Global Fall Protection Market

Taille du marché en milliards USD

TCAC :

%

USD

3.60 Billion

USD

6.66 Billion

2024

2032

USD

3.60 Billion

USD

6.66 Billion

2024

2032

| 2025 –2032 | |

| USD 3.60 Billion | |

| USD 6.66 Billion | |

|

|

|

|

Global fall protection Market, By Type (Soft Goods, Hard Goods, Individual Protection, Collective Protection, Installed System, Access System, Rescue Kit, and Services), Product (Anchors and Connectors, Body Wear, Devices, and Other products), Industry (Mining, Construction, Oil, Gas, Energy And Utilities, Telecommunication, Agriculture, Transportation, Marine, Ship, building, and Others) - Industry Trends and Forecast to 2032.

Fall Protection Market Size

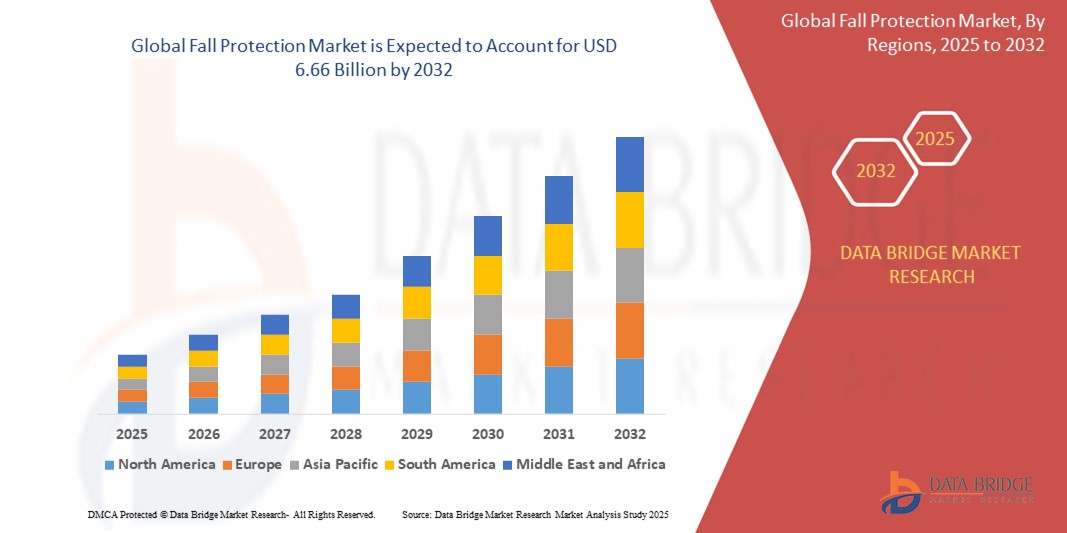

- The global fall protection market size was valued at USD 3.60 billion in 2024 and is expected to reach USD 6.66 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is primarily driven by increasing workplace safety regulations, growing awareness of fall-related hazards, and the expansion of construction and industrial activities globally

- Rising demand for advanced, durable, and user-friendly fall protection systems, coupled with technological advancements in safety equipment, is further propelling market growth

Fall Protection Market Analysis

- Fall protection systems, including harnesses, guardrails, anchors, and rescue kits, are critical for ensuring worker safety in high-risk environments such as construction sites, oil rigs, and telecommunication towers

- The demand for fall protection is fueled by stringent occupational safety standards, rising construction activities, and increasing adoption of advanced safety solutions in emerging economies

- Asia-Pacific dominated the fall protection market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, large-scale infrastructure projects, and growing safety awareness in countries such as China, India, and Japan

- Europe is expected to be the fastest-growing region during the forecast period, propelled by stringent EU safety regulations, increasing investments in renewable energy projects, and a strong focus on workplace safety

- The soft goods segment dominated the largest market revenue share of 38.5% in 2024, driven by the widespread use of harnesses, lanyards, and belts due to their comfort, flexibility, and compliance with stringent safety standards

Report Scope and Fall Protection Market Segmentation

|

Attributes |

Fall Protection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fall Protection Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global fall protection market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing, offering deeper insights into equipment usage, worker behavior, and maintenance needs

- AI-powered fall protection systems facilitate proactive safety measures, identifying potential equipment failures or unsafe practices before they result in accidents

- For instances, companies are developing AI-driven platforms that analyze worker movements and environmental conditions to optimize safety protocols or provide real-time alerts for fall risks

- This trend enhances the effectiveness of fall protection systems, making them more appealing to industries such as construction, oil and gas, and manufacturing

- AI algorithms can analyze patterns in worker behavior, such as improper harness usage or frequent exposure to high-risk areas, to improve training and safety compliance

Fall Protection Market Dynamics

Driver

“Rising Demand for Advanced Safety Features”

- Increasing demand for enhanced workplace safety, driven by stringent regulations and growing awareness of fall-related risks, is a key driver for the global fall protection market

