Europe Cancer Photodynamic Therapy Market

Taille du marché en milliards USD

TCAC :

%

USD

872.14 Million

USD

1,353.25 Million

2024

2032

USD

872.14 Million

USD

1,353.25 Million

2024

2032

| 2025 –2032 | |

| USD 872.14 Million | |

| USD 1,353.25 Million | |

|

|

|

|

Segmentation du marché européen de la thérapie photodynamique du cancer : par type de produit (médicaments photosensibilisants, dispositifs de thérapie photodynamique), par indication cancéreuse (oncologie cutanée, cancers de la tête et du cou, cancers de l’œsophage, du poumon, de la vessie, du col de l’utérus, de la prostate), par modalité thérapeutique (thérapie seule, thérapie adjuvante, thérapie palliative, autres), par technique opératoire (irradiation externe, administration intracavitaire (endoscopique), administration interstitielle (interne), autres), par stade de la maladie (cancer de stade précoce, cancer de stade avancé), par caractéristiques démographiques des patients (personnes âgées, adultes, enfants), par utilisateur final (hôpitaux, cliniques de dermatologie et d’oncologie cutanée, centres de chirurgie ambulatoire, instituts de recherche et d’enseignement, autres), par canal de distribution (appels d’offres directs, distributeurs tiers, vente en ligne, autres) – Tendances du secteur et prévisions jusqu’en 2032

Taille du marché européen de la thérapie photodynamique contre le cancer

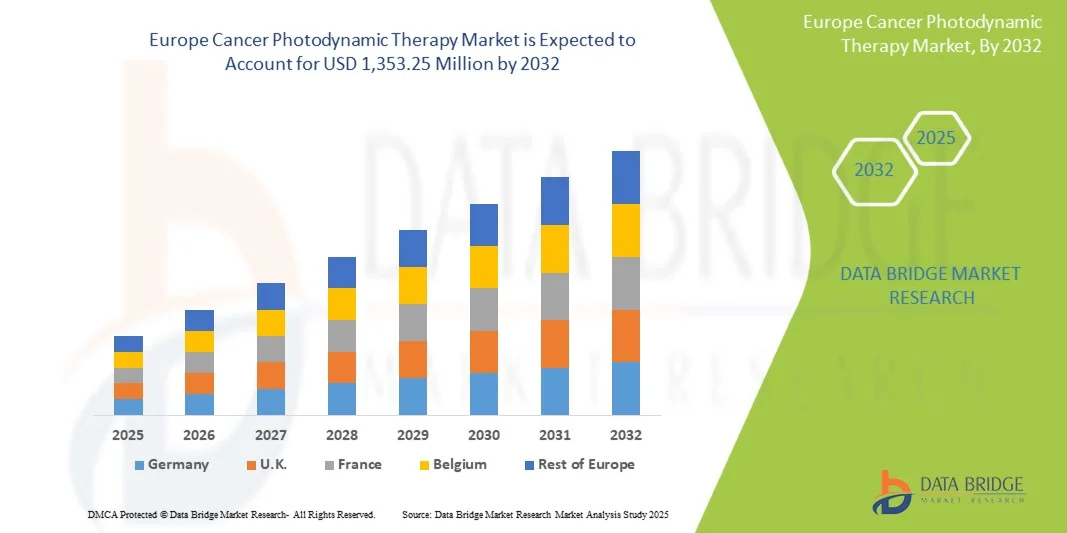

- Le marché européen de la thérapie photodynamique contre le cancer était évalué à 872,14 millions de dollars en 2024 et devrait atteindre 1 353,25 millions de dollars d’ici 2032, avec un TCAC de 5,8 % au cours de la période de prévision.

- Le marché est principalement tiré par la hausse de la prévalence du cancer, l'augmentation des dépenses de santé et la sensibilisation croissante aux options de traitement avancées. Les progrès rapides des infrastructures de santé et l'expansion des centres spécialisés dans le traitement du cancer contribuent également à ce développement.

- Cette croissance est alimentée par des facteurs tels que les initiatives gouvernementales promouvant le diagnostic précoce et les thérapies innovantes, un large bassin de patients et des investissements croissants d'entreprises internationales et locales dans les technologies de thérapie photodynamique.

Analyse du marché européen de la thérapie photodynamique contre le cancer

- Le marché de la thérapie photodynamique (PDT) contre le cancer connaît une croissance soutenue, portée par l'augmentation de la prévalence du cancer, la sensibilisation croissante aux traitements non invasifs et les progrès réalisés dans le domaine des médicaments photosensibilisants et des technologies laser.

- Les marchés émergents connaissent une adoption rapide de la PDT, stimulée par les initiatives gouvernementales, la hausse des dépenses de santé et le vieillissement de la population. Toutefois, le coût élevé des traitements et le remboursement limité demeurent des freins importants, tandis que les innovations constantes dans les thérapies combinées et les photosensibilisateurs ciblés offrent des perspectives de croissance considérables.

- L'Allemagne devrait dominer le marché européen de la thérapie photodynamique contre le cancer avec la plus grande part de revenus (19,26 %) en 2025, grâce à une infrastructure de santé avancée, une forte adoption des traitements innovants, d'importants investissements en R&D, des politiques de remboursement favorables et une sensibilisation aux thérapies minimalement invasives.

- L'Allemagne devrait connaître la croissance la plus rapide sur le marché européen de la thérapie photodynamique contre le cancer au cours de la période de prévision, avec un TCAC de 8,9 %. Cette croissance est alimentée par la hausse de la prévalence du cancer, le développement des infrastructures de santé, la sensibilisation accrue aux thérapies de pointe et les initiatives gouvernementales favorisant le diagnostic précoce. Par ailleurs, l'adoption croissante des technologies innovantes et l'augmentation des revenus disponibles stimulent la demande de thérapie photodynamique en Allemagne.

