Global E Commerce Packaging Materials Market

Taille du marché en milliards USD

TCAC :

%

USD

80.20 Billion

USD

176.98 Billion

2025

2033

USD

80.20 Billion

USD

176.98 Billion

2025

2033

| 2026 –2033 | |

| USD 80.20 Billion | |

| USD 176.98 Billion | |

|

|

|

|

Segmentation du marché mondial des matériaux d'emballage pour le commerce électronique, par type de matériau (boîtes en carton ondulé, emballages de protection, sacs en polyéthylène, enveloppes d'expédition et autres), application (électronique, vêtements et accessoires, maison et cuisine, santé et beauté, alimentation et boissons et autres), utilisateur final (détaillants, entreprises de logistique et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des matériaux d'emballage pour le commerce électronique

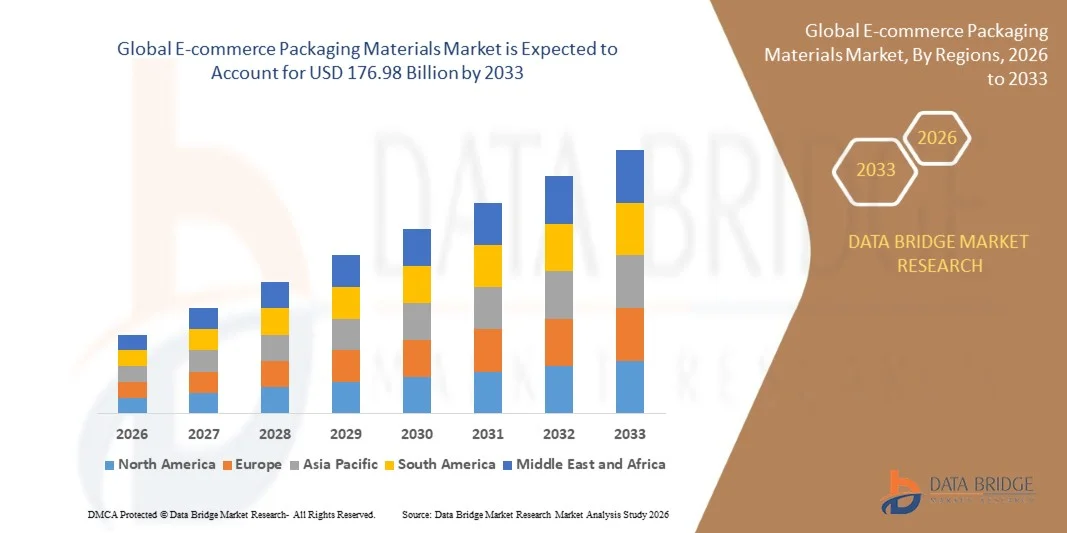

- Le marché mondial des matériaux d'emballage pour le commerce électronique était évalué à 80,2 milliards de dollars américains en 2025 et devrait atteindre 176,98 milliards de dollars américains d'ici 2033 , avec un TCAC de 10,40 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'expansion rapide du commerce électronique et de la vente au détail en ligne, ce qui stimule la demande croissante de matériaux d'emballage durables, protecteurs et écologiques afin de garantir la livraison sécurisée des produits dans diverses catégories.

- De plus, les attentes croissantes des consommateurs en matière d'emballages sécurisés, écologiques et esthétiques font des matériaux d'emballage avancés un facteur de différenciation clé dans la chaîne d'approvisionnement du commerce électronique. La convergence de ces facteurs accélère l'adoption de solutions d'emballage innovantes, stimulant ainsi significativement la croissance du secteur.

Analyse du marché des matériaux d'emballage pour le commerce électronique

- Les matériaux d'emballage pour le commerce électronique, notamment les boîtes en carton ondulé, les emballages de protection, les sacs en polyéthylène et les enveloppes d'expédition, sont de plus en plus essentiels pour garantir la sécurité des produits, minimiser les retours et améliorer l'expérience client dans les opérations de vente au détail et de logistique.

- La demande croissante de matériaux d'emballage pour le commerce électronique est principalement alimentée par l'essor des achats en ligne, la sensibilisation accrue aux solutions d'emballage durables et le besoin de matériaux d'expédition économiques et fiables qui préservent l'intégrité des produits de l'entrepôt jusqu'au domicile du consommateur.

