Global Hand Holes Market

Taille du marché en milliards USD

TCAC :

%

USD

1.37 Billion

USD

2.09 Billion

2024

2032

USD

1.37 Billion

USD

2.09 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 2.09 Billion | |

|

|

|

|

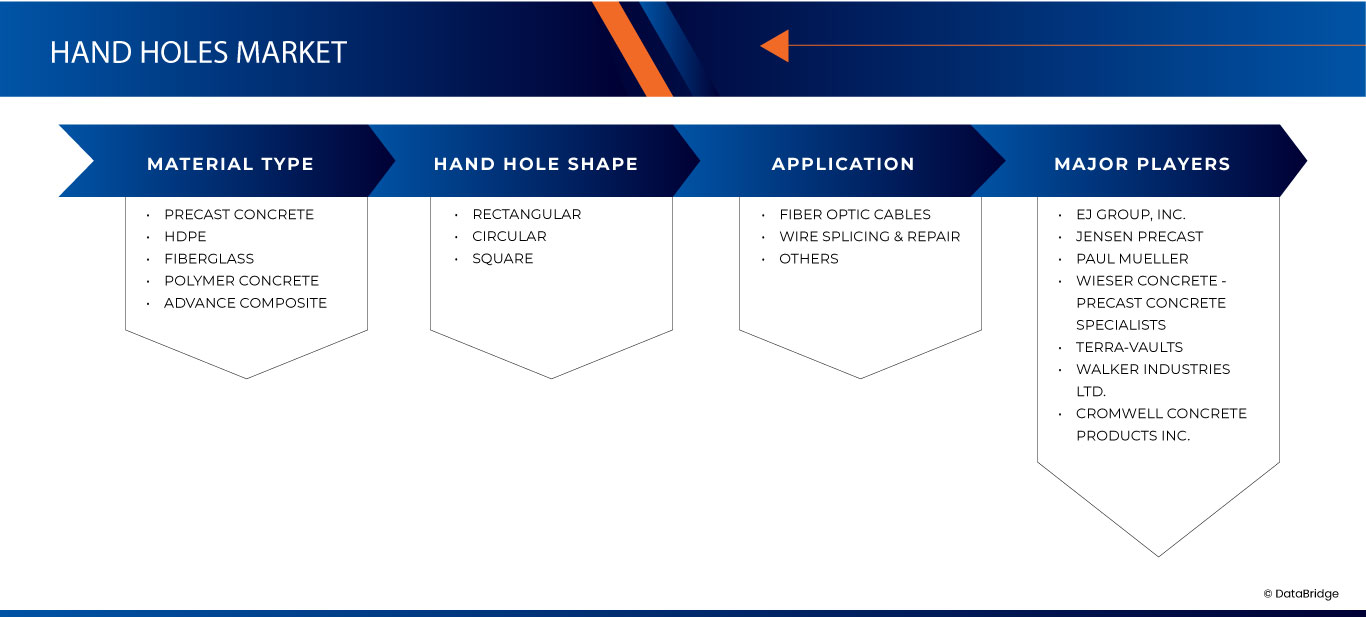

Global Hand Holes Market Segmentation, By Material Type (Precast Concrete, HDPE, Fiberglass, Polymer Concrete, and Advance Composite), Hand Holes Size (Rectangular, Circular, and Square), Application (Fiber Optic Cables, Wire Splicing & Repair, and Others) - Industry Trends and Forecast to 2032

Hand Holes Market Analysis

The global hand holes market has experienced steady growth driven by the increasing demand for efficient and reliable access to underground utility systems across various industries. The market offers a wide range of products, including hand holes made from durable materials such as polymer concrete and fiberglass, designed for telecommunications, electrical, and gas infrastructure. Key applications span across sectors such as construction, utilities, telecommunications, and infrastructure development. The rising focus on safety, regulatory compliance, and the need for long-lasting, easy-to-maintain solutions are driving market expansion. In addition, innovations in materials, customization options, and the adoption of advanced manufacturing technologies are shaping the future of the global hand holes market.

