Global Chewing Gum Market

Taille du marché en milliards USD

TCAC :

%

USD

5.50 Billion

USD

8.38 Billion

2024

2032

USD

5.50 Billion

USD

8.38 Billion

2024

2032

| 2025 –2032 | |

| USD 5.50 Billion | |

| USD 8.38 Billion | |

|

|

|

|

Global Chewing Gum Market Segmentation, By Sugar Type (Sugared Chewing Gum and Sugar-free Chewing Gum), Product Type (Pallet Type, Stick/Tab Type, Centre-Filled Type, Cut and Wrap Type and Ball Type), Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Departmental Stores and Online) – Industry Trends and Forecast to 2032.

Chewing Gum Market Size

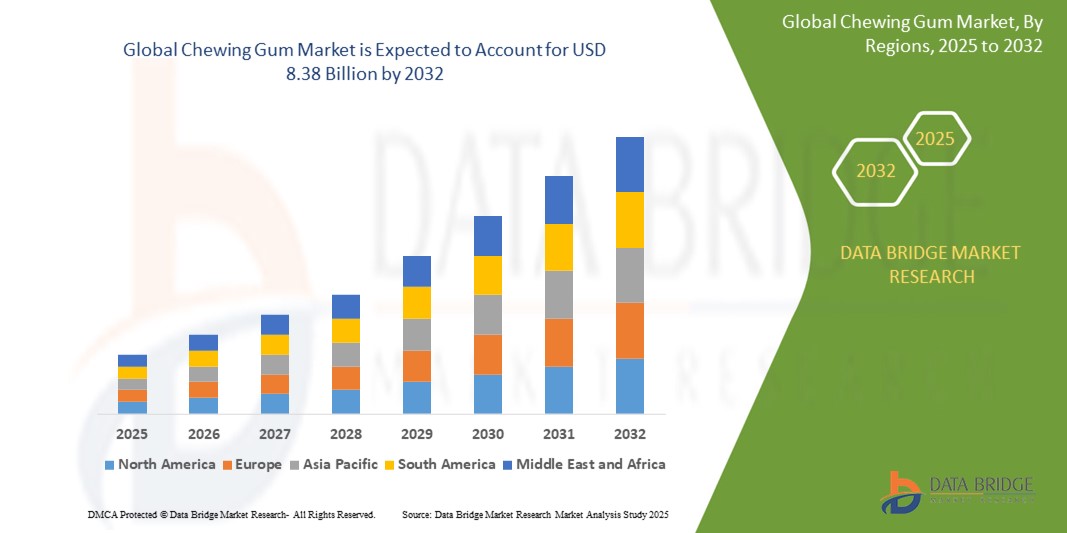

- The global chewing gum market size was valued at USD 5.50 billion in 2024 and is expected to reach USD 8.38 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is primarily driven by increasing consumer demand for sugar-free and functional chewing gums, rising awareness of oral health benefits, and innovative product offerings such as gums with natural ingredients and unique flavors

- In addition, the shift toward convenience-driven snacking and the expansion of e-commerce platforms are accelerating the adoption of chewing gum products, significantly contributing to industry growth

Chewing Gum Market Analysis

- Chewing gum is a popular confectionery product consumed globally for refreshment, oral health, and stress relief. The market is witnessing growth due to the rising popularity of sugar-free and functional gums, which offer benefits such as breath freshening, stress reduction, and dental care

- The demand for chewing gum is propelled by increasing urbanization, growing consumer focus on health-conscious snacking, and the introduction of innovative flavors and eco-friendly packaging

- North America dominated the chewing gum market with the largest revenue share of 42.5% in 2024, driven by high consumer spending, strong brand presence, and widespread availability through diverse distribution channels

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rising disposable incomes, increasing urbanization, and growing demand for convenient, on-the-go snacks

- The sugar-free chewing gum segment dominated the largest market revenue share of 54.5% in 2024, driven by growing health awareness among consumers, particularly regarding oral health and reduced sugar intake. Sugar-free gums, often sweetened with xylitol, offer dental health benefits and appeal to consumers managing weight and diabetes

Report Scope and Chewing Gum Market Segmentation

|

Attributes |

Chewing Gum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chewing Gum Market Trends

“Increasing Demand for Functional and Sugar-Free Chewing Gum”

- The global chewing gum market is experiencing a notable trend toward the integration of functional ingredients and sugar-free formulations

- These advancements allow for enhanced consumer benefits, such as improved oral health, stress relief, and energy boosts, driven by ingredients such as xylitol, caffeine, and vitamins

- Sugar-free chewing gum, in particular, is gaining traction due to its dental health benefits, including cavity prevention and plaque reduction, appealing to health-conscious consumers

