Global Building Thermal Insulation Materials Market

Taille du marché en milliards USD

TCAC :

%

USD

26.14 Billion

USD

39.80 Billion

2024

2032

USD

26.14 Billion

USD

39.80 Billion

2024

2032

| 2025 –2032 | |

| USD 26.14 Billion | |

| USD 39.80 Billion | |

|

|

|

|

Marché mondial des matériaux d'isolation thermique pour bâtiments, par type de matériau (laine de roche, laine de verre, mousse plastique, autres), type de bâtiment (bâtiment résidentiel, bâtiment non résidentiel), application (isolation de toiture, isolation de murs, isolation de sols), plage de températures (-160 °C à -50 °C, -49 °C à 0 °C, -1 °C à 100 °C et 101 °C à 650 °C) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des matériaux d'isolation thermique des bâtiments

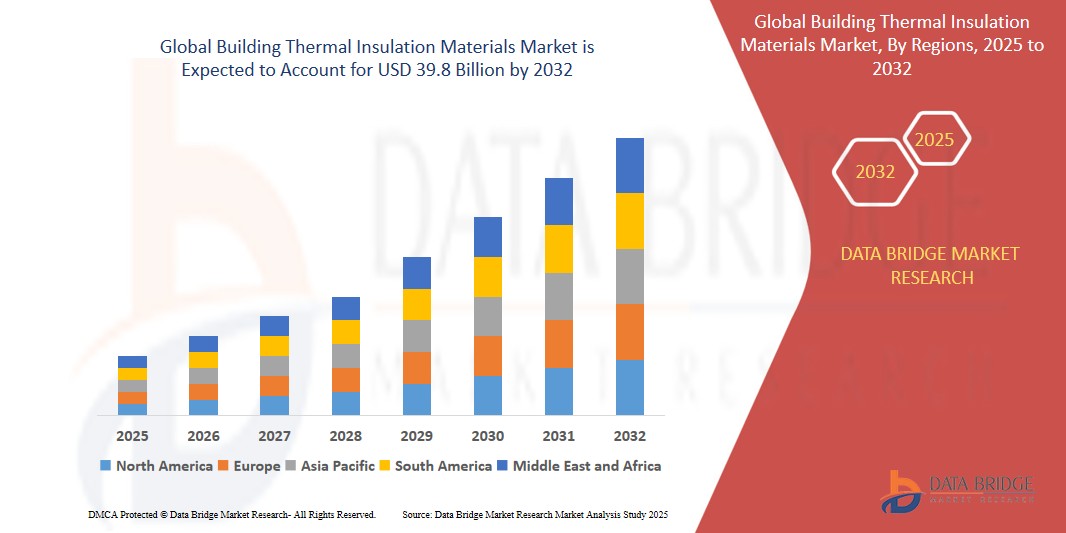

- La taille du marché mondial des matériaux d'isolation thermique pour bâtiments était évaluée à 26,14 milliards USD en 2024 et devrait atteindre 39,8 milliards USD d'ici 2032 , à un TCAC de 6,1 % au cours de la période de prévision.

- Le marché des matériaux d'isolation thermique pour le bâtiment connaît une croissance constante, portée par la demande croissante de solutions de construction écoénergétiques dans les secteurs résidentiel, commercial et industriel. Ces matériaux jouent un rôle essentiel dans la réduction des transferts de chaleur, les économies d'énergie et le confort des occupants des bâtiments, conformément aux objectifs mondiaux de conservation de l'énergie.

- Par ailleurs, l'importance croissante accordée aux pratiques de construction durables et aux normes de construction strictes visant à réduire les émissions de carbone stimulent l'expansion du marché. L'urbanisation croissante, le développement des infrastructures dans les économies émergentes et les avancées en matière de technologies d'isolation écologiques et performantes devraient soutenir la croissance du marché. Les innovations dans les matériaux tels que les aérogels, les panneaux isolants sous vide et les isolants biosourcés ouvrent de nouvelles perspectives et améliorent les performances thermiques de toutes les applications.

Analyse du marché des matériaux d'isolation thermique des bâtiments

- Les matériaux d'isolation thermique des bâtiments sont de plus en plus adoptés dans les secteurs résidentiel, commercial et industriel, en raison de leur efficacité à réduire la consommation d'énergie, à améliorer le confort intérieur et à respecter les réglementations strictes en matière d'efficacité énergétique. Ces matériaux contribuent significativement à la construction durable en minimisant les transferts de chaleur et en diminuant la consommation énergétique liée aux systèmes CVC.

