Global Rare Inherited Metabolic Disorders Drug Market

Taille du marché en milliards USD

TCAC :

%

USD

217.80 Million

USD

530.10 Million

2025

2033

USD

217.80 Million

USD

530.10 Million

2025

2033

| 2026 –2033 | |

| USD 217.80 Million | |

| USD 530.10 Million | |

|

|

|

|

Segmentation du marché mondial des médicaments contre les maladies métaboliques héréditaires rares, par classe thérapeutique (médicaments de remplacement enzymatique, thérapie génique, médicaments de réduction du substrat, petites molécules, oligonucléotides et protéines), voie d'administration (parentérale, orale et intrathécale), développement clinique (médicaments commercialisés, essais cliniques de phase III, essais cliniques de phase I-II et candidats précliniques), indication (maladies de surcharge lysosomale, troubles du cycle de l'urée, troubles du métabolisme des acides aminés, acidémies organiques, maladies mitochondriales, maladies peroxysomales et autres maladies métaboliques héréditaires rares) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des médicaments contre les maladies métaboliques héréditaires rares

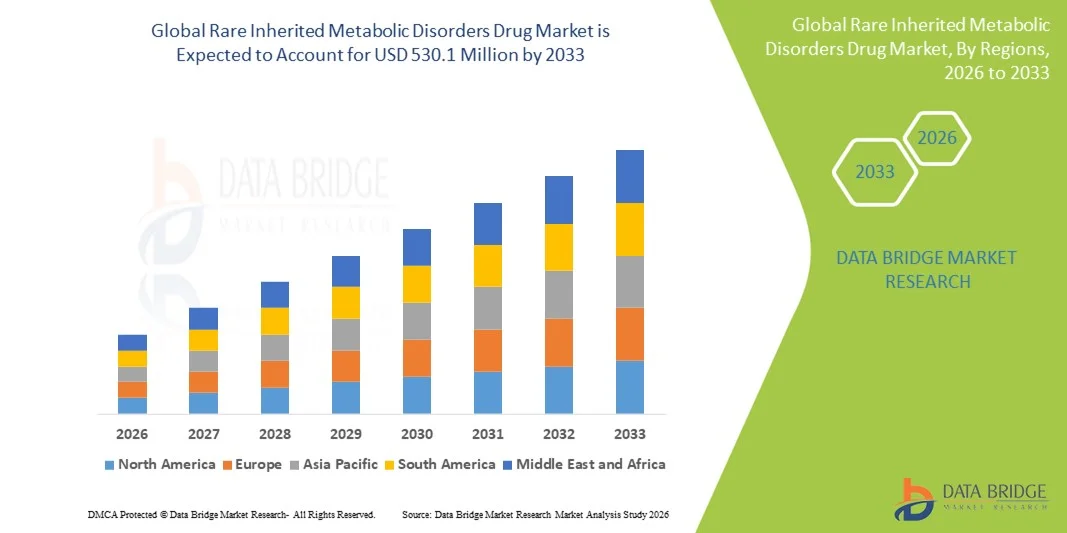

- Le marché mondial des médicaments contre les maladies métaboliques héréditaires rares était évalué à 217,8 millions de dollars américains en 2025 et devrait atteindre 530,1 millions de dollars américains d'ici 2033 , soit un TCAC de 11,80 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'augmentation des taux de diagnostic, les progrès des thérapies de précision et un soutien réglementaire important aux médicaments orphelins, qui continuent de stimuler l'innovation dans les traitements de remplacement enzymatique, à base de petites molécules, à base d'ARN et les thérapies géniques émergentes.

- De plus, la demande croissante de thérapies efficaces modifiant l'évolution de la maladie chez les patients pédiatriques et adultes favorise leur adoption, les systèmes de santé privilégiant l'intervention précoce et l'amélioration des résultats à long terme. Ces facteurs convergents accélèrent l'adoption des médicaments ciblés contre les maladies inflammatoires inflammatoires, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des médicaments contre les maladies métaboliques héréditaires rares

- Les médicaments ciblant les maladies métaboliques héréditaires rares, notamment les enzymothérapies substitutives, les thérapies géniques, les médicaments de réduction du substrat, les petites molécules, les oligonucléotides et les protéines, deviennent des piliers thérapeutiques essentiels pour de nombreuses maladies métaboliques héréditaires rares, car ils améliorent la correction métabolique, ralentissent la progression de la maladie et améliorent les résultats à long terme chez les patients pédiatriques et adultes.