- For instance, companies are launching innovative products, such as gums with CBD for relaxation or nicotine gums to aid smoking cessation, catering to niche consumer needs

- This trend is increasing the appeal of chewing gum as a functional product, attracting both individual consumers and those seeking healthier snacking alternatives

- Functional gum formulations can address various consumer preferences, including breath freshening, teeth whitening, and even weight management support

Chewing Gum Market Dynamics

Driver

“Rising Consumer Preference for Convenient and Health-Conscious Snacks”

- Growing consumer demand for portable, on-the-go snacks is a key driver for the global chewing gum market, particularly in urbanized regions

- Chewing gum enhances oral hygiene with features such as sugar-free options and xylitol-based formulations, which promote dental health and fresh breath

- Government initiatives and dental health campaigns, especially in North America and Europe, are encouraging the adoption of sugar-free chewing gum as part of oral care routines

- The expansion of e-commerce platforms and digital marketing strategies is further enabling broader access to a variety of chewing gum products, offering convenience and personalized purchasing experiences

- Manufacturers are increasingly introducing innovative flavors and functional gums as standard or premium offerings to meet evolving consumer expectations and enhance product value

Restraint/Challenge

“High Production Costs and Environmental Concerns”

- The significant costs associated with developing premium, organic, or functional chewing gum formulations, including natural ingredients and biodegradable bases, can be a barrier to market growth, especially in price-sensitive regions

- Incorporating advanced technologies, such as microencapsulation for long-lasting flavor, adds to production complexity and expenses

- In addition, environmental concerns related to non-biodegradable gum waste and plastic packaging pose a major challenge. Chewing gum litter and its environmental impact are prompting stricter regulations and consumer pushback in regions such as Europe

- The lack of standardized regulations across countries regarding ingredient safety, labeling, and waste management complicates operations for global manufacturers and suppliers

- These factors may deter cost-conscious consumers and limit market expansion, particularly in emerging markets where environmental awareness is growing or affordability is a key concern

Chewing Gum market Scope

The market is segmented on the basis of sugar type, product type, and distribution channel.

- By Sugar Type

On the basis of sugar type, the global chewing gum market is segmented into sugared chewing gum and sugar-free chewing gum. The sugar-free chewing gum segment dominated the largest market revenue share of 54.5% in 2024, driven by growing health awareness among consumers, particularly regarding oral health and reduced sugar intake. Sugar-free gums, often sweetened with xylitol, offer dental health benefits and appeal to consumers managing weight and diabetes.

The sugared chewing gum segment is expected to witness steady growth from 2025 to 2032, supported by its popularity due to traditional flavors and strong brand presence. However, its growth is tempered by increasing consumer preference for healthier alternatives.

- By Product Type

On the basis of product type, the global chewing gum market is segmented into pellet type, stick/tab type, centre-filled type, cut and wrap type, and ball type. The pellet type segment is expected to hold the largest market revenue share of 40.2% in 2024, driven by its compact size, portability, and long-lasting flavor, which appeal to on-the-go consumers. Its widespread availability in major retail channels further strengthens its dominance.

The centre-filled type segment is anticipated to experience the fastest growth rate from 2025 to 2032, fueled by consumer demand for innovative and sensory-rich chewing experiences. The introduction of unique fillings, such as fruit-flavored or functional ingredients, enhances its appeal, particularly among younger demographics.

- By Distribution Channel

On the basis of distribution channel, the global chewing gum market is segmented into supermarkets and hypermarkets, pharmacies, convenience stores, departmental stores, and online. The convenience stores segment is expected to hold the largest market revenue share of 35.8% in 2024, driven by their accessibility and strategic product placement near checkout counters, promoting impulse purchases.

The online segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the rise of e-commerce platforms and changing consumer shopping habits. The convenience of online retail, coupled with subscription-based and customized gum offerings, is enhancing market penetration and consumer reach.

Chewing Gum Market Regional Analysis

- North America dominated the chewing gum market with the largest revenue share of 42.5% in 2024, driven by high consumer spending, strong brand presence, and widespread availability through diverse distribution channels

- Consumers prioritize chewing gum for oral health benefits, stress relief, and fresh breath, particularly in regions with busy lifestyles and growing health consciousness

- Growth is supported by advancements in gum formulations, including functional ingredients such as xylitol and natural flavors, alongside rising adoption in both convenience and premium segments

U.S. Chewing Gum Market Insight

The U.S. chewing gum market captured the largest revenue share of 88.4% in 2024 within North America, fueled by strong demand for sugar-free and functional chewing gums, as well as widespread consumer awareness of oral hygiene benefits. The trend towards innovative product offerings, such as nicotine gums and vitamin-enriched variants, further boosts market expansion. Major brands’ focus on creative marketing and diverse distribution channels, including online platforms, complements robust retail sales, creating a dynamic market ecosystem.

