Global Medical Device Clinical Investigation Advisory Solutions Market

Taille du marché en milliards USD

TCAC :

%

USD

186.21 Million

USD

446.13 Million

2025

2033

USD

186.21 Million

USD

446.13 Million

2025

2033

| 2026 –2033 | |

| USD 186.21 Million | |

| USD 446.13 Million | |

|

|

|

|

Segmentation du marché mondial des solutions de conseil en matière d'investigations cliniques pour les dispositifs médicaux, par type de service (conseil réglementaire et gestion des essais cliniques), utilisateur final (entreprises de dispositifs médicaux et organismes de recherche sous contrat (CRO)) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des solutions de conseil en investigation clinique pour dispositifs médicaux

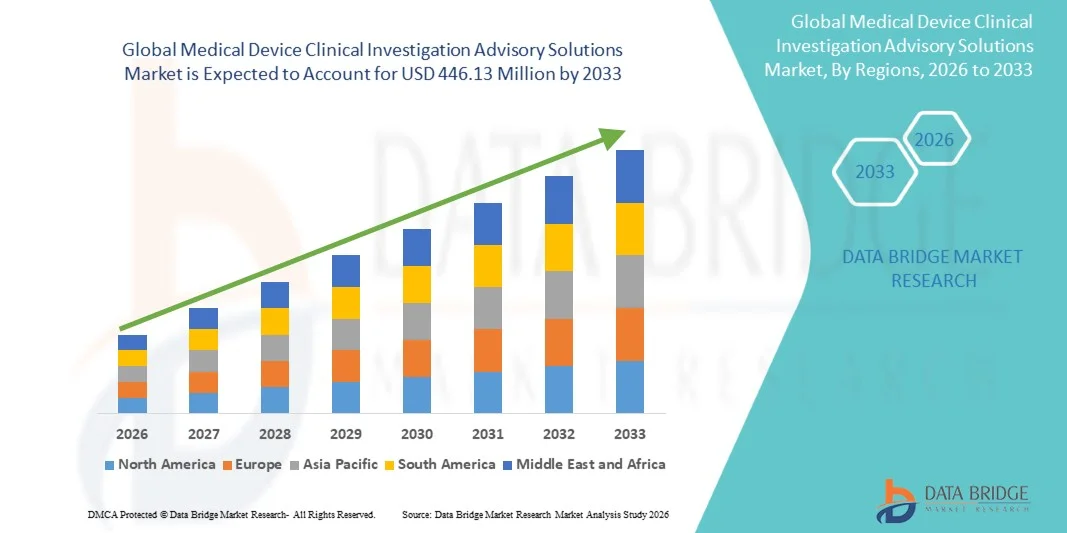

- Le marché mondial des solutions de conseil en matière d'investigations cliniques pour les dispositifs médicaux était évalué à 186,21 millions de dollars américains en 2025 et devrait atteindre 446,13 millions de dollars américains d'ici 2033 , avec un TCAC de 11,54 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la complexité croissante des cadres réglementaires dans l'industrie des dispositifs médicaux, associée à l'adoption croissante de l'externalisation des services de conseil en matière d'investigation clinique afin de garantir des approbations de produits plus rapides et une meilleure conformité sur les marchés mondiaux.

- De plus, la demande croissante de conseils rentables et menés par des experts en matière d'essais cliniques incite les fabricants de dispositifs médicaux à s'appuyer sur des solutions de conseil spécialisées, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des solutions de conseil en investigation clinique pour les dispositifs médicaux

- Les solutions de conseil en matière d'investigations cliniques pour dispositifs médicaux, qui offrent des conseils d'experts et un soutien réglementaire pour les essais cliniques, sont de plus en plus essentielles pour les fabricants de dispositifs médicaux afin d'accélérer les approbations de produits, d'assurer la conformité et d'optimiser les opérations cliniques sur les marchés mondiaux.

- La demande croissante pour ces solutions de conseil est principalement alimentée par la complexité grandissante des cadres réglementaires, la nécessité d'accélérer la mise sur le marché et le recours accru à l'externalisation par les entreprises de dispositifs médicaux à la recherche d'un soutien spécialisé et rentable pour leurs essais cliniques.

