Global Hypercholesterolemia Treatment Market

Taille du marché en milliards USD

TCAC :

%

USD

20.32 Billion

USD

67.55 Billion

2024

2032

USD

20.32 Billion

USD

67.55 Billion

2024

2032

| 2025 –2032 | |

| USD 20.32 Billion | |

| USD 67.55 Billion | |

|

|

|

|

Global Hypercholesterolemia Treatment Market Segmentation, By Treatment (Diagnosis, Medication, Physical Therapy, and Others), Drug Type (AEM-2802, AEM-2814, Alirocumab, Evinacumab, and Others), Route of Administration (Oral, Parenteral, and Others), End-Users (Hospitals, Homecare, Speciality Centres, and Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy) - Industry Trends and Forecast to 2032

Hypercholesterolemia Treatment Market Size

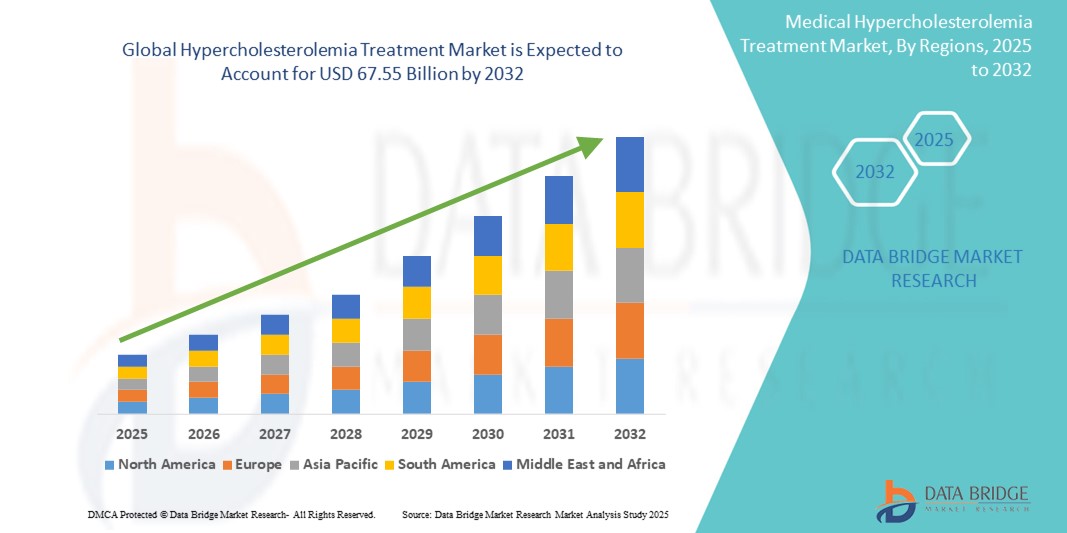

- The global hypercholesterolemia treatment market size was valued at USD 20.32 billion in 2024 and is expected to reach USD 67.55 billion by 2032, at a CAGR of 16.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases, sedentary lifestyles, and unhealthy dietary habits, which contribute significantly to rising cholesterol levels globally

- Furthermore, rising awareness about cholesterol management, coupled with the development of advanced lipid-lowering therapies such as PCSK9 inhibitors and RNA-based drugs, is establishing targeted cholesterol control as a key healthcare priority. These converging factors are accelerating the demand for hypercholesterolemia treatment options, thereby significantly boosting the industry's growth

Hypercholesterolemia Treatment Market Analysis

- Hypercholesterolemia treatments, encompassing statins, PCSK9 inhibitors, bile acid sequestrants, and emerging RNA-based therapies, are increasingly vital components of preventive cardiovascular care in both primary and specialty healthcare settings due to their proven efficacy in lowering LDL cholesterol and reducing cardiovascular risk

- The escalating demand for hypercholesterolemia treatments is primarily fueled by the global rise in cardiovascular diseases, aging populations, sedentary lifestyles, and increasing consumption of high-fat diets, all contributing to elevated cholesterol levels

- North America dominated the hypercholesterolemia treatment market with the largest revenue share of 42.5% in 2024, characterized by widespread screening programs, early diagnosis, advanced healthcare infrastructure, and the strong presence of major pharmaceutical companies, particularly in the U.S., which leads in the adoption of next-generation cholesterol-lowering drugs

- Asia-Pacific is expected to be the fastest growing region in the hypercholesterolemia treatment market during the forecast period due to increasing awareness of cardiovascular health, rising healthcare spending, and the expansion of healthcare access across emerging economies

