Europe Cereals Market

Taille du marché en milliards USD

TCAC :

%

USD

31.36 Billion

USD

59.11 Billion

2024

2032

USD

31.36 Billion

USD

59.11 Billion

2024

2032

| 2025 –2032 | |

| USD 31.36 Billion | |

| USD 59.11 Billion | |

|

|

|

|

Segmentation du marché des céréales en Europe, par type de produit (blé, riz, maïs, orge, avoine, seigle, sorgho, millet, quinoa, sarrasin, triticale, fonio, teff, amarante, kamut et autres), forme du produit (grains entiers, farine, flocons, grains roulés, grains soufflés, semoule moulue, grains concassés, amidon, son, germe et autres), niveau de transformation (enrichi, décortiqué, poli, précuit, mélangé, instantané, germé, grillé, extrudé, partiellement cuit, micronisé, cru, entièrement cuit, cuit à la vapeur, assaisonné, sucré, enrobé et autres), format de consommation (à la cuillère avec du lait/yaourt, barres à emporter, porridge, snack sec, snacks, prêt à cuire, prêt à réchauffer, à mélanger Ingrédient, infusé pour boissons et autres), catégorie de produit (ingrédients de boulangerie (mélanges de farine/céréales), céréales pour petit-déjeuner, matières premières/aliments pour animaux, collations céréalières, mélanges de céréales instantanés, céréales pour nourrissons, kits repas à base de céréales, intrants de brassage/distillation et autres), nature (conventionnel et biologique), catégorie (certifié OGM et sans OGM), avantages fonctionnels (enrichi en vitamines, riche en fibres, faible/sans sucre, riche en protéines, sans gluten, bon pour le cœur, enrichi en probiotiques/prébiotiques, hypocholestérolémiant, faible indice glycémique, enrichi en oméga-3, faible en matières grasses, sans allergènes, riche en fer, faible/sans sel, adapté au régime paléo, adapté au régime cétogène, certifié végétalien et autres), durée de conservation (long terme (stable à température ambiante), moyen terme et court terme (périssable)), emballage (Boîte, sachet, sac, sachet/stick, sac (en vrac), pot, carton Tetra Pack/aseptique, boîte, fût, emballage écologique et autres), taille de l'emballage (petits emballages (51 g à 250 g), emballages moyens (251 g à 500 g), grands emballages (501 g à 1 kg), portions individuelles (moins de 50 g), très grands emballages (1,1 kg à 2,5 kg) et emballages en vrac (plus de 2,5 kg)), gamme de prix (économique (jusqu'à 2,49 USD), milieu de gamme (2,50 à 6,99 USD) et premium (7,00 USD et plus)), canal de distribution (B2B et B2C) – Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des céréales

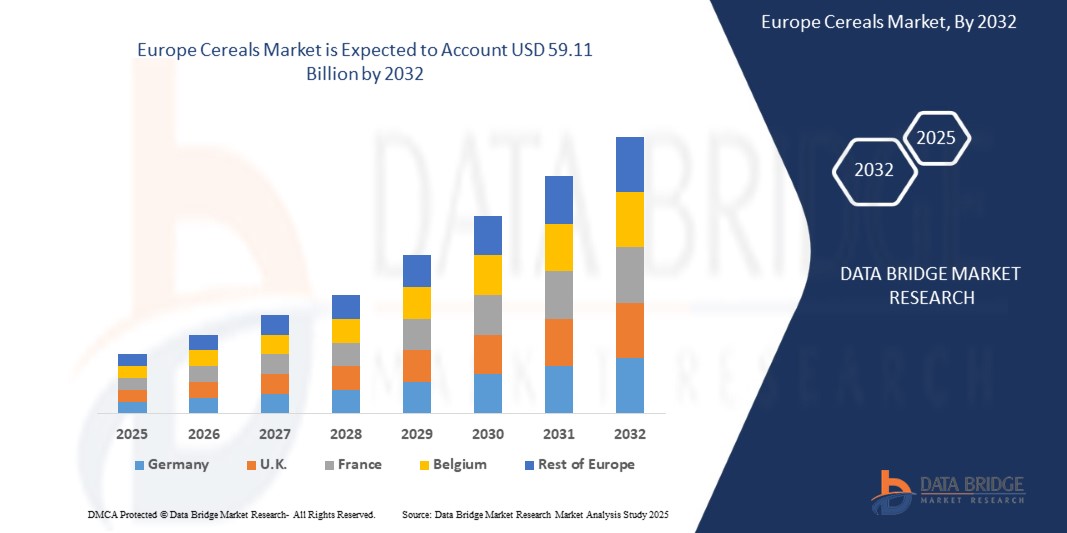

- La taille du marché européen des céréales était évaluée à 31,36 milliards USD en 2024 et devrait atteindre 59,11 milliards USD d'ici 2032 , à un TCAC de 8,4 % au cours de la période de prévision.

- La croissance du marché est tirée par des facteurs tels que la demande croissante d'options de petit-déjeuner pratiques et nutritives, la sensibilisation croissante des consommateurs à la santé, l'innovation dans les formulations de céréales et l'expansion de la disponibilité via les canaux de vente au détail en ligne.

- En outre, l’évolution des préférences des consommateurs pour les aliments nutritifs et fonctionnels, ainsi que l’urbanisation croissante et la pénétration croissante du commerce de détail en ligne, accélèrent l’adoption des produits céréaliers, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des céréales

- Le marché des céréales représente un segment clé de l'industrie agroalimentaire européenne, notamment les céréales prêtes à consommer et les céréales chaudes. Ces produits sont largement consommés comme options de petit-déjeuner pratiques et nutritives, adaptées aux modes de vie modernes et actifs. Ce marché propose une gamme diversifiée de produits à base de blé, d'avoine, de maïs, de riz et d'orge, adaptés aux différents besoins des consommateurs, notamment soucieux de leur santé, bio et sans gluten.

- Les fabricants de céréales innovent de plus en plus avec des variantes riches en protéines, enrichies et végétales, afin de s'adapter aux tendances santé et aux changements alimentaires en Europe. Ces développements étendent la portée du marché des céréales aux catégories d'aliments fonctionnels, notamment dans les régions développées où les consommateurs privilégient les étiquettes propres et la valeur nutritionnelle. La tendance croissante aux substituts de repas et aux en-cas nomades soutient également la croissance du marché.

