Global Organic Juices Market

Taille du marché en milliards USD

TCAC :

%

USD

24.68 Billion

USD

71.70 Billion

2025

2033

USD

24.68 Billion

USD

71.70 Billion

2025

2033

| 2026 –2033 | |

| USD 24.68 Billion | |

| USD 71.70 Billion | |

|

|

|

|

Global Organic Juices Market Segmentation, By Type (Fruits (Apple, Orange, Grapes, Pineapple, and Others), Vegetables (Beetroot, and Others), and Blends), Packaging Type (Bottles, Cartoons, and Others) Distribution Channel (Store-Based (Hypermarkets & Supermarkets Convenience Stores, and Others) and Non-Store-Based) - Industry Trends and Forecast to 2033

What is the Global Organic Juices Market Size and Growth Rate?

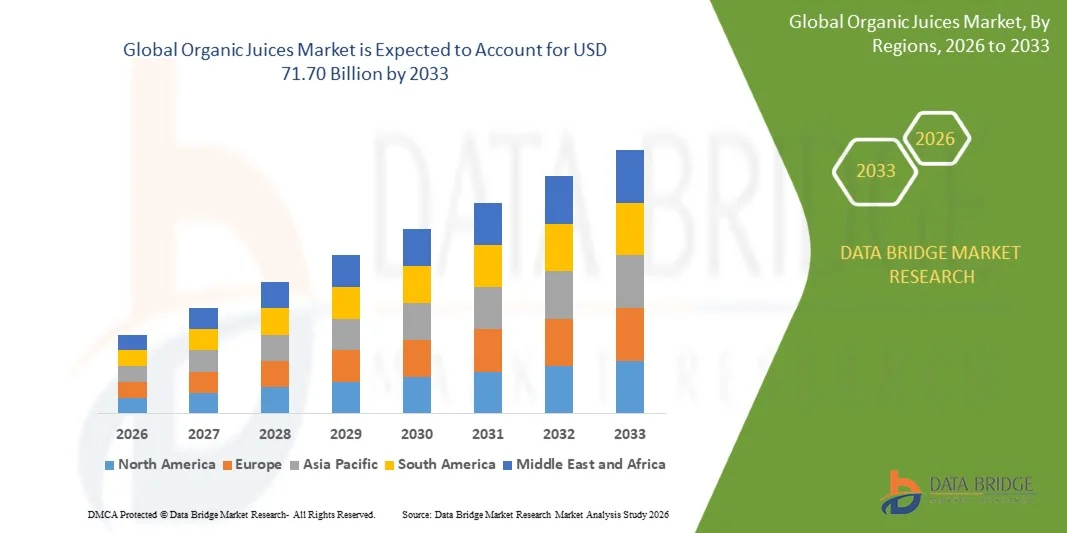

- The global organic juices market size was valued at USD 24.68 billion in 2025 and is expected to reach USD 71.70 billion by 2033, at a CAGR of 14.26% during the forecast period

- Market growth is primarily driven by rising consumer preference for clean-label beverages, increasing awareness regarding health and wellness, growing demand for chemical-free and preservative-free drinks, expanding adoption of organic farming practices, and strong growth in functional and cold-pressed juice consumption across retail and foodservice channels

What are the Major Takeaways of Organic Juices Market?

- Increasing consumption of natural, plant-based, and nutrient-rich beverages, along with expanding availability of organic juices through supermarkets, specialty stores, and online platforms, is creating significant growth opportunities for the Organic Juices market

- However, high production costs, limited availability of certified organic raw materials, shorter shelf life, and price sensitivity in developing regions are expected to act as key restraints impacting market growth over the forecast period

- North America dominated the organic juices market with a revenue share of 42.05% in 2025, driven by high consumer awareness regarding organic and clean-label beverages, strong purchasing power, and widespread availability of certified organic juice products across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness of health and wellness across China, Japan, India, South Korea, and Southeast Asia

- The Fruit-based organic juices segment dominated the market with an estimated share of around 52.4% in 2025, supported by high consumer preference for familiar flavors, natural sweetness, and widespread availability of organic fruits

Report Scope and Organic Juices Market Segmentation

|

Attributes |

Organic Juices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic Juices Market?

