Global Cellular Rubber Market

Taille du marché en milliards USD

TCAC :

%

USD

1.85 Billion

USD

2.06 Billion

2025

2033

USD

1.85 Billion

USD

2.06 Billion

2025

2033

| 2026 –2033 | |

| USD 1.85 Billion | |

| USD 2.06 Billion | |

|

|

|

|

Segmentation du marché mondial du caoutchouc cellulaire, par type de produit (feuilles, rouleaux et autres), par type de matériau (caoutchouc nitrile butadiène cellulaire (NBR), néoprène, monomère éthylène propylène diène (EPDM), caoutchouc silicone cellulaire et autres), par utilisateur final (automobile, électronique, aérospatiale et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché du caoutchouc cellulaire

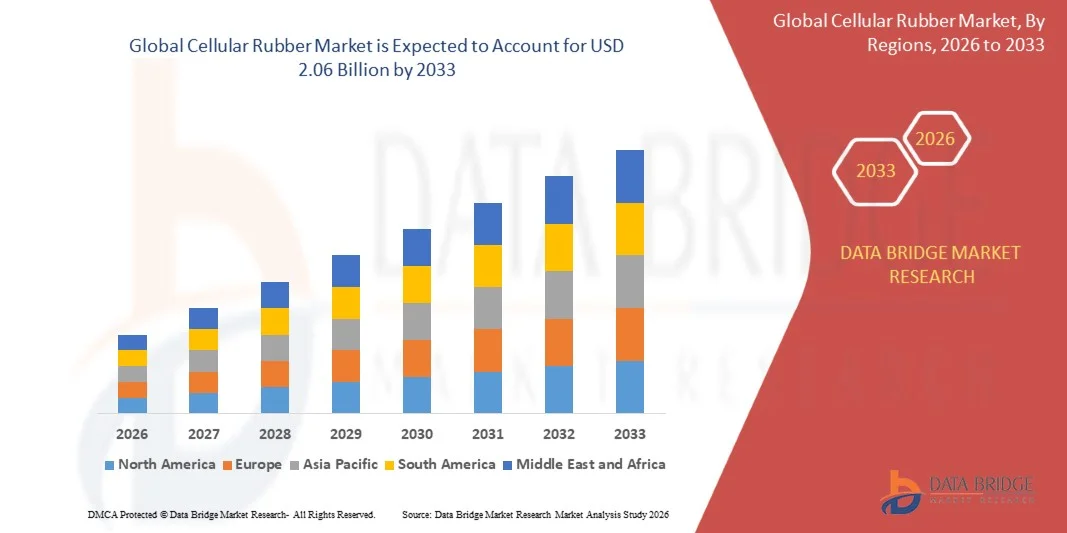

- Le marché mondial du caoutchouc cellulaire était évalué à 1,85 milliard de dollars américains en 2025 et devrait atteindre 2,06 milliards de dollars américains d'ici 2033 , avec un TCAC de 4,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de matériaux d'étanchéité et d'isolation légers et performants dans les secteurs de l'automobile, de l'aérospatiale et des applications industrielles.

- L'adoption croissante du caoutchouc cellulaire dans les solutions de réduction du bruit, de contrôle des vibrations et de gestion thermique contribue à l'expansion du marché.

Analyse du marché du caoutchouc cellulaire

- Le marché connaît une forte demande en raison des propriétés polyvalentes du caoutchouc cellulaire, telles que sa flexibilité, sa compressibilité et sa résistance à l'humidité, aux produits chimiques et à la chaleur.

- Les progrès technologiques dans les procédés de fabrication de mousse et le développement de produits en EPDM, néoprène et caoutchouc cellulaire à base de silicone de haute qualité améliorent les performances et élargissent leur utilisation dans de nombreux secteurs.

- L'Amérique du Nord a dominé le marché du caoutchouc cellulaire en 2025, avec la plus grande part de revenus, grâce à la demande croissante de matériaux d'étanchéité, d'isolation et de contrôle des vibrations haute performance dans les secteurs de l'automobile, de la construction et de l'électronique.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial du caoutchouc cellulaire , grâce à l'expansion des activités de fabrication et à la consommation croissante de composants à base de caoutchouc dans les principaux secteurs industriels.