- Le segment des médicaments photosensibilisants devrait dominer le marché européen de la thérapie photodynamique du cancer avec une part de marché de 75,15 % en 2025. Cette domination s'explique par leur rôle central dans le traitement, leur haute spécificité de ciblage des cellules cancéreuses, l'augmentation du nombre d'autorisations de mise sur le marché de nouveaux médicaments, leur utilisation croissante dans les thérapies combinées et les efforts continus de R&D visant à améliorer l'efficacité et à réduire les effets secondaires.

Portée du rapport et segmentation du marché européen de la thérapie photodynamique contre le cancer

|

Attributs |

Principaux enseignements du marché de la soie |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché européen de la thérapie photodynamique contre le cancer

« Intégration avec d’autres thérapies anticancéreuses »

- La capacité de la thérapie photodynamique (PDT) à induire une destruction localisée des cellules tumorales tout en stimulant les réponses immunitaires en fait un partenaire intéressant pour le traitement multimodal du cancer.

- De plus en plus de preuves montrent que la PDT peut augmenter la libération d'antigènes tumoraux, moduler le microenvironnement tumoral et améliorer l'infiltration ou l'activation des cellules immunitaires — des mécanismes qui peuvent agir en synergie avec les inhibiteurs de points de contrôle immunitaire, les vaccins thérapeutiques contre le cancer, la chimiothérapie ou la radiothérapie.

- L'association de la PDT à des thérapies systémiques peut transformer le contrôle local en réponses systémiques durables, permettre des réductions de dose d'agents toxiques et élargir les indications (par exemple, les maladies non résécables ou métastatiques).

- Avec la multiplication des recherches cliniques et translationnelles, l'intégration à d'autres modalités représente une voie prometteuse pour élargir la pertinence clinique et l'adoption commerciale de la PDT.

Dynamique du marché européen de la thérapie photodynamique contre le cancer

Conducteur

« Prévalence croissante du cancer »

- L’augmentation de la prévalence du cancer à l’échelle mondiale est l’un des principaux facteurs alimentant la demande de thérapies telles que la thérapie photodynamique (PDT).

- Avec la croissance et le vieillissement des populations, et l'amélioration des outils de diagnostic, de plus en plus de cas de cancer sont détectés chaque année.

- Des taux plus élevés de facteurs de risque tels que le tabagisme, l'obésité, la sédentarité, la pollution atmosphérique et les infections dans les pays à revenu faible et intermédiaire contribuent également à l'augmentation de l'incidence

- Face à un nombre croissant de patients nécessitant des modalités de traitement localisées efficaces, moins invasives et plus économiques, la PDT devient de plus en plus attrayante.

- L'augmentation de la prévalence du cancer met à rude épreuve les systèmes de santé, créant une pression urgente pour des thérapies capables d'améliorer les résultats, de réduire les effets secondaires et d'être déployées plus largement.

Retenue/Défi

« Profondeur de pénétration lumineuse limitée »

- L'une des principales limitations qui freinent l'adoption plus large et l'efficacité de la thérapie photodynamique est la pénétration restreinte de la lumière activatrice dans les tissus humains.

- Étant donné que les photosensibilisateurs doivent être activés par une lumière de longueurs d'onde spécifiques, l'absorption et la diffusion de la lumière par les tissus réduisent la profondeur de pénétration de l'illumination.

- Les photosensibilisateurs à lumière visible ne fonctionnent souvent que pour les tumeurs superficielles ou facilement accessibles ; les tumeurs plus profondes ou plus volumineuses restent un défi.

- Cette limitation entraîne une destruction tumorale incomplète, nécessite une administration invasive de la lumière (par exemple, sondes à fibres optiques, endoscopie), augmente la complexité de la procédure et peut conduire à de mauvais résultats ou à une récidive.

- En attendant des avancées majeures pour surmonter cet obstacle, la thérapie photodynamique (PDT) reste limitée quant au nombre de cancers qu'elle peut traiter de manière non invasive et efficace.

Portée du marché européen de la thérapie photodynamique contre le cancer

Le marché est segmenté en fonction du type de produit, de l'indication cancéreuse, de la modalité thérapeutique, de la technique opératoire, du stade de la maladie, des caractéristiques démographiques des patients, de l'utilisateur final et du canal de distribution.

- Par type de produit

Le marché européen de la thérapie photodynamique (PDT) contre le cancer est segmenté, selon le type de produit, en deux catégories : les médicaments photosensibilisants et les dispositifs de PDT. En 2025, les médicaments photosensibilisants devraient dominer le marché avec une part de 75,15 %, grâce à leur rôle crucial dans l’efficacité des traitements, leur large applicabilité à différents types de cancers et leurs formulations variées (intraveineuse, topique, orale, intravésicale et intrapéritonéale). Cette domination s’explique notamment par la prévalence croissante du cancer, l’adoption grandissante des thérapies mini-invasives, les innovations pharmaceutiques continues et les autorisations réglementaires, qui, ensemble, font des photosensibilisants la principale source de revenus, devant les dispositifs de PDT.

Le segment des médicaments photosensibilisants est celui qui connaît la croissance la plus rapide sur le marché européen de la thérapie photodynamique du cancer, avec un TCAC de 5,9 %, grâce à l'adoption croissante de traitements ciblés et peu invasifs. La demande est stimulée par une meilleure connaissance de l'efficacité de la PDT, la réduction des effets secondaires par rapport aux thérapies conventionnelles et le développement de photosensibilisateurs de nouvelle génération offrant une sélectivité tumorale accrue et une pénétration tissulaire plus profonde. Par ailleurs, les recherches cliniques et les autorisations de mise sur le marché de nouveaux agents photosensibilisants contribuent à l'expansion du marché.