- Fall protection systems provide critical safety features, such as self-retracting lifelines, automatic fall detection, and rescue systems, ensuring worker safety at elevated heights

- Government mandates, particularly in regions such as Europe with strict occupational safety standards, are accelerating the adoption of advanced fall protection systems

- The proliferation of IoT and advancements in sensor technology enable real-time monitoring and faster response times, further supporting market growth

- Industries such as construction and energy are increasingly adopting integrated fall protection systems as standard or optional features to meet regulatory requirements and enhance worker safety

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The high initial investment required for advanced fall protection equipment, such as smart harnesses, IoT-enabled devices, and installation services, poses a significant barrier, particularly for small and medium-sized enterprises in emerging markets

- Retrofitting existing workplaces with fall protection systems can be complex and costly, limiting adoption in cost-sensitive regions

- Data security and privacy concerns are major challenges, as IoT-enabled fall protection systems collect sensitive data on worker movements and workplace conditions, raising risks of breaches or misuse

- The fragmented regulatory landscape across countries, with varying standards for data protection and workplace safety, complicates compliance for global manufacturers and service providers

- These factors may deter adoption, especially in regions with high cost sensitivity or stringent data privacy regulations

Fall Protection market Scope

The market is segmented on the basis of type, product, and industry.

- By Type

On the basis of type, the global fall protection market is segmented into soft goods, hard goods, individual protection, collective protection, installed system, access system, rescue kit, and services. The soft goods segment dominated the largest market revenue share of 38.5% in 2024, driven by the widespread use of harnesses, lanyards, and belts due to their comfort, flexibility, and compliance with stringent safety standards. These products are highly effective in reducing impact forces during falls, making them essential across multiple industries.

The services segment is expected to witness the fastest growth rate of 9.2% from 2025 to 2032, fueled by the increasing need for installation, inspection, maintenance, training, and certification of fall protection systems. As industries prioritize regulatory compliance and worker safety, demand for professional services to ensure optimal system performance is rising.

- By Product

On the basis of product, the global fall protection market is segmented into anchors and connectors, body wear, devices, and other products. The body wear segment dominated the market with a revenue share of 45.0% in 2024, primarily due to the critical role of harnesses and lanyards in individual fall protection. These products are widely adopted in high-risk environments such as construction and oil & gas, driven by their ergonomic designs and compliance with safety regulations.

The devices segment, including self-retracting lifelines (SRLs) and fall arrest systems, is anticipated to experience the fastest growth rate of 8.7% from 2025 to 2032. Advancements in SRL technology, such as impact indicators and quick-activating braking mechanisms, enhance safety and mobility, boosting adoption across industries such as construction and manufacturing.

- By Industry

On the basis of industry, the global fall protection market is segmented into mining, construction, oil & gas, energy and utilities, telecommunication, agriculture, transportation, marine and shipbuilding, and others. The construction industry held the largest market revenue share of 42.0% in 2024, driven by the high risk of falls at elevated heights and stringent safety regulations mandating the use of fall protection equipment such as guardrails, harnesses, and safety nets. The rise in global construction activities further fuels demand.

The energy and utilities segment is expected to witness the fastest growth rate of 9.5% from 2025 to 2032, propelled by the increasing adoption of fall protection solutions in renewable energy sectors, such as wind and solar power. Workers involved in maintenance and installation of wind turbines and solar panels require specialized equipment, driving market growth.

Fall Protection Market Regional Analysis

- Asia-Pacific dominated the fall protection market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, large-scale infrastructure projects, and growing safety awareness in countries such as China, India, and Japan

- Europe is expected to be the fastest-growing region during the forecast period, propelled by stringent EU safety regulations, increasing investments in renewable energy projects, and a strong focus on workplace safety

U.S. Fall Protection Market Insight

The U.S. fall protection market is expected to witness significant growth, fueled by strong demand in construction, oil & gas, and manufacturing. The market is driven by increasing awareness of workplace safety and regulatory mandates, such as OSHA 1910.140 and 1926.502, which require fall protection at heights above six feet. Consumer preference for advanced solutions such as self-retracting lifelines and smart wearables, combined with a trend toward customized safety gear, supports market expansion. Aftermarket demand and factory-installed systems further enhance growth.

Europe Fall Protection Market Insight

Europe is the fastest-growing region in the global fall protection market, driven by strict EU safety directives and a focus on advanced safety technologies. Countries such as Germany and the U.K. lead due to their emphasis on worker safety in construction, utilities, and manufacturing. The demand for soft goods, such as harnesses and lanyards, and collective protection systems, such as guardrails, is rising due to increasing infrastructure projects and regulatory compliance. Innovations in lightweight and ergonomic equipment further accelerate market growth.

U.K. Fall Protection Market Insight

The U.K. market for fall protection is expected to witness significant growth, driven by demand for enhanced worker safety and compliance with stringent regulations in construction and telecommunications. Consumers prioritize solutions that improve comfort, such as ergonomic harnesses, while meeting safety standards such as EN 363. The rise in urban infrastructure projects and growing awareness of fall-related hazards boost the adoption of advanced systems, including IoT-integrated wearables and rescue kits, in both OEM and aftermarket segments.

