Global Population Health Management Phm Market

Taille du marché en milliards USD

TCAC :

%

USD

43.03 Billion

USD

185.02 Billion

2024

2032

USD

43.03 Billion

USD

185.02 Billion

2024

2032

| 2025 –2032 | |

| USD 43.03 Billion | |

| USD 185.02 Billion | |

|

|

|

|

Global Population Health Management (PHM) Market Segmentation, By Platform (Cloud-Based and On-Premise), Component (Software and Services), End User (Healthcare Providers, Hospitals and Physician Groups, Healthcare Payers, and Others) - Industry Trends and Forecast to 2032

Population Health Management (PHM) Market Size

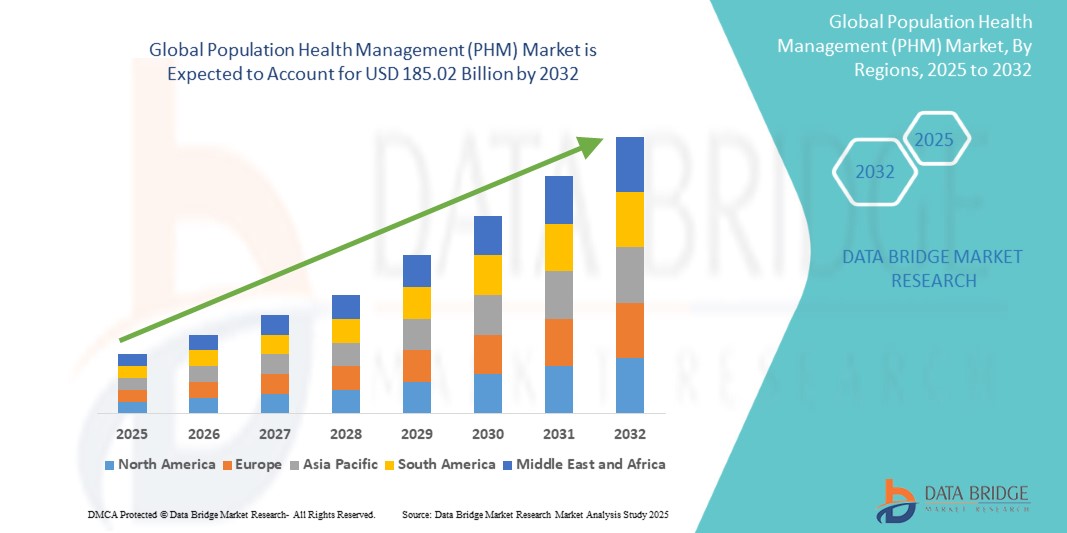

- The global population health management (PHM) market size was valued atUSD 43.03 billion in 2024and is expected to reachUSD 185.02 billion by 2032, at aCAGR of 20.00%during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic diseases, increasing healthcare costs, a growing focus on preventive care, and the integration of advanced technologies in healthcare systems

Population Health Management (PHM) Market Analysis

- The population health management market is witnessing rapid expansion due to increased adoption of value-based care models and integration of healthcare systems with data analytics platforms, enhancing patient outcomes and decision-making efficiency

- Healthcare providers are leveraging real-time data monitoring and interoperable systems to streamline operations, reduce redundancies, and promote personalized care strategies across diverse patient populations

- North America is expected to dominate the population health management (PHM) market due to advanced healthcare infrastructure, high adoption of digital health technologies, strong government support for healthcare reforms, and a growing focus on value-based care models

- Asia-Pacific is expected to be the fastest-growing region in the population health management (PHM) market during the forecast period due to increasing healthcare digitization, a growing aging population, rising chronic diseases, and significant investments in healthcare infrastructure

- The cloud-based platforms segment is expected to dominate the population health management (PHM) market with the largest share of 80.5% in 2025 due to its scalability, cost-efficiency, and real-time access to patient data across multiple systems

Report Scope andPopulation Health Management (PHM) Market Segmentation

|

Attributes |

Population Health Management (PHM) KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Population Health Management (PHM) Market Trends