- L'Amérique du Nord a dominé le marché des matériaux d'emballage pour le commerce électronique avec une part de 33,5 % en 2025, en raison de l'adoption croissante du commerce de détail en ligne, de la demande croissante d'emballages sûrs et durables et de la présence d'acteurs majeurs du commerce électronique.

- La région Asie-Pacifique devrait connaître la croissance la plus rapide sur le marché des matériaux d'emballage pour le commerce électronique au cours de la période de prévision, en raison de l'expansion rapide du commerce de détail en ligne, de la hausse des revenus disponibles et de la sensibilisation croissante aux emballages durables dans des pays comme la Chine, le Japon et l'Inde.

- Le segment des boîtes en carton ondulé a dominé le marché avec une part de marché de 41,8 % en 2025, grâce à leur robustesse, leur recyclabilité et leur rentabilité pour l'expédition d'une large gamme de produits. Les entreprises de commerce électronique privilégient souvent les boîtes en carton ondulé pour leur capacité à protéger les marchandises pendant le transport et leur compatibilité avec les systèmes d'emballage automatisés. Ce segment bénéficie également d'innovations telles que les designs personnalisables et les matériaux durables, ce qui renforce la visibilité de la marque et la satisfaction client.

Portée du rapport et segmentation du marché des matériaux d'emballage pour le commerce électronique

|

Attributs |

Matériaux d'emballage pour le e-commerce : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des matériaux d'emballage pour le commerce électronique

« Adoption croissante de matériaux d’emballage durables et écologiques »

- Une tendance majeure du marché des matériaux d'emballage pour le e-commerce est l'adoption croissante de solutions d'emballage durables, recyclables et biodégradables, impulsée par une prise de conscience environnementale accrue des consommateurs et par des réglementations plus strictes concernant les plastiques à usage unique. Cette tendance positionne les matériaux écologiques comme des éléments essentiels de la logistique et des opérations de vente au détail modernes du e-commerce.

- Par exemple, DS Smith et Smurfit Kappa fournissent de plus en plus de boîtes en carton ondulé recyclables et de solutions d'emballage de protection à base de fibres aux principaux détaillants en ligne. Ces matériaux réduisent l'empreinte carbone, minimisent l'impact environnemental et améliorent l'image de marque auprès des consommateurs soucieux de l'environnement.

- Le marché observe une utilisation croissante des systèmes d'emballage réutilisables et consignés, permettant de multiples cycles d'expédition et favorisant des opérations rentables et durables pour les prestataires logistiques. Cette tendance stimule l'innovation dans la conception d'emballages qui garantissent la sécurité des produits tout en s'inscrivant dans les principes de l'économie circulaire.

- Les consommateurs exigent des emballages alliant durabilité et résistance, garantissant la protection des produits pendant le transport tout en minimisant l'utilisation de matériaux non recyclables. Les entreprises répondent à cette demande par des solutions légères, robustes et écologiques qui améliorent leur efficacité opérationnelle.

- L'essor du commerce en ligne pour les produits électroniques, la mode et l'alimentation accélère encore l'adoption d'emballages durables de pointe. Ces secteurs nécessitent des solutions protectrices, légères et esthétiques qui répondent aux exigences réglementaires et aux attentes des consommateurs en matière de développement durable.

- La pénétration croissante du commerce électronique à l'échelle mondiale, notamment en Asie-Pacifique et en Amérique du Nord, renforce cette tendance. Les détaillants et les prestataires logistiques intègrent de plus en plus de solutions d'emballage écologiques dans leurs chaînes d'approvisionnement, ce qui contribue à la transition générale vers des opérations de commerce électronique respectueuses de l'environnement.

Dynamique du marché des matériaux d'emballage pour le commerce électronique

Conducteur

« Croissance rapide du commerce électronique et de la vente au détail en ligne »

- L'essor rapide du commerce électronique et de la vente au détail en ligne engendre une forte demande en matériaux d'emballage protecteurs, durables et fonctionnels. Ces matériaux sont essentiels pour garantir une livraison sécurisée, réduire les retours de produits et offrir une expérience client positive.

- Par exemple, Amazon et Alibaba utilisent massivement des cartons ondulés, des emballages de protection et des sacs en polyéthylène pour répondre aux exigences d'expédition de millions de commandes en ligne chaque jour. Ces matériaux contribuent à préserver l'intégrité des produits, à réduire les pertes logistiques et à optimiser les opérations d'entreposage et de livraison du dernier kilomètre.