- L'importance croissante accordée à la certification des bâtiments écologiques, à la neutralité carbone et à la construction éco-responsable à l'échelle mondiale accélère la demande de matériaux isolants de pointe, notamment la laine minérale, la mousse de polyuréthane, le polystyrène expansé (PSE) et les alternatives écologiques biosourcées. Constructeurs et promoteurs privilégient les solutions offrant performances thermiques, résistance au feu et contrôle de l'humidité.

- North America dominates the Building Thermal Insulation Materials Market with the largest revenue share of 38.01% in 2024, driven by established regulatory standards such as LEED and the International Energy Conservation Code (IECC), along with significant investments in energy-efficient retrofitting projects across the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, growth in residential construction, and government initiatives promoting energy-efficient infrastructure in countries such as China, India, South Korea, and Southeast Asian nations

- Among material types, mineral wool holds a significant market share of 44.6% in 2024 due to its excellent thermal and acoustic insulation properties, non-combustibility, and wide applicability in both new construction and renovation. However, demand for bio-based and recyclable insulation materials is rising rapidly, reflecting the construction industry's shift toward sustainable and circular economy practices

Report Scope and Building Thermal Insulation Materials Market Segmentation

|

Attributes |

Building Thermal Insulation Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Building Thermal Insulation Materials Market Trends

“Technological Advancements and Sustainable Innovation in Thermal Insulation Solutions”

- A prominent and growing trend in the Global Building Thermal Insulation Materials Market is the integration of advanced material science and sustainable innovation to improve thermal efficiency, reduce environmental impact, and comply with increasingly stringent energy efficiency standards across the construction sector

- Leading companies such as Saint-Gobain, Owens Corning, and BASF are investing in the development of next-generation insulation materials, including aerogels, vacuum insulation panels, and phase-change materials, which offer superior performance in thinner profiles and support net-zero energy building goals

- The industry is witnessing a shift toward eco-friendly, recyclable, and bio-based insulation materials such as hemp, cellulose, and sheep wool that reduce embodied carbon, support circular economy principles, and align with global green building initiatives

- Digitalization in construction—such as Building Information Modeling (BIM)—is enhancing the planning, installation, and lifecycle management of insulation materials, ensuring optimal integration and performance across a structure’s envelope

- There is rising demand for multifunctional insulation systems that combine thermal resistance with properties such as fire retardancy, acoustic insulation, and moisture control, particularly in high-performance building applications and passive house designs

- This trend toward technologically advanced, sustainable, and multifunctional insulation solutions is reshaping the market landscape. Companies focusing on R&D, green innovation, and regulatory compliance are poised to capitalize on emerging opportunities in both new construction and retrofitting markets

Building Thermal Insulation Materials Market Dynamics

Driver

“Rising Demand for Energy Efficiency, Sustainable Construction, and Advanced Insulation Technologies”

- The increasing global focus on reducing energy consumption, minimizing carbon emissions, and enhancing building performance is a primary driver propelling the Building Thermal Insulation Materials Market. Thermal insulation plays a critical role in achieving these objectives by improving energy efficiency and lowering heating and cooling demands across residential, commercial, and industrial buildings

- For instance, in February 2025, Kingspan Group launched a new range of ultra-thin vacuum insulation panels designed for space-constrained urban housing projects, offering superior R-values and aligning with the growing demand for compact, high-performance insulation solutions in modern architecture

- Growing regulatory mandates and building codes—such as the International Energy Conservation Code (IECC), European Energy Performance of Buildings Directive (EPBD), and China’s Green Building Evaluation Standards—are compelling developers to integrate high-quality insulation materials into both new constructions and retrofit projects

- Advancements in insulation technologies, including nanotechnology-based insulants, reflective thermal barriers, and phase-change materials, are enabling improved thermal regulation, fire resistance, and durability, while also supporting long-term sustainability goals

- The increasing need for resilient and climate-adaptive building envelopes, especially in regions facing extreme temperatures and rapid urbanization, is driving the adoption of innovative insulation systems tailored to diverse environmental conditions

- This convergence of energy efficiency imperatives, environmental regulations, and technological innovation is accelerating the global growth of the Building Thermal Insulation Materials Market, with Asia-Pacific, Latin America, and the Middle East emerging as high-potential regions due to infrastructure development, supportive policy frameworks, and rising awareness of green building practices

Restraint/Challenge

“High Installation Costs and Regulatory Barriers Hindering Market Adoption”

