Global Alpha And Beta Emitters Based Radiopharmaceuticals Market

Taille du marché en milliards USD

TCAC :

%

USD

801.45 Million

USD

1,769.20 Million

2024

2032

USD

801.45 Million

USD

1,769.20 Million

2024

2032

| 2025 –2032 | |

| USD 801.45 Million | |

| USD 1,769.20 Million | |

|

|

|

|

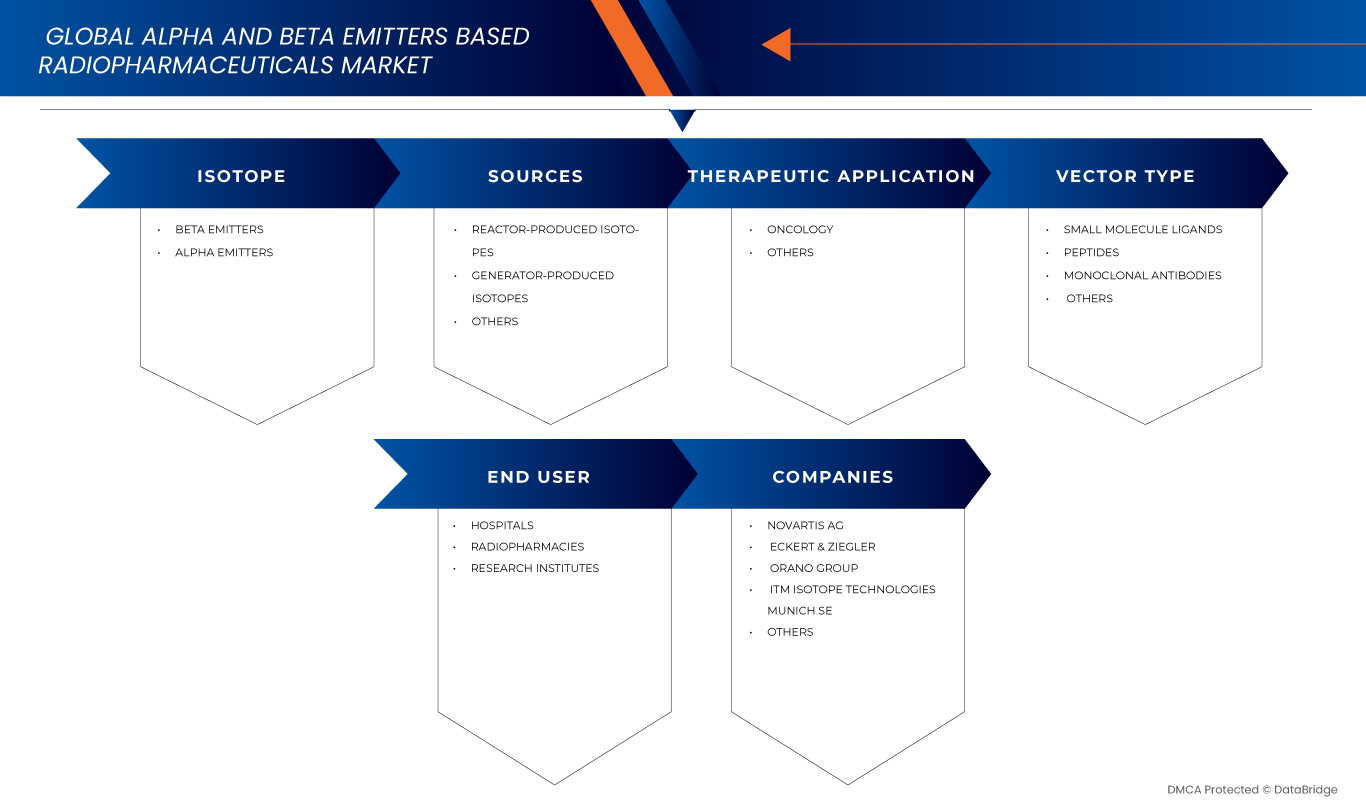

Segmentation du marché mondial des radiopharmaceutiques à base d'émetteurs alpha et bêta, par isotope (émetteurs bêta et alpha), sources (isotopes produits par réacteur, isotopes produits par générateur et autres), application thérapeutique (oncologie et autres), type de vecteur (ligands de petites molécules, peptides, anticorps monoclonaux et autres), utilisateur final (hôpitaux, radiopharmacies et instituts de recherche) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

