Europe Otoscope Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

54.60 Million

USD

72.30 Million

2024

2032

USD

54.60 Million

USD

72.30 Million

2024

2032

| 2025 –2032 | |

| USD 54.60 Million | |

| USD 72.30 Million | |

|

|

|

|

Europe Otoscope Devices Market Segmentation, By Type of Product (Pocket Otoscope, Full Size Otoscope and Video Otoscope), Portability (Wall-Mounted, Hand-Held and Standalone), Type (Wired and Wireless), Mobility (Rigid and Flexible), Application (Diagnosis and Surgical), End User (Hospitals, ENT Centres and Clinics), Distribution Channel (Direct Tender and Retail Sales)- Industry Trends and Forecast to 2032

Otoscope Devices Market Size

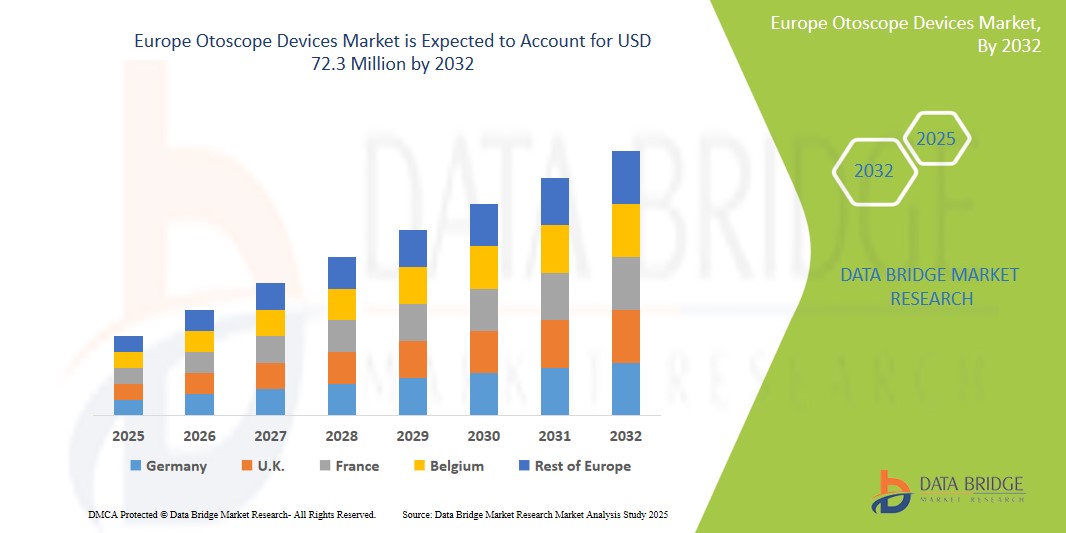

- The Europe Otoscope Devices Market was valued atUSD54.6 Million in 2024 and is expected to reachUSD 72.3 Million by 2032,at aCAGR of 4.5%during the forecast period.

- The growth of the Europe Otoscope Devices Market is driven by several key factors. Firstly, the increasing incidence of ear infections, hearing disorders, and ENT-related conditions across both pediatric and geriatric populations is significantly contributing to market demand. Moreover, advancements in otoscope technology—such as digital and video otoscopes offering enhanced imaging and diagnostic accuracy—are encouraging widespread adoption among ENT specialists and general practitioners. Additionally, the rise in routine health screenings and government-funded healthcare initiatives across Europe further supports the market expansion.

Europe Otoscope Devices Market Analysis

- Otoscope devices play a vital role in ear health diagnostics by enabling healthcare professionals to visually examine the ear canal and tympanic membrane for signs of infection, inflammation, or abnormalities. These instruments are essential in diagnosing conditions such as otitis media, impacted cerumen, and perforated eardrums. Otoscopes are widely used across various medical settings, including ENT clinics, pediatric care, primary healthcare centers, and emergency departments.

- The demand for otoscope devices in Europe is primarily driven by the rising prevalence of ear-related disorders among children and the elderly, increasing ENT consultations, and growing awareness of early diagnosis and preventive healthcare. The adoption of advanced digital and video otoscopes, which provide real-time imaging and improved diagnostic accuracy, is also contributing significantly to market growth across the region.

