Global Spinal Allografts Market

Taille du marché en milliards USD

TCAC :

%

USD

3.84 Billion

USD

5.32 Billion

2024

2032

USD

3.84 Billion

USD

5.32 Billion

2024

2032

| 2025 –2032 | |

| USD 3.84 Billion | |

| USD 5.32 Billion | |

|

|

|

|

Global Spinal Allografts Market Segmentation, By Surgery (Open Spine Surgery and Minimally Invasive Spine Surgery), Product (Machined Bones Allograft and Demineralized Bone Matrix), End-Users (Hospitals, Ambulatory Surgical Centers, and Others) - Industry Trends and Forecast to 2032Global Spinal Allografts Market Segmentation, By Surgery (Open Spine Surgery and Minimally Invasive Spine Surgery), Product (Machined Bones Allograft and Demineralized Bone Matrix), End-Users (Hospitals, Ambulatory Surgical Centers, and Others) - Industry Trends and Forecast to 2032

Spinal Allografts Market Size

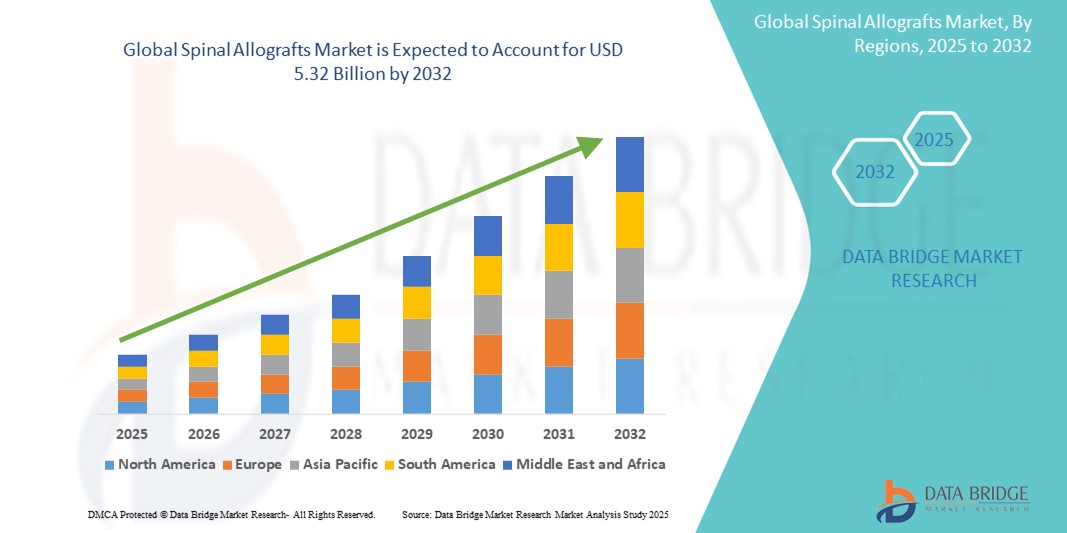

- The global spinal allografts market size was valued at USD 3.84 billion in 2024 and is expected to reach USD 5.32 billion by 2032, at a CAGR of 4.15% during the forecast period

- The market growth is primarily driven by the increasing prevalence of spinal disorders, a growing geriatric population, and rising demand for minimally invasive spine surgeries that utilize allograft solutions for enhanced fusion and recovery outcomes

- Moreover, advancements in tissue processing techniques, improved regulatory frameworks, and heightened awareness among surgeons regarding the benefits of allografts over autografts are contributing to the rising adoption of these biologics in spinal procedures. These factors collectively are propelling the expansion of the spinal allografts market globally

Spinal Allografts Market Analysis

- Spinal allografts, which involve the transplantation of donor bone or soft tissue for spinal fusion procedures, are increasingly essential in modern spinal surgeries due to their ability to eliminate donor site morbidity, reduce operative time, and enhance surgical outcomes in both degenerative and traumatic spinal conditions

- The rising demand for spinal allografts is largely driven by the growing incidence of spine-related disorders, a rapidly aging population, and a rising preference for biologic materials that promote natural bone regeneration without the complications of autograft harvesting

- North America dominated the spinal allografts market with the largest revenue share of 42.5% in 2024, supported by a high volume of spinal procedures, advanced healthcare infrastructure, favorable reimbursement policies, and strong adoption of biologics among U.S. surgeons and healthcare providers