- L'Allemagne domine le marché européen des céréales et devrait connaître la croissance la plus rapide, grâce à de solides habitudes de consommation, à la fidélité à la marque et à la présence d'acteurs reconnus du secteur tels que Kellogg's, General Mills et Post Holdings. La région bénéficie également d'une infrastructure de vente au détail mature et d'une forte sensibilisation des consommateurs aux questions de santé et de bien-être.

- Le segment du blé devrait dominer le marché des céréales grâce à sa praticité, sa grande stabilité et sa large disponibilité. Ce segment joue un rôle crucial dans l'évolution des habitudes de petit-déjeuner des consommateurs et offre des options enrichies, savoureuses et adaptées à chaque régime, répondant à divers besoins nutritionnels.

Portée du rapport et segmentation du marché des céréales

|

Attributs |

Marché des céréales : informations clés |

|

Segments couverts |

|

|

Pays couverts |

Europe

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des céréales

« Innovation dans les céréales fonctionnelles et la nutrition personnalisée »

- Le marché européen des céréales connaît une évolution majeure avec la demande croissante de céréales fonctionnelles et d'une nutrition personnalisée adaptée aux objectifs de santé et aux préférences alimentaires des consommateurs.

- Cette tendance pousse les fabricants à reformuler les céréales traditionnelles en y incorporant des ingrédients présentant des avantages spécifiques pour la santé, tels qu'une teneur élevée en fibres, un soutien immunitaire, une bonne santé cardiaque et une meilleure digestion.

- Par exemple, les principales marques de céréales lancent des produits enrichis en superaliments (graines de chia, graines de lin), en probiotiques, en prébiotiques et en adaptogènes tels que l'ashwagandha et la maca pour attirer les consommateurs soucieux de leur bien-être.

- Ce changement reflète la sensibilisation croissante à la santé préventive et la préférence pour les aliments propres et riches en nutriments, positionnant les céréales fonctionnelles comme des composants essentiels des régimes alimentaires modernes.

Dynamique du marché des céréales

Conducteur

Demande croissante d'options alimentaires pratiques et nutritives

- Les modes de vie urbains deviennent de plus en plus trépidants, ce qui entraîne une forte demande de solutions de petit-déjeuner rapides, nutritives et faciles à préparer.

- Les produits céréaliers répondent efficacement à ce besoin en raison de leur commodité, de leur longue durée de conservation, de leurs profils nutritionnels diversifiés et de leur large disponibilité dans les canaux de vente au détail modernes et traditionnels.

- Les options de céréales prêtes à consommer et instantanées permettent aux consommateurs de gagner du temps tout en garantissant un apport équilibré en nutriments essentiels tels que les fibres, les vitamines et les minéraux.

- Cette préférence croissante pour des choix alimentaires pratiques et sains entraîne une demande soutenue de céréales dans divers groupes démographiques, en particulier les professionnels, les étudiants et les familles soucieuses de leur santé.

- En avril 2024, selon un rapport de FoodNavigator, Kellogg's s'est associé à une société leader en sciences de la nutrition afin d'exploiter les données de santé des consommateurs et des outils d'IA pour développer des mélanges de céréales personnalisés. En analysant des millions de données relatives aux habitudes alimentaires, aux préférences et aux états de santé, Kellogg's a lancé une gamme de céréales personnalisées, conçues pour favoriser la santé intestinale, le bien-être cardiaque et le niveau d'énergie. Cette initiative reflète la demande croissante de solutions céréalières fonctionnelles, basées sur des données et conçues pour une nutrition personnalisée.

- De telles innovations soulignent la manière dont les marques adoptent la transformation numérique et l'analyse de la santé pour stimuler l'innovation des produits et améliorer l'engagement des consommateurs, alimentant ainsi une croissance soutenue du marché dans toutes les catégories de céréales en Europe.

Retenue/Défi

Préoccupations sanitaires concernant la teneur en sucre des céréales du petit-déjeuner

- Le coût substantiel de l’approvisionnement en matières premières de première qualité et du développement de céréales fonctionnelles, biologiques ou personnalisées pose des défis importants, en particulier pour les petites et moyennes entreprises (PME).

- Ces coûts comprennent l'approvisionnement en ingrédients spécialisés (par exemple, superaliments, probiotiques), les technologies de transformation avancées, le respect des normes de certification sanitaire et de labellisation propre, ainsi que le marketing sur des segments santé de niche. De nombreux petits producteurs de céréales manquent de ressources financières ou de capacités de R&D pour concurrencer les marques européennes établies, ce qui ralentit l'innovation et limite la pénétration du marché.

- En octobre 2023, un rapport d'AgriBusiness Review soulignait que le coût du lancement de gammes de céréales fonctionnelles ou biologiques allait bien au-delà de l'approvisionnement en matières premières. Il comprend l'investissement dans des machines spécialisées, la R&D pour l'amélioration nutritionnelle, l'innovation en matière d'emballage, la certification (comme le bio ou le sans gluten) et la sensibilisation des consommateurs. Ces dépenses cumulées sont souvent ingérables pour les petites marques qui souhaitent pénétrer le segment des céréales santé.

- Les capacités financières et les infrastructures technologiques limitées obligent de nombreux petits et moyens producteurs de céréales à retarder ou à renoncer au développement de tels produits, limitant ainsi leur compétitivité dans les catégories premium et fonctionnelles. Cet obstacle financier freine considérablement la diversification des marchés et l'innovation dans l'ensemble de la filière céréalière.

Portée du marché des céréales

Le marché européen des céréales est segmenté en treize segments notables basés sur le type de produit, la forme du produit, le niveau de transformation, le format de consommation, la catégorie de produit, la nature, la catégorie, les avantages fonctionnels, la durée de conservation, l'emballage, la taille de l'emballage, la gamme de prix, le canal de distribution

- Par type de produit

Le marché des céréales est segmenté selon le type de produit : blé, riz, maïs, orge, avoine, seigle, sorgho, millet, quinoa, sarrasin, triticale, fonio, teff, amarante, kamut, etc. Le blé et le maïs devraient dominer le marché en 2025 et connaître la croissance la plus rapide grâce à leur disponibilité en Europe, leur accessibilité financière et leur utilisation intensive dans les industries agroalimentaires et fourragères. La demande croissante de céréales anciennes comme le quinoa et l'amarante devrait stimuler la croissance des céréales de spécialité et de santé au cours de la période de prévision.

