Global Bio Based Construction Polymer Market

Taille du marché en milliards USD

TCAC :

%

USD

12.79 Billion

USD

20.97 Billion

2024

2032

USD

12.79 Billion

USD

20.97 Billion

2024

2032

| 2025 –2032 | |

| USD 12.79 Billion | |

| USD 20.97 Billion | |

|

|

|

|

Global Bio Based Construction Polymer Market, By Product (Cellulose Acetate, Polyethylene Terephthalate (PET), Epoxies, Polyurethanes (PUR), Polyethylene (PE), and Others), Application (Pipes, Insulation, Profile, and Others) - Industry Trends and Forecast to 2032.

Bio Based Construction Polymer Market Size

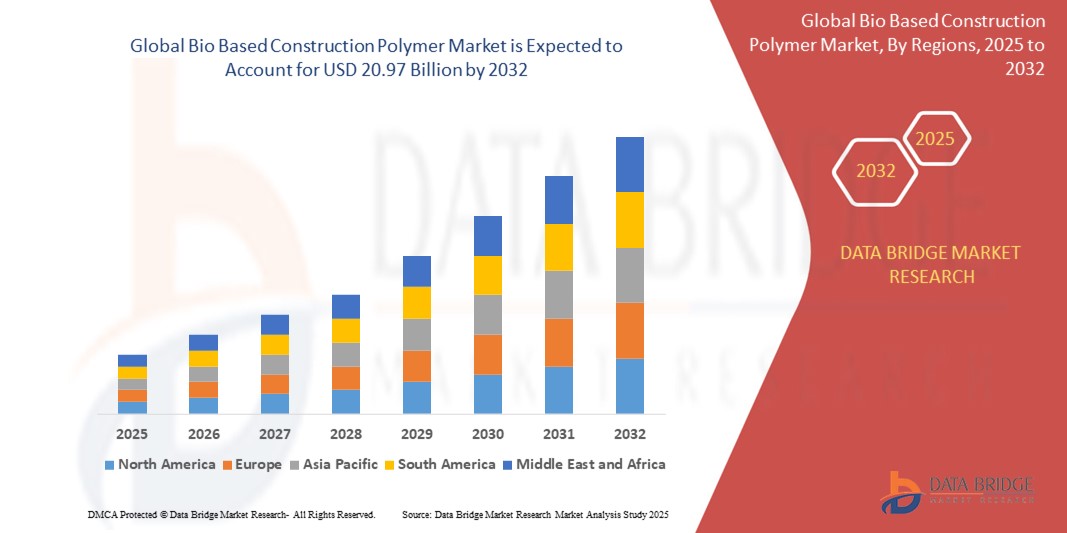

- The global bio based construction polymer market size was valued at USD 12.79 billion in 2024 and is expected to reach USD 20.97 billion by 2032, at a CAGR of 6.38% during the forecast period

- The market growth is primarily driven by increasing demand for sustainable and eco-friendly construction materials, advancements in bio-based polymer technologies, and supportive government regulations promoting green building initiatives

- Rising consumer and industry awareness of environmental concerns, coupled with the push for reducing carbon footprints in construction, is positioning bio-based polymers as a preferred alternative to traditional petroleum-based materials, significantly boosting market expansion

Bio Based Construction Polymer Market Analysis

- Bio-based construction polymers, derived from renewable sources such as plant-based materials, are increasingly integral to sustainable construction practices, offering eco-friendly alternatives for applications such as pipes, insulation, and profiles due to their reduced environmental impact and enhanced durability

- The surge in demand is fueled by growing adoption of green building standards, rising environmental consciousness, and the need for energy-efficient construction materials

- Asia-Pacific dominated the bio-based construction polymer market with the largest revenue share of 37.9% in 2024, driven by rapid urbanization, large-scale infrastructure projects, and government initiatives promoting sustainable construction in countries such as China, Japan, and India

- Europe is expected to be the fastest-growing region during the forecast period, propelled by stringent environmental regulations, increasing investments in green building technologies, and growing consumer preference for sustainable materials