- Indication de cancer

Selon l'indication cancéreuse, le marché européen de la thérapie photodynamique (PDT) est segmenté en oncologie cutanée, oncologie cervico-faciale, cancers de l'œsophage, du poumon, de la vessie, du col de l'utérus et de la prostate. En 2025, le segment de l'oncologie cutanée devrait dominer le marché avec une part de 52,21 %, en raison de la forte prévalence des cancers de la peau, de la sensibilisation accrue au dépistage précoce et de l'efficacité de la PDT pour obtenir des résultats esthétiques supérieurs. Ce segment bénéficie de l'adoption généralisée des médicaments photosensibilisants et des dispositifs de PDT, notamment pour les patients gériatriques et adultes, qui représentent la plus grande part de la population. De plus, la demande croissante de thérapies ciblées et peu invasives pour les kératoses actiniques, les carcinomes basocellulaires et les carcinomes spinocellulaires, ainsi que des politiques de remboursement favorables dans les principales régions, renforcent sa position de leader sur le marché par rapport aux autres indications cancéreuses.

Le segment de l'oncologie cutanée est celui qui connaît la croissance la plus rapide sur le marché européen de la thérapie photodynamique contre le cancer, avec un TCAC de 6,3 %. Cette croissance s'explique par la prévalence croissante des cancers de la peau, la sensibilisation accrue au diagnostic précoce et la préférence pour les traitements peu invasifs présentant moins d'effets secondaires. La thérapie photodynamique offre une action ciblée, une récupération rapide et de meilleurs résultats esthétiques, ce qui la rend particulièrement intéressante en oncologie dermatologique. Par ailleurs, les progrès technologiques réalisés dans le domaine des photosensibilisateurs et des systèmes de diffusion de la lumière favorisent son adoption dans ce segment.

- Par modalité thérapeutique

Selon la modalité thérapeutique, le marché européen de la thérapie photodynamique (PDT) contre le cancer est segmenté en thérapie autonome, thérapie adjuvante, thérapie palliative et autres. En 2025, le segment de la thérapie autonome devrait dominer le marché avec une part de 41,20 %, grâce à son efficacité en tant que traitement de première intention des cancers localisés, notamment les cancers de la peau, de l'œsophage et du poumon. Cette domination s'explique principalement par sa grande efficacité, son caractère peu invasif, ses excellents résultats esthétiques et la préférence clinique croissante pour les thérapies ciblées. Au niveau régional, l'Amérique du Nord et l'Europe sont en tête de l'adoption de la PDT autonome grâce à des infrastructures de santé avancées, des systèmes de remboursement établis et une forte sensibilisation des patients. Les marchés émergents d'Asie-Pacifique connaissent quant à eux une adoption croissante, portée par la hausse de la prévalence du cancer, l'expansion des réseaux hospitaliers et un accès accru aux traitements oncologiques modernes. Ces dynamiques régionales, associées à une meilleure information et une sensibilisation accrue aux avantages de la PDT, renforcent la position dominante de la thérapie autonome à l'échelle mondiale.

La thérapie en monothérapie est le segment à la croissance la plus rapide sur le marché européen de la thérapie photodynamique du cancer, avec un TCAC de 6,2 %. Cette croissance s'explique par sa simplicité, son rapport coût-efficacité et la réduction des effets secondaires par rapport aux thérapies combinées. Elle permet un traitement ciblé des tumeurs sans recourir à des médicaments ou interventions supplémentaires, améliorant ainsi l'observance du traitement par le patient. Son adoption croissante en ambulatoire, la sensibilisation accrue aux traitements mini-invasifs et les progrès réalisés dans le domaine des photosensibilisateurs et des systèmes d'administration de la lumière contribuent également à la croissance rapide de ce segment.

- Par la technique de procédure

Selon la technique opératoire, le marché européen de la thérapie photodynamique contre le cancer est segmenté en quatre catégories : faisceau externe, administration intracavitaire (endoscopique), administration interstitielle (interne) et autres. En 2025, le segment du faisceau externe devrait dominer le marché avec une part de 68,97 %, grâce à son caractère non invasif, sa facilité d’utilisation et son efficacité pour les tumeurs superficielles. Son adoption rapide en Amérique du Nord et en Europe, soutenue par des infrastructures de santé performantes et des politiques de remboursement adéquates, ainsi que la demande croissante en Asie-Pacifique, liée à l’augmentation de la prévalence du cancer et à une meilleure sensibilisation à cette maladie, expliquent sa position de leader sur le marché.

Le segment de l'administration intracavitaire (endoscopique) est celui qui connaît la croissance la plus rapide avec un TCAC de 6,3 % sur le marché européen de la thérapie photodynamique du cancer, car il permet une administration minimalement invasive et ciblée de lumière et de photosensibilisateur aux tumeurs des organes creux, réduit l'exposition systémique et les effets secondaires, permet des traitements répétables, améliore l'accès à la tumeur dans les cancers de l'œsophage, des bronches et de la vessie et raccourcit le temps de récupération.

- Par stade de la maladie

En fonction du stade de la maladie, le marché européen de la thérapie photodynamique (PDT) du cancer est segmenté en cancers de stade précoce et cancers de stade avancé. En 2025, le segment des cancers de stade précoce devrait dominer le marché avec une part de 81,51 %, grâce à l'efficacité de la PDT pour cibler les tumeurs localisées, minimiser les dommages aux tissus sains et offrir de meilleurs résultats esthétiques. Ce segment bénéficie d'une forte sensibilisation des patients, d'une préférence pour les traitements peu invasifs et d'une adoption généralisée en Amérique du Nord et en Europe, tandis que la hausse des taux de diagnostic du cancer et le développement des infrastructures d'oncologie en Asie-Pacifique renforcent sa position de leader sur le marché.

Le segment des cancers de stade précoce connaît la croissance la plus rapide sur le marché européen de la thérapie photodynamique (PDT), avec un TCAC de 5,8 %. Cette croissance s'explique par l'adoption croissante des traitements mini-invasifs, une meilleure sensibilisation au dépistage précoce et l'amélioration des résultats cliniques grâce à la PDT. Les cancers de stade précoce répondent mieux aux thérapies ciblées, ce qui se traduit par une efficacité accrue et moins d'effets secondaires. Par ailleurs, les initiatives gouvernementales favorables et les progrès réalisés dans le domaine des photosensibilisateurs et des systèmes d'administration de lumière contribuent à une pénétration plus rapide du marché dans ce segment.

