Global Styrene Butadiene Styrene Sbs Block Copolymer Market

Taille du marché en milliards USD

TCAC :

%

USD

710.39 Million

USD

1,098.52 Million

2025

2033

USD

710.39 Million

USD

1,098.52 Million

2025

2033

| 2026 –2033 | |

| USD 710.39 Million | |

| USD 1,098.52 Million | |

|

|

|

|

Segmentation du marché mondial des copolymères séquencés styrène-butadiène-styrène (SBS), par type (SBS thermoplastique (TPS-SBS) et SBS thermodurcissable (TS-SBS)), qualité (qualité standard, qualité haute résistance aux chocs, qualité à faible teneur en styrène et qualité copolymère), application (automobile, médical, électronique, construction et emballage), méthode de transformation (moulage par injection, extrusion, moulage par compression et soufflage) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

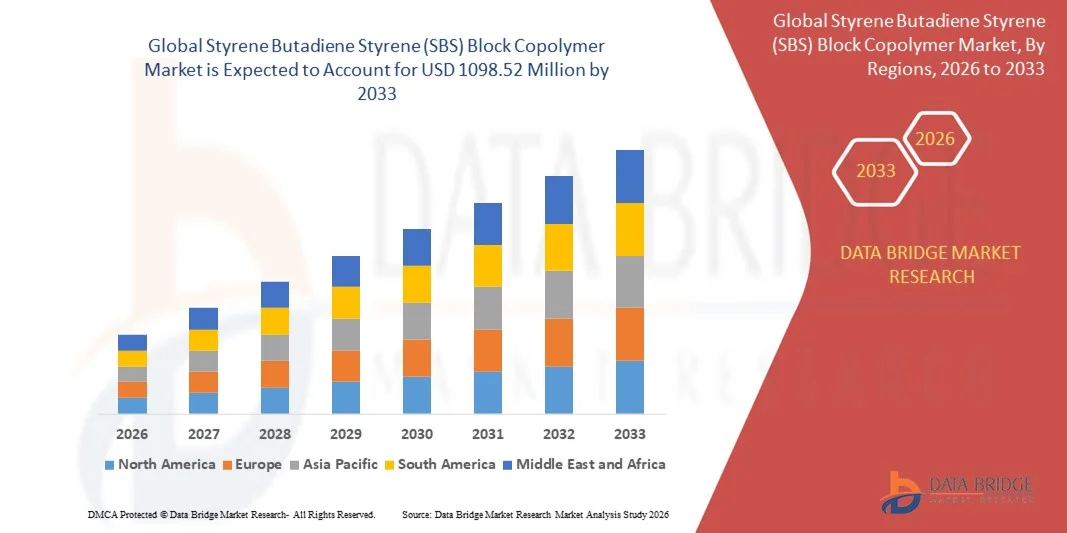

- Le marché mondial des copolymères séquencés styrène-butadiène-styrène (SBS) était évalué à 710,39 millions de dollars américains en 2025 et devrait atteindre 1 098,52 millions de dollars américains d’ici 2033 , avec un TCAC de 5,60 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante du SBS dans les domaines du pavage, de la toiture, des adhésifs, des mastics et de la modification des polymères.

- La demande croissante émanant des projets de construction et de développement d'infrastructures soutient davantage l'expansion du marché.

Analyse du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

- Le marché connaît une forte croissance grâce à la flexibilité, la durabilité et la résistance aux chocs supérieures offertes par le SBS dans tous les secteurs d'utilisation finale.

- L'augmentation des investissements dans l'entretien des routes, les systèmes d'étanchéité et les matériaux de construction durables renforce les perspectives du marché.

- L'Amérique du Nord a dominé le marché des copolymères séquencés styrène-butadiène-styrène (SBS) avec la plus grande part de revenus (38,5 %) en 2025, grâce à la forte demande de matériaux légers, durables et résistants aux chocs dans les secteurs de l'automobile, de la construction et de l'emballage.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial des copolymères séquencés styrène-butadiène-styrène (SBS) , sous l'effet de l'urbanisation croissante, de l'expansion du secteur industriel et de la demande grandissante de matériaux polymères durables et polyvalents.