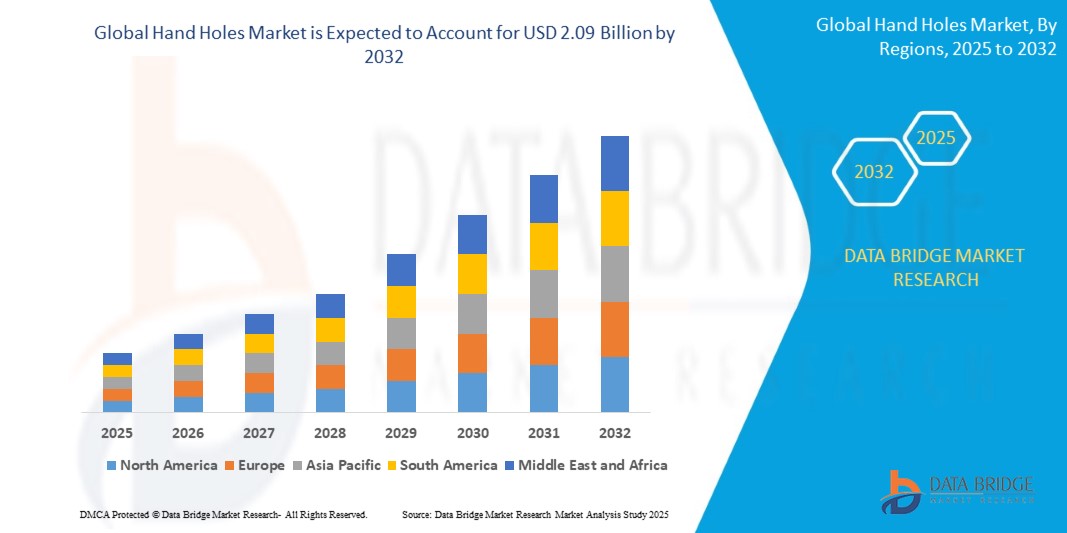

Hand Holes Market Size

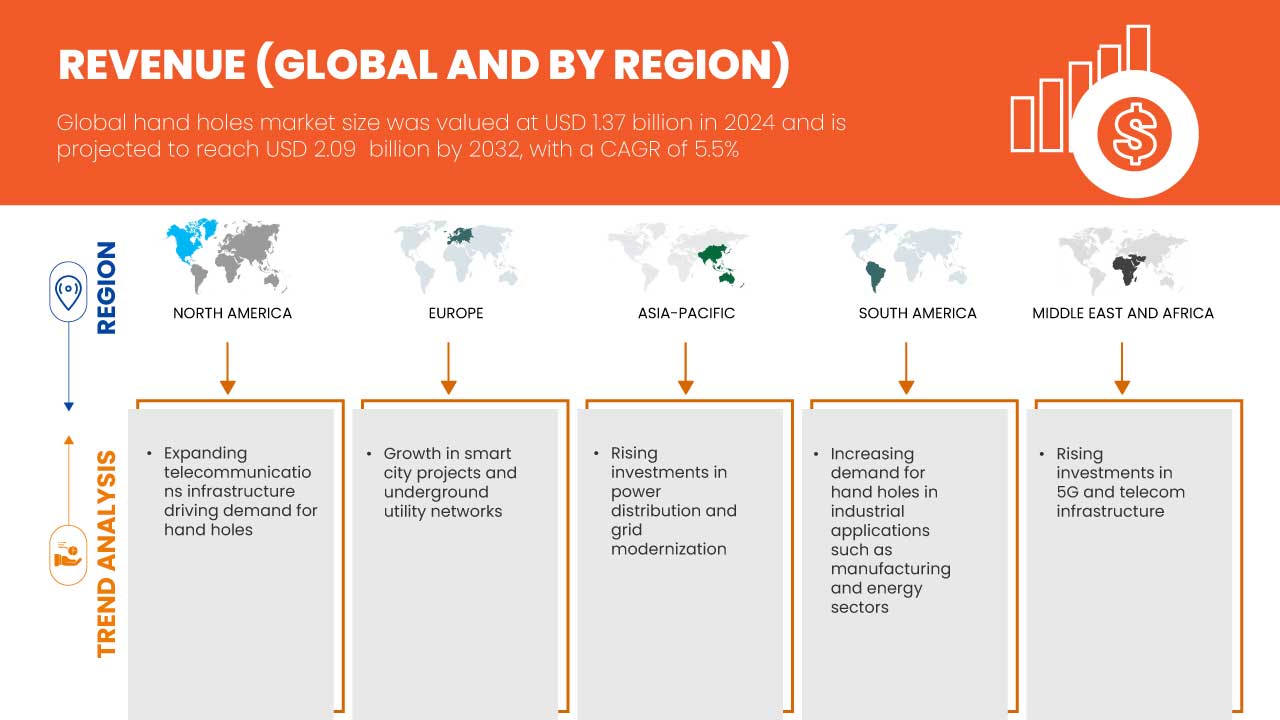

Global hand holes market size was valued at USD 1.37 billion in 2024 and is projected to reach USD 2.09 billion by 2032, with a CAGR of 5.5% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Hand Holes Market Trends

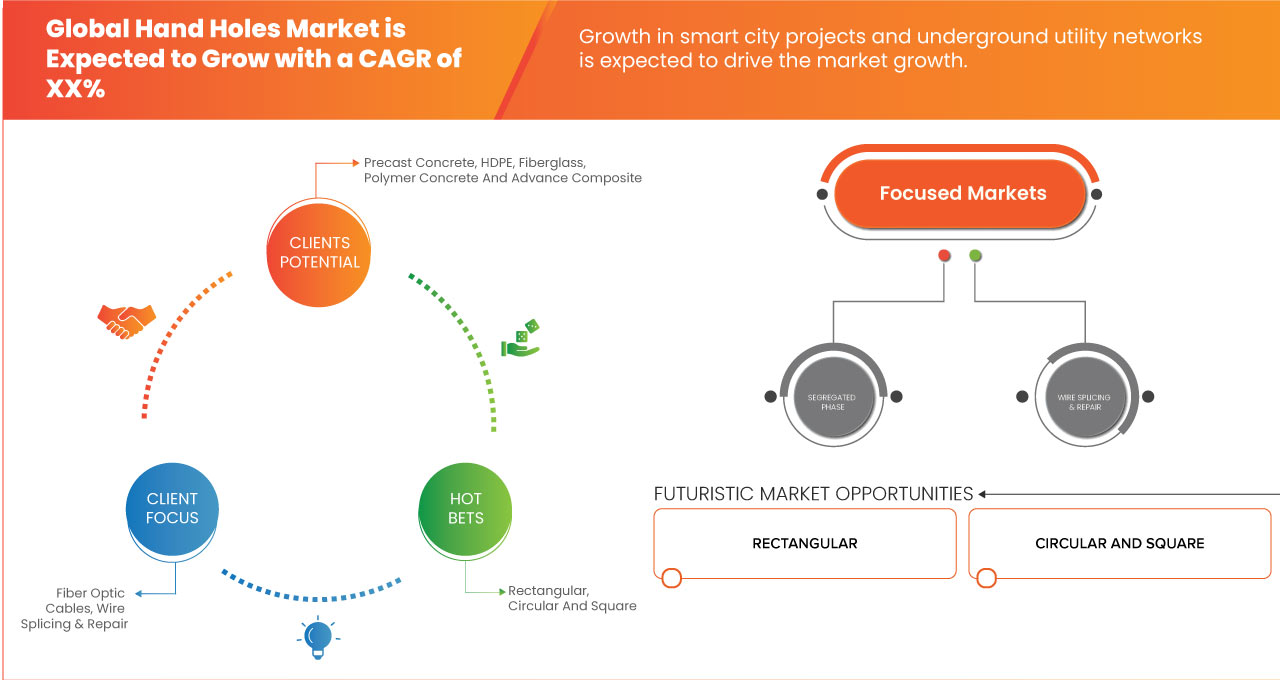

“Growth in Smart City Projects and Underground Utility Networks.”

The rapid expansion of smart city projects and underground utility networks is significantly driving the global hand holes market. Governments and urban planners worldwide are increasingly investing in smart infrastructure to enhance connectivity, sustainability, and efficient urban management. Smart cities rely on extensive underground utility networks, including fiber-optic cables, power lines, and water management systems, all of which require durable and accessible underground enclosures. Hand holes play a crucial role in these networks by providing safe and easy access to cables and junctions, ensuring efficient maintenance and long-term reliability. As cities integrate IoT-driven solutions, 5G networks, and automated utility systems, the demand for robust hand holes is set to rise.

