Global Saturated Kraft Paper Market

Taille du marché en milliards USD

TCAC :

%

USD

1.76 Billion

USD

2.60 Billion

2024

2032

USD

1.76 Billion

USD

2.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.76 Billion | |

| USD 2.60 Billion | |

|

|

|

|

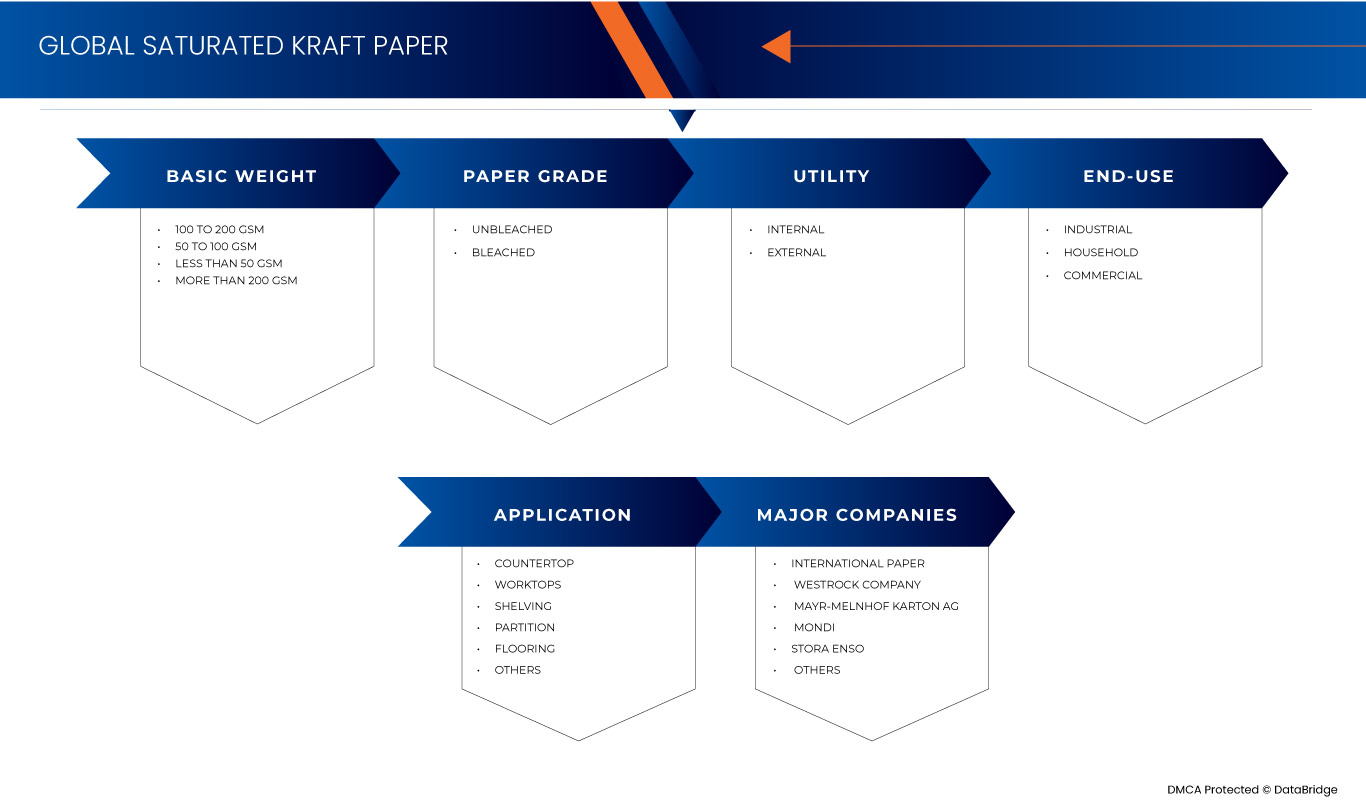

Segmentation du marché mondial du papier kraft saturé, grammage (100 à 200 g/m², 50 à 100 g/m², moins de 50 g/m² et plus de 200 g/m²), qualité du papier (écru et blanchi), application (comptoirs, plans de travail, étagères, cloisons et revêtements de sol), utilité (interne et externe), utilisation finale (industrielle, domestique et commerciale) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du papier kraft saturé