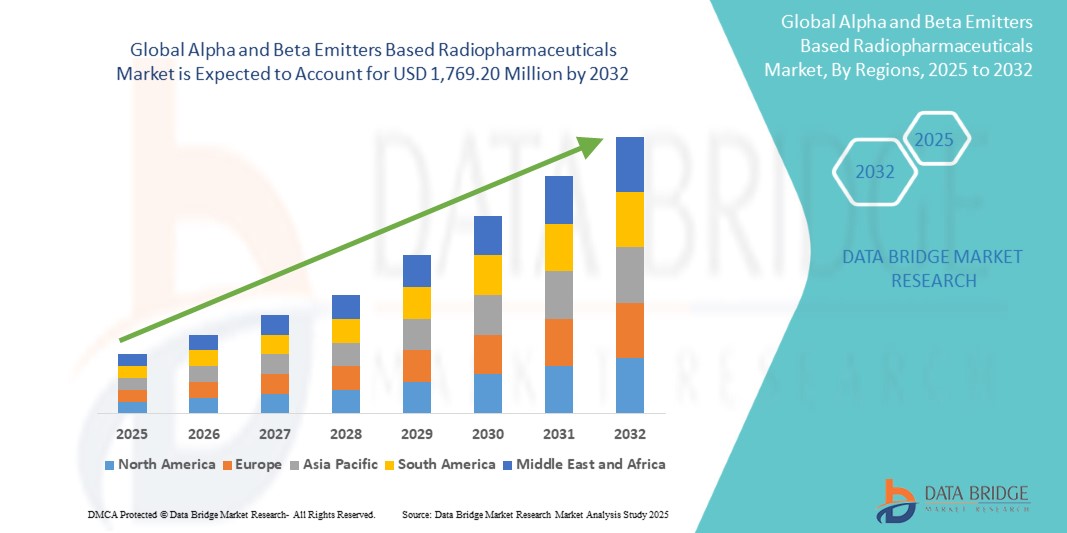

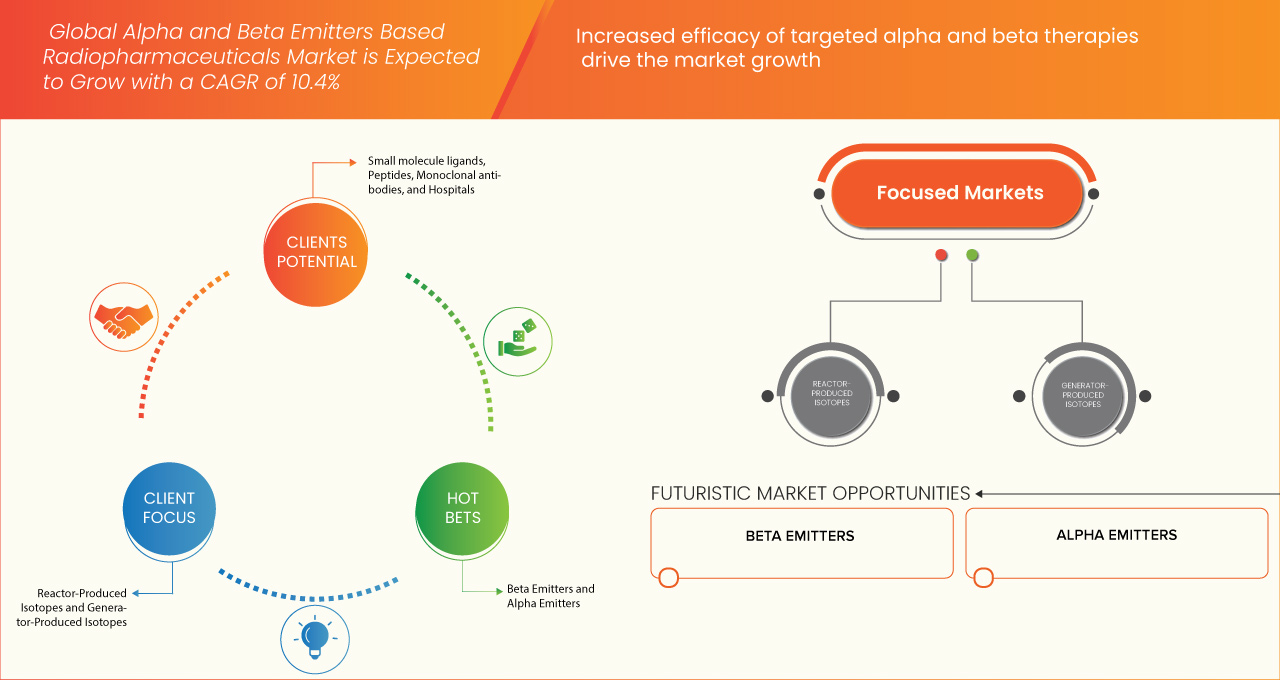

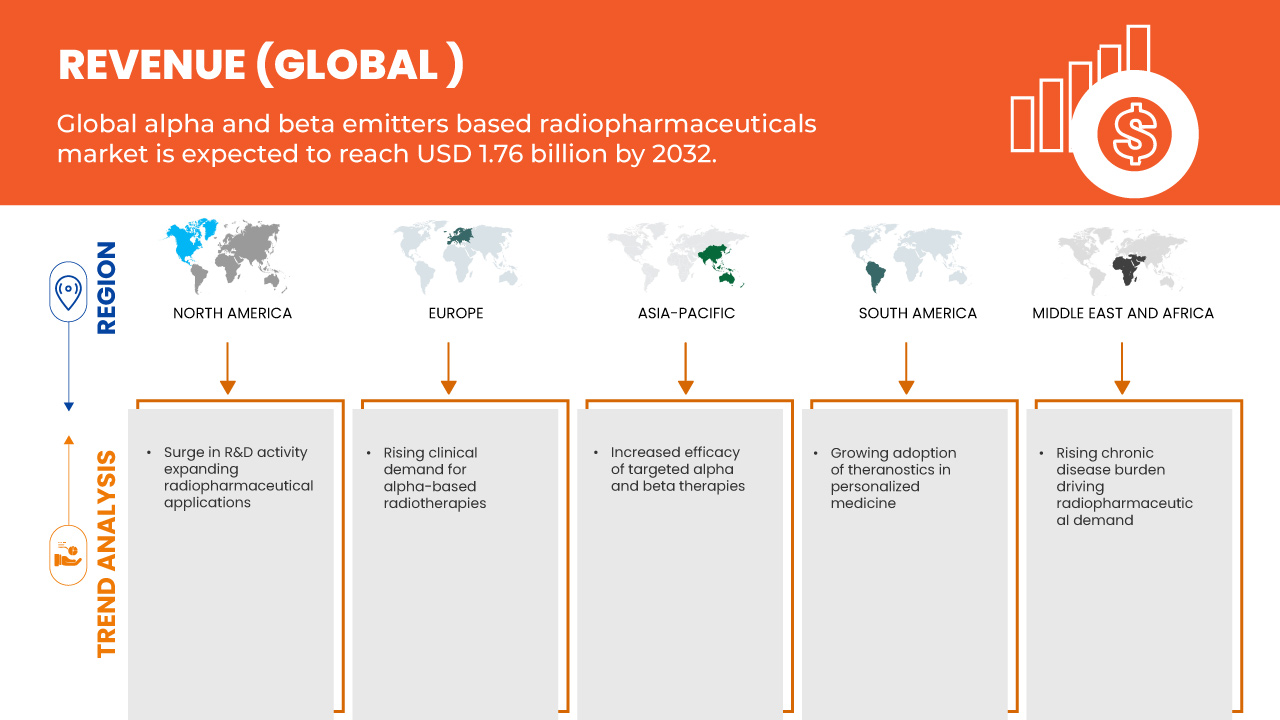

- La taille du marché mondial des produits radiopharmaceutiques à base d'émetteurs alpha et bêta était évaluée à 801,45 millions USD en 2024 et devrait atteindre 1 769,20 millions USD d'ici 2032 , à un TCAC de 10,4 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l’efficacité accrue des thérapies alpha et bêta ciblées

- De plus, l'adoption croissante du théranostic en médecine personnalisée. Ces facteurs convergents accélèrent l'adoption de solutions radiopharmaceutiques basées sur des émetteurs alpha et bêta, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

- Les produits radiopharmaceutiques à base d'émetteurs alpha et bêta sont de plus en plus reconnus pour leur précision dans la thérapie ciblée, en particulier en oncologie et en médecine nucléaire, offrant des options de diagnostic et de traitement efficaces avec des effets secondaires minimes.

- L'incidence croissante du cancer dans le monde, ainsi que la sensibilisation croissante à la médecine personnalisée et les progrès de la technologie radiopharmaceutique, stimulent la demande mondiale de produits radiopharmaceutiques à base d'émetteurs alpha et bêta.

- L'Amérique du Nord détient une part importante du marché mondial des produits radiopharmaceutiques à base d'émetteurs alpha et bêta, représentant environ 42,59 % des revenus en 2025, soutenue par une infrastructure de soins de santé avancée, de vastes activités de R&D et l'adoption précoce de nouvelles technologies thérapeutiques.

- La région Amérique du Nord devrait être le marché à la croissance la plus rapide pour les produits radiopharmaceutiques à base d'émetteurs alpha et bêta au cours de la période de prévision, propulsée par l'expansion des infrastructures de soins de santé, l'augmentation de la prévalence du cancer et les initiatives gouvernementales pour l'amélioration des soins de santé.

- Le segment des émetteurs bêta devrait dominer le marché avec une part de 84,78 % en 2025, grâce à leur grande efficacité dans la thérapie alpha ciblée (TAT), à l'amélioration des résultats pour les patients et à la recherche croissante axée sur les isotopes émetteurs alpha comme l'actinium-225 et le radium-223 pour le traitement du cancer.

Portée du rapport et segmentation du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

|

Attributs |