- Par forme de produit

Selon la forme du produit, le marché des céréales est segmenté en grains entiers, farine, flocons, grains aplatis, grains soufflés, farine moulue, grains concassés, amidon, son, germe, etc. Les grains entiers devraient dominer le marché en 2025 et connaître la croissance la plus rapide, portée par une sensibilisation croissante aux régimes riches en fibres et aux préférences « clean label ». La farine et le son devraient connaître une croissance régulière grâce à leur utilisation en boulangerie-pâtisserie et en alimentation diététique.

- Par niveau de traitement

Selon le degré de transformation, le marché des céréales est segmenté en céréales enrichies, décortiquées, polies, précuites, mélangées, instantanées, germées, torréfiées, extrudées, partiellement cuites, micronisées, crues, entièrement cuites, cuites à la vapeur, assaisonnées, sucrées, enrobées, etc. Les céréales enrichies devraient dominer le marché en 2025 et connaître la croissance la plus rapide grâce à leurs atouts nutritionnels. Les formats instantanés et précuits stimulent la demande des populations urbaines pour des solutions de repas rapides.

- Par format de consommation

En fonction du format de consommation, le marché des céréales est segmenté en céréales à consommer à la cuillère avec du lait ou du yaourt, barres à emporter, porridge, snacks secs, en sachets, prêtes à cuire, prêtes à réchauffer, avec ingrédients, infusées, etc. Les céréales à consommer à la cuillère devraient dominer le marché en 2025 et connaître la croissance la plus rapide grâce à leur utilisation traditionnelle. Les céréales prêtes à cuire et les sachets devraient quant à eux connaître une croissance rapide grâce à leur portabilité et leur praticité.

- Par catégorie de produit

Par catégorie de produits, le marché des céréales est segmenté en ingrédients de boulangerie (mélanges de farines et de céréales), céréales pour petit-déjeuner, matières premières/aliments pour animaux, snacks céréaliers, mélanges de céréales instantanés, céréales infantiles, kits repas à base de céréales, intrants de brassage/distillerie, etc. Le petit-déjeuner devrait dominer le marché en 2025 et connaître la croissance la plus rapide grâce à sa consommation généralisée. Les snacks céréaliers et les céréales infantiles devraient quant à eux connaître une croissance rapide en raison de l'évolution des habitudes alimentaires et d'une parentalité soucieuse de leur santé.

- Par nature

En raison de la nature des produits, le marché des céréales est segmenté en céréales conventionnelles et biologiques. Les céréales conventionnelles dominent en volume grâce à leur prix abordable et à des chaînes d'approvisionnement bien établies.

Les céréales biologiques devraient connaître la croissance la plus rapide au cours de la période 2025-2032, stimulée par la demande croissante des consommateurs pour des produits sans pesticides et à étiquette propre.

- Par catégorie

Le marché des céréales est segmenté en catégories : céréales certifiées OGM et céréales non certifiées OGM. Le segment des céréales non certifiées OGM devrait dominer le marché en 2025 et connaître la croissance la plus rapide, grâce à la sensibilisation croissante des consommateurs et à leur préférence pour les céréales d'origine naturelle, notamment en Europe.

- Par avantages fonctionnels

Sur la base de leurs avantages fonctionnels, le marché des céréales est segmenté comme suit : enrichies en vitamines, riches en fibres, faibles ou sans sucre, riches en protéines, sans gluten, bonnes pour le cœur, enrichies en probiotiques/prébiotiques, hypocholestérolémiantes, à faible indice glycémique, enrichies en oméga-3, faibles en matières grasses, sans allergènes, riches en fer, faibles ou sans sel, paléo, cétogènes, certifiées végétaliennes, etc. Les céréales riches en fibres et bonnes pour le cœur devraient dominer le marché en 2025 et connaître la croissance la plus rapide grâce à l'importance croissante accordée à la prévention et à la gestion du poids.

- Par durée de conservation

En fonction de la durée de conservation, le marché des céréales est segmenté en deux catégories : longue durée (à température ambiante), moyenne durée et courte durée (périssable). Les céréales longue durée devraient dominer le marché en 2025 et connaître la croissance la plus rapide grâce à leur durabilité et à leurs avantages logistiques, notamment sur les marchés de détail et d'exportation.

- Par emballage

En termes d'emballage, le marché des céréales est segmenté en boîtes, sachets, sacs, sachets/stick packs, sacs (en vrac), pots, Tetra Pack/carton aseptique, boîtes métalliques, fûts, emballages écologiques, etc. Les boîtes et les sachets devraient dominer le marché en 2025 et constituer le segment à la croissance la plus rapide dans la distribution. Les emballages écologiques devraient quant à eux connaître une croissance rapide grâce aux initiatives en matière de développement durable et aux solutions d'emballage économiques. La préférence des consommateurs pour les formats refermables, légers et écologiques soutient la croissance, notamment dans les secteurs de l'alimentation, des soins personnels et du e-commerce, axés sur la fraîcheur et la réduction des déchets.

- Par taille d'emballage

En fonction de la taille des emballages, le marché des céréales est segmenté en petits paquets (51 g à 250 g), moyens paquets (251 g à 500 g), grands paquets (501 g à 1 kg), portions individuelles (moins de 50 g), très grands paquets (1,1 kg à 2,5 kg) et vrac (plus de 2,5 kg). Les petits et moyens paquets devraient dominer le marché en 2025 et connaître la croissance la plus rapide grâce à leur prix abordable et à leur adéquation aux besoins des ménages individuels. Les vracs, quant à eux, sont courants dans les ventes B2B et institutionnelles.

- Par gamme de prix

En fonction des prix, le marché des céréales est segmenté en économique (jusqu'à 2,49 USD), milieu de gamme (2,50 à 6,99 USD) et premium (à partir de 7 USD). Le milieu de gamme devrait dominer le marché en 2025 et connaître la croissance la plus rapide grâce à son équilibre entre accessibilité et qualité. Les céréales premium gagnent quant à elles du terrain sur les marchés urbains, avec la hausse des revenus disponibles.

- Par canal de distribution

En fonction des canaux de distribution, le marché des céréales est segmenté en B2B et B2C. Le B2C devrait dominer le marché en 2025 et connaître la croissance la plus rapide, la majorité des ventes étant réalisées par les supermarchés, les commerces de proximité et les plateformes en ligne. Le B2B, quant à lui, est porté par la restauration, l'approvisionnement institutionnel et l'usage industriel.