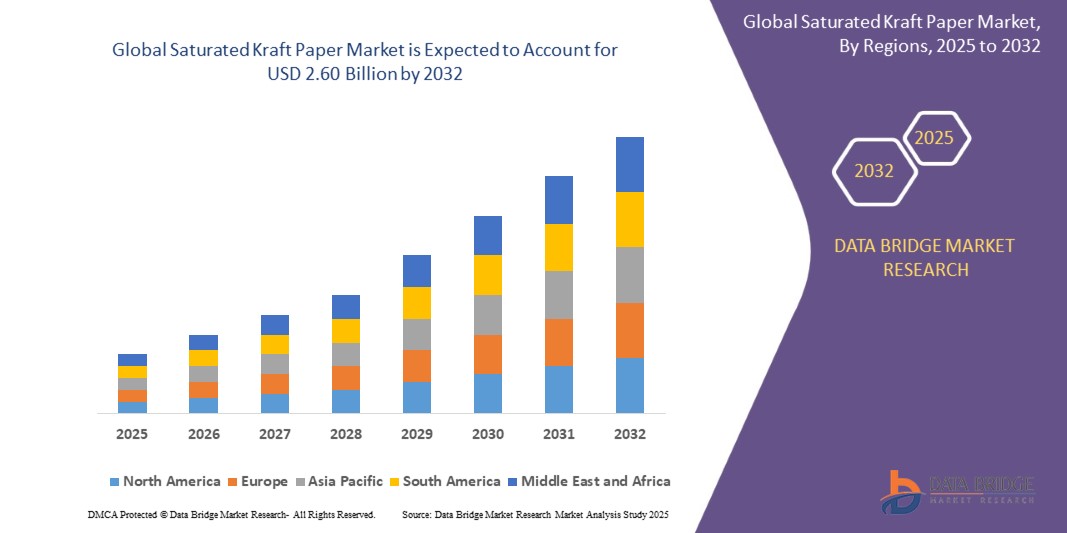

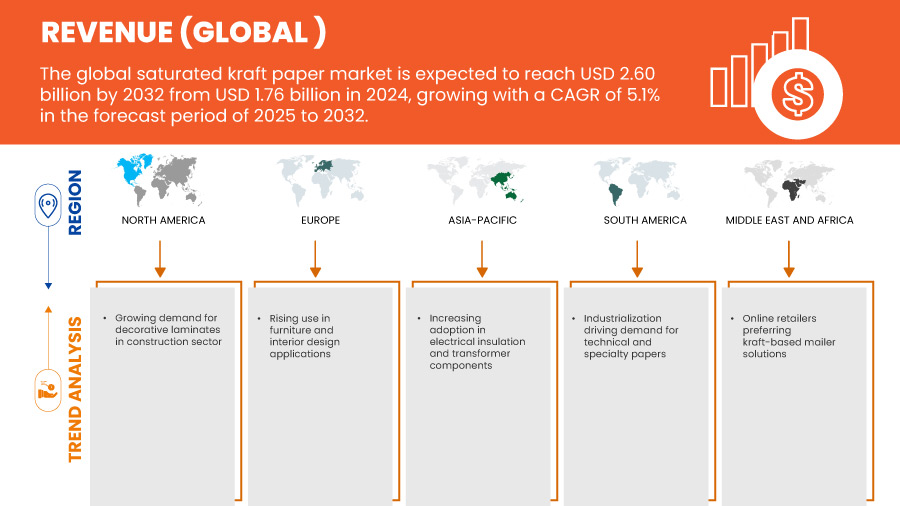

- Le marché mondial du papier kraft saturé était évalué à 1,76 milliard USD en 2024 et devrait atteindre 2,60 milliards USD d'ici 2032.

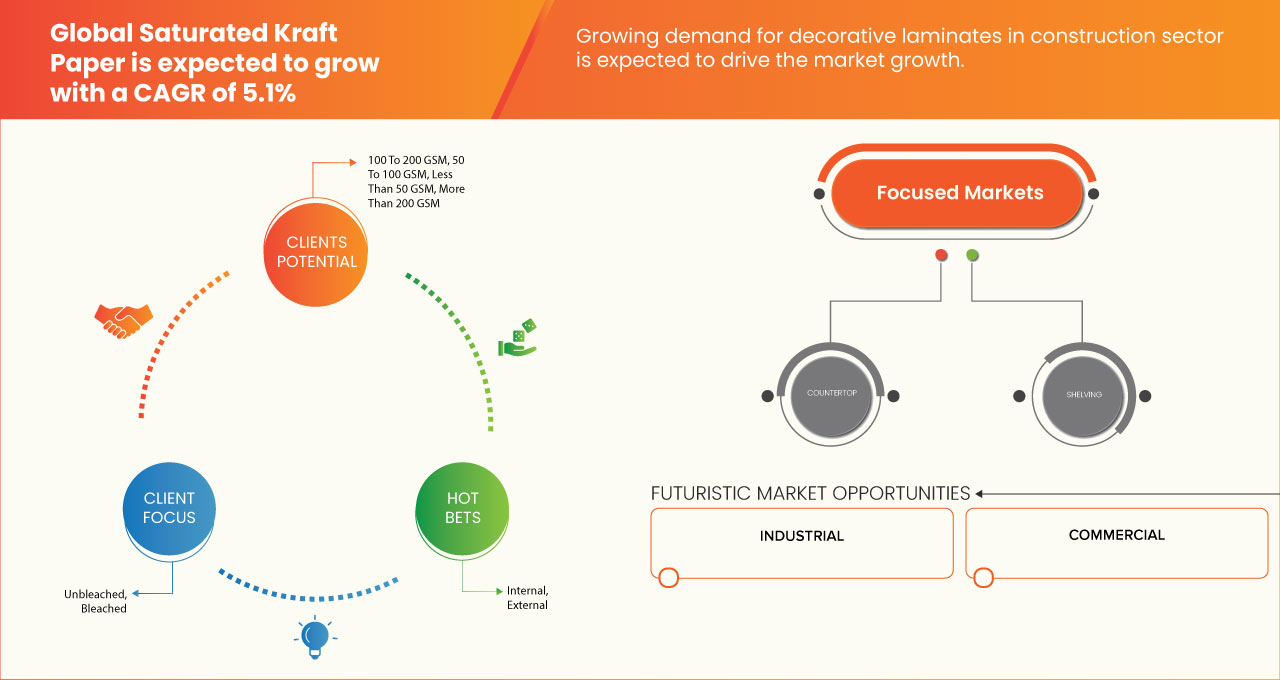

- Au cours de la période de prévision de 2025 à 2032, le marché devrait croître à un TCAC de 5,1 %, principalement grâce à l'industrialisation et à l'urbanisation rapides.

- Cette croissance est tirée par des facteurs tels que l’expansion du commerce électronique, les alternatives écologiques, la rentabilité et la demande croissante d’emballages durables.