- Le segment TPS-SBS a représenté la plus grande part de marché en termes de chiffre d'affaires en 2025, grâce à ses excellentes propriétés thermoplastiques, sa facilité de mise en œuvre et sa polyvalence dans les secteurs de la construction et de l'automobile. Le TPS-SBS est particulièrement apprécié pour les applications exigeant flexibilité, durabilité et stabilité thermique.

Portée du rapport et segmentation du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

|

Attributs |

Aperçu du marché du copolymère séquencé styrène-butadiène-styrène (SBS) |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

Adoption croissante du SBS dans les applications de construction et automobiles

- La demande croissante d'élastomères thermoplastiques haute performance transforme le marché des copolymères séquencés SBS en améliorant la flexibilité, la durabilité et la résistance des asphaltes, des adhésifs et des mastics. Cette évolution permet aux fabricants de répondre aux normes de performance rigoureuses des secteurs de la construction et de l'automobile, ce qui se traduit par une meilleure qualité des produits et une durée de vie prolongée.

- L'importance croissante accordée au développement des infrastructures routières et aux matériaux de revêtement de haute qualité accélère l'adoption des liants bitumineux modifiés au SBS. Ces liants améliorent la durabilité des routes, réduisent les coûts d'entretien et optimisent les performances sous différentes conditions de température et de charge, stimulant ainsi la croissance du marché.

- La polyvalence et le rapport coût-efficacité des copolymères séquencés SBS les rendent attractifs pour les fabricants de nombreux secteurs. Leur capacité à se mélanger à d'autres polymères et à améliorer leurs propriétés mécaniques favorise leur utilisation dans les adhésifs, les chaussures, les revêtements et les composants automobiles.

- Par exemple, en 2023, plusieurs entreprises de construction européennes et nord-américaines ont signalé une amélioration des performances routières et une réduction des fissures après l'utilisation d'asphalte modifié au SBS, démontrant ainsi l'efficacité du polymère dans les projets d'infrastructure.

- Bien que l'adoption du SBS dans la construction et l'automobile soit en hausse, l'expansion du marché dépend de la poursuite des recherches, de l'innovation produit et de l'optimisation des procédés. Les fabricants doivent s'attacher à développer des formulations sur mesure pour répondre aux exigences spécifiques de chaque secteur et tirer profit de la demande croissante.

Dynamique du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

Conducteur

Demande croissante dans les secteurs de la construction et de l'automobile

- L'expansion rapide des infrastructures urbaines et des réseaux routiers alimente la demande en asphalte modifié SBS et en solutions polymères haute performance. Les pouvoirs publics et les promoteurs privés privilégient les matériaux durables et écologiques, ce qui a favorisé l'adoption des copolymères séquencés SBS. Par ailleurs, la tendance aux villes intelligentes et aux routes à longue durée de vie encourage une utilisation plus large du SBS dans les grands projets de génie civil, contribuant ainsi à la croissance du marché.

- Les constructeurs automobiles utilisent de plus en plus le SBS dans les composants intérieurs, les joints et les adhésifs afin d'améliorer la durabilité, l'élasticité et la résistance aux températures élevées. Cette tendance est motivée par le besoin de matériaux légers et performants pour les véhicules électriques et conventionnels. Les attentes croissantes des consommateurs en matière de produits automobiles plus sûrs et plus résistants, ainsi que la transition vers la production de véhicules électriques, favorisent également l'adoption du SBS dans les composants automobiles critiques.

- Des politiques réglementaires favorables à la construction de routes de qualité et à l'utilisation de matériaux durables accélèrent la croissance du marché. Les incitations et les normes en faveur d'infrastructures durables encouragent l'utilisation du SBS dans le pavage et les applications industrielles. Par ailleurs, les gouvernements d'Europe, d'Amérique du Nord et d'Asie imposent des réglementations visant à améliorer la qualité et la durabilité des routes, ce qui renforce la demande du marché pour l'asphalte modifié au SBS.

- Par exemple, en 2022, plusieurs projets autoroutiers aux États-Unis et en Allemagne ont intégré de l'asphalte modifié au SBS afin d'améliorer les performances, la durabilité et la résistance à l'orniérage et à la fissuration par fatigue des routes. Des initiatives similaires ont également été observées en Asie-Pacifique, où des solutions SBS ont été intégrées à de nouveaux réseaux routiers urbains pour résister aux conditions climatiques extrêmes et aux fortes charges de trafic, démontrant ainsi l'efficacité de ce polymère dans différentes régions du monde.

