Global Dual Her2egfr Inhibitor Drugs Market

Taille du marché en milliards USD

TCAC :

%

USD

1.93 Billion

USD

5.39 Billion

2025

2033

USD

1.93 Billion

USD

5.39 Billion

2025

2033

| 2026 –2033 | |

| USD 1.93 Billion | |

| USD 5.39 Billion | |

|

|

|

|

Global Dual HER2/EGFR Inhibitor Drugs Market Segmentation, By Drug Type (Dual Tyrosine Kinase Inhibitors (TKIs), Dual-Target Biologics, and Combination Targeted Therapies), Mechanism Of Action (Reversible Inhibitors, Irreversible Inhibitors, and Multi-target Inhibitors), Indication (Breast Cancer, Lung Cancer, Gastric Cancer, Colorectal Cancer, Head & Neck Cancer, and Others), End User (Hospitals, Specialty Cancer Clinics, Retail Pharmacies, and Online Pharmacies)- Industry Trends and Forecast to 2033

Dual HER2/EGFR Inhibitor Drugs Market Size

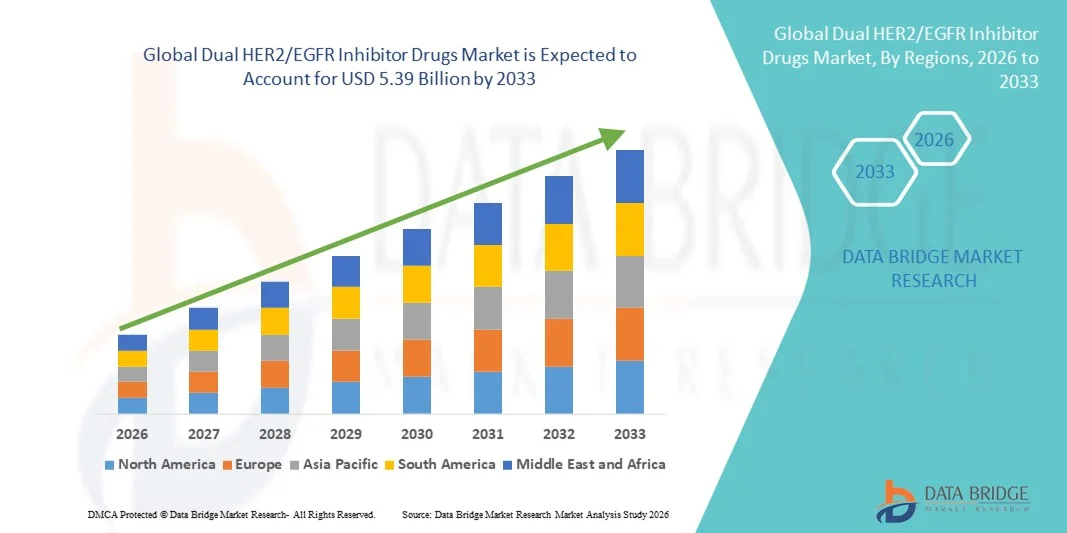

- The global dual HER2/EGFR inhibitor drugs market size was valued at USD 1.93 billion in 2025 and is expected to reach USD 5.39 billion by 2033, at a CAGR of 13.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within targeted oncology therapies and precision medicine, leading to increased utilization in both hospital and specialty cancer care settings

- Furthermore, rising patient demand for effective, biomarker-driven, and combination treatment options for cancer is establishing dual HER2/EGFR inhibitors as a preferred targeted therapy approach. These converging factors are accelerating the clinical uptake of dual inhibitors, thereby significantly boosting the industry’s growth

Dual HER2/EGFR Inhibitor Drugs Market Analysis

- Dual HER2/EGFR inhibitor drugs, offering simultaneous blockade of human epidermal growth factor receptor 2 (HER2) and epidermal growth factor receptor (EGFR) pathways, are increasingly vital components of modern targeted cancer therapy in both hospital and specialty oncology settings due to their ability to overcome resistance mechanisms, enhance treatment response, and align with precision oncology strategies