Analyse du marché du papier kraft saturé

- Le marché mondial du papier kraft saturé connaît une croissance constante, tirée par la demande croissante dans les secteurs de la construction, de l'ameublement et de la décoration intérieure, où le matériau est apprécié pour sa résistance, sa flexibilité et sa résistance à l'humidité et aux produits chimiques.

- L'accent croissant mis sur les matériaux durables et recyclables alimente également l'expansion du marché, car le papier kraft saturé est souvent produit à partir de pâte de bois renouvelable et certifié sous des écolabels tels que FSC et PEFC.

- Les fabricants innovent avec des formulations de résine et des technologies de traitement pour améliorer les performances des produits et répondre à diverses exigences d'utilisation finale.

- Les principales régions contribuant à la croissance du marché comprennent l'Amérique du Nord, l'Europe et l'Asie-Pacifique, les économies émergentes présentant un potentiel important en raison de l'urbanisation rapide et du développement des infrastructures.

- Par exemple,

- En décembre 2023, Mondi a annoncé l'élargissement de sa gamme de papier kraft saturant et une augmentation de sa capacité afin de mieux servir les fabricants de panneaux de construction, de plans de travail, de meubles et de films techniques. Grâce à une nouvelle machine à papier dans son usine de Štĕtí (République tchèque) et à une production optimisée à Frantschach (Autriche) et à Dynäs (Suède), Mondi garantit des délais de livraison courts, un approvisionnement fiable et une production optimisée d'Advantage MF Boost pour les applications laminées en Europe.

- En décembre 2021, Nordic Paper Holding AB a finalisé l'acquisition de Glassine Canada Inc. pour un prix préliminaire de 46,3 millions de dollars américains. L'entreprise acquise est spécialisée dans le papier sulfurisé pour applications alimentaires et dessert principalement les marchés nord-américains. Cette acquisition a renforcé la présence de Nordic Paper Holding AB en Amérique du Nord et élargi sa gamme de produits et sa proximité avec ses clients.

- Elle a soutenu la croissance du marché saturé du papier kraft en améliorant les capacités de production et en répondant à la demande croissante de papiers spéciaux et de qualité alimentaire.

Portée du rapport et segmentation du marché du papier kraft saturé

|

Attributs |

Informations clés sur le marché du papier kraft saturé |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

Amérique du Nord

Europe

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché du papier kraft saturé

« Expansion des emballages pour le commerce électronique »

- Le marché saturé du papier kraft connaît une forte croissance, notamment grâce à l'essor du e-commerce. Avec l'augmentation des achats en ligne, la demande de solutions d'emballage durables augmente, faisant du papier kraft un choix populaire.

- Ce type de papier est écologique, durable et parfait pour emballer des marchandises nécessitant une protection supplémentaire pendant l'expédition.

- Avec l'essor du e-commerce, les entreprises se tournent vers le papier kraft pour sa capacité à traiter des produits de différentes tailles et à garantir une livraison sécurisée. La tendance à la réduction de l'utilisation du plastique stimule également le marché, le papier kraft offrant une alternative éco-responsable.

- Par exemple,

- En octobre 2023, le secteur du e-commerce connaît une croissance rapide, portée par les nouvelles technologies et les innovations axées sur le développement durable. Les fabricants rationalisent leurs processus pour créer des solutions d'emballage plus respectueuses de l'environnement. Avec la généralisation des smartphones et de l'accès à Internet à l'échelle mondiale, les achats en ligne sont plus nombreux que jamais. Cela a entraîné une évolution significative des modes d'emballage et de livraison des produits, privilégiant le développement durable. L'avenir du e-commerce et de l'emballage s'annonce prometteur, porté par ces avancées et par une demande croissante de pratiques éco-responsables.

- Mars 2024 Selon Mondi Group. À mesure que les emballages du e-commerce évoluent, il est crucial de comprendre comment les consommateurs les manipulent après réception de leurs commandes. Une enquête révèle que le développement durable est une préoccupation majeure pour les consommateurs, nombre d'entre eux souhaitant réduire leurs déchets d'emballage. Il est intéressant de noter que 47 % des baby-boomers sont susceptibles de recycler leurs emballages, contre seulement 32 % de la génération Z. La jeune génération, qui achète souvent des vêtements dans des emballages plastiques, a tendance à les jeter avec les ordures ménagères. Cela souligne la nécessité de solutions d'emballage plus durables, en particulier pour les produits populaires auprès des jeunes consommateurs.

- Dans l’ensemble, la croissance du commerce électronique favorise l’adoption du papier kraft saturé dans les emballages de tous les secteurs.

Dynamique du marché du papier kraft saturé

Conducteur

« Demande croissante de stratifiés décoratifs dans le secteur de la construction »

- Le papier kraft saturé sert de matériau de base dans la production de stratifiés haute pression (HPL), qui sont largement utilisés pour améliorer les surfaces telles que les revêtements de sol, les comptoirs et les panneaux muraux.

- À mesure que l’urbanisation s’accélère et que les préférences des consommateurs évoluent vers des intérieurs esthétiques et durables, le besoin de tels stratifiés augmente

- Cette tendance stimule directement la consommation de papier kraft saturé, compte tenu de son rôle essentiel dans la production de stratifiés. De plus, l'accent mis par le secteur de la construction sur des matériaux durables et économiques amplifie encore cette demande, le papier kraft saturé offrant recyclabilité et avantages environnementaux.

- Par conséquent, la relation symbiotique entre la croissance des stratifiés décoratifs dans la construction et le marché saturé du papier kraft souligne l'expansion de ce dernier en réponse à l'évolution des préférences architecturales et de design.

