Global Cij Inkjet Coders Market

Taille du marché en milliards USD

TCAC :

%

USD

4.64 Billion

USD

10.40 Billion

2024

2032

USD

4.64 Billion

USD

10.40 Billion

2024

2032

| 2025 –2032 | |

| USD 4.64 Billion | |

| USD 10.40 Billion | |

|

|

|

|

Global Continuous Inkjet (CIJ) Inkjet Coders Market Segmentation, By Material (Plastics, Metals, and Ceramics), Application (Food and Beverage, Pharmaceuticals, and Automotive) - Industry Trends and Forecast to 2032

Continuous Inkjet (CIJ) Inkjet Coders Market Size

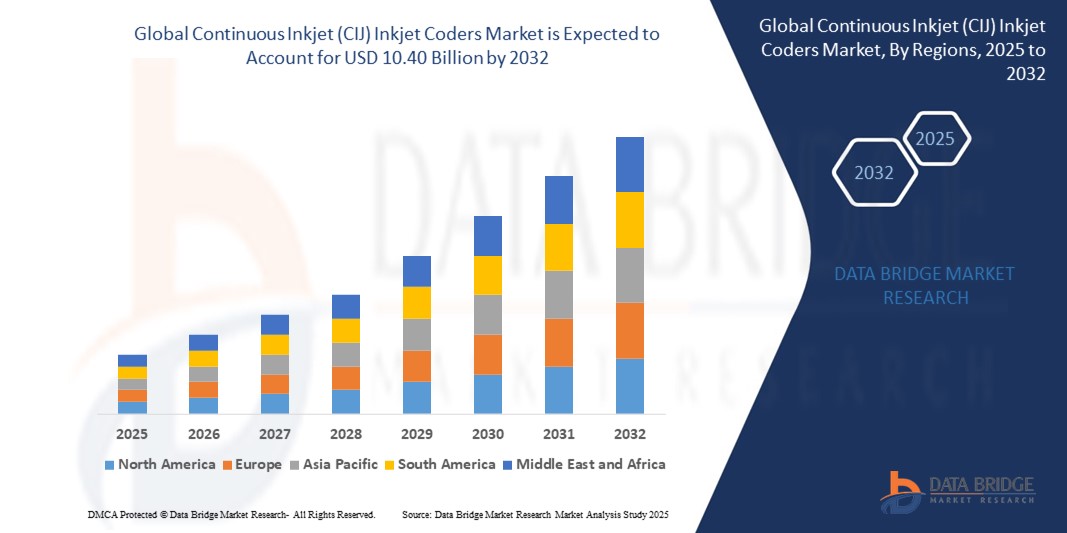

- The global continuous inkjet (CIJ) inkjet coders market size was valued at USD 4.64 billion in 2024 and is expected to reach USD 10.40 billion by 2032, at a CAGR of 10.60% during the forecast period

- The market growth is largely fuelled by the rising demand for high-speed, non-contact printing technologies across packaging, food & beverage, pharmaceutical, and cosmetic industries

- The expanding global manufacturing base and increased focus on traceability and regulatory compliance are also contributing significantly to market expansion

Continuous Inkjet (CIJ) Inkjet Coders Market Analysis

- Continuous inkjet coders are widely adopted due to their ability to operate in harsh environments, print on curved and uneven surfaces, and deliver high-speed marking even on fast-moving production lines

- These coders are highly versatile and can print on various substrates such as plastic, glass, metal, paper, and cardboard, making them ideal for industries requiring batch numbers, expiration dates, logos, and barcodes

- North America dominated the continuous inkjet (CIJ) inkjet coders market with the largest revenue share in 2024, driven by the region’s advanced manufacturing infrastructure, stringent labeling regulations, and widespread automation across industries

- Asia-Pacific region is expected to witness the highest growth rate in the global continuous inkjet (CIJ) inkjet coders market, driven by rapid industrialization, expanding manufacturing activities across food, pharmaceutical, and packaging sectors, and growing demand for efficient, high-speed printing technologies

- The plastics segment dominated the market with the largest revenue share of 48.6% in 2024, driven by its extensive use across packaging applications in food and beverage and pharmaceutical industries. CIJ coders are widely preferred for printing expiration dates, barcodes, and batch numbers on plastic surfaces due to their high-speed marking capabilities and excellent adhesion. The demand is further propelled by the growing use of plastic containers, wrappers, and labels in consumer goods packaging

Report Scope and Continuous Inkjet (CIJ) Inkjet Coders Market Segmentation

|

Attributes |

Continuous Inkjet (CIJ) Inkjet Coders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Continuous Inkjet (CIJ) Inkjet Coders Market Trends

“Continuous Shift Towards Eco-Friendly Ink Solutions”