Analyse régionale du marché des céréales

- Le marché européen des céréales détenait une part de revenus de 24,23 % en 2025, grâce à une forte consommation de céréales prêtes à consommer, une forte présence de la marque et une disponibilité généralisée dans les formats de vente au détail modernes.

- La région bénéficie d'une industrie agroalimentaire mature, d'une demande croissante de produits céréaliers biologiques et enrichis, et de l'innovation continue d'acteurs clés tels que Kellogg's, General Mills et Post Holdings. De plus, la préférence croissante des consommateurs pour des options de petit-déjeuner pratiques et saines renforce encore davantage leur leadership sur le marché européen.

Aperçu du marché allemand des céréales

Le marché allemand des céréales a représenté la plus grande part de chiffre d'affaires en Europe en 2024, avec plus de 14 % de chiffre d'affaires, grâce à une consommation céréalière élevée par habitant, à la fidélité à la marque et à un réseau de distribution bien établi. Des acteurs majeurs tels que General Mills, Kellogg's, Post Holdings et Quaker (PepsiCo) dominent le marché avec une large gamme de céréales prêtes à consommer et fonctionnelles. La demande de céréales biologiques, riches en fibres et en protéines, continue de croître, reflétant l'évolution des tendances en matière de santé et de bien-être.

Aperçu du marché britannique des céréales

En 2024, le marché britannique des céréales a représenté la plus grande part de chiffre d'affaires en Europe, avec plus de 12,40 %, grâce à une sensibilisation croissante aux questions de santé, à la demande d'options de petit-déjeuner pratiques et à la popularité des produits riches en fibres, pauvres en sucres et d'origine végétale. L'innovation en matière d'arômes, d'emballages et d'ingrédients fonctionnels soutient également la croissance continue du marché.

Part de marché des céréales

Le marché des céréales est principalement dirigé par des entreprises bien établies, notamment :

- Weetabix (Royaume-Uni)

- Associated British Foods plc (Royaume-Uni)

- B&G Foods, Inc. (États-Unis)

- bio-familia AG (Suisse)

- Rude Health (Royaume-Uni)

- Clextral (France)

- Dr. Oetker (Allemagne)

- Seitenbacher (Allemagne)

Derniers développements sur le marché européen des céréales

- En mars 2025 , General Mills a lancé une nouvelle gamme de céréales pour petit-déjeuner riches en protéines sous la marque « Nature Valley », ciblant les consommateurs soucieux de leur santé et les adeptes du sport. Ce produit propose des variantes enrichies en protéines de lactosérum, en fibres et sans sucres ajoutés, répondant ainsi à la demande croissante d'aliments fonctionnels.

- En janvier 2025 , Kellogg's a annoncé son expansion stratégique en Asie du Sud-Est avec l'ouverture d'une nouvelle usine au Vietnam afin de répondre à la demande régionale croissante de solutions de petit-déjeuner pratiques. L'usine produira une variété de céréales adaptées aux goûts locaux, notamment des options à faible teneur en sucre et d'origine végétale.

- En octobre 2024 , Nestlé s'est associé à Danone et à une start-up spécialisée dans les technologies de la santé pour co-développer une plateforme de nutrition personnalisée. Cette plateforme utilise les données alimentaires des consommateurs pour recommander des produits céréaliers riches en nutriments spécifiques tels que les oméga-3, les fibres et le fer, inaugurant ainsi une nouvelle ère de nutrition de précision pour le petit-déjeuner.

- En avril 2025 , Post Holdings a dévoilé un emballage durable pour sa gamme de céréales « Honey Bunches of Oats ». Ces nouveaux emballages recyclables et biodégradables soutiennent l'engagement de l'entreprise à réduire de 50 % son utilisation de plastique d'ici 2030 et à répondre aux besoins des consommateurs soucieux de l'environnement.

- En février 2025 , la marque « Saffola » de Marico a lancé en Inde des céréales à base de millet dans sa gamme « Healthy Crunch ». Ce lancement s'inscrit dans le cadre de l'Année internationale du millet et répond à la popularité croissante des céréales anciennes dans les formules de petit-déjeuner modernes.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES:-

4.1.1 INTENSITY OF COMPETITIVE RIVALRY (HIGH)

4.1.2 BARGAINING POWER OF BUYERS/CONSUMERS (HIGH)

4.1.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.1.4 THREAT OF SUBSTITUTE PRODUCTS (MODERATE TO HIGH)

4.1.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.2 BRAND OUTLOOK

4.2.1 COMPARATIVE BRAND ANALYSIS

4.2.2 PRODUCT AND BRAND OVERVIEW

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS:

4.4 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.5 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.5.1 IMPACT ON PRICE

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.6 REGULATORY FRAMEWORK AND GUIDELINES

4.7 VALUE CHAIN

4.7.1 EUROPE CEREALS MARKET VALUE CHAIN

4.7.2 PRODUCTION:

4.7.3 PROCESSING:

4.7.4 MARKETING/DISTRIBUTION:

4.7.5 BUYERS:

4.8 SUPPLY CHAIN ANALYSIS

4.9 COST ANALYSIS BREAKDOWN

4.1 PROFIT MARGINS SCENARIO

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.12 PRICING ANALYSIS

4.13 PATENT ANALYSIS

4.13.1 PATENT QUALITY AND STRENGTH

4.13.2 PATENT FAMILIES

4.13.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.13.4 LICENSING AND COLLABORATIONS

4.13.5 COMPANY PATENT LANDSCAPE

4.13.6 REGION PATENT LANDSCAPE

4.14 IP STRATEGY AND MANAGEMENT

4.14.1 PATENT ANALYSIS

4.14.2 PROFIT MARGINS SCENARIO

4.15 IMPACT OF ECONOMIC SLOWDOWN ON THE EUROPE CEREALS MARKET

4.15.1 IMPACT ON PRICES

4.15.2 IMPACT ON SUPPLY CHAIN

4.15.3 IMPACT ON SHIPMENT

4.15.4 IMPACT ON DEMAND

4.15.5 IMPACT ON STRATEGIC DECISIONS

4.16 SUPPLY CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 TYPES OF LOGISTICS COSTS INVOLVED

4.16.3 FACTORS INFLUENCING EACH COST TYPE

4.16.4 STRATEGIES TO MINIMIZE LOGISTIC COSTS

4.16.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.17.1 PROMINENT COMPANIES

