Global Oligosaccharides In Sports Nutrition Market

Taille du marché en milliards USD

TCAC :

%

USD

357.22 Million

USD

515.84 Million

2025

2033

USD

357.22 Million

USD

515.84 Million

2025

2033

| 2026 –2033 | |

| USD 357.22 Million | |

| USD 515.84 Million | |

|

|

|

|

Global Oligosaccharides in Sports Nutrition Market Segmentation, By Source (Bacteria, Plants, Algae, Fungi, and Others), Type (Galactoligosaccharides, Human Milk Oligosaccharides, and Fructooligosaccharides), Form (Liquid and Powder) - Industry Trends and Forecast to 2033

What is the Global Oligosaccharides in Sports Nutrition Market Size and Growth Rate?

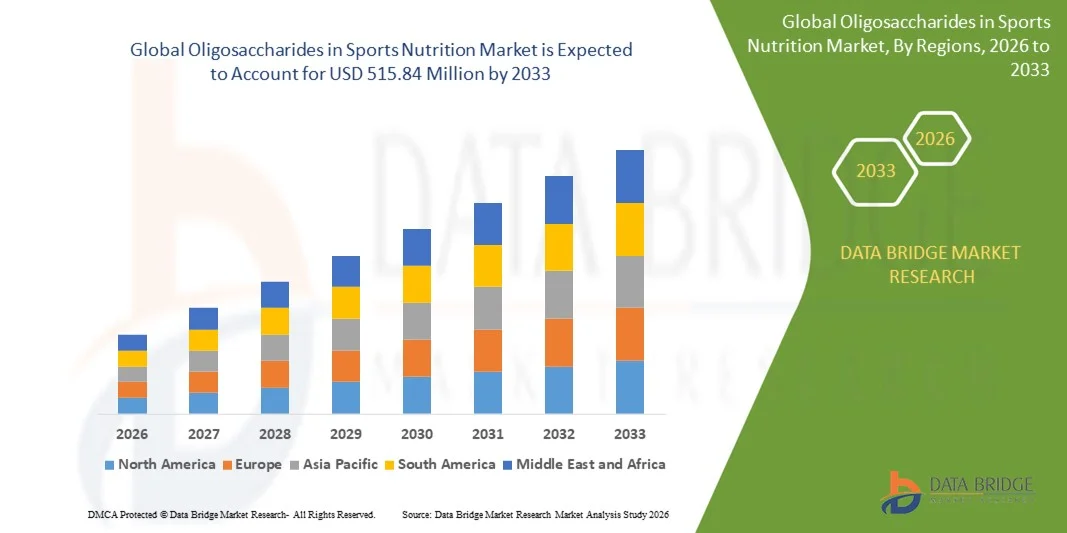

- The global oligosaccharides in sports nutrition market size was valued at USD 357.22 million in 2025 and is expected to reach USD 515.84 million by 2033, at a CAGR of4.70% during the forecast period

- The rise in the use of the product is processed and functional foods act as one of the major factors driving the growth of oligosaccharides in sports nutrition market. The increase in the demand for oligosaccharides as it is indigestible food ingredient beneficial for stimulating the growth of favorable microorganism in the colon and the increase in the preference for high-quality nutritional food, especially for athletes and sports professionals the market growth

What are the Major Takeaways of Oligosaccharides in Sports Nutrition Market?

- The increase in demand for nutrition, personalized nutrition, and wellness products because of the growing health consciousness and growth in awareness regarding the benefits of the product further influence the market

- In addition, the increase in sports, lifestyle changes, and rise in disposable income positively affect the oligosaccharides in sports nutrition market. Furthermore, oligosaccharides in sports nutrition market and development in the product extend profitable opportunities to the market players

- North America dominated the oligosaccharides in sports nutrition market with a 42.05% revenue share in 2025, driven by increasing demand for functional nutrition supplements, protein powders, and energy drinks across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.23% from 2026 to 2033, propelled by rapid expansion of functional nutrition markets, growing health-conscious populations, and rising adoption of fortified sports supplements across China, Japan, India, South Korea, and Southeast Asia

- The Bacteria segment dominated the market with a 42.6% share in 2025, driven by extensive use of bacterial fermentation methods to produce prebiotic oligosaccharides with high purity, consistent quality, and enhanced functional benefits

Report Scope and Oligosaccharides in Sports Nutrition Market Segmentation

|

Attributes |

Oligosaccharides in Sports Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oligosaccharides in Sports Nutrition Market?