- Alors que la demande augmente dans les secteurs de la construction et de l'automobile, un approvisionnement constant en matières premières de haute qualité, la standardisation des produits et des méthodes de production rentables demeurent essentiels au maintien de la croissance du marché. Les acteurs du marché se concentrent également sur les innovations technologiques, telles que les formulations modifiées et les techniques de production écologiques, afin de répondre à l'évolution des besoins de l'industrie et de réduire l'impact environnemental.

Retenue/Défi

Coûts de production élevés et volatilité des matières premières

- Le coût de production des copolymères séquencés SBS est relativement élevé en raison de la volatilité des matières premières que sont le styrène et le butadiène. Les fluctuations de prix peuvent impacter la rentabilité et limiter l'adoption de ces copolymères, notamment auprès des fabricants et dans les régions sensibles aux coûts. Cette sensibilité aux prix est encore accentuée par les perturbations des chaînes d'approvisionnement mondiales, ce qui rend les prévisions budgétaires et la planification de la production difficiles pour les producteurs de SBS.

- Dans de nombreuses régions en développement, la disponibilité limitée d'installations de production de pointe et d'expertise technique restreint la production et l'utilisation à grande échelle des copolymères séquencés SBS. Il en résulte une dépendance aux produits importés, ce qui accroît les coûts globaux et la complexité de la chaîne d'approvisionnement. De plus, le manque de capacités de R&D locales freine l'innovation et l'adaptation aux exigences spécifiques des applications régionales, limitant ainsi la pénétration du marché dans ces régions.

- La croissance du marché est également freinée par les réglementations environnementales et de sécurité liées à la manipulation du styrène et du butadiène. Le respect des normes d'émission et des bonnes pratiques de fabrication peut accroître les coûts d'exploitation des producteurs. Le renforcement du contrôle de la manipulation des produits chimiques et de la gestion des déchets incite davantage les fabricants à adopter des pratiques durables, ce qui peut entraîner une hausse des coûts de production.

- Par exemple, en 2023, plusieurs fabricants de SBS en Asie ont signalé des perturbations de leur chaîne d'approvisionnement et une augmentation de leurs coûts de production en raison de la volatilité du prix du styrène et des exigences réglementaires. Les retards dans l'approvisionnement et le transport des matières premières ont accentué l'incertitude, affectant les délais de livraison des projets de construction et automobiles.

- Alors que la technologie SBS continue de progresser, il est essentiel de s'attaquer aux problèmes de coûts, de volatilité des matières premières et de réglementation. Les acteurs du secteur doivent privilégier l'efficacité des procédés, les méthodes de production durables et la fabrication locale pour libérer le potentiel de croissance à long terme du marché des copolymères séquencés SBS. De plus, investir dans des matières premières alternatives, des stratégies de recyclage et une production écoénergétique peut contribuer à stabiliser les coûts et à garantir un approvisionnement constant pour répondre à la demande mondiale.

Étendue du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché du copolymère séquencé styrène-butadiène-styrène (SBS) est segmenté en quatre segments notables en fonction du type, de la qualité, de l'application et de la méthode de traitement.

- Par type

Le marché est segmenté, selon le type de matériau, en styrène-butadiène-styrène thermoplastique (TPS-SBS) et en styrène-butadiène-styrène thermodurcissable (TS-SBS). Le segment TPS-SBS détenait la plus grande part de chiffre d'affaires en 2025, grâce à ses excellentes propriétés thermoplastiques, sa facilité de mise en œuvre et sa polyvalence dans les secteurs de la construction et de l'automobile. Le TPS-SBS est particulièrement apprécié pour les applications exigeant flexibilité, durabilité et stabilité thermique.

Le segment TS-SBS devrait connaître le taux de croissance le plus rapide entre 2026 et 2033, grâce à sa résistance mécanique supérieure, sa résistance chimique et sa stabilité thermique, ce qui le rend idéal pour les applications automobiles, industrielles et adhésives hautes performances.

- Par niveau

Le marché est segmenté, selon la qualité, en quatre catégories : qualité standard, qualité haute résistance aux chocs, qualité à faible teneur en styrène et qualité copolymère. En 2025, le segment de la qualité standard détenait la plus grande part de revenus, grâce à ses performances équilibrées, son rapport coût-efficacité et sa large applicabilité dans les secteurs de la construction, de l’automobile et de l’industrie.