- The escalating demand for dual HER2/EGFR inhibitors is primarily fueled by the rising global cancer burden, expanding biomarker and genomic testing, and a growing clinical preference for targeted and combination therapies over traditional chemotherapy

- North America dominated the dual HER2/EGFR inhibitor drugs market with the largest revenue share of 41.6% in 2025, characterized by advanced oncology care infrastructure, strong reimbursement frameworks, and the presence of major biopharmaceutical innovators, with the U.S. seeing notable uptake in HER2-positive breast and other solid tumors driven by continuous clinical advancements

- Asia-Pacific is expected to be the fastest growing region in the dual HER2/EGFR inhibitor drugs market during the forecast period due to improving cancer diagnostics, expanding access to targeted biologics, and rising healthcare expenditures across key countries

- Breast cancer segment dominated the dual HER2/EGFR inhibitor drugs market with a market share of 66.7% in 2025, driven by the high prevalence of HER2-positive breast cancer, strong clinical validation of dual-target strategies, and their inclusion in multiple treatment guidelines

Report Scope and Dual HER2/EGFR Inhibitor Drugs Market Segmentation

|

Attributes |

Dual HER2/EGFR Inhibitor Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dual HER2/EGFR Inhibitor Drugs Market Trends

Advancing Precision Oncology Through Dual-Targeted Therapies

- A significant and accelerating trend in the global dual HER2/EGFR inhibitor drugs market is the deepening integration of precision oncology approaches and molecularly targeted therapies that simultaneously inhibit HER2 and EGFR pathways. This convergence is significantly improving treatment personalization and clinical decision-making in oncology care

- For instance, dual inhibitors such as lapatinib and neratinib are being incorporated into treatment protocols for HER2-positive cancers where EGFR signaling also plays a role, allowing clinicians to address multiple tumor growth pathways with a single therapeutic strategy

- Dual-target inhibition enables features such as overcoming pathway cross-talk, delaying resistance mechanisms, and improving progression-free survival in certain patient populations. For instance, some clinical strategies utilize dual inhibition to sustain tumor response where single-target therapies show limited durability. Furthermore, optimized dosing strategies allow more controlled and sustained receptor blockade

- The seamless integration of dual HER2/EGFR inhibitors with biomarker testing and genomic profiling facilitates more precise patient selection. Through a single diagnostic workflow, oncologists can align targeted therapies with tumor biology, creating a more individualized and evidence-based treatment experience

- This trend toward more personalized, biology-driven, and combination-oriented cancer treatment is fundamentally reshaping clinical expectations for targeted oncology care. Consequently, companies are developing next-generation dual inhibitors and bispecific molecules with improved selectivity and safety profiles

- The demand for dual HER2/EGFR inhibitors that offer effective multi-pathway control is growing steadily across oncology centers and specialty clinics, as providers increasingly prioritize precision treatment and improved survival outcomes

Dual HER2/EGFR Inhibitor Drugs Market Dynamics

Driver

Growing Need Due to Rising Cancer Burden and Targeted Therapy Adoption

- The increasing global incidence of HER2-positive and EGFR-driven cancers, coupled with the accelerating adoption of targeted oncology therapies, is a significant driver for the heightened demand for dual HER2/EGFR inhibitors

- For instance, in recent years, oncology drug developers have expanded clinical programs evaluating dual-target inhibitors in breast and other solid tumors, reflecting stronger industry focus on multi-pathway blockade strategies

- As clinicians become more aware of resistance patterns in single-target therapies and seek improved outcomes, dual inhibitors provide broader pathway suppression, offering a compelling alternative to conventional monotherapies

- Furthermore, the growing use of companion diagnostics and molecular testing is making dual-target therapies an integral component of modern oncology practice, enabling better therapy-patient matching

- Rising awareness among oncologists regarding pathway cross-talk between HER2 and EGFR is encouraging broader clinical consideration of dual inhibition strategies in complex tumor profiles

