Global Tax It Software Market

Taille du marché en milliards USD

TCAC :

%

USD

20.87 Billion

USD

38.46 Billion

2024

2032

USD

20.87 Billion

USD

38.46 Billion

2024

2032

| 2025 –2032 | |

| USD 20.87 Billion | |

| USD 38.46 Billion | |

|

|

|

|

Segmentation du marché mondial des logiciels de fiscalité, par offre (logiciels et services), type d'impôt (impôt sur le revenu, impôt sur les sociétés et impôt foncier), mode de déploiement (cloud et sur site), taille de l'organisation (petites et moyennes entreprises et grandes entreprises), modèle de revenus (achat unique et par abonnement), secteur d'activité (banque, services financiers et assurances (BFSI), informatique et télécommunications, fabrication, vente au détail et biens de consommation, santé, énergie et services publics, et médias et divertissement) - Tendances et prévisions du secteur jusqu'en 2032

Analyse du marché mondial des logiciels de fiscalité

Le marché mondial des logiciels de fiscalité connaît une croissance rapide, stimulé par la complexité croissante des réglementations fiscales mondiales et par la nécessité pour les entreprises de garantir leur conformité dans plusieurs juridictions. Ce marché englobe des solutions qui automatisent les calculs fiscaux, les rapports et les processus de déclaration tout en s'intégrant aux systèmes d'entreprise pour réduire les efforts manuels et minimiser les erreurs. Les avancées technologiques telles que l'IA et le cloud computing améliorent les capacités des logiciels, offrent des mises à jour en temps réel, une évolutivité et une précision améliorée. Le marché est en outre soutenu par l'adoption croissante par les PME et les grandes entreprises en quête d'efficacité opérationnelle.