Par exemple,

- En décembre 2024, NBM Media Pvt. Ltd. a souligné que CenturyPly avait réaffirmé sa position de leader sur le marché indien du contreplaqué et du placage décoratif, avec une valorisation de 1 640,97 millions de dollars américains. L'entreprise poursuit son expansion dynamique grâce à des investissements dans des installations nouvelles et existantes en Andhra Pradesh afin d'accroître sa capacité de production de MDF et de stratifiés. Des innovations telles que les stratifiés anti-traces de doigts, les placages design et les cabines Century soulignent son approche avant-gardiste du design. CenturyPly élargit également son réseau de distributeurs dans les villes de rang 2 à 4 et vise à doubler ses exportations de stratifiés pour atteindre 34,62 millions de dollars américains en trois ans, reflétant une forte demande nationale et internationale.

- Selon Techbullion, le marché du papier devrait connaître une croissance en décembre 2021 grâce à la demande croissante de stratifiés décoratifs pour les revêtements de sol, le mobilier et les applications intérieures. L'essor des meubles prêts à monter et des surfaces stratifiées dans le secteur de la construction, conjugué aux innovations continues en matière de design, stimule l'expansion du marché. De plus, la croissance du e-commerce ouvre de nouvelles sources de revenus. La durabilité, la recyclabilité et la résistance à l'humidité du papier kraft saturé en font un matériau idéal pour diverses applications dans le secteur de la construction et de l'intérieur.

- Le papier kraft saturé, essentiel à la production de stratifiés haute pression pour des surfaces telles que les revêtements de sol et les plans de travail, bénéficie directement de cette tendance. Cette symbiose souligne l'importance du papier kraft saturé pour répondre aux exigences modernes de la construction et du design.

Opportunité

« Les détaillants en ligne privilégient les solutions d'expédition basées sur le papier Kraft »

- Le papier kraft saturé offre des opportunités intéressantes, notamment avec l'adoption croissante des solutions d'expédition kraft par les e-commerçants. Avec l'essor du e-commerce, la demande d'emballages à la fois durables et durables augmente.

- Les enveloppes d'expédition en papier kraft, biodégradables et légères, répondent à ces critères, ce qui en fait un choix privilégié pour l'expédition de divers produits. De plus, les avancées technologiques dans la conception des enveloppes d'expédition en papier kraft, notamment leur résistance accrue à l'eau et aux déchirures, élargissent leur champ d'application à différents secteurs.

- Les fabricants qui se concentrent sur ces innovations peuvent répondre efficacement aux besoins évolutifs du secteur du commerce électronique et capitaliser sur le potentiel du marché.

Par exemple,

- En janvier 2021, selon un article publié par NewsPackaging, Mondi a lancé une machine à papier kraft d'une valeur de 72,2 millions de dollars dans son usine de Štětí, en République tchèque. Il s'agit de la première machine en Europe dédiée à la production de papier kraft spécial à partir de fibres fraîches et recyclées pour les sacs de courses en magasin et en ligne. La machine produisait jusqu'à 130 000 tonnes par an de papier EcoVantage 100 % recyclable, offrant une résistance élevée, une excellente imprimabilité et un aspect naturel. Ce développement a créé une opportunité sur le marché saturé du papier kraft en soutenant la transition des e-commerçants vers des solutions d'expédition à base de kraft, à la fois durables et adaptées aux besoins d'emballage des marques et du e-commerce.

- En juin 2023, selon GIE Media, Inc., Walmart a annoncé l'adoption des enveloppes d'expédition en papier kraft pour la livraison à domicile et la possibilité de retirer les sacs lors des commandes à emporter en ligne. L'objectif est une généralisation d'ici la fin de l'année. Avec une croissance de 27 % de ses activités de commerce électronique, l'entreprise souhaitait soutenir le traitement des commandes en utilisant des alternatives papier sur l'ensemble de son réseau. Cette décision devait stimuler la demande de papier kraft de plus de 2 000 tonnes par an. Cette décision représentait une opportunité évidente sur un marché saturé, témoignant de l'adoption croissante des solutions d'expédition en papier kraft par les principaux e-commerçants.

- L'essor rapide du e-commerce a entraîné une demande accrue de matériaux d'emballage fiables et adaptables. Le papier kraft, reconnu pour sa résistance et sa polyvalence, est parfaitement adapté à ces exigences.

- Ce changement permet aux fabricants de papier kraft d'innover et de diversifier leur offre de produits, notamment en développant des variantes de papier kraft améliorées pour répondre aux besoins spécifiques des détaillants en ligne.

Retenue/Défi

« Disponibilité de matériaux de substitution à moindre coût de production »

- Le marché est confronté à une contrainte importante en raison de la disponibilité croissante de matériaux de substitution qui offrent des performances similaires ou améliorées à des coûts de production inférieurs

- Des alternatives telles que les composites biogéniques (par exemple, PaperShell), les stratifiés synthétiques et les feuilles à base de plastique à faible coût gagnent du terrain dans des secteurs tels que le meuble, l'emballage et la construction.

- Ces substituts offrent souvent une meilleure durabilité, une meilleure résistance à l'humidité ou une plus grande flexibilité esthétique, tout en étant rentables. Alors que les industries privilégient la durabilité et la rentabilité, la demande de papier kraft saturé traditionnel pourrait diminuer, impactant ainsi la croissance du marché.

Par exemple,

- En février 2025, selon un article publié par Wood Central, l'évolution croissante vers des matériaux biogéniques innovants tels que PaperShell apparaît comme un frein potentiel pour le marché. Développé à partir de papier kraft vierge ou recyclé, PaperShell offre une alternative légère, malléable et très durable pour une utilisation dans l'architecture, l'automobile et les biens de consommation. Sa capacité à remplacer les matériaux traditionnels à faible impact environnemental et l'intérêt croissant des industries en quête de solutions rentables et durables soulignent la disponibilité croissante de matériaux de substitution, remettant en cause la domination des produits traditionnels en papier kraft saturé.

