Global Legionella Testing Market

Taille du marché en milliards USD

TCAC :

%

USD

368.50 Billion

USD

711.40 Billion

2025

2033

USD

368.50 Billion

USD

711.40 Billion

2025

2033

| 2026 –2033 | |

| USD 368.50 Billion | |

| USD 711.40 Billion | |

|

|

|

|

Global Legionella Testing Market Segmentation, By Test Type (Culture Methods, UAT, Serology, DFA Test, Nucleic Acid-Based Detection, and PCR), Testing Method (Water Testing, and IVD Testing), Application (Clinical Testing Methods and Environmental Testing Methods), End-User (Hospitals & Clinics, and Diagnostic Laboratories) - Industry Trends and Forecast to 2033

Legionella Testing Market Size

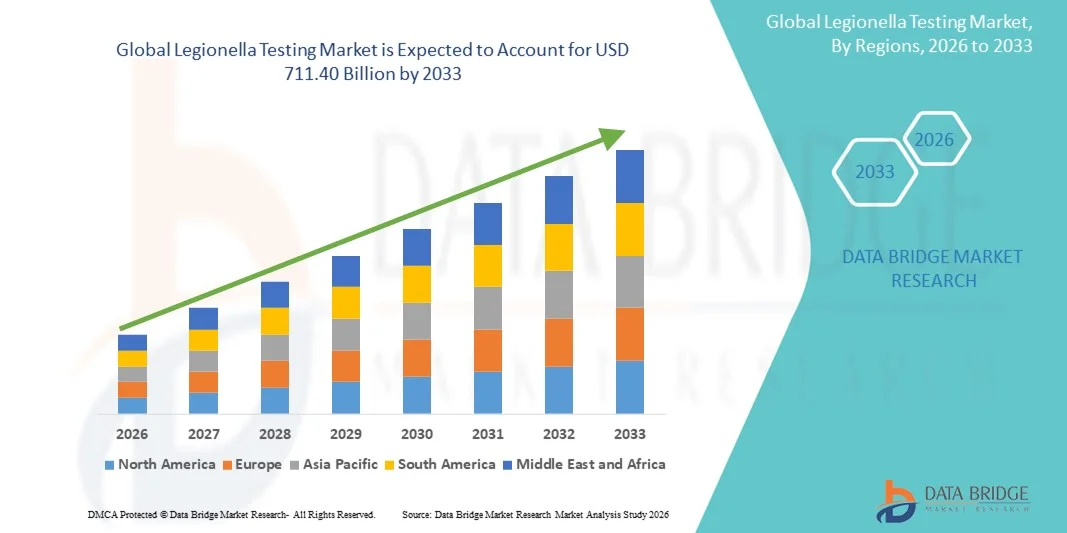

- The global legionella testing market size was valued at USD 368.50 billion in 2025 and is expected to reach USD 711.40 billion by 2033, at a CAGR of 8.57% during the forecast period

- The market growth is largely fueled by increasing awareness of waterborne diseases, stringent government regulations, and technological advancements in rapid and accurate Legionella detection methods, leading to greater adoption in commercial, industrial, and residential sectors

- Furthermore, rising concerns regarding public health and water safety, coupled with the demand for preventive monitoring and risk management solutions, are accelerating the uptake of Legionella Testing solutions, thereby significantly boosting the industry's growth

Legionella Testing Market Analysis

- Legionella Testing solutions, including rapid detection kits, culture-based methods, and PCR-based assays, are increasingly vital components of water safety management and public health monitoring in both residential, commercial, and industrial settings due to their ability to ensure early detection, prevent outbreaks, and maintain compliance with regulatory standards

- The escalating demand for legionella testing is primarily fueled by growing awareness of waterborne diseases, stringent government regulations, rising concerns regarding public health, and a preference for accurate, reliable, and timely monitoring solutions that can minimize risk and ensure safe water systems

- North America dominated the legionella testing market with the largest revenue share of 42% in 2025, characterized by advanced laboratory infrastructure, high adoption of routine water testing protocols, and the presence of key industry players. The U.S. contributed the majority of the regional share due to proactive public health policies, strong regulatory enforcement, and widespread use of automated and culture-based testing methods

- Asia-Pacific is expected to be the fastest growing region in the Legionella Testing market during the forecast period, registering a CAGR from 2026 to 2033, driven by rapid urbanization, increasing construction of commercial and healthcare facilities, government initiatives promoting water safety, and rising awareness of Legionnaires’ disease in countries such as China, India, and Japan

- The Environmental Testing Methods segment held the largest market revenue share of 49.2% in 2025, owing to widespread implementation in water management programs for hotels, hospitals, and industrial plants

