRUCKING MARKET, BY CARGO TYPE, 2018-2033 (USD THOUSAND)

17.3 CONTAINERIZED

17.4 DRY CARGO

17.5 PERISHABLES

17.6 BULK LIQUIDS

17.7 BULK SOLIDS

17.8 HIGH-VALUE

17.9 OVERSIZED CARGO

17.1 HAZARDOUS

17.11 OTHERS

18 BANGLADESH READY MADE GARMENTS MARKET, BY OPERATION TYPE.

18.1 OVERVIEW

18.2 BANGLADESH TRUCKING MARKET, BY OPERATION TYPE, 2018-2033 (USD THOUSAND)

18.3 DOMESTIC

18.4 INTERNATIONAL

19 BANGLADESH TRUCKING MARKET, BY PRICING MODEL.

19.1 OVERVIEW

19.2 BANGLADESH TRUCKING MARKET, BY PRICING MODEL, 2018-2033 (USD THOUSAND)

19.3 DISTANCE-BASED

19.4 WEIGHT-BASED

19.5 TRIP-BASED

19.6 TIME-BASED

19.7 SUBSCRIPTION

19.8 OTHERS

20 BANGLADESH TRUCKING MARKET, BY APPLICATION.

20.1 OVERVIEW

20.2 BANGLADESH TRUCKING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

20.3 RMGS & TEXTILES

20.4 FMCG

20.5 FOOD & BEVERAGES

20.6 MANUFACTURING

20.7 RETAIL

20.8 E-COMMERCE

20.9 MINING, ENERGY & UTILITY

20.1 OIL & GAS

20.11 AUTOMOTIVE

20.12 CHEMICALS

20.13 TRANSPORTATION

20.14 HEALTHCARE

20.15 ELECTRONICS

20.16 APPARELS & FOOTWEAR

20.17 IT & TELECOM

20.18 DEFENSE

20.19 OTHERS

20.2 BANGLADESH RMGS & TEXTILES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.20.1 SPOT HAULAGE

20.20.2 MULTI-DROP DISTRIBUTION

20.20.3 EXPEDITED DELIVERY

20.20.4 INTERMODAL FEEDER

20.20.5 OTHERS

20.21 BANGLADESH FMCG IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.21.1 SPOT HAULAGE

20.21.2 MULTI-DROP DISTRIBUTION

20.21.3 EXPEDITED DELIVERY

20.21.4 INTERMODAL FEEDER

20.21.5 OTHERS

20.22 BANGLADESH FOOD & BEVERAGES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.22.1 SPOT HAULAGE

20.22.2 MULTI-DROP DISTRIBUTION

20.22.3 EXPEDITED DELIVERY

20.22.4 INTERMODAL FEEDER

20.22.5 OTHERS

20.23 BANGLADESH MANUFACTURING IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.23.1 SPOT HAULAGE

20.23.2 MULTI-DROP DISTRIBUTION

20.23.3 EXPEDITED DELIVERY

20.23.4 INTERMODAL FEEDER

20.23.5 OTHERS

20.24 BANGLADESH RETAIL IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.24.1 SPOT HAULAGE

20.24.2 MULTI-DROP DISTRIBUTION

20.24.3 EXPEDITED DELIVERY

20.24.4 INTERMODAL FEEDER

20.24.5 OTHERS

20.25 BANGLADESH E-COMMERCE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.25.1 SPOT HAULAGE

20.25.2 MULTI-DROP DISTRIBUTION

20.25.3 EXPEDITED DELIVERY

20.25.4 INTERMODAL FEEDER

20.25.5 OTHERS

20.26 BANGLADESH MINING, ENERGY & UTILITY IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.26.1 SPOT HAULAGE

20.26.2 MULTI-DROP DISTRIBUTION

20.26.3 EXPEDITED DELIVERY

20.26.4 INTERMODAL FEEDER

20.26.5 OTHERS

20.27 BANGLADESH OIL & GAS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.27.1 SPOT HAULAGE

20.27.2 MULTI-DROP DISTRIBUTION

20.27.3 EXPEDITED DELIVERY

20.27.4 INTERMODAL FEEDER

20.27.5 OTHERS

20.28 BANGLADESH AUTOMOTIVE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.28.1 SPOT HAULAGE