Taille du marché mondial des logiciels de fiscalité

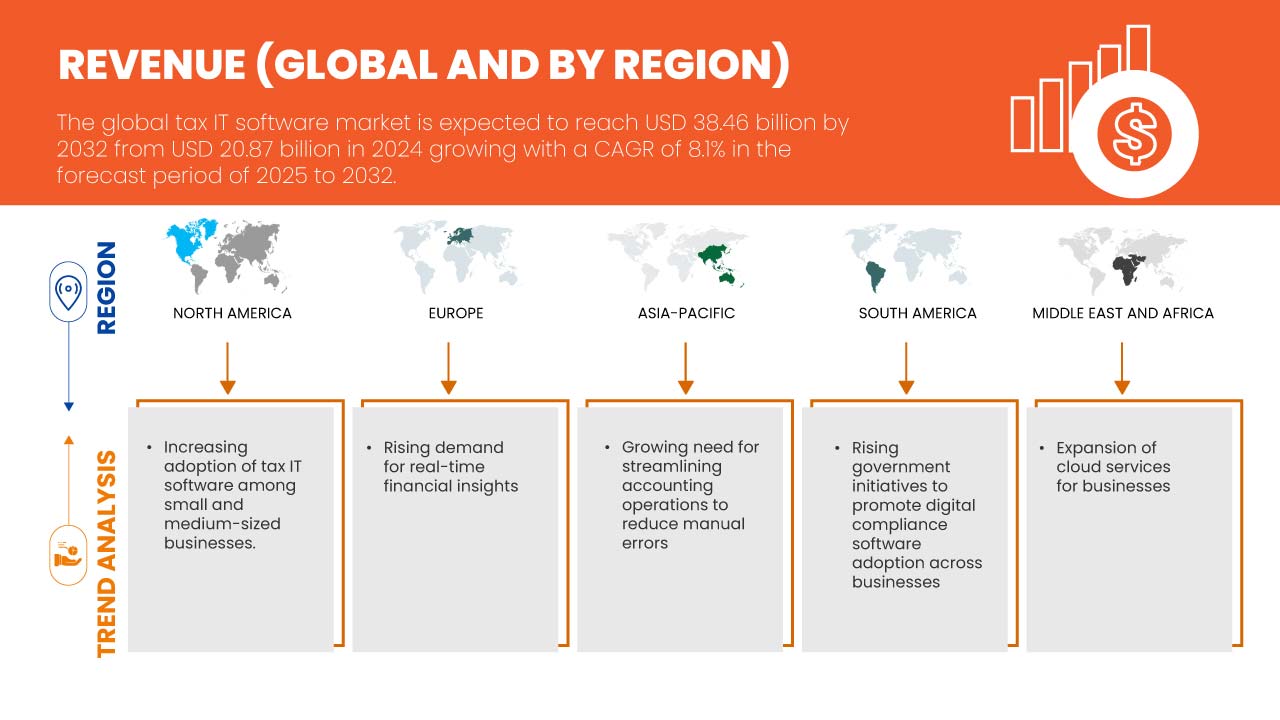

Français Data Bridge Market Research analyse que le marché mondial des logiciels fiscaux devrait atteindre 38,46 milliards USD d'ici 2032, contre 20,87 milliards USD en 2024, avec un TCAC de 8,1 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE.

Tendances du marché mondial des logiciels de fiscalité

« Efforts accrus de détection des crimes financiers »

Les efforts accrus de détection des délits financiers ont intensifié la surveillance des mesures de lutte contre le blanchiment d’argent (LBC), en mettant l’accent sur le renforcement des systèmes de conformité et de surveillance. Les institutions financières mettent en œuvre des procédures plus rigoureuses pour identifier les transactions suspectes et les tendances révélatrices de blanchiment d’argent. Ces mesures comprennent le renforcement des contrôles internes, l’amélioration des pratiques de déclaration des transactions et l’amélioration de la collaboration avec les organismes de réglementation. L’effort en faveur d’une plus grande transparence et d’une plus grande responsabilité vise à perturber les réseaux de criminalité financière et à réduire les flux financiers illicites. En adoptant des cadres de lutte contre le blanchiment d’argent complets, les organisations cherchent à atténuer les risques et à protéger l’intégrité du système financier. Cette approche proactive reflète un engagement plus large en faveur de la lutte contre la criminalité financière et du maintien de la conformité réglementaire.

Portée du rapport et segmentation du marché mondial des logiciels informatiques fiscaux

|

Rapport métrique |

Informations sur le marché mondial des logiciels de fiscalité |

|

Segments couverts |

Informatique et télécommunications, fabrication, vente au détail et biens de consommation, santé, énergie et services publics, et médias et divertissement |

|

Pays couverts |

États-Unis, Canada et Mexique, Royaume-Uni, Allemagne, France, Italie, Espagne, Russie, Pays-Bas, Suisse, Belgique, Turquie, Luxembourg et reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Australie et Nouvelle-Zélande, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Taïwan, Vietnam et reste de l'Asie-Pacifique, Brésil, Argentine et reste de l'Amérique du Sud et Émirats arabes unis, Arabie saoudite, Afrique du Sud, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

Microsoft (États-Unis), ADP, Inc. (États-Unis), Yayoi Co., Ltd. (Japon), Wolters Kluwer NV (Pays-Bas), Stripe (États-Unis), SAP (États-Unis), Thomson Reuters (États-Unis), Oracle (États-Unis), NTT data (Japon), QUICKBOOKS (INTUIT INC.) (États-Unis), SAGE GROUP PLC (Royaume-Uni), Vertex (États-Unis), TKC Corporation (Japon), SOVOS Compliance, LLC (États-Unis), Avalara (États-Unis), Money Forward, Inc. (Japon), freee KK (Japon), TaxDiva (Inde), Esker (France), PCA Corporation (Japon) et Epicor Software Corporation (États-Unis) |

|

Opportunités de marché |

|

|

Données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché mondial des logiciels de fiscalité

Les logiciels de gestion fiscale font référence à des solutions technologiques spécialisées conçues pour automatiser et rationaliser les processus de gestion fiscale, notamment le calcul, la conformité, la production de rapports et le dépôt des impôts. Ces systèmes s'intègrent aux plateformes d'entreprise pour garantir une gestion précise de la taxe de vente, de la taxe d'utilisation, de la TVA et d'autres types de taxes dans plusieurs juridictions. En exploitant des fonctionnalités avancées telles que les mises à jour des taux en temps réel, la gestion des certificats d'exonération et les rapports détaillés, Tax IT Software réduit les charges de travail manuelles, minimise les risques de non-conformité et améliore l'efficacité opérationnelle des entreprises confrontées à des réglementations fiscales complexes.

