Global Injectable Drug Delivery Market

Taille du marché en milliards USD

TCAC :

%

USD

24.97 Billion

USD

68.29 Billion

2024

2032

USD

24.97 Billion

USD

68.29 Billion

2024

2032

| 2025 –2032 | |

| USD 24.97 Billion | |

| USD 68.29 Billion | |

|

|

|

|

Global Injectable Drug Delivery Market Segmentation, By Type (Injectable Drug Delivery Devices and Injectable Drug Delivery Formulation), Formulation Packaging (Ampoules, Vials, Cartridges, and Bottles), Therapeutic Application (Autoimmune Diseases, Hormonal Disorders, Orphan Diseases, Cancer, and Others), Usage Pattern (Curative Care, Immunization, and Other), Site Of Administration (Skin, Circulatory/Musculoskeletal System, Organs, and Central Nervous System), Distribution Channel (Hospital and Retail Pharmacy Stores), End User (Hospitals and Clinics, Home Care Settings, and Others) - Industry Trends and Forecast to 2032

Injectable Drug Delivery Market Size

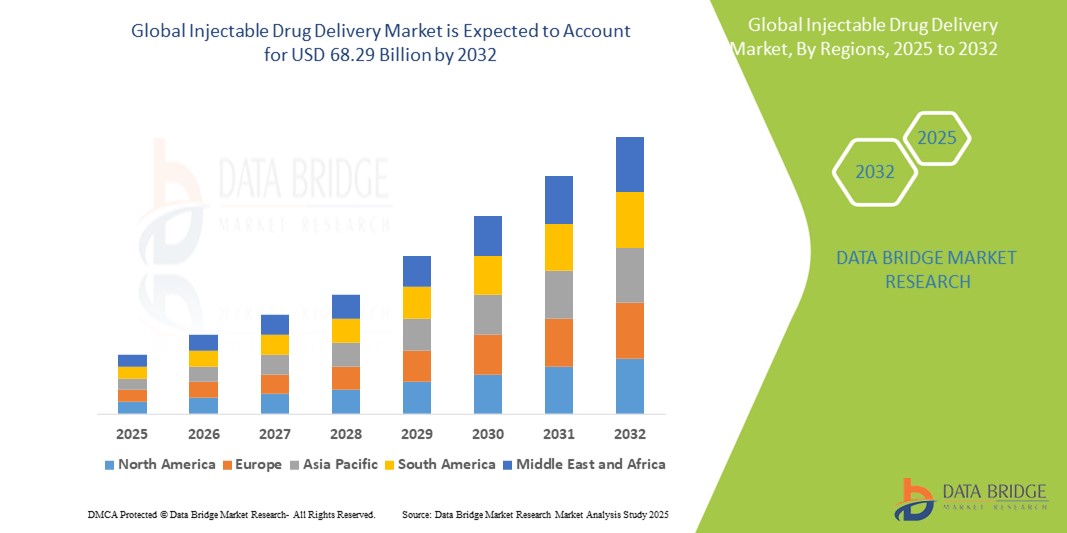

- The global injectable drug delivery market size was valued atUSD 24.97 billion in 2024and is expected to reachUSD 68.29 billion by 2032, at aCAGR of 13.40%during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic diseases, growing demand for self-administration and home healthcare, and ongoing technological advancements in drug delivery systems

Injectable Drug Delivery Market Analysis

- Injectable drug delivery systems are essential for administering medications directly into the body, ensuring rapid onset of action and improved bioavailability. They are widely used for the treatment of chronic conditions such as diabetes, cancer, autoimmune disorders, and hormonal imbalances

- The demand for injectable drug delivery systems is significantly driven by the rising prevalence of chronic diseases, increasing patient preference for minimally invasive treatment options, and the growing trend of home-based care

- North America is expected to dominate the injectable drug delivery market with a market share of 40.6%, due to the presence of advanced healthcare infrastructure, high adoption of biologics and biosimilars, and strong presence of key pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the injectable drug market during the forecast period due to rising healthcare expenditure, increasing awareness of chronic disease management, and growing demand for self-injection devices

- Injectable drug delivery formulation segment is expected to dominate the market with a market share of 58% due to the increasing prevalence of chronic diseases, increasing adaption of self-injection and the rising demand for biologics. Furthermore, innovations in formulation technologies such as long-acting injectables and depot formulations are enabling more convenient dosing schedules, further propelling market growth

Report Scope and Injectable Drug Delivery Market Segmentation

|

Attributes |

Injectable Drug Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Injectable Drug Delivery Market Trends

“Technological Advancements in Injectable Drug Delivery Systems”