Informations clés sur le marché des radiopharmaceutiques à base d'émetteurs alpha et bêta |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Asie-Pacifique

Europe

Amérique du Sud

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire. |

Tendances du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

« Efficacité accrue des thérapies alpha et bêta ciblées »

- L'un des principaux moteurs du marché mondial des produits radiopharmaceutiques à base d'émetteurs alpha et bêta est l'adoption clinique croissante de thérapies ciblées par radionucléides, en raison de leur efficacité prouvée dans le traitement des cancers avancés tels que les tumeurs neuroendocrines et le cancer de la prostate métastatique résistant à la castration (mCRPC).

- Par exemple, en mai 2023, selon l'article publié par le NCBI, le protocole approuvé [177Lu]Lu-PSMA-617 (7,4 GBq par cycle toutes les 6 semaines pendant un maximum de 6 cycles) a démontré une forte sécurité et une efficacité antitumorale en situation réelle, avec une posologie flexible (6 à 9,3 GBq) et des intervalles de traitement (4 à 10 semaines). Cette performance clinique constante renforce la confiance des médecins et accélère son adoption sur le marché.

- Les produits radiopharmaceutiques comme le Lu-177, en particulier lorsqu'ils sont utilisés dans la thérapie par radionucléides à récepteurs peptidiques (PRRT), ont démontré un succès remarquable dans le traitement des tumeurs neuroendocrines, en délivrant un puissant rayonnement bêta directement sur les sites tumoraux tout en préservant les tissus sains, ce qui conduit à de meilleurs résultats et à une demande accrue.

- Les avancées technologiques et la validation clinique des isotopes émetteurs alpha, comme l'Ac-225, ont propulsé le marché. L'Ac-225 s'est avéré très efficace pour cibler les cellules cancéreuses de la prostate résistantes aux thérapies traditionnelles, avec des effets secondaires minimes et un fort impact thérapeutique.

Dynamique du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

Conducteur

« Adoption croissante du théranostic en médecine personnalisée »

- L'adoption croissante des radiopharmaceutiques théranostiques émetteurs alpha et bêta, tels que le lutétium 177 (Lu-177) et le terbium 161 (Tb-161), est un moteur majeur du marché mondial des radiopharmaceutiques. En associant l'imagerie diagnostique à une thérapie ciblée dans un flux de travail clinique unique, ces agents offrent des soins précis et personnalisés, améliorant ainsi les résultats et simplifiant la planification du traitement.