20.28.2 MULTI-DROP DISTRIBUTION

20.28.3 EXPEDITED DELIVERY

20.28.4 INTERMODAL FEEDER

20.28.5 OTHERS

20.29 BANGLADESH CHEMICALS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.29.1 SPOT HAULAGE

20.29.2 MULTI-DROP DISTRIBUTION

20.29.3 EXPEDITED DELIVERY

20.29.4 INTERMODAL FEEDER

20.29.5 OTHERS

20.3 BANGLADESH TRANSPORTATION IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.30.1 SPOT HAULAGE

20.30.2 MULTI-DROP DISTRIBUTION

20.30.3 EXPEDITED DELIVERY

20.30.4 INTERMODAL FEEDER

20.30.5 OTHERS

20.31 BANGLADESH HEALTHCARE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.31.1 SPOT HAULAGE

20.31.2 MULTI-DROP DISTRIBUTION

20.31.3 EXPEDITED DELIVERY

20.31.4 INTERMODAL FEEDER

20.31.5 OTHERS

20.32 BANGLADESH ELECTRONICS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.32.1 SPOT HAULAGE

20.32.2 MULTI-DROP DISTRIBUTION

20.32.3 EXPEDITED DELIVERY

20.32.4 INTERMODAL FEEDER

20.32.5 OTHERS

20.33 BANGLADESH APPARELS & FOOTWEAR IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.33.1 SPOT HAULAGE

20.33.2 MULTI-DROP DISTRIBUTION

20.33.3 EXPEDITED DELIVERY

20.33.4 INTERMODAL FEEDER

20.33.5 OTHERS

20.34 BANGLADESH IT & TELECOM IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.34.1 SPOT HAULAGE

20.34.2 MULTI-DROP DISTRIBUTION

20.34.3 EXPEDITED DELIVERY

20.34.4 INTERMODAL FEEDER

20.34.5 OTHERS

20.35 BANGLADESH DEFENSE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.35.1 SPOT HAULAGE

20.35.2 MULTI-DROP DISTRIBUTION

20.35.3 EXPEDITED DELIVERY

20.35.4 INTERMODAL FEEDER

20.35.5 OTHERS

21 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE.

21.1 OVERVIEW

21.2 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE, 2018-2033 (USD THOUSAND)

21.3 PRIVATE FLEET TRUCKING

21.4 FOR-HIRE TRUCKING

21.5 DEDICATED CONTRACT CARRIAGE (DCC)

22 BANGLADESH TRUCKING MARKET, BY END USE.

22.1 OVERVIEW

22.2 BANGLADESH TRUCKING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

22.3 B2B (BUSINESS-TO-BUSINESS)

22.4 B2C (BUSINESS-TO-CONSUMER)

23 BANGLADESH TRUCKING MARKET: COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: BANGLADESH

24 SWOT ANALYSIS

25 COMPANY PROFILE

25.1 DHL

25.1.1 COMPANY SNAPSHOT

25.1.2 REVENUE ANALYSIS

25.1.3 PRODUCT PORTFOLIO

25.1.4 RECENT DEVELOPMENT

25.2 KUEHNE+NAGEL

25.2.1 COMPANY SNAPSHOT

25.2.2 REVENUE ANALYSIS

25.2.3 PRODUCT PORTFOLIO

25.2.4 RECENT DEVELOPMENT

25.3 DSV

25.3.1 COMPANY SNAPSHOT

25.3.2 PRODUCT PORTFOLIO

25.3.3 RECENT DEVELOPMENT

25.4 NIPPON EXPRESS HOLDINGS

25.4.1 COMPANY SNAPSHOT

25.4.2 REVENUE ANALYSIS

25.4.3 PRODUCT PORTFOLIO

25.4.4 RECENT DEVELOPMENT

25.5 PATHAO LTD

25.5.1 COMPANY SNAPSHOT

25.5.2 PRODUCT PORTFOLIO

25.5.3 RECENT DEVELOPMENT

25.6 2C SHIPPING

25.6.1 COMPANY SNAPSHOT

25.6.2 PRODUCT PORTFOLIO

25.6.3 RECENT DEVELOPMENTS

25.7 3I LOGISTICS PVT. LTD.

