Global Byod Enterprise Mobility Market

Taille du marché en milliards USD

TCAC :

%

USD

84.80 Billion

USD

188.30 Billion

2024

2032

USD

84.80 Billion

USD

188.30 Billion

2024

2032

| 2025 –2032 | |

| USD 84.80 Billion | |

| USD 188.30 Billion | |

|

|

|

|

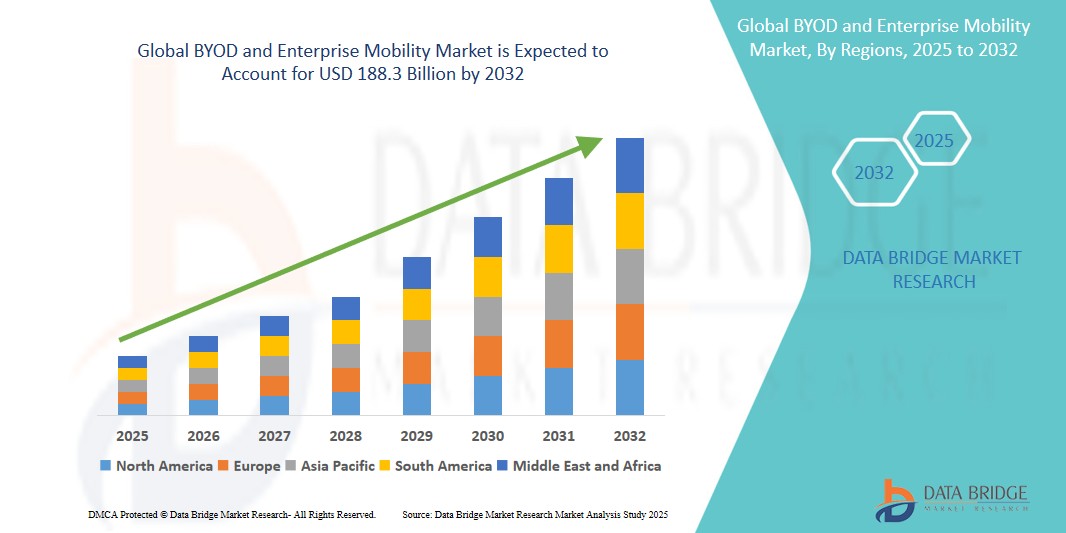

Global Bring Your Own Device (BYOD) and Enterprise Mobility Market Segmentation, By Component (Software, Hardware, Services), Deployment (Cloud, On-Premises), Device Type (Smartphones, Laptops, Tablets, Others), End User (BFSI, Healthcare, Retail, IT and Telecom, Manufacturing, Government, and Others), and Region - Industry Trends and Forecast to 2032

BYOD and Enterprise Mobility Market Size

- The global BYOD and enterprise mobility market size was valued atUSD 84.8 billion in 2024 and is expected to reachUSD 188.3 billion by 2032, at aCAGR of 9.2%during the forecast period

- This growth is fueled by the increasing demand for flexible work environments, widespread adoption of smart devices, and the need for enhanced enterprise mobility solutions to support remote and hybrid work models.

BYOD and Enterprise Mobility Market Analysis

- BYOD and Enterprise Mobility solutions enable employees to use personal devices such as smartphones, laptops, and tablets for work purposes, enhancing flexibility, productivity, and job satisfaction while reducing hardware costs for organizations.

- The market is driven by the proliferation of cloud-based technologies, advancements in mobile device management (MDM), and the growing adoption of zero-trust security models to mitigate cyber threats in BYOD environments.

- North America dominates the market due to its advanced IT infrastructure, early adoption of digital technologies, and the presence of key players like Microsoft, Cisco, and IBM.

- Asia-Pacific is expected to witness the fastest growth, driven by rapid digitalization, increasing smartphone penetration, and government initiatives promoting flexible work arrangements in countries like China, India, and Japan.

- The BFSI (Banking, Financial Services, and Insurance) segment is projected to hold a significant market share of approximately 25.44% in 2025, driven by the need for secure mobile banking and compliance with stringent data protection regulations.

Report Scope and BYOD and enterprise mobility Market Segmentation

|

Attributes |

BYOD and enterprise mobility Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

BYOD and Enterprise Mobility Market Trends

“ntegration of Zero-Trust Architecture and AI-Powered Security”

- The adoption of zero-trust architecture (ZTA) is a key trend, ensuring that every device and user is verified before accessing corporate resources, addressing security challenges in decentralized work environments.

- AI-powered security solutions, such as identity access management (IAM) and endpoint detection and response (EDR), are gaining traction for real-time threat detection and automated response in BYOD ecosystems.

- For instance, in July 2022, Samsung partnered with Microsoft to introduce a mobile hardware-backed device attestation solution, enhancing security for corporate BYOD environments.