- La demande croissante est alimentée par les progrès de la médecine génétique, l'expansion des programmes de dépistage néonatal, l'amélioration de la précision diagnostique et la forte priorité accordée à la recherche et au développement des médicaments orphelins, autant d'éléments qui, ensemble, dynamisent les processus de développement et accélèrent la translation clinique par voie parentérale, orale et intrathécale.

- L'Amérique du Nord a dominé le marché en 2025, représentant la plus grande part de revenus (42,9 %), grâce à une infrastructure solide pour la prise en charge des maladies métaboliques, une utilisation importante des thérapies de remplacement enzymatique commercialisées, une adoption rapide des technologies de thérapie génique et un portefeuille de produits en développement actif comprenant des candidats commercialisés, en phase III, en phase I-II et précliniques pour les maladies métaboliques héréditaires.

- La région Asie-Pacifique devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison de l'augmentation des dépenses de santé, de la sensibilisation croissante aux troubles du cycle de l'urée, des acides aminés et des mitochondries, et de l'accès élargi aux médicaments oraux à petites molécules et aux thérapies parentérales complexes.

- Le segment des maladies de surcharge lysosomale a dominé le marché avec une part de marché de 45,2 % en 2025, grâce à la forte prévalence des MSL au sein de l'ensemble des maladies inflammatoires chroniques de l'intestin (MICI), à la large disponibilité des médicaments de remplacement enzymatique et aux investissements continus dans les thérapies de réduction du substrat, les thérapies géniques et les thérapies protéiques adaptées aux sous-types de MSL.

Portée du rapport et segmentation du marché des médicaments contre les maladies métaboliques héréditaires rares

|

Attributs |

Aperçu du marché des médicaments contre les maladies métaboliques héréditaires rares |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des médicaments contre les maladies métaboliques héréditaires rares

Accélération des thérapies géniques et moléculaires pour la modification à long terme des maladies

- Une tendance importante et croissante sur le marché mondial des médicaments contre les maladies métaboliques héréditaires rares est le développement rapide de la thérapie génique, de la thérapie par oligonucléotides et des protéines thérapeutiques de nouvelle génération, qui permettent une correction métabolique plus ciblée et une modification à long terme de la maladie dans de nombreuses catégories de maladies métaboliques héréditaires.

- Par exemple, les plateformes de thérapie génique à base d'AAV en cours de développement pour des affections telles que le déficit en OTC et la maladie de Pompe démontrent une expression enzymatique durable et un bénéfice thérapeutique potentiel en dose unique, redéfinissant les attentes en matière de prise en charge à long terme.

- La découverte de médicaments guidée par l'IA permet une meilleure compréhension du repliement incorrect des enzymes, des perturbations des voies métaboliques et des corrélations génotype-phénotype, ce qui favorise une sélection plus précise des candidats médicaments ; par exemple, les plateformes émergentes identifient des correcteurs de petites molécules optimisés et des voies de réduction des substrats pour les maladies de surcharge lysosomale et les maladies mitochondriales.

- L'intégration harmonieuse des diagnostics génétiques, du dépistage néonatal élargi et de la sélection des traitements guidée par les biomarqueurs permet une intervention thérapeutique plus précoce, permettant aux médecins d'associer les patients aux thérapies parentérales, orales ou intrathécales les plus appropriées.

- Cette évolution vers des thérapies plus personnalisées et spécifiques aux mécanismes d'action remodèle fondamentalement les processus cliniques, incitant les entreprises à élargir leurs portefeuilles aux médicaments de thérapie génique, aux médicaments de remplacement enzymatique et aux médicaments oligonucléotidiques ciblant des phénotypes métaboliques rares.

- La demande de thérapies avancées offrant une correction métabolique plus profonde et de meilleurs résultats fonctionnels croît rapidement, car les patients et les systèmes de santé privilégient de plus en plus les traitements modificateurs de la maladie par rapport à la prise en charge symptomatique traditionnelle.

