Europe Aluminium Wire Rod Market

Taille du marché en milliards USD

TCAC :

%

USD

18.62 Billion

USD

33.57 Billion

2024

2035

USD

18.62 Billion

USD

33.57 Billion

2024

2035

| 2025 –2035 | |

| USD 18.62 Billion | |

| USD 33.57 Billion | |

|

|

|

|

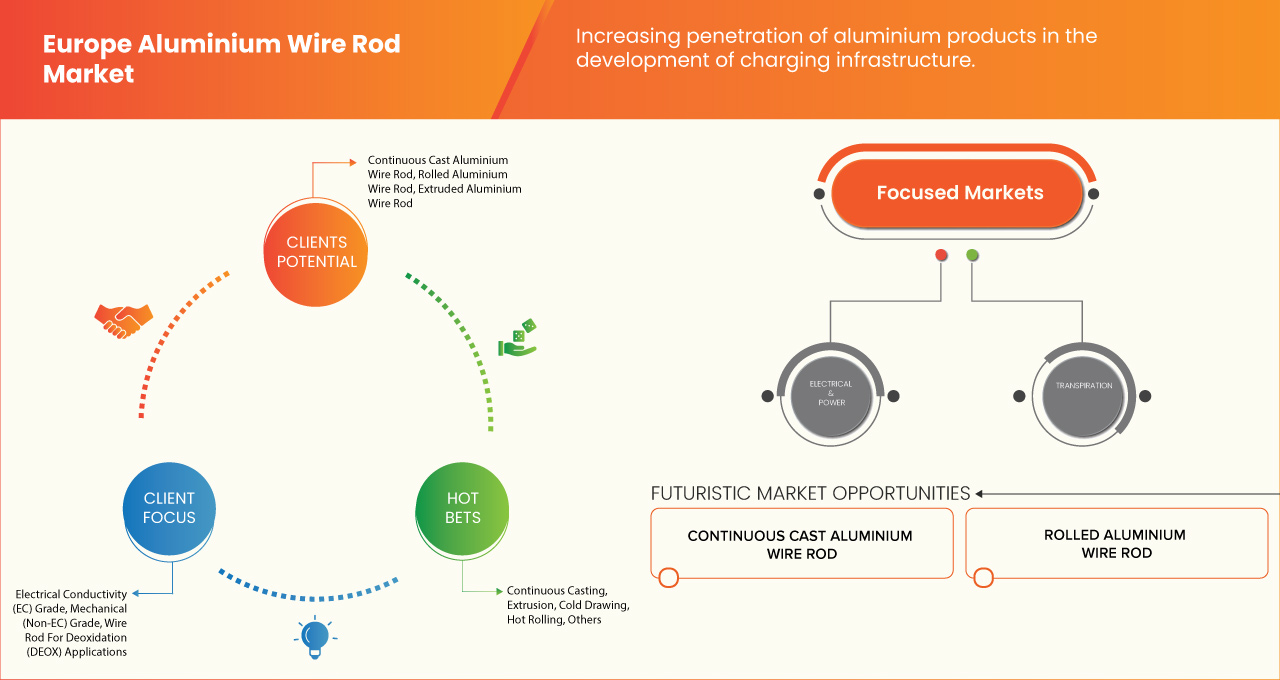

Europe Aluminum Wire Rod Market By Product Type (Continuous Cast Aluminium Wire Rod, Rolled Aluminium Wire Rod, Extruded Aluminium Wire Rod), By Grade (Electrical Conductivity (EC) Grade, Mechanical (Non-EC) Grade, Wire Rod For Deoxidation (DEOX) Applications), By Diameter (Below 9.5 Mm, 5 Mm - 12 Mm, Above 12 Mm), By Processing (Continuous Casting, Extrusion, Cold Drawing, Hot Rolling, Others), By Application (Electrical & Power, Industrial & Manufacturing, Transportation, Others), By End-Use (Energy & Utilities, Telecommunications, Automotive, Aerospace & Defense, Building & Construction, Industrial Machinery & Equipment, Others) – Industry Trends and Forecast to 2035

Aluminum Wire Rod Market Analysis

The aluminum wire rod market is driven by rising demand in power transmission, automotive, and construction industries. With increasing investments in renewable energy and grid expansion, the need for efficient electrical conductors boosts market growth. Asia-Pacific, led by China and India, dominates due to industrialization and infrastructure development. Key players focus on lightweight, high-conductivity alloys to enhance performance. However, fluctuating aluminum prices and supply chain disruptions pose challenges. The market is expected to grow steadily, supported by technological advancements and the global shift towards energy-efficient solutions.