- Le segment des feuilles a représenté la plus grande part de revenus du marché en 2025, grâce à son utilisation généralisée dans les secteurs de l'automobile, de la construction et de l'industrie pour l'étanchéité, l'amortissement et l'isolation. Les feuilles sont privilégiées pour leur facilité de mise en œuvre, leur densité uniforme et leur aptitude à la fabrication de joints haute performance et de solutions d'isolation thermique.

Portée du rapport et segmentation du marché du caoutchouc cellulaire

|

Attributs |

Principaux enseignements du marché du caoutchouc cellulaire |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché du caoutchouc cellulaire

« Utilisation croissante du caoutchouc cellulaire dans les applications d’étanchéité haute performance »

La demande croissante de matériaux d'étanchéité durables, légers et flexibles transforme le marché du caoutchouc cellulaire. Des secteurs comme l'automobile, l'aérospatiale et l'électronique adoptent de plus en plus le caoutchouc à base de mousse pour le contrôle des vibrations, l'isolation et l'étanchéité. Cette évolution est motivée par le besoin de matériaux capables de résister à des températures extrêmes et à des conditions environnementales difficiles, garantissant ainsi une performance durable. La modernisation industrielle croissante renforce encore l'exigence de solutions d'étanchéité fiables et économes en énergie.

L’intérêt croissant pour l’efficacité énergétique et la réduction du bruit dans les véhicules et les machines industrielles accélère l’adoption des composants en caoutchouc cellulaire. Les fabricants utilisent l’EPDM, le néoprène et le caoutchouc cellulaire à base de silicone pour une étanchéité et une isolation acoustique supérieures, contribuant ainsi à des normes de sécurité et de confort accrues. Cette tendance est renforcée par les pressions réglementaires qui favorisent les systèmes mécaniques silencieux, à faibles émissions et à haut rendement.

L'expansion des installations de fabrication avancées et des technologies d'automatisation favorise l'utilisation du caoutchouc cellulaire dans des applications telles que les systèmes de chauffage, de ventilation et de climatisation (CVC), les boîtiers électroniques et les équipements industriels. Sa résistance aux produits chimiques, à l'ozone et aux UV renforce son utilisation aussi bien en intérieur qu'en extérieur. La demande croissante de composants de protection durables dans les environnements industriels soumis à de fortes contraintes stimule également l'innovation continue en matière de matériaux.

Par exemple, en 2023, plusieurs constructeurs automobiles européens ont fait état d'une utilisation accrue du caoutchouc EPDM à cellules fermées pour l'isolation thermique et l'étanchéité des batteries de véhicules électriques, améliorant ainsi leur efficacité et prolongeant la durée de vie des composants. Cette adoption s'inscrit dans la dynamique sectorielle visant à renforcer la sécurité, la régulation thermique et la durabilité des véhicules électriques. L'augmentation de la production de véhicules électriques devrait encore élargir le champ d'application des matériaux en caoutchouc cellulaire avancés.

Bien que le caoutchouc cellulaire gagne du terrain dans les applications hautes performances, sa croissance future repose sur l'innovation continue en matière de matériaux, l'optimisation des coûts et une meilleure adaptabilité à l'évolution des exigences réglementaires et de développement durable. Les fabricants privilégient de plus en plus les formulations écologiques et les technologies de caoutchouc recyclables pour répondre aux normes environnementales mondiales. Les collaborations stratégiques et les avancées en matière de R&D demeurent essentielles pour maintenir un avantage concurrentiel.

Dynamique du marché du caoutchouc cellulaire

Conducteur

« Adoption croissante dans les secteurs de l’automobile, de la construction et de l’électronique »

Le secteur automobile en pleine expansion accroît considérablement la demande de caoutchouc cellulaire en raison de son rôle essentiel dans l'étanchéité, la réduction du bruit et le contrôle des vibrations. L'électrification croissante des véhicules, conjuguée au besoin accru de matériaux légers et résistants à la chaleur, stimule fortement la consommation de composants en caoutchouc cellulaire. L'évolution vers des équipements de sécurité et de confort améliorés dans les véhicules modernes favorise également son adoption par les constructeurs automobiles et les équipementiers de rang 1.

Le secteur de la construction recourt de plus en plus au caoutchouc cellulaire pour l'isolation, l'amortissement et l'étanchéité. L'essor des infrastructures et des rénovations renforce la demande en matériaux d'étanchéité haute performance garantissant durabilité et efficacité énergétique. L'accent mis sur les bâtiments durables et économes en énergie favorise également le recours aux technologies d'isolation avancées à base de caoutchouc.