- CIJ coders are increasingly being equipped with smart and IoT features such as cloud connectivity, real-time performance analytics, and predictive maintenance

- These enhancements allow for remote monitoring and troubleshooting, reducing machine downtime and improving operational efficiency

- Manufacturers are leveraging Industry 4.0 advancements to upgrade their printing infrastructure for better automation and scalability

- IoT-enabled printers enable companies to track consumables such as ink and solvents and automatically notify for replenishment

- For instance, Domino’s Ax-Series printers are embedded with smart sensors and cloud-based monitoring tools, enabling real-time diagnostics and predictive service scheduling

Continuous Inkjet (CIJ) Inkjet Coders Market Dynamics

Driver

“Rising Demand for Traceability and Compliance in Packaging”

- Global regulations in food, pharmaceutical, and consumer goods industries are mandating clear, durable, and compliant product codes

- CIJ coders provide high-speed, non-contact printing on a wide range of surfaces, ideal for fast-moving production lines

- These systems ensure reliable coding of batch numbers, expiry dates, and traceability information without affecting packaging

- They help companies meet serialization and anti-counterfeiting requirements critical in supply chain transparency

- For instance, To comply with the U.S. FDA’s Drug Supply Chain Security Act (DSCSA), many pharmaceutical firms use CIJ coders for serialization of medicine packages

Restraint/Challenge

“High Operational and Maintenance Costs Associated with CIJ Coders”

- CIJ printers require regular maintenance and frequent replenishment of inks and solvents, raising total operating costs

- The technology involves complex components that need skilled personnel for servicing and troubleshooting

- Smaller manufacturers may find the total cost of ownership too high and opt for simpler alternatives such as thermal inkjet coders

- Environmental concerns regarding the use of solvent-based inks are also resulting in increased regulatory attention

- For instance, In cost-sensitive markets such as Southeast Asia, many SMEs prefer low-maintenance alternatives such as TIJ coders due to CIJ’s higher operational overhead

Continuous Inkjet (CIJ) Inkjet Coders Market Scope

The market is segmented on the basis of material and application.

• By Material

On the basis of material, the continuous inkjet (CIJ) inkjet coders market is segmented into plastics, metals, and ceramics. The plastics segment dominated the market with the largest revenue share of 48.6% in 2024, driven by its extensive use across packaging applications in food and beverage and pharmaceutical industries. CIJ coders are widely preferred for printing expiration dates, barcodes, and batch numbers on plastic surfaces due to their high-speed marking capabilities and excellent adhesion. The demand is further propelled by the growing use of plastic containers, wrappers, and labels in consumer goods packaging.

The metals segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand from the automotive and industrial sectors. CIJ inkjet coders provide durable and high-contrast printing on metal surfaces, making them suitable for tracking parts and ensuring traceability in complex supply chains. The ability to operate reliably in high-temperature and rugged conditions also contributes to their increasing adoption.

• By Application

On the basis of application, the CIJ inkjet coders market is segmented into food and beverage, pharmaceuticals, and automotive. The food and beverage segment held the largest revenue share in 2024, supported by stringent regulations mandating clear labeling and traceability. CIJ coders are ideal for high-speed, non-contact printing on various substrates such as bottles, cans, and packaging films, offering consistent and legible codes even in humid or dusty environments.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for secure and accurate coding of medicine packaging. These coders support serialization and anti-counterfeiting efforts by enabling precise printing on blister packs, cartons, and vials. The demand is also bolstered by growing regulatory compliance and the global expansion of pharmaceutical manufacturing facilities.

Continuous Inkjet (CIJ) Inkjet Coders Market Regional Analysis

• North America dominated the continuous inkjet (CIJ) inkjet coders market with the largest revenue share in 2024, driven by the region’s advanced manufacturing infrastructure, stringent labeling regulations, and widespread automation across industries

• The demand for traceability, anti-counterfeit measures, and compliance with food and pharmaceutical labeling standards is fueling CIJ inkjet coder adoption

• Technological advancements, high production speeds, and increasing focus on efficient and reliable coding solutions further enhance the region’s dominance in sectors such as packaging, automotive, and FMCG

U.S. Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The U.S. continuous inkjet (CIJ) inkjet coders market accounted for the largest revenue share in North America in 2024, bolstered by strong regulatory frameworks, high-volume production lines, and early adoption of advanced coding technologies. Manufacturers across food, beverage, and pharmaceutical sectors are integrating CIJ coders for consistent, high-speed printing on varied substrates. In addition, the U.S. market benefits from rising demand for smart factories and Industry 4.0 implementation, contributing to automation and traceability improvements.