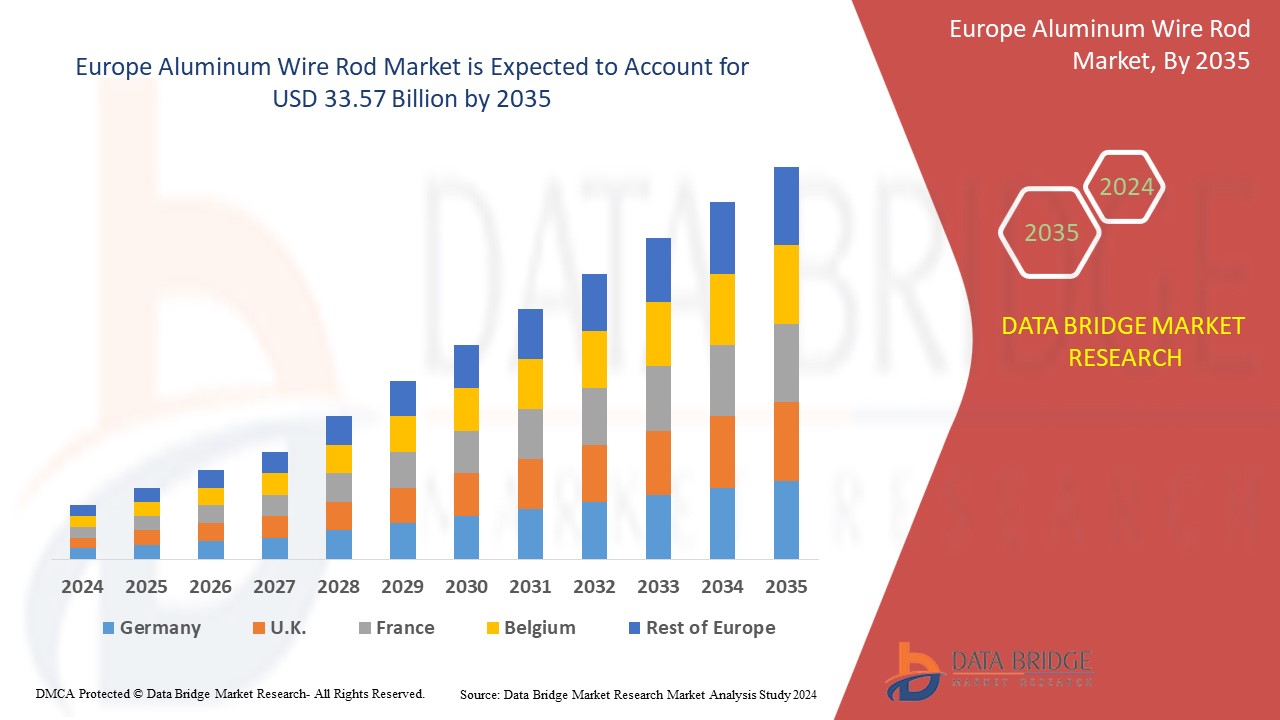

Aluminum Wire Rod Market Size

The Europe Aluminum Wire Rod Market is expected to reach USD 33.57 billion by 2035 from USD 18.62 billion in 2024, growing with a substantial CAGR of 5.6% in the forecast period of 2025 to 2035. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Aluminum Wire Rod Market Trends

The aluminum wire rod market is witnessing key trends, including increasing demand for lightweight and high-conductivity materials in power transmission and automotive industries. The shift towards renewable energy and smart grids is driving growth, along with expanding urban infrastructure projects. Recycling and sustainability initiatives are gaining traction as companies focus on eco-friendly production. Technological advancements in high-strength aluminum alloys improve efficiency and durability. However, market fluctuations due to raw material price volatility and supply chain disruptions remain challenges. Overall, the industry is moving towards innovation and sustainable growth.

Report Scope and Aluminum Wire Rod Market Segmentation

|

Attributes |

Aluminum Wire Rod Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

France, Germany, Italy, U.K., Spain, Russia, Netherlands, Poland, Belgium, Switzerland, Denmark, Norway, Sweden, Turkey, Rest of Europe |

|

Key Market Players |

Hindalco Industries Ltd. (India), Norsk Hydro ASA (Norway), Alcoa Corporation (United States), TRIMET Aluminium SE (Germany), RusAL (Russia), Hellenic Cables (Greece), Vimetco NV (Netherlands), Scepter Inc (United States), Lamifil (Belgium), JSC “Zvetlit” (Belarus), Esal Rod Alloys, S.A. (Spain), NPA Skawina (Poland), Emta Cable (Turkey)and among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminum Wire Rod Market Definition

Aluminum wire rod is a semi-finished product made from aluminum and its alloys, used primarily in electrical, automotive, and construction industries. Produced through continuous casting and rolling or extrusion, it serves as a key material for manufacturing electrical cables, conductors, and welding wires. Its lightweight, high conductivity, and corrosion resistance make it ideal for power transmission and distribution applications. Aluminum wire rods come in various grades to meet industry standards, ensuring durability and efficiency. Growing demand for energy-efficient solutions and renewable power grids continues to drive market growth.

Aluminum Wire Rod Market Dynamics

Drivers

GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS

Overhead conductors are a physical medium to carry electrical energy from one end to another end of conductors, which are good conductors of heat—the important components of overhead conductors and underground electrical transmission and distribution systems. The conductor used in power cables is selected based on the different types and sizes of conductors available. The ideal conductor offers features such as maximum electrical conductivity, high tensile strength, and can withstand mechanical stresses. It has the least specific gravity and is easily available at a low cost.

Power cables have aluminium rod connectors attached for various features that any conductor offers, such as a larger diameter for current flow, which reduces corona, less conductivity, lesser tensile strength, and lower tensile strength than other metals such as copper. Hence, due to various features depicted by the aluminium metal, the metals are in high demand for power cables across Europe. The aluminium products are utilized in power cables; they offer more protection from weather and chemicals and are saved from getting corroded.

