Global Bioinformatics Market

Taille du marché en milliards USD

TCAC :

%

USD

14.27 Billion

USD

57.03 Billion

2024

2032

USD

14.27 Billion

USD

57.03 Billion

2024

2032

| 2025 –2032 | |

| USD 14.27 Billion | |

| USD 57.03 Billion | |

|

|

|

|

Segmentation du marché mondial de la bioinformatique, par type (outils de gestion des connaissances, logiciels et services de bioinformatique), secteur (biotechnologie médicale, enseignement supérieur, biotechnologie animale, biotechnologie agricole , biotechnologie environnementale, biotechnologie médico-légale et autres), application ( génomique et développement de médicaments, protéomique, études évolutives, études agricoles, sciences vétérinaires, métabolomique, transcriptomique et autres), mode d'achat (achat groupé et achat individuel), méthode (génomique et protéomique), utilisateur final (instituts de recherche et établissements d'enseignement supérieur, organismes de recherche clinique, entreprises biotechnologiques et pharmaceutiques, laboratoires de recherche, hôpitaux et autres) - Tendances du secteur et prévisions jusqu'en 2032

Taille du marché de la bioinformatique

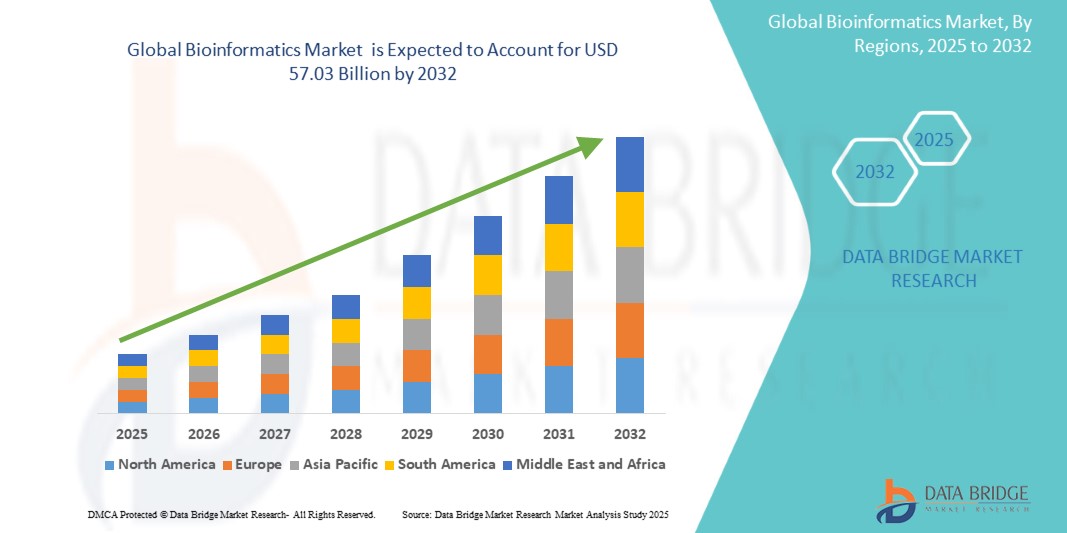

- Le marché mondial de la bioinformatique était évalué à 14,27 milliards de dollars en 2024 et devrait atteindre 57,03 milliards de dollars d'ici 2032.

- Au cours de la période de prévision allant de 2025 à 2032, le marché devrait croître à un TCAC de 18,90 %, principalement sous l'effet de la demande croissante de recherche génomique.

- Cette croissance est alimentée par l'augmentation des applications dans la découverte de médicaments et les progrès de l'analyse de données basée sur l'intelligence artificielle (IA).

Analyse du marché de la bioinformatique

- La bioinformatique a acquis une large acceptation grâce à son rôle dans la recherche génomique, la découverte de médicaments et la médecine personnalisée, contribuant ainsi aux progrès de la santé, de l'agriculture et des biotechnologies. Sa capacité à analyser des données biologiques complexes, à accélérer la médecine de précision et à soutenir les technologies de séquençage du génome a consolidé sa place dans les sciences de la vie modernes.