- Germany holds a substantial share of the Europe otoscope devices market, supported by its sophisticated healthcare infrastructure, increasing government investments in primary care, and the widespread implementation of telemedicine services. Leading countries such as Germany, the United Kingdom, and France are driving market expansion due to their emphasis on routine health screenings, high adoption of innovative medical technologies, and supportive reimbursement frameworks that enhance accessibility to ENT diagnostics.

Report ScopeOtoscope DevicesMarket Segmentation

|

Attributes |

Otoscope DevicesKey Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Otoscope Devices Market Trends

“Personalized Therapies and Technological Advancements in Neurostimulation Precision”

- Otoscope devices play an essential role in ENT diagnostics by allowing healthcare professionals to examine the external auditory canal and tympanic membrane for signs of infection, inflammation, or structural abnormalities. These devices are widely used across diverse medical settings, including primary care clinics, ENT specialty centers, pediatric units, and emergency departments.

- The demand for otoscope devices in Europe is primarily driven by the rising prevalence of ear infections, hearing loss, and related ENT disorders—particularly among pediatric and geriatric populations. Increased awareness about the importance of early detection and routine ear examinations is further encouraging the adoption of otoscopes across the region.

- Europe holds a significant share of the global otoscope devices market, supported by its well-developed healthcare infrastructure, rising adoption of digital health technologies, and strong presence of established medical device companies. Countries such as Germany, the United Kingdom, and France are at the forefront, owing to their emphasis on preventive care, widespread ENT screening programs, and integration of telemedicine services into primary care settings.

- For instance, in the United Kingdom, the NHS has increasingly adopted digital otoscope systems as part of community-based health initiatives to improve access to ENT diagnostics and reduce specialist referral wait times.

- The European market is also guided by regulatory frameworks such as the Medical Device Regulation (MDR) and oversight from the European Medicines Agency (EMA), which promote the safety, performance, and innovation of diagnostic tools. Technological advancements, including the development of video and wireless otoscopes, are improving diagnostic accuracy, patient comfort, and clinician workflow—thus enhancing the overall quality of ENT care.

Otoscope Devices Market Dynamics

Driver

“Rising Prevalence of ENT Disorders and Advancements in Diagnostic Technologies”

- The Europe otoscope devices market is primarily driven by the increasing incidence of ear infections, hearing impairments, and ENT-related disorders, particularly among pediatric and elderly populations. Conditions such as otitis media, impacted cerumen, and eustachian tube dysfunction are contributing to a sustained demand for accurate and efficient otoscopic examinations across the region.

- European healthcare systems are increasingly emphasizing early diagnosis and preventive care, which has led to the integration of otoscope devices in routine screenings, primary care practices, and telehealth platforms. This approach aims to improve patient outcomes, reduce long-term treatment costs, and ensure timely intervention—especially in regions with growing elderly demographics, such as Germany, Italy, and Spain.

- Rising awareness about ear health and hearing preservation, supported by public health campaigns and ENT screening programs, has led to a surge in otoscope usage across pediatric care, general practice, and community health centers. Parents, general practitioners, and school health professionals are increasingly relying on these devices for early detection and management of common ear conditions in children.

- Technological innovations in the field—such as digital otoscopes, wireless connectivity, and high-resolution imaging capabilities—are transforming the diagnostic experience. These innovations not only enhance visualization and diagnostic accuracy but also support data sharing and documentation in electronic health records (EHR), making them a valuable tool in modern clinical workflows.

- For instance, In 2023, in 2023, Heine Optotechnik (Germany) introduced a next-generation digital otoscope with enhanced LED HQ illumination and smartphone integration, enabling improved diagnostic visualization and facilitating teleconsultations in ENT care

- This upward trend is further supported by growing investments in digital health infrastructure, the expansion of telemedicine services, and favorable regulatory policies that encourage the adoption of technologically advanced medical devices across Europe.