The aluminium wire rod is more focused on now a day because various industries require more power and lesser cost material; those are good conductors of heat and need less maintenance.

For instance, In February 2022, Elcowire announced the acquisition of KME's Rod and Wire Business in Germany. This acquisition took place to double its production capacity. The company will be able to have a larger workforce

Thus, there is a huge demand for aluminium wire rods in power cables and overhead conductors, which helps in taking better decisions and thus is expected to drive the growth of the Europe aluminium wire rod market.

INCREASING PENETRATION OF ALUMINIUM PRODUCTS IN THE DEVELOPMENT OF CHARGING INFRASTRUCTURE

The world of charging stations for electric vehicles is developing quickly. The incorporation of aluminium extrusions in E-charging stations is one of the most useful solutions. The charging stations are being developed in various European countries due to hydro eco-design methodology. The methodology has been introduced to manufacture products with the latest sustainability standard. The light-weighting of aluminium is one of the most effective ways to improve the energy efficiency of electric and hybrid vehicles. Light cars need less electricity to travel the same distance. The modular aluminium solutions for electric vehicle packs can lower production and operations costs and offer maximum design flexibility.

For instance, In September 2021, according to an article by ET Times, it was announced that the U.K. government had pledged £440m to improve the infrastructure around electric vehicles, local authorities devised plans for Clean Air Zones, and the Plug-In Car Grant attracted new buyers to the electric car market every month, which could help the aluminium wire rod business According to a survey conducted by autostat, the Europe public charging infrastructure comprises 285,496 publicly accessible charging points and has been growing immensely over the years.

As per the above instances, Europe has many charging stations and is growing immensely due to a proper resource management system. This is expected to act as a driving factor for the Europe aluminium wire rod.

Opportunities

Increase in Various Strategic Decisions such as Partnerships and Mergers

The strategic partnership helps both companies to work for the desired goal. As the marketplace is changing and evolving, customers are consistently looking for newly developed products. By forming a strategic partnership, companies can understand the market well before entering, which will assist in targeting potential customers and expanding their network in the market. Few market leaders in electronic components are signing an agreement to work with continuous process improvement by making the best use of advanced technology to meet the users' needs in the market. Therefore, the companies can increase their brand awareness and broaden their product line with all advanced instruments and solutions. Hence, a rise in partnerships and mergers among market players is expected to foster the market's growth.

For instance, In May 2022, Midal Cables Ltd announced a partnership between Imerys' Al Zayani, Yellow Door Energy, and Midal to install a solar power plant in Bahrain. The partnership will help the companies to increase solar energy production. This will help the company increase its profit margin and diversify its energy portfolio solutions

These strategic partnerships or mergers can result in technological advancement and improved product portfolios for involved parties. This may give companies a cutting edge or an opportunity in a highly competitive Europe market.

Technological Advancements in Alloy Development

Innovations in aluminium alloys are enhancing material properties such as conductivity, strength, corrosion resistance, and durability, making wire rods more suitable for a broader range of applications. These advancements enable aluminium wire rods to compete more effectively with alternative materials, such as copper, in industries where performance and efficiency are critical. One key area of development is high-conductivity aluminium alloys, which improve electrical transmission efficiency while maintaining the lightweight benefits of aluminium. This makes them particularly valuable for power grids, renewable energy infrastructure, and electric vehicle (EV) wiring, where energy efficiency and sustainability are major concerns. As governments and industries push for energy transition and decarbonization, the demand for such advanced alloys is expected to rise, driving new opportunities for aluminium wire rod manufacturers.

In the automotive and aerospace sectors, the development of high-strength aluminium alloys is expanding the use of aluminium wire rods in lightweight structural components and electrical systems. As industries prioritize weight reduction for fuel efficiency and lower emissions, advanced aluminium alloys provide an ideal solution, further increasing demand.

In addition to above, improvements in alloy processing techniques, such as grain refinement and nanostructured alloys, are enhancing the mechanical properties of aluminium wire rods. These innovations enable manufacturers to produce superior-quality wire rods with greater reliability, reducing material wastage and production costs.

For instance, The offshore wind industry in Scotland has benefited from the development of corrosion-resistant aluminium alloys, which extend the lifespan of electrical components exposed to harsh marine environments. Specialised aluminium wire rods with enhanced anti-corrosion properties are now being used in cable connections, supporting the growth of offshore renewable energy projects

With continuous research and development in alloy formulations, European aluminium wire rod manufacturers have the opportunity to differentiate their products, expand into high-performance applications, and strengthen their position in both domestic and international markets.

Restraints/Challenges

Potential Risks Associated with Aluminium Wiring

The potential risks associated with aluminum wiring pose significant challenges for the Europe aluminum wire rod market, impacting its adoption and market perception. One of the primary concerns is the inherent property of aluminum to oxidize when exposed to air, leading to the formation of a resistive layer on the wire surface. This oxidation can result in poor electrical connections, increased resistance, and overheating, raising safety concerns such as fire hazards. These risks have historically deterred industries, particularly in residential and commercial construction, from fully embracing aluminum wiring, despite its cost advantages over copper.