Report Scope and Hand Holes Market Segmentation

|

Attributes |

Hand Holes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Switzerland, Belgium, Denmark , Sweden , Poland Rest of Europe, China , Japan, India, South Korea, Australia, Singapore, Indonesia, Thailand , Malaysia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

EJ Group, Inc. (U.S.), JENSEN PRECAST (U.S.), Paul Mueller (U.S.), Wieser Concrete - Precast Concrete Specialists (U.S.), Terra-Vaults (U.S.), A.C. MILLER (U.S.), UTILITY STRUCTURES INC. (U.S.), CONCAST INC. (U.S.), LOCKE SOLUTIONS (U.S.), UCP UTILITY CONCRETE PRODUCTS (U.S.), Walker Industries Ltd. (U.S.), CROMWELL CONCRETE PRODUCTS INC. (U.S.), ADVANCE CONCRETE PRODUCTS CO (U.S.), Crest Precast Concrete (U.S.), PRECAST CONCRETE STRUCTURES ASSOCIATION OF FLORIDA, INC. (U.S.), S&M Precast (U.S.), NovaLight Telecom Supply (U.S.), and Zibo Taiji Industrial Enamel Co., Ltd. (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Hand Holes Market Definition

The hand holes refer to small, access point structures made from durable materials, typically used in underground utility systems such as telecommunications, electrical, and gas infrastructure. These products provide secure, convenient entry to cables, wires, and other components for maintenance, inspection, or repair. Hand holes are widely utilized across various industries, including construction, telecommunications, and utilities, to ensure easy access to critical underground systems while maintaining safety and compliance with industry standards. They are essential for improving operational efficiency and ensuring the longevity and functionality of utility networks.

Hand Holes Market Dynamics

Drivers

- Expanding Telecommunications Infrastructure Driving Demand for Hand Holes

The expansion of telecommunications infrastructure, driven by increasing broadband penetration and 5G deployment, is significantly boosting the demand for hand holes in underground cable management. As network providers scale up fiber optic installations to support high-speed internet and data transmission, durable and efficient hand holes are essential for housing and protecting critical network components. Governments and private sector investments in smart cities, rural connectivity, and IoT-driven communication networks are further propelling the need for advanced underground enclosures that ensure seamless access and maintenance of telecom cables.

Moreover, the growing emphasis on network reliability and minimal service disruptions has led to the adoption of high-quality hand holes that offer enhanced durability, load-bearing capacity, and protection against environmental factors. The integration of modular and customizable hand hole solutions is becoming a preferred choice for telecom operators, enabling easy installation and scalability. As digital transformation accelerates globally, the demand for hand holes will continue to rise, supporting the expansion of robust and future-ready telecommunications infrastructure.

For instance,

In October 2024, according to the article published by Cision US Inc., HGC Global Communications reported strong business performance in 2024, driven by fiber broadband expansion, ICT solutions, and cybersecurity services. The company is enhancing telecommunications infrastructure in Hong Kong and emerging Asian markets, investing in fiber optic networks, data center interconnections, and rural connectivity. With HGC rolling out 1,500 km of fiber and installing 6,000+ access points, the demand for underground infrastructure is rising. As telecom operators worldwide expand broadband and 5G networks, the need for durable hand holes for cable management and scalability is expected to drive growth in the global hand holes market.

- Growth In Smart City Projects and Underground Utility Networks

The rapid expansion of smart city projects and underground utility networks is significantly driving the global hand holes market. Governments and urban planners worldwide are increasingly investing in smart infrastructure to enhance connectivity, sustainability, and efficient urban management. Smart cities rely on extensive underground utility networks, including fiber-optic cables, power lines, and water management systems, all of which require durable and accessible underground enclosures. Hand holes play a crucial role in these networks by providing safe and easy access to cables and junctions, ensuring efficient maintenance and long-term reliability. As cities integrate IoT-driven solutions, 5G networks, and automated utility systems, the demand for robust hand holes is set to rise.

Par ailleurs, les réseaux souterrains se développent dans les économies développées et émergentes afin de soutenir la croissance et la modernisation urbaines. Les pays privilégient le déploiement de réseaux de fibre optique, de réseaux électriques et de canalisations d'eau souterrains afin de réduire les perturbations en surface et d'améliorer la fiabilité des services essentiels. Cette évolution vers les infrastructures souterraines améliore non seulement l'esthétique des villes, mais minimise également les dommages causés par les facteurs environnementaux et les perturbations accidentelles. Par conséquent, l'adoption croissante des réseaux souterrains, associée aux initiatives de villes intelligentes, alimente une croissance soutenue du marché mondial des puits d'accès, en faisant un élément essentiel du développement urbain moderne.

Par exemple,

En juillet 2020, selon un article publié par Sterlite Power, l'entreprise a achevé le projet Gurugram Smart City Optical Fiber Intracity en partenariat avec GMDA, déployant un réseau de fibre optique 100 % souterrain pour améliorer la connectivité des bâtiments gouvernementaux, des entreprises et des services critiques tels que la sécurité, la surveillance et la gouvernance électronique. Cette initiative s'inscrit dans le développement mondial des villes intelligentes, soulignant la nécessité d'infrastructures numériques avancées. Alors que les villes du monde entier étendent leurs réseaux souterrains pour prendre en charge l'IoT, la 5G et la surveillance intelligente, la demande de boîtiers durables tels que les trous d'homme augmente, stimulant la croissance du marché mondial des trous d'homme.

- Augmentation des investissements dans la distribution d'électricité et la modernisation du réseau

L'augmentation des investissements dans la distribution d'électricité et la modernisation des réseaux stimule considérablement le marché mondial des puits de visite. Alors que les gouvernements et les entreprises de services publics se concentrent sur la modernisation des réseaux électriques vieillissants et l'intégration croissante des énergies renouvelables, la demande de boîtiers souterrains fiables pour les câbles électriques augmente. Les réseaux intelligents, qui nécessitent des systèmes avancés de gestion des câbles, s'appuient sur des puits de visite pour abriter les connexions électriques, garantir l'accessibilité pour la maintenance et améliorer la durabilité des réseaux souterrains. De plus, avec la transition vers les énergies renouvelables telles que le solaire et l'éolien, les nouveaux projets d'infrastructures de transport et de distribution augmentent encore le besoin de boîtiers souterrains robustes.