Dynamique du marché des médicaments contre les maladies métaboliques héréditaires rares

Conducteur

Besoin croissant lié à l'augmentation des taux de diagnostic et aux progrès de la médecine génétique

- L'augmentation mondiale des diagnostics de maladies métaboliques héréditaires rares, favorisée par l'élargissement du dépistage néonatal, des tests génomiques plus complets et une sensibilisation accrue des cliniciens, stimule considérablement la demande de thérapies médicamenteuses spécialisées, notamment l'enzymothérapie substitutive, la thérapie génique et les petites molécules.

- Par exemple, en 2025, plusieurs sociétés biopharmaceutiques ont fait progresser des programmes de phase III sur les troubles métaboliques utilisant des approches basées sur les AAV et l'ARNm, accélérant ainsi la dynamique du marché pour les traitements modificateurs de la maladie.

- À mesure que davantage de patients sont diagnostiqués plus tôt et présentent des profils moléculaires plus clairs, l'adoption de médicaments ciblés visant à régénérer les enzymes, à corriger les voies métaboliques ou à réduire la quantité de substrat augmente rapidement dans tous les contextes cliniques.

- De plus, l'importance croissante accordée à la médecine de précision et le succès clinique des programmes de développement de médicaments orphelins placent les thérapies IMD au cœur des filières de développement des maladies rares à l'échelle mondiale.

- La facilité d'utilisation des différentes voies d'administration, notamment les traitements enzymatiques de substitution par voie parentérale, les petites molécules orales et les thérapies intrathécales pour les affections neurométaboliques, continue de favoriser leur adoption dans les centres métaboliques pédiatriques et adultes, l'accessibilité accrue aux traitements soutenant la croissance globale du marché.

- L'expansion des registres de patients, l'amélioration des infrastructures de conseil génétique et l'augmentation des investissements dans le développement de médicaments contre les maladies inflammatoires myofibroblastiques contribuent également à une demande de marché forte et durable à long terme.

Retenue/Défi

Coûts de traitement élevés et procédures réglementaires strictes : des obstacles majeurs

- Les préoccupations liées au coût extrêmement élevé des thérapies de remplacement enzymatique, des thérapies géniques et autres produits biologiques avancés constituent un obstacle majeur à une plus large diffusion sur le marché, notamment dans les régions où les infrastructures de remboursement sont limitées.

- Par exemple, les débats très médiatisés autour du prix des thérapies géniques ponctuelles pour les troubles métaboliques ont soulevé des questions chez les organismes payeurs et les agences de santé concernant leur accessibilité financière et leur viabilité à long terme.

- Il est essentiel de répondre à ces préoccupations financières par le biais d'une tarification basée sur la valeur, d'un remboursement lié aux résultats et d'une couverture d'assurance plus étendue afin de favoriser l'accès des patients aux soins, car de nombreuses thérapies contre les maladies inflammatoires et dégénératives de l'intestin dépassent le seuil de coût pour la plupart des familles sans soutien structuré.

- De plus, les exigences réglementaires strictes en matière de validation clinique — notamment le suivi de sécurité à long terme pour les thérapies géniques et les normes CMC complexes pour les produits biologiques — allongent les délais de développement et augmentent les difficultés globales de fabrication.

- Bien que les initiatives réglementaires aux États-Unis et en Europe soutiennent le développement des médicaments orphelins, la complexité de la production d'enzymes de haute pureté, de vecteurs viraux et d'oligonucléotides spécialisés continue d'entraver la mise à l'échelle, en particulier pour les petites entreprises de biotechnologie qui se lancent dans le développement des médicaments orphelins.

- Le dépassement de ces défis grâce à des technologies de fabrication améliorées, des modèles de remboursement coordonnés et une harmonisation réglementaire mondiale sera essentiel pour permettre une adoption plus large et une expansion durable du marché.

Portée du marché des médicaments contre les maladies métaboliques héréditaires rares

Le marché est segmenté en fonction de la classe de médicament, de la voie d'administration, du stade de développement clinique et de l'indication.