- Selon les caractéristiques démographiques des patients

Sur la base des caractéristiques démographiques des patients, le marché européen de la thérapie photodynamique contre le cancer est segmenté en trois catégories : gériatrie, adultes et pédiatrie. En 2025, le segment gériatrique devrait dominer le marché avec une part de 67,12 %, en raison de la prévalence plus élevée du cancer chez les personnes âgées, de leur susceptibilité accrue aux cancers cutanés et de leur préférence pour les traitements ciblés et peu invasifs. L’adoption de cette thérapie est forte en Amérique du Nord et en Europe, grâce à des infrastructures de santé performantes, une sensibilisation accrue et une population vieillissante croissante.

Le segment gériatrique est celui qui connaît la croissance la plus rapide sur le marché européen de la thérapie photodynamique contre le cancer, avec un TCAC de 6,0 %, en raison de la prévalence plus élevée du cancer chez les personnes âgées. Le vieillissement affaiblit le système immunitaire et accroît la vulnérabilité à divers cancers, stimulant ainsi la demande de traitements efficaces et peu invasifs comme la PDT. De plus, la PDT présente moins d'effets secondaires et une récupération plus rapide, ce qui la rend adaptée aux patients âgés susceptibles de ne pas tolérer les thérapies agressives et contribue à la croissance du marché au sein de cette population.

- Par l'utilisateur final

Selon l'utilisateur final, le marché européen de la thérapie photodynamique (PDT) contre le cancer est segmenté en hôpitaux, cliniques de dermatologie et de cancérologie cutanée, centres de chirurgie ambulatoire, instituts de recherche et établissements universitaires, et autres. En 2025, le segment des hôpitaux devrait dominer le marché avec une part de 41,33 %, grâce à leurs infrastructures complètes, la présence de services d'oncologie spécialisés et leur capacité à proposer des traitements PDT intégrés. Les hôpitaux publics et privés, notamment les établissements de niveau 1 et 2 en Amérique du Nord et en Europe, sont à l'avant-garde de l'adoption de cette thérapie grâce à leurs systèmes de santé performants et aux dispositifs de remboursement. Le développement des réseaux hospitaliers et l'expansion des services d'oncologie en Asie-Pacifique renforcent encore la position dominante des hôpitaux en tant que principaux utilisateurs finaux de la PDT contre le cancer à l'échelle mondiale.

Le segment hospitalier représente la croissance la plus rapide du marché européen de la thérapie photodynamique contre le cancer, avec un TCAC de 6,5 %. Cette croissance s'explique par l'adoption croissante de traitements anticancéreux de pointe, l'augmentation du nombre de patients et la disponibilité de services d'oncologie spécialisés. Les hôpitaux offrent une prise en charge complète en matière de thérapie photodynamique, incluant le diagnostic, le traitement et les soins post-thérapeutiques, ce qui les rend privilégiés par rapport aux cliniques indépendantes. Par ailleurs, la sensibilisation accrue, les initiatives gouvernementales et la prise en charge par les assurances contribuent également à l'essor de la thérapie photodynamique en milieu hospitalier.

- Par canal de distribution

Le marché européen de la thérapie photodynamique contre le cancer est segmenté, selon le canal de distribution, en appels d'offres directs, distributeurs tiers, vente en ligne et autres. En 2025, le segment des appels d'offres directs devrait dominer le marché avec une part de 50,79 %, grâce aux achats groupés effectués par les hôpitaux, les programmes de santé publique et les grands centres d'oncologie, ce qui garantit la maîtrise des coûts et un approvisionnement fiable en photosensibilisateurs et dispositifs de thérapie photodynamique. On observe également une forte adoption en Amérique du Nord et en Europe, soutenue par des systèmes d'achat hospitaliers structurés et des appels d'offres de santé publique, ainsi que par une demande institutionnelle croissante.

Le segment des appels d'offres directs est celui qui connaît la croissance la plus rapide sur le marché européen de la thérapie photodynamique contre le cancer, avec un TCAC de 6,0 %. Cette croissance s'explique par l'augmentation des achats d'appareils de PDT de pointe par les gouvernements et les hôpitaux via des contrats directs. Cette approche garantit la rentabilité, un approvisionnement plus rapide et un approvisionnement fiable pour les programmes de traitement du cancer à grande échelle. De plus, la hausse des dépenses publiques de santé, les initiatives gouvernementales en matière de soins contre le cancer et la préférence pour les achats centralisés favorisent l'adoption des appels d'offres directs par rapport aux distributeurs ou aux plateformes en ligne.

Analyse régionale du marché européen de la thérapie photodynamique contre le cancer

- L'Allemagne devrait dominer le marché européen de la thérapie photodynamique contre le cancer avec la plus grande part de revenus (19,26 %) en 2025, grâce à une infrastructure de santé avancée, une forte adoption des traitements innovants, d'importants investissements en R&D, des politiques de remboursement favorables et une sensibilisation aux thérapies minimalement invasives.

- L'Allemagne devrait connaître la croissance la plus rapide sur le marché européen de la thérapie photodynamique contre le cancer au cours de la période de prévision, avec un TCAC de 8,9 %. Cette croissance est alimentée par la hausse de la prévalence du cancer, le développement des infrastructures de santé, la sensibilisation accrue aux thérapies de pointe et les initiatives gouvernementales favorisant le diagnostic précoce. Par ailleurs, l'adoption croissante des technologies innovantes et l'augmentation des revenus disponibles stimulent la demande de thérapie photodynamique en Allemagne.