Report Scope and Legionella Testing Market Segmentation

|

Attributes |

Legionella Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Roche Diagnostics (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Legionella Testing Market Trends

Rising Focus on Water Safety and Regulatory Compliance

- A key and accelerating trend in the global legionella testing market is the growing emphasis on water safety and regulatory compliance across residential, commercial, and industrial facilities. Governments and health agencies are increasingly mandating routine testing of water systems to prevent outbreaks of Legionnaires’ disease

- For instance, in 2023, the U.S. Centers for Disease Control and Prevention (CDC) updated its guidelines for water system monitoring in large buildings, encouraging more frequent Legionella testing and risk assessments

- The adoption of advanced testing kits and rapid detection methods is reshaping expectations for water quality monitoring. Facilities are investing in more precise and faster testing solutions to minimize health risks and regulatory penalties

- Facilities such as hospitals, hotels, and industrial complexes are now integrating routine Legionella monitoring into their standard operating procedures, highlighting a shift toward proactive risk management

- The increasing prevalence of aging plumbing systems in developed markets and the expansion of large-scale water infrastructure in emerging economies further drive adoption of reliable testing solutions

- These trends are fundamentally reshaping the Legionella Testing market, creating sustained demand for both consumables and analytical systems capable of rapid and accurate detection

- Companies such as IDEXX Laboratories and Bio-Rad are expanding their product portfolios with specialized Legionella testing kits to meet rising regulatory and health safety requirements

Legionella Testing Market Dynamics

Driver

Growing Need Due to Health Concerns and Industrial Safety Regulations

- The increasing prevalence of Legionnaires’ disease outbreaks and the associated public health risks is a significant driver for market growth. Awareness of the severe consequences of Legionella contamination is prompting organizations to adopt routine testing protocols

- For instance, in May 2024, Bio-Rad Laboratories launched a new rapid Legionella PCR assay designed for hospitals and water treatment facilities, enabling faster identification and mitigation of contamination risks

- Facilities are now prioritizing preventive testing measures, especially in high-risk environments such as hospitals, nursing homes, hotels, and large commercial buildings

- Government regulations, including OSHA standards and EU directives on water hygiene, mandate regular monitoring of water systems, further accelerating the market adoption of testing solutions

- The convenience of rapid on-site testing and automated monitoring systems also drives demand, allowing organizations to reduce downtime and respond quickly to contamination events

- Increased awareness campaigns and training initiatives are educating facility managers and public health officials on the importance of early detection, leading to higher testing frequency and broader adoption

- Overall, the rising focus on health and industrial safety creates a sustained, growing market for Legionella testing products and services

Restraint/Challenge

High Testing Costs and Technical Complexity

- Challenges associated with the relatively high cost of advanced Legionella testing kits and laboratory equipment can limit widespread adoption, particularly among small businesses and developing regions

- For instance, a municipal water facility in India reported that the cost of adopting a real-time PCR-based Legionella testing system was nearly 3–4 times higher than conventional culture-based methods, discouraging small-scale implementation

- Furthermore, technical complexity and the need for skilled laboratory personnel to conduct and interpret certain testing protocols may pose barriers, especially in regions with limited access to trained microbiologists

- The reliance on multiple reagents, calibration standards, and precise handling procedures increases operational costs and can impact testing consistency if staff are inadequately trained

- Despite cost reductions and simplifications in recent rapid detection technologies, budget constraints and infrastructural limitations continue to hinder adoption in some markets

- Addressing these challenges requires industry players to offer more cost-effective solutions, modular testing kits, and educational support for facility operators, ensuring reliability and regulatory compliance without imposing prohibitive costs

- Overcoming the cost and complexity barriers will be critical for enabling broader, sustained adoption of Legionella testing solutions across diverse global markets

Legionella Testing Market Scope

The market is segmented on the basis of test type, testing method, application, and end-user.

- By Test Type

On the basis of test type, the Legionella Testing market is segmented into Culture Methods, UAT, Serology, DFA Test, Nucleic Acid-Based Detection, and PCR. The Culture Methods segment dominated the largest market revenue share of 41.5% in 2025, owing to its status as the gold standard for Legionella detection and widespread acceptance across clinical and environmental laboratories. Culture methods provide reliable confirmation of viable bacteria in water systems, which is critical for compliance with regulatory standards. Hospitals, large hotels, and industrial facilities rely heavily on culture methods due to their accuracy, reproducibility, and ability to quantify bacterial load. In addition, the simplicity of routine culture kits and the familiarity among laboratory staff support continued adoption. Established providers like Bio-Rad and IDEXX Laboratories maintain strong distribution of culture-based kits globally. The segment benefits from standardized protocols recommended by WHO and CDC, reinforcing trust in results. Culture methods also allow long-term sample storage and retrospective analysis, valuable for epidemiological studies. Despite being relatively time-consuming, their reliability ensures they remain dominant across developed regions such as North America and Europe. Investments in water safety programs and building compliance initiatives further support market growth.