- Asia-Pacific is expected to be the fastest growing region in the spinal allografts market during the forecast period due to increasing healthcare investments, expanding access to advanced surgical options, and growing awareness of allograft-based treatments

- Open Spine Surgery segment dominated the spinal allografts market with a market share of 58.8% in 2024, driven by its higher volume of traditional spinal procedures still performed globally, especially in complex cases requiring extensive grafting and structural support

Report Scope and Spinal Allografts Market Segmentation

|

Attributes |

Spinal Allografts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spinal Allografts Market Trends

“Advancement in Allograft Processing and Biologic Integration”

- A prominent and evolving trend in the global spinal allografts market is the increasing use of advanced tissue processing technologies and biologic enhancements to improve graft integration, safety, and clinical outcomes. Techniques such as proprietary demineralization processes, sterilization via low-dose gamma irradiation, and preservation methods such as freeze-drying are improving the structural integrity and osteoinductive potential of allografts

- For instance, LifeNet Health’s patented Allowash XG technology enhances the safety of bone allografts while preserving biomechanical properties, making it a widely used processing method across North America. Similarly, MTF Biologics has introduced DBM formulations with optimized carrier systems for better handling and bone growth stimulation

- The trend also includes the integration of allografts with growth factors, stem cells, or synthetic carriers to create next-generation composite grafts. These biologically enriched constructs provide a scaffold with enhanced healing potential, especially in challenging spinal fusion procedures

- Increasing surgeon preference for allografts due to their ability to reduce donor site morbidity, eliminate the need for autograft harvesting, and minimize operation time is fueling demand. Moreover, advancements in surgical instrumentation and minimally invasive techniques are facilitating more precise placement and utilization of allografts

- This push towards biologically active, clinically effective, and surgeon-friendly spinal allografts is reshaping product innovation, with manufacturers focusing on enhancing both regenerative capability and ease of use. Consequently, companies such as Osiris Therapeutics and NuVasive are investing in product pipelines that combine allograft scaffolds with osteogenic and osteoinductive properties to support better spinal fusion outcomes

- The growing interest in biologic integration and surgeon-tailored graft solutions across hospitals and ambulatory surgical centers highlights a significant shift toward personalized, outcome-driven spinal repair strategies

Spinal Allografts Market Dynamics

Driver

“Growing Burden of Spinal Disorders and Shift Toward Biologic Grafts”

- The rising global prevalence of spinal conditions such as degenerative disc disease, spinal stenosis, and trauma-related deformities is a major driver of the spinal allografts market. As the population ages and orthopedic comorbidities increase, the number of spinal fusion surgeries continues to grow, thereby escalating the demand for allografts

- For instance, in 2024, the U.S. alone recorded over 1.6 million spinal surgeries, with a significant proportion utilizing allograft materials to avoid autograft complications. Clinical guidelines are increasingly recommending the use of allografts due to their favorable safety profile and reduced recovery times

- The shift toward biologic solutions that can enhance fusion rates, reduce surgical time, and improve postoperative outcomes is prompting hospitals and surgical centers to adopt allografts over synthetic or autogenous alternatives. The growing body of evidence supporting the efficacy of demineralized bone matrix and structural allografts further strengthens their adoption

- In addition, the rise of value-based healthcare systems and the pressure to deliver cost-effective surgical interventions are pushing providers to opt for standardized, readily available graft options that ensure predictable outcomes with minimal complications

Restraint/Challenge

“Regulatory Hurdles and Disease Transmission Concerns”

- Despite clinical benefits, concerns over potential disease transmission, immune reactions, and stringent regulatory requirements for donor tissue processing pose key challenges to market expansion. Regulatory agencies such as the FDA and EMA enforce strict guidelines for donor screening, sterilization, and traceability, which can increase production timelines and costs for manufacturers

- High-profile recalls or reports of contamination—even if rare—can erode clinician and patient confidence in allograft use. Moreover, variability in graft quality due to donor-dependent factors and processing inconsistencies may affect clinical outcomes in some cases

- While companies such as RTI Surgical and Arthrex emphasize rigorous quality controls, the perception of safety risks still persists, particularly in emerging markets with less established tissue banking infrastructure

- In addition, reimbursement variability across regions and limited coverage in some healthcare systems for biologic grafts can restrict adoption

- Overcoming these obstacles through global harmonization of tissue standards, ongoing education for surgeons, and innovation in sterilization technologies will be essential for unlocking the full growth potential of spinal allografts worldwide

Spinal Allografts Market Scope

The market is segmented on the basis of surgery type, product type, and end-user.