Another challenge lies in the mechanical properties of aluminum. Compared to copper, aluminum is more prone to creep and fatigue under mechanical stress, which can cause connections to loosen over time. This necessitates the use of specialized connectors, installation techniques, and regular maintenance, increasing the overall cost and complexity of using aluminum wire rods. For manufacturers, this means investing in research and development to create improved alloys and coatings that mitigate these risks, adding to production costs.

Furthermore, the lingering stigma from past incidents involving aluminum wiring continues to affect market confidence. Educating end-users and stakeholders about the advancements in aluminum wire rod technology and its safe application is essential but challenging. Overcoming these perceptions requires significant effort in marketing, certification, and collaboration with regulatory bodies to establish trust.

For instance, Aluminum's tendency to creep under mechanical stress has been a significant issue in electrical applications. In industrial settings where vibrations are common, aluminum wiring connections have been known to loosen over time, leading to arcing and potential fire risks. This has forced industries to adopt more expensive and complex installation methods, such as using specialized connectors and anti-oxidant pastes, increasing overall costs

Collectively, these risks create barriers to the widespread adoption of aluminum wire rods in Europe, challenging manufacturers to innovate while addressing safety and reliability concerns to remain competitive in the market.

Rise in Dependency of Manufacturers on Different Suppliers

Different aluminium components such as wires, cables, and rods are required to manufacture electrical devices and build charging infrastructure. Consumer demand for advanced devices has raised the requirement for aluminium products. Manufacturing companies mostly get these components such as ICs, semiconductors, PCBs, and others from their supplier as they mostly give those discounts and provide the products in bulk. COVID-19 has disrupted the global supply chain of several electronic companies.

La chaîne d'approvisionnement des fils machine en aluminium en Europe commence par la collecte des matières premières, leur fabrication et leur assemblage, de l'état solide à l'état liquide, pour mouler l'aluminium en fil machine. L'étape suivante de l'analyse de la chaîne d'approvisionnement consiste à transférer des matériaux tels que des tiges, des fils et des câbles vers diverses industries, en fonction de leurs besoins.

L'étape la plus importante de la chaîne d'approvisionnement est la couverture du marché pour distribuer les produits aux différents détaillants et consommateurs. La demande de fil machine en aluminium augmente de jour en jour en raison de ses propriétés de durabilité et de sa capacité à être utilisé pour diverses connexions, notamment l'alimentation électrique. La chaîne d'approvisionnement est un maillon crucial pour tout fabricant, car elle joue un rôle crucial dans le transport des produits finis jusqu'aux consommateurs.

Par exemple, en mars 2021, AMAG Austria Metall AG a obtenu la certification IATF 16949:2016. Cette certification a été accordée pour la production de produits laminés en aluminium et en alliages d'aluminium. Elle permettra aux entreprises de se faire connaître sur le marché. La production d'alliages par des fabricants certifiés est complexe pour les start-ups, ce qui peut constituer un défi pour le marché.

Par conséquent, la dépendance des fabricants à l’égard de différents fournisseurs devrait constituer un défi pour le marché européen du fil machine en aluminium.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse approfondie du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché, notamment en matière de pénurie de matières premières et de retards d'expédition. Cela permet d'évaluer les possibilités stratégiques, d'élaborer des plans d'action efficaces et d'aider les entreprises à prendre des décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets anticipés du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse de marché et les services de veille proposés par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leur chiffre d'affaires, et estimer leurs dépenses de résultat.

Portée du marché des fils machine en aluminium

Le marché est segmenté selon le type de produit, la qualité, le diamètre, la transformation et l'application. La croissance de ces segments vous aidera à analyser les segments à faible croissance des industries et à fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, les aidant ainsi à prendre des décisions stratégiques pour identifier les principaux débouchés.

Marché européen du fil machine en aluminium, par type de produit

- Fil machine en aluminium coulé en continu

- Fil machine en aluminium laminé

- Fil machine en aluminium extrudé

Marché européen du fil machine en aluminium, par qualité

- Classe de conductivité électrique (Ec)

- Degré de conductivité électrique (Ec), par degré

- Aluminium de haute pureté (99,5 % et plus)

- Aluminium de haute pureté (99,5 % et plus), par qualité

- Fil machine en aluminium 1350 Ec

- Fil machine en aluminium 1370 Ec

- Autres nuances à haute conductivité

- Tiges en alliage de qualité EC

- Tiges en alliage de qualité EC, par qualité

- Fil machine en aluminium 6101

- Fil machine en aluminium 6201

- Tiges en alliage de qualité EC, par qualité

- Qualité mécanique (non écologique)

- Catégorie mécanique (non écologique), par catégorie

- Fil machine en aluminium 5005

- Fil machine en aluminium 5052

- Fil machine en aluminium 8176

- Tiges mécaniques série 6xxx

- Catégorie mécanique (non écologique), par catégorie

- Fil machine pour applications de désoxydation (Deox)

