Global Oil And Gas Infrastructure Market

Taille du marché en milliards USD

TCAC :

%

USD

561.30 Million

USD

987.20 Million

2025

2033

USD

561.30 Million

USD

987.20 Million

2025

2033

| 2026 –2033 | |

| USD 561.30 Million | |

| USD 987.20 Million | |

|

|

|

|

Global Oil & Gas Infrastructure Market Segmentation, By Category (Surface and Lease Equipment, Gathering and Processing, Gas and NGL Pipelines, Oil and Gas Storage, Refining and Oil Products Transport, and Export Terminals), Operation (Transmission and Distribution) - Industry Trends and Forecast to 2033

What is the Global Oil and Gas Infrastructure Market Size and Growth Rate?

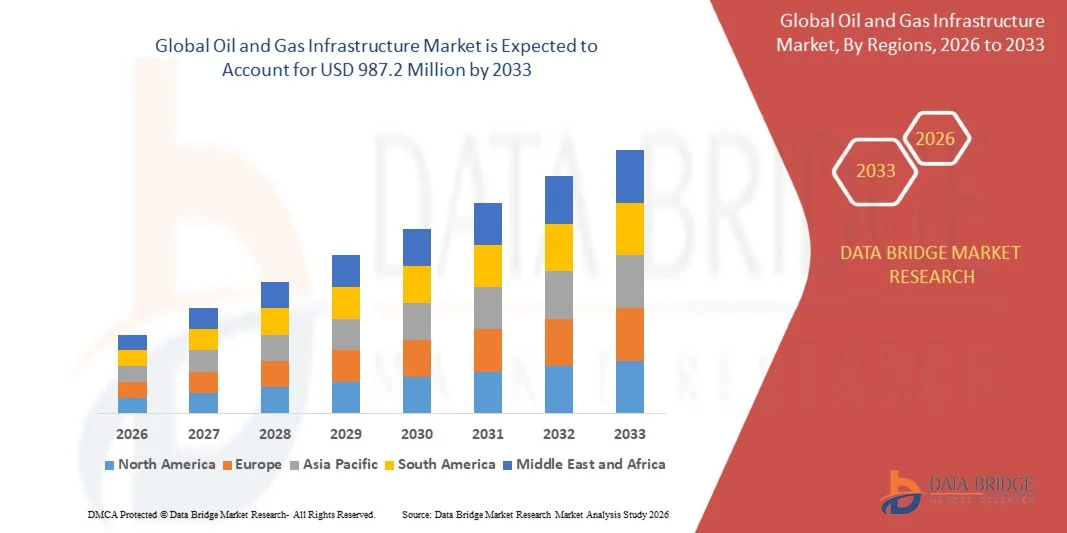

- The global oil & gas infrastructure market size was valued at USD 561.3 million in 2025 and is expected to reach USD 987.2 million by 2033, at a CAGR of5.20% during the forecast period

- Market growth is supported by rising demand for power-efficient and high-performance electronic systems, increasing application of logic analyzers in integrated circuits, personal computers, and memory devices, and growing need for error detection, complex logic debugging, and digital circuit testing

- In addition, rapid adoption of IoT-enabled devices, technological advancements in digital logic analyzers, and enhanced triggering and analysis capabilities are expected to further accelerate market expansion.

What are the Major Takeaways of Oil & Gas Infrastructure Market?

- Expanding demand for tablets, PCs, and advanced electronic systems in developing economies, coupled with a growing number of research and development initiatives, is creating significant growth opportunities and strengthening the long-term outlook of the oil & gas infrastructure market

- However, challenges such as shortage of skilled professionals, increasing design and integration complexities, and system interaction issues are expected to act as key restraints, potentially limiting market growth over the forecast period

- North America dominated the oil & gas infrastructure market with an estimated 34.26% revenue share in 2025, driven by large-scale investments in pipeline networks, LNG terminals, oil storage facilities, and refining infrastructure across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 5.9% from 2026 to 2033, driven by rising energy demand, rapid industrialization, urbanization, and expanding oil & gas consumption across China, India, Japan, South Korea, and Southeast Asia

- The Gas and NGL Pipelines segment dominated the market with an estimated 38.6% share in 2025, owing to extensive investments in cross-country transmission pipelines, rising natural gas demand, and expansion of LNG and NGL transportation networks

Report Scope and Oil & Gas Infrastructure Market Segmentation

|

Attributes |

Oil & Gas Infrastructure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil & Gas Infrastructure Market?