- One prominent trend in the evolution of injectable drug delivery systems is the increasing integration of smart technologies such as auto-injectors and wearable devices that improve patient adherence and reduce the need for healthcare professional intervention

- These innovations enhance the accuracy and convenience of drug administration, enabling patients to self-administer treatments at home with ease, improving overall treatment outcomes

- For instance, modern auto-injectors and prefilled syringes with integrated safety features are becoming increasingly popular for managing chronic conditions such as diabetes and rheumatoid arthritis, enabling precise, hassle-free injections

- These advancements are transforming the injectable drug delivery landscape, driving the demand for more sophisticated, user-friendly devices that cater to both patients and healthcare providers

Injectable Drug Delivery Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases and Increasing Demand for Biologic Therapies”

- The increasing prevalence of chronic diseases such as diabetes, cancer, rheumatoid arthritis, and cardiovascular diseases is significantly driving the demand for injectable drug delivery systems

- As these diseases require long-term treatment, including biologics and other injectable therapies, the need for efficient, safe, and easy-to-use drug delivery systems is growing rapidly

- Furthermore, the rising demand for biologic drugs, which are typically administered via injection, is fueling the growth of the injectable drug delivery market

For instance,

- In January 2022, according to a report by the World Health Organization (WHO), the global prevalence of chronic diseases is steadily increasing, with more than 60% of deaths worldwide attributed to chronic conditions. This is contributing to the rising demand for injectable drug delivery systems to manage these diseases effectively

- As a result, the global demand for injectable drug delivery systems is rising, providing significant market opportunities for innovation and growth in this sector

Opportunity

“Integration of Smart Technologies and Wearable Devices in Injectable Drug Delivery”

- The growing integration of smart technologies such as wearable injectors, auto-injectors, and connected devices is revolutionizing the injectable drug delivery market by offering enhanced convenience and precision

- These technologies enable patients to self-administer treatments at home, improving medication adherence and reducing healthcare costs. Additionally, they allow for real-time monitoring and tracking of drug delivery, which improves treatment outcomes and provides valuable data for healthcare providers

For instance,

- In March 2025, a study published in the Journal of Medical Devices highlighted the success of connected auto-injectors in chronic disease management, such as diabetes, where devices can automatically adjust dosages based on continuous glucose monitoring, enhancing treatment personalization

- The integration of these smart technologies in injectable drug delivery systems provides significant opportunities for growth, especially as patients and healthcare providers seek more flexible and efficient solutions for managing chronic conditions

Restraint/Challenge

“Regulatory and Compliance Challenges in Injectable Drug Delivery”

- The injectable drug delivery market faces significant challenges due to stringent regulatory requirements and compliance hurdles, particularly in the approval and commercialization of new devices and therapies

- Regulatory bodies such as the FDA and EMA have complex approval processes that can delay the time-to-market for new injectable drug delivery systems, increasing development costs and limiting access to innovative solutions

- Additionally, manufacturers must ensure compliance with various international standards, such as Good Manufacturing Practice (GMP) and ISO certifications, which can be resource-intensive and costly

For instance,

- In January 2024, according to a report by Medical Device and Diagnostic Industry, one of the key barriers for new injectable devices entering the market is the lengthy FDA approval process. The average approval time for new drug delivery devices can take several years, slowing the pace at which life-saving technologies are made available to patients

- These regulatory challenges can lead to delays in product development, restrict market access for smaller players, and ultimately limit the growth potential of the injectable drug delivery market

Injectable Drug Delivery Market Scope

The market is segmented on the basis of type, formulation packaging, therapeutic application, usage pattern, site of administration, distribution channel, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Formulation Packaging |

|

|

By Therapeutic Application |

|

|

By Usage Pattern |

|

|

By Site of Administration |

|

|

By Distribution Channel

|

|

|

By End User |

|

In 2025, the injectable drug delivery formulation is projected to dominate the market with a largest share in type segment

The injectable drug delivery formulation segment is expected to dominate the injectable drug delivery market with the largest share of 58% in 2025 due to the increasing prevalence of chronic diseases, increasing adaption of self-injection and the rising demand for biologics. Furthermore, innovations in formulation technologies such as long-acting injectables and depot formulations are enabling more convenient dosing schedules, further propelling market growth

The autoimmune diseases is expected to account for the largest share during the forecast period in therapeutic application market

In 2025, the autoimmune diseases segment is expected to dominate the market with the largest market share of 43.4% due to the increasing prevalence of autoimmune disorders such as rheumatoid arthritis, lupus, and multiple sclerosis, requiring long-term treatment regimens that often involve biologics and other complex medications administered via injection

Injectable Drug Delivery Market Regional Analysis

“North America Holds the Largest Share in the Injectable Drug Delivery Market”