25.7.1 COMPANY SNAPSHOT

25.7.2 PRODUCT PORTFOLIO

25.7.3 RECENT DEVELOPMENT

25.8 A H KHAN & COMPANY LIMITED

25.8.1 COMPANY SNAPSHOT

25.8.2 PRODUCT PORTFOLIO

25.8.3 RECENT DEVELOPMENTS

25.9 ABC FREIGHT FORWARDING & SHIPPING LTD.

25.9.1 COMPANY SNAPSHOT

25.9.2 PRODUCT PORTFOLIO

25.9.3 RECENT DEVELOPMENTS

25.1 AGILITY GLOBAL.

25.10.1 COMPANY SNAPSHOT

25.10.2 PRODUCT PORTFOLIO

25.10.3 RECENT DEVELOPMENT

25.11 AN EJOGAJOG LIMITED SERVICE.

25.11.1 COMPANY SNAPSHOT

25.11.2 PRODUCT PORTFOLIO

25.11.3 RECENT DEVELOPMENT

25.12 APT MERCHANT SHIPPING LINE LTD.

25.12.1 COMPANY SNAPSHOT

25.12.2 PRODUCT PORTFOLIO

25.12.3 RECENT DEVELOPMENTS

25.13 ATLAS LOGISTICS LTD (ATLAS LOGISTICS BANGLADESH(PVT). LTD)

25.13.1 COMPANY SNAPSHOT

25.13.2 PRODUCT PORTFOLIO

25.13.3 RECENT DEVELOPMENT

25.14 CEVA LOGISTICS

25.14.1 COMPANY SNAPSHOT

25.14.2 PRODUCT PORTFOLIO

25.14.3 RECENT DEVELOPMENT

25.15 COSMOS LOGISTICS

25.15.1 COMPANY SNAPSHOT

25.15.2 PRODUCT PORTFOLIO

25.15.3 RECENT DEVELOPMENT

25.16 CROWN LOGISTICS LTD.

25.16.1 COMPANY SNAPSHOT

25.16.2 PRODUCT PORTFOLIO

25.16.3 RECENT DEVELOPMENT

25.17 EUR SERVICE (BD) LTD.

25.17.1 COMPANY SNAPSHOT

25.17.2 PRODUCT PORTFOLIO

25.17.3 RECENT DEVELOPMENTS

25.18 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.