- Fil machine pour applications de désoxydation (Deox), par qualité

- Tiges de désoxydation primaire de l'aluminium

- Tiges de désoxydation secondaire de l'aluminium

- Fil machine pour applications de désoxydation (Deox), par qualité

- Degré de conductivité électrique (Ec), par degré

Marché européen du fil machine en aluminium, par diamètre

- Moins de 9,5 mm

- 5 mm - 12 mm

- Au-dessus de 12 mm

Marché européen du fil machine en aluminium, par traitement

- Coulée continue

- Extrusion

- étirage à froid

- laminage à chaud

- Autres

Marché européen du fil machine en aluminium, par application

- Électricité et énergie

- Électricité et énergie, par application

- Conducteurs aériens

- Conducteurs aériens, par application

- CAA

- ACAR

- AAAC

- ACSR

- Conducteurs aériens, par application

- Enroulement du transformateur

- Câbles électriques souterrains

- Composants de jeux de barres et d'appareillage de commutation

- Autres

- Conducteurs aériens

- Électricité et énergie, par application

- Industrie et fabrication

- Industrie et fabrication, par application

- Fil de soudage

- Composants de machines

- Treillis et filets en aluminium

- Fil machine pour applications de désoxydation (Deox)

- Autres

- Industrie et fabrication, par application

- Transport

- Transport, par application

- faisceau de câbles automobile

- Composants des véhicules électriques (VE)

- Applications ferroviaires et métropolitaines

- Autres

- Transport, par application

- Autres

Marché européen du fil machine en aluminium, par utilisation finale

- Énergie et services publics

- Télécommunications

- Automobile

- Aérospatiale et défense

- Bâtiment et construction

- Machines et équipements industriels

- Autres

Marché européen du fil machine en aluminium, par pays

- France

- Allemagne

- Italie

- ROYAUME-UNI

- Espagne

- Russie

- Pays-Bas

- Pologne

- Belgique

- Suisse

- Danemark

- Norvège

- Suède

- Turquie

- Reste de l'Europe

Analyse régionale du marché des fils machine en aluminium

Le marché est analysé et des informations sur la taille du marché et les tendances sont fournies en six segments notables basés sur le type de produit, le type, la forme, la source, la fonction, l'utilisation finale et l'application comme référence ci-dessus.

Les pays couverts par le marché sont la France, l'Allemagne, l'Italie, le Royaume-Uni, l'Espagne, la Russie, les Pays-Bas, la Pologne, la Belgique, la Suisse, le Danemark, la Norvège, la Suède, la Turquie et le reste de l'Europe.

La France est le pays qui connaît la plus forte croissance sur le marché européen du fil d'aluminium, en raison de la demande croissante dans des secteurs comme l'automobile, la construction et l'électricité. Le pays bénéficie de technologies de fabrication avancées, d'infrastructures solides et d'une transition vers des matériaux durables et légers pour diverses applications.

La France domine le marché européen du fil machine en aluminium grâce à sa base industrielle solide, ses avancées technologiques et une forte demande de secteurs comme l'automobile, la construction et l'électricité. Ses infrastructures bien établies, sa main-d'œuvre qualifiée et l'importance qu'elle accorde au développement durable et à l'efficacité énergétique contribuent largement à sa position dominante sur le marché.

La section nationale du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions réglementaires nationales qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques américaines, ainsi que les difficultés rencontrées face à la concurrence forte ou faible des marques locales et nationales, l'impact des tarifs douaniers nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Part de marché du fil machine en aluminium

Le paysage concurrentiel du marché fournit des informations détaillées par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence dans le pays, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la dominance de sa source. Les données ci-dessus ne concernent que les activités des entreprises par rapport au marché.

Les leaders du marché du fil machine en aluminium opérant sur le marché sont :

- Hindalco Industries Ltd. (Inde)

- Norsk Hydro ASA (Norvège)

- Alcoa Corporation (États-Unis)

- TRIMET Aluminium SE (Allemagne)

- RusAL (Russie), Hellenic Cables (Grèce)

- Vimetco NV (Pays-Bas)

- Scepter Inc (États-Unis)

- Lamifil (Belgique)

- JSC « Zvetlit » (Biélorussie)

- Esal Rod Alloys, SA (Espagne)

- NPA Skawina (Pologne)

- Câble Emta (Turquie)

Derniers développements sur le marché du fil machine en aluminium

- En mars 2021, Norsk Hydro ASA a décidé de lancer une usine de production primaire complète en Norvège afin de réduire ses coûts et d'augmenter sa capacité de production. Ce lancement permettra à l'entreprise d'utiliser ses ressources en fonction de la demande du marché.

- En septembre 2023, Hindalco Industries Limited, entreprise de laminage et de recyclage d'aluminium, s'est associée à l'entreprise italienne Metra SpA, leader de l'extrusion d'aluminium. Cette collaboration vise à développer des technologies avancées d'extrusion et de fabrication d'aluminium pour les voitures de trains à grande vitesse en Inde, soutenant ainsi la vision du gouvernement indien de stimuler la production nationale. En combinant l'expertise d'Hindalco dans l'aluminium avec les technologies avancées de Metra en matière d'extrusion, d'usinage et de soudage, ce partenariat apportera à l'Inde une technologie de pointe – actuellement limitée à l'Europe, à la Chine, au Japon et à quelques autres pays – et contribuera ainsi à la modernisation des chemins de fer indiens.