- Expanding oncology infrastructure and access to specialty cancer centers in emerging markets are supporting greater adoption of advanced targeted therapies, including dual inhibitors

- The clinical value of improved disease control, extended progression-free survival, and combination compatibility with chemotherapy or immunotherapy are key factors propelling adoption in both developed and emerging healthcare markets

Restraint/Challenge

Safety Concerns and Regulatory Complexity Hurdle

- Concerns surrounding toxicity management and adverse event profiles of targeted oncology drugs pose a significant challenge to broader market expansion. As dual inhibitors affect multiple pathways, they may present tolerability considerations that require close monitoring

- For instance, reports of gastrointestinal or dermatologic side effects with some tyrosine kinase inhibitors have made certain clinicians cautious in specific patient populations

- Addressing these safety concerns through optimized dosing, patient monitoring, and supportive care is crucial for wider clinical acceptance. Companies emphasize improved selectivity and safety data in development programs to reassure healthcare providers. In addition, the high cost of targeted cancer therapies compared to traditional treatments can be a barrier in cost-sensitive healthcare systems, particularly in low- and middle-income regions

- While reimbursement coverage is gradually expanding, the perceived cost burden of novel targeted therapies can still limit accessibility, especially where healthcare budgets are constrained

- Lengthy clinical trial timelines and stringent regulatory requirements for oncology drugs can delay market entry of new dual-target therapies, slowing commercial availability

- Variability in biomarker testing availability across regions can limit optimal patient identification, potentially restricting the eligible treatment population for dual HER2/EGFR inhibitors

- Overcoming these challenges through safer drug design, broader reimbursement support, and continued clinical evidence generation will be vital for sustained market growth

Dual HER2/EGFR Inhibitor Drugs Market Scope

The market is segmented on the basis of drug type, mechanism of action, indication, and end user.

- By Drug Type

On the basis of drug type, the market is segmented into dual tyrosine kinase inhibitors (TKIs), dual-target biologics, and combination targeted therapies. The dual tyrosine kinase inhibitors (TKIs) segment dominated the market with the largest market revenue share in 2025, driven by their established clinical efficacy and regulatory approvals in HER2-positive cancers. These drugs are widely used because they effectively block intracellular HER2 and EGFR signaling pathways simultaneously. Their oral administration improves patient convenience and long-term adherence to therapy. Oncologists are highly familiar with their safety and efficacy profiles, supporting continued preference in treatment protocols. The availability of both branded and generic options enhances accessibility across developed and emerging markets. Continued label expansions and lifecycle management strategies also reinforce the dominance of this segment.

The dual-target biologics segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for highly selective and next-generation targeted therapies. These biologics are engineered to bind extracellular receptors with high specificity. They demonstrate potential for reduced off-target toxicity compared to small-molecule drugs. Rising investment in antibody and bispecific technology is strengthening the development pipeline. Clinical trials are expanding their evaluation in resistant tumor populations. Their compatibility with immunotherapy combinations further contributes to rapid growth.

- By Mechanism of Action

On the basis of mechanism of action, the market is segmented into reversible inhibitors, irreversible inhibitors, and multi-target inhibitors. The irreversible inhibitors segment held the largest market revenue share in 2025 driven by their ability to permanently bind to HER2 and EGFR receptors. This leads to prolonged pathway suppression and sustained therapeutic effects. These inhibitors are often preferred in resistant cancer cases. Clinical evidence supports their use in aggressive HER2-positive tumors. Physicians value their strong and durable receptor blockade. Continued research and positive clinical outcomes sustain their leadership position.

The multi-target inhibitors segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the shift toward broader pathway inhibition strategies in oncology. These inhibitors act on multiple signaling pathways beyond HER2 and EGFR. They help reduce tumor escape mechanisms. Pharmaceutical companies are investing heavily in multi-kinase drug development. Their applicability across several tumor types increases clinical interest. Strong pipeline innovation is accelerating segment growth.