- Le marché est principalement tiré par la demande croissante de séquençage de nouvelle génération (NGS), le développement des applications dans la découverte de biomarqueurs et l'intégration de l'intelligence artificielle (IA) et de l'apprentissage automatique (AA) pour une meilleure interprétation des données biologiques. De plus, l'augmentation des investissements dans les infrastructures bioinformatiques, les solutions de cloud computing et les collaborations biopharmaceutiques accélère l'expansion du marché.

- Par exemple, aux États-Unis et en Europe, la demande d'outils bioinformatiques a fortement augmenté en raison de l'adoption croissante de la médecine de précision et de la recherche génomique pilotée par l'IA, contribuant ainsi à une croissance soutenue du marché.

- À l'échelle mondiale, la bioinformatique demeure une pierre angulaire de l'analyse des données génomiques et de la recherche biopharmaceutique. Des innovations telles que les plateformes bioinformatiques en nuage, les techniques de biologie computationnelle avancées et les diagnostics génétiques basés sur l'IA transforment le secteur et garantissent la pérennité du marché.

Portée du rapport et segmentation du marché de la bioinformatique

|

Attributs |

Principaux enseignements du marché de la bioinformatique |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les analyses de scénarios de marché telles que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché de la bioinformatique

« L’adoption croissante de la bioinformatique dans la médecine de précision et la découverte de médicaments »

- La demande croissante de médecine personnalisée favorise l'intégration de la bioinformatique dans la recherche génomique, la découverte de médicaments et l'identification de biomarqueurs afin de développer des thérapies ciblées.

- Les entreprises pharmaceutiques et biotechnologiques exploitent l'IA et les outils d'apprentissage automatique basés sur la bioinformatique pour accélérer le développement de médicaments, améliorer le diagnostic des maladies et optimiser l'efficacité des traitements.

- L'intérêt croissant porté aux technologies de séquençage de nouvelle génération (NGS) et à l'analyse des données génomiques stimule les investissements dans les plateformes bioinformatiques basées sur le cloud pour un traitement des données évolutif et efficace.

Par exemple,

- En mars 2024, Illumina, Inc. s'est associée à AstraZeneca pour améliorer les outils d'interprétation génomique basés sur l'IA afin d'accélérer la découverte de cibles thérapeutiques.

- En janvier 2024, Thermo Fisher Scientific a lancé une nouvelle plateforme de découverte de médicaments basée sur la bioinformatique, permettant une recherche pharmaceutique plus rapide et plus précise.

- En septembre 2023, BGI a annoncé des avancées dans le séquençage génomique piloté par l'IA, améliorant la précision et la rapidité de l'analyse bioinformatique pour la médecine personnalisée.

- Alors que les industries de la santé et pharmaceutiques continuent d'adopter la recherche axée sur les données, la bioinformatique restera un élément clé de la médecine génomique, de l'innovation pharmaceutique et des solutions de soins de santé de précision, garantissant ainsi la croissance à long terme du secteur.

Dynamique du marché de la bioinformatique

Conducteur

« L’adoption croissante de la bioinformatique en oncologie de précision »

- La prévalence croissante du cancer stimule la demande en bioinformatique, qui joue un rôle crucial dans l'analyse génomique, la découverte de biomarqueurs et les stratégies de traitement personnalisé du cancer.

- Les entreprises pharmaceutiques et les instituts de recherche exploitent l'intelligence artificielle et l'apprentissage automatique, fondés sur la bioinformatique, pour développer des thérapies ciblées, améliorer le dépistage précoce du cancer et optimiser les résultats des traitements.

- Les projets de génomique du cancer financés par les gouvernements et les progrès des technologies de séquençage de nouvelle génération (SNG) accélèrent encore l'intégration de la bioinformatique dans la recherche en oncologie.

Par exemple,

- En novembre 2024, QIAGEN a lancé une plateforme de bioinformatique basée sur l'IA pour améliorer l'interprétation des données génomiques en oncologie de précision.

- En août 2024, Thermo Fisher Scientific s'est associé à des centres de recherche sur le cancer de premier plan pour développer des outils bioinformatiques destinés à l'élaboration de plans de traitement personnalisés.

- En mars 2024, l'Institut national du cancer a augmenté son financement de la recherche en bioinformatique, soutenant l'analyse génomique basée sur l'IA pour le dépistage précoce du cancer.