L'industrie électronique adopte le caoutchouc cellulaire pour la protection des dispositifs, la gestion thermique et l'absorption des chocs. La miniaturisation croissante et la production grand public d'électronique ont encore stimulé la demande du marché. Face à des dispositifs électroniques toujours plus compacts et sensibles à la température, les fabricants intègrent du caoutchouc cellulaire pour améliorer la fiabilité, prévenir les dommages et optimiser la stabilité de fonctionnement.

Par exemple, en 2022, plusieurs fabricants d'électronique de la région Asie-Pacifique ont intégré du caoutchouc cellulaire à base de silicone dans des composants sensibles afin d'améliorer la dissipation thermique et de les protéger des contraintes mécaniques. Cette évolution reflète le besoin croissant de composants durables, légers et à haute efficacité thermique dans l'électronique haute performance. L'automatisation croissante et la production de semi-conducteurs accélèrent encore cette demande dans toute la région.

Alors que l'adoption intersectorielle continue de progresser, garantir une qualité constante, maintenir la maîtrise des coûts et gérer les dépendances de la chaîne d'approvisionnement sont essentiels à la stabilité du marché à long terme. Les fabricants doivent concilier innovation et accessibilité financière pour répondre aux besoins variés des industries utilisatrices finales. Le renforcement des chaînes d'approvisionnement mondiales et l'amélioration de la disponibilité des matières premières seront déterminants pour soutenir une expansion durable du marché.

Retenue/Défi

« Fluctuation des prix des matières premières et complexité de la fabrication »

La volatilité des prix des matières premières telles que le caoutchouc naturel, les dérivés pétrochimiques et les polymères spécialisés représente un défi majeur pour les fabricants. Ces variations de coûts imprévisibles mettent à rude épreuve la budgétisation et la planification à long terme des producteurs dans les principales régions. Par conséquent, les entreprises peinent souvent à maintenir des prix compétitifs sans compromettre la qualité de leurs produits.

La fabrication de caoutchouc cellulaire de haute qualité exige précision, équipements de pointe et un contrôle qualité rigoureux. De nombreuses régions sont confrontées à une pénurie de main-d'œuvre qualifiée et d'expertise technique, ce qui nuit à l'efficacité et à l'extensibilité de la production. Ce manque de connaissances spécialisées limite également la capacité des fabricants à diversifier leurs gammes de produits pour répondre à l'évolution des secteurs d'utilisation finale.

Les contraintes liées à la chaîne d'approvisionnement et la disponibilité limitée de caoutchoucs spécifiques dans les régions en développement freinent la pénétration du marché et allongent les délais de production. Des secteurs comme l'automobile et l'électronique exigent un approvisionnement régulier et ponctuel, ce qui amplifie l'impact des retards de livraison de matériaux. Cela crée des goulots d'étranglement pour les équipementiers à la recherche de solutions d'étanchéité et d'isolation haute performance.

• Par exemple, en 2023, plusieurs fabricants nord-américains ont signalé des retards de production dus à des pénuries de composés de caoutchouc essentiels, ce qui a affecté leurs engagements d'approvisionnement envers les secteurs automobile et industriel. Ces pénuries ont perturbé les calendriers de projets et augmenté les coûts opérationnels. Par conséquent, de nombreuses entreprises ont été contraintes de rechercher des fournisseurs de matériaux alternatifs ou d'adapter leurs stratégies d'approvisionnement.

Si l'innovation dans le domaine des matériaux améliore la performance et la durabilité, la maîtrise de la volatilité des coûts, l'augmentation des capacités de production et l'optimisation de la chaîne d'approvisionnement demeurent essentielles pour libérer tout le potentiel de croissance du marché. Les entreprises investissent de plus en plus dans l'optimisation des formulations et les procédés de recyclage afin de réduire leur dépendance aux matières premières volatiles. Le renforcement des réseaux mondiaux de fournisseurs et l'adoption de l'automatisation apparaissent également comme des stratégies clés pour une stabilité à long terme.

Étendue du marché du caoutchouc cellulaire

Le marché est segmenté en fonction du type de produit, du type de matériau et de l'utilisateur final.

• Par type de produit

Le marché du caoutchouc cellulaire est segmenté, selon le type de produit, en feuilles, rouleaux et autres. En 2025, le segment des feuilles représentait la plus grande part de chiffre d'affaires, grâce à son utilisation répandue dans les secteurs de l'automobile, de la construction et de l'industrie pour l'étanchéité, l'amortissement et l'isolation. Les feuilles sont privilégiées pour leur facilité de mise en œuvre, leur densité uniforme et leur aptitude à la fabrication de joints haute performance et de solutions d'isolation thermique.