Europe Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The Europe CIJ inkjet coders market is expected to witness the fastest growth rate from 2025 to 2032, driven by environmental packaging initiatives, automation trends, and strong compliance with EU regulations on product labeling. Industries across Germany, France, and Italy are emphasizing precise coding solutions for traceability and quality assurance. The rise of sustainable ink technologies and the incorporation of low-maintenance, user-friendly CIJ systems is also supporting growth in the region.

U.K. Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by robust demand from food processing, beverage, and pharmaceutical sectors. Increased consumer focus on product transparency and expiration date clarity is encouraging the use of CIJ coders in packaging lines. Furthermore, the U.K.’s strong emphasis on export-ready goods and retail compliance supports market expansion, especially among contract manufacturers and private-label producers.

Germany Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The Germany’s CIJ inkjet coders market is expected to witness the fastest growth rate from 2025 to 2032, fueled by its highly automated industrial base and strong demand for precise, high-speed coding equipment. The country’s leadership in automotive and engineering sectors is a key contributor to adoption, as manufacturers require efficient coding solutions for complex parts and fast production lines. In addition, the integration of CIJ coders with MES (Manufacturing Execution Systems) and ERP platforms is gaining popularity across German facilities.

Asia-Pacific Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The Asia-Pacific CIJ inkjet coders market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding manufacturing sectors, and increasing investments in packaging technology in countries such as China, India, and Japan. The need for cost-effective, reliable coding on diverse materials is encouraging the adoption of CIJ systems. Furthermore, local production of coding devices and ink supplies contributes to affordability and increased market penetration.

China Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The China dominated the Asia-Pacific CIJ inkjet coders market in 2024, supported by large-scale production in food & beverage, electronics, and packaging sectors. Government emphasis on product authentication and supply chain visibility is boosting the demand for continuous inkjet coding systems. The availability of low-cost manufacturing, domestic brands, and supportive trade policies further propels growth in China’s high-speed production environment.

Japan Continuous Inkjet (CIJ) Inkjet Coders Market Insight

The Japan’s CIJ inkjet coders market is expected to witness the fastest growth rate from 2025 to 2032, due to the nation’s precision-driven manufacturing landscape and demand for compact, efficient coding solutions. The Japanese focus on product quality, cleanroom production standards, and compact factory spaces aligns with the features of modern CIJ coders. In addition, the country’s leadership in electronics and healthcare device manufacturing drives consistent need for high-quality date, batch, and identification marking systems.

Continuous Inkjet (CIJ) Inkjet Coders Market Share

The Continuous Inkjet (CIJ) Inkjet Coders industry is primarily led by well-established companies, including:

- Domino Printing Sciences plc (U.K.)

- Videojet Technologies (India) Pvt. Ltd. (U.S.)

- Markem-Imaje (U.S.)

- Linx Printing Technologies (U.K.)

- KGK Jet India Private Limited (India)

- Hitachi Industrial Equipment Systems Co., Ltd. (Japan)

- CONTROL PRINT LTD. (India)

- Squid Ink. (U.S.)

- REA Elektronik GmbH (Germany)

- ANSER CODING INC. (Taiwan)

- Leibinger Group (Germany)

- Engage Technologies Corporation (U.S.)

Latest Developments in Global Continuous Inkjet (CIJ) Inkjet Coders Market

- In January 2024, Domino Printing Sciences plc introduced a new series of CIJ inkjet coders, marking a product development aimed at enhancing connectivity and user interface capabilities. The launch is set to streamline production workflows by enabling easier integration and improved operational efficiency. This innovation is expected to strengthen Domino’s position in the industrial coding market and meet the growing demand for smart factory-compatible solutions

- In November 2023, Videojet Technologies, Inc. launched an advanced CIJ inkjet coder model as part of its product development strategy. The new model delivers high-resolution printing and exceptional reliability at high speeds, addressing the specific needs of fast-paced packaging lines. This advancement is poised to boost Videojet’s market appeal across industries prioritizing print precision and production efficiency