- Medication segment dominated the Hypercholesterolemia treatment market with a market share of 74.8% in 2024, driven by its widespread use of statins and advanced lipid-lowering drugs offering proven efficacy and long-term cardiovascular risk reduction

Report Scope and Hypercholesterolemia Treatment Market Segmentation

|

Attributes |

Hypercholesterolemia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hypercholesterolemia Treatment Market Trends

“Advancements in Targeted Therapies and RNA-Based Drug Innovation”

- A significant and accelerating trend in the global hypercholesterolemia treatment market is the emergence of targeted therapies, including PCSK9 inhibitors and novel RNA-based drugs, which are revolutionizing cholesterol management, especially for patients unresponsive to traditional statins

- For instance, Leqvio (inclisiran), an siRNA-based drug approved in several countries, offers twice-yearly dosing to lower LDL cholesterol by targeting PCSK9 synthesis, thereby improving patient adherence and long-term outcomes. Similarly, therapies such as evinacumab, an ANGPTL3 inhibitor, provide promising options for rare genetic forms such as homozygous familial hypercholesterolemia

- These innovations not only offer new treatment options but also improve outcomes in high-risk populations, including statin-intolerant patients. Companies such as Novartis and Regeneron are at the forefront of developing such next-generation therapies with extended dosing intervals and improved safety profiles

- The integration of genetic profiling and biomarker-based diagnostics is also reshaping treatment personalization, allowing for more precise and effective cholesterol-lowering strategies tailored to individual risk factors

- This shift toward precision medicine and long-acting formulations is enhancing compliance, reducing cardiovascular events, and fundamentally altering how clinicians approach chronic lipid management

- As a result, the demand for advanced, targeted hypercholesterolemia therapies is rapidly growing across both developed and emerging markets, driven by better outcomes, simplified dosing, and improved quality of life for patients

Hypercholesterolemia Treatment Market Dynamics

Driver

“Rising Cardiovascular Disease Burden and Preventive Health Awareness”

- The global rise in cardiovascular diseases, driven by sedentary lifestyles, poor diets, obesity, and aging populations, is significantly increasing the demand for effective hypercholesterolemia treatments

- For instance, according to WHO, cardiovascular diseases remain the leading cause of death globally, and elevated LDL cholesterol is a major modifiable risk factor, prompting governments and healthcare systems to prioritize cholesterol screening and control initiatives

- Increased awareness campaigns, availability of cholesterol screening, and preventive health checkups are promoting early diagnosis and treatment initiation, particularly in urban and semi-urban areas

- The proven efficacy of lipid-lowering therapies in preventing major cardiovascular events such as heart attacks and strokes is driving adoption, especially among at-risk populations with comorbidities such as diabetes and hypertension

- Moreover, public and private payer support for high-cost therapies, especially in the U.S. and EU, is accelerating access to advanced treatments such as PCSK9 inhibitors and RNAi-based drugs. This growing emphasis on cardiovascular prevention is a powerful driver for sustained market growth

Restraint/Challenge

“High Cost of Advanced Therapies and Access Barriers in Low-Income Regions”

- Despite promising clinical outcomes, the high cost of newer therapies such as PCSK9 inhibitors and RNA-based drugs poses a significant barrier to widespread adoption, particularly in developing economies and among underinsured populations

- For instance, treatments such as alirocumab and inclisiran often come with annual costs that may not be affordable without insurance coverage or government reimbursement, limiting their reach to wealthier or insured patients

- In many low- and middle-income countries, access to cholesterol-lowering medications is still limited to generics such as statins, and even then, consistent availability can be a challenge due to supply chain issues and underfunded health systems

- In addition, limited physician awareness of advanced treatment protocols and inadequate screening programs in certain regions further delay diagnosis and appropriate intervention.

- Overcoming these barriers through pricing reforms, increased generic manufacturing, expanded screening efforts, and physician education will be essential to unlock the full global potential of hypercholesterolemia treatment solutions

Hypercholesterolemia Treatment Market Scope

The market is segmented on the basis of treatment, drug type, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the hypercholesterolemia treatment market is segmented into diagnosis, medication, physical therapy, and others. The medication segment dominated the market with the largest revenue share of 74.8% in 2024, driven by the extensive use of statins, PCSK9 inhibitors, and newer therapies such as inclisiran. These pharmaceutical solutions are highly effective in lowering LDL cholesterol and are widely prescribed as the primary treatment option for hypercholesterolemia. Easy availability, established clinical efficacy, and strong physician preference further support the dominance of this segment.