4.17.2 SMALL & MEDIUM SIZE COMPANIES

4.17.3 END USERS

4.18 PRODUCTION CONSUMPTION ANALYSIS

4.19 RAW MATERIAL SOURCING ANALYSIS (EUROPE CEREALS MARKET)

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.20.1 OVERVIEW:

4.21 TARIFFS & IMPACT ON THE MARKET

4.21.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.21.3 VENDOR SELECTION CRITERIA DYNAMICS

4.21.4 IMPACT ON SUPPLY CHAIN

4.21.4.1 RAW MATERIAL PROCUREMENT

4.21.4.2 MANUFACTURING AND PRODUCTION

4.21.4.3 LOGISTICS AND DISTRIBUTION

4.21.4.4 PRICE PITCHING AND POSITION OF MARKET

4.21.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.5.1 SUPPLY CHAIN OPTIMIZATION

4.21.5.2 JOINT VENTURE ESTABLISHMENTS

4.21.6 IMPACT ON PRICES

4.21.7 REGULATORY INCLINATION

4.21.7.1 GEOPOLITICAL SITUATION

4.21.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.21.8 FREE TRADE AGREEMENTS

4.21.9 ALLIANCES ESTABLISHMENTS

4.21.10 STATUS ACCREDITATION (INCLUDING MFTN)

4.21.11 DOMESTIC COURSE OF CORRECTION

4.21.12 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.21.13 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR NUTRITIONAL AND FUNCTIONAL FOODS

5.1.2 URBANIZATION AND CHANGING LIFESTYLES BOOSTING READY-TO-EAT CEREALS

5.1.3 SURGE OF PLANT‑BASED AND FUNCTIONAL INGREDIENTS DRIVEN BY HEALTH & ENVIRONMENTAL CONCERNS

5.2 RESTRAINTS

5.2.1 FLUCTUATING RAW MATERIAL PRICES AND CLIMATE RISKS

5.2.2 GROWING CRITICISM OVER ADDED SUGAR AND PROCESSING

5.3 OPPORTUNITIES

5.3.1 CONSUMERS ARE INCREASINGLY CHOOSING HIGH-FIBER, LOW-SUGAR, AND ORGANIC CEREALS

5.3.2 THE RISING SHIFT TOWARD PLANT-BASED DIETARY PATTERNS INFLUENCING CONSUMER PREFERENCES.

5.3.3 ONLINE GROCERY ENABLING CEREAL BRANDS TO SELL DIRECTLY, GATHER CONSUMER DATA, AND OFFER SUBSCRIPTIONS

5.4 CHALLENGES

5.4.1 SIGNIFICANT HURDLES FOR SUPPLY CHAINS DUE TO LOGISTICS DISRUPTIONS, COMPLEX REGULATIONS, AND INEFFICIENT DISTRIBUTION NETWORKS

5.4.2 INCREASED COMPETITION FROM ALTERNATIVES LIKE GRANOLA, PROTEIN BARS, SMOOTHIES, YOGURT, AND ETHNIC BREAKFASTS

6 EUROPE CEREALS MARKET, BY CEREAL TYPE

6.1 OVERVIEW

6.2 WHEAT

6.2.1 WHEAT, BY TYPE

6.3 RICE

6.3.1 RICE, BY TYPE

6.4 MAIZE(CORN)

6.4.1 MAIZE(CORN), BY TYPE

6.5 BARLEY

6.5.1 BARLEY, BY TYPE

6.6 OATS

6.6.1 OATS, BY TYPE

6.7 RYE

6.7.1 RYE, BY TYPE

6.8 SORGHUM

6.8.1 SORGHUM, BY TYPE

6.9 MILLET

6.9.1 MILLET, BY TYPE

6.1 QUINOA

6.10.1 QUINOA, BY TYPE

6.11 BUCKWHEAT

6.12 TRITICALE

6.13 FONIO

6.14 TEFF

6.15 AMARANTH

6.16 KAMUT

6.17 OTHERS

7 EUROPE CEREALS MARKET, PRODUCT FORM

7.1 OVERVIEW

7.2 WHOLE GRAINS

7.3 FLOUR

7.4 FLAKED GRAINS

7.5 ROLLED GRAINS

7.6 PUFFED GRAINS

7.7 GROUND MEAL

7.8 CRACKED GRAINS

7.9 STARCH

7.1 BRAN

7.11 GERM

7.12 OTHERS

8 EUROPE CEREALS MARKET, BY PROCESSING LEVEL

8.1 OVERVIEW

8.2 FORTIFIED

8.3 DEHUSKED

8.4 POLISHED

8.5 PRE-COOKED

8.6 BLENDED

8.7 INSTANT

8.8 SPROUTED

8.9 ROASTED

8.1 EXTRUDED

8.11 PARTIALLY COOKED

8.12 MICRONIZED

8.13 RAW

8.14 FULLY COOKED

8.15 STEAMED

8.16 SEASONED

8.17 SWEETENED

8.18 COATED

8.19 OTHERS

9 EUROPE CEREALS MARKET, BY CONSUMPTION FORMAT

9.1 OVERVIEW

9.2 SPOON-EATEN WITH MILK/YOGURT

9.3 ON-THE-GO BARS

9.4 PORRIDGE

9.5 DRY SNACK

9.6 SNACK PACKS

9.7 READY-TO-COOK

9.8 READY-TO-HEAT

9.9 MIX-IN INGREDIENT

9.1 BEVERAGE-INFUSED

9.11 OTHERS

10 EUROPE CEREALS MARKET, BY PRODUCT CATEGORY

10.1 OVERVIEW

10.2 BAKERY INGREDIENTS (FLOUR/GRAIN BLENDS)

10.3 BREAKFAST CEREALS

10.3.1 BREAKFAST CEREALS, BY TYPE

10.3.1.1 Ready-To-Eat (RTE), By Type

10.3.1.2 Hot Cereals, By Type

10.4 FEEDSTOCK/ANIMAL FEED

10.5 CEREAL SNACKS

10.5.1 CEREAL SNACKS, BY TYPE

10.6 INSTANT CEREAL MIXES

10.7 INFANT CEREALS

10.7.1 INFANT CEREALS, BY TYPE

10.8 CEREAL-BASED MEAL KITS

10.9 BREWING/DISTILLING INPUTS

10.1 OTHERS

11 EUROPE CEREALS MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 EUROPE CEREALS MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 GMO-BASED