Le segment des rouleaux devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par leur adoption croissante dans les installations de production à grande échelle et les applications de scellage en continu. Les rouleaux sont de plus en plus utilisés dans les systèmes de chauffage, de ventilation et de climatisation, les boîtiers électroniques et les équipements industriels en raison de leur flexibilité, de leur disponibilité en grandes longueurs et de leur rentabilité pour le traitement en grande quantité.

• Par type de matériau

Le marché du caoutchouc cellulaire est segmenté selon le type de matériau : caoutchouc nitrile butadiène cellulaire (NBR), néoprène, éthylène propylène diène monomère (EPDM), caoutchouc silicone cellulaire et autres. En 2025, le segment EPDM détenait la plus grande part de marché en termes de chiffre d'affaires grâce à sa résistance supérieure aux intempéries, à l'ozone, à la chaleur et aux produits chimiques, ce qui en fait un matériau de choix pour l'étanchéité automobile, l'isolation des bâtiments et les applications extérieures. Sa longue durée de vie et ses excellentes performances en environnements difficiles contribuent à son utilisation généralisée.

Le segment du caoutchouc de silicone cellulaire devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à son exceptionnelle stabilité thermique et à sa compatibilité avec les applications exigeantes des secteurs de l'électronique, de l'aérospatiale et des environnements à haute température. Sa structure légère, sa faible toxicité et ses caractéristiques de compression constantes contribuent également à sa demande croissante dans les applications d'étanchéité de précision.

• Par l'utilisateur final

Le marché du caoutchouc cellulaire est segmenté, selon l'utilisateur final, en automobile, électronique, aérospatiale et autres. Le segment automobile détenait la plus grande part de chiffre d'affaires en 2025, grâce à l'utilisation croissante du caoutchouc cellulaire pour l'étanchéité, les joints, l'amortissement des vibrations et les composants de réduction du bruit. La transition vers les véhicules électriques a encore renforcé la demande de matériaux légers, résistants à la chaleur et économes en énergie.

Le secteur de l'électronique devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'augmentation de la production d'électronique grand public et le besoin croissant de solutions d'isolation thermique, d'absorption des chocs et de protection des appareils. Le caoutchouc cellulaire devient essentiel pour la protection des composants électroniques compacts, garantissant ainsi la fiabilité et les performances à long terme des appareils miniaturisés.

Analyse régionale du marché du caoutchouc cellulaire

• L’Amérique du Nord a dominé le marché du caoutchouc cellulaire en 2025, avec la plus grande part de revenus, grâce à la demande croissante de matériaux d’étanchéité, d’isolation et de contrôle des vibrations haute performance dans les secteurs de l’automobile, de la construction et de l’électronique.

• Les industries de la région privilégient de plus en plus les composants en caoutchouc cellulaire légers, durables et résistants aux températures élevées, qui favorisent le respect des normes d'efficacité énergétique et améliorent les performances des produits dans des environnements exigeants.

Cette adoption généralisée est également favorisée par des capacités de fabrication avancées, d'importants investissements en R&D et l'importance croissante accordée à la réduction du bruit, à l'étanchéité aux intempéries et à la durabilité des matériaux dans diverses applications industrielles.

Analyse du marché américain du caoutchouc cellulaire

Le marché américain du caoutchouc cellulaire a généré la plus grande part de revenus en Amérique du Nord en 2025, grâce à l'utilisation intensive d'EPDM, de néoprène et de caoutchouc cellulaire à base de nitrile dans les secteurs de l'automobile, de l'aérospatiale, du CVC et des boîtiers électroniques. Les industries privilégient de plus en plus les matériaux offrant une étanchéité, une résistance thermique et une capacité de récupération après compression supérieures, ce qui favorise le développement des produits en caoutchouc à cellules fermées et ouvertes. Par ailleurs, la croissance des investissements dans les véhicules électriques, les infrastructures d'énergies renouvelables et l'isolation des bâtiments stimule davantage la consommation de matériaux en caoutchouc cellulaire haute performance.