L'expansion des projets d'électrification, notamment dans les régions en développement, alimente également la demande de puits de visite dans les réseaux de distribution d'électricité. Les pays qui investissent dans l'électrification rurale et l'extension du réseau pour améliorer l'accès à l'énergie déploient de vastes systèmes de câblage souterrain, rendant les puits de visite durables essentiels à une gestion efficace de l'électricité. De plus, l'adoption de lignes de transport souterraines à haute tension en zone urbaine, visant à réduire l'encombrement visuel et à améliorer la sécurité, contribue à la croissance du marché. Avec la poursuite des efforts de modernisation, les puits de visite joueront un rôle crucial dans la sécurisation, l'organisation et la maintenance des réseaux de distribution d'électricité dans le monde entier.

Par exemple,

En janvier 2025, selon un article publié par Reuters, les investissements dans le réseau électrique américain explosent, la demande croissante d'électricité provenant des centres de données pilotés par l'IA et des projets d'énergie propre incitant les services publics et les entreprises privées à accroître leurs capacités de transport. Avec plus de 2,5 TW de projets d'énergie renouvelable en attente et une demande d'électricité prévue en hausse de 3 % par an, une modernisation à grande échelle des infrastructures est en cours. Cet intérêt croissant pour la distribution d'électricité et l'expansion du réseau accroît le besoin de réseaux souterrains, ce qui stimule la demande de puits de visite pour faciliter la gestion et la maintenance efficaces des câbles, alimentant ainsi la croissance du marché.

Opportunités

- Demande croissante de trous de main dans les applications industrielles telles que les secteurs de la fabrication et de l'énergie

La demande croissante de trous de visite dans les applications industrielles, notamment dans les secteurs de la fabrication et de l'énergie, représente une opportunité de croissance significative pour le marché mondial des trous de visite. À mesure que les industries développent leurs infrastructures pour prendre en charge l'automatisation, la communication de données et la distribution d'énergie, le besoin d'enceintes souterraines durables et accessibles augmente. Les trous de visite jouent un rôle crucial dans le logement des connexions électriques et de fibre optique, garantissant une gestion efficace du réseau et une maintenance aisée. Leur capacité à protéger les câblages critiques et à offrir un accès rapide pour les réparations les rend indispensables dans les environnements industriels où la disponibilité et la fiabilité sont primordiales.

Par ailleurs, la transition du secteur de l'énergie vers les réseaux intelligents et les énergies renouvelables favorise le déploiement de réseaux électriques et de communication souterrains. Les puits de visite facilitent l'installation et la maintenance des câbles souterrains pour les parcs éoliens, les centrales solaires et les installations de distribution d'électricité, soutenant ainsi la volonté du secteur de développer des infrastructures performantes et résilientes. Avec l'augmentation des investissements dans l'automatisation industrielle et les projets énergétiques, la demande de puits de visite de haute qualité devrait augmenter, créant ainsi de nouvelles opportunités pour les fabricants de développer des solutions innovantes, rentables et durables adaptées à ces secteurs.

Par exemple:

- En mai 2023, selon un article publié par HFCL, l'adoption généralisée de la fibre optique dans de nombreux secteurs, notamment les télécommunications, la santé, les transports, l'aérospatiale, les villes intelligentes et les services publics d'électricité, stimule la demande de transmission de données fiable et à haut débit. Le rôle crucial de la fibre optique dans la 5G, l'IoT et l'Industrie 4.0 incite à la croissance du besoin de boîtiers souterrains sécurisés. Cela représente une opportunité pour le marché mondial des trous d'homme, car ces boîtiers sont essentiels pour protéger les connexions par fibre optique dans les secteurs de la fabrication et de l'énergie, garantissant une connectivité fluide dans les usines intelligentes, les réseaux électriques et l'automatisation industrielle.

- Intégration croissante des systèmes intelligents de gestion des câbles pour une efficacité améliorée

The rising integration of smart cable management systems is transforming the Hand Holes market, enhancing efficiency, scalability, and operational reliability. As data centers expand to meet increasing digital demands, managing complex cabling networks becomes more challenging. Smart cable management solutions, equipped with real-time monitoring, automated tracking, and intelligent routing capabilities, enable data centers to reduce downtime, optimize airflow, and improve maintenance efficiency. These systems help identify cable faults, prevent overheating, and ensure proper organization, leading to enhanced performance and reduced operational costs.

Moreover, the adoption of AI-driven and IoT-enabled cable management solutions is further driving efficiency in data centers. These technologies provide predictive maintenance insights, remote troubleshooting, and automated cable adjustments, minimizing human intervention and enhancing sustainability. As businesses prioritize high-density cabling infrastructures and energy-efficient operations, the demand for advanced smart cable management solutions is expected to rise. This presents significant growth opportunities for structured cabling providers to develop innovative, automated, and scalable solutions tailored to modern data center needs.

For instance,

In June 2022, According to the article published by Sunbird Software, Inc., proper data center cabling management is crucial for efficiency, with structured cabling offering significant advantages over unstructured cabling. The article highlights best practices, industry standards, and key considerations such as cable labeling, airflow management, and the use of patch panels and DCIM software. The growing adoption of smart cable management systems, including advanced DCIM software, automated labeling, and intelligent monitoring, is creating new opportunities in the structured cabling market by improving efficiency, reducing downtime, and optimizing capacity planning. As data centers expand, real-time tracking, predictive maintenance, and seamless scalability will drive further demand for structured cabling integrated with smart technologies

- Rising Investments in 5G and Telecom Infrastructure

The rapid expansion of 5G and telecom infrastructure is driving significant opportunities in the global hand holes market. With increasing investments in fiber optic networks and small cell deployments, telecom providers require reliable underground access points for efficient cable management. Hand holes offer a secure and accessible solution for housing fiber optic cables, splicing points, and network components, ensuring seamless connectivity and reduced maintenance downtime. As governments and private firms accelerate their 5G rollout plans, the demand for durable and scalable hand hole solutions is expected to rise.