- En juin 2022, Stora Enso a lancé AvantForte WhiteTop, un papier kraft 100 % vierge, sans OBA, conçu pour les emballages haut de gamme, tels que les produits frais et le e-commerce. Conçu avec la technologie Tri-Ply, il offre une résistance et une qualité d'impression supérieures, permettant une utilisation optimale des matériaux. Fabriqué sur le site modernisé d'Oulu, en Finlande, ce produit reflète l'évolution du marché vers des alternatives renouvelables, sans plastique et performantes. Cette innovation accentue la pression sur les producteurs de papier kraft saturant conventionnel, car de nouveaux papiers kraft haute résistance pourraient constituer des alternatives efficaces dans certains cas d'utilisation finale.

- L'adoption croissante de matériaux de substitution peu coûteux et performants constitue un frein considérable pour le marché saturé du papier kraft. À mesure que les industries se tournent vers des alternatives plus économiques et durables, la demande de papier kraft conventionnel pourrait diminuer. Cette concurrence croissante des substituts pourrait freiner l'expansion du marché, incitant les fabricants à innover et à améliorer la proposition de valeur du papier kraft saturé.

Portée du marché du papier kraft saturé

Le marché est segmenté sur la base du poids de base, de la qualité du papier, de l'application, de l'utilité et de l'utilisation finale.

|

Segmentation |

Sous-segmentation |

|

Par poids de base |

|

|

Par qualité de papier |

|

|

Par application |

|

|

Par utilitaire |

|

|

Par utilisation finale |

|

Analyse régionale du marché du papier kraft saturé

« L'Asie-Pacifique est la région dominante sur le marché du papier kraft saturé »

- L'Asie-Pacifique domine le marché mondial saturé du papier kraft pour plusieurs raisons essentielles. Premièrement, la région abrite certaines des plus grandes économies manufacturières du monde, comme la Chine et l'Inde, où la demande en matériaux d'emballage est en plein essor.

- La croissance rapide du commerce électronique dans ces pays a considérablement accru le besoin de solutions d'emballage durables et résistantes comme le papier kraft saturé.

- L'Asie-Pacifique accorde une grande importance au développement durable, les gouvernements et les entreprises préconisant des alternatives écologiques aux emballages plastiques traditionnels. Cela incite les fabricants à adopter des matériaux plus durables, facilement disponibles dans la région.

- Une autre raison est l'ampleur du marché de consommation de la région, qui privilégie de plus en plus les produits respectueux de l'environnement. La prise de conscience croissante des enjeux environnementaux a entraîné une demande d'emballages recyclables et biodégradables, favorisant ainsi l'adoption du papier kraft.

« L'Asie-Pacifique devrait enregistrer le taux de croissance le plus élevé »

- L'Asie-Pacifique devrait enregistrer la plus forte croissance du marché mondial du papier kraft saturé, grâce à plusieurs facteurs. Le secteur du e-commerce, en pleine expansion dans la région, en est un moteur essentiel, l'augmentation des achats en ligne se traduisant par une demande accrue de solutions d'emballage durables et écologiques comme le papier kraft saturé.

- Des pays comme la Chine et l’Inde sont de grands centres de fabrication, permettant une production rentable de papier kraft saturé

- Alors que la durabilité devient une priorité plus importante, les consommateurs et les entreprises de la région Asie-Pacifique recherchent des alternatives d'emballage au plastique, faisant du papier kraft un choix attrayant

- Ces pays adoptent également des réglementations environnementales plus strictes, incitant les entreprises à opter pour des matériaux d'emballage recyclables et biodégradables. La sensibilisation croissante des consommateurs de la région aux enjeux environnementaux alimente la demande d'emballages durables.

Part de marché du papier kraft saturé

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- International Paper (États-Unis)

- Société WestRock. (États-Unis)

- Mayr-Melnhof Karton AG (Autriche)

- Mondiaux (Autriche)

- Ahlström

- Stora Enso (Finlande)

- SCG International Corporation (Thaïlande)

- Nordic Paper (Suède)

- Mayr-Melnhof Karton AG

- Ranheim

- WARAQ, (Arabie Saoudite)

- Fortune Paper Mills LLP (Inde)

- Potsdam Specialty Paper Inc. (États-Unis)

- Produits de papier Pudumjee (Inde)

- Gordon Paper Company, Inc. (États-Unis)

- Northern Technologies International Corporation (NTIC). (États-Unis)

- Société de papier Fleenor

- Smurfit Kappa (États-Unis)

- Venkraft Paper Mills Pvt.Ltd. (Inde)

- Onyx Papers. (États-Unis)

- Namibie Critical Metals Inc. (Canada)

Derniers développements sur le marché mondial du papier kraft saturé

- En décembre 2021, le groupe MM a annoncé son intention de pénétrer le marché du papier kraft pour sacs, en s'appuyant sur son usine de Kwidzyn en Pologne pour répondre à la demande croissante d'emballages durables à base de fibres. L'entreprise se concentrera sur le papier kraft blanchi pour sacs tout en augmentant sa capacité de production de papier kraft saturant ABSORBEX. Peter Oswald, PDG, a souligné la forte croissance des ventes d'IPACK et les projets d'innovation dans le domaine du papier kraft.

