Global Ethoxylates Market

Taille du marché en milliards USD

TCAC :

%

USD

21.78 Billion

USD

32.56 Billion

2024

2032

USD

21.78 Billion

USD

32.56 Billion

2024

2032

| 2025 –2032 | |

| USD 21.78 Billion | |

| USD 32.56 Billion | |

|

|

|

|

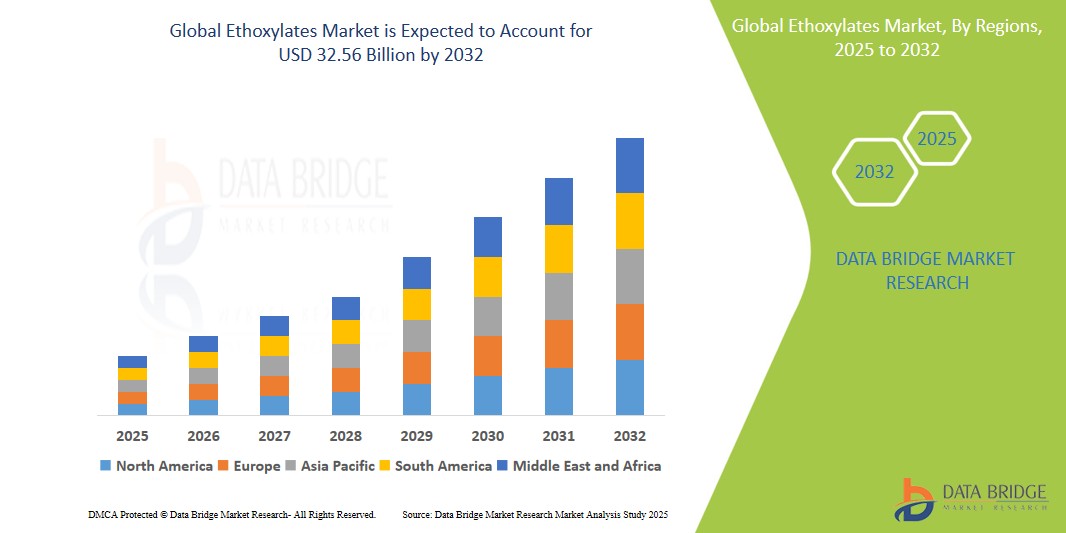

Global Ethoxylates Market, By Type (Alcohol Ethoxylates (AE), Fatty Amine Ethoxylates, Fatty Acid Ethoxylates, Methyl Ester Ethoxylates (MEE) and Glyceride Ethoxylates), End User Industry (Household and Personal Care, Pharmaceutical, Agrochemicals, Oilfields Chemicals and Others) - Industry Trends and Forecast to 2032

Ethoxylates Market Size

- The Global Ethoxylates Market was valued at USD 21.78 Billion in 2024 and is expected to reach USD 32.56 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.90%, primarily driven by the increasing demand for surfactants in household and industrial cleaning applications, personal care products, and pharmaceutical formulations

- This growth is further supported by expanding industrial and institutional sectors, rising urban population with improved living standards, and innovations in eco-friendly and biodegradable ethoxylate products

Ethoxylates Market Analysis

- Ethoxylates are widely utilized in detergents, emulsifiers, and dispersing agents due to their excellent solubility, low toxicity, and cost-effectiveness, making them essential in a variety of industries such as agriculture, textiles, and oil & gas

- The market is witnessing increased demand for alcohol ethoxylates and fatty acid ethoxylates, especially in non-ionic surfactants for household and personal care applications

- Key drivers include the rising emphasis on sustainable and green chemistry, regulatory support for biodegradable surfactants, and growing industrial use in formulations requiring effective emulsification and foaming properties

- Concerns over environmental impact, especially from non-biodegradable variants like nonylphenol ethoxylates (NPEs), and stringent regulations in developed regions, may pose challenges to market growth

Report Scope and Ethoxylates Market Segmentation

|

Attributes |

Ethoxylates Key Market Insights |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ethoxylates Market Trends

“Rising Demand for Eco-Friendly and High-Efficiency Surfactants”

- The global market is experiencing a notable shift toward sustainable, biodegradable, and low-toxicity ethoxylates as industries aim to meet tightening environmental regulations and cater to eco-conscious consumers

- Major players are investing in green chemistry innovations, such as bio-based alcohol ethoxylates derived from plant-based feedstocks, to replace traditional petrochemical-derived variants

- Technological advancements are also enabling the development of customized ethoxylate surfactants with enhanced emulsifying, dispersing, and wetting properties tailored for specific industrial and consumer applications

- For instance, BASF and Clariant have introduced renewable-based surfactants for use in personal care and cleaning products, which exhibit reduced environmental impact without compromising performance

- This trend underscores a broader move toward sustainable surfactant solutions, supported by consumer preferences, corporate ESG commitments, and government regulations across Europe, North America, and parts of Asia

Ethoxylates Market Dynamics

Driver

“Growing Consumption in Household and Industrial Cleaning Applications”

- A key growth driver is the expanding use of ethoxylates in household detergents, institutional cleaners, and industrial formulations, where they act as efficient emulsifiers and wetting agents

- The rise in urban populations, improved living standards, and growing hygiene awareness have significantly increased the demand for high-performance cleaning agents globally