- Par exemple, en juillet 2023, une revue publiée dans le NCBI a fait état d'une utilisation clinique croissante des protocoles théranostiques à base de Lu-177 (par exemple, ¹⁷⁷Lu-DOTATATE pour les tumeurs neuroendocrines et ¹⁷⁷Lu-PSMA pour le cancer de la prostate). L'approbation de ces agents par la FDA a validé leur innocuité et leur efficacité, accélérant leur adoption et soulignant la puissante synergie des associations diagnostiques-thérapeutiques.

- La prise de conscience croissante parmi les oncologues et les spécialistes en médecine nucléaire de l'efficacité du flux de travail, de la précision du traitement et de la toxicité réduite associées aux approches théranostiques stimule la demande, car les cliniciens recherchent des outils fiables pour la gestion personnalisée du cancer.

- De plus, alors que les systèmes de santé sont confrontés à des pressions croissantes pour améliorer les taux de survie et contrôler les coûts, les solutions intégrées d'imagerie-thérapie comme Lu-177 et Tb-161 réduisent le temps de traitement, évitent les interventions inefficaces et améliorent la qualité de vie, consolidant ainsi leur proposition de valeur.

- La préférence croissante pour l'oncologie de précision, associée à la R&D continue sur les isotopes de nouvelle génération tels que Tb-149, Tb-152/155 et Ac-225, positionne les radiopharmaceutiques théranostiques comme une pierre angulaire des soins modernes contre le cancer et un moteur de croissance clé pour le marché mondial.

Retenue/Défi

« Défis de la chaîne d'approvisionnement et de l'évolutivité liés aux courtes demi-vies des isotopes »

- La courte demi-vie des radionucléides tels que le plomb 212 (environ 10,6 heures) crée des obstacles logistiques et opérationnels majeurs : la production doit avoir lieu à proximité des sites de traitement, les fenêtres de transport ne sont que de quelques heures et des chaînes d'approvisionnement « juste à temps » hautement coordonnées sont nécessaires, ce qui limite collectivement la fabrication à grande échelle et la portée du marché.

- Par exemple, en avril 2025, LEK Consulting a noté que la demi-vie de 10,6 heures du Pb-212 oblige à une production décentralisée, proche du patient, et à une infrastructure de générateur sur site, limitant les économies d'échelle et compliquant la logistique de distribution.

- De plus, les systèmes de générateurs complexes nécessaires pour extraire le Pb-212 (et d'autres isotopes à courte durée de vie) ajoutent des couches de conformité réglementaire, d'exigences de radioprotection et de dépenses d'investissement, ce qui rend le déploiement à grande échelle difficile pour les hôpitaux et les radiopharmacies.

- Bien que les progrès réalisés dans les générateurs compacts, les méthodes de purification plus rapides et les centres de production régionaux pourraient éventuellement atténuer ces pressions, la nature fondamentale et sensible au temps des isotopes à courte durée de vie reste un frein important à l’adoption et à la croissance généralisées du marché des produits radiopharmaceutiques.

Portée du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

Le marché est segmenté sur la base de l’isotope, des sources, de l’application thérapeutique, du type de vecteur et de l’utilisateur final.

- Par isotope

Selon le type d'isotope, le marché est segmenté en émetteurs bêta et émetteurs alpha. En 2025, le segment des émetteurs bêta devrait dominer le marché avec une part de marché de 84,78 %, grâce à l'adoption clinique généralisée d'isotopes tels que le lutétium 177 (Lu-177) et l'yttrium 90 (Y-90) pour le traitement des tumeurs neuroendocrines, du cancer du foie et du cancer de la prostate. Les émetteurs bêta sont privilégiés pour leur demi-vie relativement longue, leurs profils de sécurité établis et leur compatibilité avec les flux de travail cliniques existants.

Le segment des émetteurs bêta devrait connaître la croissance la plus rapide, soit 9,1 % entre 2025 et 2032, grâce à l'utilisation croissante de l'actinium 225 (Ac-225) et du plomb 212 (Pb-212) dans les traitements avancés contre le cancer. Les émetteurs alpha offrent un transfert d'énergie linéaire (TEL) élevé et une efficacité tumorale accrue avec un minimum de dommages collatéraux, ce qui les rend particulièrement adaptés aux cancers résistants et métastatiques.

- Par sources

Selon les sources, le marché est classé en isotopes produits par réacteur, isotopes produits par générateur, et autres. En 2025, les isotopes produits par réacteur domineront le marché grâce à l'offre importante et à la large disponibilité d'émetteurs bêta clés tels que le Lu-177 et l'iode-131.

Cependant, les isotopes produits en réacteur devraient connaître la croissance la plus rapide, stimulés par la demande croissante d'isotopes comme le Pb-212 et le Ra-223, qui nécessitent une production décentralisée et au plus près du patient. L'essor des générateurs sur site s'inscrit également dans l'intérêt croissant pour les thérapies alpha et les radiopharmaceutiques à courte durée de vie.

- Par application thérapeutique

Concernant les applications thérapeutiques, le marché est segmenté entre l'oncologie et les autres disciplines. En 2025, l'oncologie dominera le marché, les radiopharmaceutiques jouant un rôle central dans les thérapies ciblées contre le cancer de la prostate, les tumeurs neuroendocrines et le lymphome. Le succès croissant des thérapies ciblant le PSMA et basées sur la PRRT renforce le leadership de l'oncologie dans ce domaine.