- North America dominates the injectable drug delivery market with a market share of 40.6%, driven by advanced healthcare infrastructure, a high rate of chronic disease prevalence, and the increasing demand for self-administered treatments

- The U.S. holds a significant share of over 30%, due to a rising number of patients requiring injectable medications, including insulin, biologics, and cancer therapies, coupled with the increasing adoption of advanced drug delivery systems

- The presence of major pharmaceutical companies, well-established reimbursement frameworks, and substantial investments in R&D further strengthen the market in this region

- Additionally, the growing preference for home care settings and the rise in the use of prefilled syringes, autoinjectors, and wearable injectors contribute to the expansion of the injectable drug delivery market in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Injectable Drug Delivery Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the injectable drug delivery market, driven by rapid advancements in healthcare infrastructure, increasing healthcare access, and rising demand for injectable biologics and vaccines

- Countries such as China, India, and Japan are emerging as key markets due to the growing incidence of chronic diseasessuch asdiabetes, cancer, and cardiovascular disorders, which require injectable drug therapies

- Japan, with its well-established healthcare system and advanced medical technologies, is a key market for injectable drug delivery devices. The country is witnessing a shift towards self-injection devices, particularly for chronic conditionssuch asdiabetes

- China and India, with their large populations and improving healthcare facilities, are seeing increased adoption of injectable drug delivery systems, spurred by government initiatives to improve healthcare access and affordability. These markets are also experiencing a growing presence of international pharmaceutical and medical device manufacturers, further contributing to market growth

Injectable Drug Delivery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AbbVie Inc. (U.S.)

- Becton, Dickinson and Company (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Johnson & Johnson (U.S.)

- Sanofi S.A. (France)

- Merck & Co., Inc. (U.S.)

- Baxter International Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Amgen Inc. (U.S.)

- Roche Holding AG (Switzerland)

- Stryker Corporation (U.S.)

- Medtronic plc (Ireland)

- Mylan N.V. (U.S.)

- Schott AG (Germany)

- Antares Pharma, Inc. (U.S.)

- Horizon Therapeutics (Ireland)

- B. Braun Melsungen AG (Germany)

- Gerresheimer AG (Germany)

- Cipla Ltd. (India)

Latest Developments in Global Injectable Drug Delivery Market

- In January 2024, Amneal Pharmaceuticals announced the successful launch of 39 new retail and injectable products throughout 2023, with 13 introduced in the fourth quarter alone. This strategic expansion highlights Amneal's dedication to diversifying its product portfolio and addressing the growing demand for innovative drug delivery solutions. The company's initiatives are aimed at providing healthcare providers and patients with a broader selection of therapeutic options, contributing to the continued growth and development of the global injectable drug delivery market

- In January 2024, Kindeva Drug Delivery announced the acquisition of Summit Biosciences, a leader in nasal drug development and manufacturing. This strategic acquisition strengthens Kindeva’s position in the nasal drug delivery segment, expanding its product portfolio and enhancing its capabilities in delivering innovative therapies. The move is designed to accelerate product development and address the increasing demand for effective nasal drug delivery solutions, contributing to the overall growth of the global injectable drug delivery market

- In July 2024, Schott AG launched new 10ml ready-to-use cartridges intended for the storage of medications targeting a range of diseases, including cancer, genetic disorders, metabolic conditions, cardiovascular diseases, and immunological disorders. These cartridges are designed to be compatible with Ypsomed's YpsoDose device, facilitating a pre-filled and pre-loaded system that enables easier self-administration by patients at home. This innovation aligns with the growing demand for convenient and efficient drug delivery solutions, further contributing to the expansion of the global injectable drug delivery market by enhancing patient convenience and supporting the shift towards home-based therapies

- In April 2024, Baxter announced the expansion of its product portfolio in the U.S., introducing five new injectable medications, including pre-filled syringes and ready-to-use intravenous solutions. These products are designed to meet unmet medical needs in critical areas such as anti-infective and anti-hypotensive treatments. This expansion underscores Baxter's commitment to advancing the injectable drug delivery market by providing healthcare providers with efficient, ready-to-use solutions that improve patient care and streamline treatment administration, supporting the overall growth of the global injectable drug delivery market

- In January 2022, West Pharmaceutical Services announced a strategic partnership with Corning to advance pharmaceutical injectable drug delivery systems. This collaboration combines the strengths of both companies in developing innovative solutions designed to ensure the safe and efficient administration of injectable medications. The partnership is expected to foster significant advancements in the pharmaceutical sector, enhancing patient outcomes and optimizing drug delivery processes, thereby contributing to the continued growth and innovation within the global injectable drug delivery market

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.