“Integration of Artificial Intelligence in Population Health Management”

- Artificial Intelligenceis increasingly being integrated into population health management to enhance predictive analytics, streamline administrative workflows, and support clinical decision-making

- Healthcare providers are using AI-powered tools to analyze large datasets, enabling early identification of at-risk patients and allowing timely interventions

- For instances, Mount Sinai Health System uses machine learning models to predict heart failure risks in patients

- AI is also being applied to automate routine tasks such as appointment scheduling and patient follow-ups, which helps reduce the burden on healthcare staff

- For instance, Cleveland Clinic utilizes AI chatbots to manage appointment bookings and symptom assessments

- The adoption of AI helps improve care coordination by delivering actionable insights that support personalized treatment plans and reduce hospital readmissions

- This trend demonstrates a shift toward data-driven and technology-enabled healthcare delivery, which aims to improve population health outcomes while reducing costs and operational inefficiencies

Population Health Management (PHM) Market Dynamics

Driver

“Rising Burden of Chronic Diseases”

- The growing prevalence of chronic conditions such as diabetes, cardiovascular disorders, and respiratory diseases is significantly increasing the demand for population health management, as these illnesses require constant monitoring and long-term coordinated care

- Traditional healthcare models are often unable to manage the complexity and cost of chronic disease treatment, leading to the adoption of PHM systems that offer real-time data analysis for proactive interventions

- Healthcare providers using PHM tools have reported notable improvements, such as a reduction in emergency visits and hospital readmissions by identifying and managing high-risk patients early

- For instance, Kaiser Permanente used predictive analytics to reduce heart failure hospitalizations

- Aging populations globally are contributing to the chronic disease burden, necessitating more comprehensive care management systems

- For instance, Japan’s use of community-based PHM models has shown success in managing elderly care

- As healthcare systems shift from volume-based to value-based care, PHM is increasingly seen as essential for improving outcomes while reducing overall system costs and inefficiencies

Opportunity

“Growing Adoption of Digital Health Technologies”

- The increasing adoption of digital health technologies such as wearable devices, mobile apps, and telehealth platforms offers significant opportunities to enhance population health management through real-time data monitoring and improved patient engagement

- These tools enable the collection of vital patient health information outside traditional clinical settings, feeding valuable data into PHM systems for more informed and timely interventions

- Wearable devices have proven effective in chronic disease management by notifying physicians of abnormal health patterns

- For instances, Fitbit’s partnership with healthcare systems allows early detection of heart irregularities

- Mobile health apps support medication adherence and lifestyle management through reminders and customized feedback

- For instance, the MySugr diabetes app helps patients monitor glucose levels while sharing data with healthcare providers

- As digital literacy and internet access continue to expand globally, these integrated solutions are transforming PHM into a scalable, efficient model capable of supporting preventive care and long-term health improvements across populations

Restraint/Challenge

“Data Privacy Concerns”

- Data privacy concerns are a significant challenge in the population health management market, as these systems rely on the collection and analysis of sensitive personal health data from multiple sources

- Healthcare providers must ensure compliance with strict data protection regulations and safeguard patient information from cyber threats, which adds complexity to PHM implementation

- Breaches of health data can erode patient trust and lead to legal consequences

- For instance, the 2023 cyberattack on a major U.S. hospital network exposed millions of patient records and highlighted vulnerabilities in digital health systems

- The integration of data from electronic health records, mobile apps, and wearable devices increases the risk of unauthorized access, especially when systems lack secure interoperability

- For instance, disconnected platforms can lead to accidental data leaks during manual transfers

- These privacy concerns make many healthcare organizations hesitant to fully adopt PHM solutions, despite their potential to improve care quality and operational efficiency

Population Health Management (PHM) Market Scope

The market is segmented on the basis of platform, component, and end user.

|

Segmentation |

Sub-Segmentation |

|

ByPlatform |

|

|

ByComponent |

|

|

ByEnd User |

|

In 2025, the cloud-based platforms is projected to dominate the market with a largest share in platform segment