Le segment de l’oncologie comprend les troubles cardiovasculaires, endocriniens et neurologiques et devrait connaître une croissance régulière avec le développement de nouveaux radioligands et l’expansion vers des indications non oncologiques.

- Par type de vecteur

En fonction du type de vecteur, le marché est segmenté en ligands à petites molécules, peptides, anticorps monoclonaux et autres. En 2025, les ligands à petites molécules devraient détenir la plus grande part de marché en raison de leur pénétration tissulaire rapide et de leur utilisation répandue dans les thérapies ciblant le PSMA et la somatostatine.

Les ligands à petites molécules devraient connaître une croissance significative au cours de la période de prévision grâce aux progrès des technologies de conjugaison et à leur capacité à offrir une sélectivité tumorale accrue, des temps de circulation plus longs et une efficacité de liaison améliorée. Ces vecteurs sont particulièrement essentiels pour les thérapies par émetteur alpha, où la précision est primordiale.

- Par utilisateur final

Le marché est segmenté par utilisateur final : hôpitaux, radiopharmacies et instituts de recherche. En 2025, les hôpitaux représenteront la part la plus importante, grâce à l'accès accru des patients à la médecine nucléaire, à la croissance des services de théranostique et à des systèmes de remboursement solides dans les pays développés.

Le segment des radiopharmacies devrait connaître une croissance rapide en raison de la demande croissante de préparations centralisées et décentralisées de radiopharmaceutiques, notamment ceux à courte demi-vie. Les instituts de recherche continueront de jouer un rôle essentiel dans l'innovation et les essais cliniques, notamment pour les isotopes de nouvelle génération comme le terbium 161 et l'actinium 225.

Analyse régionale du marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

- L'Amérique du Nord domine le marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta avec la plus grande part de revenus de 42,59 % en 2025 et devrait croître à un TCAC robuste jusqu'en 2032.

- S'appuyant sur des pipelines oncologiques de pointe, une adoption rapide du théranostic et un réseau dense d'installations de TEP/SPECT et de radiopharmacie, le financement fédéral important de la recherche en médecine nucléaire dans la région, le remboursement avantageux des radioligands et les investissements continus des producteurs de Lu-177 et d'Ac-225 garantissent la résilience de la chaîne d'approvisionnement nationale et le maintien de la position de leader sur le marché.

- Les grandes économies comme les États-Unis et le Canada s'appuient sur une infrastructure de production d'isotopes mature, une vaste activité d'essais cliniques et des partenariats public-privé pour accroître la fabrication et permettre un accès rapide aux patients.

Aperçu du marché américain des radiopharmaceutiques à base d'émetteurs alpha et bêta

Les États-Unis détiennent la majeure partie des revenus de l'Amérique du Nord en 2025, grâce à un écosystème de soins de santé avancé, aux premières approbations de la FDA (par exemple, Lu-177 PSMA-617) et aux extensions de capacité continues de fournisseurs tels que PharmaLogic et SHINE.

Aperçu du marché canadien des radiopharmaceutiques à base d'émetteurs alpha et bêta

Le Canada affiche une croissance à deux chiffres grâce à de nouvelles mises à niveau de cyclotrons et de réacteurs qui soutiennent la production nationale de Lu-177, tandis qu'un réseau croissant de centres de théranostic ambulatoire répond à la demande croissante en oncologie de précision.

Aperçu du marché des radiopharmaceutiques à base d'émetteurs alpha et bêta en Asie-Pacifique

L'Asie-Pacifique est une région en pleine croissance, captant une part significative des revenus mondiaux en 2025, stimulée par la hausse de l'incidence du cancer, l'importance du bassin de patients et les investissements publics massifs dans les capacités de médecine nucléaire. Les programmes nationaux de lutte contre le cancer, l'expansion des flottes de cyclotrons et la localisation de la production de Lu-177 et d'Ac-225 soutiennent la dynamique de la région, tandis que l'amélioration du remboursement élargit l'accès des patients. Les grandes économies que sont la Chine, l'Inde, le Japon et la Corée du Sud développent rapidement la production de produits radiopharmaceutiques grâce à des initiatives étatiques et à des collaborations avec des fournisseurs mondiaux d'isotopes.

Aperçu du marché chinois des radiopharmaceutiques à base d'émetteurs alpha et bêta

La Chine détient la plus grande part de la région Asie-Pacifique en 2025, propulsée par une concentration stratégique sur l'autosuffisance nationale en isotopes et les coentreprises (par exemple, la protonthérapie IBA et les collaborations isotopiques avec CGN) qui renforcent la sécurité de la chaîne d'approvisionnement.

Aperçu du marché indien des radiopharmaceutiques à base d'émetteurs alpha et bêta

L'Inde enregistre le rythme de croissance le plus rapide de la région grâce aux programmes du Département de l'énergie atomique qui ont augmenté la production indigène de Lu-177 et de ligand PSMA au BARC, réduisant considérablement la dépendance aux importations et augmentant les volumes de thérapie.

Aperçu du marché sud-coréen des radiopharmaceutiques à base d'émetteurs alpha et bêta

La feuille de route du ministère sud-coréen des Sciences visant à favoriser une industrie d'exportation de produits radiopharmaceutiques d'ici 2035, y compris la production nationale de Lu-177, positionne le pays pour une croissance élevée à moyen terme et un statut de plaque tournante régionale de l'approvisionnement.