Increasing Focus on Functional, High-Purity, and Performance-Enhancing Oligosaccharides

- The oligosaccharides in sports nutrition market is witnessing strong adoption of highly functional oligosaccharides that support enhanced energy release, gut health, and nutrient absorption for athletes and fitness enthusiasts

- Manufacturers are introducing multi-functional, prebiotic-enriched, and specialty oligosaccharides that can be incorporated into sports drinks, protein supplements, and nutrition bars, offering improved solubility, taste, and performance benefits

- Growing demand for clean-label, low-calorie, and high-purity ingredients is driving usage across sports nutrition manufacturers, dietary supplement producers, and functional beverage companies

- For instance, companies such as Yakult, Kerry Group, Dupont Nutrition & Health, and FrieslandCampina have launched advanced oligosaccharide formulations optimized for energy delivery, muscle recovery, and digestive health

- Increasing awareness of gut microbiome benefits, post-workout recovery, and functional nutrition is accelerating the shift toward scientifically validated, performance-focused oligosaccharides

- As consumer preference for health-optimized supplements grows, oligosaccharides will remain vital in enhancing athletic performance, endurance, and overall nutrition

What are the Key Drivers of Oligosaccharides in Sports Nutrition Market?

- Rising demand for high-quality, functional ingredients that support energy, endurance, and gut health in sports nutrition products

- For instance, in 2025, leading companies such as Kerry Group, Dupont Nutrition & Health, and Yakult expanded their oligosaccharide portfolios to include prebiotic-rich, high-solubility formulations suitable for sports beverages and protein supplements

- Growing adoption of personalized nutrition, fitness supplements, and functional foods is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in enzymatic synthesis, purification technologies, and product fortification have strengthened ingredient performance, digestibility, and formulation flexibility

- Increasing use of oligosaccharides in energy bars, recovery drinks, and functional beverages is creating opportunities for higher-margin, specialty sports nutrition products

- Supported by steady investments in R&D, nutraceutical innovation, and sports science studies, the market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Oligosaccharides in Sports Nutrition Market?

- High costs associated with premium, high-purity oligosaccharides restrict adoption among small supplement manufacturers and emerging brands

- For instance, during 2024–2025, fluctuations in raw material prices, specialized extraction techniques, and supply chain constraints increased formulation costs for several global suppliers

- Complexity in ingredient blending, taste masking, and stability increases the need for specialized formulation expertise

- Limited awareness in emerging markets regarding functional benefits of oligosaccharides in sports nutrition slows adoption

- Competition from alternative carbohydrates, prebiotics, and functional fibers creates pricing pressure and reduces product differentiation

- To address these issues, companies are focusing on cost-efficient production, research-backed health claims, product innovation, and fortified formulations to increase global adoption of oligosaccharides in sports nutrition

How is the Oligosaccharides in Sports Nutrition Market Segmented?

The market is segmented on the basis of source, type, and form.

- By Source

On the basis of source, the oligosaccharides in sports nutrition market is segmented into Bacteria, Plants, Algae, Fungi, and Others. The Bacteria segment dominated the market with a 42.6% share in 2025, driven by extensive use of bacterial fermentation methods to produce prebiotic oligosaccharides with high purity, consistent quality, and enhanced functional benefits. These bacterial-derived oligosaccharides are widely used in sports nutrition powders, energy drinks, and recovery supplements due to their superior solubility, digestibility, and bioactivity. Manufacturers favor bacterial sources for their ability to provide standardized functional ingredients suitable for large-scale production, ensuring stable supply for global sports nutrition brands.

The Algae segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for sustainable, plant-based oligosaccharides with additional bioactive properties. Expansion of vegan sports nutrition products and functional beverages is accelerating adoption of algae-based oligosaccharides across the market.

- By Type

On the basis of type, the market is segmented into Galactooligosaccharides (GOS), Human Milk Oligosaccharides (HMOs), and Fructooligosaccharides (FOS). The Galactooligosaccharides (GOS) segment dominated the market with a 38.9% share in 2025, supported by high demand for gut-friendly, prebiotic oligosaccharides that enhance nutrient absorption, immunity, and post-workout recovery. GOS is extensively used in protein supplements, sports drinks, and nutrition bars for its proven benefits in maintaining digestive health and energy metabolism.

The Human Milk Oligosaccharides (HMOs) segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing consumer preference for bioactive and premium ingredients that mimic human milk benefits. Sports nutrition brands are increasingly incorporating HMOs into recovery formulations and functional beverages to provide advanced immunity and performance support, boosting market adoption.

- By Form

On the basis of form, the oligosaccharides in sports nutrition market is segmented into Liquid and Powder. The Powder segment dominated the market with a 44.3% share in 2025, as it is preferred for inclusion in protein powders, energy bars, and ready-to-mix sports drinks due to its longer shelf life, ease of transport, and precise dosing capability. Powdered oligosaccharides also allow better integration into diverse supplement matrices while maintaining bioactivity and prebiotic functionality.