Germany Fall Protection Market Insight

Germany is expected to experience rapid growth in the fall protection market, attributed to its advanced industrial sector and strong focus on workplace safety and energy efficiency. German industries, particularly construction and manufacturing, prefer technologically advanced solutions such as smart harnesses and corrosion-resistant anchors for high-risk environments. The integration of fall protection in premium equipment and aftermarket solutions, coupled with regulatory compliance, supports sustained market growth.

Asia-Pacific Fall Protection Market Insight

The Asia-Pacific region dominates the global fall protection market, holding the largest share in 2024, driven by rapid industrialization and infrastructure development in countries such as China, India, and Japan. Increasing awareness of worker safety, coupled with stricter regulations, boosts demand for soft goods, hard goods, and services. The region’s growth is further fueled by the expansion of construction, oil & gas, and wind energy sectors, with a focus on advanced technologies such as IoT-enabled safety gear and lightweight materials.

Japan Fall Protection Market Insight

Japan’s fall protection market is expected to witness rapid growth due to strong consumer demand for high-quality, technologically advanced safety solutions that enhance worker comfort and compliance. The presence of major industrial players and the integration of fall protection systems in OEM equipment accelerate market penetration. Rising interest in aftermarket customization and the adoption of smart safety gear, such as sensor-equipped harnesses, further contribute to market growth.

China Fall Protection Market Insight

China holds the largest share of the Asia-Pacific fall protection market, propelled by rapid urbanization, increasing industrial activities, and growing awareness of workplace safety. The country’s expanding construction and energy sectors drive demand for fall protection solutions such as harnesses, anchors, and rescue kits. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, while government initiatives promoting safety standards support the adoption of advanced fall protection technologies.

Fall Protection Market Share

The fall protection industry is primarily led by well-established companies, including:

- Honeywell international Inc (U.S.)

- 3M (U.S.)

- MSA (U.S.)

- Guardian Fall (U.S.)

- Petzl. (France)

- W.W. Grainger Inc (U.S.)

- SKYLOTEC (Germany)

- Kee Safety, Inc (U.S.)

- FallTech (U.S.)

- Webb-Rite Safety (U.S.)

- Tritech Fall Protection Systems (Canada)

- Safewaze (U.S.)

- French Creek Production (U.S.)

- Gravitec Systems, Inc (U.S.)

What are the Recent Developments in Global Fall Protection Market?

- In March 2025, SureWerx acquired Reliance Fall Protection®, LLC, a U.S.-based leader in engineered fall protection systems, including horizontal lifelines, self-retracting lifelines, and anchorage solutions. This acquisition, finalized on March 26, enhances SureWerx’s global safety portfolio by complementing its existing FALL SAFE and PeakWorks brands. Reliance’s expertise in highly technical fall protection solutions strengthens SureWerx’s position as a comprehensive provider of advanced safety technologies for workers at height across industrial sectors

- In January 2025, 3M and its subsidiary Capital Safety launched a new generation of smart safety harnesses equipped with integrated sensors designed to monitor worker movement, posture, and environmental conditions in real time. These harnesses enhance job site safety by transmitting instant alerts to supervisors in the event of a fall, unusual motion, or hazardous exposure, enabling faster response and improved incident prevention. The innovation builds on 3M’s legacy of fall protection through its DBI-SALA® and Protecta® brands, reinforcing its leadership in connected safety solutions

- In December 2024, a major safety equipment supplier partnered with a leading wearable technology company to develop smart fall protection gear that integrates IoT and real-time monitoring. These next-generation wearables are designed to detect falls, monitor worker movement and environmental conditions, and automatically trigger emergency responses, significantly enhancing workplace safety. The collaboration reflects a growing trend toward connected safety solutions, where sensor-driven data enables faster incident response and proactive risk mitigation in high-risk environments

- In November 2024, Honeywell Safety Products expanded its global safety portfolio by acquiring a leading fall protection equipment provider, further strengthening its presence in the construction and industrial safety sectors. This strategic acquisition complements Honeywell’s existing offerings—such as COMBISAFE® edge protection systems, SkyReach anchors, and Safety Net Fans—and reinforces its commitment to delivering comprehensive, high-performance fall protection solutions. The move aligns with Honeywell’s broader mission to provide innovative, user-friendly, and regulation-compliant safety technologies across diverse work environments

- In July 2024, SureWerx® acquired FALL SAFE®, a Portugal-based leader in critical-use personal protective equipment (PPE) specializing in fall protection systems. This strategic move strengthens SureWerx’s global footprint—particularly in Europe—and enhances its portfolio with FALL SAFE’s advanced offerings, including harnesses, lifelines, descenders, and engineered anchorage solutions. FALL SAFE’s reputation for innovation and regulatory compliance complements SureWerx’s existing brands such as PeakWorks® and FALL SAFE® Training, reinforcing its position as a global leader in technical fall protection

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.