- Par classe de médicament

Le marché est segmenté, selon la classe thérapeutique, en médicaments de substitution enzymatique, thérapies géniques, médicaments de réduction du substrat, petites molécules, oligonucléotides et protéines. Le segment des médicaments de substitution enzymatique a dominé le marché en 2025, grâce à leur utilisation clinique établie de longue date dans les maladies de surcharge lysosomale et à des systèmes de remboursement performants sur les principaux marchés. Ces thérapies restent le traitement de première intention pour des affections telles que la maladie de Pompe, la maladie de Fabry et la maladie de Gaucher, en raison de leur capacité prouvée à compenser le déficit enzymatique et à ralentir la progression de la maladie. Leur utilisation systématique dans les centres métaboliques pédiatriques et adultes renforce leur position de leader dans le traitement des maladies métaboliques héréditaires rares. La large familiarité des cliniciens avec ces médicaments, la standardisation des posologies et l'élargissement des indications contribuent également à la domination de ce segment. Les fabricants continuent d'investir dans des formulations améliorées, des variantes à demi-vie prolongée et des enzymes recombinantes de nouvelle génération afin de maintenir leur position sur le marché.

Le segment des médicaments de thérapie génique devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'évolution vers une correction métabolique à long terme, voire curative, grâce aux plateformes AAV, lentivirales et d'édition génique. Les programmes de thérapie génique se développent rapidement pour les troubles du cycle de l'urée, les maladies mitochondriales et les maladies lysosomales sévères, pour lesquelles les besoins médicaux sont importants. Le soutien réglementaire croissant, les désignations de thérapie innovante et la maturation des résultats cliniques alimentent une forte dynamique pour cette classe de médicaments. L'augmentation des investissements des entreprises de biotechnologie innovantes et les partenariats stratégiques avec les CDMO accélèrent la montée en puissance de la production. À mesure que les thérapies à dose unique et à action prolongée seront validées cliniquement, leur adoption devrait connaître une forte croissance à l'échelle mondiale.

- Par voie d'administration

Selon la voie d'administration, le marché est segmenté en trois catégories : parentérale, orale et intrathécale. Le segment parentéral a dominé le marché en 2025, générant la plus grande part de revenus, principalement en raison de la prévalence des thérapies de remplacement enzymatique et des protéines thérapeutiques nécessitant une administration intraveineuse ou sous-cutanée. L'administration parentérale demeure la norme pour les produits biologiques de haut poids moléculaire utilisés dans les maladies de surcharge lysosomale (MSL), les maladies mitochondriales et les acidémies organiques. Les centres cliniques du monde entier sont bien équipés pour les thérapies par perfusion, ce qui explique l'utilisation prédominante de cette voie. La disponibilité croissante de dispositifs de perfusion à domicile et de formulations à action prolongée renforce encore sa position dominante. Les voies parentérales garantissent une biodisponibilité élevée et une exposition systémique constante, les rendant indispensables pour les maladies métaboliques héréditaires sévères.

Le segment intrathécal devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par le développement croissant des thérapies ciblant le système nerveux central. De nombreuses maladies métaboliques héréditaires rares (MMH) présentent des manifestations neurologiques, et l'administration intrathécale permet un accès direct au système nerveux central, où l'administration systémique est moins efficace. Les progrès réalisés dans l'administration par cathéter et les vecteurs conçus pour pénétrer le système nerveux central favorisent l'adoption de cette approche. Les entreprises développent de plus en plus de thérapies géniques, d'oligonucléotides et d'enzymes par voie intrathécale pour les indications neurométaboliques. L'augmentation de l'activité clinique et l'amélioration de la sécurité des procédures accélèrent cette croissance.

- Par stade de développement clinique

Sur la base du développement clinique, le marché est segmenté en médicaments commercialisés, essais cliniques de phase III, essais cliniques de phase I-II et candidats précliniques. Le segment des médicaments commercialisés dominait le marché en 2025, grâce à la présence établie des enzymothérapies, des traitements à base de petites molécules et à la commercialisation initiale de certaines thérapies géniques. Les produits commercialisés demeurent la principale source de revenus grâce à la confiance des médecins, à leurs résultats probants à long terme et à leur large prise en charge. Les traitements établis pour la maladie de Gaucher, la maladie de Fabry, le déficit en OTC et d'autres maladies métaboliques héréditaires continuent de générer une forte demande clinique. La gestion continue du cycle de vie, l'extension des indications et l'amélioration des formulations renforcent leur position dominante. La disponibilité de cadres structurés de suivi des patients favorise également l'adoption des traitements commercialisés.