- De plus, la présence d'acteurs majeurs du marché et de cadres réglementaires favorables accélère la croissance et l'adoption du marché dans la région.

Aperçu du marché de la thérapie photodynamique contre le cancer au Royaume-Uni et en Europe

Le marché britannique de la thérapie photodynamique contre le cancer joue un rôle majeur dans l'industrie européenne des dispositifs médicaux plastiques, grâce à son infrastructure de santé performante, ses capacités de recherche de pointe et ses centres d'oncologie réputés. L'adoption généralisée des thérapies innovantes, le soutien important des pouvoirs publics au traitement du cancer et le nombre d'essais cliniques actifs stimulent la croissance de ce marché. Par ailleurs, les collaborations entre les entreprises pharmaceutiques et les instituts de recherche au Royaume-Uni accélèrent le développement et la commercialisation de la thérapie photodynamique, faisant du Royaume-Uni un acteur clé du marché européen.

Analyse du marché de la thérapie photodynamique contre le cancer en Allemagne et en Europe

Le marché de la thérapie photodynamique (PDT) contre le cancer en Allemagne et en Europe devrait connaître une croissance soutenue, grâce à des infrastructures de santé performantes, à une forte adoption des traitements innovants contre le cancer et à un soutien gouvernemental important à la recherche en oncologie. La sensibilisation croissante aux thérapies mini-invasives, l'augmentation de l'incidence de cancers tels que ceux de la peau et du poumon, ainsi que les politiques de remboursement des nouvelles thérapies contribuent également à stimuler leur adoption. Par ailleurs, la présence de fabricants clés d'appareils de PDT et les collaborations de recherche accélèrent la pénétration du marché et sa croissance durable.

Les principaux acteurs du marché sont :

- Novartis Pharma AG (Suisse)

- Galderma SA (Suisse)

- Bausch Health Companies Inc. (Canada)

- Photocure ASA (Norvège)

- ADVANZ PHARMA Corp. (Royaume-Uni)

- Sun Pharmaceutical Industries Ltd. (Inde)

- Biofrontera AG (Allemagne)

- LUMIBIRD SA (France)

- LUZITIN SA (Portugal)

- Lumeda Inc. (Suède)

- ImPact Biotech (Israël)

- biolitec Holding GmbH & Co KG (Allemagne)

- Modulight Corporation (Finlande)

- (Canada)

Dernières évolutions du marché européen de la thérapie photodynamique contre le cancer

- En février 2023, la collaboration entre Galderma et German Medical Engineering (GME) représente une avancée stratégique sur le marché de la dermatologie et de la thérapie photodynamique (PDT). En associant Metvix de Galderma, photosensibilisateur de référence pour les lésions précancéreuses et les cancers cutanés non mélanomiques, au dispositif MultiLite de GME, ce partenariat renforce l'offre de traitements intégrés de Galderma et élargit sa capacité à proposer à la fois la PDT conventionnelle à la lumière rouge (C-PDT) et la PDT à la lumière artificielle du jour (ADL-PDT), plus confortable pour le patient.

- En 2025, McKesson a finalisé l'acquisition de Core Ventures (Community Oncology Revitalization Enterprise Ventures), acquérant une participation majoritaire d'environ 70 % pour environ 2,49 milliards de dollars américains, afin de renforcer ses soins oncologiques communautaires par le biais de Florida Cancer Specialists & Research Institute.

- En 2025, Biofrontera AG a transféré tous les actifs américains liés à Ameluz et RhodoLED à Biofrontera Inc., recevant une participation de 10 % et des redevances de 12 à 15 % sur les ventes américaines d'Ameluz.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CANCER PHOTODYNAMIC THERAPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.3.1 INTRODUCTION