Opportunity

“Expansion of Otoscope Devices in Telehealth and Community-Based ENT Diagnostics”

- The ongoing shift toward outpatient and ambulatory care across Europe is opening new avenues for Otoscope Devices that support less invasive procedures, faster patient recovery, and reduced healthcare costs. These developments are making advanced neurostimulation therapies more accessible outside traditional hospital settings.

- Rising demand for day surgeries and decentralized treatment delivery is driving the adoption of compact, patient-specific neuromodulation systems that can be implanted through minimally invasive techniques, enabling shorter procedure times and same-day discharges in neurology and pain management clinics.

- Digital planning platforms and remote programming tools are increasingly being integrated into outpatient care workflows, allowing clinicians to pre-configure stimulation protocols and adjust them post-implantation via wireless technologies. This model enhances patient convenience and reduces the need for frequent follow-up visits.

- For instance, In January 2024, in February 2024, Dino-Lite Europe introduced a compact USB digital otoscope compatible with telehealth platforms. Designed for use in community clinics and home settings, it offers high-resolution imaging and real-time video transmission to ENT specialists, facilitating timely remote diagnosis and follow-up care.

- This opportunity is further amplified by digitization of healthcare systems across Europe, rising investments in telehealth infrastructure, and policy-level support for non-hospital-based care delivery—driving demand for smart diagnostic tools like connected otoscopes that promote efficiency, accessibility, and patient-centric care.

Restraint/Challenge

“High Equipment Costs and Stringent EU MDR Regulations Hindering Adoption and Innovation”

- The high cost of advanced otoscope devices, particularly digital and video-enabled models, poses a significant barrier to their widespread adoption—especially in smaller clinics, primary care practices, and underfunded healthcare settings across Europe. Budget constraints within public health systems often limit the procurement of cutting-edge diagnostic tools, impeding equitable access to quality ENT care.

- The European Union Medical Device Regulation (EU MDR) presents an additional layer of challenge for otoscope device manufacturers. The regulation demands comprehensive clinical validation, post-market surveillance, and technical documentation, all of which increase time-to-market and development costs, especially for digital and connected devices that incorporate imaging and telehealth functionalities.

- Small and mid-sized manufacturers face a disproportionate burden under MDR. Many struggle with the financial and regulatory complexities required to update product certifications or launch new innovations—resulting in delayed product entries, reduced R&D pipelines, or complete withdrawal from European markets.

- For instance, According to a 2024 report from MedTech Europe highlighted that over 45% of small diagnostic device companies had postponed or cancelled new product launches due to MDR compliance burdens, directly impacting innovation in ENT diagnostics across Europe.

- These constraints are exacerbated in decentralized healthcare systems or rural areas, where ENT specialists and diagnostic resources are scarce. The inability to deploy cost-effective, portable otoscope devices in such settings limits the reach of early detection and preventative care initiatives—ultimately hampering efforts to improve ear health at a population level.

Otoscope Devices Market Scope

The market is segmented on the basis, product type, Portability, Type, Mobility, application, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Portability |

|

|

By Type |

|

|

By Mobility |

|

|

By Application |

|

|

By End User |

|

|

ByDistribution Channel |

|

In 2025, Video Otoscope is projected to dominate the market with a largest share in product type segment

The video otoscopes segment is expected to lead the Europe Otoscope Devices Market with the largest share of 36.72% in 2025, driven by the growing adoption of digital diagnostic tools in ENT (ear, nose, and throat) care. Video otoscopes offer superior imaging capabilities, allowing clinicians to visualize and capture high-resolution images and videos of the ear canal and tympanic membrane, which significantly improves diagnostic accuracy, documentation, and patient communication. The rising demand for telemedicine and remote consultations across Europe is a major contributor to this growth, as video otoscopes can easily integrate with telehealth platforms—enabling ENT specialists to remotely assess conditions like otitis media, cerumen impaction, or eardrum perforations. These devices are also gaining traction in pediatric care, where real-time visualization helps reduce misdiagnosis and improves treatment outcomes.