- L'Amérique du Nord a dominé le marché des solutions de conseil en matière d'investigation clinique des dispositifs médicaux avec la plus grande part de revenus (39,2 %) en 2025, caractérisée par une forte présence d'entreprises clés du secteur des dispositifs médicaux, une infrastructure de recherche clinique mature et des exigences réglementaires strictes.

- La région Asie-Pacifique devrait connaître la croissance la plus rapide du marché au cours de la période de prévision, en raison de la croissance rapide du secteur des dispositifs médicaux, de l'augmentation des activités d'essais cliniques et de l'externalisation accrue des services réglementaires et de conseil.

- Le segment du conseil réglementaire a dominé la plus grande part de revenus du marché, soit 58,4 %, en 2025, sous l'effet de la complexité croissante des réglementations relatives aux dispositifs médicaux dans des régions telles que l'Amérique du Nord, l'Europe et l'Asie-Pacifique.

Portée du rapport et segmentation du marché des solutions de conseil en investigation clinique des dispositifs médicaux

|

Attributs |

Solutions de conseil en investigations cliniques pour dispositifs médicaux : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché des solutions de conseil en investigation clinique pour dispositifs médicaux

« Adoption croissante des services de conseil en matière d’investigation clinique avancée »

- Une tendance notable sur le marché mondial des solutions de conseil en matière d'investigation clinique des dispositifs médicaux est l'adoption croissante de services de conseil spécialisés pour soutenir les essais cliniques, les soumissions réglementaires et la surveillance post-commercialisation des dispositifs médicaux.

- Les entreprises investissent de plus en plus dans des solutions qui contribuent à rationaliser la conception des études cliniques, l'élaboration des protocoles et la conformité réglementaire afin de réduire les délais de mise sur le marché et d'atténuer les risques.

- Par exemple, en 2024, plusieurs fabricants de dispositifs médicaux en Amérique du Nord se sont associés à des fournisseurs de solutions de conseil pour optimiser leurs stratégies d'essais cliniques et garantir des approbations réglementaires plus rapides.

- On observe également une demande croissante de solutions intégrées combinant expertise scientifique, réglementaire et opérationnelle afin d'aider les fabricants à mener efficacement des investigations cliniques de haute qualité et conformes aux normes.

- Cette tendance reflète la complexité croissante des cadres réglementaires et le besoin de conseils d'experts tout au long du cycle de vie du produit, favorisant ainsi l'adoption mondiale des services de conseil en matière d'investigations cliniques.

Dynamique du marché des solutions de conseil en investigation clinique pour dispositifs médicaux

Conducteur

« Besoin croissant de conformité réglementaire et de gestion efficace des essais cliniques »

- L'augmentation des exigences réglementaires applicables aux dispositifs médicaux, notamment les normes strictes de sécurité et d'efficacité, est l'un des principaux facteurs favorisant l'adoption de solutions de conseil.

- Les fabricants recherchent un accompagnement spécialisé pour s'orienter dans la complexité des réglementations, préparer leurs dossiers de soumission et garantir leur conformité aux exigences d'organismes tels que la FDA, l'EMA et autres autorités régionales.

- Par exemple, début 2025, une entreprise européenne de dispositifs médicaux a eu recours à des services de conseil pour faciliter sa mise en conformité avec le nouveau règlement européen relatif aux dispositifs médicaux (MDR), réduisant ainsi le risque de retards d'approbation.

- De plus, la nécessité d'optimiser l'efficacité des essais cliniques, de réduire les coûts opérationnels et de raccourcir les cycles de développement des produits stimule la demande pour ces solutions.

- La sensibilisation accrue à la sécurité des patients, à la qualité des données cliniques et à la gestion des risques encourage davantage les fabricants à recourir à des services de conseil professionnels pour améliorer la conception et les résultats des études.

Retenue/Défi

« Coûts élevés et disponibilité limitée d'expertise spécialisée »

- Le coût relativement élevé du recours à des services de conseil en matière d'investigation clinique de dispositifs médicaux peut constituer un obstacle pour les petits et moyens fabricants, en particulier sur les marchés émergents.