In addition, urbanization and smart city initiatives are fueling the need for advanced telecom infrastructure, where hand holes play a crucial role in underground network expansion. The growing emphasis on high-speed internet and IoT connectivity is further pushing telecom operators to invest in resilient underground cable management systems. This rising demand presents a lucrative opportunity for manufacturers to develop innovative, lightweight, and high-strength hand holes that cater to the evolving needs of 5G and next-generation telecom networks.

For instance:

- In December 2024, according to the article published by Business Standard, telecom operators in India, including Bharti Airtel and Vodafone Idea, are advocating for tariff hikes and reduced levies to recover their ₹70,000 crore investment in 5G infrastructure. While the price increase led to some subscriber losses, it remains crucial for long-term growth and enhanced digital services. Rising investments in 5G and telecom infrastructure also present a significant opportunity for the global hand holes market, as expanding fiber optic networks require durable underground enclosures to protect critical connections, ensure seamless data transmission, and enhance network reliability

Restraints

- Stringent Regulations and Standards for Underground Installations

Stringent regulations and standards for underground installations act as a restraint in the global hand holes market by creating barriers to entry and increasing the complexity of installation processes. Regulatory frameworks governing the design, installation, and maintenance of underground systems are often rigorous, particularly in urban and environmentally sensitive areas. These regulations mandate specific materials, structural designs, and installation methods, limiting the flexibility of manufacturers and increasing the time and cost associated with each project. As a result, compliance with these stringent standards can lead to delays in project timelines, increased operational costs, and limited product innovation in the market.

Moreover, the frequent changes in these regulatory standards, driven by evolving environmental concerns, safety requirements, and technological advancements, pose additional challenges. Companies in the hand holes market must continuously adapt to these changes, which can involve significant investment in R&D and redesign efforts. In some cases, the complexity of obtaining necessary permits and approvals for underground installations can also delay project execution and increase costs for developers. Consequently, these regulatory hurdles create a challenging environment for market growth and limit the ability of companies to scale operations efficiently.

For instance:

In October 2024, according to the article published by Central Lincoln PUD, the utility provider has outlined guidelines for obtaining temporary and permanent electrical service for commercial and non-residential structures, mandating underground installations for all new permanent services. These stringent regulations on meter base placement, clearance requirements, and trenching depths add complexity and compliance costs to underground infrastructure projects, potentially slowing down hand hole adoption and increasing project timelines for utility providers and contractors.

- High Installation and Maintenance Costs

High installation and maintenance costs present a significant restraint for the global hand holes market, limiting their widespread adoption in underground infrastructure projects. The installation process requires skilled labor, specialized equipment, and compliance with strict regulations, all of which drive up expenses. Excavation, conduit placement, and precise installation of hand holes add to the overall cost burden. In addition, the need for durable materials that can withstand environmental stress further increases the investment required for deployment. These high upfront costs make alternative cable management solutions, such as direct burying or aerial installations, more attractive in cost-sensitive markets.

Maintenance costs further compound this restraint, as underground hand holes require regular inspections, cleaning, and potential repairs to ensure long-term functionality. Environmental factors such as soil movement, water ingress, and accidental damage from construction activities can lead to costly maintenance and replacements. Advanced management technologies such as GIS mapping and remote monitoring help optimize maintenance efforts, but they require additional investments. As a result, infrastructure providers often seek cost-effective alternatives, reducing the demand for traditional hand holes in underground networks..

For instance:

According to the article published by FMUSER INTERNATIONAL GROUP LIMITED, the high costs of underground fiber optic cable installation—driven by expensive materials, labor-intensive processes, regulatory compliance, and ongoing maintenance—pose a major challenge for the global hand hole market. The article outlines key cost factors, including materials, labor, site preparation, and ancillary expenses, while also highlighting advanced methods such as GPR, cable locators, GIS mapping, and remote monitoring for efficient cable management. Due to the financial burden associated with underground installations, the adoption of hand holes is restricted, making cost-effective alternatives more appealing.

Challenges

- Compatibility Issues with Existing Underground Infrastructure

The integration of advanced hand hole materials, such as nanostitched composites, into existing underground infrastructure poses significant compatibility challenges. Many legacy telecom and utility networks were designed with traditional concrete or polymer-based hand holes, which may not align seamlessly with newer lightweight composite materials. Differences in structural dimensions, load-bearing capacities, and installation methods can create obstacles in adopting these advanced solutions without extensive modifications to existing underground networks.

In addition, varying regional standards and regulations for underground infrastructure further complicate the adoption of new hand hole materials. Municipal and utility providers may require rigorous testing and certification to ensure compatibility with existing conduit systems, soil conditions, and environmental factors. These challenges can lead to delays in approval processes, increased installation costs, and potential resistance from stakeholders accustomed to conventional materials.

For instance:

In February 2025, according to the article published by Times of India, the central government has instructed the UT administration to integrate shareable telecom and power ducts into all linear infrastructure projects to enhance digital connectivity and minimize disruptions from frequent road excavations for optical fiber cable (OFC) deployment. The new Right of Way (RoW) rules aim to streamline telecom network installations while preserving urban aesthetics. However, incorporating these shared ducts into existing underground infrastructure presents compatibility challenges for hand holes, as older systems may not be designed for such integration. Retrofitting hand hole enclosures to fit multi-utility ducts could lead to structural limitations, increased installation complexity, and higher costs.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Hand Holes Market Scope

The global hand holes market is segmented into three notable segments based on the material type, hand holes size, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material Type

- Béton préfabriqué

- Carré

- Rectangulaire

- Circulaire

- PEHD

- Carré

- Rectangulaire

- Circulaire

- Fibre de verre

- Carré

- Rectangulaire

- Circulaire

- béton polymère

- Carré

- Rectangulaire

- Circulaire

- Composite avancé

- Carré

- Rectangulaire

- Circulaire

Taille des trous pour les mains

- Rectangulaire

- Circulaire

- Carré

Application

- Câbles à fibres optiques

- Par type de matériau

- Béton préfabriqué

- béton polymère

- Fibre de verre

- PEHD

- Composite avancé

- Par type de matériau

- Épissure et réparation de fils

- Par type de matériau

- Béton préfabriqué

- béton polymère

- Fibre de verre

- PEHD

- Composite avancé

- Par type de matériau

- Autres

Analyse régionale du marché des trous de main

Le marché mondial des trous de main est segmenté en trois segments notables en fonction du pays, du type de matériau, de la taille des trous de main et de l'application, comme indiqué ci-dessus.