25.18.1 COMPANY SNAPSHOT

25.18.2 REVENUE ANALYSIS

25.18.3 PRODUCT PORTFOLIO

25.18.4 RECENT DEVELOPMENT

25.19 FARAJI LOGISTICS

25.19.1 COMPANY SNAPSHOT

25.19.2 PRODUCT PORTFOLIO

25.19.3 RECENT DEVELOPMENT

25.2 FAREAST LOGISTICS BD LTD

25.20.1 COMPANY SNAPSHOT

25.20.2 PRODUCT PORTFOLIO

25.20.3 RECENT DEVELOPMENT

25.21 FLEET FREIGHT

25.21.1 COMPANY SNAPSHOT

25.21.2 PRODUCT PORTFOLIO

25.21.3 RECENT DEVELOPMENT

25.22 FOX PARCEL

25.22.1 COMPANY SNAPSHOT

25.22.2 PRODUCT PORTFOLIO

25.22.3 RECENT DEVELOPMENT

25.23 FREIGHT OPTIONS LTD

25.23.1 COMPANY SNAPSHOT

25.23.2 PRODUCT PORTFOLIO

25.23.3 RECENT DEVELOPMENT

25.24 GEODIS

25.24.1 COMPANY SNAPSHOT

25.24.2 PRODUCT PORTFOLIO

25.24.3 RECENT DEVELOPMENT

25.25 HOMEBOUND

25.25.1 COMPANY SNAPSHOT

25.25.2 PRODUCT PORTFOLIO

25.25.3 RECENT DEVELOPMENT

25.26 KM GROUP

25.26.1 COMPANY SNAPSHOT

25.26.2 PRODUCT PORTFOLIO

25.26.3 RECENT DEVELOPMENTS

25.27 LOOP.

25.27.1 COMPANY SNAPSHOT

25.27.2 PRODUCT PORTFOLIO

25.27.3 RECENT DEVELOPMENT

25.28 M&M TRANSPORT AGENCY

25.28.1 COMPANY SNAPSHOT

25.28.2 PRODUCT PORTFOLIO

25.28.3 RECENT DEVELOPMENT

25.29 M/S. JAMUNA TRANSPORT AGENCY

25.29.1 COMPANY SNAPSHOT

25.29.2 PRODUCT PORTFOLIO

25.29.3 RECENT DEVELOPMENT

25.3 NATIONAL CARRIERS CORPORATION

25.30.1 COMPANY SNAPSHOT

25.30.2 PRODUCT PORTFOLIO

25.30.3 RECENT DEVELOPMENT

25.31 NAVANA LOGISTICS LTD

25.31.1 COMPANY SNAPSHOT

25.31.2 PRODUCT PORTFOLIO

25.31.3 RECENT DEVELOPMENT

25.32 OBHAI SOLUTIONS LIMITED

25.32.1 COMPANY SNAPSHOT

25.32.2 PRODUCT PORTFOLIO

25.32.3 RECENT DEVELOPMENT

25.33 ORIENT OVERSEAS CONTAINER LINE LIMITED

25.33.1 COMPANY SNAPSHOT

25.33.2 REVENUE ANALYSIS

25.33.3 PRODUCT PORTFOLIO

25.33.4 RECENT DEVELOPMENT

25.34 RELIABLE LOGISTICS SERVICE

25.34.1 COMPANY SNAPSHOT

25.34.2 PRODUCT PORTFOLIO

25.34.3 RECENT DEVELOPMENT

25.35 RK FREIGHT LTD

25.35.1 COMPANY SNAPSHOT

25.35.2 PRODUCT PORTFOLIO

25.35.3 RECENT DEVELOPMENT

25.36 SCAN GLOBAL LOGISTICS

25.36.1 COMPANY SNAPSHOT

25.36.2 PRODUCT PORTFOLIO

25.36.3 RECENT DEVELOPMENT

25.37 SEKO LOGISTICS

25.37.1 COMPANY SNAPSHOT

25.37.2 PRODUCT PORTFOLIO

25.37.3 RECENT DEVELOPMENT

25.38 SINOBEN GROUP

25.38.1 COMPANY SNAPSHOT

25.38.2 PRODUCT PORTFOLIO

25.38.3 RECENT DEVELOPMENT

25.39 SOFTECH (NISSHIN TRANS CONSOLIDATOR BD LTD)

25.39.1 COMPANY SNAPSHOT

25.39.2 PRODUCT PORTFOLIO

25.39.3 RECENT DEVELOPMENT

25.4 SUMMIT ALLIANCE PORT LIMITED

25.40.1 COMPANY SNAPSHOT

25.40.2 REVENUE ANALYSIS

25.40.3 PRODUCT PORTFOLIO

25.40.4 RECENT DEVELOPMENT

25.41 TITAS TRANSPORT AGENCY

25.41.1 COMPANY SNAPSHOT

25.41.2 PRODUCT PORTFOLIO

25.41.3 RECENT DEVELOPMENTS

25.42 TLI (TRANSPORTATION LOGISTICS INT'L BANGLADESH LTD.)

25.42.1 COMPANY SNAPSHOT

25.42.2 PRODUCT PORTFOLIO

25.42.3 RECENT DEVELOPMENT

25.43 TOWER FREIGHT LOGISTICS LIMITED.

25.43.1 COMPANY SNAPSHOT

25.43.2 PRODUCT PORTFOLIO

25.43.3 RECENT DEVELOPMENT

25.44 TRANSWORLD SHIPPING LIMITED

25.44.1 COMPANY SNAPSHOT

25.44.2 PRODUCT PORTFOLIO

25.44.3 RECENT DEVELOPMENT

25.45 TRUCK LAGBE LIMITED

25.45.1 COMPANY SNAPSHOT

25.45.2 PRODUCT PORTFOLIO

25.45.3 RECENT DEVELOPMENTS

25.46 URANUS FREIGHT LOGISTICS LTD

25.46.1 COMPANY SNAPSHOT

25.46.2 PRODUCT PORTFOLIO

25.46.3 RECENT DEVELOPMENTS

25.47 VISCO LOGISTICS BANGLADESH LTD

25.47.1 COMPANY SNAPSHOT

25.47.2 PRODUCT PORTFOLIO

25.47.3 RECENT DEVELOPMENT

25.48 WAC BANGLADESH LIMITED

25.48.1 COMPANY SNAPSHOT

25.48.2 PRODUCT PORTFOLIO

25.48.3 RECENT DEVELOPMENT

25.49 YUSEN LOGISTICS GLOBAL MANAGEMENT CO., LTD.

25.49.1 COMPANY SNAPSHOT

25.49.2 PRODUCT PORTFOLIO

25.49.3 RECENT DEVELOPMENT

26 QUESTIONNAIRE

27 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 COMPANY SERVICE PLATFORM MATRIX