- Les solutions de conseil avancées nécessitent souvent des contrats ou des honoraires à long terme, ce qui peut s'avérer prohibitif pour les organisations disposant de budgets limités.

- Par exemple, plusieurs start-ups en Asie ont retardé le recours à des services de conseil en 2023 en raison de contraintes budgétaires, ce qui a affecté le rythme de leurs investigations cliniques.

- La disponibilité limitée de conseillers qualifiés et expérimentés dans certaines régions restreint également la pénétration du marché et peut entraîner des retards dans les projets.

- Relever ces défis grâce à des modèles de services rentables, à l'expansion régionale des cabinets de conseil et aux options de consultation à distance sera essentiel pour une croissance durable du marché.

Portée du marché des solutions de conseil en investigation clinique pour dispositifs médicaux

Le marché est segmenté en fonction du type de service et des utilisateurs finaux.

• Par type de service

Le marché des solutions de conseil en matière d'investigations cliniques pour dispositifs médicaux est segmenté, selon le type de service, en conseil réglementaire et gestion des essais cliniques. Le segment du conseil réglementaire a représenté la plus grande part de marché (58,4 %) en 2025, sous l'effet de la complexité croissante des réglementations relatives aux dispositifs médicaux en Amérique du Nord, en Europe et en Asie-Pacifique. Les entreprises du secteur des dispositifs médicaux s'appuient fortement sur les services de conseil réglementaire pour gérer les procédures d'autorisation de mise sur le marché, de conformité post-commercialisation et de soumission. L'importance accrue accordée à la sécurité des patients et aux normes de qualité des produits alimente la demande. Les consultants en réglementation fournissent des conseils en matière de gestion des risques, d'étiquetage et de documentation, garantissant ainsi un accès plus rapide au marché. Les exigences strictes de conformité imposées par des organismes tels que la FDA, l'EMA et la PMDA renforcent le recours à ces services. Les progrès technologiques en matière de soumission électronique et de suivi réglementaire numérique accroissent encore l'efficacité. Ce segment bénéficie de contrats à long terme avec les principaux fabricants de dispositifs médicaux. L'augmentation des volumes de lancement de dispositifs innovants et d'instruments de diagnostic de haute valeur génère une demande soutenue. Les services de conseil réglementaire réduisent les risques juridiques et opérationnels pour les fabricants. L'accent mis sur l'harmonisation mondiale des normes contribue à la position dominante de ce segment. L'externalisation de l'expertise réglementaire permet aux entreprises d'optimiser leurs coûts et d'accélérer leur mise sur le marché. Ces facteurs font du conseil réglementaire le segment de services le plus important.

Le segment de la gestion des essais cliniques devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 11,3 %, entre 2026 et 2033. Cette croissance est portée par le nombre croissant d'essais cliniques et d'études post-commercialisation pour les dispositifs médicaux nouveaux et innovants. L'adoption croissante des plateformes numériques de gestion des essais cliniques garantit une planification, un recrutement des patients, un suivi et un reporting simplifiés. L'externalisation de la gestion des essais cliniques auprès de prestataires spécialisés allège la charge opérationnelle des fabricants de dispositifs. La complexité croissante des essais multicentriques et le besoin de saisie de données en temps réel soutiennent cette croissance. Les autorités réglementaires insistent sur l'intégrité des données, la préparation aux audits et le suivi basé sur les risques, ce qui stimule la demande. L'expansion des projets de R&D de dispositifs médicaux sur les marchés émergents favorise l'adoption de ces solutions. Les CRO proposent de plus en plus de solutions de gestion d'essais cliniques complètes pour une efficacité accrue. L'analyse avancée et le suivi piloté par l'IA améliorent la précision et réduisent les délais. La demande de solutions rentables lors du développement des dispositifs soutient l'adoption de ces solutions. L'intégration aux dossiers médicaux électroniques et aux dispositifs portables accélère l'efficacité des essais cliniques. La tendance croissante des essais centrés sur le patient favorise également l'adoption de ces solutions. L'ensemble de ces facteurs fait de la gestion des essais cliniques le segment de services à la croissance la plus rapide.