- The polyethylene terephthalate (PET) segment dominated the largest market revenue share of 49.5% in 2024, driven by its renewability, recyclability, and stability as a sustainable alternative to petroleum-based plastics, particularly in applications such as films and fibers for construction. Its adoption is further supported by volatility in petroleum prices, encouraging manufacturers to shift toward bio-based alternatives

Report Scope and Bio Based Construction Polymer Market Segmentation

|

Attributes |

Bio Based Construction Polymer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio Based Construction Polymer Market Trends

“Increasing Integration of Advanced Material Science and Biotechnology”

- The global bio-based construction polymer market is experiencing a significant trend toward the integration of advanced material science and biotechnology

- These technologies enable the development of high-performance bio-based polymers, such as bio-based polyethylene (PE) and polyurethane (PUR), with enhanced properties such as durability, flexibility, and thermal insulation

- Advanced bio-based composites, combining natural fibers with polymer matrices, are being utilized for lightweight, durable, and sustainable structural components, such as panels and beams

- For instances, companies are developing bio-resin formulations from renewable sources such as plant oils and lignin, improving moisture resistance and adhesion for applications in coatings, adhesives, and sealants

- This trend enhances the appeal of bio-based polymers by offering comparable or superior performance to petroleum-based alternatives, driving adoption in sustainable construction projects

- Biotechnology advancements allow for tailored polymer properties, enabling precise customization for specific construction applications such as insulation or piping

Bio Based Construction Polymer Market Dynamics

Driver

“Rising Demand for Sustainable and Eco-Friendly Building Materials”

- Growing consumer and regulatory demand for sustainable construction materials is a key driver for the global bio-based construction polymer market

- Bio-based polymers, derived from renewable sources such as plant starch, cellulose, and vegetable oils, reduce carbon footprints and reliance on fossil fuels, aligning with global sustainability goals

- Government regulations, particularly in Europe with initiatives such as the EU’s Green Deal, mandate the use of eco-friendly materials, boosting the adoption of bio-based polymers

- The proliferation of green building certifications, such as LEED, and advancements in bio-based polymer production technologies are enabling broader applications in pipes, insulation, and profiles

- Construction companies are increasingly incorporating bio-based polymers as standard materials in projects to meet environmental standards and enhance building energy efficiency

- Asia-Pacific dominates the market, driven by rapid urbanization and infrastructure development, particularly in China and India, where demand for sustainable materials is surging

Restraint/Challenge

“High Production Costs and Limited Supply Chain Infrastructure”

- The high initial costs of producing bio-based polymers, including processing renewable feedstocks into usable intermediates, pose a significant barrier to widespread adoption, particularly in cost-sensitive emerging markets

- The complexity of integrating bio-based polymers into existing construction processes and supply chains can increase project costs and timelines

- Data from industry reports indicate that bio-based polymers can be 20-50% more expensive to produce than petroleum-based alternatives, limiting scalability

- Limited global supply chain infrastructure for bio-based materials, compared to well-established petroleum-based polymer supply chains, restricts large-scale production and distribution

- Awareness and technical knowledge gaps among stakeholders, such as architects and contractors, about the benefits and applications of bio-based polymers can hinder market growth, particularly in regions with lower environmental awareness

- These factors may slow market expansion in regions outside Asia-Pacific, where cost sensitivity and underdeveloped supply chains are more pronounced, despite Europe being the fastest-growing region due to supportive regulations and sustainability initiatives

Bio Based Construction Polymer market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the global bio based construction polymer Market is segmented into cellulose acetate, polyethylene terephthalate (PET), epoxies, polyurethanes (PUR), polyethylene (PE), and others. The polyethylene terephthalate (PET) segment dominated the largest market revenue share of 49.5% in 2024, driven by its renewability, recyclability, and stability as a sustainable alternative to petroleum-based plastics, particularly in applications such as films and fibers for construction. Its adoption is further supported by volatility in petroleum prices, encouraging manufacturers to shift toward bio-based alternatives.