Dynamique du marché mondial des logiciels de fiscalité

Conducteurs

- Adoption croissante des logiciels de gestion fiscale parmi les petites et moyennes entreprises

Les PME sont de plus en plus confrontées à des complexités croissantes dans la gestion de la conformité fiscale. Elles se tournent donc vers des solutions automatisées qui simplifient les processus, réduisent les erreurs et garantissent l'exactitude. La nécessité pour ces entreprises de s'adapter aux différentes réglementations fiscales, notamment la taxe de vente, la TVA et d'autres lois fiscales locales, a entraîné une augmentation de l'utilisation de logiciels informatiques fiscaux. Ces solutions rationalisent les calculs fiscaux et s'intègrent également de manière transparente aux systèmes financiers, offrant un moyen plus efficace de gérer les impôts tout en restant conforme aux réglementations en constante évolution.

De plus, la transition croissante vers la numérisation et les solutions basées sur le cloud accélère l’adoption de logiciels informatiques fiscaux dans le secteur des PME. Ces entreprises recherchent de plus en plus des solutions évolutives et rentables qui leur permettent de gérer leurs opérations fiscales sans avoir besoin de ressources internes importantes. En automatisant les tâches fiscales de routine telles que la déclaration, le dépôt et le suivi de la conformité, les PME peuvent réduire les charges administratives, gagner du temps et se concentrer sur des initiatives de croissance stratégique. Cette tendance devrait se poursuivre à mesure que les logiciels informatiques fiscaux deviennent plus accessibles, conviviaux et intégrés à des plateformes de gestion financière plus larges, ce qui en fait un outil essentiel pour les PME du monde entier.

Par exemple,

En novembre 2024, selon un article publié par The Indian Express, une enquête de Deloitte India montre que 81 % des petites entreprises prévoient de numériser leurs opérations fiscales au cours des cinq prochaines années, ce qui met en évidence une évolution vers des fonctions fiscales axées sur la technologie. Malgré des défis tels que les problèmes d’intégration et la pénurie de professionnels de la technologie fiscale, il existe une forte volonté d’adopter des solutions informatiques fiscales soutenues par les initiatives de numérisation du gouvernement. Cet intérêt croissant des petites entreprises pour la modernisation de leurs processus fiscaux signale une demande croissante de logiciels informatiques fiscaux, stimulant la croissance du marché et l’innovation pour répondre aux besoins spécifiques des petites organisations.