TABLE 3 TRUCK/FLEET SIZE OF MAJOR PLAYERS

TABLE 4 USED CASE ANALYSIS

TABLE 5 GLOBAL VS REGIONAL TARIFF STRUCTURES

TABLE 6 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH TRUCKING MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH BOX TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH FUEL IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH GASES IN TRUCKING, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY PRESSURIZATION, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY REFRIGERATION, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY INSULATION, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH REFRIGERATED TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH PERISHABLE GOODS IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH MEDICAL SUPPLIES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH BEVERAGES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH FLATBEDS TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH TRUCKING MARKET, BY LOAD TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 BANGLADESH TRUCKING MARKET, BY DRIVE TRAIN, 2018-2033 (USD THOUSAND)

TABLE 24 BANGLADESH TRUCKING MARKET, BY PAYLOAD, 2018-2033 (USD THOUSAND)

TABLE 25 BANGLADESH TRUCKING MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

TABLE 26 BANGLADESH TRUCKING MARKET, BY OWNERSHIP, 2018-2033 (USD THOUSAND)

TABLE 27 BANGLADESH TRUCKING MARKET, BY FLEET SIZE, 2018-2033 (USD THOUSAND)

TABLE 28 BANGLADESH TRUCKING MARKET, BY CARGO TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 BANGLADESH TRUCKING MARKET, BY OPERATION TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 BANGLADESH TRUCKING MARKET, BY PRICING MODEL, 2018-2033 (USD THOUSAND)

TABLE 31 BANGLADESH TRUCKING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 32 BANGLADESH RMGS & TEXTILES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 BANGLADESH FMCG IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 BANGLADESH FOOD & BEVERAGES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 BANGLADESH MANUFACTURING IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 BANGLADESH RETAIL IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 BANGLADESH E-COMMERCE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 BANGLADESH MINING, ENERGY & UTILITY IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 BANGLADESH OIL & GAS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 BANGLADESH AUTOMOTIVE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 BANGLADESH CHEMICALS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 BANGLADESH TRANSPORTATION IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 BANGLADESH HEALTHCARE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 BANGLADESH ELECTRONICS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 BANGLADESH APPARELS & FOOTWEAR IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 BANGLADESH IT & TELECOM IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 BANGLADESH DEFENSE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 BANGLADESH TRUCKING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 BANGLADESH TRUCKING MARKET: SEGMENTATION

FIGURE 2 BANGLADESH TRUCKING MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH TRUCKING MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH TRUCKING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 BANGLADESH TRUCKING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH TRUCKING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH TRUCKING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH TRUCKING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 BANGLADESH TRUCKING MARKET: MULTIVARIATE MODELING

FIGURE 10 BANGLADESH TRUCKING MARKET: SERVICE TYPE TIMELINE CURVE

FIGURE 11 BANGLADESH TRUCKING MARKET: END-USER COVERAGE GRID

FIGURE 12 BANGLADESH TRUCKING MARKET: SEGMENTATION

FIGURE 13 FIVE SEGMENTS COMPRISE THE BANGLADESH TRUCKING MARKET, BY SERVICE TYPE (2025)

FIGURE 14 BANGLADESH TRUCKING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION IS EXPECTED TO DRIVE THE BANGLADESH TRUCKING MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 SPOT HAULAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH TRUCKING MARKET IN 2026 & 2033

FIGURE 18 DROC

FIGURE 19 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE, 2025

FIGURE 20 BANGLADESH TRUCKING MARKET, BY VEHICLE, 2025

FIGURE 21 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE, 2025

FIGURE 22 BANGLADESH TRUCKING MARKET, BY LOAD TYPE, 2025

FIGURE 23 BANGLADESH TRUCKING MARKET, BY DIESEL, 2025

FIGURE 24 BANGLADESH TRUCKING MARKET, BY PAYLOAD, 2025

FIGURE 25 BANGLADESH TRUCKING MARKET, BY DISTANCE, 2025

FIGURE 26 BANGLADESH TRUCKING MARKET, BY OWNERSHIP, 2025

FIGURE 27 BANGLADESH TRUCKING MARKET, BY FLEET SIZE, 2025

FIGURE 28 BANGLADESH TRUCKING MARKET, BY CARGO TYPE, 2025

FIGURE 29 BANGLADESH READY-MADE GARMENTS MARKET, BY OPERATION TYPE, 2025

FIGURE 30 BANGLADESH TRUCKING MARKET, BY PRICING MODEL, 2025

FIGURE 31 BANGLADESH TRUCKING MARKET, BY APPLICATION, 2025

FIGURE 32 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE, 2025

FIGURE 33 BANGLADESH TRUCKING MARKET, BY END USE, 2025

FIGURE 34 BANGLADESH TRUCKING MARKET: COMPANY SHARE 2025 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.