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 BENEFITS OF CONTINUOUS INKJET PRINTING SYSTEMS

6 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY TYPE

6.1 OVERVIEW

6.2 THERMAL CONTINUOUS INKJET (CIJ)

6.3 PIEZOELECTRIC CONTINUOUS INKJET (CIJ)

7 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY PRINT SPEED

7.1 OVERVIEW

7.2 BELOW 400 M/MIN

7.3 400 – 600 M/MIN

7.4 ABOVE 600 M/MIN

8 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY LINES OF PRINT

8.1 OVERVIEW

8.2 UPTO 3 LINES

8.3 MAXIMUM 5 LINES

8.4 ABOVE 5 LINES

9 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY SUBSTRATES

9.1 OVERVIEW

9.2 METALS

9.3 GLASS

9.4 PAPER

9.4.1 PAPERBOARD

9.4.2 CARDBOARD

9.5 PLASTIC

9.6 WOOD & LUMBER

9.7 TEXTILE

9.8 OTHERS

10 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY INK TYPE

10.1 OVERVIEW

10.2 NON-TRANSFER INK

10.3 SOFT-PIGMENTED INK

10.4 HARD-PIGMENTED INK

10.5 ALCOHOL-RESISTANT INK

10.6 THERMOCHROMIC INK

10.7 UV-READABLE INK

11 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY APPLICATIONS

11.1 OVERVIEW

11.2 FOOD & BEVERAGE

11.2.1 BY SUBSTRATES

11.2.1.1. METALS

11.2.1.2. GLASS

11.2.1.3. PAPER

11.2.1.4. PLASTIC

11.2.1.5. WOOD & LUMBER

11.2.1.6. TEXTILE

11.2.1.7. OTHERS

11.3 MEDICAL APPLICATION

11.3.1 BY SUBSTRATES

11.3.1.1. METALS

11.3.1.2. GLASS

11.3.1.3. PAPER

11.3.1.4. PLASTIC

11.3.1.5. WOOD & LUMBER

11.3.1.6. TEXTILE

11.3.1.7. OTHERS

11.4 COSMETIC INDUSTRY

11.4.1 BY SUBSTRATES

11.4.1.1. METALS

11.4.1.2. GLASS

11.4.1.3. PAPER

11.4.1.4. PLASTIC

11.4.1.5. WOOD & LUMBER

11.4.1.6. TEXTILE

11.4.1.7. OTHERS

11.5 AUTOMOBILE INDUSTRY

11.5.1 BY SUBSTRATES

11.5.1.1. METALS

11.5.1.2. GLASS

11.5.1.3. PAPER

11.5.1.4. PLASTIC

11.5.1.5. WOOD & LUMBER

11.5.1.6. TEXTILE

11.5.1.7. OTHERS

11.6 PIPES, WIRES & CABLES

11.6.1 BY SUBSTRATES

11.6.1.1. METALS

11.6.1.2. GLASS

11.6.1.3. PAPER

11.6.1.4. PLASTIC

11.6.1.5. WOOD & LUMBER

11.6.1.6. TEXTILE

11.6.1.7. OTHERS

11.7 TOBACCO INDUSTRY

11.7.1 BY SUBSTRATES

11.7.1.1. METALS

11.7.1.2. GLASS

11.7.1.3. PAPER

11.7.1.4. PLASTIC

11.7.1.5. WOOD & LUMBER

11.7.1.6. TEXTILE

11.7.1.7. OTHERS

11.8 PACKING INDUSTRY

11.8.1 BY SUBSTRATES

11.8.1.1. METALS

11.8.1.2. GLASS

11.8.1.3. PAPER

11.8.1.4. PLASTIC

11.8.1.5. WOOD & LUMBER

11.8.1.6. TEXTILE

11.8.1.7. OTHERS

11.9 OTHERS

12 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, BY GEOGRAPHY

GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 NORWAY

12.2.11 FINLAND

12.2.12 SWITZERLAND

12.2.13 DENMARK

12.2.14 SWEDEN

12.2.15 POLAND

12.2.16 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 NEW ZEALAND

12.3.7 SINGAPORE

12.3.8 THAILAND

12.3.9 MALAYSIA

12.3.10 INDONESIA

12.3.11 PHILIPPINES

12.3.12 TAIWAN

12.3.13 VIETNAM

12.3.14 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 OMAN

12.5.6 BAHRAIN

12.5.7 ISRAEL

12.5.8 KUWAIT

12.5.9 QATAR

12.5.10 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL CONTINUOUS INKJET (CIJ) INKJET CODERS MARKET, COMPANY PROFILE

15.1 VIDEOJET TECHNOLOGIES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 LINX PRINTING TECHNOLOGIES.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 KOENIG & BAUER CODING GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 INKJET, INC.’S

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 HITACHI INDUSTRIAL EQUIPMENT & SOLUTIONS AMERICA, LLC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 PRINTJET CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 DOMINO PRINTING SCIENCES PLC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 LEIBINGER GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 MATTHEWS AUSTRALASIA PTY LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 SNEED CODING SOLUTIONS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CONTROL PRINT LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 BESTCODE

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 CITRONIX INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 EBS

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MARKEM-IMAJE (A DOVER COMPANY)

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 NEEDHAM INKS LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SQUID INK

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 TROY CO.,LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 PANNIER CORPORATION.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 KEYENCE CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 BHAVMARK SYSTEM PVT. LTD.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 KGK JET INDIA PRIVATE LIMITED

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.