- L'arrivée croissante de petites et moyennes entreprises dans le secteur du commerce électronique accroît le besoin de solutions d'emballage standardisées et économiques, capables d'évoluer au rythme de la croissance de l'activité.

- L'exigence croissante des consommateurs en matière de livraison rapide et de sécurité des produits favorise l'adoption de matériaux d'emballage de haute qualité. Les détaillants investissent dans des emballages personnalisés et à leur marque, qui enrichissent l'expérience de déballage et fidélisent la clientèle.

- L'importance croissante accordée au développement durable, à la conformité réglementaire et à l'efficacité opérationnelle incite les entreprises à adopter des solutions d'emballage innovantes qui allient responsabilité environnementale et fonctionnalité, renforçant ainsi l'expansion du marché.

Retenue/Défi

« Coût élevé des solutions d'emballage avancées et personnalisées »

- Le marché des matériaux d'emballage pour le commerce électronique est confronté à des difficultés liées aux coûts élevés des solutions d'emballage avancées, durables et personnalisées. Ces coûts peuvent freiner leur adoption par les petits détaillants et les jeunes entreprises aux budgets plus restreints.

- Par exemple, la mise en œuvre de systèmes d'emballage entièrement recyclables ou réutilisables par des entreprises comme DS Smith et Smurfit Kappa implique des investissements dans des matériaux spécialisés, des procédés de production et la personnalisation du design. Cela augmente le coût unitaire des emballages et impacte la rentabilité globale.

- Des coûts élevés sont également engendrés par l'approvisionnement en matières premières durables et le respect des réglementations environnementales strictes. Ces facteurs peuvent freiner l'adoption sur les marchés sensibles aux coûts.

- La complexité de la conception d'emballages alliant protection, esthétique et durabilité contribue à accroître les difficultés de production et les coûts. Les fabricants doivent optimiser leurs processus afin de maintenir des prix compétitifs tout en proposant des solutions de haute qualité.

- Le marché continue de subir des pressions pour développer des emballages performants et écologiques tout en maîtrisant les coûts opérationnels. Relever ces défis est essentiel pour favoriser une adoption généralisée et répondre efficacement à la demande croissante du commerce électronique.

Étendue du marché des matériaux d'emballage pour le commerce électronique

Le marché est segmenté en fonction du type de matériau, de l'application et de l'utilisateur final.

• Par type de matériau

Le marché des emballages pour le e-commerce est segmenté selon le type de matériau : cartons ondulés, emballages de protection, sacs en polyéthylène, enveloppes d'expédition et autres. En 2025, le segment des cartons ondulés dominait le marché avec une part de marché de 41,8 %, grâce à leur robustesse, leur recyclabilité et leur rentabilité pour l'expédition d'une large gamme de produits. Les entreprises de e-commerce privilégient souvent les cartons ondulés pour leur capacité à protéger les marchandises pendant le transport et leur compatibilité avec les systèmes d'emballage automatisés. Ce segment bénéficie également d'innovations telles que les designs personnalisables et les matériaux durables, ce qui améliore la visibilité des marques et la satisfaction client.

Le segment des emballages de protection devrait connaître la croissance la plus rapide, soit 19,5 %, entre 2026 et 2033, portée par la demande croissante de solutions pour protéger les articles fragiles et de grande valeur lors de la livraison. Par exemple, le film à bulles de Sealed Air et d'autres solutions de calage sont de plus en plus utilisés pour l'expédition de produits électroniques et de luxe. Les emballages de protection minimisent les dommages pendant la manutention, réduisent les coûts de retour et renforcent la confiance des consommateurs dans le commerce électronique. Leur popularité croissante est également favorisée par les progrès réalisés dans le domaine des matériaux de protection légers et écologiques, qui allient sécurité et durabilité.

• Sur demande

Le marché des matériaux d'emballage pour le e-commerce est segmenté, selon l'application, en électronique, vêtements et accessoires, maison et cuisine, santé et beauté, alimentation et boissons, et autres. Le segment de l'électronique a dominé le marché en 2025, générant la plus grande part de revenus, grâce à la valeur élevée et à la fragilité des produits électroniques qui nécessitent des solutions de protection spécifiques. Les entreprises privilégient les emballages qui préviennent les dommages pendant le transport, respectent les normes d'expédition internationales et facilitent le déballage. Ce segment bénéficie également de l'essor des achats de produits électroniques en ligne et de la croissance des expéditions d'appareils électroniques et connectés.