• Par les utilisateurs finaux

Le marché des solutions de conseil en investigations cliniques pour dispositifs médicaux est segmenté, selon les utilisateurs finaux, en deux catégories : les entreprises de dispositifs médicaux et les organismes de recherche sous contrat (CRO). En 2025, le segment des entreprises de dispositifs médicaux représentait la plus grande part de marché (64,7 %), portée par le nombre croissant de lancements de dispositifs médicaux à l’échelle mondiale et la nécessité de se conformer à des normes réglementaires strictes. Ces entreprises s’appuient fortement sur des services de conseil externes pour accélérer leur entrée sur le marché et garantir leur conformité. La complexité croissante des classifications de produits, des tests de sécurité et de la surveillance post-commercialisation alimente la demande. Les grands et moyens fabricants de dispositifs externalisent leur expertise réglementaire et clinique afin d’optimiser leurs coûts et d’accélérer la mise sur le marché. L’innovation rapide dans les dispositifs de diagnostic, chirurgicaux et implantables renforce la dépendance aux solutions de conseil. Les entreprises ont besoin d’un soutien continu pour les modifications d’étiquetage, le signalement des effets indésirables et la préparation aux audits. Les initiatives d’harmonisation mondiale, telles que l’ISO 13485 et le règlement MDR, favorisent l’adoption de ces normes. Les partenariats avec les CRO et les cabinets de conseil améliorent l’efficacité opérationnelle. Les retards réglementaires sont minimisés, réduisant ainsi les risques commerciaux. Des contrats à forte valeur ajoutée et des partenariats de conseil à long terme consolident la position dominante du segment. Les entreprises d'Amérique du Nord et d'Europe sont en tête de l'adoption, mais les marchés émergents y contribuent de plus en plus. L'ensemble de ces facteurs fait des entreprises de dispositifs médicaux le principal segment d'utilisateurs finaux.

Le segment des organismes de recherche sous contrat (CRO) devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 10,2 %, entre 2026 et 2033, porté par la tendance croissante à l'externalisation des essais cliniques et des services d'assistance réglementaire. Les CRO recherchent de plus en plus des solutions de conseil pour élargir leur offre de services et améliorer leur efficacité opérationnelle. La multiplication des essais cliniques multicentriques et internationaux exige une gestion efficace des essais et un accompagnement en matière de conformité. La collaboration accrue entre les fabricants de dispositifs médicaux et les CRO alimente cette croissance. Les avancées technologiques, telles que la surveillance pilotée par l'IA et les plateformes d'essais numériques, favorisent l'adoption de ces solutions. Les CRO visent à réduire les délais et les coûts opérationnels tout en garantissant la qualité des données et la conformité réglementaire. L'expansion des services aux marchés émergents soutient l'adoption de ces solutions. La forte demande d'expertise spécialisée dans les catégories de dispositifs à haut risque accélère la croissance. Les CRO s'appuient sur des services de conseil pour garantir le succès de leurs soumissions réglementaires et atténuer les risques. L'augmentation des investissements dans les infrastructures de santé et le lancement de dispositifs innovants renforcent encore le potentiel du marché. L'adoption de modèles d'essais virtuels et hybrides encourage le recours aux solutions de conseil. L'ensemble de ces facteurs fait des CRO le segment d'utilisateurs finaux dont la croissance est la plus rapide.

Analyse régionale du marché des solutions de conseil en investigation clinique pour dispositifs médicaux

- L'Amérique du Nord a dominé le marché des solutions de conseil en matière d'investigation clinique des dispositifs médicaux avec la plus grande part de revenus, soit 39,2 %, en 2025.

- Portée par un écosystème de santé mature, une forte concentration d'entreprises de dispositifs médicaux et des cadres réglementaires solides soutenant la recherche clinique

- La région bénéficie d'infrastructures de pointe pour les essais cliniques, de professionnels de la recherche hautement qualifiés et de systèmes de conformité réglementaire bien établis, ce qui encourage l'externalisation des services de conseil pour le développement de dispositifs médicaux, la validation clinique et les soumissions réglementaires.