- En août 2023, Hindalco a conclu une alliance stratégique avec Texmaco Rail & Engineering Ltd., une société d'ingénierie spécialisée, pour développer et fabriquer des wagons et des voitures en aluminium. Cette collaboration vise à aider les chemins de fer indiens à atteindre leurs objectifs en matière d'émissions et à améliorer leur efficacité opérationnelle. Dans le cadre de ce partenariat, Hindalco fournira ses alliages d'aluminium de pointe, notamment des profilés, des tôles et des plaques, ainsi que son expertise en fabrication et en soudage. La rame de fret en aluminium de l'entreprise, lancée l'année dernière, pèse 180 tonnes de moins, offre un rapport charge utile/poids à vide supérieur de 19 % et est économe en énergie avec une usure minimale. Texmaco, fort de 80 ans d'expérience dans la fabrication de wagons de fret, apportera son expertise en conception, mettra en place l'usine de production et gérera la production et la main-d'œuvre qualifiée.

- En janvier 2021, Emta Cable a obtenu la certification ISO 9001:2015 pour la qualité de fabrication de tous ses produits en aluminium. Cette certification permettra à l'entreprise de diversifier son portefeuille de produits avec la meilleure qualité possible et de renforcer la valeur de sa marque.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 PRODUCTION CAPACITY OUTLOOK

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.5.5 CONCLUSION

4.6 COMPETITIVE ANALYSIS: ALUMINIUM WIRE RODS/CABLES VS COPPER WIRE ROD/CABLES

4.6.1 KEY PLAYERS IN THE ALUMINIUM AND COPPER WIRE ROD/CABLE MARKET

4.6.2 TECHNICAL COMPARISON OF ALUMINIUM VS. COPPER WIRE RODS/CABLES

4.6.3 INDUSTRY-SPECIFIC DEMAND TRENDS IN EUROPE

4.6.4 COMPETITIVE POSITIONING AND MARKET SHARE IN EUROPE

4.6.5 FUTURE MARKET TRENDS AND GROWTH DRIVERS

4.6.6 CONCLUSION

4.7 IMPORT ANALYSIS

4.7.1 IMPORT VOLUME OF ALUMINIUM WIRE ROD INTO EUROPE

4.7.1.1 APPLICATIONS AND DEMAND DRIVERS

4.7.1.2 TRADE DYNAMICS AND GEOPOLITICAL FACTORS

4.7.1.3 OUTLOOK AND STRATEGIC CONSIDERATIONS

4.7.2 MAJOR IMPORTERS

4.7.2.1 MAJOR IMPORTING COUNTRIES IN EUROPE

4.7.2.1.1 GERMANY

4.7.2.1.2 FRANCE

4.7.2.1.3 U.K.

4.7.2.1.4 ITALY

4.7.2.1.5 SPAIN AND EASTERN EUROPE (POLAND, HUNGARY, CZECH REPUBLIC)

4.7.2.2 KEY SUPPLIERS AND ALTERNATIVE IMPORT SOURCES OF ALUMINIUM WIRE ROD FOR EUROPE

4.7.2.2.1 MALAYSIA

4.7.2.2.2 TURKEY

4.7.2.2.3 INDIA

4.7.2.2.4 BAHRAIN

4.7.2.2.5 OMAN

4.7.2.2.6 EGYPT

4.7.2.2.7 UNITED ARAB EMIRATES

4.7.3 FUTURE OUTLOOK FOR ALUMINUM WIRE ROD IMPORTS IN EUROPE

4.7.3.1 DECLINING DEPENDENCE ON RUSSIAN ALUMINUM

4.7.3.2 THE RISE OF ALTERNATIVE SUPPLIERS

4.7.3.3 TRADE REGULATIONS AND MARKET POLICIES WILL SHAPE IMPORT STRATEGIES

4.7.3.4 GROWTH IN DEMAND FOR SUSTAINABLE AND RECYCLED ALUMINUM

4.7.4 FLUCTUATING RAW MATERIAL AND ENERGY PRICES

4.7.4.1 TECHNOLOGICAL ADVANCEMENTS IN ALUMINUM PROCESSING

4.7.5 FUTURE IMPORT VOLUMES AND MARKET GROWTH EXPECTATIONS

4.7.6 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PRIMARY RAW MATERIALS USED IN ALUMINUM WIRE ROD PRODUCTION

4.8.2 SUPPLY CHAIN AND IMPORT TRENDS

4.8.3 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9.4 CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 ADVANCEMENTS IN SMELTING AND REFINING TECHNOLOGIES

4.10.2 INNOVATIONS IN CONTINUOUS CASTING AND ROLLING TECHNOLOGIES

4.10.3 SURFACE TREATMENT AND COATING TECHNOLOGIES

4.10.4 RECYCLING AND CIRCULAR ECONOMY INNOVATIONS

4.10.5 INDUSTRY 4.0 AND DIGITALIZATION IN ALUMINUM WIRE ROD PRODUCTION

4.10.6 ADVANCEMENTS IN ALUMINUM WIRE RODS FOR ELECTRICAL AND AUTOMOTIVE APPLICATIONS

4.10.7 CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY AND COMPLIANCE

4.11.2 RAW MATERIAL SOURCING AND PURITY

4.11.3 MANUFACTURING PROCESS AND TECHNOLOGY

4.11.4 SUPPLY CHAIN RELIABILITY AND LOGISTICS

4.11.5 SUSTAINABILITY AND ENVIRONMENTAL COMPLIANCE

4.11.6 PRICING AND COST COMPETITIVENESS

4.11.7 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS

6.1.2 INCREASING PENETRATION OF ALUMINIUM PRODUCTS IN THE DEVELOPMENT OF CHARGING INFRASTRUCTURE

6.1.3 INCREASING NEED FOR ALLOY GRADE WIRES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DIFFERENT TYPES OF ALUMINIUM WIRES