Le segment de l'habillement et des accessoires devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, porté par l'essor du commerce de mode en ligne et la demande croissante d'emballages légers, durables et esthétiques. Par exemple, Amazon et Zalando ont mis en place des pochettes et des enveloppes personnalisées pour améliorer l'expérience client et réduire les frais de livraison. Les solutions d'emballage de ce segment allient souvent fonctionnalité et esthétique, assurant la protection des vêtements tout en valorisant l'identité de la marque. Les innovations en matière de matériaux recyclables et résistants aux déchirures favorisent également l'adoption d'emballages de pointe dans le secteur du e-commerce de la mode.

• Par l'utilisateur final

Le marché des matériaux d'emballage pour le e-commerce est segmenté, selon l'utilisateur final, en trois catégories : les détaillants, les entreprises de logistique et autres. En 2025, le segment des détaillants dominait le marché, générant la plus grande part de revenus grâce à leur maîtrise directe des normes d'emballage et à l'importance croissante accordée à la satisfaction client. Les détaillants privilégient les emballages qui protègent les produits, réduisent les retours et offrent une expérience de déballage attrayante, renforçant ainsi la fidélité à la marque. Ce segment bénéficie également de partenariats stratégiques avec des fournisseurs d'emballages proposant des solutions personnalisées et durables.

Le secteur de la logistique devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'augmentation du volume des expéditions e-commerce nécessitant une manutention spécialisée et des emballages standardisés. Par exemple, FedEx et DHL ont adopté des solutions d'emballage sur mesure afin d'optimiser l'espace, de garantir la sécurité du transport et d'améliorer l'efficacité opérationnelle. Les prestataires logistiques privilégient des matériaux durables, légers et polyvalents qui réduisent les dommages liés au transport tout en soutenant les initiatives écoresponsables. Cette adoption croissante est également favorisée par l'intégration technologique dans les processus de tri et de livraison.

Analyse régionale du marché des matériaux d'emballage pour le commerce électronique

- L'Amérique du Nord a dominé le marché des matériaux d'emballage pour le commerce électronique en 2025, avec la plus grande part de revenus (33,5 %), grâce à l'adoption croissante du commerce de détail en ligne, à la demande croissante d'emballages sûrs et durables et à la présence d'acteurs majeurs du commerce électronique.

- Les détaillants et les entreprises de logistique de la région privilégient les matériaux d'emballage durables, légers et recyclables afin de garantir la protection des produits, de réduire les coûts d'expédition et d'améliorer la satisfaction client.

- Cette adoption généralisée est également favorisée par des revenus disponibles élevés, des infrastructures logistiques avancées et des attentes croissantes des consommateurs en matière d'emballages de marque et écologiques, faisant des matériaux d'emballage du commerce électronique un élément essentiel des chaînes d'approvisionnement.

Analyse du marché américain des matériaux d'emballage pour le commerce électronique

Le marché américain des matériaux d'emballage pour le e-commerce a généré la plus grande part de revenus en Amérique du Nord en 2025, porté par la croissance rapide du commerce en ligne, des ventes directes aux consommateurs et l'expansion des réseaux logistiques du e-commerce. Les entreprises privilégient de plus en plus les solutions d'emballage qui garantissent la sécurité des produits, minimisent les retours et proposent des alternatives durables. L'intérêt croissant pour l'expérience de déballage personnalisée, associé à l'adoption de matériaux innovants tels que les cartons ondulés et les emballages de protection, dynamise davantage le marché. Par ailleurs, la prise de conscience accrue de l'impact environnemental et les réglementations gouvernementales favorisant les matériaux recyclables contribuent significativement à son expansion.

Analyse du marché européen des matériaux d'emballage pour le e-commerce

Le marché européen des matériaux d'emballage pour le e-commerce devrait connaître une croissance annuelle composée (TCAC) importante au cours de la période de prévision, principalement sous l'effet de réglementations strictes en matière de développement durable et de la pénétration croissante du e-commerce dans la région. La demande croissante d'emballages protecteurs et légers encourage l'adoption de solutions avancées. Les détaillants et les entreprises de logistique européens privilégient également les matériaux écologiques, recyclables et réutilisables. La région enregistre une croissance dans les secteurs de l'électronique, du vêtement et de la livraison de produits alimentaires, les matériaux d'emballage étant intégrés aussi bien aux expéditions standard qu'aux offres de produits haut de gamme.