Analyse du marché américain des solutions de conseil en investigation clinique pour les dispositifs médicaux

Le marché américain des solutions de conseil en matière d'études cliniques pour dispositifs médicaux a généré la majeure partie des revenus en Amérique du Nord en 2025, porté par le recours massif aux services de conseil clinique externalisés et par un besoin croissant d'expertise réglementaire pour l'homologation des dispositifs médicaux. Les entreprises font de plus en plus appel à des cabinets de conseil spécialisés pour concevoir des études cliniques, élaborer des stratégies réglementaires et gérer efficacement les dossiers de soumission. Ceci est particulièrement important pour les dispositifs innovants nécessitant une autorisation de mise sur le marché ou la conformité aux réglementations de la FDA. La solide infrastructure de recherche du pays, associée à une priorité accordée à l'innovation et à l'accélération des procédures d'homologation, continue de stimuler la croissance du marché.

Analyse du marché européen des solutions de conseil en investigation clinique des dispositifs médicaux

Le marché européen des solutions de conseil en matière d'investigations cliniques pour les dispositifs médicaux devrait connaître une croissance annuelle composée (TCAC) importante au cours de la période de prévision, portée par des réglementations strictes telles que le règlement européen relatif aux dispositifs médicaux (RDM), l'adoption croissante de dispositifs médicaux innovants et le développement des initiatives de recherche clinique. Les entreprises externalisent de plus en plus les services de conseil clinique afin de gérer les exigences de conformité complexes, les essais multicentriques et d'accélérer les soumissions réglementaires.

Analyse du marché britannique des solutions de conseil en investigation clinique pour les dispositifs médicaux

Le marché britannique des solutions de conseil en matière d'investigation clinique pour les dispositifs médicaux devrait connaître une croissance soutenue, grâce à un écosystème de santé mature, une infrastructure de recherche clinique robuste et des initiatives gouvernementales favorisant l'innovation dans ce domaine. Le cadre réglementaire du pays encourage l'externalisation auprès de cabinets de conseil spécialisés pour la gestion des essais cliniques, la stratégie réglementaire et la conformité au règlement britannique relatif aux dispositifs médicaux (MDR) et aux normes internationales. L'essor des dispositifs médicaux mini-invasifs et technologiquement avancés a également accru la demande de conseils d'experts en matière de validation clinique et de stratégies d'entrée sur le marché.

Analyse du marché allemand des solutions de conseil en investigation clinique pour les dispositifs médicaux

Le marché allemand des solutions de conseil en matière d'investigations cliniques pour les dispositifs médicaux contribue fortement à la croissance du marché européen, grâce à son infrastructure de santé performante, à l'adoption généralisée des technologies médicales et à un fort investissement dans la recherche et le développement. Les fabricants allemands de dispositifs médicaux s'appuient de plus en plus sur ces solutions pour se conformer au règlement relatif aux dispositifs médicaux (MDR), concevoir des essais cliniques efficaces et obtenir plus rapidement l'approbation de leurs dispositifs innovants. L'accent mis par le pays sur la médecine de précision, les technologies de santé numérique et les diagnostics de pointe stimule davantage la demande de services de conseil externalisés.

Analyse du marché des solutions de conseil en investigation clinique pour les dispositifs médicaux en Asie-Pacifique

Le marché des solutions de conseil en matière d'investigations cliniques pour les dispositifs médicaux en Asie-Pacifique devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison de l'expansion rapide du secteur des dispositifs médicaux, de l'externalisation accrue des services de conseil clinique et du renforcement des exigences réglementaires. Le développement des infrastructures de santé, l'expansion de la production de dispositifs médicaux et l'accès à une expertise en matière de conseil à un coût abordable sont les principaux moteurs de cette croissance. Des pays comme la Chine, l'Inde et le Japon observent une demande accrue de services de conseil clinique afin de garantir la conformité et l'approbation sur le marché des dispositifs innovants dans les meilleurs délais.

Analyse du marché japonais des solutions de conseil en investigation clinique pour les dispositifs médicaux

La croissance du marché japonais des solutions de conseil en essais cliniques de dispositifs médicaux est alimentée par un secteur de la santé de pointe, une population vieillissante et une forte demande en dispositifs médicaux innovants. Les sociétés de conseil clinique accompagnent les fabricants de dispositifs dans leurs démarches réglementaires, la conception des essais et le respect des normes locales, permettant ainsi une validation clinique efficace et un accès plus rapide au marché.