The polyurethane (PUR) segment is expected to witness the fastest growth rate from 2025 to 2032, with a projected CAGR of 14.8%. This growth is attributed to the increasing demand for bio-based polyurethanes in insulation applications, particularly in energy-efficient buildings in Europe and the United States. Their excellent thermal insulation properties, corrosion resistance, and lightweight design make them ideal for pipes, panels, flooring, and roofing.

- By Application

On the basis of application, the global bio based construction polymer Market is segmented into pipes, insulation, profile, and others. The pipes segment dominated the market with a revenue share of 38% in 2024, driven by the widespread use of bio-based polymers such as bio-based polyethylene (PE) and polypropylene (PP) in water supply, sewage systems, and industrial processes. These materials offer durability, corrosion resistance, and flexibility, reducing reliance on fossil fuels and aligning with global sustainability goals.

The insulation segment is anticipated to experience the fastest growth from 2025 to 2032, with a projected CAGR of 14.8%. The rising demand for energy-efficient buildings, particularly in Europe and the U.S., is driving the adoption of bio-based polyurethanes and cellulose-based materials for insulation. These materials enhance thermal performance, reduce heat loss, and contribute to lower carbon emissions, supporting global efforts toward sustainable construction.

Bio Based Construction Polymer Market Regional Analysis

- Asia-Pacific dominated the bio-based construction polymer market with the largest revenue share of 37.9% in 2024, driven by rapid urbanization, large-scale infrastructure projects, and government initiatives promoting sustainable construction in countries such as China, Japan, and India

- Consumers prioritize bio-based polymers for their eco-friendliness, high strength-to-weight ratio, and durability, particularly in regions with stringent environmental regulations and growing sustainability awareness

- Growth is supported by advancements in bio-based polymer technologies, such as lignin-based epoxies and soy-based polyurethanes, alongside rising adoption in both new construction projects and retrofit applications

U.S. Bio Based Construction Polymer Market Insight

The U.S. bio based construction polymer market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of sustainability and carbon footprint reduction benefits. The trend towards green building certifications and increasing regulations promoting eco-friendly materials further boost market expansion. The integration of bio-based polymers in structural components and insulation by major construction firms complements aftermarket sales, creating a diverse product ecosystem.

Europe Bio Based Construction Polymer Market Insight

The Europe bio-based construction polymer market is expected to witness the fastest growth rate, supported by a regulatory emphasis on circular economy principles and sustainable construction practices. Consumers seek polymers that enhance energy efficiency while reducing environmental impact. The growth is prominent in both new building projects and retrofit initiatives, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban development.

U.K. Bio-Based Construction Polymer Market Insight

The U.K. market for bio-based construction polymers is expected to witness rapid growth, driven by demand for sustainable materials that improve energy efficiency and reduce carbon emissions in urban and suburban settings. Increased interest in green building aesthetics and rising awareness of environmental benefits encourage adoption. Evolving regulations promoting sustainable construction influence consumer choices, balancing performance with compliance.

Germany Bio-Based Construction Polymer Market Insight

Germany is expected to witness a high growth rate in bio-based construction polymers, attributed to its advanced construction sector and strong consumer focus on sustainability and energy efficiency. German consumers prefer technologically advanced polymers that reduce building heat loss and contribute to lower energy consumption. The integration of these polymers in premium construction projects and aftermarket applications supports sustained market growth.

Asia-Pacific Bio-Based Construction Polymer Market Insight

The Asia-Pacific region dominates the global bio-based construction polymer market, driven by expanding construction activities and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of sustainability, energy efficiency, and environmental protection is boosting demand. Government initiatives promoting green buildings and eco-friendly materials further encourage the use of advanced bio-based polymers.

Japan Bio-Based Construction Polymer Market Insight

Japan’s bio-based construction polymer market is expected to witness a high growth rate due to strong consumer preference for high-quality, technologically advanced polymers that enhance building comfort and sustainability. The presence of major construction material manufacturers and the integration of bio-based polymers in new buildings accelerate market penetration. Rising interest in aftermarket retrofitting also contributes to growth.