Analyse du marché européen du caoutchouc cellulaire

Le marché européen du caoutchouc cellulaire devrait connaître la croissance la plus rapide entre 2026 et 2033, sous l'impulsion de réglementations environnementales strictes, de l'expansion de la production automobile et de la demande croissante de matériaux d'étanchéité durables et résistants aux intempéries. L'accent mis en Europe sur la construction écoénergétique et les technologies de fabrication avancées accélère l'adoption des produits en caoutchouc cellulaire EPDM, silicone et néoprène. Le développement des applications dans les machines industrielles, l'électronique et les transports soutient également la croissance du marché, tant dans les secteurs établis que dans les industries émergentes.

Analyse du marché britannique du caoutchouc cellulaire

Le marché britannique du caoutchouc cellulaire devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante de solutions d'isolation, d'amortissement acoustique et d'étanchéité de haute qualité dans les secteurs de la construction résidentielle, commerciale et industrielle. L'adoption croissante de matériaux de construction durables et le renforcement des normes réglementaires au Royaume-Uni stimulent l'essor du caoutchouc cellulaire dans les secteurs du CVC, des armoires électriques et des transports. Par ailleurs, le recours accru à des composants légers en caoutchouc cellulaire dans l'assemblage des véhicules électriques contribue également à l'expansion du marché.

Analyse du marché allemand du caoutchouc cellulaire

Le marché allemand du caoutchouc cellulaire devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la vigueur des industries automobile et mécanique du pays, qui dépendent fortement de solutions d'étanchéité, de joints et de contrôle des vibrations de pointe. L'accent mis par l'Allemagne sur la fabrication de haute précision, l'innovation en matière de matériaux et le développement durable favorise l'adoption rapide du caoutchouc cellulaire dans les systèmes de batteries pour véhicules électriques, les composants d'isolation et les équipements industriels. L'intégration croissante de caoutchouc cellulaire ignifugé et haute performance répond également aux exigences strictes en matière de sécurité et de qualité.

Analyse du marché du caoutchouc cellulaire en Asie-Pacifique

Le marché du caoutchouc cellulaire en Asie-Pacifique devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par une industrialisation rapide, une production manufacturière croissante et une demande accrue de matériaux d'isolation et d'étanchéité dans les secteurs de l'automobile, de la construction et de l'électronique. Le développement des infrastructures, l'augmentation des revenus disponibles et les politiques gouvernementales favorables à la croissance industrielle contribuent à cette croissance. Par ailleurs, la position de la région Asie-Pacifique en tant que pôle de production majeur de composants automobiles et de dispositifs électroniques stimule la consommation de caoutchouc cellulaire dans de multiples applications.

Analyse du marché japonais du caoutchouc cellulaire

Le marché japonais du caoutchouc cellulaire devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à un écosystème industriel de pointe, à une forte orientation vers l'ingénierie de précision et à l'adoption croissante de matériaux d'étanchéité haute performance. Les secteurs japonais de l'électronique et de l'automobile utilisent de plus en plus le caoutchouc cellulaire pour l'isolation thermique, l'amortissement des vibrations et la protection des composants dans des applications compactes et de haute technologie. Par ailleurs, l'accent mis au Japon sur les bâtiments à haute performance énergétique et des normes de sécurité strictes favorise l'utilisation de matériaux en caoutchouc cellulaire spécialisés dans les projets commerciaux et industriels.

Analyse du marché chinois du caoutchouc cellulaire

En 2025, le marché chinois du caoutchouc cellulaire représentait la plus grande part de chiffre d'affaires de la région Asie-Pacifique, grâce à une production automobile soutenue, une industrie électronique en pleine expansion et une croissance rapide des infrastructures industrielles. La Chine est l'un des plus grands consommateurs d'EPDM, de NBR et de caoutchouc cellulaire à base de silicone, largement utilisés dans la construction, les transports et les équipements industriels. L'accent mis par le pays sur l'industrie 4.0, les grands projets de construction et le développement continu des secteurs des véhicules électriques et de l'électronique contribuent significativement à la croissance du marché.

Part de marché du caoutchouc cellulaire

L'industrie du caoutchouc cellulaire est principalement dominée par des entreprises bien établies, notamment :

- Rogers Corporation (États-Unis)

- Armacell (Allemagne)

- Saint-Gobain (France)

- Klinger (Autriche)

- FoamTech (États-Unis)

- Griffon Corporation (États-Unis)

- Trelleborg AB (Suède)

- Moulin à caoutchouc (États-Unis)

- Produits en mousse américains (États-Unis)

- Stockwell Elastomerics (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.