Global Radiology Information Systems Ris Market

Taille du marché en milliards USD

TCAC :

%

USD

1.13 Billion

USD

2.13 Billion

2024

2032

USD

1.13 Billion

USD

2.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 2.13 Billion | |

|

|

|

|

Global Radiology Information Systems (RIS) Market Segmentation, By Type (Integrated, and Standalone), Component (Services, Software, and Hardware), Deployment Mode (Web Based, On-Premise, and Cloud-Based), End User (Hospitals and Clinics, Outpatient Department, Office Based Physicians, Emergency Healthcare Service Providers, and Research and Academic Institute) - Industry Trends and Forecast to 2032

Radiology Information Systems (RIS) Market Size

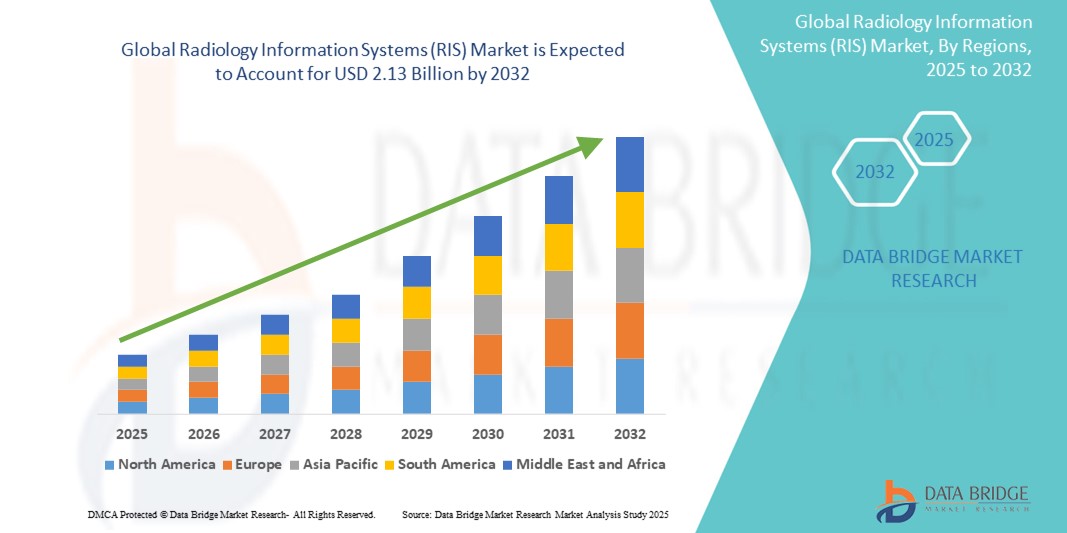

- The global radiology information systems (RIS) market size was valued atUSD 1.13 billion in 2024and is expected to reachUSD 2.13 billion by 2032, at aCAGR of 8.15%during the forecast period

- This growth is driven by factors such as the increasing demand for streamlined workflow in radiology departments, rising adoption of electronic health records (EHRs), growing imaging procedures, and the need for efficient data management and reporting tools

Radiology Information Systems (RIS) Market Analysis

- The global radiology information systems market is showing steady expansion, with healthcare facilities increasingly relying on digital tools to manage imaging data more efficiently

- A key focus remains on improving the accuracy and accessibility of radiological records, which enhances workflow and supports faster clinical decision-making

- North America is expected to dominate the Radiology Information Systems (RIS)s market with 49.05% share due to its advanced healthcare infrastructure and high technology adoption rates

- Asia-Pacific is expected to be the fastest growing region in the Radiology Information Systems (RIS) market during the forecast period with 8.05% share due to increasingly adopting digital solutions in healthcare, contributing to rapid market expansion

- The Web Based segment is expected to dominate the Radiology Information Systems (RIS) market with the largest share of 77.05% in 2025 due to its ease of deployment, scalability, and remote accessibility. These systems enable healthcare professionals to access imaging data and reports from any location, which significantly improves workflow efficiency and patient care

Report Scope and Radiology Information Systems (RIS) Market Segmentation

|

Attributes |

Radiology Information Systems (RIS) KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Radiology Information Systems (RIS) Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- One major trend shaping the radiology information systems market is the shift toward cloud-based solutions for better accessibility and data security

- Cloud platforms are helping healthcare providers manage imaging data more efficiently while minimizing the need for complex in-house infrastructure

- Many facilities are adopting these solutions to support remote access, enabling radiologists to review and interpret images from different locations

- The ability to scale storage and services as needed also makes cloud-based systems a flexible option for growing imaging demands

- Healthcare organizations are increasingly recognizing the value of cloud integration in reducing operational costs and enhancing collaboration across departments

- For instance, some hospitals now use cloud-enabled radiology systems to allow off-site radiologists to access and report on imaging cases in real time

- In conclusion, this growing preference for cloud-based systems is transforming how radiology data is managed and accessed across healthcare settings

Radiology Information Systems (RIS) Market Dynamics

Driver

“RISing Demand for Streamlined Workflow in Radiology Departments”

- RISing demand for streamlined workflows is driving growth in the radiology information systems market due to increasing imaging procedure volumes

- Hospitals and diagnostic centers face pressure to manage imaging records, appointment scheduling, reporting, and billing efficiently

- Radiology information systems centralize and automate these processes, reducing administrative burdens for radiologists and technicians

- Integration with hospital systems ensures accurate data entry, faster report turnaround, and smoother coordination between departments

- For instance, using RIS, a hospital can reduce waiting times and improve clinical decision-making by ensuring real-time access to patient imaging history