Aperçu du marché européen des radiopharmaceutiques à base d'émetteurs alpha et bêta

L'Europe représente un peu plus d'un quart des revenus mondiaux (≈ 25 %) en 2025 et devrait croître à un TCAC régulier jusqu'en 2032, soutenue par des réglementations environnementales et de qualité strictes qui favorisent la production d'isotopes en interne et l'adoption généralisée de la théranostique. Les consortiums de recherche financés par l'UE, les essais paneuropéens des composés Ac-225 et Tb-161 et l'expansion rapide des radiopharmacies centralisées soutiennent la croissance régionale, tandis que le cadre EURATOM de l'UE garantit l'approvisionnement en isotopes provenant des réacteurs.

Des économies comme l’Allemagne, la France et le Royaume-Uni sont à la pointe des installations théranostiques, des lignes de production GMP et des réseaux de recherche clinique.

Aperçu du marché allemand des radiopharmaceutiques à base d'émetteurs alpha et bêta

L'Allemagne devrait être en tête des revenus européens en 2025, portée par son réseau dense de cliniques de médecine nucléaire, ses incitations à l'investissement pour les usines GMP Lu-177 et la croissance continue des centres d'imagerie thérapeutique, portant la valeur du marché à 39,29 millions USD d'ici 2024.

Aperçu du marché français des radiopharmaceutiques à base d'émetteurs alpha et bêta

La France affiche une solide expansion grâce à une politique de santé résiliente au changement climatique qui encourage les thérapies à faible dose et à haute efficacité, et les clusters autour d'Orano et du CEA canalisent les financements vers des programmes d'émetteurs alpha de nouvelle génération et le déploiement de générateurs décentralisés.

Part de marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

Le marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta est principalement dirigé par des sociétés bien établies, notamment :

- Novartis AG (Suisse)

- Eckert & Ziegler Allemagne)

- ITM Isotope Technologies Munich SE (Allemagne)

- SHINE Technologies, LLC (États-Unis)

- Actinium Pharmaceuticals, Inc. (États-Unis)

- Alpha Tau Medical Ltd. (Israël)

- ARICEUM THERAPEUTICS (Allemagne)

- Bayer AG (Allemagne)

- Curium (États-Unis)

- IONETIX Corporation (États-Unis)

- Isotopia (Israël)

- Lantheus (États-Unis)

- Lilly (États-Unis)

- Niowave (États-Unis)

- RMN (États-Unis)

- Oncoinvent (Norvège)

- Groupe Orano (Paris)

- Radiopharm Theranostics Limited (Australie)

- Telix Pharmaceuticals Limited (Australie)

- Terthera (Pays-Bas)

Derniers développements sur le marché des produits radiopharmaceutiques à base d'émetteurs alpha et bêta

- En mai 2025, ITM Isotope Technologies Munich SE et Radiopharm Theranostics ont annoncé un accord d'approvisionnement en lutécium-177 sans porteur ajouté (nca 177Lu). Ce partenariat soutient le développement clinique de Radiopharm pour ses thérapies à base de Lu-177, notamment RAD 204, RAD 202 et RV01, garantissant ainsi un accès à des isotopes de haute qualité pour le traitement radiopharmaceutique ciblé des tumeurs solides dans le cadre d'essais cliniques en cours et à venir.

- En mars 2025, la FDA a approuvé le Pluvicto de Novartis (Lu-177 vipivotide tétraxétan) pour une utilisation précoce dans le cancer de la prostate métastatique résistant à la castration et PSMA-positif, permettant son administration après un ARPI et avant la chimiothérapie. D'après les résultats de l'essai de phase III PSMAfore, le Pluvicto a réduit le risque de progression ou de décès de 59 %, doublant la médiane de survie sans progression radiographique, tout en maintenant un profil de sécurité favorable et en élargissant significativement l'accès des patients.

- En mars 2025, Eckert & Ziegler et AtomVie Global Radiopharma ont signé un accord mondial d'approvisionnement en lutétium-177 (Theralugand) sans porteur ajouté. Ce partenariat garantit un approvisionnement stable et de haute qualité en Lu-177 pour les activités radiopharmaceutiques CDMO d'AtomVie, soutenant ainsi le développement à un stade précoce ou avancé à l'échelle mondiale et renforçant les capacités des deux entreprises en matière d'innovation radiopharmaceutique, de conformité réglementaire et de solutions de médecine nucléaire centrées sur le patient.

- En mars 2025, Eckert & Ziegler et Actinium Pharmaceuticals ont signé un accord d'approvisionnement en Actinium-225 (Ac-225) de haute pureté. Ce partenariat garantit une source fiable d'Ac-225 pour soutenir le développement d'Actimab-A et d'autres candidats radiothérapeutiques ciblant la LAM et les tumeurs solides, renforçant ainsi le portefeuille clinique d'Actinium et répondant aux défis mondiaux d'approvisionnement en isotopes pour les thérapies radiopharmaceutiques de précision.