- En mars 2025, Mondi a annoncé sa collaboration avec Hans Schmid KG pour la fourniture d'Ad/Vantage Boost, un papier kraft saturé destiné aux stratifiés pour meubles et sols. Reconnu pour sa résistance et son pouvoir absorbant, Ad/Vantage Boost agit comme support de résine, garantissant des applications de stratifiés haute performance. Fabriqué à partir de fibres longues 100 % responsables en Suède et en Autriche, il est disponible avec les certifications FSC ou PEFC. Ce partenariat renforce l'approvisionnement européen en papier imprégné haut de gamme pour les plans de travail, le mobilier et les applications industrielles.

- En septembre 2024, Ahlstrom a lancé une étude de faisabilité visant à ajouter des capacités de couchage saturé et antiadhésif pour les papiers support pour rubans adhésifs, répondant ainsi à la demande croissante, notamment sur le continent américain. Cet investissement permettrait d'enrichir sa gamme de produits, notamment les papiers support crêpés, destinés à des secteurs comme l'automobile, l'aérospatiale, la construction et l'emballage. Il s'inscrit dans les objectifs de développement durable d'Ahlstrom en améliorant la recyclabilité et en utilisant davantage de matériaux renouvelables. Une décision est attendue peu après la finalisation de l'étude.

- En octobre 2024, MM Kotkamills a lancé ALASKA KRAFT, un nouveau carton en fibres vierges entièrement couché, produit dans son usine MM Količevo en Slovénie. Ce carton se compose d'une couche supérieure blanche contenant 10 % de fibres recyclées et d'un verso en kraft brun, alliant résistance et attrait visuel. Conçu pour des applications d'emballage telles que les barquettes de fruits, les manchons et les barquettes à emporter, il allie rigidité, durabilité et durabilité élevées grâce à l'utilisation de fibres vierges et recyclées issues de sources responsables. Grâce à ce lancement, l'entreprise a renforcé son portefeuille de produits éco-responsables et amélioré sa flexibilité de service sur les marchés européens.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SATURATED KRAFT PAPER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 BASIC WEIGHT TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 RAW MATERIAL COVERAGE

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 IMPORT EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 TARIFFS & IMPACT ON THE MARKET

4.6.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.6.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.6.3 VENDOR SELECTION CRITERIA DYNAMICS

4.6.4 IMPACT ON SUPPLY CHAIN

4.6.4.1 RAW MATERIAL PROCUREMENT

4.6.4.2 MANUFACTURING AND PRODUCTION

4.6.4.3 LOGISTICS AND DISTRIBUTION

4.6.4.4 PRICE PITCHING AND POSITION OF MARKET

4.6.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.6.5.1 SUPPLY CHAIN OPTIMIZATION

4.6.5.2 JOINT VENTURE ESTABLISHMENTS

4.6.6 IMPACT ON PRICES

4.6.7 REGULATORY INCLINATION

4.6.7.1 GEOPOLITICAL SITUATION

4.6.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.6.7.2.1 FREE TRADE AGREEMENTS

4.6.7.3 DOMESTIC COURSE OF CORRECTION

4.6.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.7 VENDOR SELECTION CRITERIA

4.8 PESTEL ANALYSIS

4.8.1 POLITICAL FACTORS

4.8.2 ECONOMIC FACTORS

4.8.3 SOCIAL FACTORS

4.8.4 TECHNOLOGICAL FACTORS

4.8.5 ENVIRONMENTAL FACTORS

4.8.6 LEGAL FACTORS

4.9 REGULATION COVERAGE

4.1 POTENTIAL BUYER LIST

4.11 SUPPLY VS DEMAND ANALYSIS

4.12 LAMINATE PRODUCERS

4.13 SKB PRODUCERS

4.14 PRODUCTION CAPACITY OVERVIEW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR DECORATIVE LAMINATES IN CONSTRUCTION SECTOR

5.1.2 RISING USE IN FURNITURE AND INTERIOR DESIGN APPLICATIONS

5.1.3 INCREASING ADOPTION IN ELECTRICAL INSULATION AND TRANSFORMER COMPONENTS

5.1.4 INDUSTRIALIZATION DRIVING DEMAND FOR TECHNICAL AND SPECIALTY PAPERS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTE MATERIALS WITH LOWER PRODUCTION COSTS