Analyse du marché chinois des solutions de conseil en investigation clinique pour les dispositifs médicaux

En 2025, le marché chinois des solutions de conseil en matière d'investigations cliniques pour les dispositifs médicaux détenait la plus grande part de revenus de la région Asie-Pacifique. Cette situation est due à la croissance rapide du secteur national des dispositifs médicaux, aux initiatives gouvernementales favorisant la conformité réglementaire et à la collaboration avec des cabinets de conseil internationaux. Ce contexte a permis de raccourcir les cycles d'approbation et d'améliorer l'accès au marché pour les dispositifs médicaux, stimulant ainsi la demande de solutions de conseil en matière d'investigations cliniques.

Part de marché des solutions de conseil en investigation clinique pour dispositifs médicaux

Le secteur des solutions de conseil en matière d'investigation clinique des dispositifs médicaux est principalement dominé par des entreprises bien établies, notamment :

- Medpace (États-Unis)

- ICON plc (Irlande)

- PPD Inc. (États-Unis)

- Parexel International (États-Unis)

- Laboratoires Charles River (États-Unis)

- Covance Inc. (États-Unis)

- Services d'essais cliniques de Medtronic (États-Unis)

- Syneos Health (États-Unis)

- Eurofins Scientifique (Luxembourg)

- Développement de produits pharmaceutiques (PPD) (États-Unis)

- Wuxi AppTec (Chine)

- SGS Life Sciences (Suisse)

- Développement de médicaments Labcorp (États-Unis)

- Parexel International Corp (États-Unis)

- CRF Santé (Royaume-Uni)

- PRA Sciences de la santé (États-Unis)

- Accenture Life Sciences (Irlande)

- Covance (États-Unis)

- Clinipace (États-Unis)

Dernières évolutions du marché mondial des solutions de conseil en investigation clinique pour les dispositifs médicaux

- En janvier 2025, Tigermed a étendu son partenariat stratégique avec Medidata afin d'accélérer les essais cliniques de dispositifs médicaux grâce à la plateforme numérique de Medidata. Cette plateforme automatise la saisie des données et rationalise les opérations des CRO dans le cadre d'études cliniques internationales, améliorant ainsi l'efficacité de la gestion des essais.

- En janvier 2025, NAMSA a acquis les activités d'essais de dispositifs médicaux américaines de WuXi AppTec, élargissant ainsi son portefeuille de solutions de recherche et d'essais cliniques afin de fournir des services de conseil précliniques et cliniques plus complets aux fabricants de dispositifs cherchant à obtenir des approbations réglementaires et à se préparer au marché.

- En janvier 2025, Canyon Labs a finalisé l'acquisition des activités de services de laboratoire et de conseil d'iuvo BioScience, renforçant ainsi ses services de soutien aux CRO, tels que les tests de biocompatibilité et les analyses, qui sont des composantes essentielles des solutions de conseil tout au long du cycle de vie des dispositifs médicaux.

- En février 2025, Arterex a acquis Phoenix, une société italienne de conception et de développement de dispositifs médicaux, ce qui a permis d'améliorer le soutien et les services de conseil en matière de développement clinique de bout en bout pour les tests de dispositifs et la conformité réglementaire sur les marchés européens.

- En février 2025, Arterex a également acquis Adroit, renforçant ainsi ses capacités mondiales de recherche et de fabrication sous contrat, et facilitant de ce fait la simplification des services de développement clinique et de conseil réglementaire pour les entreprises de dispositifs médicaux.

- En mars 2025, InTandem Capital a annoncé un investissement stratégique dans Clinilabs, témoignant de l'intérêt croissant des investisseurs pour les CRO spécialisées dans la recherche sur les dispositifs médicaux, ce qui contribue indirectement aux services de conseil en matière de stratégie d'investigation et de réglementation.

- En mars 2025, ICON plc a étendu ses services d'externalisation réglementaire dans la région Asie-Pacifique, en se concentrant sur des consultations réglementaires plus rapides et adaptées aux spécificités régionales, ainsi que sur un soutien aux essais cliniques pour les clients du secteur des dispositifs médicaux sur des marchés comme la Chine et l'Inde.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.