Analyse du marché britannique des matériaux d'emballage pour le commerce électronique

Le marché britannique des matériaux d'emballage pour le e-commerce devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période prévisionnelle, portée par l'essor des ventes en ligne, les exigences croissantes des consommateurs en matière de protection des produits et les préoccupations environnementales. La tendance croissante à la livraison le jour même ou le lendemain a incité les détaillants à investir dans des emballages à la fois résistants et économiques. Par ailleurs, la solide infrastructure logistique du Royaume-Uni, conjuguée à la popularité des emballages de marque et esthétiques, continue de stimuler la croissance du marché.

Analyse du marché allemand des matériaux d'emballage pour le e-commerce

Le marché allemand des matériaux d'emballage pour le e-commerce devrait connaître une croissance annuelle composée (TCAC) importante au cours de la période de prévision, portée par une réglementation environnementale stricte et un écosystème e-commerce performant. Les distributeurs et prestataires logistiques allemands privilégient les emballages recyclables, résistants et légers afin de répondre aux exigences réglementaires et aux attentes des clients. L'intégration de matériaux durables dotés de propriétés protectrices garantit des livraisons sécurisées tout en valorisant une image de marque éco-responsable. La demande est en hausse dans les secteurs de l'électronique, de la maison et de la cuisine, ainsi que de la santé et de la beauté, favorisant l'adoption de solutions d'emballage innovantes.

Analyse du marché des matériaux d'emballage pour le commerce électronique en Asie-Pacifique

Le marché des matériaux d'emballage pour le e-commerce en Asie-Pacifique devrait connaître la plus forte croissance annuelle composée (TCAC) entre 2026 et 2033, portée par l'essor rapide du commerce en ligne, la hausse des revenus disponibles et la sensibilisation croissante aux emballages durables dans des pays comme la Chine, le Japon et l'Inde. La pénétration croissante du e-commerce dans la région, soutenue par l'adoption des paiements numériques et les initiatives gouvernementales favorisant les infrastructures logistiques, alimente la demande en solutions d'emballage avancées. Par ailleurs, la région Asie-Pacifique joue un rôle central dans la fabrication de matériaux d'emballage, améliorant ainsi l'accessibilité et l'abordabilité pour les détaillants et les entreprises de logistique.

Analyse du marché japonais des matériaux d'emballage pour le commerce électronique

Le marché japonais des matériaux d'emballage pour le e-commerce est en pleine expansion, porté par le développement du secteur de la vente en ligne, les avancées technologiques et la demande croissante de solutions d'emballage sécurisées et de haute qualité. Les consommateurs japonais privilégient les emballages qui garantissent la sécurité des produits, améliorent l'expérience de déballage et s'inscrivent dans une démarche écoresponsable. Les distributeurs et les entreprises de logistique adoptent de plus en plus des matériaux protecteurs et légers pour répondre aux besoins des secteurs de l'électronique, de la mode et des produits de santé et de beauté. La demande croissante d'emballages pratiques et esthétiques contribue également à la croissance du marché.

Analyse du marché chinois des matériaux d'emballage pour le commerce électronique

Le marché chinois des matériaux d'emballage pour le e-commerce a représenté la plus grande part de revenus de la région Asie-Pacifique en 2025, grâce à l'essor du commerce en ligne, à l'expansion de la classe moyenne et à l'urbanisation rapide du pays. Les matériaux d'emballage assurant la protection des produits, permettant une livraison rapide et conformes aux normes de développement durable sont très demandés. Les solides capacités de production de la Chine, la disponibilité de solutions d'emballage abordables et les initiatives gouvernementales favorisant la logistique du e-commerce sont les principaux moteurs de ce marché. Cette croissance est également soutenue par l'adoption croissante de ces matériaux dans les secteurs de l'électronique, de l'agroalimentaire et de l'habillement, faisant de la Chine un acteur majeur de la région Asie-Pacifique.