- In addition, industrial growth in emerging economies is boosting the need for surface-active agents in food processing, textiles, and agrochemicals

- Companies like Unilever and Procter & Gamble are increasing their usage of alcohol ethoxylates in biodegradable formulations to align with sustainability goals and consumer expectations

- The widespread applicability and regulatory favorability of non-ionic surfactants are fueling consistent market expansion

Opportunity

“Expansion in Pharmaceutical and Personal Care Sectors”

- Ethoxylates are gaining traction in the pharmaceutical and personal care industries as solubilizers, emulsifiers, and stabilizers in products such as creams, ointments, shampoos, and drug delivery systems

- The rising global population, increased spending on healthcare and personal grooming, and product innovations are creating new growth avenues

- For instance, PEG (polyethylene glycol) ethoxylates are widely used in oral, topical, and injectable drug formulations due to their high safety profile and compatibility

- The shift toward mild and non-irritating ingredients in skincare and baby care products is also encouraging the use of gentle, non-ionic ethoxylates

- These developments represent significant opportunities for ethoxylate manufacturers to diversify their portfolios into high-margin, value-added applications

Restraint/Challenge

“Environmental Concerns and Regulatory Pressure on Nonylphenol Ethoxylates (NPEs)”

- A major challenge to market growth is the environmental impact of certain ethoxylates, particularly nonylphenol ethoxylates (NPEs), which are persistent and toxic in aquatic environments

- Regulatory bodies like the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have imposed restrictions or bans on NPEs, compelling industries to seek safer alternatives

- The transition to greener substitutes requires reformulation and incurs significant R&D and compliance costs

- In addition, raw material price volatility and supply chain constraints can impact production scalability and profitability

- These factors, combined with consumer scrutiny and increasing pressure for transparency, pose reputational and financial risks for companies still relying on legacy ethoxylate chemistries

Ethoxylates Market Scope

The market is segmented on the basis of product, raw material, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End User Industry |

|

Ethoxylates Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Ethoxylates Market

- Asia-Pacific is projected to register the highest growth rate in the Ethoxylates Market during the forecast period, owing to rising industrialization, expanding middle-class population, and rapid urban development

- China, India, Japan, and South Korea are key growth engines, supported by a booming consumer goods sector, increasing demand for agrochemicals, and high-volume manufacturing of cleaning and personal care products

- Government initiatives promoting Make-in-India, smart city development, and clean energy expansion further boost ethoxylate consumption across various industries

- The region also benefits from lower production costs, abundant raw materials, and rising R&D capabilities, attracting significant foreign direct investment in the chemical and surfactant space

- The growing awareness of eco-friendly surfactants and the push toward environmentally safe formulations are expected to reinforce regional growth momentum

Europe is Expected to be One of the Fastest Growing Regions in the Ethoxylates Market”

- Europe holds a significant share in the Global Ethoxylates Market due to its mature industrial base, strong environmental regulations, and demand from household, personal care, and industrial sectors

- Countries such as Germany, the U.K., France, and the Netherlands are major contributors, benefiting from the presence of leading chemical and surfactant manufacturers like BASF, Clariant, and Croda International

- Additionally, Europe’s shift towards circular economy practices and investments in sustainable home and personal care products are enhancing the consumption of greener ethoxylate alternatives

- Increased innovation in formulated surfactants and a focus on reducing carbon footprints continue to strengthen Europe’s position in the global market.

Ethoxylates Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE

- Clariant

- Nouryon

- Shell group of companies

- Sasol LTD

- Solvay

- Evonik Industries AG

- Arkema

- Akzo Nobel N.V.

- Dow

- DuPont.

- Huntsman International LLC

- SABIC

- India Glycols Limited.

- Mitsui Chemicals, Inc.

- Stepan Company

- INEOS AG

- J.C. Enterprises

- Nikko Chemicals Co., Ltd.

- VENUS ETHOXYETHERS PVT.LTD.

- Air Products Inc.

Latest Developments in Global Ethoxylates Market

- In August 2024, Shandong Longhua completed the integration of its Ethoxylates upgrading project, reaching a production capacity of 310,000 tons per year. This expansion supports the company's broader goal of achieving one million tons of polyether products, addressing rising demand in clean energy and construction sectors.

- In August 2024, BASF announced it would exclusively offer bio-based ethyl acrylate (EA) starting Q4 2024, phasing out fossil-based EA. This move aligns with its carbon reduction and sustainability goals.

- In July 2024, Clariant entered a partnership with OMV to reduce the carbon footprint of ethylene and ethylene oxide derivatives, both critical precursors for ethoxylates, strengthening the company’s position in low-carbon chemical production.

- In March 2024, Clariant introduced the Sapogenat T range, a replacement for banned nonylphenol ethoxylates (NPEs). The range includes non-ionic emulsifiers designed to enhance pesticide efficacy and environmental safety

- In January 2023, BASF launched a new line of eco-friendly ethoxylates, designed to deliver high-performance surfactant properties with reduced environmental impact, meeting demand from industries like home care, personal care, and I&I cleaning.

- In November 2021, Solvay launched a reactive waterborne emulsifier for solid epoxy resins, a key innovation addressing growing demand for sustainable and high-performance emulsifiers in coatings and adhesives.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.