- En mai 2024, Novartis AG a annoncé son accord pour l'acquisition de Mariana Oncology pour un montant initial d'un milliard de dollars US et jusqu'à 750 millions de dollars US en paiements d'étape. Cette acquisition renforce le portefeuille de produits de radiothérapie par ligands (RLT) de Novartis grâce à des actifs précliniques ciblant les tumeurs solides, notamment le candidat médicament à base d'actinium MC-339 pour le cancer du poumon à petites cellules, et renforce ses capacités de recherche, d'approvisionnement et d'innovation en matière de RLT.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 END USER MARKET COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PIPELINE

4.4 SUPPLY CHAIN ECOSYSTEM

4.4.1 PROMINENT COMPANIES

4.4.2 SMALL & MEDIUM SIZE COMPANIES

4.4.3 END USERS

4.5 INDUSTRY INSIGHTS:

4.5.1 MICRO AND MACRO ECONOMIC FACTORS

4.5.2 KEY PRICING STRATEGIES

4.6 MARKETED DRUG ANALYSIS

4.6.1 DRUG

4.6.1.1 BRAND NAME

4.6.1.2 GENERIC NAME

4.6.2 THERAPEUTIC INDICATION

4.6.3 PHARMACOLOGICAL CLASS OF THE DRUG

4.6.4 DRUG PRIMARY INDICATION

4.6.5 MARKET STATUS

4.6.6 MEDICATION TYPE

4.6.7 DRUG DOSAGE FORM

4.6.8 DOSAGES AVAILABILITY

4.6.9 PACKAGING TYPE

4.6.10 DRUG ROUTE OF ADMINISTRATION

4.6.11 DOSING FREQUENCY

4.6.12 DRUG INSIGHT

4.6.13 OVERVIEW OF DRUG DEVELOPMENT ACTIVITIES

4.6.13.1 FORECAST MARKET OUTLOOK

4.6.13.2 CROSS COMPETITION

4.6.13.3 THERAPEUTIC PORTFOLIO

4.6.13.4 CURRENT DEVELOPMENT SCENARIO

4.7 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.7.2.2 UNITED STATES: MEDICARE/MEDICAID TARIFF POLICIES, CMS PRICING MODELS

4.7.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.7.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

4.7.2.5 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.7.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.7.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

4.8 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.8.1.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.8.1.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.8.1.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

4.8.2 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.8.2.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

4.8.2.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.8.2.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.8.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.8.4 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.9 EPIDEMIOLOGY OVERVIEW

4.9.1 INCIDENCE OF ALL CANCERS BY GENDER

4.9.2 TREATMENT RATE

4.9.3 MORTALITY RATE

4.9.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.9.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY FRAMEWORK

5.1 REGULATORY FRAMEWORK OVERVIEW FOR THE NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.1.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.1.2 REGULATORY APPROVAL PATHWAYS

5.1.3 LICENSING AND REGISTRATION

5.1.4 POST-MARKETING SURVEILLANCE

5.1.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.2 REGULATORY FRAMEWORK OVERVIEW FOR THE SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.2.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.2.2 REGULATORY APPROVAL PATHWAYS

5.2.3 LICENSING AND REGISTRATION

5.2.4 POST-MARKETING SURVEILLANCE

5.2.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.3 REGULATORY FRAMEWORK OVERVIEW FOR THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.3.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.3.2 REGULATORY APPROVAL PATHWAYS

5.3.3 LICENSING AND REGISTRATION

5.3.4 POST-MARKETING SURVEILLANCE

5.3.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.4 REGULATORY FRAMEWORK OVERVIEW FOR THE ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.4.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.4.2 REGULATORY APPROVAL PATHWAYS

5.4.3 LICENSING AND REGISTRATION

5.4.4 POST-MARKETING SURVEILLANCE

5.4.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.5 REGULATORY FRAMEWORK OVERVIEW FOR THE MIDDLE EAST AND AFRICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.5.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.5.2 REGULATORY APPROVAL PATHWAYS

5.5.3 LICENSING AND REGISTRATION

5.5.4 POST-MARKETING SURVEILLANCE

5.5.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED EFFICACY OF TARGETED ALPHA AND BETA THERAPIES

6.1.2 GROWING ADOPTION OF THERANOSTICS IN PERSONALIZED MEDICINE

6.1.3 RISING CLINICAL DEMAND FOR ALPHA-BASED RADIOTHERAPIES

6.1.4 RISING CHRONIC DISEASE BURDEN DRIVING RADIOPHARMACEUTICAL DEMAND

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN AND SCALABILITY CHALLENGES FROM SHORT ISOTOPE HALF-LIVES

6.2.2 STRINGENT REGULATORY LANDSCAPE LIMITING MARKET FLEXIBILITY

6.2.3 SAFETY AND EXPOSURE RISKS IN RADIOPHARMACEUTICAL USE

6.3 OPPORTUNITIES

6.3.1 SURGE IN R&D ACTIVITY EXPANDING RADIOPHARMACEUTICAL APPLICATIONS

6.3.2 EXPANSION OF LU-177-PSMA THERAPY IN PROSTATE CANCER TREATMENT

6.3.3 STRATEGIC COLLABORATIONS DRIVING RADIOPHARMACEUTICAL INNOVATION

6.4 CHALLENGES

6.4.1 HIGH COST OF DEVELOPMENT AND IMPLEMENTATION OF RADIOPHARMACEUTICALS

6.4.2 SHORTAGE OF SKILLED WORKFORCE IN NUCLEAR MEDICINE AND RADIOCHEMISTRY

7 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE

7.1 OVERVIEW

7.2 BETA EMITTERS

7.2.1 LUTETIUM-177

7.2.2 TERBIUM-161

7.3 ALPHA EMITTERS

7.3.1 ACTINIUM-225

7.3.2 LEAD -212

8 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES

8.1 OVERVIEW

8.2 REACTOR-PRODUCED ISOTOPES

8.3 GENERATOR-PRODUCED ISOTOPES

8.4 OTHERS

9 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 PROSTATE CANCER

9.2.2 NEUROENDOCRINE TUMORS

9.2.3 LIVER CANCER

9.2.4 BRAIN TUMORS

9.2.5 BREAST CANCER

9.2.6 LEUKEMIA

9.3 OTHERS

10 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULE LIGANDS

10.3 PEPTIDES

10.4 MONOCLONAL ANTIBODIES

10.5 OTHERS

11 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ONCOLOGY CENTERS

11.2.2 NUCLEAR MEDICINE DEPARTMENTS

11.3 RADIOPHARMACIES

11.4 RESEARCH INSTITUTES

12 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 U.K.