- By Indication

On the basis of indication, the market is segmented into breast cancer, lung cancer, gastric cancer, colorectal cancer, head & neck cancer, and others. The breast cancer segment dominated the market with the largest market revenue share of 66.7% in 2025, driven by the high prevalence of HER2-positive breast cancer worldwide. Dual inhibitors are well integrated into treatment guidelines. Strong clinical data supports their use in both early and metastatic settings. HER2 testing is routine, enabling patient identification. Oncologists frequently prescribe dual-target therapy in this indication. Continuous awareness programs also sustain demand.

The lung cancer segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising detection of HER2 and EGFR mutations in lung tumors. The expansion of genomic profiling is improving diagnosis. The targeted therapy adoption in lung cancer is rising globally. Ongoing clinical trials are validating dual inhibition strategies. The high global burden of lung cancer supports growth. The increasing precision oncology adoption further drives demand. High disease burden supports strong growth potential.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty cancer clinics, retail pharmacies, and online pharmacies. The hospitals segment held the largest market revenue share in 2025 driven by their central role in oncology diagnosis and treatment. Most targeted therapies are initiated in hospital settings. Hospitals provide multidisciplinary cancer care teams. They have advanced diagnostic and monitoring infrastructure. Reimbursement systems often favor hospital-based care. Their strong patient inflow maintains dominance.

The specialty cancer clinics segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing preference for specialized oncology care. These clinics focus on precision treatment and personalized management. Patients increasingly seek dedicated cancer centers. Expansion of private oncology networks supports growth. Access to clinical trials attracts more patients. Improved outpatient care models also contribute to rising adoption. Expansion of private oncology networks supports segment growth. Access to clinical trials further drives patient inflow.

Dual HER2/EGFR Inhibitor Drugs Market Regional Analysis

- North America dominated the dual HER2/EGFR inhibitor drugs market with the largest revenue share of 41.6% in 2025, characterized by advanced oncology care infrastructure, strong reimbursement frameworks, and the presence of major biopharmaceutical innovators

- Healthcare providers in the region highly value the clinical benefits, targeted efficacy, and biomarker-guided treatment approach offered by dual HER2/EGFR inhibitors, along with their integration into standardized oncology care pathways and treatment guidelines

- This widespread adoption is further supported by high healthcare expenditure, a strong presence of leading biopharmaceutical companies, and the growing preference for personalized cancer therapies, establishing dual HER2/EGFR inhibitors as a favored option in both hospital and specialty oncology settings

U.S. Dual HER2/EGFR Inhibitor Drugs Market Insight

The U.S. dual HER2/EGFR inhibitor drugs market captured the largest revenue share within North America in 2025, fueled by the swift adoption of targeted oncology therapies and the expanding use of precision medicine in cancer care. Clinicians are increasingly prioritizing biomarker-driven treatment strategies through dual-pathway inhibition. The growing preference for personalized oncology care, combined with strong demand for advanced targeted drugs and genomic testing integration, further propels the market. Moreover, the increasing availability of companion diagnostics and supportive reimbursement frameworks is significantly contributing to market expansion.

Europe Dual HER2/EGFR Inhibitor Drugs Market Insight

The Europe dual HER2/EGFR inhibitor drugs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong oncology research and the escalating need for effective targeted cancer therapies. The rise in cancer incidence, coupled with expanding access to precision diagnostics, is fostering adoption. European healthcare systems are also supportive of innovative oncology treatments with proven clinical value. The region is seeing growth across hospital and specialty cancer centers, with dual inhibitors incorporated into advanced treatment protocols.

U.K. Dual HER2/EGFR Inhibitor Drugs Market Insight

The U.K. dual HER2/EGFR inhibitor drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of precision oncology and a focus on improving cancer survival outcomes. In addition, strong national cancer programs and early diagnostic initiatives encourage the use of targeted therapies. The U.K.’s emphasis on evidence-based treatment and access to innovative medicines is expected to continue stimulating market growth.