Part de marché des matériaux d'emballage pour le commerce électronique

Le secteur des matériaux d'emballage pour le commerce électronique est principalement dominé par des entreprises bien établies, notamment :

- Berry Global Inc. (États-Unis)

- DS Smith Plc (Royaume-Uni)

- Ranpak Holdings Corp. (États-Unis)

- Pregis Corporation (États-Unis)

- Stora Enso Oyj (Finlande)

- Amcor Plc (Australie)

- Sealed Air Corporation (États-Unis)

- Groupe Mondi (Royaume-Uni)

- Georgia-Pacific LLC (États-Unis)

- Groupe Nefab AB (Suède)

- ProAmpac LLC (États-Unis)

- Cascades Inc. (Canada)

- Huhtamaki Oyj (Finlande)

- Coveris Holdings SA (Luxembourg)

- WestRock Company (États-Unis)

- Groupe Smurfit Kappa (Irlande)

- UFP Technologies, Inc. (États-Unis)

- International Paper Company (États-Unis)

- Sonoco Products Company (États-Unis)

- Avery Dennison Corporation (États-Unis)

Dernières évolutions du marché mondial des matériaux d'emballage pour le commerce électronique

- En novembre 2025, le groupe Hinojosa Packaging a finalisé l'acquisition d'ASV Packaging, spécialiste français des emballages pliants et autres solutions de conditionnement. Cette acquisition renforce considérablement la présence d'Hinojosa en Europe et lui permet d'élargir son offre aux emballages unitaires, aux plateaux et aux solutions d'emballage pour le e-commerce. L'intégration des compétences d'ASV permet à Hinojosa de proposer des services d'emballage complets aux distributeurs et aux prestataires logistiques, répondant ainsi à la demande croissante d'emballages durables et protecteurs sur le marché européen du e-commerce.

- En novembre 2025, Sealed Air, fournisseur mondial de premier plan de solutions d'emballage de protection telles que le film à bulles et les matériaux de calage, a été racheté par la société de capital-investissement CD&R pour 10,3 milliards de dollars américains. Cette acquisition permet à Sealed Air de sécuriser des investissements à long terme, d'accélérer l'innovation dans le domaine de l'emballage de protection et d'améliorer la fiabilité de l'approvisionnement des prestataires logistiques du e-commerce. Cette opération renforce la capacité de Sealed Air à répondre à la demande mondiale croissante de solutions de livraison sécurisées et sans dommages et favorise l'adoption de matériaux d'emballage performants et de pointe.

- En janvier 2025, DS Smith a lancé TailorTemp, une solution d'emballage entièrement recyclable à base de fibres pour les expéditions de produits thermosensibles. Cette innovation permet aux entreprises de commerce électronique et pharmaceutiques d'expédier des produits de la chaîne du froid sans recourir aux glacières en polystyrène traditionnelles, réduisant ainsi l'impact environnemental et renforçant leur engagement en matière de développement durable. Cette solution répond à la demande croissante des acteurs du secteur et des consommateurs pour des emballages écologiques tout en garantissant la sécurité des produits, positionnant ainsi DS Smith comme un leader des solutions d'emballage durables pour le commerce électronique.

- En 2025, DS Smith a lancé Tape Back et Lift Up, deux innovations visant à réduire l'utilisation du plastique dans les emballages e-commerce. Tape Back élimine les languettes d'ouverture en plastique à usage unique et facilite les retours, tandis que Lift Up remplace le film plastique rétractable des packs de boissons par du carton ondulé. Ces solutions sont déjà adoptées par des partenaires majeurs comme Coca-Cola HBC Austria, témoignant de la confiance du secteur dans les alternatives durables. Ces initiatives soutiennent les pratiques d'emballage de l'économie circulaire, réduisent l'impact environnemental et encouragent l'adoption généralisée des emballages à base de fibres dans les chaînes d'approvisionnement du e-commerce.

- En 2025, DS Smith a franchi une étape majeure en matière de développement durable en remplaçant plus de 1,2 milliard d'emballages plastiques dans l'ensemble de ses activités internationales. Cette performance illustre la tendance croissante du secteur vers des emballages réutilisables et à base de fibres pour le e-commerce et conforte le leadership de l'entreprise dans les solutions d'emballage durables. La réduction de l'utilisation du plastique répond aux exigences réglementaires et environnementales et aux attentes croissantes des consommateurs en matière de solutions de livraison écoresponsables, renforçant ainsi l'image de marque de DS Smith et de ses clients e-commerce.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.