4.3.2 PRODUCTION SIDE ANALYSIS

4.3.2.1 PHOTOSENSITIZER MANUFACTURING

4.3.2.2 DEVICE MANUFACTURING

4.3.2.3 RESEARCH AND INNOVATION

4.3.3 CONSUMPTION SIDE ANALYSIS

4.3.3.1 CLINICAL APPLICATION

4.3.3.2 TREATMENT VOLUMES AND TRENDS

4.3.3.3 DOSAGE AND PROTOCOLS

4.3.4 PRODUCTION–CONSUMPTION DYNAMICS

4.3.4.1 SUPPLY CONSTRAINTS

4.3.4.2 REGIONAL OVERVIEW

4.3.4.3 FUTURE OUTLOOK

4.3.5 CONCLUSION

4.4 COST ANALYSIS BREAKDOWN

4.4.1 INTRODUCTION

4.4.2 DIRECT MEDICAL COSTS

4.4.2.1 COST OF PHOTOSENSITIZERS

4.4.2.2 LIGHT DELIVERY SYSTEMS

4.4.2.3 HEALTHCARE FACILITY CHARGES

4.4.3 INDIRECT COSTS

4.4.3.1 PATIENT-RELATED EXPENSES

4.4.3.2 POST-TREATMENT MONITORING

4.4.4 COMPARATIVE COST-EFFECTIVENESS

4.4.5 REIMBURSEMENT AND INSURANCE IMPACT

4.4.6 REGIONAL COST VARIATIONS

4.4.7 FUTURE COST TRENDS AND REDUCTION STRATEGIES

4.4.7.1 TECHNOLOGICAL ADVANCEMENTS

4.4.7.2 HEALTHCARE EFFICIENCY INITIATIVES

4.4.8 CONCLUSION

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 INTRODUCTION

4.5.2 NEXT-GENERATION PHOTOSENSITIZERS

4.5.3 ADVANCEMENTS IN LIGHT DELIVERY SYSTEMS

4.5.4 NANOTECHNOLOGY-ENABLED DELIVERY

4.5.5 COMBINATION THERAPIES AND IMMUNOMODULATION

4.5.6 DIGITAL INTEGRATION AND TREATMENT PLANNING

4.5.7 RECENT TRENDS AND OUTLOOK

4.5.8 CONCLUSION

4.6 VALUE CHAIN ANALYSIS

4.6.1 INTRODUCTION

4.6.2 RESEARCH & DEVELOPMENT

4.6.2.1 DISCOVERY OF PHOTOSENSITIZERS

4.6.2.2 DEVELOPMENT OF LIGHT DELIVERY SYSTEMS

4.6.2.3 CLINICAL TRIALS AND REGULATORY APPROVALS

4.6.3 MANUFACTURING

4.6.3.1 PRODUCTION OF PHOTOSENSITIZERS

4.6.3.2 FABRICATION OF LIGHT DELIVERY DEVICES

4.6.4 DISTRIBUTION & LOGISTICS

4.6.4.1 SUPPLY CHAIN MANAGEMENT

4.6.4.2 INTERNATIONAL TRADE AND MARKET ACCESS

4.6.5 CLINICAL APPLICATION

4.6.5.1 INTEGRATION INTO TREATMENT PROTOCOLS

4.6.5.2 TRAINING AND EDUCATION

4.6.6 POST-TREATMENT MONITORING & SUPPORT

4.6.6.1 FOLLOW-UP CARE

4.6.6.2 PATIENT SUPPORT SERVICES

4.6.7 TECHNOLOGICAL ADVANCEMENTS INFLUENCING THE PDT VALUE CHAIN

4.6.7.1 NANOTECHNOLOGY IN PDT

4.6.7.2 ARTIFICIAL INTELLIGENCE AND IMAGING

4.6.7.3 PERSONALIZED MEDICINE

4.6.8 CONCLUSION

4.7 VENDOR SELECTION CRITERIA

4.7.1 INTRODUCTION

4.7.2 CORE SELECTION CRITERIA

4.7.2.1 REGULATORY COMPLIANCE

4.7.2.2 CLINICAL EVIDENCE AND RESEARCH SUPPORT

4.7.2.3 TECHNICAL PERFORMANCE AND DEVICE COMPATIBILITY

4.7.2.4 QUALITY MANAGEMENT AND MANUFACTURING STANDARDS

4.7.2.5 SERVICE, TRAINING, AND AFTER-SALES SUPPORT

4.7.2.6 SUPPLY CHAIN RELIABILITY

4.7.3 RECENT TRENDS IN VENDOR SELECTION

4.7.4 RISK FACTORS AND VULNERABILITIES

4.7.5 KEY PERFORMANCE INDICATORS

4.7.6 STRATEGIC RECOMMENDATIONS

4.7.7 CONCLUSION

4.8 PATENT ANALYSIS

4.8.1 PATENT QUALITY AND STRENGTH

4.8.2 PATENT FAMILIES

4.8.3 LICENSING AND COLLABORATIONS

4.8.4 REGIONAL PATENT LANDSCAPE

4.8.5 IP STRATEGY AND MANAGEMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9.4 CONCLUSION

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 INTRODUCTION

4.10.2 ECOSYSTEM ARCHITECTURE — KEY ACTORS AND ROLES

4.10.2.1 CORE TECHNOLOGY PROVIDERS

4.10.2.2 ENABLING INSTITUTIONS

4.10.3 VALUE CHAIN AND FUNCTIONAL FLOWS

4.10.3.1 RESEARCH AND DISCOVERY

4.10.3.2 CLINICAL DEVELOPMENT AND REGULATORY VALIDATION

4.10.3.3 MANUFACTURING AND QUALITY ASSURANCE

4.10.3.4 DISTRIBUTION, PROCUREMENT AND CLINICAL ADOPTION

4.10.4 MARKET ENABLERS AND INFRASTRUCTURE

4.10.4.1 SCIENTIFIC AND REGULATORY ENABLERS

4.10.4.2 REIMBURSEMENT AND HEALTH-ECONOMICS INFRASTRUCTURE

4.10.4.3 MANUFACTURING AND SUPPLY-CHAIN CAPACITY

4.10.5 INTERDEPENDENCIES AND STRATEGIC PARTNERSHIPS

4.10.5.1 ACADEMIA-INDUSTRY TECHNOLOGY TRANSFER

4.10.5.2 VERTICAL INTEGRATION AND CONTRACT MANUFACTURING

4.10.5.3 CLINICAL NETWORKS AND KOL ECOSYSTEMS

4.10.6 RISKS, CONSTRAINTS AND SYSTEMIC VULNERABILITIES

4.10.6.1 REGULATORY COMPLEXITY FOR COMBINED PRODUCTS

4.10.6.2 SUPPLY-CHAIN CONCENTRATION AND MATERIAL RISK

4.10.6.3 EVIDENCE AND REIMBURSEMENT UNCERTAINTY

4.10.6.4 CLINICAL OPERATIONAL BARRIERS

4.10.7 STRATEGIC IMPLICATIONS AND RECOMMENDATIONS

4.10.8 OUTLOOK — EVOLUTION OF THE ECOSYSTEM

4.10.9 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 INTRODUCTION

4.11.2 RECENT TECHNOLOGICAL INNOVATIONS

4.11.2.1 ADVANCED PHOTOSENSITIZERS

4.11.2.2 OXYGEN-SELF-SUFFICIENT PLATFORMS

4.11.2.3 ALTERNATIVE ACTIVATION MODALITIES

4.11.2.4 SMART NANOPLATFORMS

4.11.2.5 NOVEL CHEMICAL STRUCTURES

4.11.3 STRATEGIC INNOVATIONS IN DELIVERY SYSTEMS

4.11.3.1 LIGHT DELIVERY DEVICES

4.11.3.2 COMBINATION THERAPIES

4.11.3.3 IMAGING INTEGRATION

4.11.4 KEY CHALLENGES

4.11.5 STRATEGIC THEMES

4.11.6 STRATEGIC IMPLICATIONS FOR MARKET PLAYERS

4.11.7 RECOMMENDATIONS

4.11.8 OUTLOOK AND STRATEGIC RISKS

4.11.9 CONCLUSION

4.12 PRICING ANALYSIS

4.12.1 INTRODUCTION

4.12.2 COMPONENTS OF THE TOTAL TREATMENT PRICE

4.12.2.1 PHOTOSENSITIZING AGENT (DRUG) COSTS

4.12.2.2 DEVICE CAPITAL AND MAINTENANCE COST

4.12.2.3 CONSUMABLES AND PROCEDURAL OVERHEAD

4.12.2.4 INDIRECT AND DOWNSTREAM COSTS

4.12.3 PRICING MODELS AND APPROACHES

4.12.3.1 COST-PLUS AND MARKUP MODELS

4.12.3.2 VALUE-BASED AND OUTCOMES-LINKED PRICING

4.12.3.3 BUNDLED PAYMENTS AND PROCEDURAL TARIFFS

4.12.3.4 SUBSCRIPTION AND MANAGED-SERVICE MODELS FOR DEVICES

4.12.4 REIMBURSEMENT LANDSCAPE

4.12.4.1 UNITED STATES: MEDICARE AND COMMERCIAL PAYERS

4.12.4.2 EUROPE AND OTHER HIGH-INCOME MARKETS

4.12.4.3 EMERGING MARKETS AND OUT-OF-POCKET DYNAMICS

4.12.5 REGIONAL PRICE DIFFERENTIALS AND DRIVERS

4.12.5.1 MANUFACTURING FOOTPRINT AND SUPPLY-CHAIN EFFECTS

4.12.5.2 REGULATORY BURDEN AND MARKET ACCESS TIMELINES

4.12.5.3 CLINICAL PRACTICE PATTERNS AND REIMBURSEMENT POLICY

4.12.6 PRICE SENSITIVITY, ACCESS, AND EQUITY

4.12.6.1 PRICE ELASTICITY IN HOSPITAL PROCUREMENT

4.12.6.2 PATIENT ACCESS AND SOCIOECONOMIC BARRIERS

4.12.7 COMPETITIVE & STRATEGIC PRICING IMPLICATIONS

4.12.7.1 DIFFERENTIATION-BASED PREMIUM PRICING

4.12.7.2 PENETRATION PRICING AND VOLUME STRATEGIES

4.12.7.3 MANAGED ENTRY AGREEMENTS AND OUTCOMES GUARANTEES

4.12.8 RECOMMENDATIONS FOR STAKEHOLDERS

4.12.8.1 FOR MANUFACTURERS

4.12.8.2 FOR PROVIDERS AND HOSPITAL SYSTEMS

4.12.8.3 FOR PAYERS AND POLICYMAKERS

4.12.9 RISKS, UNCERTAINTIES, AND FUTURE PRICE PRESSURES

4.12.10 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 INTRODUCTION

5.2 TARIFF LANDSCAPE RELEVANT TO PDT PRODUCTS

5.2.1 CATEGORIES OF TRADE EXPOSURE

5.2.2 RECENT AND EMERGING TARIFF MEASURES OF CONSEQUENCE

5.3 DIRECT COST IMPACTS

5.3.1 INCREASED LANDED COSTS AND MARGIN COMPRESSION

5.3.2 PRICE VOLATILITY AND PROCUREMENT BUDGETING

5.4 SUPPLY-CHAIN & MANUFACTURING IMPLICATIONS

5.4.1 SUPPLIER DIVERSIFICATION AND RESHORING INCENTIVES

5.4.2 SOURCING OF HIGH-VALUE NANOMATERIALS AND COMPONENTS

5.4.3 REGULATORY AND QUALIFICATION COSTS FOR NEW SUPPLIERS

5.5 CLINICAL ACCESS, PRICING & REIMBURSEMENT EFFECTS

5.5.1 ACCESS RISK FOR PATIENTS AND PROVIDERS

5.5.2 REIMBURSEMENT PRESSURE AND HEALTH-ECONOMIC ASSESSMENTS