Le segment des candidats précliniques devrait connaître la croissance la plus rapide entre 2026 et 2033, reflétant l'essor des nouvelles approches de découverte de médicaments métaboliques. L'innovation préclinique se développe rapidement dans les domaines de l'édition génique, des voies de réduction des substrats, des plateformes d'oligonucléotides et des thérapies protéiques recombinantes. L'augmentation des investissements des jeunes entreprises de biotechnologie et des sociétés pharmaceutiques contribue à la solidité des pipelines. La disponibilité de modèles de maladies avancés, du criblage à haut débit et de la cartographie des voies métaboliques assistée par l'IA accélère les progrès en phase précoce. À mesure que davantage de candidats passent de la phase de découverte aux études précliniques, ce segment devrait connaître une croissance soutenue.

- Par indication

En fonction de l'indication, le marché est segmenté en maladies lysosomales, troubles du cycle de l'urée, troubles du métabolisme des acides aminés, acidémies organiques, maladies mitochondriales, maladies peroxysomales et autres maladies métaboliques héréditaires rares. Le segment des maladies lysosomales dominait le marché en 2025 avec une part de 45,2 %, grâce à la forte prévalence de ces maladies au sein du paysage des maladies métaboliques héréditaires et à la grande disponibilité des thérapies de substitution enzymatique et de réduction du substrat. Les maladies lysosomales telles que les maladies de Gaucher, de Fabry et de Pompe représentent une part importante des maladies métaboliques rares traitées dans le monde. Des parcours diagnostiques établis, des registres de patients robustes et des portefeuilles de produits diversifiés continuent de soutenir une forte demande. Le développement continu des thérapies de substitution enzymatique de nouvelle génération, des thérapies de réduction du substrat par voie orale et des thérapies géniques émergentes renforce encore la position de leader de ce segment. Des investissements pharmaceutiques importants et une activité mondiale soutenue dans les essais cliniques garantissent une domination à long terme.

Le segment des maladies mitochondriales devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'intérêt croissant porté à la recherche sur les dysfonctionnements mitochondriaux et l'émergence de stratégies innovantes telles que les petites molécules, la thérapie génique et le remplacement des protéines. L'amélioration des technologies de diagnostic accroît les taux de détection, notamment chez les nourrissons et les jeunes enfants. Les entreprises développent des thérapies ciblées qui s'attaquent au stress oxydatif, aux anomalies du métabolisme énergétique et aux anomalies de l'ADN mitochondrial. Le soutien réglementaire croissant apporté aux maladies orphelines à fort besoin accélère le développement des traitements en développement. À mesure que les nouvelles thérapies mitochondriales franchissent des étapes cliniques importantes, leur adoption devrait fortement augmenter.

Analyse régionale du marché des médicaments contre les maladies métaboliques héréditaires rares

- L'Amérique du Nord a dominé le marché en 2025, représentant la plus grande part de revenus (42,9 %), grâce à une infrastructure solide pour la prise en charge des maladies métaboliques, une utilisation importante des thérapies de remplacement enzymatique commercialisées, une adoption rapide des technologies de thérapie génique et un portefeuille de produits en développement actif comprenant des candidats commercialisés, en phase III, en phase I-II et précliniques pour les maladies métaboliques héréditaires.

- Dans la région, les patients et les professionnels de santé accordent une importance croissante au diagnostic précoce, aux options de traitement avancées et aux programmes de prise en charge complets, qui incluent l'accès à des thérapies parentérales, orales et intrathécales adaptées aux maladies de surcharge lysosomale, aux déficits en acides aminés et aux maladies mitochondriales.

- Cette adoption généralisée est également favorisée par des politiques de remboursement avantageuses, des programmes de dépistage néonatal bien établis et une activité de R&D soutenue, qui, ensemble, accélèrent la mise sur le marché des médicaments commercialisés ainsi que des candidats cliniques en phase avancée et en phase précoce.