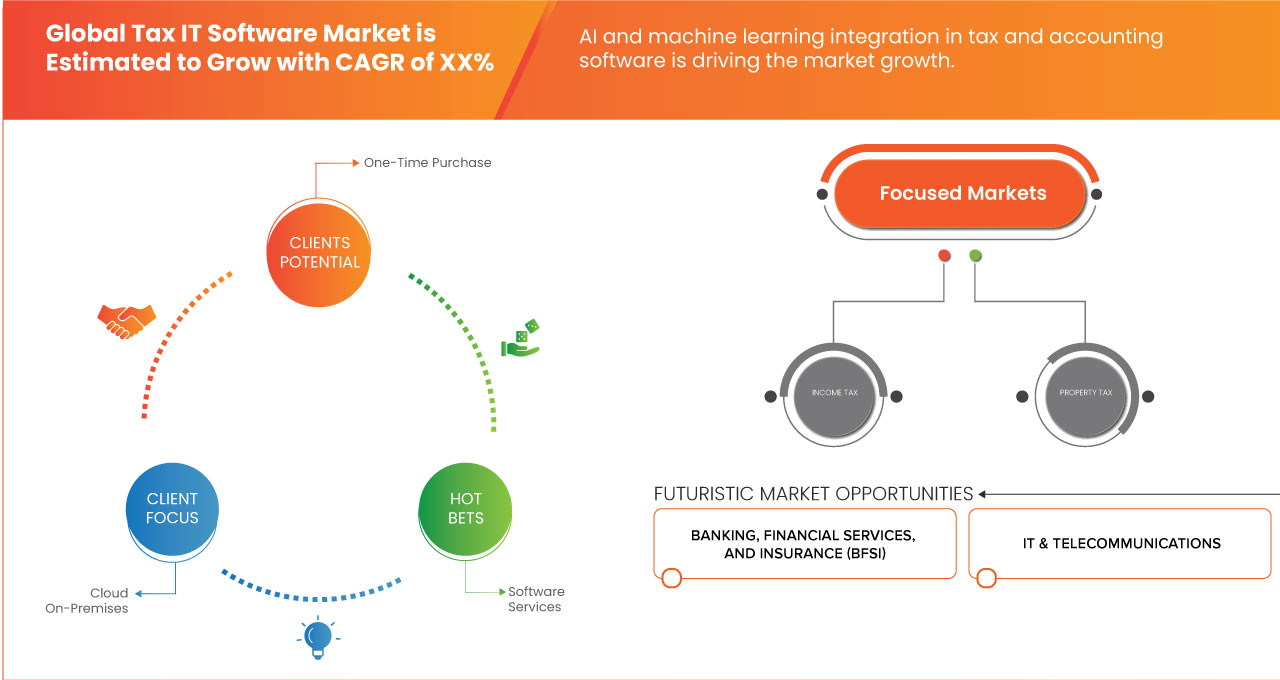

- Intégration de l'IA et de l'apprentissage automatique dans les logiciels de fiscalité et de comptabilité

L’intégration de l’IA et de l’apprentissage automatique (ML) dans les logiciels fiscaux et comptables transforme le marché des logiciels informatiques fiscaux en automatisant les processus complexes et en améliorant les capacités de prise de décision. Les outils basés sur l’IA simplifient des tâches telles que l’extraction de données, le calcul des impôts et le suivi de la conformité, réduisant ainsi le recours à l’intervention manuelle. Les algorithmes ML améliorent la précision des contrôles fiscaux et la détection des fraudes en analysant de grands ensembles de données et en identifiant les anomalies en temps réel. Ces avancées aident les entreprises à garantir leur conformité aux réglementations fiscales en constante évolution tout en rationalisant leurs opérations et en gagnant du temps.

L’adoption de l’IA et du ML dans les logiciels fiscaux est particulièrement avantageuse pour répondre aux complexités réglementaires auxquelles sont confrontées les entreprises de toutes tailles. Les petites et moyennes entreprises (PME) bénéficient de fonctionnalités intelligentes telles que l’analyse prédictive et la planification fiscale adaptative, leur permettant de prendre des décisions éclairées et d’optimiser leurs stratégies financières. Cette évolution vers des solutions fiscales plus intelligentes, basées sur l’IA, stimule la croissance du marché, car les entreprises accordent de plus en plus d’importance à l’efficacité, à la précision et à l’évolutivité de leurs processus de gestion fiscale.

Par exemple,

En mai 2024, selon un article publié par Arizent, Wolters Kluwer a lancé une plateforme de gestion des performances d'entreprise basée sur l'IA, CCH Tagetik. La plateforme comprend des fonctionnalités telles que Ask AI, AI Automapping, AI Anomaly Detection et AI Driver-Based Analysis pour améliorer le reporting, la gouvernance des données et l'analyse financière. Cela marque un changement significatif vers l'IA et l'apprentissage automatique dans les logiciels fiscaux et comptables, améliorant l'automatisation, l'intégrité des données et l'efficacité analytique, ce qui correspond à la demande croissante de solutions basées sur l'IA dans le secteur des logiciels informatiques fiscaux.

Opportunités

- Expansion des services cloud pour les entreprises

Alors que les entreprises continuent d’adopter la transformation numérique, la demande de solutions évolutives, flexibles et rentables a stimulé la croissance des plateformes basées sur le cloud. Les services cloud permettent aux professionnels de la fiscalité et aux entreprises d’accéder à des outils et logiciels avancés sans avoir à investir massivement dans une infrastructure. Cette flexibilité permet aux entreprises de s’adapter rapidement à l’évolution des exigences réglementaires, de rationaliser leurs opérations et d’améliorer leur efficacité globale. En outre, les plateformes cloud offrent un accès aux données en temps réel, une collaboration et une intégration transparente avec d’autres systèmes d’entreprise, ce qui les rend de plus en plus attrayantes pour les entreprises qui cherchent à améliorer leurs fonctions fiscales et comptables.