Les pays couverts sur le marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Russie, la Turquie, les Pays-Bas, la Suisse, la Belgique, le Danemark, la Suède, la Pologne, le reste de l'Europe, la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, Singapour, l'Indonésie, la Thaïlande, la Malaisie, les Philippines, le reste de l'Asie-Pacifique, l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique, le Brésil, l'Argentine et le reste de l'Amérique du Sud.

La région Asie-Pacifique devrait dominer le marché mondial des trous de visite en raison de la demande croissante de ces produits dans les applications industrielles, notamment dans les secteurs de la fabrication et de l'énergie. Cette région représente une opportunité de croissance significative pour ce marché. À mesure que les industries développent leurs infrastructures pour prendre en charge l'automatisation, la communication de données et la distribution d'énergie, le besoin d'enceintes souterraines durables et accessibles augmente. De plus, l'accent mis par la région Asie-Pacifique sur l'intégration croissante de systèmes intelligents de gestion des câbles transforme le marché des trous de visite, améliorant ainsi l'efficacité, l'évolutivité et la fiabilité opérationnelle. À mesure que les centres de données se développent pour répondre aux exigences numériques croissantes, la gestion de réseaux de câblage complexes devient plus complexe.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions réglementaires nationales qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte ou de la faible concurrence des marques locales et nationales, l'impact des tarifs douaniers nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Part de marché des trous de main

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché des trous de main opérant sur le marché sont :

- EJ Group, Inc. (États-Unis)

- JENSEN PRECAST (États-Unis)

- Paul Mueller (États-Unis)

- Wieser Concrete - Spécialistes du béton préfabriqué (États-Unis)

- Terra-Vaults (États-Unis)

- AC MILLER (États-Unis)

- UTILITY STRUCTURES INC. (États-Unis)

- CONCAST INC. (États-Unis)

- LOCKE SOLUTIONS (États-Unis)

- PRODUITS DE BÉTON UTILITAIRES UCP (États-Unis)

- Walker Industries Ltd. Puunene, (États-Unis)

- CROMWELL CONCRETE PRODUCTS INC. (États-Unis)

- ADVANCE CONCRETE PRODUCTS CO (États-Unis)

- Crest en béton préfabriqué. (États-Unis)

- ASSOCIATION DES STRUCTURES PRÉFABRIQUÉES EN BÉTON DE FLORIDE, INC. (États-Unis)

- S&M Precast (États-Unis)

- NovaLight Telecom Supply (Géorgie)

- Zibo Taiji Industrial Enamel Co., Ltd (Chine)

Derniers développements sur le marché des trous de main

- En juillet 2024, EJ a acquis certains actifs du groupe Bremhove en Belgique, renforçant ainsi sa production et sa gamme de produits dans la région EMEA. L'acquisition de Fondatel Lecomte, Hermelock et Stora a également permis d'accueillir de nouveaux collaborateurs venus de Belgique, de France, de Pologne et de République tchèque.

- En mai 2024, EJ a acquis certains actifs d'American Foundry and Manufacturing Co., société fondée en 1888 et historiquement leader dans la fourniture de bornes d'incendie et de pièces détachées pour la ville de Saint-Louis, dans le Missouri. La production principale de bornes d'incendie a été transférée dans les installations d'EJ afin d'assurer un approvisionnement continu de la région de Saint-Louis.

- En mars 2024, Jensen Precast a acquis ProGlass Inc., un fabricant de produits en fibre de verre basé à Shelton, dans l'État de Washington. Cette acquisition a élargi l'offre de produits de Jensen pour le marché des services publics d'électricité, notamment les couvercles de coffres, les plaques de transformateur et les boîtiers de boucle.

- En mars 2024, Hole Products, fabricant d'outillage et de consommables de forage, et Rig Source, fournisseur d'appareils de forage et d'équipements de soutien, ont annoncé un partenariat stratégique. Cette collaboration vise à offrir des solutions intégrées aux foreurs, améliorant ainsi le service client et l'offre de produits.

- En avril 2021, Wieser Concrete a fièrement annoncé l'acquisition de Minnesota Precast Industries à Rosemount, dans le Minnesota. Cette transition a marqué la fin d'une époque pour Brett Twining, qui avait dirigé Minnesota Precast pendant des décennies et s'était forgé une réputation d'excellence en matière de service client. Cette acquisition a élargi l'offre de Wieser, notamment en proposant des fosses septiques de grande capacité (jusqu'à 160 000 litres), ainsi qu'une variété de produits pour les secteurs agricole, routier, commercial et souterrain.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HAND HOLES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 REGULATORY STANDARDS

4.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.4.1 MARKET PENETRATION

4.4.2 KEY DRIVERS

4.4.3 MARKET PENETRATION

4.4.4 KEY DRIVERS

4.4.5 MARKET PENETRATION

4.4.6 KEY DRIVERS

4.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.6 COMPANY COMPETITIVE ANALYSIS

4.7 USE CASE AND ITS ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXPANDING TELECOMMUNICATIONS INFRASTRUCTURE DRIVING DEMAND FOR HAND HOLES

5.1.2 GROWTH IN SMART CITY PROJECTS AND UNDERGROUND UTILITY NETWORKS

5.1.3 RISING INVESTMENTS IN POWER DISTRIBUTION AND GRID MODERNIZATION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS AND STANDARDS FOR UNDERGROUND INSTALLATIONS

5.2.2 HIGH INSTALLATION AND MAINTENANCE COSTS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR HAND HOLES IN INDUSTRIAL APPLICATIONS SUCH AS MANUFACTURING AND ENERGY SECTORS