- Face à la demande croissante de médecine de précision, la bioinformatique continuera de transformer la recherche en oncologie, le développement de médicaments et les soins aux patients, garantissant ainsi des traitements contre le cancer plus efficaces et personnalisés.

Opportunité

« Adoption croissante de la bioinformatique dans l’agriculture et la génomique des cultures »

- La demande croissante en matière d'agriculture durable et de cultures génétiquement optimisées favorise l'adoption de la bioinformatique dans la sélection végétale, la recherche sur la résistance aux ravageurs et les stratégies d'amélioration des rendements.

- Les progrès réalisés dans le séquençage du génome et la biologie computationnelle permettent aux chercheurs de développer des cultures résilientes face au climat, réduisant ainsi l'impact des facteurs de stress environnementaux sur la production alimentaire.

- Les gouvernements et les entreprises agrotechnologiques investissent dans la recherche en bio-informatique pour améliorer la productivité des cultures, garantir la sécurité alimentaire et optimiser la gestion des ressources agricoles.

Par exemple,

- En mars 2025, Syngenta a collaboré avec une entreprise de bioinformatique de premier plan pour développer une analyse du génome des cultures basée sur l'IA en vue d'une sélection de précision.

- En décembre 2024, Bayer AG a lancé une plateforme basée sur la bioinformatique pour améliorer les variétés de cultures résistantes aux ravageurs et réduire la dépendance aux pesticides chimiques.

- En septembre 2024, le Conseil indien de la recherche agricole (ICAR) a lancé une initiative nationale intégrant la bioinformatique à la cartographie génétique des cultures résistantes à la sécheresse.

- À mesure que le secteur agricole adopte une prise de décision fondée sur les données, la bioinformatique continuera de révolutionner la génomique des cultures, l'agriculture durable et la sécurité alimentaire, devenant ainsi un moteur essentiel de l'innovation agricole.

Retenue/Défi

« Confidentialité et sécurité des données dans les applications bioinformatiques »

- L'utilisation croissante de la bioinformatique en génomique, en santé et dans l'industrie pharmaceutique soulève des inquiétudes quant à la confidentialité des données, aux menaces de cybersécurité et à l'accès non autorisé aux informations génétiques sensibles.

- Des cadres réglementaires stricts tels que le RGPD et la loi HIPAA imposent des défis de conformité aux entreprises qui traitent des données biomédicales et génomiques à grande échelle, ce qui a un impact sur la recherche et les applications commerciales.

- La recrudescence des cyberattaques et des violations de données dans les secteurs de la santé et des biotechnologies a entraîné un renforcement des exigences de sécurité et la nécessité de recourir à des technologies de chiffrement avancées.

Par exemple,

- En janvier 2025, le département américain de la Santé et des Services sociaux (HHS) a introduit des mesures de conformité plus strictes pour les entreprises de bioinformatique traitant des données génétiques de patients en vertu de la réglementation HIPAA.

- Face aux préoccupations croissantes en matière de sécurité des données qui freinent l'adoption de la bioinformatique, les acteurs du secteur doivent investir dans un chiffrement robuste, une gestion des données basée sur la blockchain et des solutions de cybersécurité pilotées par l'IA afin de garantir la conformité réglementaire et de préserver la confiance des utilisateurs.

Étendue du marché de la bioinformatique

Le marché est segmenté en fonction du type, du secteur, de l'application, du mode d'achat, de la génomique et de l'utilisateur final.

|

Segmentation |

Sous-segmentation |

|

Par type |

|

|

Par secteur |

|

|

Sur demande |

|

|

Par mode d'achat |

|

|

Par méthode |

|

|

Par l'utilisateur final |

|

Analyse régionale du marché de la bioinformatique

« L’Amérique du Nord est la région dominante sur le marché de la bioinformatique »

- L'Amérique du Nord domine le marché mondial de la bioinformatique grâce à ses capacités de recherche avancées, à la forte présence de son industrie biotechnologique et à d'importants financements publics pour les projets de génomique et de biologie computationnelle.

- La région est à la pointe de la bioinformatique pilotée par l'IA, de la médecine de précision et du séquençage de nouvelle génération (NGS), accélérant la découverte de médicaments et les soins de santé personnalisés.