“Increasing Shift Toward Clean-Label, Functional, and Cold-Pressed Organic Juices”

- The organic juices market is witnessing strong adoption of cold-pressed, minimally processed, and preservative-free juice formulations, driven by rising consumer preference for clean-label and natural beverages

- Manufacturers are increasingly focusing on functional organic juices enriched with probiotics, vitamins, antioxidants, adaptogens, and superfruits to support immunity, digestion, and overall wellness

- Growing demand for convenient, ready-to-drink, and premium organic beverages is accelerating product innovation across retail, foodservice, and online distribution channels

- For instance, companies such as Naked Juice, Suja Juice, Tropicana, Simply Orange, and Lakewood Organic have expanded their organic portfolios with cold-pressed, low-sugar, and functional juice variants

- Increasing consumer awareness regarding sugar reduction, non-GMO ingredients, and sustainable sourcing is pushing brands toward transparent labeling and organic certifications

- As health-conscious lifestyles continue to rise globally, organic juices will remain a key growth segment within the functional and premium beverage industry

What are the Key Drivers of Organic Juices Market?

- Rising consumer preference for organic, natural, and chemical-free beverages due to growing health awareness and lifestyle-related diseases

- For instance, in 2024–2025, several global brands introduced low-sugar, no-added-preservative, and functional organic juice products to meet evolving consumer expectations

- Increasing demand for plant-based, vegan, and clean-label drinks across the U.S., Europe, and Asia-Pacific is supporting market expansion

- Growth of modern retail, e-commerce platforms, and direct-to-consumer channels has improved product accessibility and brand visibility

- Rising disposable incomes and willingness to pay a premium for certified organic and sustainably sourced beverages are boosting market value

- Supported by innovation in processing technologies and strong investments in organic agriculture, the Organic Juices market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Organic Juices Market?

- High production and raw material costs associated with organic farming, certification, and cold-pressed processing limit affordability

- For instance, during 2024–2025, fluctuations in organic fruit supply and rising logistics costs impacted pricing for several organic juice manufacturers

- Shorter shelf life of organic juices compared to conventional beverages increases storage, transportation, and wastage challenges

- Limited availability of certified organic raw materials in emerging markets restricts large-scale production

- Intense competition from functional beverages, smoothies, plant-based drinks, and flavored water creates pricing pressure

- To address these challenges, companies are focusing on supply chain optimization, sustainable sourcing, shelf-life extension technologies, and portfolio diversification to strengthen global adoption of organic juices

How is the Organic Juices Market Segmented?

The market is segmented on the basis of type, vegetables, packaging type, and distribution channel.

• By Type

On the basis of type, the organic juices market is segmented into Fruits (Apple, Orange, Grapes, Pineapple, and Others), Vegetables (Beetroot, and Others), and Blends. The Fruit-based organic juices segment dominated the market with an estimated share of around 52.4% in 2025, supported by high consumer preference for familiar flavors, natural sweetness, and widespread availability of organic fruits. Apple and orange juices remain the most consumed due to their taste, nutritional benefits, and suitability for daily consumption across all age groups.

The Blends segment is expected to register the fastest CAGR from 2026 to 2033, driven by growing demand for functional beverages that combine fruits and vegetables to deliver enhanced nutrition, detox benefits, and reduced sugar content. Increasing consumer interest in immunity-boosting, antioxidant-rich, and wellness-focused drinks is accelerating innovation in blended organic juice formulations.

• By Vegetables

Based on vegetables, the organic juices market is segmented into Beetroot and Others. The Beetroot segment dominated the market with a share of approximately 46.8% in 2025, owing to its high nutritional value, rich nitrate content, and strong association with heart health, stamina enhancement, and detoxification. Beetroot juice is widely adopted by fitness enthusiasts and health-conscious consumers, particularly in Europe and North America.

The Other vegetables segment is projected to grow at the fastest CAGR during the forecast period, driven by increasing use of carrot, spinach, celery, cucumber, and kale juices. Rising awareness of plant-based nutrition, digestive health, and low-calorie beverages is encouraging consumers to explore diversified vegetable juice options. Product innovations focusing on improved taste profiles and blended formulations are further supporting growth across this segment.

• By Packaging Type

On the basis of packaging type, the organic juices market is segmented into Bottles, Cartons, and Others. The Bottles segment dominated the market with a share of nearly 58.6% in 2025, primarily due to convenience, portability, resealability, and strong consumer preference for premium glass and PET bottle packaging. Bottles are widely used for cold-pressed and ready-to-drink organic juices across retail and foodservice channels.

The Cartons segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for sustainable, lightweight, and eco-friendly packaging solutions. Increasing adoption of aseptic carton packaging for extended shelf life, reduced refrigeration needs, and improved transportation efficiency is driving growth, especially across emerging markets and mass retail distribution.

• By Distribution Channel

Based on distribution channel, the organic juices market is segmented into Store-Based (Hypermarkets & Supermarkets, Convenience Stores, and Others) and Non-Store-Based. The Store-Based segment dominated the market with a share of about 64.2% in 2025, driven by strong consumer reliance on physical retail for product comparison, brand trust, and immediate availability. Hypermarkets and supermarkets play a key role in offering a wide variety of organic juice brands and flavors.

