Global Palletizers Market

Taille du marché en milliards USD

TCAC :

%

USD

923.49 Billion

USD

1,438.90 Billion

2024

2032

USD

923.49 Billion

USD

1,438.90 Billion

2024

2032

| 2025 –2032 | |

| USD 923.49 Billion | |

| USD 1,438.90 Billion | |

|

|

|

|

Global Palletizers Market Segmentation, By Technology (Conventional Palletizers and Robotic Palletizers), Product Type (Cases and Boxes, Bags and Sacks, Pails and Drums, Trays and Crates, and Bundles), End-user (Food and Beverage Pharmaceuticals, Personal Care and Cosmetics, Chemicals, Construction Industry, and Others) – Industry Trends and Forecast to 2032.

Palletizers Market Size

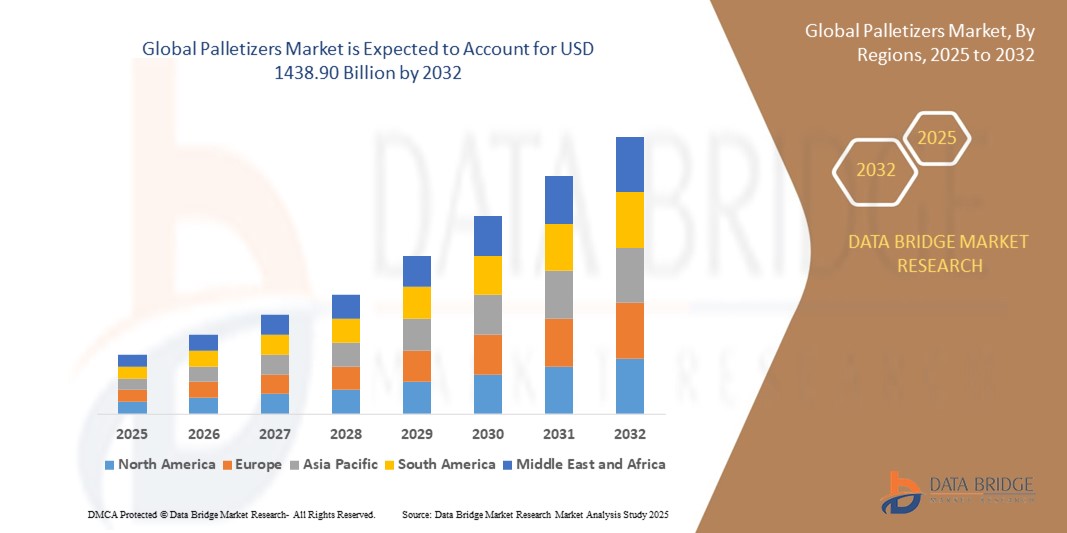

- The global palletizers market size was valued at USD 923.49 billion in 2024 and is expected to reach USD 1438.90 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is primarily driven by the increasing demand for automation in material handling, advancements in robotic technologies, and the need for efficient supply chain operations across various industries

- The growing adoption of palletizers in warehouses and manufacturing facilities, coupled with the rising focus on reducing manual labor and improving operational efficiency, is significantly boosting market expansion

Palletizers Market Analysis

- Palletizers, essential for automating the stacking and organization of goods on pallets, are critical components in modern supply chain and logistics systems, offering enhanced efficiency, precision, and scalability in material handling

- The surge in demand for palletizers is fueled by the rapid growth of e-commerce, increasing adoption of automation in industries, and the need for optimized warehouse management systems

- North America dominated the palletizers market with the largest revenue share of 38.5% in 2024, driven by early adoption of automation technologies, a strong manufacturing base, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, expanding manufacturing sectors, and increasing investments in automation in countries such as China, India, and Japan

- The conventional palletizers segment dominated the largest market revenue share of 54.2% in 2024, driven by its widespread adoption in high-productivity settings due to reliability, cost-effectiveness, and ability to handle diverse product types at high speeds, processing up to 150 cases per minute

Report Scope and Palletizers Market Segmentation

|

Attributes |

Palletizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Palletizers Market Trends

“Increasing Integration of AI and Automation Technologies”

- The global palletizers market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and automation technologies

- These technologies enable advanced process optimization, predictive maintenance, and real-time monitoring of palletizing operations

- AI-driven palletizers can analyze operational data to optimize stacking patterns, improve efficiency, and reduce errors in material handling

- For instance, companies are developing AI-powered robotic palletizers that adapt to varying product sizes and packaging formats, enhancing flexibility in industries such as food and beverage and pharmaceuticals

- This trend is increasing the appeal of palletizing systems for manufacturers and logistics providers by improving throughput and reducing operational downtime

- AI algorithms can also monitor equipment performance, predict maintenance needs, and minimize disruptions by addressing potential issues proactively

Palletizers Market Dynamics

Driver

“Rising Demand for Automation and Efficiency in Supply Chains”

- The growing need for streamlined supply chain operations and increased operational efficiency is a key driver for the global palletizers market