6.2.2 CHANGE IN ECONOMIC AND POLITICAL OUTLOOK

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIPS AND MERGERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN ALLOY DEVELOPMENT

6.4 CHALLENGES

6.4.1 POTENTIAL RISKS ASSOCIATED WITH ALUMINIUM WIRING

6.4.2 RISE IN DEPENDENCY OF MANUFACTURERS ON DIFFERENT SUPPLIERS

7 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CONTINUOUS CAST ALUMINIUM WIRE ROD

7.3 ROLLED ALUMINIUM WIRE ROD

7.4 EXTRUDED ALUMINIUM WIRE ROD

8 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE

8.1 OVERVIEW

8.2 ELECTRICAL CONDUCTIVITY (EC) GRADE

8.2.1 ELECTRICAL CONDUCTIVITY (EC) GRADE, BY GRADE

8.2.1.1 HIGH-PURITY ALUMINIUM (99.5%+), BY GRADE

8.2.1.2 ALLOYED EC GRADE RODS, BY GRADE

8.3 MECHANICAL (NON-EC) GRADE

8.3.1 MECHANICAL (NON-EC) GRADE, BY GRADE

8.4 WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS

8.4.1 WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS, BY GRADE

9 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER

9.1 OVERVIEW

9.2 BELOW 9.5 MM

9.3 5 MM - 12 MM

9.4 ABOVE 12 MM

10 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING

10.1 OVERVIEW

10.2 CONTINUOUS CASTING

10.3 EXTRUSION

10.4 COLD DRAWING

10.5 HOT ROLLING

10.6 OTHERS

11 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ELECTRICAL & POWER

11.2.1 ELECTRICAL & POWER, BY APPLICATION

11.2.1.1 OVERHEAD CONDUCTORS, BY APPLICATION

11.3 INDUSTRIAL & MANUFACTURING

11.3.1 INDUSTRIAL & MANUFACTURING, BY APPLICATION

11.4 TRANSPORTATION

11.4.1 TRANSPORTATION, BY APPLICATION

11.5 OTHERS

12 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE

12.1 OVERVIEW

12.2 ENERGY & UTILITIES

12.3 TELECOMMUNICATIONS

12.4 AUTOMOTIVE

12.5 AEROSPACE & DEFENSE

12.6 BUILDING & CONSTRUCTION

12.7 INDUSTRIAL MACHINERY & EQUIPMENT

12.8 OTHERS

13 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRIES

13.1 EUROPE

13.1.1 FRANCE

13.1.2 GERMANY

13.1.3 ITALY

13.1.4 U.K.

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 POLAND

13.1.9 BELGIUM

13.1.10 SWITZERLAND

13.1.11 DENMARK

13.1.12 NORWAY

13.1.13 SWEDEN

13.1.14 TURKEY

13.1.15 REST OF EUROPE

14 EUROPE ALUMINIUM WIRE ROD MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 NORSK HYDRO ASA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 TRIMET ALUMINIUM SE

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 HINDALCO INDUSTRIES LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 ALCOA CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 HELLENIC CABLES

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 EMTA CABLE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ESAL ROD ALLOYS, S.A.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 JSC "ZVETLIT"

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 LAMIFIL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 NPA SKAWINA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 RUSAL

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 SCEPTER INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIMETCO NV

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 4 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 5 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD/KG)

TABLE 6 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 7 EUROPE ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 8 EUROPE HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 9 EUROPE ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 10 EUROPE MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 11 EUROPE WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 12 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 13 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 14 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 15 EUROPE ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 16 EUROPE OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 17 EUROPE INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 18 EUROPE TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 19 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 20 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRY, 2018-2035 (USD THOUSAND)

TABLE 21 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRY, 2018-2035 (TONS)