5.2.2 ENVIRONMENTAL REGULATIONS ON CHEMICAL USAGE IN PAPER TREATMENT

5.3 OPPORTUNITIES

5.3.1 ONLINE RETAILERS PREFER KRAFT-BASED MAILER SOLUTIONS

5.3.2 FLEXIBLE PACKAGING INNOVATIONS USING KRAFT LAYERS

5.3.3 RISING INTEREST IN RENEWABLE PACKAGING SOLUTIONS

5.4 CHALLENGES

5.4.1 FLUCTUATING WOOD PULP PRICES IMPACT PRODUCTION COST

5.4.2 HIGH COMPETITION FROM LOW-COST ASIAN SUPPLIERS

6 GLOBAL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT

6.1 OVERVIEW

6.2 100 TO 200 GSM

6.3 50 TO 100 GSM

6.4 LESS THAN 50 GSM

6.5 MORE THAN 200 GSM

7 GLOBAL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE

7.1 OVERVIEW

7.2 UNBLEACHED

7.2.1 UNBLEACHED, BY TYPE

7.3 BLEACHED

7.3.1 BLEACHED, BY TYPE

8 GLOBAL SATURATED KRAFT PAPER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COUNTERTOP

8.3 WORKTOPS

8.4 SHELVING

8.5 PARTITION

8.6 FLOORING

8.7 OTHERS

9 GLOBAL SATURATED KRAFT PAPER MARKET, BY UTILITY

9.1 OVERVIEW

9.2 INTERNAL

9.3 EXTERNAL

10 GLOBAL SATURATED KRAFT PAPER MARKET, BY END-USE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 HOUSEHOLD

10.4 COMMERCIAL

11 GLOBAL SATURATED KRAFT PAPER MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 JAPAN

11.2.4 SOUTH KOREA

11.2.5 INDONESIA

11.2.6 THAILAND

11.2.7 SINGAPORE

11.2.8 AUSTRALIA AND NEW ZEALAND

11.2.9 MALAYSIA

11.2.10 PHILIPPINES

11.2.11 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 U.K

11.4.3 FRANCE

11.4.4 ITALY

11.4.5 NETHERLANDS

11.4.6 BELGIUM

11.4.7 RUSSIA

11.4.8 TURKEY

11.4.9 LUXEMBOURG

11.4.10 SWITZERLAND

11.4.11 REST OF EUROPE

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 UNITED ARAB EMIRATES

11.6.2 SAUDI ARABIA

11.6.3 SOUTH AFRICA

11.6.4 ISRAEL

11.6.5 EGYPT

11.6.6 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL SATURATED KRAFT PAPER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTERNATIONAL PAPERS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 WESTROCK COMPANY

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 REVENUE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MAYR-MELNHOF KARTON AG

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 RECENT DEVELOPMENT

14.4 MONDI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 AHLSTROM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 FLEENOR PAPER COMPANY

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 FORTUNE PAPER MILLS LLP

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GORDON PAPER COMPANY, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HAL INDUSTRIES INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 MM KOTKAMILLS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS/NEWS

14.11 NORDIC PAPER HOLDING AB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NORTHERN TECHNOLOGIES INTERNATIONAL CORPORATION (NTIC) (A PART OF ZERUST)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ONYX PAPERS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 POTSDAM SPECIALTY PAPER INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PUDUMJEE PAPER PRODUCTS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 RANHEIM PAPER & BOARD

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SCG INTERNATIONAL CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 STORA ENSO

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 VENKRAFT PAPER MILLS PVT. LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 WARAQ

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 SATURATED KRAFT PAPER TOP EXPORTS IN 12 MONTHS

TABLE 2 REGULATORY STANDARDS RELATED TO GLOBAL SATURATED KRAFT PAPER MARKET

TABLE 3 POTENTIAL BUYER LIST IN THE GLOBAL SATURATED KRAFT PAPER MARKET

TABLE 4 KEY SUPPLY ACROSS THE REGIONS

TABLE 5 SUPPLY VS DEMAND GAPS: KEY OBSERVATIONS

TABLE 6 LAMINATE PRODUCERS

TABLE 7 SKB PRODUCERS

TABLE 8 CHINA LOW PRICE SATURATED KRAFT PAPER

TABLE 9 ASIAN LOW-COST SATURATED KRAFT PAPER SUPPLIERS

TABLE 10 GLOBAL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 12 GLOBAL 100 TO 200 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL 50 TO 100 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL LESS THAN 50 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL MORE THAN 200 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL COUNTERTOP IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL WORKTOPS IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL SHELVING IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL PARTITION IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL FLOORING IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL OTHERS IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL INTERNAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL EXTERNAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 40 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 43 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 55 CHINA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 56 CHINA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CHINA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CHINA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 CHINA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)..

TABLE 60 CHINA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 61 CHINA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 62 CHINA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 63 CHINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 64 CHINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 65 INDIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 66 INDIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 67 INDIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)..

TABLE 72 INDIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 77 JAPAN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 78 JAPAN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 79 JAPAN SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 80 JAPAN UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 JAPAN BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 JAPAN SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 JAPAN SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND).

TABLE 84 JAPAN SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 90 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 91 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH KOREA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH KOREA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH KOREA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH KOREA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH KOREA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH KOREA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 101 INDONESIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 102 INDONESIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 103 INDONESIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 104 INDONESIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDONESIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 INDONESIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 INDONESIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 108 INDONESIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 109 INDONESIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 110 INDONESIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 111 INDONESIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 112 INDONESIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 113 THAILAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 114 THAILAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 115 THAILAND SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 116 THAILAND UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 THAILAND BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 THAILAND SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 THAILAND SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 120 THAILAND SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 121 THAILAND INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 125 SINGAPORE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 126 SINGAPORE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 127 SINGAPORE SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 128 SINGAPORE UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SINGAPORE BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SINGAPORE SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 131 SINGAPORE SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 132 SINGAPORE SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 133 SINGAPORE INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 134 SINGAPORE HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 135 SINGAPORE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 136 SINGAPORE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 137 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 138 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 139 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 140 AUSTRALIA AND NEW ZEALAND UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 AUSTRALIA AND NEW ZEALAND BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 144 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA AND NEW ZEALAND INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 146 AUSTRALIA AND NEW ZEALAND HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA AND NEW ZEALAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 148 AUSTRALIA AND NEW ZEALAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 149 MALAYSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 150 MALAYSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 151 MALAYSIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 152 MALAYSIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MALAYSIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 MALAYSIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 MALAYSIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 156 MALAYSIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 157 MALAYSIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 158 MALAYSIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 161 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 163 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 164 PHILIPPINES UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 PHILIPPINES BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 168 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 169 PHILIPPINES INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 170 PHILIPPINES HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 171 PHILIPPINES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 172 PHILIPPINES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 173 REST OF ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 174 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 175 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 176 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 177 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 178 NORTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NORTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 181 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 182 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 183 NORTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 184 NORTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 185 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 186 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 187 U.S. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 188 U.S. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 189 U.S. SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 190 U.S. UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 U.S. BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 U.S. SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 U.S. SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 194 U.S. SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)..