12.3.3 FRANCE

12.3.4 ITALY

12.3.5 SPAIN

12.3.6 POLAND

12.3.7 RUSSIA

12.3.8 NORWAY

12.3.9 TURKEY

12.3.10 AUSTRIA

12.3.11 IRELAND

12.3.12 NETHERLANDS

12.3.13 SWITZERLAND

12.3.14 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.2 AUSTRALIA

12.4.3 JAPAN

12.4.4 SOUTH KOREA

12.4.5 SINGAPORE

12.4.6 INDIA

12.4.7 INDONESIA

12.4.8 PHILIPPINES

12.4.9 THAILAND

12.4.10 MALAYSIA

12.4.11 VIETNAM

12.4.12 TAIWAN

12.4.13 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 CHILE

12.5.4 PERU

12.5.5 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 U.A.E.

12.6.5 KUWAIT

12.6.6 ISRAEL

12.6.7 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NOVARTIS AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ECKERT & ZIEGLER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ITM ISOTOPE TECHNOLOGIES MUNICH SE

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SHINE TECHNOLOGIES, LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ACTINIUM PHARMACEUTICALS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PIPELINE PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALPHA TAU MEDICAL LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PIPELINE PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ARICEUM THERAPEUTICS

15.7.1 COMPANY SNAPSHOT

15.7.2 PIPELINE PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BAYER AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PIPELINE PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CURIUM

15.9.1 COMPANY SNAPSHOT

15.9.2 PIPELINE PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IONETIX CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PIPELINE PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 ISOTOPIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PIPELINE PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 LANTHEUS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PIPELINE PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LILLY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PIPELINE PRODUCT PORTFOLIO

15.14 NIOWAVE

15.14.1 COMPANY SNAPSHOT

15.14.2 PIPELINE PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 NMR

15.15.1 COMPANY SNAPSHOT

15.15.2 PIPELINE PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ONCOINVENT

15.16.1 COMPANY SNAPSHOT

15.16.2 PIPELINE PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ORANO GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PIPELINE PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 RADIOPHARM THERANOSTICS LIMITED

15.18.1 COMPANY SNAPSHOT

15.18.2 PIPELINE PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TELIX PHARMACEUTICALS LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PIPELINE PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TERTHERA

15.20.1 COMPANY SNAPSHOT

15.20.2 PIPELINE PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 5 PENETRATION AND GROWTH PROSPECT MAPPING

TABLE 6 INCIDENCE OF CANCER BY GENDER

TABLE 7 CANCER MORTALITY RATE

TABLE 8 CANCER TREATMENT SUCCESS RATE

TABLE 9 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL REACTOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL GENERATOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL SMALL MOLECULE LIGANDS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL PEPTIDES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL MONOCLONAL ANTIBODIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL RADIOPHARMACIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL RESEARCH INSTITUTES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 65 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 MEXICO ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.K. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.K. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 93 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 U.K. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 U.K. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 FRANCE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 102 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 FRANCE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 106 FRANCE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 108 ITALY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 111 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 ITALY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 117 SPAIN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SPAIN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 120 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 SPAIN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 124 SPAIN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 126 POLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 POLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 129 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 POLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 133 POLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 135 RUSSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 RUSSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 138 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 RUSSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 142 RUSSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 144 NORWAY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORWAY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 147 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 NORWAY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 NORWAY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 153 TURKEY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 TURKEY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 156 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 TURKEY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 160 TURKEY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 165 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 AUSTRIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 169 AUSTRIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 171 IRELAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 IRELAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 174 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 IRELAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 178 IRELAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NETHERLANDS ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 NETHERLANDS HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 189 SWITZERLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SWITZERLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 192 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 SWITZERLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 196 SWITZERLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 REST OF EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 ASIA-PACIFIC ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 207 ASIA-PACIFIC HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 216 CHINA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 218 AUSTRALIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 AUSTRALIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 221 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 AUSTRALIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 225 AUSTRALIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 227 JAPAN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 JAPAN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 230 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 JAPAN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 234 JAPAN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH KOREA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH KOREA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 245 SINGAPORE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SINGAPORE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 248 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 SINGAPORE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 252 SINGAPORE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 254 INDIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 INDIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 257 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 258 INDIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 261 INDIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 263 INDONESIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 INDONESIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 266 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 INDONESIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 270 INDONESIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 272 PHILIPPINES BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 PHILIPPINES ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 275 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 PHILIPPINES ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 279 PHILIPPINES HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 281 THAILAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 THAILAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 284 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 285 THAILAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 288 THAILAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 290 MALAYSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 MALAYSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 293 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 294 MALAYSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 297 MALAYSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 299 VIETNAM BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 VIETNAM ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 302 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 303 VIETNAM ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 306 VIETNAM HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 308 TAIWAN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 TAIWAN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 311 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 312 TAIWAN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 315 TAIWAN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 REST OF ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 319 SOUTH AMERICA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SOUTH AMERICA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 323 SOUTH AMERICA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH AMERICA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 328 BRAZIL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BRAZIL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 331 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 332 BRAZIL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 335 BRAZIL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 337 ARGENTINA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 ARGENTINA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 340 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 341 ARGENTINA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 344 ARGENTINA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)