Aperçu du marché américain des médicaments contre les maladies métaboliques héréditaires rares

En 2025, le marché américain a généré 40 % des revenus en Amérique du Nord, grâce à des infrastructures de santé performantes, au dépistage néonatal élargi et à l'adoption généralisée des thérapies enzymatiques substitutives, des thérapies géniques et des médicaments à petites molécules. Patients et professionnels de santé privilégient de plus en plus l'accès à des thérapies de précision ciblant les anomalies métaboliques sous-jacentes. Le recours croissant aux traitements parentéraux, oraux et intrathécaux, associé à des essais cliniques dynamiques et à des systèmes de remboursement performants, stimule davantage la croissance du marché. Par ailleurs, l'intégration des tests génomiques et des plateformes de santé numérique pour le suivi des patients contribue significativement à cette croissance.

Aperçu du marché européen des médicaments contre les maladies métaboliques héréditaires rares

Le marché européen devrait connaître une croissance annuelle composée (TCAC) substantielle au cours de la période de prévision, principalement grâce aux initiatives gouvernementales soutenant les thérapies pour les maladies rares, à une réglementation stricte des soins de santé et au besoin croissant de traitements avancés pour les maladies lysosomales, mitochondriales et du cycle de l'urée. L'urbanisation croissante, l'amélioration des capacités de diagnostic et la disponibilité de thérapies commercialisées et en développement favorisent l'adoption de ces traitements. Les systèmes de santé européens privilégient l'intervention précoce et l'accès aux thérapies enzymatiques substitutives et aux thérapies par petites molécules, contribuant ainsi à la croissance des hôpitaux, des cliniques spécialisées et des centres de recherche.

Aperçu du marché britannique des médicaments contre les maladies métaboliques héréditaires rares

Le marché britannique devrait connaître une croissance annuelle composée (TCAC) remarquable au cours de la période de prévision, portée par une meilleure sensibilisation aux maladies métaboliques héréditaires, le soutien gouvernemental à l'accès aux médicaments orphelins et l'adoption croissante de thérapies innovantes, notamment la thérapie génique. Les préoccupations liées au diagnostic précoce et à la prise en charge à long terme de la maladie incitent les cliniciens et les patients à privilégier les thérapies ciblées. L'infrastructure de santé performante du pays et son intense activité de recherche et d'essais cliniques continuent de stimuler la croissance du marché.

Aperçu du marché allemand des médicaments contre les maladies métaboliques héréditaires rares

Le marché allemand devrait connaître une croissance annuelle composée (TCAC) considérable au cours de la période de prévision, portée par une sensibilisation accrue aux troubles métaboliques, une infrastructure de santé performante et l'adoption de thérapies de pointe telles que l'enzymothérapie substitutive, la thérapie génique et les oligonucléotides. Le système de santé allemand privilégie une prise en charge centrée sur le patient et une intervention thérapeutique précoce, ce qui soutient la demande de traitements parentéraux et oraux. L'intégration de plateformes de traitement innovantes aux recommandations cliniques et aux systèmes de gestion des patients favorise une croissance soutenue.

Aperçu du marché des médicaments contre les maladies métaboliques héréditaires rares en Asie-Pacifique

Le marché Asie-Pacifique devrait connaître la croissance annuelle composée la plus rapide au cours de la période de prévision, portée par l'augmentation des dépenses de santé, la hausse des taux de diagnostic et la sensibilisation croissante aux maladies métaboliques héréditaires rares dans des pays comme la Chine, le Japon et l'Inde. Le développement des cliniques spécialisées, le soutien gouvernemental aux médicaments orphelins et la disponibilité accrue des thérapies enzymatiques et des thérapies à base de petites molécules favorisent l'adoption de ces traitements. Le renforcement des capacités de production pharmaceutique de la région et l'amélioration de l'accessibilité financière des traitements contribuent également à l'accélération de la croissance du marché.