12.3 NON-GMO CERTIFIED

13 EUROPE CEREALS MARKET, BY FUNCTIONAL BENEFITS

13.1 OVERVIEW

13.2 VITAMIN-FORTIFIED

13.3 HIGH-FIBER

13.4 LOW/NO SUGAR

13.5 HIGH-PROTEIN

13.6 GLUTEN-FREE

13.7 HEART-HEALTHY

13.8 PROBIOTIC/PREBIOTIC ENHANCED

13.9 CHOLESTEROL-LOWERING

13.1 LOW GLYCEMIC INDEX

13.11 OMEGA-3 ENRICHED

13.12 LOW FAT

13.13 ALLERGEN-FREE

13.14 HIGH-IRON

13.15 LOW/NO SALT

13.16 PALEO-FRIENDLY

13.17 KETO-FRIENDLY

13.18 VEGAN-CERTIFIED

13.19 OTHERS

14 EUROPE CEREALS MARKET, BY SHELF LIFE

14.1 OVERVIEW

14.2 LONG-TERM (AMBIENT SHELF-STABLE)

14.3 MEDIUM-TERM

14.4 SHORT-TERM (PERISHABLE)

15 EUROPE CEREALS MARKET, BY PACKAGING

15.1 OVERVIEW

15.2 BOX

15.2.1 BOX, BY TYPE

15.3 POUCH

15.3.1 POUCH, BY TYPE

15.4 BAG

15.4.1 BAG, BY TYPE

15.5 SACHET/STICK PACK

15.6 SACK (BULK)

15.7 JAR

15.7.1 JAR, BY TYPE

15.8 TETRA PACK / ASEPTIC CARTON

15.9 CANISTER

15.1 DRUM

15.11 ECO-PACKAGING

15.11.1 ECO-PACKAGING, BY TYPE

15.12 OTHERS

16 EUROPE CEREALS MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 SMALL PACKS (51G–250G)

16.3 MEDIUM PACKS (251G–500G)

16.4 LARGE PACKS (501G–1KG)

16.5 SINGLE SERVE PACKS (BELOW 50G)

16.6 EXTRA LARGE PACKS (1.1KG–2.5KG)

16.7 BULK PACKS (ABOVE 2.5KG)

17 EUROPE CEREALS MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 ECONOMY (UPTO USD 2.49)

17.3 MID-RANGE (USD 2.50-6.99)

17.4 PREMIUM (USD 7.00 AND ABOVE)

18 EUROPE CEREALS MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 B2B

18.3 B2C

18.3.1 B2C, BY TYPE

18.3.2 ONLINE, BY TYPE

18.3.3 OFFLINE, BY TYPE

19 EUROPE CEREALS MARKET, BY REGION

19.1 EUROPE

19.1.1 GERMANY

19.1.2 U.K.

19.1.3 FRANCE

19.1.4 ITALY

19.1.5 SPAIN

19.1.6 NETHERLANDS

19.1.7 POLAND

19.1.8 RUSSIA

19.1.9 BELGIUM

19.1.10 SWITZERLAND

19.1.11 TURKEY

19.1.12 SWEDEN

19.1.13 NORWAY

19.1.14 DENMARK

19.1.15 FINLAND

19.1.16 REST OF EUROPE

20 EUROPE CEREALS MARKET

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 NESTLÉ

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 BRAND PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 ASSOCIATED BRITISH FOODS PLC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 BUSINESS PORTFOLIO

22.2.5 RECENT NEWS

22.3 GENERAL MILLS INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 BRAND PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 POST HOLDINGS, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 BRAND PORTFOLIO

22.4.5 RECENT DEVELOPMENT

22.5 WK KELLOGG CO

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 BRAND PORTFOLIO

22.5.5 RECENT DEVELOPMENT

22.6 BAGRRY'S

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS/NEWS

22.7 B&G FOODS, INC.

22.7.1 COMPANY SNAPSHOT

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT DEVELOPMENT

22.8 BARBARA'S BAKERY

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 BIO-FAMILIA EN

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 BOB’S RED MILL NATURAL FOODS

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 CÉRÉAL BIO

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 CLEXTRAL

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 DR. OETKER

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENTS/NEWS

22.14 HERO GROUP

22.14.1 COMPANY SNAPSHOT

22.14.2 REVENUE ANALYSIS

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT DEVELOPMENTS/NEWS

22.15 KASHI LLC

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 KWALITY

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 LIMAGRAIN - INGRÉDIENTS

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 MARICO

22.18.1 COMPANY SNAPSHOT

22.18.2 REVENUE ANALYSIS

22.18.3 BRAND PORTFOLIO

22.18.4 RECENT DEVELOPMENTS/NEWS

22.19 MULDER BREAKFAST CEREALS

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 NATURE'S PATH

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 PEPSICO

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 RUDE HEALTH

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 SANITARIUM

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 SEITENBACHER

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 SEVEN SUNDAYS

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENTS/NEWS

22.26 SURREAL UK

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 THE HAIN CELESTIAL GROUP, INC.

22.27.1 COMPANY SNAPSHOT

22.27.2 REVENUE ANALYSIS

22.27.3 BRAND PORTFOLIO

22.27.4 RECENT DEVELOPMENTS/NEWS

22.28 THE QUAKER OATS COMPANY

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 THE SILVER PALATE

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 WEETABIX

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENTS/NEWS

23 QUESTIONNAIRE

24 RELATED REPORTS

Liste des tableaux

TABLE 1 SUMMARY OF COMPETITIVE POSITIONING:

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 EXPORT

TABLE 4 IMPORT

TABLE 5 COST FOR KEY EQUIPMENT AND THE OVERALL CEREALS PROCESSING PLANTS

TABLE 6 PROFIT MARGIN SCENARIOS

TABLE 7 CONSUMER BUYING BEHAVIOUR

TABLE 8 PRODUCTION

TABLE 9 CONSUMPTION

TABLE 10 CONSUMER BUYING BEHAVIOUR

TABLE 11 CEREAL IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 12 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 13 REGULATORY INCLINATION

TABLE 14 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 15 ALLIANCES ESTABLISHMENTS