The PCR-based detection segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by the increasing demand for rapid, sensitive, and specific detection solutions in clinical diagnostics and environmental monitoring. PCR enables detection of low bacterial concentrations within hours, unlike traditional culture methods that take several days. Fast turnaround is particularly critical during outbreak investigations in hospitals and hotels. Advancements in multiplex PCR and real-time PCR assays have improved diagnostic accuracy and reduced contamination risks. Portable and automated PCR devices are increasingly adopted for on-site testing in industrial water systems. Regulatory approvals in multiple countries foster adoption in North America, Europe, and Asia-Pacific. Awareness of Legionnaires’ disease and technological innovations in nucleic acid-based testing further accelerate market expansion. The rising need for early outbreak detection in water systems and hospitals enhances the segment’s growth trajectory.

- By Testing Method

On the basis of testing method, the Legionella Testing market is segmented into Water Testing and IVD Testing. The Water Testing segment accounted for the largest market revenue share of 47.8% in 2025, driven by mandatory water system monitoring in hospitals, hotels, and commercial buildings. Organizations prioritize water testing due to regulations requiring proof of safety in potable water, cooling towers, and plumbing systems. Standardized testing protocols and routine maintenance schedules support consistent adoption. Water testing provides actionable results for preventive measures, helping facility managers mitigate contamination risks efficiently. Countries like the U.S., Germany, and Japan have stringent guidelines for Legionella testing in water, bolstering the market. Providers offer integrated water testing kits combining sample collection, culture, and rapid detection methods, enhancing convenience and reliability. Rising awareness of Legionella contamination in commercial buildings fuels adoption. Environmental regulations and government compliance programs also drive market demand.

The IVD Testing segment is expected to register the fastest CAGR of 19.8% from 2026 to 2033, propelled by the rising incidence of hospital-acquired Legionnaires’ disease and the need for rapid patient diagnosis. IVD solutions, including urinary antigen tests and serology kits, allow quick clinical diagnosis, enabling timely treatment and reducing mortality. Hospitals and diagnostic laboratories are increasingly integrating IVD testing into routine screening programs, particularly in immunocompromised patients. Automated ELISA and lateral flow devices further support adoption. Government health initiatives and rising awareness of early diagnosis drive segment growth.

- By Application

On the basis of application, the market is segmented into Clinical Testing Methods and Environmental Testing Methods. The Environmental Testing Methods segment held the largest market revenue share of 49.2% in 2025, owing to widespread implementation in water management programs for hotels, hospitals, and industrial plants. Environmental testing is crucial for outbreak prevention and compliance with local and international guidelines. The segment’s dominance is driven by mandatory building safety codes, rising litigation risks, and the expansion of commercial infrastructure in North America and Europe. Environmental testing provides preventive insights and actionable data to mitigate contamination in water systems. Providers increasingly offer bundled services including sampling, culture, and rapid testing. Countries with strict water safety regulations encourage continuous adoption. The segment also benefits from technological advancements in automated water testing equipment.

The Clinical Testing Methods segment is projected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by increasing awareness of early diagnosis and treatment of Legionnaires’ disease in hospitals and clinics. Rapid clinical assays, PCR-based detection, and point-of-care testing facilitate timely diagnosis and improve patient outcomes. Rising prevalence of nosocomial infections in aging populations across Europe, North America, and Asia-Pacific accelerates adoption. Hospitals are implementing routine Legionella screening protocols for high-risk patients. Advanced diagnostics improve patient care while reducing outbreak risks. Technological innovation, government regulations, and awareness campaigns boost segment growth.

- By End-User

On the basis of end-user, the Legionella Testing market is segmented into Hospitals & Clinics and Diagnostic Laboratories. The Diagnostic Laboratories segment dominated the largest revenue share of 52% in 2025, supported by high demand for outsourced Legionella testing services from commercial buildings, hotels, and municipal water systems. Laboratories offer specialized testing capabilities, including culture, PCR, and multiplex assays, providing accurate results to both healthcare and environmental clients. The segment benefits from established laboratory networks, accreditation programs, and partnerships with commercial clients. Large-scale laboratories in North America and Europe dominate this segment due to advanced capabilities.