TABLE 195 U.S. INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 196 U.S. HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 197 U.S. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 198 U.S. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 201 CANADA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 213 MEXICO SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 223 EUROPE SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 224 EUROPE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 225 EUROPE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 226 EUROPE SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 227 EUROPE UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 EUROPE BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 EUROPE SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 EUROPE SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 231 EUROPE SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 232 EUROPE INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 233 EUROPE HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 234 EUROPE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 235 EUROPE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 236 GERMANY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 237 GERMANY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 238 GERMANY SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 239 GERMANY UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 GERMANY BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 GERMANY SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 242 GERMANY SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 243 GERMANY SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 244 GERMANY INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 245 GERMANY HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 246 GERMANY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 247 GERMANY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 248 U.K. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 249 U.K. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 250 U.K. SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 251 U.K. UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 U.K. BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 U.K. SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 254 U.K. SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 255 U.K. SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)..

TABLE 256 U.K. INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 257 U.K. HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 258 U.K. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 259 U.K. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 260 FRANCE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 261 FRANCE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 262 FRANCE SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 263 FRANCE UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 FRANCE BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 FRANCE SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 266 FRANCE SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 267 FRANCE SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 268 FRANCE INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 269 FRANCE HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 270 FRANCE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 271 FRANCE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 272 ITALY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 273 ITALY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 274 ITALY SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 275 ITALY UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 ITALY BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 ITALY SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 278 ITALY SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)…

TABLE 279 ITALY SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 280 ITALY INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 281 ITALY HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 282 ITALY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 283 ITALY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 286 SPAIN SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 287 SPAIN UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SPAIN BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)..

TABLE 291 SPAIN SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 296 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 297 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 298 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 299 NETHERLANDS UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 NETHERLANDS BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 302 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 303 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 304 NETHERLANDS INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 305 NETHERLANDS HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 306 NETHERLANDS COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 307 NETHERLANDS COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 308 BELGIUM SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 309 BELGIUM SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 310 BELGIUM SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 311 BELGIUM UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 BELGIUM BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 BELGIUM SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 314 BELGIUM SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 315 BELGIUM SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 316 BELGIUM INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 317 BELGIUM HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 318 BELGIUM COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 319 BELGIUM COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 320 RUSSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 321 RUSSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 322 RUSSIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 323 RUSSIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 RUSSIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 RUSSIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 326 RUSSIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 327 RUSSIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 328 RUSSIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 329 RUSSIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 330 RUSSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 331 RUSSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 332 TURKEY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 333 TURKEY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 334 TURKEY SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 335 TURKEY UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 TURKEY BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 TURKEY SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 338 TURKEY SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 339 TURKEY SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 340 TURKEY INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 341 TURKEY HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 342 TURKEY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 343 TURKEY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 344 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 345 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 346 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 347 LUXEMBOURG UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 LUXEMBOURG BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 350 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 351 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 352 LUXEMBOURG INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 353 LUXEMBOURG HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 354 LUXEMBOURG COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 355 LUXEMBOURG COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 356 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 357 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 358 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 359 SWITZERLAND UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 SWITZERLAND BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 362 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 363 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 364 SWITZERLAND INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 365 SWITZERLAND HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 366 SWITZERLAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 367 SWITZERLAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 368 REST OF EUROPE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 369 SOUTH AMERICA SATURATED KRAFT PAPER, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 370 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 371 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 372 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 373 SOUTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SOUTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 376 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 377 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 378 SOUTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 379 SOUTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 380 SOUTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 381 SOUTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 382 BRAZIL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 383 BRAZIL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 384 BRAZIL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 385 BRAZIL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 BRAZIL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 BRAZIL SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 388 BRAZIL SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 389 BRAZIL SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 390 BRAZIL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 391 BRAZIL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 392 BRAZIL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 393 BRAZIL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 394 ARGENTINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 395 ARGENTINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 396 ARGENTINA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 397 ARGENTINA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 ARGENTINA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 ARGENTINA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 400 ARGENTINA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 401 ARGENTINA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 402 ARGENTINA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 403 ARGENTINA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 404 ARGENTINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 405 ARGENTINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 406 REST OF SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 407 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 408 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 409 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 410 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 411 MIDDLE EAST AND AFRICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 MIDDLE EAST AND AFRICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 414 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 415 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 416 MIDDLE EAST AND AFRICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 417 MIDDLE EAST AND AFRICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 418 MIDDLE EAST AND AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 419 MIDDLE EAST AND AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 420 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 421 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 422 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 423 UNITED ARAB EMIRATES UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 UNITED ARAB EMIRATES BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 426 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 427 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 428 UNITED ARAB EMIRATES INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 429 UNITED ARAB EMIRATES HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 430 UNITED ARAB EMIRATES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 431 UNITED ARAB EMIRATES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 432 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 433 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 434 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 435 SAUDI ARABIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 SAUDI ARABIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 438 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 439 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 440 SAUDI ARABIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 441 SAUDI ARABIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 442 SAUDI ARABIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 443 SAUDI ARABIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 444 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 445 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 446 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 447 SOUTH AFRICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 SOUTH AFRICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 449 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 450 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 451 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 452 SOUTH AFRICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 453 SOUTH AFRICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 454 SOUTH AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 455 SOUTH AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 456 ISRAEL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 457 ISRAEL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 458 ISRAEL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 459 ISRAEL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 ISRAEL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 ISRAEL SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 462 ISRAEL SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 463 ISRAEL SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 464 ISRAEL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 465 ISRAEL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 466 ISRAEL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 467 ISRAEL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 468 EGYPT SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 469 EGYPT SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 470 EGYPT SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 471 EGYPT UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 EGYPT BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)