- By Surgery Type

On the basis of surgery, the spinal allografts market is segmented into open spine surgery and minimally invasive spine surgery. The open spine surgery segment dominated the market with the largest revenue of 58.8% in 2024, primarily due to the high number of complex spinal deformities and degenerative disc diseases being treated through conventional open approaches. This segment benefits from clinical familiarity and procedural accessibility, especially in emerging markets and among older patient populations where minimally invasive techniques may be less suitable.

The minimally invasive spine surgery segment is expected to witness the fastest CAGR from 2025 to 2032. The rising preference for less traumatic procedures, quicker recovery times, reduced infection risks, and shorter hospital stays is fueling its adoption. Technological advances in endoscopic and robotic-assisted techniques further support this trend, with increasing acceptance among healthcare providers and patients asuch as.

- By Product Type

On the basis of product, the market is segmented into machined bones allograft and demineralized bone matrix (DBM). The demineralized bone matrix segment held the largest market share in 2024, attributed to its high osteoinductive potential and wide clinical applicability in spinal fusion procedures. DBMs are particularly valued for their ability to promote bone regeneration and healing, often used in combination with autografts or other scaffolding materials to enhance clinical outcomes.

The machined bones allograft segment is expected to grow significantly during the forecast period. These precisely shaped grafts offer structural support and are often preferred in reconstructive procedures requiring mechanical stability. Their ease of handling and consistent geometry make them favorable for surgeons performing spinal arthrodesis or vertebral body replacement.

- By End User

On the basis of end-users, the spinal allografts market is segmented into hospitals, ambulatory surgical centers (ASCs), and others. The hospital segment dominated the market in 2024 due to the higher volume of complex spinal procedures conducted in hospital settings, particularly in tertiary care centers. The availability of advanced surgical infrastructure, multidisciplinary teams, and post-operative care facilities drives the segment’s strong presence.

The ambulatory surgical centers (ASCs) segment is projected to experience the fastest growth rate from 2025 to 2032. The shift toward outpatient spine surgeries, cost-effectiveness, and reduced patient wait times contribute to the increasing preference for ASCs. Regulatory support and advances in minimally invasive techniques further bolster the segment’s momentum in the forecast period.

Spinal Allografts Market Regional Analysis

- North America dominated the spinal allografts market with the largest revenue share of 42.5% in 2024, supported by a high volume of spinal procedures, advanced healthcare infrastructure, favorable reimbursement policies, and strong adoption of biologics among U.S. surgeons and healthcare providers

- The presence of advanced healthcare infrastructure and leading orthopedic and spine care centers enables early diagnosis and adoption of advanced grafting materials, including allografts

- Moreover, the region benefits from the strong presence of key market players, rising geriatric population, and growing awareness regarding minimally invasive spine surgeries, reinforcing its position as the leading contributor to global market revenue

U.S. Spinal Allografts Market Insight

The U.S. spinal allografts market captured the largest revenue share of 83% in 2024 within North America, driven by the high incidence of spinal conditions such as degenerative disc disease and scoliosis. The growing geriatric population and increasing adoption of spinal fusion surgeries are fueling demand for allograft-based treatments. In addition, favorable reimbursement structures, advanced surgical technologies, and the strong presence of key players contribute significantly to market dominance. The shift toward minimally invasive procedures and rising demand for biologic solutions further accelerate growth.

Europe Spinal Allografts Market Insight

The Europe spinal allografts market is projected to expand at a substantial CAGR throughout the forecast period, owing to rising healthcare expenditures, an aging population, and an uptick in spinal disorders. The region is increasingly adopting allograft materials due to their reduced risk of disease transmission and faster recovery times. Furthermore, growing investments in spine care centers, coupled with regulatory support for biologic implants, are propelling market demand across countries such as Germany, France, and the U.K.

U.K. Spinal Allografts Market Insight

The U.K. spinal allografts market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising demand for non-autologous graft options in spinal fusion surgeries. The presence of well-established healthcare systems and growing concerns regarding post-operative complications from synthetic implants are encouraging the use of allografts. In addition, increasing awareness of advanced biologic grafts and their advantages is boosting adoption in both public and private healthcare facilities.

Germany Spinal Allografts Market Insight

The Germany spinal allografts market is expected to expand at a considerable CAGR during the forecast period, driven by the country's sophisticated medical infrastructure and emphasis on innovation. A significant rise in the number of spine surgeries and the adoption of advanced treatment protocols favor the use of allografts. Germany's focus on research and development, combined with growing surgeon preference for biologic materials over synthetic alternatives, supports strong market growth.