The diagnosis segment is expected to witness steady growth through 2032, fueled by increasing awareness of cardiovascular disease risks and the expansion of routine cholesterol screening programs, particularly in urban and developed regions.

- By Drug Type

On the basis of drug type, the market is segmented into AEM-2802, AEM-2814, alirocumab, evinacumab, and others. The alirocumab segment held the largest market share of 32.6% in 2024, owing to its proven efficacy in reducing LDL cholesterol levels in patients who are statin-intolerant or at high cardiovascular risk. The strong clinical profile, global approvals, and increasing use in specialty care have positioned it as a leading choice among PCSK9 inhibitors.

The evinacumab segment is projected to grow at the fastest CAGR during the forecast period, supported by its unique mechanism targeting ANGPTL3, making it a vital treatment for rare genetic forms of hypercholesterolemia such as HoFH.

- By Route Of Administration

On the basis of route of administration, the market is segmented into oral, parenteral, and others. The oral segment dominated the market with the highest revenue share of 69.1% in 2024, driven by the widespread use of statins and bile acid sequestrants, which are available in oral form. Oral administration ensures ease of use, improved patient compliance, and convenience for long-term therapy.

The parenteral segment is expected to grow significantly during forecast period, due to the increasing adoption of injectable PCSK9 inhibitors and RNA-based drugs offering long dosing intervals and high efficacy.

- By End User

On the basis of end-users, the market is segmented into hospitals, homecare, specialty centres, and others. The hospital segment accounted for the largest share of 45.7% in 2024, owing to the concentration of diagnostic services, prescription initiation, and advanced treatments being primarily provided through hospital networks. Patients with high cardiovascular risk are frequently managed through hospital-led care models, contributing to this segment’s dominance.

The homecare segment is anticipated to grow rapidly during forecast period, due to increasing availability of oral medications and remote patient monitoring technologies, improving long-term adherence and comfort.

- By Distribution Channel

On the basis of distribution channel, the hypercholesterolemia treatment market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The retail pharmacy segment led the market with a revenue share of 51.2% in 2024, driven by ease of access, wide availability of cholesterol-lowering drugs, and increased over-the-counter purchases in developed markets. Retail pharmacies continue to serve as the primary point of medication refill for chronic conditions.

The online pharmacy segment is expected to witness the fastest growth from 2025 to 2032 due to rising e-commerce penetration, especially in urban areas, and the convenience of home delivery for chronic care medications.

Hypercholesterolemia Treatment Market Regional Analysis

- North America dominated the hypercholesterolemia treatment market with the largest revenue share of 42.5% in 2024, characterized by widespread screening programs, early diagnosis, advanced healthcare infrastructure, and the strong presence of major pharmaceutical companies, particularly in the U.S., which leads in the adoption of next-generation cholesterol-lowering drugs

- Consumers in the region benefit from early diagnosis, routine screening programs, and broad insurance coverage that supports the adoption of both generic statins and premium therapies such as PCSK9 inhibitors

- This strong market position is further reinforced by ongoing R&D activities, a growing elderly population, and proactive government initiatives promoting preventive cardiovascular care, making North America a key driver of innovation and demand in the global market

U.S. Hypercholesterolemia Treatment Market Insight

The U.S. hypercholesterolemia treatment market captured the largest revenue share of 78.4% in 2024 within North America, fueled by the high prevalence of cardiovascular conditions and widespread access to both generic and advanced lipid-lowering therapies. The growing emphasis on preventive healthcare and regular cholesterol screening programs drives consistent demand. The market is further supported by substantial healthcare expenditure, strong reimbursement structures, and a robust pipeline of novel therapies such as PCSK9 inhibitors and RNA-based drugs, contributing to the continued expansion of the U.S. market.

Europe Hypercholesterolemia Treatment Market Insight

The Europe hypercholesterolemia treatment market is projected to expand at a steady CAGR throughout the forecast period, driven by aging demographics, increased cardiovascular disease burden, and rising awareness of preventive cholesterol management. Regulatory support for innovative therapies and expanded reimbursement for newer agents are encouraging adoption across the region. The market is experiencing significant growth across primary care and specialty cardiology, with statins remaining the cornerstone of treatment and newer agents gaining traction in high-risk patients.

U.K. Hypercholesterolemia Treatment Market Insight

The U.K. hypercholesterolemia treatment market is anticipated to grow at a robust CAGR during the forecast period, supported by well-established NHS screening programs and strong clinical focus on cardiovascular prevention. The adoption of advanced therapies, including PCSK9 inhibitors and inclisiran, is gaining pace, particularly among patients with statin intolerance or familial hypercholesterolemia. Public health campaigns and national guidelines continue to enhance diagnosis rates and encourage early intervention.