The Liquid segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for ready-to-drink functional beverages, hydration solutions, and liquid recovery supplements that provide quick absorption and convenience. Manufacturers are focusing on liquid oligosaccharides to cater to on-the-go athletes and consumers seeking performance-oriented nutrition, propelling segment growth across North America, Europe, and Asia-Pacific.

Which Region Holds the Largest Share of the Oligosaccharides in Sports Nutrition Market?

- North America dominated the oligosaccharides in sports nutrition market with a 42.05% revenue share in 2025, driven by increasing demand for functional nutrition supplements, protein powders, and energy drinks across the U.S. and Canada. High adoption of prebiotic formulations, fortified sports nutrition products, and specialty recovery supplements continues to fuel regional growth, supported by robust manufacturing infrastructure and innovation ecosystems

- Leading companies in North America are introducing advanced oligosaccharide-based formulations with enhanced solubility, targeted prebiotic effects, and bioactive functionality, strengthening the region’s technological advantage. Continuous investment in R&D, nutraceutical innovation, and consumer health awareness drives sustained market expansion

- High regulatory standards, well-established distribution networks, and strong consumer preference for scientifically backed sports nutrition products reinforce regional market leadership

U.S. Oligosaccharides in Sports Nutrition Market Insight

The U.S. is the largest contributor in North America, supported by extensive sports nutrition consumption, growing fitness trends, and high demand for prebiotic-enriched supplements. Rising interest in recovery drinks, protein powders, and immunity-boosting sports products intensifies demand for oligosaccharides. Presence of major nutrition brands, strong retailer networks, and health-conscious consumer behavior further drives market growth.

Canada Oligosaccharides in Sports Nutrition Market Insight

Canada contributes significantly to regional growth, driven by increasing adoption of functional supplements, expanding sports nutrition retail, and government-backed health initiatives. Manufacturers focus on prebiotic-enriched products, protein-based supplements, and convenient functional beverages. Rising consumer interest in gut health, performance enhancement, and immunity support strengthens market adoption across the country.

Asia-Pacific Oligosaccharides in Sports Nutrition Market

Asia-Pacific is projected to register the fastest CAGR of 8.23% from 2026 to 2033, propelled by rapid expansion of functional nutrition markets, growing health-conscious populations, and rising adoption of fortified sports supplements across China, Japan, India, South Korea, and Southeast Asia. Increasing production of protein powders, energy drinks, and performance beverages accelerates demand for oligosaccharides as functional prebiotic ingredients. High consumer awareness, growing e-commerce penetration, and expansion of sports nutrition manufacturing hubs further enhance market growth. Rising interest in immunity, gut health, and performance optimization continues to drive adoption of oligosaccharides across the region.

China Oligosaccharides in Sports Nutrition Market Insight

China is the largest contributor to Asia-Pacific due to strong domestic consumption of functional sports products, expanding protein supplement markets, and government support for nutraceutical innovation. Rising interest in prebiotic-enriched beverages, protein bars, and immunity-focused supplements drives demand for high-purity oligosaccharides, with local production capacity supporting domestic and export needs.

Japan Oligosaccharides in Sports Nutrition Market Insight

Japan shows steady growth, supported by mature sports nutrition markets, high consumer willingness to pay for premium functional products, and strong retail distribution channels. Growing focus on gut health, energy metabolism, and recovery supplements reinforces long-term market adoption of oligosaccharides.

India Oligosaccharides in Sports Nutrition Market Insight

India is emerging as a major growth hub, driven by rising fitness awareness, growing gym and sports culture, and increasing demand for prebiotic-enriched nutrition products. Expansion of local sports supplement brands and online retail channels accelerates oligosaccharides adoption in protein powders, health drinks, and energy supplements.

South Korea Oligosaccharides in Sports Nutrition Market Insight

South Korea contributes significantly due to strong demand for high-performance sports supplements, functional beverages, and immunity-boosting products. Rising production of fortified energy drinks, protein powders, and functional snacks drives adoption of oligosaccharides with enhanced prebiotic functionality. Technological innovation, advanced manufacturing capabilities, and digital health trends support sustained growth across the region.

Which are the Top Companies in Oligosaccharides in Sports Nutrition Market?

The oligosaccharides in sports nutrition industry is primarily led by well-established companies, including:

- Nissin Sugar Co. Ltd. (Japan)

- Yakult Pharmaceutical Industry Co., Ltd. (Japan)

- Kerry Group plc (Ireland)

- Taiwan Fructoso (Taiwan)

- DuPont Nutrition & Health (U.S.)

- Royal FrieslandCampina N.V. (Netherlands)

- Abbott (U.S.)

- Ingredion (U.S.)

- Biosynth Carbosynth (U.K.)

- Dextra Laboratories Ltd. (U.K.)

- Inbiose NV (Belgium)

- Jennewein Biotechnologie GmbH (Germany)

- Tereos (France)

- Zuchem (U.K.)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.