Asia-Pacific Spinal Allografts Market Insight

The Asia-Pacific spinal allografts market is poised to grow at the fastest CAGR of 25% during the forecast period of 2025 to 2032, driven by the rising geriatric population, increasing awareness of spinal treatments, and expanding healthcare access in countries such as China, India, and Japan. Rapid advancements in surgical procedures and the shift toward biologic implants are stimulating demand. Government support for healthcare infrastructure and growing medical tourism also contribute to market expansion across the region.

Japan Spinal Allografts Market Insight

The Japan spinal allografts market is gaining momentum due to the country's aging population and high demand for advanced spinal procedures. Japan’s healthcare system encourages early adoption of biologic solutions, with a focus on minimally invasive surgeries. Growing partnerships between domestic and international players are enhancing access to cutting-edge spinal graft materials, fostering consistent market growth in both hospital and outpatient settings.

India Spinal Allografts Market Insight

The India spinal allografts market accounted for the largest market revenue share in Asia Pacific in 2024, supported by a rising patient base, increasing spine surgery volumes, and improving healthcare infrastructure. Growing awareness of allograft advantages over autografts, coupled with government initiatives to support advanced surgical interventions, is driving adoption. Furthermore, the presence of cost-effective domestic manufacturers and the expansion of private multispecialty hospitals are enhancing market accessibility.

Spinal Allografts Market Share

The spinal allografts industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Smith + Nephew (U.K.)

- Orthofix Medical Inc. (U.S.)

- NuVasive, Inc. (U.S.)

- MTF Biologics (U.S.)

- AlloSource (U.S.)

- RTI Surgical Holdings, Inc. (U.S.)

- Xtant Medical Holdings, Inc. (U.S.)

- Seaspine Holdings Corporation (U.S.)

- DePuy Synthes (Johnson & Johnson) (U.S.)

- Integra LifeSciences Holdings Corporation (U.S.)

- Globus Medical, Inc. (U.S.)

- LifeNet Health (U.S.)

- Osiris Therapeutics, Inc. (U.S.)

- Theragenics Corporation (U.S.)

- Arthrex, Inc. (U.S.)

- Wright Medical Group N.V. (Netherlands)

What are the Recent Developments in Global Spinal Allografts Market?

- In April 2023, MTF Biologics, a leading nonprofit organization dedicated to providing high-quality allografts, announced the launch of a next-generation machined bone allograft designed to support complex spinal fusion procedures. This innovation leverages advanced processing techniques to improve graft integration and structural integrity, catering to the rising demand for biologically enhanced solutions. The development reflects MTF Biologics’ commitment to advancing spinal care through precision-engineered allograft products that promote optimal patient outcomes

- In March 2023, Orthofix Medical Inc. received FDA clearance for its expanded line of Trinity Elite® allograft solutions. The new formulation combines viable cells with a demineralized bone matrix, enhancing osteoinductivity and improving fusion potential. This milestone strengthens Orthofix’s position in the biologics segment, offering spine surgeons more reliable and regenerative options for spinal fusion surgeries in both minimally invasive and open approaches

- In February 2023, RTI Surgical Holdings, Inc. announced a strategic collaboration with a prominent academic research institution to explore the next generation of demineralized bone matrix (DBM) formulations tailored for spinal applications. The partnership aims to combine clinical expertise with material science innovations to enhance graft performance, thereby supporting RTI’s goal of delivering high-quality, evidence-based allograft solutions for spine care

- In February 2023, AlloSource introduced ProChondrix CR, a cryopreserved osteochondral allograft designed to restore cartilage and support spinal load-bearing surfaces. Though primarily used in orthopedic repair, this innovation is being adapted for spinal procedures requiring biologically active surfaces. The product exemplifies AlloSource’s broader mission to extend the benefits of living tissue allografts to the spinal sector, offering new pathways for patient recovery

- In January 2023, Xtant Medical Holdings, Inc. launched its Fortilink-TS line of interbody implants integrated with cancellous bone allografts. These implants are designed for thoracolumbar spinal fusion procedures, enhancing structural support and biological healing. The launch represents Xtant’s continued focus on combining hardware and biologics to deliver comprehensive solutions for complex spine conditions, aligning with the growing preference for biologically active implant systems.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.