- Aux États-Unis et au Canada, de grandes universités, des instituts de recherche et des entreprises pharmaceutiques sont activement impliqués dans le séquençage du génome, la protéomique et la conception informatique de médicaments.

- L'intégration généralisée du cloud computing, de l'apprentissage automatique et de l'analyse des données dans les sciences de la vie stimule davantage la croissance du marché.

« La région Asie-Pacifique devrait enregistrer le taux de croissance le plus élevé. »

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché de la bioinformatique, sous l'effet de la hausse des investissements dans la recherche génomique, de la demande croissante en médecine de précision et de l'expansion des secteurs biotechnologique et pharmaceutique.

- La Chine et l'Inde émergent comme des marchés clés grâce au soutien croissant des gouvernements à la biotechnologie, aux progrès du séquençage de nouvelle génération (NGS) et à l'adoption croissante de solutions bioinformatiques basées sur l'IA.

- La Chine est à la pointe de l'innovation en bioinformatique dans la région, grâce à des initiatives soutenues par l'État visant à améliorer l'analyse des données génomiques et à renforcer la collaboration entre les entreprises de biotechnologie et les institutions de recherche.

- L'Inde connaît une expansion rapide de son marché, soutenue par une industrie pharmaceutique en pleine croissance, des activités de recherche clinique croissantes et une demande grandissante de solutions informatiques pour la découverte de médicaments.

- La présence d'entreprises de bioinformatique de premier plan, la transformation numérique rapide du secteur de la santé et le développement des collaborations de recherche transfrontalières alimentent davantage la croissance du marché de la bioinformatique en Asie-Pacifique.

Part de marché de la bioinformatique

L'analyse concurrentielle du marché fournit des informations détaillées par concurrent. Ces informations comprennent un aperçu de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses initiatives sur de nouveaux marchés, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, ses lancements de produits, l'étendue de sa gamme de produits et sa position dominante sur le marché. Les données présentées ci-dessus concernent uniquement les activités principales des entreprises liées au marché.

Les principaux acteurs du marché sont :

- Thermo Fisher Scientific Inc. (États-Unis)

- Illumina, Inc. (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- QIAGEN (Allemagne)

- SOPHiA GENETICS (Suisse)

- BGI (Chine)

- Eurofins Scientifique (Luxembourg)

- Société des eaux (Australie)

- DNASTAR (États-Unis)

- Dassault Systèmes (France)

- Bayer AG (Allemagne)

- DNAnexus, Inc. (États-Unis)

- PerkinElmer (États-Unis)

- Seven Bridges Genomics (États-Unis)

- Quest Diagnostics Incorporated (États-Unis)

- AstridBio Technologies Inc. (États-Unis)

- BioBam Bioinformatique (Espagne)

- Strand (Inde)

- GenoFAB (États-Unis)

Dernières évolutions du marché mondial de la bioinformatique

- En octobre 2022, Illumina, Inc. et AstraZeneca ont établi une collaboration de recherche stratégique visant à accélérer la découverte de cibles thérapeutiques en intégrant l'interprétation du génome basée sur l'IA aux outils d'analyse génomique, renforçant ainsi la confiance dans l'identification des cibles médicamenteuses grâce aux connaissances issues des données omiques humaines.

- En septembre 2022, Thermo Fisher Scientific est devenu un sponsor fondateur du Pennsylvania Biotechnology Center (PABC), soutenant à la fois l'incubateur B+Labs basé à Philadelphie et le site du PABC à Doylestown, en Pennsylvanie, pour aider les jeunes entreprises des sciences de la vie à accélérer leur commercialisation.

- En juin 2022, LatchBio a lancé une plateforme bioinformatique complète pour la gestion de données biotechnologiques à grande échelle, visant à rationaliser la découverte scientifique et à améliorer l'efficacité de la recherche.

- En mars 2022, ARUP a dévoilé Rio, une plateforme de traitement et d'analyse bioinformatique conçue pour améliorer la rapidité et la précision des résultats des tests de séquençage de nouvelle génération (NGS).

- En janvier 2021, BGI a étendu sa collaboration avec le ministère de la Santé du Brunei afin de renforcer les initiatives de santé publique, notamment la réponse aux urgences, le dépistage diagnostique, la médecine personnalisée et la détection précoce du cancer grâce aux technologies de séquençage avancées.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.