Le segment des matériaux à haute résistance aux chocs devrait connaître le taux de croissance le plus rapide entre 2026 et 2033, alimenté par la demande croissante de résistance supérieure aux chocs, de résistance mécanique et de durabilité dans les pièces automobiles, les matériaux d'emballage et les projets d'infrastructure.

- Sur demande

En fonction du secteur d'application, le marché est segmenté en automobile, médical, électronique, construction et emballage. Le segment de la construction détenait la plus grande part de revenus en 2025, grâce à l'utilisation intensive d'asphalte modifié au SBS et de matériaux de construction à base de polymères pour les routes, les ponts et les bâtiments commerciaux.

Le secteur automobile devrait connaître le taux de croissance le plus rapide entre 2026 et 2033, grâce à l'utilisation croissante du SBS dans les joints, les adhésifs et les composants intérieurs pour améliorer la durabilité, l'élasticité et les performances thermiques.

- Par méthode de traitement

Selon le procédé de fabrication, le marché est segmenté en moulage par injection, extrusion, moulage par compression et soufflage. Le segment de l'extrusion détenait la plus grande part de chiffre d'affaires en 2025, grâce à son efficacité dans la production de profilés continus, de composants de construction et de pièces industrielles de qualité constante.

Le segment du moulage par injection devrait connaître le taux de croissance le plus rapide entre 2026 et 2033, alimenté par une adoption croissante dans les secteurs de l'automobile, de l'emballage et du médical, qui exigent des formes précises, des finitions de haute qualité et des performances mécaniques fiables.

Analyse régionale du marché des copolymères séquencés styrène-butadiène-styrène (SBS)

- L'Amérique du Nord a dominé le marché des copolymères séquencés styrène-butadiène-styrène (SBS) avec la plus grande part de revenus (38,5 %) en 2025, grâce à la forte demande de matériaux légers, durables et résistants aux chocs dans les secteurs de l'automobile, de la construction et de l'emballage.

- Les fabricants de la région adoptent de plus en plus les copolymères séquencés SBS en raison de leur polyvalence, de leurs hautes performances et de leur capacité à améliorer la qualité et la durée de vie des produits.

- Cette utilisation généralisée est également favorisée par des infrastructures de fabrication avancées, une forte croissance industrielle et une préférence pour les matériaux haute performance dans des applications telles que les pièces automobiles, les dispositifs médicaux et l'électronique.

Aperçu du marché américain des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché américain des copolymères séquencés SBS a généré la plus grande part de revenus en Amérique du Nord en 2025, porté par la croissance de la production automobile et la demande de matériaux légers et résistants. L'adoption du SBS dans les secteurs de l'emballage et du médical est également en hausse grâce à sa durabilité et sa flexibilité. Par ailleurs, les innovations constantes dans les techniques de transformation et l'intégration du SBS dans les procédés d'extrusion, de moulage par injection et de soufflage contribuent à l'expansion du marché.

Aperçu du marché européen des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché européen des copolymères séquencés SBS devrait connaître la croissance la plus rapide entre 2026 et 2033, sous l'impulsion de réglementations strictes en faveur de matériaux durables et performants dans les secteurs de l'automobile et de la construction. La demande croissante de polymères écologiques, économes en énergie et recyclables favorise l'adoption des copolymères séquencés SBS dans diverses applications. L'urbanisation croissante, l'expansion industrielle et la tendance aux matériaux légers contribuent également à la croissance de ce marché.

Aperçu du marché britannique des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché britannique des copolymères séquencés SBS devrait connaître une croissance rapide entre 2026 et 2033, portée par l'utilisation croissante de polymères haute performance dans les secteurs de l'automobile, de l'électronique et de l'emballage. Cette adoption est favorisée par l'accent mis sur la durabilité, la résistance aux chocs et l'efficacité des produits. Par ailleurs, les initiatives gouvernementales encourageant l'innovation industrielle et l'utilisation de matériaux avancés soutiennent l'expansion du marché.