TABLE 22 FRANCE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 23 FRANCE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 24 FRANCE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 25 FRANCE ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 26 FRANCE HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 27 FRANCE ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 28 FRANCE MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 29 FRANCE WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 30 FRANCE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 31 FRANCE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 32 FRANCE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 33 FRANCE ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 34 FRANCE OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 35 FRANCE INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 36 FRANCE TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 37 FRANCE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 38 GERMANY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 39 GERMANY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 40 GERMANY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 41 GERMANY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 42 GERMANY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 43 GERMANY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 44 GERMANY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 45 GERMANY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 46 GERMANY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 47 GERMANY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 48 GERMANY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 49 GERMANY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 50 GERMANY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 51 GERMANY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 52 GERMANY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 53 GERMANY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 54 ITALY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 55 ITALY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 56 ITALY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 57 ITALY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 58 ITALY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 59 ITALY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 60 ITALY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 61 ITALY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 62 ITALY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 63 ITALY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 64 ITALY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 65 ITALY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 66 ITALY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 67 ITALY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 68 ITALY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 69 ITALY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 70 U.K. ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 71 U.K. ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 72 U.K. ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 73 U.K. ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 74 U.K. HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 75 U.K. ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 76 U.K. MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 77 U.K. WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 78 U.K. ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 79 U.K. ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 80 U.K. ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 81 U.K. ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 82 U.K. OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 83 U.K. INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 84 U.K. TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 85 U.K. ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 86 SPAIN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 87 SPAIN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 88 SPAIN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 89 SPAIN ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 90 SPAIN HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 91 SPAIN ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 92 SPAIN MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 93 SPAIN WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 94 SPAIN ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 95 SPAIN ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 96 SPAIN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 97 SPAIN ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 98 SPAIN OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 99 SPAIN INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 100 SPAIN TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 101 SPAIN ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 102 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 103 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 104 RUSSIA ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 105 RUSSIA ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 106 RUSSIA HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 107 RUSSIA ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 108 RUSSIA MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 109 RUSSIA WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 110 RUSSIA ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 111 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 112 RUSSIA ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 113 RUSSIA ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 114 RUSSIA OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 115 RUSSIA INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 116 RUSSIA TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 117 RUSSIA ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 118 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 119 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 120 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 121 NETHERLANDS ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 122 NETHERLANDS HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 123 NETHERLANDS ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 124 NETHERLANDS MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 125 NETHERLANDS WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 126 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 127 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 128 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 129 NETHERLANDS ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 130 NETHERLANDS OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 131 NETHERLANDS INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 132 NETHERLANDS TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 133 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 134 POLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 135 POLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 136 POLAND ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 137 POLAND ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 138 POLAND HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 139 POLAND ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 140 POLAND MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 141 POLAND WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 142 POLAND ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 143 POLAND ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 144 POLAND ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 145 POLAND ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 146 POLAND OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 147 POLAND INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 148 POLAND TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 149 POLAND ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 150 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 151 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 152 BELGIUM ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 153 BELGIUM ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 154 BELGIUM HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 155 BELGIUM ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 156 BELGIUM MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 157 BELGIUM WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 158 BELGIUM ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 159 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 160 BELGIUM ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 161 BELGIUM ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 162 BELGIUM OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 163 BELGIUM INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 164 BELGIUM TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 165 BELGIUM ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 166 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 167 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 168 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 169 SWITZERLAND ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 170 SWITZERLAND HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 171 SWITZERLAND ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 172 SWITZERLAND MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 173 SWITZERLAND WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 174 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 175 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 176 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 177 SWITZERLAND ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 178 SWITZERLAND OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 179 SWITZERLAND INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 180 SWITZERLAND TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 181 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 182 DENMARK ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 183 DENMARK ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 184 DENMARK ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 185 DENMARK ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 186 DENMARK HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 187 DENMARK ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 188 DENMARK MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 189 DENMARK WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 190 DENMARK ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 191 DENMARK ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 192 DENMARK ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 193 DENMARK ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 194 DENMARK OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 195 DENMARK INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 196 DENMARK TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 197 DENMARK ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 198 NORWAY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 199 NORWAY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 200 NORWAY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 201 NORWAY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 202 NORWAY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 203 NORWAY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 204 NORWAY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 205 NORWAY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 206 NORWAY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 207 NORWAY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 208 NORWAY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 209 NORWAY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 210 NORWAY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 211 NORWAY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 212 NORWAY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 213 NORWAY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 214 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 215 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 216 SWEDEN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 217 SWEDEN ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 218 SWEDEN HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 219 SWEDEN ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 220 SWEDEN MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 221 SWEDEN WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 222 SWEDEN ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 223 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 224 SWEDEN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 225 SWEDEN ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 226 SWEDEN OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 227 SWEDEN INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 228 SWEDEN TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 229 SWEDEN ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 230 TURKEY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 231 TURKEY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 232 TURKEY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 233 TURKEY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 234 TURKEY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 235 TURKEY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 236 TURKEY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 237 TURKEY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 238 TURKEY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 239 TURKEY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 240 TURKEY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 241 TURKEY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 242 TURKEY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 243 TURKEY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 244 TURKEY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 245 TURKEY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 246 REST OF EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 247 REST OF EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

Liste des figures

FIGURE 1 EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 2 EUROPE ALUMINIUM WIRE ROD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALUMINIUM WIRE ROD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALUMINIUM WIRE ROD MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALUMINIUM WIRE ROD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALUMINIUM WIRE ROD MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ALUMINIUM WIRE ROD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ALUMINIUM WIRE ROD MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ALUMINIUM WIRE ROD MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ALUMINIUM WIRE ROD MARKET: APPLICATION COVERAGE GRID

FIGURE 11 EUROPE ALUMINIUM WIRE ROD MARKET: SEGMENTATION

FIGURE 12 GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS IS EXPECTED TO DRIVE THE EUROPE ALUMINIUM WIRE ROD MARKET IN THE FORECAST PERIOD

FIGURE 13 THE CONTINUOUS CAST ALUMINIUM WIRE ROD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALUMINIUM WIRE ROD MARKET IN 2025 AND 2035

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 18 EUROPE ALUMINIUM WIRE ROD MARKET: BY PRODUCT TYPE, 2024

FIGURE 19 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2024

FIGURE 20 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2024

FIGURE 21 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2024

FIGURE 22 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2024

FIGURE 23 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2024

FIGURE 24 EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 25 EUROPE ALUMINUM WIRE ROD MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.