The ENT centres is expected to account for the largest share during the forecast period in end user market

In 2025, ENT (Ear, Nose, and Throat) centres are projected to hold the largest market share of 41.58% in the Europe Otoscope Devices Market, owing to the rising prevalence of ear-related disorders such as otitis media, hearing loss, impacted cerumen, and eustachian tube dysfunction. These healthcare settings are the primary point of care for routine ear examinations, diagnostic evaluations, and minor surgical procedures, making them the dominant end-user segment. ENT centres across Europe—particularly in healthcare-advanced nations like Germany, the U.K., and France—are increasingly adopting digital and video otoscope devices to improve diagnostic precision and enhance patient care experiences. The growing use of tele-otoscopy and connected diagnostic tools in both rural and urban ENT practices is further expanding access to early diagnosis and reducing specialist referral delays.

Otoscope Devices Market Regional Analysis

“Germany is the Dominant Country in the Otoscope Devices Market”

- Germany holds the leading position in the Europe Otoscope Devices Market, supported by its advanced healthcare infrastructure, high diagnostic standards in ENT (ear, nose, and throat) care, and substantial investments in point-of-care medical technologies.

- The country’s strong focus on early detection and treatment of ear infections, hearing disorders, and middle ear pathologies, particularly among pediatric and elderly populations, significantly contributes to the high adoption of otoscope devices in clinical settings.

- Germany benefits from the widespread availability of digital and video otoscopes, integration of electronic health records (EHR), and the growing trend toward tele-otoscopy—making ENT diagnostics more accessible and accurate across primary care and specialized clinics.

- The presence of major medical device companies, such as Carl Zeiss Meditec AG and KARL STORZ SE & Co. KG, along with robust public and private healthcare reimbursement systems, promotes continuous innovation and product accessibility.

- Additionally, Germany’s extensive network of ENT specialists, audiologists, and general practitioners, combined with government-funded screening programs for hearing loss and otitis media, reinforces its dominant position in the regional otoscope devices market.

“U.K. is Projected to Register the Highest Growth Rate”

- The United Kingdom is expected to register the fastest growth in the Europe Otoscope Devices Market, driven by an increasing prevalence of ear-related conditions such as otitis media, hearing impairments, and chronic otological infections—especially among pediatric and geriatric populations.

- The country’s expanding focus on primary and community-based ENT care, combined with government-backed initiatives to enhance early diagnostic capabilities, is accelerating the adoption of advanced otoscope technologies, including digital and video otoscopes.

- The National Health Service (NHS)’s emphasis on integrating telemedicine and remote diagnostics in routine care is further supporting the uptake of otoscope devices, especially in rural and underserved areas where ENT specialists may be limited.

- The U.K.'s thriving ecosystem of academic medical centers, ENT specialists, and medical technology companies is driving innovation in portable and AI-integrated otoscopy solutions, enabling faster and more accurate diagnosis of auditory and middle ear conditions.

- Additionally, increasing awareness of preventive hearing healthcare, favorable reimbursement policies, and rising demand for minimally invasive, point-of-care diagnostic tools position the U.K. as a rapidly growing market for otoscope devices within Europe.

Otoscope Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Heine Optotechnik GmbH & Co. KG (Germany)

- Rudolf Riester GmbH (Germany)

- Welch Allyn, Inc. – A Hillrom Company (U.S.)

- Zumax Medical Co., Ltd. (China)

- GF Health Products, Inc. (U.S.)

- Spengler Holtex Group (France)

- Dino-Lite Europe (The Netherlands)

- Luxamed GmbH & Co. KG (Germany)

- Dr. Mom Otoscopes (U.S.)

- Firefly Global (U.S.)

Latest Developments in Global Otoscope Devices Market

- In June 2021, Hillrom introduced the Welch Allyn MacroView Plus Otoscope, enhancing ear exams with a three-times-larger viewing area. The device includes the iExaminer SmartBracket accessory, enabling digital image capture via smartphones. This feature supports efficient documentation and referrals, improving patient care and streamlining diagnoses, especially for front-line care during the pandemic.

- In January 2021, WiscMed announced the release of the Wispr® digital otoscope software upgrade (version 95), offering improved image and video lighting, enhanced power management, and better low-power alerts. The free upgrade is available for all Wispr owners and ensures better eardrum visualization and optimized device performance, enhancing patient care and customer service.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.