The Non-Store-Based segment is projected to witness the fastest growth over the forecast period, fueled by rapid expansion of e-commerce platforms, direct-to-consumer models, and online grocery delivery services. Increasing smartphone penetration, digital payment adoption, and preference for doorstep delivery are accelerating online sales of organic juices, particularly among urban and younger consumers.

Which Region Holds the Largest Share of the Organic Juices Market?

- North America dominated the organic juices market with a revenue share of 42.05% in 2025, driven by high consumer awareness regarding organic and clean-label beverages, strong purchasing power, and widespread availability of certified organic juice products across the U.S. and Canada. Rising preference for cold-pressed, non-GMO, and preservative-free juices continues to support market growth across retail and foodservice channels

- Leading companies in North America are focusing on product innovation, functional juice formulations, sustainable packaging, and expanded organic fruit sourcing, strengthening the region’s competitive advantage

- Well-established organic certification frameworks, strong distribution networks, and high demand for health-focused beverages further reinforce North America’s market leadership

U.S. Organic Juices Market Insight

The U.S. is the largest contributor in North America, supported by strong demand for premium organic beverages, rising health consciousness, and growing adoption of plant-based diets. Increasing consumption of organic fruit and vegetable juices among millennials and fitness-oriented consumers, along with rapid expansion of e-commerce and cold-chain logistics, continues to drive market growth.

Canada Organic Juices Market Insight

Canada contributes significantly to regional growth, driven by rising demand for natural and sustainably sourced beverages. Strong government support for organic farming, increasing penetration of organic products in supermarkets, and growing preference for low-sugar and functional juices are supporting steady market expansion across the country.

Asia-Pacific Organic Juices Market

Asia-Pacific is projected to register the fastest CAGR of 6.9% from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness of health and wellness across China, Japan, India, South Korea, and Southeast Asia. Growing demand for organic, preservative-free beverages and expanding modern retail infrastructure are accelerating market adoption across the region.

China Organic Juices Market Insight

China is the largest contributor to Asia-Pacific, supported by a rapidly expanding middle class, increasing concerns over food safety, and rising demand for certified organic products. Strong domestic production capacity, growing imports of organic fruits, and expansion of premium beverage brands are driving market growth.

Japan Organic Juices Market Insight

Japan shows steady growth driven by high consumer focus on quality, nutrition, and functional health benefits. Demand for organic vegetable juices, detox drinks, and low-calorie beverages, along with premium packaging preferences, continues to support market expansion.

India Organic Juices Market Insight

India is emerging as a high-growth market, fueled by increasing health awareness, rising demand for natural beverages, and expansion of organic farming initiatives. Growing popularity of fruit-based organic juices and improved cold-chain infrastructure are accelerating adoption.

South Korea Organic Juices Market Insight

South Korea contributes notably due to strong demand for functional and premium beverages. Increasing focus on clean-label products, lifestyle diseases prevention, and innovative juice blends supports sustained market growth.

Which are the Top Companies in Organic Juices Market?

The organic juices industry is primarily led by well-established companies, including:

- Naked Juice (U.S.)

- Suja Juice (U.S.)

- Bolthouse Farms (U.S.)

- Odwalla (U.S.)

- V8 (U.S.)

- Simply Orange (U.S.)

- Tropicana (U.S.)

- R.W. Knudsen Family (U.S.)

- Lakewood Organic (U.S.)

What are the Recent Developments in Global Organic Juices Market?

- In September 2025, Suja Juice (US) announced a partnership with a major grocery chain to expand its distribution network across the Midwest, enabling the brand to reach new customers who prioritize organic and cold-pressed juices, and strengthening its market visibility for sustained sales growth

- In August 2025, Naked Juice (US) launched a new line of organic smoothies targeted at health-conscious millennials, diversifying its product portfolio while catering to the trend for convenient, nutritious beverages, thereby enhancing brand presence and competitive positioning in the market

- In July 2025, Bolthouse Farms (US) introduced a sustainability initiative aimed at reducing its carbon footprint by 30% over the next five years, reflecting the growing consumer preference for environmentally responsible brands and reinforcing its leadership in sustainable organic juice production

- In January 2024, Suja Organic (US) launched a new line of ready-to-drink Suja Organic Protein Shakes with 16 grams of plant-based protein from rice, pea, and hemp, enriched with essential vitamins, almond milk, coconut cream, and Acacia fiber, providing convenient nutrition and expanding the brand’s presence in the protein beverage segment

- In May 2023, Topo Chico (US) launched a range of fruit-flavored sparkling waters infused with herbal extracts, including lime with mint, blueberry with hibiscus, and tangerine with ginger, catering to consumers seeking refreshing and functional beverages while broadening the brand’s innovative product portfolio

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.