- In conclusion, the trend toward efficient workflow solutions will continue as healthcare providers aim to optimize operations, reduce costs, and improve patient satisfaction

Opportunity

“Integration of Artificial Intelligence for Enhanced Image Analysis”

- A key opportunity in the radiology information systems market is the integration of artificial intelligence for advanced image analysis

- AI helps radiologists manage growing workloads and complex imaging data, providing support for faster and more accurate diagnoses

- By embedding AI into RIS, tasks such as lesion detection, measurement calculations, and anomaly flagging can be automated

- For instance, AI can detect subtle abnormalities that might be overlooked in high-volume settings, leading to earlier diagnosis and improved outcomes

- AI systems can continuously learn from large datasets, improving diagnostic accuracy and offering consistent results over time

- In conclusion, the integration of AI into radiology information systems enhances clinical efficiency, providing smarter, more personalized care without requiring an overhaul of IT infrastructure

Restraint/Challenge

“High Cost of System Implementation and Maintenance”

- A major challenge in adopting radiology information systems is the high cost of implementation and ongoing maintenance

- The initial investment required for software, hardware upgrades, integration with existing systems, and user training can be significant

- Ongoing expenses such as licensing fees, technical support, and regular updates add to the financial burden for healthcare providers

- For instance, small clinics with limited budgets may hesitate to adopt or upgrade systems due to the high upfront costs

- Transitioning from legacy systems to advanced platforms may disrupt operations temporarily, requiring staff retraining and further investment

- In conclusion, to overcome these challenges, flexible pricing models or government-supported initiatives could help improve access to radiology information systems and accelerate market growth

Radiology Information Systems (RIS) Market Scope

The market is segmented on the basis of type, component, deployment type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Component |

|

|

By Deployment Mode |

|

|

By End User |

|

In 2025, the Web Based segment is projected to dominate the market with a largest share in deployment type segment

The web based segment is expected to dominate the Radiology Information Systems (RIS) market with the largest share of 77.05% in 2025 due to its ease of deployment, scalability, and remote accessibility. These systems enable healthcare professionals to access imaging data and reports from any location, which significantly improves workflow efficiency and patient care. Web based solutions require less complex IT infrastructure, reducing upfront investment costs for hospitals and clinics. They also support real-time data sharing, allowing seamless collaboration among radiologists, physicians, and specialists.

The Integrated segment is expected to account for the largest share during the forecast period in type segment

In 2025, the integrated segment is expected to dominate the market with the largest market share of 67.05% due to its ability to streamline radiology workflows by connecting various functions such as scheduling, reporting, billing, and image management within a single platform. This integration reduces the need for multiple standalone systems, minimizing data entry errors and improving communication across departments. Healthcare providers benefit from a unified system that enhances operational efficiency and supports quicker clinical decision-making. Integrated radiology information systems also enable real-time access to patient data and imaging results, helping improve diagnostic accuracy and patient outcomes.

Radiology Information Systems (RIS) Market Regional Analysis

“North America Holds the Largest Share in the Radiology Information Systems (RIS) Market”

- North America holds the largest share of the global radiology information systems market with 49.05% share

- The U.S. is the primary contributor due to its advanced healthcare infrastructure and high technology adoption rates

- A strong regulatory framework and well-established healthcare organizations drive the dominance of this region

- The demand for integrated systems and advanced solutions in radiology is high in this market

- North America is expected to maintain its leadership position in the coming years due to continuous technological advancements in radiology systems

“Asia-Pacific is Projected to Register the HighestCAGR in the Radiology Information Systems (RIS) Market”

- The Asia Pacific region is witnessing the fastest growth in the radiology information systems market with 8.05% share

- Countries such as China, India, and Japan are increasingly adopting digital solutions in healthcare, contributing to rapid market expansion

- Significant investments in healthcare infrastructure and growing healthcare awareness are key growth drivers

- The rising prevalence of chronic diseases and the need for efficient diagnostic solutions are further accelerating the demand for radiology information systems

- As healthcare modernization efforts continue, this region is expected to see robust growth over the next few years

Radiology Information Systems (RIS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points providesd are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthcare GmbH (Germany)

- Oracle (U.S.)

- McKesson Corporation (U.S.)

- GE HealthCare (U.S.)

- Canon Medical Systems Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Esaote SPA (Italy)

- Hitachi Ltd. (Japan)

- Veradigm LLC (U.S.)

- MedInformatix, Inc. (U.S.)

- Epic Systems Corporation (U.S.)

- Carestream Health (U.S.)

- Shimadzu Corporation (Japan)

- Hologic, Inc. (U.S.)

- EIZO Corporation (Japan)

- Sectra AB (Sweden)

- Fischer Medical (U.S.)

Latest Developments in Global Radiology Information Systems (RIS) Market

- In November 2022, a strategic partnership between Epic and Google Cloud was formed, enabling hospitals utilizing Epic electronic health records (EHR) technology to store records in the cloud. This collaboration broadens healthcare organizations' choices for managing records in a cloud environment, offering enhanced flexibility and access to specialized tools

- In March 2022, Intelerad Medical Systems introduced the EnterpRISe Imaging and Informatics Suite during the HIMSS Global Health Conference. This innovative solution offers radiologists an emerging option for medical image management, potentially enhancing efficiency and capabilities in the dynamic landscape of healthcare information and management systems

- In February 2022, Carestream Health India introduced the DRX Compass, a precise, convenient, and customizable digital radiology solution. Engineered to enhance radiologists' efficiency, it offers a new level of accuracy in diagnostic imaging, reflecting advancements in technology and addressing the evolving needs of the healthcare industry

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.