- The high initial capital investment required for the installation and integration of advanced thermal insulation systems remains a major restraint in the Building Thermal Insulation Materials Market. Materials such as vacuum insulation panels, aerogels, and phase-change insulants, while offering superior performance, are significantly more expensive than conventional alternatives like fiberglass and EPS, limiting their uptake in cost-sensitive projects

- For example, implementing high-performance insulation in large-scale commercial or industrial buildings often involves complex retrofitting procedures, structural adjustments, and specialized labor, increasing overall project costs and deterring widespread adoption, particularly in developing economies

- Stringent regulatory and certification requirements related to fire safety, thermal performance, and environmental impact—such as ASTM, ISO, and EN standards—necessitate thorough testing, quality assurance, and product documentation. This can slow down time-to-market and increase compliance costs for manufacturers, particularly small and medium enterprises

- The lack of harmonized global building codes and insulation standards poses an additional challenge for multinational companies, as navigating diverse regulatory landscapes across countries complicates product standardization, logistics, and scalability

- Volatility in raw material prices—such as petrochemical derivatives for polyurethane foams or mineral resources for stone wool—adds financial uncertainty and impacts pricing strategies, especially amid global supply chain disruptions, inflationary trends, and geopolitical instability

- In some emerging markets, a limited awareness of the long-term cost savings and environmental benefits of thermal insulation, combined with a shortage of skilled installers and limited enforcement of energy codes, continues to restrict market penetration

- Overcoming these restraints will require broader policy support, increased public-private investment in sustainable construction technologies, cost-reduction strategies through economies of scale, and educational initiatives to promote best practices in energy-efficient building design.

Building Thermal Insulation Materials Market Scope

- By Material Type

On the basis of material type, the Building Thermal Insulation Materials Market is segmented into Stone Wool, Glass Wool, Plastic Foam, and Others

The Plastic Foam segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its widespread use in residential, commercial, and industrial construction for energy-efficient thermal insulation. This material type—encompassing expanded polystyrene (EPS), extruded polystyrene (XPS), and polyurethane foam—is highly favored for its low thermal conductivity, lightweight structure, and moisture resistance. These properties make plastic foams ideal for a variety of applications including walls, roofs, and floors, particularly in regions with extreme temperature variations

- By Building Type

On the basis of building type, the Building Thermal Insulation Materials Market is segmented into Residential Building and Non-Residential Building.

The Residential Building segment dominates the market with the largest revenue share of 28.4% in 2024, driven by the rising demand for energy-efficient housing and increasing implementation of building codes mandating thermal insulation in new constructions. This segment benefits from rapid urbanization, growing awareness of energy savings among homeowners, and government incentives promoting sustainable residential development. Insulation materials are extensively used in walls, roofs, and floors of homes to reduce heating and cooling costs, enhance indoor comfort, and lower carbon footprints

- By Application

On the basis of application, the Building Thermal Insulation Materials Market is segmented into Roof Insulation, Wall Insulation, Floor Insulation

The Wall Insulation segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its critical role in reducing heat transfer, enhancing building energy efficiency, and ensuring thermal comfort in both residential and commercial structures. Wall insulation materials are widely used in external and internal wall assemblies to minimize energy loss through conduction and convection, especially in regions with extreme climatic conditions

- By Material Type

On the basis of temperature range, the Building Thermal Insulation Materials Market is segmented into (-160°C to -50°C), (-49°C to 0°C), (-1°C to 100°C), and (101°C to 650°C).

The (-1°C to 100°C) segment dominates the market with the largest revenue share of 28.4% in 2024, owing to its broad applicability in standard building insulation scenarios including residential, commercial, and light industrial constructions. This temperature range encompasses typical indoor and ambient outdoor conditions, making it ideal for commonly used insulation applications such as wall cavities, attics, and underfloor installations

Building Thermal Insulation Materials Market Regional Analysis

- North America dominates the Building Thermal Insulation Materials Market with the largest revenue share of 39.01% in 2024, driven by strong demand across construction, industrial, and commercial sectors. The region benefits from advanced building codes, increasing focus on energy efficiency, and growing investments in sustainable construction materials. High awareness of green building practices and regulatory incentives supporting energy conservation further bolster market growth

- Leading manufacturers in North America are innovating with eco-friendly and high-performance insulation solutions such as stone wool, plastic foam, and glass wool, aimed at reducing carbon footprints and enhancing building energy ratings. The trend toward retrofitting older buildings to meet stricter thermal performance standards also contributes to market expansion