5.3.2 RISING INVESTMENTS IN 5G AND TELECOM INFRASTRUCTURE

5.3.3 GROWING EMPHASIS ON SUSTAINABLE AND LIGHTWEIGHT HAND HOLE MATERIALS

5.4 CHALLENGES

5.4.1 COMPATIBILITY ISSUES WITH EXISTING UNDERGROUND INFRASTRUCTURE

5.4.2 RISK OF WATER INGRESS AND CORROSION IN HARSH ENVIRONMENTS

6 GLOBAL HAND HOLES MARKET, BY MATERIAL TYPE

6.1 OVERVIEW

6.2 PRECAST CONCRETE

6.2.1 RECTANGULAR

6.2.2 CIRCULAR

6.2.3 SQUARE

6.3 HDPE

6.3.1 RECTANGULAR

6.3.2 CIRCULAR

6.3.3 SQUARE

6.4 FIBER GLASS

6.4.1 RECTANGULAR

6.4.2 CIRCULAR

6.4.3 SQUARE

6.5 POLYMER CONCRETE

6.5.1 RECTANGULAR

6.5.2 CIRCULAR

6.5.3 SQUARE

6.6 ADVANCE COMPOSITE

6.6.1 ADVANCE CONCRETE

6.6.1.1 RECTANGULAR

6.6.1.2 CIRCULAR

6.6.1.3 SQUARE

7 GLOBAL HAND HOLES MARKET, BY HAND HOLE SIZE

7.1 OVERVIEW

7.2 RECTANGULAR

7.3 CIRCULAR

7.4 SQUARE

8 GLOBAL HAND HOLES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 FIBER OPTIC CABLES

8.2.1 PRECAST CONCRETE

8.2.2 HDPE

8.2.3 FIBERGLASS

8.2.4 POLYMER CONCRETE

8.2.5 ADVANCE COMPOSITE

8.3 WIRE SPLICING & REPAIR

8.3.1 PRECAST CONCRETE

8.3.2 HDPE

8.3.3 FIBERGLASS

8.3.4 POLYMER CONCRETE

8.3.5 ADVANCE COMPOSITE

8.4 OTHERS

9 GLOBAL HAND HOLES MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 JAPAN

9.2.3 INDIA

9.2.4 SOUTH KOREA

9.2.5 AUSTRALIA

9.2.6 SINGAPORE

9.2.7 INDONESIA

9.2.8 THAILAND

9.2.9 MALAYSIA

9.2.10 PHILIPPINES

9.2.11 REST OF ASIA PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S

9.3.2 CANADA

9.3.3 MEXICO

9.4 EUROPE

9.4.1 U.K

9.4.2 GERMANY

9.4.3 FRANCE

9.4.4 ITALY

9.4.5 SPAIN

9.4.6 RUSSIA

9.4.7 TURKEY

9.4.8 BELGIUM

9.4.9 POLAND

9.4.10 NETHERLANDS

9.4.11 SWEDEN

9.4.12 SWITZERLAND

9.4.13 DENMARK

9.4.14 REST OF EUROPE

9.5 MIDDLE EAST AND AFRICA

9.5.1 SAUDI ARABIA

9.5.2 U.A.E

9.5.3 SOUTH AFRICA

9.5.4 EGYPT

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL HAND HOLES MARKET COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 EJ GROUP INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 JENSEN ENTERPRISE INC

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT NEWS

12.3 PAUL MUELLER COMPANY

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 WIESER CONCRETE

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 TERRA-VAULTS

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 A.C. MILLER

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 ADVANCE CONCRETE PRODUCTS CO.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT NEWS

12.8 CONCAST INC

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 CREST PRECAST CONCRETE

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 CROMWELL CONCRETE PRODUCTS INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 LOCKE SOLUTIONS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT NEWS

12.12 NOVALIGHT TELECOM SUPPLY

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 PRECAST CONCRETE STRUCTURES ASSOCIATION OF FLORIDA, INC.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 S&M PRECAST

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 UTILITY CONCRETE PRODUCTS

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 UTILITY STRUCTURES INCORPORATED

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 WALKER INDUSTRIES, LTD.

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 ZIBO TAIJI INDUSTRIAL ENAMEL CO.,LTD