- Palletizing systems enhance productivity by automating repetitive tasks, reducing manual labor, and ensuring precise stacking for storage and transportation

- Government initiatives promoting Industry 4.0 and smart manufacturing, particularly in regions such as North America and Europe, are accelerating the adoption of advanced palletizing solutions

- The expansion of e-commerce and the need for rapid order fulfillment are driving demand for robotic palletizers, which offer scalability and flexibility for handling diverse product types

- Manufacturers are increasingly integrating factory-fitted palletizing systems to meet rising production demands and improve operational accuracy

Restraint/Challenge

“High Initial Investment and Data Security Concerns”

- The high upfront costs associated with acquiring, installing, and integrating advanced palletizing systems, particularly robotic palletizers, pose a significant barrier, especially for small and medium-sized enterprises in emerging market

- Retrofitting existing facilities with automated palletizing systems can be complex and expensive, requiring specialized expertise and infrastructure upgrades.

- Data security and privacy concerns are also a major challenge, as modern palletizers often rely on IoT and cloud-based systems that collect and transmit operational data, raising risks of cyberattacks and data breaches

- Compliance with varying global regulations on data protection and industrial automation standards adds complexity for manufacturers operating across multiple regions

- These factors can limit market growth in cost-sensitive regions or industries with stringent data privacy requirements

Palletizers market Scope

The market is segmented on the basis of technology, product type, and end-user.

- By Technology

On the basis of technology, the global palletizers market is segmented into Conventional Palletizers and Robotic Palletizers. The Conventional Palletizers segment dominated the largest market revenue share of 54.2% in 2024, driven by its widespread adoption in high-productivity settings due to reliability, cost-effectiveness, and ability to handle diverse product types at high speeds, processing up to 150 cases per minute. These systems are well-established in industries such as food and beverage and pharmaceuticals, where consistent output is critical.

The Robotic Palletizers segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by advancements in robotics, AI integration, and the ability to handle varied packaging formats with precision and flexibility. The increasing adoption of robotic systems in e-commerce and logistics, along with their ability to reduce labor costs and enhance operational efficiency, drives this growth.

- By Product Type

On the basis of product type, the global palletizers market is segmented into Cases and Boxes, Bags and Sacks, Pails and Drums, Trays and Crates, and Bundles. The Cases and Boxes segment dominated the market with a revenue share of 45.2% in 2024, attributed to its extensive use in standardized packaging across industries such as food and beverage, pharmaceuticals, and consumer goods. These palletizers optimize stacking patterns and ensure load stability for efficient storage and transportation.

The Bags and Sacks segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increasing demand in industries such as agriculture, chemicals, and food processing, where bags are used for packaging grains, powders, and other bulk products. The versatility of palletizers in handling various bag sizes and weights supports this segment's growth.

- By End-User

On the basis of end-user, the global palletizers market is segmented into Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, Chemicals, Construction Industry, and Others. The Food and Beverage segment held the largest market revenue share of 33.0% in 2024, driven by high production volumes and the need for efficient, hygienic packaging solutions to meet strict regulatory standards. Palletizers in this segment handle diverse packaging formats such as bottles, cans, and cartons, ensuring compliance with food safety requirements.

The Pharmaceuticals segment is expected to witness the fastest growth rate of 7.1% from 2025 to 2032, fueled by the expanding pharmaceutical industry and stringent regulations requiring precise handling to prevent contamination and errors. The adoption of palletizers for automating the palletization of drugs, vials, and cartons enhances efficiency and reduces transportation time, particularly for time-sensitive medications.

Palletizers Market Regional Analysis

- North America dominated the palletizers market with the largest revenue share of 38.5% in 2024, driven by early adoption of automation technologies, a strong manufacturing base, and the presence of key industry players

- Businesses prioritize palletizers to enhance operational efficiency, reduce labor costs, and improve workplace safety, particularly in regions with high manufacturing and logistics activities

- Growth is supported by advancements in palletizing technology, including robotic and conventional systems, alongside rising adoption in both large-scale and small-scale operations

U.S. Palletizers Market Insight

The U.S. palletizers market captured the largest revenue share of 88.2% in 2024 within North America, fueled by strong demand for automated solutions in the food and beverage, pharmaceuticals, and logistics sectors. The trend towards warehouse automation and increasing focus on supply chain optimization boost market expansion. The integration of advanced palletizers in manufacturing facilities and distribution centers complements aftermarket upgrades, creating a dynamic market ecosystem.

Europe Palletizers Market Insight

The Europe palletizers market is expected to witness significant growth, supported by regulatory emphasis on workplace safety and operational efficiency. Businesses seek palletizers that streamline material handling while reducing manual labor. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing notable uptake due to advanced manufacturing sectors and sustainability initiatives.