Analyse du marché allemand des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché allemand des copolymères séquencés SBS devrait connaître une croissance significative entre 2026 et 2033, portée par l'accent mis en Allemagne sur l'innovation, des normes industrielles de haute qualité et le développement durable dans les applications polymères. Les copolymères SBS sont de plus en plus utilisés dans les pièces automobiles, les matériaux de construction et les dispositifs médicaux grâce à leurs propriétés mécaniques supérieures. Leur intégration dans des procédés de fabrication avancés, tels que l'extrusion et le moulage par injection, contribue également à accélérer leur adoption.

Aperçu du marché des copolymères séquencés styrène-butadiène-styrène (SBS) en Asie-Pacifique

Le marché des copolymères séquencés SBS en Asie-Pacifique devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'industrialisation et l'urbanisation rapides, ainsi que par l'essor des secteurs automobile et de la construction dans des pays comme la Chine, le Japon et l'Inde. L'augmentation des investissements dans l'électronique et l'emballage, conjuguée aux initiatives gouvernementales encourageant l'adoption de polymères avancés, dynamise ce marché. La présence d'installations de production compétitives et le développement des capacités de production locales favorisent également l'accessibilité et l'adoption de ces polymères.

Analyse du marché japonais des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché japonais des copolymères séquencés SBS devrait connaître une croissance soutenue entre 2026 et 2033, grâce à la forte présence des industries automobile et électronique du pays. La demande croissante de matériaux performants, légers et durables stimule l'adoption des SBS. L'intégration des copolymères SBS dans la fabrication de précision, les applications médicales et les produits écologiques contribue également à l'expansion du marché.

Aperçu du marché chinois des copolymères séquencés styrène-butadiène-styrène (SBS)

Le marché chinois des copolymères séquencés SBS a représenté la plus grande part de revenus de la région Asie-Pacifique en 2025, grâce à une industrialisation rapide, à l'expansion des secteurs automobile et de la construction, et à une forte consommation de polymères. L'accent mis par le pays sur la fabrication intelligente, une production rentable et la présence de fabricants nationaux de SBS favorisent une adoption généralisée. Le développement des applications dans les domaines de l'emballage, de l'électronique et des dispositifs médicaux stimule davantage la croissance du marché.

Part de marché du copolymère séquencé styrène-butadiène-styrène (SBS)

L'industrie du copolymère séquencé styrène-butadiène-styrène (SBS) est principalement dominée par des entreprises bien établies, notamment :

- Polymères Kraton (États-Unis)

- LCY Chemical Corp (Taïwan)

- Mitsui Chemicals Inc (Japon)

- Versalis SpA (Italie)

- Lanxess AG (Allemagne)

- Trinseo SA (États-Unis)

- TotalEnergies SA (France)

- Synthomer plc (Royaume-Uni)

- Kuraray Co., Ltd. (Japon)

- JSR Corporation (Japon)

Dernières évolutions du marché mondial des copolymères séquencés styrène-butadiène-styrène (SBS)

- En août 2025, Kraton Polymers (États-Unis) a annoncé un partenariat stratégique avec un grand constructeur automobile pour développer des matériaux SBS de pointe destinés aux véhicules électriques. Cette collaboration vise à enrichir la gamme de produits et la présence de Kraton sur le marché, tout en répondant à la demande croissante de matériaux spécialisés et durables dans le secteur automobile. Cette initiative devrait consolider la position de l'entreprise sur le marché des véhicules électriques et s'inscrire dans la tendance du secteur vers l'innovation et le développement durable.

- En septembre 2025, LCY Chemical Corp (Taïwan) a inauguré un nouveau site de production afin d'accroître sa production de SBS et de répondre à la demande mondiale croissante. Cette expansion vise à améliorer la fiabilité de la chaîne d'approvisionnement, à réduire les délais de livraison et à mieux satisfaire les exigences des clients. En localisant sa production, LCY est en mesure d'améliorer son efficacité opérationnelle et de répondre rapidement aux besoins du marché, illustrant ainsi une tendance plus large à la régionalisation de la production.

- En juillet 2025, Mitsui Chemicals Inc (Japon) a lancé une nouvelle gamme de produits SBS haute performance destinés au secteur de la construction. Ce développement vise à répondre à la demande croissante d'infrastructures et de construction à l'échelle mondiale, en proposant des solutions innovantes et adaptées aux besoins spécifiques du secteur. Cette initiative devrait permettre à Mitsui d'étendre sa présence sur le marché, de renforcer sa position concurrentielle et de favoriser l'adoption de matériaux polymères durables et performants.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.