U.S. Building Thermal Insulation Materials Market Insight

The U.S. Building Thermal Insulation Materials Market captured the largest revenue share of 81% in North America in 2024, propelled by stringent federal and state energy codes, rising construction activities, and incentives for sustainable building materials. The adoption of high-efficiency insulation in both new residential and commercial projects is accelerating, supported by growing public and private sector investments in green infrastructure

Europe Building Thermal Insulation Materials Market Insight

The Europe Building Thermal Insulation Materials Market is projected to grow steadily over the forecast period, supported by rigorous energy efficiency regulations and the EU Green Deal’s push for net-zero carbon buildings. The region’s strong emphasis on sustainability, recycling, and circular economy principles is driving demand for recyclable and eco-friendly insulation materials. Countries such as Germany, the U.K., and France lead with initiatives promoting low-carbon construction technologies

U.K. Building Thermal Insulation Materials Market Insight

The U.K. Building Thermal Insulation Materials Market is expected to register a notable CAGR, fueled by government-led green building programs, expanding urban development, and growing retrofitting activities targeting energy conservation. The country’s leadership in sustainable architecture and innovations in insulation technology are supporting this growth trajectory

Germany Building Thermal Insulation Materials Market Insight

Germany’s market is set to expand significantly, backed by its engineering excellence and commitment to environmental standards. The demand for advanced thermal insulation solutions is rising in both industrial and residential sectors, with a focus on materials offering superior fire resistance and long-term durability, such as stone wool and glass wool

Asia-Pacific Building Thermal Insulation Materials Market Insight

The Asia-Pacific Building Thermal Insulation Materials Market is poised to register the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, industrial growth, and government initiatives promoting energy-efficient buildings. Countries including China, India, Japan, and South Korea are increasingly adopting innovative insulation materials to meet growing demands from residential, commercial, and infrastructure projects

Japan Building Thermal Insulation Materials Market Insight

Japan’s market is gaining momentum due to strong consumer interest in energy conservation, rising construction of green buildings, and technological advancements in insulation materials suited for seismic and climate considerations. Innovation in lightweight, high-performance insulation products supports growth in both new construction and renovation sectors

China Building Thermal Insulation Materials Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by aggressive government policies targeting carbon neutrality, expanding urban infrastructure, and rising consumer awareness about energy efficiency. Substantial investments in green building technologies and collaborations with global insulation material manufacturers are accelerating market penetration

Building Thermal Insulation Materials Market Share

The smart lock industry is primarily led by well-established companies, including:

- Saint-Gobain S.A. (France)

- BASF SE (Germany)

- Owens Corning (U.S.)

- Kingspan Group plc (Ireland)

- Rockwool International A/S (Denmark)

- Johns Manville Corporation (U.S.)

- Knauf Insulation (Germany)

- Recticel Group (Belgium)

- Huntsman Corporation (U.S.)

- GAF Materials Corporation (U.S.)

- URSA Insulation S.A. (Spain)

- Atlas Roofing Corporation (U.S.)

- Cellofoam North America Inc. (U.S.)

- Beijing New Building Material Group Co., Ltd. (China)

- Fletcher Building Limited (New Zealand)

- Paroc Group Oy (Finland)

Latest Developments in Global Building Thermal Insulation Materials Market

- In April 2025, Owens Corning launched a new line of eco-friendly stone wool insulation products featuring enhanced thermal performance and improved fire resistance. These materials are designed to support stringent energy codes and green building certifications in residential and commercial projects globally

- In March 2025, Kingspan Group introduced advanced vacuum insulated panels (VIPs) with ultra-thin profiles for retrofit applications, offering superior insulation performance while minimizing space requirements. The new panels are tailored for urban renovation projects where space is limited

- In February 2025, Saint-Gobain expanded its production capacity for glass wool insulation at its European manufacturing facilities to meet rising demand driven by stricter European Union energy efficiency regulations. The expansion includes investment in automation and sustainable manufacturing processes

- In January 2025, Dow Inc. unveiled a new range of bio-based plastic foam insulation materials that combine high R-values with improved environmental profiles. These products target the growing market for sustainable construction materials and are compatible with both residential and non-residential building applications

- In January 2025, Rockwool International partnered with a leading green building certification body to develop innovative stone wool insulation solutions optimized for net-zero energy buildings. The collaboration focuses on maximizing energy savings while ensuring recyclability and minimal environmental impact.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.