Europe Chewing Gum Market Insight

The European chewing gum market is expected to witness significant growth, supported by increasing consumer preference for sugar-free and natural gum options. Demand is driven by health-conscious consumers seeking low-calorie and functional chewing gums that promote dental health. Growth is prominent in both supermarkets and pharmacies, with countries such as Germany and the U.K. showing notable uptake due to rising awareness of oral care and urban consumption trends.

U.K. Chewing Gum Market Insight

The U.K. market for chewing gum is expected to witness rapid growth, driven by demand for sugar-free and functional gums that offer breath freshening and stress relief in fast-paced urban settings. Increased interest in eco-friendly packaging and natural ingredients encourages adoption. Evolving regulations promoting reduced sugar consumption influence consumer choices, balancing taste with health benefits.

Germany Chewing Gum Market Insight

Germany is expected to witness rapid growth in the chewing gum market, attributed to its strong retail sector and high consumer focus on health and wellness. German consumers prefer sugar-free and xylitol-based gums that support dental health and align with low-sugar diets. The integration of innovative flavors and functional ingredients in both mainstream and premium products supports sustained market growth.

Asia-Pacific Chewing Gum Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rising disposable incomes, expanding retail networks, and growing consumer interest in chewing gum as a convenient snack in countries such as China, India, and Japan. Increasing awareness of oral hygiene, fresh breath, and functional benefits boosts demand. Government initiatives promoting healthier lifestyles and reduced sugar consumption further encourage the use of sugar-free chewing gums.

Japan Chewing Gum Market Insight

Japan’s chewing gum market is expected to witness rapid growth due to strong consumer preference for high-quality, innovative gum products that enhance oral health and provide functional benefits. The presence of major manufacturers and the integration of chewing gum in convenience stores and pharmacies accelerate market penetration. Rising interest in unique flavors and premium packaging also contributes to growth.

China Chewing Gum Market Insight

China holds the largest share of the Asia-Pacific chewing gum market, propelled by rapid urbanization, increasing consumer spending, and growing demand for sugar-free and functional chewing gums. The country’s expanding middle class and focus on health and wellness support the adoption of innovative gum products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Chewing Gum Market Share

The chewing gum industry is primarily led by well-established companies, including:

- Cemoi Chocolatier (France)

- Republica del Cacao (U.S.)

- Nestlé S.A. (Switzerland)

- Mars Incorporated (U.S.)

- Fuji Oil Holdings Inc. (Japan)

- Guittard Chocolate Co. (U.S.)

- Ghirardelli Chocolate Co. (U.S.)

- Varihona Inc. (France)

- Barry Callebaut AG (Switzerland)

- Alpezzi Chocolate SA De CV (Mexico)

- Kerry Group Plc (Ireland)

- Arcor Group (Argentina)

- Haribo GmbH & Co. KG (Germany)

- Katjes Fassin GmbH (Germany)

- Yildiz Holding (Turkey)

What are the Recent Developments in Global Chewing Gum Market?

- In November 2024, Mars Wrigley, a global leader in confectionery, launched "Chewns," an innovative ASMR-inspired chewing gum product in collaboration with BBC Radio 1Xtra presenter Joelah Noble. This unique product features enhanced sensory textures and flavors designed to create a calming chewing experience, catering to younger consumers seeking novel sensory engagements. The launch reinforces Mars Wrigley’s commitment to innovation in the chewing gum market

- In October 2023, Perfetti Van Melle Group B.V., a leading global confectionery manufacturer, completed the acquisition of Mondelēz International’s developed-market gum business in the United States, Canada, and Europe. This strategic move expanded Perfetti Van Melle’s portfolio, incorporating iconic brands such as Mentos and Airheads, strengthening its position as a global leader in the chewing gum and confectionery sector

- In June 2022, Sweet Victory, in collaboration with Givaudan, a multinational flavors and tastes group, introduced a botanical-infused chewing gum for children. This functional gum incorporates natural ingredients aimed at promoting wellness, appealing to health-conscious parents. The partnership highlights Sweet Victory’s focus on innovative, health-oriented chewing gum products for younger demographics

- In April 2022, Mars Wrigley Australia launched two new chewing gum products, ECLIPSE PLUS and EXTRA WHITE, designed to cater to the growing demand for sugar-free and oral health-focused gums. These products feature enhanced flavors and functional benefits such as teeth whitening and breath freshening, aligning with consumer trends toward healthier chewing gum options

- In June 2020, Rainbow, a French cannabis company, partnered with private investors to launch Kaya, a wellness brand offering stress-relieving chewing gums infused with cannabidiol (CBD). This product targets consumers seeking functional gums for mental health support, reflecting the growing trend of incorporating therapeutic ingredients in chewing gum formulations

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.