The Hospitals & Clinics segment is expected to record the fastest CAGR of 21% from 2026 to 2033, fueled by increased testing frequency for immunocompromised and elderly patients. Hospitals are adopting rapid diagnostics and point-of-care solutions to reduce hospital-acquired infection rates. Rising awareness, technological advances, and health initiatives drive segment growth. The expansion of hospital infrastructure in emerging markets also contributes to higher adoption rates. In addition, partnerships with diagnostic service providers and integration of automated testing platforms are enhancing testing efficiency and accuracy. Growing investments in healthcare IT and laboratory information management systems further support the segment’s robust growth trajectory.

Legionella Testing Market Regional Analysis

- North America dominated the legionella testing market with the largest revenue share of 42% in 2025, characterized by advanced laboratory infrastructure, high adoption of routine water testing protocols, and the presence of key industry players

- The market contributed the majority of the regional share due to proactive public health policies, strong regulatory enforcement, and widespread use of automated and culture-based testing methods

- The region’s market growth is further supported by increasing awareness about Legionnaires’ disease, government-led monitoring programs, and investments in modern water safety management systems

U.S. Legionella Testing Market Insight

The U.S. legionella testing market captured the largest revenue share in 2025 within North America, driven by stringent federal and state regulations, routine inspections in healthcare and hospitality sectors, and rising demand for rapid detection technologies. The adoption of PCR-based and culture-based testing methods, coupled with growing awareness of Legionella prevention, significantly contributes to market expansion.

Europe Legionella Testing Market Insight

The Europe legionella testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily fueled by strict regulatory standards, mandatory water testing in public facilities, and rising investments in water safety infrastructure. Countries like Germany, France, and Italy are witnessing increased adoption of advanced detection technologies and preventive testing programs.

U.K. Legionella Testing Market Insight

The U.K. legionella testing market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by heightened public awareness, regulatory compliance requirements in healthcare and hospitality sectors, and adoption of automated testing systems for faster and more reliable results.

Germany Legionella Testing Market Insight

The Germany legionella testing market is expected to expand at a considerable CAGR during the forecast period, driven by robust water safety regulations, a high concentration of healthcare and industrial facilities, and increasing adoption of rapid diagnostic techniques for Legionella detection.

Asia-Pacific Legionella Testing Market Insight

The Asia-Pacific legionella testing market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, increasing construction of commercial and healthcare facilities, government initiatives promoting water safety, and rising awareness of Legionnaires’ disease in countries such as China, India, and Japan.

Japan Legionella Testing Market Insight

The Japan legionella testing market is gaining momentum due to growing awareness of Legionnaires’ disease, stringent government water safety regulations, and increasing adoption of automated and culture-based testing methods across commercial, healthcare, and municipal water systems.

China Legionella Testing Market Insight

The China legionella testing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expansion of commercial and healthcare infrastructure, rising public health awareness, and increased regulatory enforcement for water safety. The availability of cost-effective and advanced detection solutions from domestic and international suppliers is further propelling market growth.

Legionella Testing Market Share

The Legionella Testing industry is primarily led by well-established companies, including:

• Roche Diagnostics (Switzerland)

• Bio-Rad Laboratories (U.S.)

• Lonza Group (Switzerland)

• Merck KGaA (Germany)

• Charles River Laboratories (U.S.)

• Siemens Healthineers (Germany)

• PerkinElmer (U.S.)

• Biomerieux (France)

• Magle Life Sciences (Denmark)

• EnviroLogix (U.S.)

• ATCC (U.S.)

• Eurofins Scientific (Luxembourg)

• MDL (U.S.)

• Neogen Corporation (U.S.)

• Promega Corporation (U.S.)

• TCS Biosciences (U.K.)

• Hach Company (U.S.)

Latest Developments in Global Legionella Testing Market

- In June 2021, Phigenics launched a new diagnostic method, Next‑Day LegiPlex PCR, designed to detect Legionella serogroups and species in building water systems — enabling quicker detection compared with traditional culture-based methods

- In December 2021, Pace Analytical Services acquired Special Pathogens Laboratory — a leading lab for Legionella detection, remediation, and prevention — to strengthen its specialty‑contaminant testing and regulatory‑compliance services

- In September 2024, LuminUltra Technologies acquired the Legionella‑testing assets of Genomadix Inc., including a portable qPCR platform (the “Cube™”) capable of detecting Legionella in under an hour — expanding rapid, on‑site testing capabilities

- In September 2024, Pace Analytical Services also established a “National Center of Excellence for Legionella Testing and Consulting” in Pittsburgh, U.S., aiming to offer specialized testing, outbreak response and consulting services — indicating rising demand and institutional commitment to Legionella monitoring

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.