Germany Dual HER2/EGFR Inhibitor Drugs Market Insight

The Germany dual HER2/EGFR inhibitor drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of advanced cancer therapies and demand for technologically innovative treatment solutions. Germany’s strong healthcare infrastructure and focus on clinical excellence promote adoption, particularly in comprehensive cancer centers. The integration of molecular diagnostics into routine oncology care is also increasing, with a strong preference for high-efficacy targeted therapies aligning with physician and patient expectations.

Asia-Pacific Dual HER2/EGFR Inhibitor Drugs Market Insight

The Asia-Pacific dual HER2/EGFR inhibitor drugs market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising cancer prevalence, improving healthcare infrastructure, and broader access to targeted therapies in countries such as China, Japan, and India. The region's increasing adoption of precision medicine, supported by government healthcare investments, is driving uptake. Furthermore, expansion of oncology specialty centers is improving treatment accessibility to a wider patient population.

Japan Dual HER2/EGFR Inhibitor Drugs Market Insight

The Japan dual HER2/EGFR inhibitor drugs market is gaining momentum due to the country’s advanced medical technology landscape, aging population, and strong demand for effective cancer treatments. The Japanese market places significant emphasis on early diagnosis and precision therapy. Adoption is supported by high utilization of genomic testing and targeted oncology drugs. Moreover, Japan’s focus on innovative pharmaceutical development is likely to spur demand for advanced dual-target therapies in both hospital and specialty settings.

India Dual HER2/EGFR Inhibitor Drugs Market Insight

The India dual HER2/EGFR inhibitor drugs market accounted for a leading market share in Asia-Pacific in 2025, attributed to rising cancer incidence, improving oncology infrastructure, and expanding access to targeted therapies. India is emerging as a key market for precision oncology adoption, with dual inhibitors gaining visibility in major cancer centers. Growth in health insurance coverage and government-supported cancer programs, alongside increasing availability of advanced diagnostics, are key factors propelling the market in India.

Dual HER2/EGFR Inhibitor Drugs Market Share

The Dual HER2/EGFR Inhibitor Drugs industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Sanofi (France)

- AstraZeneca (U.K.)

- Novartis AG (U.S.)

- Daiichi Sankyo (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Genentech, Inc. (U.S.)

- Puma Biotechnology, Inc. (U.S.)

- Jazz Pharmaceuticals plc (Ireland)

- Zymeworks Inc. (Canada)

- Biocon Biopharmaceuticals Pvt. Ltd (India)

- Innovent Biologics, Inc. (China)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

What are the Recent Developments in Global Dual HER2/EGFR Inhibitor Drugs Market?

- In August 2025, the U.S. FDA approved zongertinib (Hernexeos) tablets as an oral targeted therapy for adults with unresectable or metastatic non-squamous NSCLC with HER2 tyrosine kinase domain activating mutations, expanding dual HER2-pathway targeting options in lung cancer

- In July 2025, the U.S. FDA granted accelerated approval to sunvozertinib (Zegfrovy) for the treatment of adult patients with locally advanced or metastatic non–small cell lung cancer (NSCLC) harboring EGFR exon 20 insertion mutations, providing a new targeted oral therapy option for this difficult-to-treat mutation subset

- In September 2024, updated clinical data presented at a major lung cancer conference showed that BAY 2927088 demonstrated rapid, substantial, and durable responses in patients with advanced HER2-mutant NSCLC, reinforcing its promise as a novel dual-target therapy in a high-unmet need population

- In March 2024, the U.S. FDA granted Breakthrough Therapy designation to a novel HER2/EGFR-targeting TKI based on preliminary Phase I clinical evidence of significant anti-tumor activity in advanced NSCLC with HER2 or EGFR mutations, highlighting regulatory encouragement for dual-target small molecules in precision oncology

- In February 2024, Bayer’s BAY 2927088 received Breakthrough Therapy designation from the FDA for treating adults with unresectable or metastatic NSCLC whose tumors have activating HER2 mutations, supporting expedited development of a potent reversible HER2/EGFR-targeted TKI

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.