China Bio-Based Construction Polymer Market Insight

China holds the largest share of the Asia-Pacific bio-based construction polymer market, propelled by rapid urbanization, rising construction projects, and increasing demand for sustainable building solutions. The country’s growing middle class and focus on green infrastructure support the adoption of advanced bio-based polymers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Bio Based Construction Polymer Market Share

The bio based construction polymer industry is primarily led by well-established companies, including:

- Plastics Corp (U.S.)

- Harman Corporation (U.S.)

- Evonik Industries AG (Germany)

- Eastman Chemical Company (U.S.)

- DIC CORPORATION (Japan)

- Kao Corporation (Japan)

- LG Chem (South Korea)

- Perstorp (Sweden)

- UPC Technology Corporation (Taiwan)

- Kaifeng Jiuhong Chemical Co., Ltd. (China)

- Henan GO Biotech Co.,Ltd (China)

- Valtris Specialty Chemicals (U.S.)

- Velsicol Chemical LLC (U.S.)

- Ferro Corporation (U.S.)

- Mitsubishi Chemical Corporation (Japan)

What are the Recent Developments in Global Bio Based Construction Polymer Market?

- In June 2025, there is a notable surge in the adoption of bio-based polyurethane (BPU) across the construction industry. Once primarily used for insulation, BPU is now making inroads into flooring systems, coatings, adhesives, and sealants, thanks to its versatility and environmental benefits. Manufacturers are increasingly turning to renewable feedstocks such as soybeans, castor oil, and other vegetable oils to produce these materials. This shift is driven by growing environmental awareness, regulatory pressures, and consumer demand for sustainable building solutions, signaling a broader integration of bio-based technologies in modern construction

- In April 2025, Tata BlueScope Steel launched PRISMA®, a next-generation pre-painted steel solution featuring a 66% aluminum-zinc alloy coating. Engineered for modern roofing and cladding applications, PRISMA® offers a high-gloss finish, enhanced scratch resistance, and thermal efficiency—making it ideal for sustainable infrastructure. While not entirely bio-based, the product incorporates a significant bio-based component in its coating, reflecting the industry's shift toward eco-friendly construction materials. Developed through extensive R&D, PRISMA® addresses durability, aesthetics, and environmental performance, aligning with India’s growing demand for green building solutions

- In December 2024, Emirates Biotech announced plans to build the first Polylactic Acid (PLA) production facility in the Middle East, marking a major milestone in the region’s shift toward sustainable materials. Located in the UAE, the plant will be constructed in two phases—each with an annual capacity of 80,000 tonnes, totaling 160,000 tonnes per year upon completion. The facility will utilize Sulzer’s licensed PLA technology and plant-based feedstocks to produce biodegradable bioplastics, supporting global efforts to reduce plastic pollution. Construction is set to begin in 2026, with operations expected to commence by early 2028

- In July 2024, ZymoChem launched BAYSE™, the world’s first scalable, 100% bio-based, and biodegradable Super Absorbent Polymer (SAP). Designed as a sustainable alternative to fossil fuel-based SAPs, BAYSE™ is made from renewable resources and offers a microplastic-free, high-performance solution for absorbent hygiene products such as diapers. Its drop-in compatibility, competitive cost, and reduced carbon footprint make it a game-changer for the $145 billion global hygiene industry. Beyond hygiene, BAYSE™ also shows promise in construction, agriculture, cosmetics, and water treatment, where water absorption and retention are critical

- In March 2023, BASF SE began production of Sovermol, its first bio-based polyol, at its Mangalore site in India. This launch marked a significant step toward meeting the rising demand for sustainable and eco-friendly solutions across the Asia Pacific region. Derived from renewable raw materials and free of volatile organic compounds (VOCs), Sovermol is tailored for use in flooring, protective industrial coatings, wind turbines, and new energy vehicles. The facility’s strategic location near raw material sources enhances supply efficiency, while the product supports customers’ efforts to reduce carbon footprints and embrace greener construction practices

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.