“Increasing Shift Toward Digitized, Smart, and Integrated Oil & Gas Infrastructure Systems”

- The oil & gas infrastructure market is witnessing rising adoption of digital monitoring, smart sensors, and integrated control systems to enhance operational efficiency, safety, and asset reliability across upstream, midstream, and downstream facilities

- Infrastructure developers are deploying automation platforms, SCADA systems, digital twins, and AI-enabled analytics to optimize pipeline operations, storage management, and refining processes

- Growing demand for cost-efficient, remotely monitored, and predictive maintenance-enabled infrastructure is driving adoption across pipelines, terminals, refineries, and offshore installations

- For instance, companies such as Shell, BP, Exxon Mobil, and Baker Hughes are integrating digital oilfield technologies, real-time asset monitoring, and data-driven decision platforms across global infrastructure projects

- Increasing focus on operational transparency, emission monitoring, and regulatory compliance is accelerating the shift toward smart and connected oil & gas infrastructure

- As energy systems become more complex and sustainability-driven, digitally enabled Oil & Gas Infrastructure will remain critical for resilient, safe, and efficient energy transportation and processing

What are the Key Drivers of Oil & Gas Infrastructure Market?

- Rising global demand for energy transportation, storage capacity, and refining infrastructure to support growing oil and gas consumption

- For instance, during 2024–2025, major operators such as TotalEnergies, Chevron, and SLB expanded investments in pipeline modernization, LNG terminals, and digital infrastructure upgrades

- Growing development of LNG facilities, cross-border pipelines, and export terminals across North America, Asia-Pacific, and the Middle East is boosting infrastructure spending

- Advancements in automation, materials engineering, corrosion monitoring, and digital asset management are strengthening infrastructure performance and lifecycle efficiency

- Increasing investments in natural gas infrastructure as a transition fuel, along with hydrogen-ready and low-carbon compatible assets, are supporting long-term growth

- Backed by sustained capital expenditure, energy security initiatives, and infrastructure modernization programs, the Oil & Gas Infrastructure market is expected to witness steady long-term expansion

Which Factor is Challenging the Growth of the Oil & Gas Infrastructure Market?

- High capital costs associated with pipeline construction, offshore infrastructure, storage facilities, and refinery upgrades limit rapid deployment

- For instance, during 2024–2025, material price volatility, supply chain disruptions, and skilled labor shortages increased project costs and extended timelines

- Complex regulatory frameworks, environmental approvals, and land acquisition challenges delay infrastructure development

- Growing pressure from energy transition policies, decarbonization targets, and public opposition creates uncertainty for long-term fossil fuel infrastructure investments

- Competition from renewable energy infrastructure and alternative fuels affects capital allocation and project prioritization

- To mitigate these challenges, companies are focusing on digital optimization, modular construction, emissions reduction technologies, and infrastructure repurposing to sustain growth in the Oil & Gas Infrastructure market

How is the Oil & Gas Infrastructure Market Segmented?

The market is segmented on the basis of category and operation.

• By Category

On the basis of category, the oil & gas infrastructure market is segmented into Surface and Lease Equipment, Gathering and Processing, Gas and NGL Pipelines, Oil and Gas Storage, Refining and Oil Products Transport, and Export Terminals. The Gas and NGL Pipelines segment dominated the market with an estimated 38.6% share in 2025, owing to extensive investments in cross-country transmission pipelines, rising natural gas demand, and expansion of LNG and NGL transportation networks. Pipelines remain the backbone of oil and gas infrastructure, offering cost-effective, high-capacity, and continuous transportation across upstream, midstream, and downstream operations. Increasing focus on energy security, inter-regional connectivity, and replacement of aging pipeline networks further supports dominance.

The Export Terminals segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid growth in LNG exports, rising crude oil trade, and expanding port-based infrastructure across North America, the Middle East, and Asia-Pacific. Growing global energy trade and investments in storage and loading facilities are accelerating segment growth.

• By Operation

On the basis of operation, the oil & gas infrastructure market is segmented into Transmission and Distribution. The Transmission segment dominated the market with a revenue share of around 61.4% in 2025, supported by large-scale investments in long-distance pipelines, high-capacity transmission networks, and cross-border energy corridors. Transmission infrastructure plays a critical role in transporting crude oil, natural gas, and refined products from production and processing sites to consumption and export hubs. Increasing development of natural gas transmission pipelines, LNG feed lines, and inter-state networks strengthens this segment’s leadership.

The Distribution segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising urbanization, expanding city gas distribution networks, and increasing demand for last-mile connectivity in industrial, commercial, and residential sectors. Government initiatives to expand gas access and modernize distribution infrastructure are further supporting rapid growth.

Which Region Holds the Largest Share of the Oil & Gas Infrastructure Market?