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY STANDARDS RELATED TO GLOBAL HAND HOLES MARKET

TABLE 2 USED CASE ANALYSIS

TABLE 3 DIFFERENCES BETWEEN UNDERGROUND, ABOVE GROUND, AND UNDERSEA FIBER OPTIC CABLES

TABLE 4 GLOBAL HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 6 GLOBAL PRECAST CONCRETE IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL HDPE IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL FIBERGLASS IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL POLYMER CONCRETE IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ADVANCE COMPOSITE IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL RECTANGULAR IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL CIRCULAR IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL SQUARE IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL FIBER OPTIC CABLES GLOBAL HAND HOLES MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 22 GLOBAL FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL OTHERS IN HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL HAND HOLES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC HAND HOLES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 30 ASIA-PACIFIC PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 CHINA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 CHINA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 41 CHINA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 CHINA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 CHINA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 CHINA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 CHINA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 CHINA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 47 CHINA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 CHINA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 CHINA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 JAPAN HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 JAPAN HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 52 JAPAN PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 JAPAN HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 JAPAN FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 JAPAN POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 JAPAN ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 JAPAN HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 58 JAPAN HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 JAPAN FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 JAPAN WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 INDIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 INDIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 63 INDIA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 INDIA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 INDIA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 INDIA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 INDIA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH KOREA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH KOREA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 74 SOUTH KOREA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH KOREA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH KOREA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH KOREA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH KOREA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH KOREA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH KOREA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH KOREA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH KOREA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 AUSTRALIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 AUSTRALIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 85 AUSTRALIA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 AUSTRALIA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 AUSTRALIA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 AUSTRALIA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 AUSTRALIA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 AUSTRALIA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 91 AUSTRALIA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 AUSTRALIA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 AUSTRALIA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SINGAPORE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SINGAPORE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 96 SINGAPORE PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SINGAPORE HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SINGAPORE FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SINGAPORE POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SINGAPORE ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SINGAPORE HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 102 SINGAPORE HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 SINGAPORE FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SINGAPORE WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDONESIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 INDONESIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 107 INDONESIA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 INDONESIA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 INDONESIA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 INDONESIA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 INDONESIA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 INDONESIA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 113 INDONESIA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 114 INDONESIA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDONESIA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 THAILAND HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 THAILAND HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 118 THAILAND PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 THAILAND HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 THAILAND FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 THAILAND POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 THAILAND FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 THAILAND WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 MALAYSIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MALAYSIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 129 MALAYSIA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MALAYSIA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MALAYSIA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MALAYSIA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MALAYSIA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 MALAYSIA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 135 MALAYSIA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 MALAYSIA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MALAYSIA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 PHILIPPINES HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 PHILIPPINES HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 140 PHILIPPINES PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 PHILIPPINES HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 PHILIPPINES FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 PHILIPPINES POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 PHILIPPINES ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 PHILIPPINES HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 146 PHILIPPINES HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 PHILIPPINES FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 PHILIPPINES WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 REST OF ASIA-PACIFIC HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORTH AMERICA HAND HOLES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 151 NORTH AMERICA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NORTH AMERICA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 153 NORTH AMERICA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 NORTH AMERICA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 NORTH AMERICA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 NORTH AMERICA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 NORTH AMERICA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 NORTH AMERICA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 159 NORTH AMERICA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 160 NORTH AMERICA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NORTH AMERICA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 164 U.S. PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 175 CANADA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 CANADA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 186 MEXICO PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MEXICO HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MEXICO WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 EUROPE HAND HOLES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 196 EUROPE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 EUROPE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 198 EUROPE PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 EUROPE HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 EUROPE FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 EUROPE POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 EUROPE ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 EUROPE HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 204 EUROPE HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 EUROPE FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 EUROPE WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 U.K. HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 U.K. HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 209 U.K. PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 U.K. HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 U.K. FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 U.K. POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 U.K. ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.K. HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 215 U.K. HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 216 U.K. FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.K. WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 GERMANY HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 GERMANY HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 220 GERMANY PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 GERMANY HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 GERMANY FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 GERMANY POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 GERMANY ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 GERMANY HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 226 GERMANY HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 GERMANY FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 GERMANY WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 FRANCE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 FRANCE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 231 FRANCE PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 FRANCE HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 FRANCE FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 FRANCE POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 FRANCE ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 FRANCE HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 237 FRANCE HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 238 FRANCE FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 FRANCE WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 ITALY HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 ITALY HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 242 ITALY PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 ITALY HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 ITALY FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 ITALY POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 ITALY ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 ITALY HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 248 ITALY HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 ITALY FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 ITALY WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SPAIN HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 SPAIN HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 253 SPAIN PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 SPAIN HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SPAIN FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SPAIN POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 SPAIN ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 SPAIN HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 259 SPAIN HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 260 SPAIN FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SPAIN WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 264 RUSSIA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 RUSSIA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 RUSSIA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 RUSSIA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 RUSSIA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 RUSSIA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 270 RUSSIA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 271 RUSSIA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 TURKEY HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 TURKEY HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 275 TURKEY PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 TURKEY HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 TURKEY FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 TURKEY POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 TURKEY ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 TURKEY HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 281 TURKEY HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 282 TURKEY FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 TURKEY WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 BELGIUM HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 BELGIUM HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 286 BELGIUM PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 BELGIUM HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 BELGIUM FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 BELGIUM POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 BELGIUM ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 BELGIUM HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 292 BELGIUM HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 293 BELGIUM FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 BELGIUM WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 POLAND HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 POLAND HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 297 POLAND PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 POLAND HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 POLAND FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 POLAND POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 POLAND ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 POLAND HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 303 POLAND HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 304 POLAND FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 POLAND WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 NETHERLANDS HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 NETHERLANDS HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 308 NETHERLANDS PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 NETHERLANDS HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 NETHERLANDS FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 NETHERLANDS POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 NETHERLANDS ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 NETHERLANDS HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 314 NETHERLANDS HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 NETHERLANDS FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 NETHERLANDS WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 SWEDEN HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 SWEDEN HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 319 SWEDEN PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SWEDEN HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SWEDEN FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 SWEDEN POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 SWEDEN ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 SWEDEN HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 325 SWEDEN HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 326 SWEDEN FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SWEDEN WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SWITZERLAND HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 SWITZERLAND HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 330 SWITZERLAND PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 SWITZERLAND HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 SWITZERLAND FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 SWITZERLAND POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 SWITZERLAND ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 SWITZERLAND HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 336 SWITZERLAND HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 337 SWITZERLAND FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 SWITZERLAND WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 DENMARK HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 DENMARK HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 341 DENMARK PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 DENMARK HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 DENMARK FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 DENMARK POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 DENMARK ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 DENMARK HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 347 DENMARK HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 348 DENMARK FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 DENMARK WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 REST OF EUROPE HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 MIDDLE EAST AND AFRICA HAND HOLES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 352 MIDDLE EAST AND AFRICA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 MIDDLE EAST AND AFRICA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 354 MIDDLE EAST AND AFRICA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 MIDDLE EAST AND AFRICA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 MIDDLE EAST AND AFRICA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 MIDDLE EAST AND AFRICA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 MIDDLE EAST AND AFRICA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 MIDDLE EAST AND AFRICA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 360 MIDDLE EAST AND AFRICA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 361 MIDDLE EAST AND AFRICA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 MIDDLE EAST AND AFRICA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SAUDI ARABIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 SAUDI ARABIA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 365 SAUDI ARABIA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 SAUDI ARABIA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 SAUDI ARABIA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 SAUDI ARABIA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SAUDI ARABIA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 SAUDI ARABIA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 371 SAUDI ARABIA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 372 SAUDI ARABIA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SAUDI ARABIA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 U.A.E HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 U.A.E HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 376 U.A.E PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 U.A.E HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 U.A.E FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 U.A.E POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 U.A.E ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 U.A.E HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 382 U.A.E HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 383 U.A.E FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 U.A.E WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 SOUTH AFRICA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 SOUTH AFRICA HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 387 SOUTH AFRICA PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 SOUTH AFRICA HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 SOUTH AFRICA FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 SOUTH AFRICA POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 SOUTH AFRICA ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 SOUTH AFRICA HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 393 SOUTH AFRICA HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 394 SOUTH AFRICA FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 SOUTH AFRICA WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 EGYPT HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 EGYPT HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 398 EGYPT PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 EGYPT HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 EGYPT FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 EGYPT POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 EGYPT ADVANCE COMPOSITE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 EGYPT HAND HOLES MARKET, BY HAND HOLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 404 EGYPT HAND HOLES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 405 EGYPT FIBER OPTIC CABLES IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 EGYPT WIRE SPLICING & REPAIR IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 ISRAEL HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 ISRAEL HAND HOLES MARKET, BY MATERIAL TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 409 ISRAEL PRECAST CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 ISRAEL HDPE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 ISRAEL FIBERGLASS IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 ISRAEL POLYMER CONCRETE IN HAND HOLES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)