Germany Hypercholesterolemia Treatment Market Insight

The Germany hypercholesterolemia treatment market is expected to expand at a significant CAGR, driven by a high rate of diagnosis and structured chronic disease management programs. Germany's strong healthcare infrastructure and commitment to innovation support the early adoption of advanced lipid-lowering therapies. The integration of digital health tools and e-prescriptions is improving patient monitoring and medication adherence, further bolstering market growth across hospital and outpatient settings.

Asia-Pacific Hypercholesterolemia Treatment Market Insight

The Asia-Pacific hypercholesterolemia treatment market is poised to grow at the fastest CAGR the forecast period of 2025 to 2032, fueled by increasing urbanization, dietary shifts, and a rising burden of lifestyle-related diseases. Countries such as China, Japan, and India are witnessing higher diagnosis rates, supported by government-led health initiatives and expanding access to primary care. Growing affordability of statins and the entry of biosimilar PCSK9 inhibitors are expanding treatment reach to broader population segments.

Japan Hypercholesterolemia Treatment Market Insight

The Japan hypercholesterolemia treatment market is gaining momentum due to an aging population, increased cardiovascular risk, and a strong culture of regular health checkups. Widespread acceptance of statins, coupled with a growing focus on personalized medicine and advanced therapies such as inclisiran, is fueling market growth. In addition, the integration of AI-based diagnostic support tools and telemedicine platforms is enhancing early detection and patient management.

India Hypercholesterolemia Treatment Market Insight

The India hypercholesterolemia treatment market accounted for the largest revenue share in Asia Pacific in 2024, driven by rapid urbanization, rising middle-class income, and greater access to healthcare facilities. The market is expanding across both urban and rural regions due to growing awareness of cardiovascular health and the availability of low-cost statins. Government initiatives promoting preventive healthcare and increasing penetration of private health insurance are further supporting market expansion, particularly in Tier II and Tier III cities.

Hypercholesterolemia Treatment Market Share

The hypercholesterolemia treatment industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Merck & Co., Inc. (U.S.)

- Sanofi (France)

- Amgen Inc. (U.S.)

- AbbVie Inc. (U.S.)

- GSK plc (U.K.)

- Ionis Pharmaceuticals, Inc. (U.S.)

- Esperion Therapeutics, Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Lilly U.S.)

- Daiichi Sankyo Co., Ltd. (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Bristol Myers Squibb Company (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

What are the Recent Developments in Global Hypercholesterolemia Treatment Market?

- In May 2024, Novartis AG announced expanded global access to Leqvio (inclisiran), its RNA interference-based therapy for lowering LDL cholesterol, by entering into strategic pricing agreements with health ministries across Latin America and Asia. This move aims to improve availability in underserved regions while reinforcing Novartis’ leadership in next-generation lipid management solutions, particularly for patients with statin intolerance or familial hypercholesterolemia

- In March 2024, Regeneron Pharmaceuticals, Inc., in collaboration with Sanofi, released new real-world data on Praluent (alirocumab) demonstrating significant reductions in cardiovascular events in high-risk patients when used as an adjunct to statin therapy. The findings, presented at the American College of Cardiology Annual Meeting, highlight the long-term efficacy of PCSK9 inhibitors and support broader clinical adoption

- In February 2024, Ionis Pharmaceuticals, Inc. announced progress in its phase 3 trials for ION449, an investigational antisense therapy targeting PCSK9 mRNA. The therapy is designed to provide durable LDL-C reduction with infrequent dosing. This development underlines the industry's growing focus on RNA-based treatments with improved adherence and efficacy in chronic lipid control

- In January 2024, Esperion Therapeutics, Inc. received FDA approval for expanded indications of Nexletol (bempedoic acid) for primary prevention of cardiovascular disease in patients unable to tolerate statins. The approval marks a significant milestone for patients seeking alternative oral lipid-lowering therapies, reinforcing the company's commitment to addressing unmet needs in cholesterol management

- In December 2023, Amgen Inc. launched a global educational initiative in partnership with major cardiology associations to raise awareness about the importance of LDL-C reduction and early intervention. Focused on Asia-Pacific and Europe, the campaign promotes better screening and access to therapies such as Repatha (evolocumab), particularly among populations with familial hypercholesterolemia and a history of cardiovascular events

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.