- North America dominated the oil & gas infrastructure market with an estimated 34.26% revenue share in 2025, driven by large-scale investments in pipeline networks, LNG terminals, oil storage facilities, and refining infrastructure across the U.S. and Canada. Strong shale oil and gas production, expansion of midstream assets, and modernization of aging infrastructure continue to fuel regional market growth

- Leading oil & gas companies in North America are investing heavily in pipeline expansions, LNG export terminals, digital monitoring systems, and safety upgrades, strengthening the region’s infrastructure leadership. Continuous capital allocation toward energy security and export capacity supports long-term market expansion

- Well-established regulatory frameworks, advanced engineering capabilities, and a strong presence of global oil & gas operators further reinforce North America’s dominance in the oil & gas infrastructure market

U.S. Oil & Gas Infrastructure Market Insight

The U.S. is the largest contributor in North America, supported by extensive shale production, a dense pipeline network, large refining capacity, and rapidly expanding LNG export terminals. Rising investments in crude oil pipelines, natural gas transmission, storage facilities, and port infrastructure drive strong demand. Presence of major oil & gas companies, strong capital availability, and continuous infrastructure upgrades further support market growth.

Canada Oil & Gas Infrastructure Market Insight

Canada contributes significantly due to ongoing development of oil sands infrastructure, cross-border pipelines, gas processing facilities, and LNG export projects. Government support for energy exports, infrastructure modernization, and diversification of export routes strengthens long-term market growth.

Asia-Pacific Oil & Gas Infrastructure Market

Asia-Pacific is projected to register the fastest CAGR of 5.9% from 2026 to 2033, driven by rising energy demand, rapid industrialization, urbanization, and expanding oil & gas consumption across China, India, Japan, South Korea, and Southeast Asia. Large-scale investments in refineries, pipelines, LNG import terminals, and storage facilities are accelerating infrastructure development.

China Oil & Gas Infrastructure Market Insight

China is the largest contributor in Asia-Pacific, supported by massive investments in pipelines, LNG terminals, strategic petroleum reserves, and refining capacity. Government-led energy security initiatives and rising gas consumption continue to boost infrastructure expansion.

Japan Oil & Gas Infrastructure Market Insight

Japan shows steady growth due to strong demand for LNG import terminals, storage facilities, and refining upgrades. Focus on energy security and diversified supply sources supports sustained infrastructure investment.

India Oil & Gas Infrastructure Market Insight

India is emerging as a high-growth market, driven by rapid expansion of gas pipelines, city gas distribution networks, refineries, and LNG terminals. Government initiatives and rising energy demand accelerate infrastructure development.

South Korea Oil & Gas Infrastructure Market Insight

South Korea contributes significantly through investments in LNG terminals, refining capacity, and storage infrastructure. Strong industrial demand and energy import dependence support continued market growth.

Which are the Top Companies in Oil & Gas Infrastructure Market?

The oil & gas infrastructure industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- Shell (U.K.)

- BP (U.K.)

- Chevron Corporation (U.S.)

- TotalEnergies (France)

- Baker Hughes Company (U.S.)

- Centrica (U.K.)

- ConocoPhillips (U.S.)

- Energy Transfer (U.S.)

- Enterprise Products Partners (U.S.)

- Hatch (Canada)

- Halliburton (U.S.)

- Kinder Morgan (U.S.)

- Marathon Oil Company (U.S.)

- NGL Energy Partners (U.S.)

- Occidental Petroleum Corporation (U.S.)

- ONEOK (U.S.)

- Royal Vopak (Netherlands)

- SLB (U.S.)

- WILLIAMS (U.S.)

What are the Recent Developments in Global Oil & Gas Infrastructure Market?

- In January 2025, Baker Hughes secured a major order from Tecnicas Reunidas to supply six propane compressors and six gas compression trains for the third phase of Saudi Aramco’s Jafurah gas field in Saudi Arabia, including electric motor-driven compression solutions, and the project will also complement Baker Hughes’ long-term collaboration with Aramco across multiple gas facilities, strengthening the company’s position across the natural gas value chain and large-scale gas infrastructure projects

- In January 2025, BP successfully initiated gas flow from wells at the Greater Tortue Ahmeyim Phase 1 LNG project, routing production to its FPSO vessel for the next commissioning stage, and once completed the project is expected to deliver more than 2.3 million tonnes of LNG annually, marking a key milestone that enhances BP’s global LNG footprint and long-term growth prospects

- In September 2024, Exxon Mobil Corporation and Mitsubishi Corporation signed a project framework agreement enabling Mitsubishi’s participation in Exxon Mobil’s advanced Baytown, Texas facility, which will produce low-carbon hydrogen with around 98% carbon capture efficiency and up to one billion bcf per day of hydrogen along with one million tons of low-carbon ammonia annually, supporting both companies’ strategic push toward low-carbon energy infrastructure

- In August 2024, Chevron announced a USD 1 billion investment to establish an Engineering and Innovation Excellence Center in Bengaluru as its first large-scale engineering and innovation hub in India, focused on digital and engineering capabilities, reinforcing Chevron’s long-term commitment to technology-driven energy solutions and global innovation expansion

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.