TABLE 16 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 17 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 19 EUROPE WHEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE RICE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE MAIZE(CORN) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE BARLEY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE OATS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE RYE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE SORGHUM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE MILLET IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE QUINOA IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE BUCKWHEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE TRITICALE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE FONIO IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE TEFF IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE AMARANTH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE WHOLE GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE FLOUR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE FLAKED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE ROLLED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE PUFFED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE GROUND MEAL IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE CRACKED GRAINS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE STARCH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE BRAN IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE GERM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE FORTIFIEDIN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE DEHUSKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE POLISHED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE PRE-COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE BLENDED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE INSTANT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE SPROUTED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE ROASTED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE EXTRUDED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE PARTIALLY COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE MICRONIZED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE RAW IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE FULLY COOKED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE STEAMED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE SEASONED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE SWEETENED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE COATED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE SPOON-EATEN WITH MILK/YOGURT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ON-THE-GO BARS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE PORRIDGE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE DRY SNACK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE SNACK PACKS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE READY-TO-COOK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE READY-TO-HEAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE MIX-IN INGREDIENT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE BEVERAGE-INFUSED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE BAKERY INGREDIENTS (FLOUR/GRAIN BLENDS) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE BREAKFAST CEREALS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 EUROPE FEEDSTOCK/ANIMAL FEED CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 EUROPE CEREAL SNACKS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 EUROPE CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 EUROPE INSTANT CEREAL MIXES IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 EUROPE INFANT CEREALS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 EUROPE INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 EUROPE CEREAL-BASED MEAL KITS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 EUROPE BREWING/DISTILLING INPUTS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 100 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 101 EUROPE CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 102 EUROPE CONVENTIONAL IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 103 EUROPE ORGANIC IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 EUROPE CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 105 EUROPE GMO-BASED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 EUROPE NON-GMO CERTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 107 EUROPE CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 108 EUROPE VITAMIN-FORTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 EUROPE HIGH-FIBER IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 110 EUROPE LOW/NO SUGAR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 111 EUROPE HIGH-PROTEIN IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 EUROPE GLUTEN-FREE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 113 EUROPE HEART-HEALTHY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 EUROPE PROBIOTIC/PREBIOTIC ENHANCED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 EUROPE CHOLESTEROL-LOWERING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 116 EUROPE LOW GLYCEMIC INDEX IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 EUROPE OMEGA-3 ENRICHED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 118 EUROPE LOW FAT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 119 EUROPE ALLERGEN-FREE IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 EUROPE HIGH-IRON IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 EUROPE LOW/NO SALT IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 122 EUROPE PALEO-FRIENDLY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 EUROPE KETO-FRIENDLY IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 EUROPE VEGAN-CERTIFIED IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 EUROPE OTHERS IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 EUROPE CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 127 EUROPE LONG-TERM (AMBIENT SHELF-STABLE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 128 EUROPE MEDIUM-TERM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 129 EUROPE SHORT-TERM (PERISHABLE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 130 EUROPE CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 131 EUROPE BOX IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 EUROPE BOX IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 EUROPE POUCH IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 134 EUROPE POUCH IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 EUROPE BAG IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 EUROPE BAG IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 EUROPE SACHET/STICK PACK IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 138 EUROPE SACK (BULK) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 139 EUROPE JAR IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 140 EUROPE JAR IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 EUROPE TETRA PACK / ASEPTIC CARTON IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 142 EUROPE CANISTER IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 143 EUROPE DRUM IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 144 EUROPE ECO-PACKAGING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 145 EUROPE ECO-PACKAGING IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 EUROPE ECO-PACKAGING IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 147 EUROPE CEREALS MARKET, BY PACKAGING-SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 EUROPE SMALL PACKS (51G–250G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 149 EUROPE MEDIUM PACKS (251G–500G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 150 EUROPE LARGE PACKS (501G–1KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 151 EUROPE SINGLE SERVE PACKS (BELOW 50G) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 152 EUROPE EXTRA LARGE PACKS (1.1KG–2.5KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 153 EUROPE BULK PACKS (ABOVE 2.5KG) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 154 EUROPE CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 155 EUROPE ECONOMY (UPTO USD 2.49) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 156 EUROPE MID-RANGE (USD 2.50-6.99) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 157 EUROPE PREMIUM (USD 7.00 AND ABOVE) IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 158 EUROPE CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 159 EUROPE B2B IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 160 EUROPE B2C IN CEREALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 161 EUROPE B2C IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 EUROPE ONLINE IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 EUROPE OFFLINE IN CEREAL MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EUROPE CEREALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 165 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EUROPE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 167 EUROPE WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EUROPE RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EUROPE MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 EUROPE BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EUROPE OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 EUROPE RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EUROPE SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 EUROPE MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 EUROPE QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 EUROPE CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 177 EUROPE CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 178 EUROPE CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 179 EUROPE CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 180 EUROPE BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 EUROPE READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 EUROPE HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 EUROPE CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 EUROPE INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 EUROPE CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 186 EUROPE CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 EUROPE CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 188 EUROPE CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 189 EUROPE CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 190 EUROPE BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 EUROPE POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 EUROPE BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 EUROPE JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 EUROPE ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 EUROPE CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 196 EUROPE CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 197 EUROPE CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 198 EUROPE B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 EUROPE ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 EUROPE OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 GERMANY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 GERMANY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 203 GERMANY WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 GERMANY RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 GERMANY MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 GERMANY BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 GERMANY OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 GERMANY RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 GERMANY SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 GERMANY MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 GERMANY QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 GERMANY CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 213 GERMANY CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 214 GERMANY CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 215 GERMANY CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 216 GERMANY BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 GERMANY READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 GERMANY HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 GERMANY CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 GERMANY INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 GERMANY CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 222 GERMANY CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 GERMANY CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 224 GERMANY CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 225 GERMANY CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 226 GERMANY BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 GERMANY POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 GERMANY BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 GERMANY JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 GERMANY ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 GERMANY CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 232 GERMANY CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 233 GERMANY CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 234 GERMANY B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 GERMANY ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 GERMANY OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 U.K. CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.K. CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 239 U.K. WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 U.K. RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 U.K. MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 U.K. BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 U.K. OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 U.K. RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 U.K. SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 U.K. MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 U.K. QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 U.K. CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 249 U.K. CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 250 U.K. CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 251 U.K. CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 252 U.K. BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 U.K. READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 U.K. HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 U.K. CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 U.K. INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 U.K. CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 258 U.K. CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 259 U.K. CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 260 U.K. CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 261 U.K. CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 262 U.K. BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 U.K. POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 U.K. BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 U.K. JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 U.K. ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 U.K. CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 268 U.K. CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 269 U.K. CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 270 U.K. B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 U.K. ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 U.K. OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 FRANCE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 FRANCE CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 275 FRANCE WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 FRANCE RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 FRANCE MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 FRANCE BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 FRANCE OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 FRANCE RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 FRANCE SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 FRANCE MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 FRANCE QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 FRANCE CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 285 FRANCE CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 286 FRANCE CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 287 FRANCE CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 288 FRANCE BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 FRANCE READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 FRANCE HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 FRANCE CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 FRANCE INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 FRANCE CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 294 FRANCE CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 295 FRANCE CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 296 FRANCE CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 297 FRANCE CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 298 FRANCE BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 FRANCE POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 FRANCE BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 FRANCE JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 FRANCE ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 FRANCE CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 304 FRANCE CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 305 FRANCE CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 306 FRANCE B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 FRANCE ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 FRANCE OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 ITALY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 ITALY CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 311 ITALY WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 ITALY RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 ITALY MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 ITALY BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ITALY OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 ITALY RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 ITALY SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 ITALY MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 ITALY QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 ITALY CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 321 ITALY CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 322 ITALY CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 323 ITALY CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 324 ITALY BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 ITALY READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 ITALY HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 ITALY CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ITALY INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ITALY CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 330 ITALY CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 331 ITALY CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 332 ITALY CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 333 ITALY CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 334 ITALY BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 ITALY POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 ITALY BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 ITALY JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 ITALY ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 ITALY CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 340 ITALY CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 341 ITALY CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 342 ITALY B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 ITALY ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 ITALY OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SPAIN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SPAIN CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 347 SPAIN WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 SPAIN RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 SPAIN MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 SPAIN BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 SPAIN OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SPAIN RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 SPAIN SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 SPAIN MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 SPAIN QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SPAIN CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 357 SPAIN CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 358 SPAIN CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 359 SPAIN CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 360 SPAIN BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SPAIN READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 SPAIN HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SPAIN CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 SPAIN INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 SPAIN CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 366 SPAIN CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 367 SPAIN CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 368 SPAIN CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 369 SPAIN CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 370 SPAIN BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 SPAIN POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 SPAIN BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SPAIN JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SPAIN ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SPAIN CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 376 SPAIN CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 377 SPAIN CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 378 SPAIN B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 SPAIN ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 SPAIN OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 NETHERLANDS CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 NETHERLANDS CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 383 NETHERLANDS WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 NETHERLANDS RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 NETHERLANDS MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 NETHERLANDS BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 NETHERLANDS OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 NETHERLANDS RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 NETHERLANDS SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 NETHERLANDS MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 NETHERLANDS QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 NETHERLANDS CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 393 NETHERLANDS CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 394 NETHERLANDS CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 395 NETHERLANDS CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 396 NETHERLANDS BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 NETHERLANDS READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 NETHERLANDS HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 NETHERLANDS CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 NETHERLANDS INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 NETHERLANDS CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 402 NETHERLANDS CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 403 NETHERLANDS CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 404 NETHERLANDS CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 405 NETHERLANDS CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 406 NETHERLANDS BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 NETHERLANDS POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 NETHERLANDS BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 NETHERLANDS JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 NETHERLANDS ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 NETHERLANDS CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 412 NETHERLANDS CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 413 NETHERLANDS CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 414 NETHERLANDS B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 NETHERLANDS ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 NETHERLANDS OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 POLAND CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 POLAND CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 419 POLAND WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 POLAND RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 POLAND MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 422 POLAND BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 POLAND OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 POLAND RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 POLAND SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 426 POLAND MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 POLAND QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 POLAND CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 429 POLAND CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 430 POLAND CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 431 POLAND CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 432 POLAND BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 433 POLAND READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 POLAND HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 POLAND CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 POLAND INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 POLAND CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 438 POLAND CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 439 POLAND CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 440 POLAND CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 441 POLAND CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 442 POLAND BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 POLAND POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 POLAND BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 POLAND JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 POLAND ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 POLAND CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 448 POLAND CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 449 POLAND CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 450 POLAND B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 451 POLAND ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 452 POLAND OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 453 RUSSIA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 454 RUSSIA CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 455 RUSSIA WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 456 RUSSIA RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 457 RUSSIA MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 RUSSIA BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 RUSSIA OATS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 RUSSIA RYE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 RUSSIA SORGHUM IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 462 RUSSIA MILLET IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 RUSSIA QUINOA IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 RUSSIA CEREALS MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 465 RUSSIA CEREALS MARKET, BY PROCESSING LEVEL, 2018-2032 (USD THOUSAND)