The cloud-based platforms segment is expected to dominate the population health management (PHM) market with the largest share of 80.5% in 2025 due to its scalability, cost-efficiency, and real-time access to patient data across multiple systems

The services is expected to account for the largest share during the forecast period incomponentmarket

In 2025, the services segment is expected to dominate the market with the largest market share of 57.55% due to its rising demand for implementation, consulting, and continuous support services to optimize the use of PHM solutions

Population Health Management (PHM) Market Regional Analysis

“North America Holds the Largest Share in the Population Health Management (PHM) Market”

- North America is the dominating region in the population health management market, accounting for the largest market share of 64.81%

- The region leads due to its advanced healthcare infrastructure and early adoption of population health management tools across hospitals and clinics

- Strong presence of major market players and strategic collaborations, such as the partnership between Innovaccer Inc. and P3 Health Partners in 2024, are enhancing PHM adoption

- Supportive government policies encouraging value-based care and electronic health record usage further fuel market dominance

- High healthcare spending and emphasis on preventive care contribute to the continued leadership of North America in this sector

“Asia-Pacific is Projected to Register the HighestCAGR in the Population Health Management (PHM) Market”

- Asia Pacific is the fastest-growing region in the population health management market, projected to grow at the highest CAGR over the forecast period

- Growth is driven by rising healthcare demands, expanding medical infrastructure, and increasing adoption of digital health technologies in nations such as India and China

- Rapid urbanization and a growing middle class are increasing awareness and access to healthcare services, prompting PHM integration

- Governments are investing in healthcare IT initiatives to improve patient outcomes and streamline care delivery across public systems

- Local and international players are entering the Asia Pacific market with cloud-based and mobile PHM solutions tailored for cost-effective scalability

Population Health Management (PHM) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- McKesson Corporation (U.S.)

- Verisk Analytics, Inc. (U.S.)

- Health Catalyst (U.S.)

- athenahealth, Inc. (U.S.)

- Medecision (U.S.)

- Xerox Corporation (U.S.)

- Fonemed (U.S.)

- General Electric (U.S.)

- NXGN Management, LLC (U.S.)

- Optum Inc. (U.S.)

- Conifer Health Solutions, LLC (U.S.)

- IBM (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthcare GmbH (Germany)

Latest Developments in Global Population Health Management (PHM) Market

- In July 2023, the California Department of Health Care Services (DHCS) launched the Medi-Cal Connect Population Health Management (PHM) Service in collaboration with Gainwell Technologies and several partner vendors. This initiative, part of the CalAIM program, aims to integrate data from medical, behavioral, dental, pharmaceutical, and social services to provide a comprehensive view of Medi-Cal members. By aggregating this information, the service enables risk stratification, personalized care coordination, and improved health outcomes across the state's Medicaid population. The PHM Service is expected to enhance care delivery, reduce disparities, and support the transition to value-based care models

- In October 2022, MEDITECH introduced Expanse Population Insight, a significant enhancement to its population health management suite. This solution integrates data from electronic health records (EHR), claims, and other sources, providing clinicians with real-time insights into patient risk, care gaps, and utilization. By embedding these analytics directly into care workflows, it enables the creation of patient cohorts based on disease state, provider attribution, and risk contracts, facilitating targeted interventions. The platform also incorporates risk algorithms, including Innovaccer’s social vulnerability index, to address health equity concerns. This advancement supports healthcare organizations in transitioning to value-based care models by improving patient outcomes and managing costs more effectively

- In March 2021, Royal Philips partnered with U.S.-based openDoctor to enhance its Patient Management Solution with real-time, self-scheduling capabilities for radiology appointments. This integration enables patients to book exams, complete intake forms, and receive automated reminders via mobile devices, streamlining the scheduling process. The collaboration aims to reduce appointment no-shows, optimize staff efficiency, and improve patient and staff satisfaction. By automating administrative tasks, the solution allows radiology departments to focus more on personalized care, ultimately enhancing clinical outcomes and operational efficiency

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.