Aperçu du marché japonais des médicaments contre les maladies métaboliques héréditaires rares

Le marché japonais est en plein essor grâce à ses normes de santé élevées, ses diagnostics génomiques de pointe et la demande croissante de prise en charge à long terme des troubles métaboliques. L'adoption des thérapies enzymatiques et géniques progresse, parallèlement à l'intégration croissante du suivi clinique et des plateformes de santé numérique. Par ailleurs, le vieillissement de la population japonaise et l'accent mis sur l'intervention précoce chez les patients, enfants et adultes, devraient stimuler la demande de traitements de précision dans les hôpitaux et les centres de soins spécialisés.

Aperçu du marché indien des médicaments contre les maladies métaboliques héréditaires rares

En 2025, le marché indien a généré la plus grande part de revenus en Asie-Pacifique, grâce à une sensibilisation accrue aux soins de santé, au développement des infrastructures de diagnostic et à l'adoption croissante des thérapies enzymatiques, des petites molécules et des thérapies géniques émergentes. L'Inde représente l'un des plus importants marchés émergents pour les traitements des maladies rares, avec une demande croissante dans les hôpitaux, les cliniques spécialisées et les centres de santé urbains. Les initiatives gouvernementales en faveur des maladies rares, le développement des pharmacies spécialisées et la disponibilité de traitements abordables sont des facteurs clés de la croissance de ce marché.

Part de marché des médicaments contre les maladies métaboliques héréditaires rares

L'industrie pharmaceutique des maladies métaboliques héréditaires rares est principalement dominée par des entreprises bien établies, notamment :

- Sanofi (France)

- Société pharmaceutique Takeda Limitée (Japon)

- BioMarin (États-Unis)

- Amicus Therapeutics, Inc. (États-Unis)

- Pfizer Inc. (États-Unis)

- Services Johnson & Johnson, Inc. (États-Unis)

- Alexion Pharmaceuticals, Inc. (États-Unis)

- Ultragenyx Pharmaceutical Inc. (États-Unis)

- Protalix BioTherapeutics, Inc. (États-Unis)

- Avrobio, Inc. (États-Unis)

- Sigilon Therapeutics, Inc. (États-Unis)

- Orphazyme A/S (Danemark)

- JCR Pharmaceuticals Co., Ltd. (Japon)

- REGENXBIO Inc. (États-Unis)

- Homology Medicines, Inc. (États-Unis)

- Abeona Therapeutics, Inc. (États-Unis)

- LYSOGÈNE (France)

- Allivex Corporation (États-Unis)

- Bellicum Pharmaceuticals (États-Unis)

- Denali Therapeutics Inc. (États-Unis)

Quels sont les développements récents sur le marché mondial des médicaments contre les maladies métaboliques héréditaires rares ?

- En juillet 2025, la FDA a approuvé Sephience, un médicament oral de PTC Therapeutics destiné aux patients atteints de phénylcétonurie (PCU), élargissant ainsi les options thérapeutiques pour les troubles du métabolisme des acides aminés au-delà des régimes restrictifs.

- En mai 2025, une thérapie génique personnalisée utilisant la technologie CRISPR a permis de traiter avec succès un nourrisson atteint de déficit en CPS1 (une maladie rare du cycle de l'urée), constituant ainsi une étape majeure puisqu'il s'agit de la première thérapie génomique sur mesure pour une maladie métabolique.

- En avril 2025, Glycomine a levé 115 millions de dollars lors d'un tour de table de série C afin de faire progresser son traitement expérimental phare (GLM101) contre une forme de troubles congénitaux de la glycosylation (CDG), renforçant ainsi le soutien financier au développement de médicaments contre les maladies métaboliques.

- En novembre 2024, la thérapie génique Kebilidi (éladocagène exuparvovec-tneq) a été approuvée par la Food and Drug Administration (FDA) américaine pour le traitement du déficit en décarboxylase des acides aminés aromatiques (déficit en AADC), devenant ainsi la première thérapie génique approuvée par la FDA pour cette pathologie.

- En septembre 2024, la FDA a approuvé Miplyffa (arimoclomol), premier traitement autorisé pour la maladie de Niemann-Pick de type C (NPC), offrant un traitement attendu de longue date pour les symptômes neurologiques et métaboliques associés à cette maladie lysosomale rare.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.