TABLE 466 RUSSIA CEREALS MARKET, BY CONSUMPTION FORMAT, 2018-2032 (USD THOUSAND)

TABLE 467 RUSSIA CEREALS MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 468 RUSSIA BREAKFAST CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 469 RUSSIA READY-TO-EAT (RTE) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 RUSSIA HOT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 RUSSIA CEREAL SNACKS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 RUSSIA INFANT CEREALS IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 RUSSIA CEREALS MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 474 RUSSIA CEREALS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 475 RUSSIA CEREALS MARKET, BY FUNCTIONAL BENEFITS, 2018-2032 (USD THOUSAND)

TABLE 476 RUSSIA CEREALS MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 477 RUSSIA CEREALS MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 478 RUSSIA BOX IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 479 RUSSIA POUCH IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 480 RUSSIA BAG IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 481 RUSSIA JAR IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 482 RUSSIA ECO-PACKAGING IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 483 RUSSIA CEREALS MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 484 RUSSIA CEREALS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 485 RUSSIA CEREALS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 486 RUSSIA B2C IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 RUSSIA ONLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 RUSSIA OFFLINE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 489 BELGIUM CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 490 BELGIUM CEREALS MARKET, BY CEREAL TYPE, 2018-2032 (THOUSAND TONS)

TABLE 491 BELGIUM WHEAT IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 BELGIUM RICE IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 493 BELGIUM MAIZE(CORN) IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 BELGIUM BARLEY IN CEREALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)