U.K. Palletizers Market Insight

The U.K. market for palletizers is expected to witness rapid growth, driven by demand for automation in logistics and manufacturing in urban and suburban settings. Increased focus on operational efficiency and workplace safety encourages adoption. Evolving regulations promoting automation and ergonomic standards influence business choices, balancing technology integration with compliance.

Germany Palletizers Market Insight

Germany is expected to witness a high growth rate in the palletizers market, attributed to its advanced manufacturing sector and strong focus on automation and energy efficiency. German businesses prefer technologically advanced palletizers that optimize material handling and contribute to lower operational costs. The integration of these systems in premium manufacturing facilities and aftermarket solutions supports sustained market growth.

Asia-Pacific Palletizers Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding industrial production and rising investments in automation in countries such as China, India, and Japan. Increasing awareness of operational efficiency, workplace safety, and cost reduction is boosting demand. Government initiatives promoting industrial automation and smart manufacturing further encourage the adoption of advanced palletizers.

Japan Palletizers Market Insight

Japan’s palletizers market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced palletizing systems that enhance operational efficiency and safety. The presence of major manufacturers and the integration of palletizers in automated production lines accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Palletizers Market Insight

China holds the largest share of the Asia-Pacific palletizers market, propelled by rapid industrialization, rising manufacturing output, and increasing demand for automated material handling solutions. The country’s growing industrial base and focus on smart manufacturing support the adoption of advanced palletizers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Palletizers Market Share

The palletizers industry is primarily led by well-established companies, including:

- A-B-C Packaging Machine Corporation (U.S.)

- ABB (Sweden)

- Columbia Machine, Inc. (Columbia)

- Premier Tech Ltd. (Canada)

- 3M (U.S)

- Berry Global Inc. (U.S)

- Cedo Ltd (U.K)

- FANUC America Corporation (Japan)

- KION GROUP AG (Germany)

- KUKA AG (Germany)

- Honeywell International Inc (U.S.)

- Krones AG (Germany)

- Wildeck (U.S.)

- Schneider Packaging Equipment Co. Inc. (U.S.)

- Okura Yusoki Co., Ltd. (Japan)

- Fuji Robotics Americas (U.S.)

- Concetti S.P.A (Italy)

What are the Recent Developments in Global Palletizers Market?

- In May 2024, Doosan Robotics Inc. unveiled its most advanced P-SERIES (PRIME-SERIES) collaborative robots at Automate 2024 in Chicago. Headlining the launch was the P3020, the world’s most powerful palletizing cobot, boasting a 30 kg payload and an unmatched reach of 2,030 mm. Designed for high-efficiency industrial tasks, the P-SERIES features reduced power consumption, enhanced safety (PL e, Cat 4), and a wrist-singularity-free design. Its simplified 5-axis movement and increased speed make it ideal for palletizing, manufacturing, logistics, and more—delivering a new standard in human-robot collaboration

- In January 2024, KUKA AG launched the second generation of its KR QUANTEC PA palletizer, setting a new benchmark in high-speed palletizing. This upgraded model features an optimized weight distribution and center of gravity, along with enhanced drive units powered by the latest gear and motor technologies. These improvements enable a perfect balance between axis speed and acceleration, resulting in up to 10% faster cycle times compared to its predecessor. With a payload capacity of up to 240 kg and a compact footprint, it’s ideal for demanding applications, including those in the food industry, thanks to its Hygienic Oil (HO) variant

- In January 2024, FANUC CORPORATION introduced the M-950iA/500, a powerful serial-link palletizing robot designed to handle payloads up to 500 kg. Unlike traditional parallel-link robots, the M-950iA/500 features a wider range of motion, including the ability to extend its arm upright and rotate backward with minimal interference—ideal for tight workspaces and complex palletizing layouts. It boasts a 2,830 mm reach, high rigidity, and a robust wrist capable of managing large and heavy components such as EV batteries and automotive castings. The robot is also optimized for friction stir welding and machining, thanks to its precision and stiffness enhancement options

- In October 2023, Schneider Packaging Equipment Company, Inc., a Pacteon Group company, entered the robotic high-speed palletizing market through a strategic licensing agreement with ITW Hartness Division. This partnership enables Schneider to offer Hartness’s High-Speed Layer Palletizing Tool for future projects and to support existing Hartness systems already in operation. The agreement followed Hartness’s decision to reposition its product portfolio, and Schneider’s team underwent specialized training to ensure seamless integration. This move expands Schneider’s capabilities in end-of-line automation, reinforcing its position as a leader in robotic palletizing solutions

- In August 2023, Dexterity Inc. released Version 3.0 of its Palletizing and Depalletizing (PDP) software, bringing a suite of enhancements to warehouse automation. The update introduced features such as print-and-apply integration, pallet stacking, rolling cart loading, fly-by barcode scanning, and direct sortation to pallets—all aimed at boosting throughput, reducing installation time and cost, and increasing operational flexibility. These upgrades enable third-party logistics providers, retailers, and manufacturers to automate complex pallet operations more efficiently, supporting higher case-per-hour rates and seamless integration into existing workflows

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.