5.6 R&D, INNOVATION & COMPETITIVE IMPLICATIONS

5.6.1 DISRUPTION OF RESEARCH SUPPLIES AND COLLABORATION FLOWS

5.6.2 STRATEGIC REPOSITIONING AND COMPETITIVE ADVANTAGE

5.7 POLICY, COMPLIANCE & REGULATORY CONSIDERATIONS

5.7.1 USE OF WTO AND PREFERENTIAL TRADE RULES

5.7.2 TARIFF MITIGATION TOOLS AND ADVOCACY

5.8 RECOMMENDATIONS FOR STAKEHOLDERS

5.9 CONCLUSION

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.1.1 CERTIFIED STANDARDS

6.1.2 SAFETY STANDARDS

6.1.3 MATERIAL HANDLING & STORAGE

6.1.4 TRANSPORT & PRECAUTIONS

6.1.5 HAZARD IDENTIFICATION

6.1.6 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 GROWING PREFERENCE FOR MINIMALLY INVASIVE THERAPIES

7.1.3 TECHNOLOGICAL ADVANCEMENTS IN PHOTOSENSITIZERS AND DEVICES

7.1.4 EXPANDING RESEARCH AND CLINICAL DEVELOPMENT PIPELINE

7.2 RESTRAINTS

7.2.1 LIMITED DEPTH OF LIGHT PENETRATION

7.2.2 HIGH COST OF TREATMENT

7.3 OPPORTUNITIES

7.3.1 INTEGRATION WITH OTHER CANCER THERAPIES

7.3.2 DEVELOPMENT OF NOVEL PHOTOSENSITIZERS

7.3.3 M&A AND PARTNERSHIPS WITH ONCOLOGY DEVICE/LASER FIRMS AND PHARMA

7.4 CHALLENGES

7.4.1 TUMOR HYPOXIA AS A BIOLOGICAL BARRIER TO PHOTODYNAMIC THERAPY EFFICACY

7.4.2 COMPETITION FROM ALTERNATIVE TREATMENTS

8 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 PHOTOSENSITIZER DRUGS

8.3 PHOTODYNAMIC THERAPY DEVICES

9 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION

9.1 OVERVIEW

9.2 SKIN & CUTANEOUS ONCOLOGY

9.3 HEAD & NECK

9.4 ESOPHAGAL

9.5 LUNG

9.6 BLADDER

9.7 CERVICAL

9.8 PROSTATE

10 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY

10.1 OVERVIEW

10.2 STANDALONE THERAPY

10.3 ADJUNCTIVE THERAPY

10.4 PALLIATION THERAPY

10.5 OTHERS

11 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE

11.1 OVERVIEW

11.2 EXTERNAL BEAM

11.3 INTRACAVITARY (ENDOSCOPIC) DELIVERY

11.4 INTERSTITIAL (INTERNAL) DELIVERY

11.5 OTHERS

12 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE

12.1 OVERVIEW

12.2 EARLY-STAGE CANCER

12.3 LATE-STAGE CANCER

13 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS

13.1 OVERVIEW

13.2 GERIATRIC

13.3 ADULTS

13.4 PEDIATRIC

14 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 DERMATOLOGY & SKIN-CANCER CLINICS

14.4 AMBULATORY SURGICAL CENTERS (ASCS)

14.5 ACADEMIC & RESEARCH INSTITUTES

14.6 OTHERS

15 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 THIRD PARTY DISTRIBUTORS

15.4 ONLINE

15.5 OTHERS

16 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION

16.1 EUROPE

16.1.1 GERMANY

16.1.2 U.K.

16.1.3 FRANCE

16.1.4 ITALY

16.1.5 SPAIN

16.1.6 RUSSIA

16.1.7 TURKEY

16.1.8 SWITZERLAND

16.1.9 BELGIUM

16.1.10 NETHERLANDS

16.1.11 SWEDEN

16.1.12 DENMARK

16.1.13 NORWAY

16.1.14 FINLAND

16.1.15 REST OF EUROPE

17 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 NOVERTIS AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 GALDERMA S. A.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 PHOTOCURE

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 ADVANZ PHARMA CORP.

19.4.1 COMPANY SNAPSHOT

19.4.2 COMPANY SHARE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 AMERISOURCE BERGEN CORPORATION

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 BIOFRONTERA AG

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 BIOLITEC HOLDING GMBH & CO KG

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 CARDINAL HEALTH

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 HEMERION THERAPEUTICS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 IMPACT BIOTECH

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 INOVA

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 LUMIBIRD

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENT

19.13 LUZITIN

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 MCKESSON

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 MODULIGHT CORPORATION

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 ONCOLUX INC (FORMERLY LUMEDA INC.)

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SUN PHARMACEUTICAL INDUSTRIES LTD

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 THERALASE TECHNOLOGIES INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE STANDALONE THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ADJUNCTIVE THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE PALLIATION THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE EXTERNAL BEAM IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE INTRACAVITARY (ENDOSCOPIC) DELIVERY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE INTERSTITIAL (INTERNAL) DELIVERY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE EARLY-STAGE CANCER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE LATE-STAGE CANCER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE GERIATRIC IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE ADULTS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE PEDIATRIC IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE DERMATOLOGY & SKIN-CANCER CLINICS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE AMBULATORY SURGICAL CENTERS (ASCS) IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE ACADEMIC & RESEARCH INSTITUTES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE DIRECT TENDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE THIRD PARTY DISTRIBUTORS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE ONLINE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 114 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 115 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 116 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 117 GERMANY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 GERMANY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 119 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 120 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.K. PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 122 U.K. PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 123 U.K. PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.K. LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.K. ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 127 U.K. SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.K. SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 129 U.K. HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.K. ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 133 U.K. LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.K. LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 135 U.K. BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.K. HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FRANCE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 152 FRANCE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 FRANCE ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 156 FRANCE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 FRANCE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 158 FRANCE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 FRANCE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 160 FRANCE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 FRANCE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 162 FRANCE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 FRANCE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 164 FRANCE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 FRANCE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 166 FRANCE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 FRANCE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 168 FRANCE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 FRANCE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 170 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 171 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 172 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 173 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 174 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 175 FRANCE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 FRANCE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ITALY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 189 ITALY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 ITALY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 191 ITALY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 ITALY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 193 ITALY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 ITALY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 195 ITALY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 ITALY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 197 ITALY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 ITALY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 199 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 200 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 201 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 202 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 203 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 204 ITALY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 ITALY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 206 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 SPAIN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SPAIN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 216 SPAIN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SPAIN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 218 SPAIN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SPAIN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 220 SPAIN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SPAIN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 222 SPAIN BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SPAIN BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 224 SPAIN CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SPAIN CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 226 SPAIN PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SPAIN PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 228 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 229 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 231 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 232 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 233 SPAIN HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SPAIN HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 235 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 236 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 RUSSIA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 238 RUSSIA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 239 RUSSIA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 RUSSIA LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 RUSSIA ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 243 RUSSIA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 RUSSIA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 245 RUSSIA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 RUSSIA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 247 RUSSIA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 RUSSIA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 249 RUSSIA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 RUSSIA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 251 RUSSIA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 RUSSIA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 253 RUSSIA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 RUSSIA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 255 RUSSIA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 RUSSIA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 257 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 258 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 259 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 260 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 261 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 264 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 TURKEY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 267 TURKEY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 268 TURKEY PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 TURKEY LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 TURKEY ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 272 TURKEY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 TURKEY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 274 TURKEY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 TURKEY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 276 TURKEY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 TURKEY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 278 TURKEY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 TURKEY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 280 TURKEY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 TURKEY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 282 TURKEY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 TURKEY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 284 TURKEY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 TURKEY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 286 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 287 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 288 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 289 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 290 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 291 TURKEY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 TURKEY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 293 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)