- These advancements enable organizations to balance employee flexibility with robust data security, driving market growth.

BYOD and enterprise mobility Market Dynamics

Driver

“Increasing Demand for Flexible Work Environments”

- The shift toward remote and hybrid work models, accelerated by the COVID-19 pandemic, has driven the adoption of BYOD policies, allowing employees to work from anywhere using personal devices.

- BYOD enhances employee productivity and satisfaction by enabling seamless access to corporate resources, reducing operational costs for organizations.

- For instance, a 2023 U.S. Bureau of Labor Statistics report noted that 38% of American workers used personal devices for work, up from 31% in 2022.

- The growing mobile workforce and demand for real-time data access further propel market growth.

Opportunity

“Expansion of Cloud-Based Mobility Solutions”

- Cloud-based enterprise mobility solutions offer scalability, affordability, and seamless integration with BYOD policies, supporting digital transformation across industries.

- The proliferation of cloud services enables instant access to tools and applications, enhancing workforce productivity and collaboration.

- For instance, in May 2022, Accenture and SAP introduced a cloud-based service integrating RISE with SAP and security orchestration to support enterprise mobility.

- The increasing adoption of cloud solutions in SMEs presents significant growth opportunities.

Restraint/Challenge

“Security Concerns and Compliance Issues”

- Security risks, such as data breaches and malware infections, pose significant challenges in BYOD environments, particularly with personal devices lacking robust security measures.

- Compliance with data privacy regulations like GDPR, HIPAA, and CCPA adds complexity, requiring organizations to implement stringent security protocols.

- For instance, Microsoft’s 2023 Digital Defence Report highlighted a 200% increase in global cyberattacks, underscoring the need for secure BYOD solutions.

- Device fragmentation across various operating systems and software versions further complicates security management.

BYOD and Enterprise Mobility Market Scope

The market is segmented based on component, deployment, device type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment |

|

|

By Device Type |

|

|

By End User |

|

In 2025, the BFSI segment is projected to dominate the end-user segment

The BFSI segment is expected to hold a market share of approximately 25.44% in 2025, driven by the increasing adoption of mobile banking and the need for secure, compliant mobility solutions.

The cloud deployment segment is expected to account for the largest share during the forecast period in the deployment market

In 2025, the cloud deployment segment is projected to account for a market share of 60.96%, driven by its scalability, cost-effectiveness, and ability to support remote work environments.

“North America Holds the Largest Share in the BYOD and Enterprise Mobility Market”

- North America dominates the market, driven by its robust IT infrastructure, early adoption of advanced technologies, and the presence of leading vendors like VMware, Cisco, and Microsoft.

- The U.S. holds a significant share due to high smartphone penetration, stringent data privacy regulations, and widespread adoption of BYOD in BFSI, healthcare, and IT sectors.

- The region benefits from a thriving ecosystem of startups and significant investments in AI and cloud computing, reinforcing its market leadership.

“Asia-Pacific is Projected to Register the Highest CAGR in the BYOD and Enterprise Mobility Market”

- Asia-Pacific is expected to grow at a CAGR of 10.1% from 2024 to 2032, driven by rapid digitalization, increasing smart device penetration, and government initiatives promoting flexible work policies.

- Countries like China, India, and Japan are key markets, with India projected to exhibit an 18.5% CAGR due to its fast-growing IT sector and digital transformation efforts.

- The region’s strong services outsourcing industry and rising IT investments across sectors like BFSI and retail further fuel market growth

BYOD and Enterprise Mobility Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

VMware, Inc. (U.S.)

Cisco Systems, Inc. (U.S.)

IBM Corporation (U.S.)

Microsoft Corporation (U.S.)

Citrix Systems, Inc. (U.S.)

SAP SE (Germany)

MobileIron, Inc. (Ivanti) (U.S.)

BlackBerry Limited (Canada)

Oracle Corporation (U.S.)

HCL Technologies Limited (India)

Latest Developments in Global BYOD and enterprise mobility Market

- In March 2023, Microsoft and BlackBerry partnered to enhance mobile app integration within BlackBerry Dynamics, enabling seamless access to Microsoft Office 365 applications on iOS and Android devices.

- In August 2023, Hypori Halo was approved by the U.S. Army as a secure BYOD solution for Army service members, providing virtual mobility and enhanced data security.

- In January 2024, VMware introduced advanced Mobile Application Management (MAM) features to its Workspace ONE platform, improving security for BYOD environments.

- In June 2024, Cisco Systems launched an updated Meraki MDM solution, integrating AI-driven threat detection for enterprise mobility and BYOD policies.

- In September 2024, SAP SE expanded its cloud-based mobility solutions, focusing on seamless integration with BYOD policies for SMEs in Asia-Pacific.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.