L’essor des solutions informatiques fiscales basées sur le cloud répond également à des préoccupations essentielles telles que la sécurité des données, la conformité et l’évolutivité. Les fournisseurs de services cloud investissent massivement dans des mesures de sécurité robustes, garantissant la protection des données fiscales sensibles tout en se conformant aux réglementations locales et internationales en matière de confidentialité des données. Cela fait des services cloud une option viable pour les entreprises qui cherchent à atténuer les risques et à se concentrer sur leurs activités principales. À mesure que de plus en plus d’entreprises passent au cloud, le marché des logiciels informatiques fiscaux devrait connaître une adoption accrue, les fournisseurs continuant d’innover et de proposer des solutions spécialisées adaptées aux besoins évolutifs du secteur.

Par exemple,

En octobre 2020, selon un article publié par l’Economic Times, le cloud computing et le Everything-as-a-Service (XaaS) remodèlent le paysage fiscal, introduisant des complexités pour les entreprises en termes de fiscalité et de conformité aux réglementations en constante évolution. Cette évolution ouvre des opportunités d’expansion des services cloud pour les entreprises sur le marché des logiciels informatiques fiscaux, car les entreprises ont besoin de solutions logicielles fiscales avancées pour gérer les défis uniques des services basés sur le cloud et garantir la conformité aux lois fiscales mondiales.

- Initiatives gouvernementales croissantes pour promouvoir l'adoption de logiciels de conformité numérique dans les entreprises

Partout dans le monde, les gouvernements encouragent de plus en plus l’utilisation de logiciels de conformité numérique, avec des politiques encourageant les entreprises à adopter des outils numériques pour la déclaration et la conformité fiscales. Ces initiatives comprennent souvent des incitations, des subventions ou des obligations pour que les entreprises passent des processus manuels aux plateformes numériques. La poussée vers la transformation numérique est particulièrement forte dans les secteurs aux exigences réglementaires complexes, où les entreprises doivent gérer les impôts dans plusieurs juridictions.

Ce soutien gouvernemental croissant représente une opportunité importante pour le marché des logiciels informatiques fiscaux, car les entreprises recherchent des solutions logicielles pour se conformer aux nouvelles réglementations et normes. Alors que les gouvernements mettent en œuvre des règles de conformité et de déclaration fiscales plus strictes, les entreprises adoptent de plus en plus d'outils numériques pour garantir des processus fiscaux précis, rapides et efficaces. Cette évolution vers des logiciels de conformité numérique devrait stimuler la demande de solutions innovantes, ce qui profitera aux fournisseurs de logiciels et augmentera le potentiel global du marché.

Par exemple,

Selon un article publié par PKF Smith Cooper, l'initiative britannique Making Tax Digital (MTD) exige que les entreprises, les travailleurs indépendants et les propriétaires conservent des registres numériques et utilisent des logiciels tiers pour les déclarations fiscales. Le MTD pour les auto-évaluations de l'impôt sur le revenu (ITSA) sera mis en place progressivement d'ici 2026, avec des seuils de revenu pour la conformité. Cette initiative crée une opportunité pour les fournisseurs de logiciels informatiques fiscaux, car les entreprises auront besoin de solutions numériques pour répondre à l'évolution des réglementations fiscales.

Contraintes/Défis

- Coûts élevés et restrictions d'investissement initial pour l'utilisation de logiciels avancés de fiscalité et de comptabilité

Bien que les logiciels de comptabilité et de fiscalité modernes présentent de nombreux avantages, les coûts élevés d’obtention, de déploiement et de maintenance de ces systèmes peuvent constituer un obstacle de taille, en particulier pour les petites et moyennes entreprises (PME). Alors que les organisations cherchent à rationaliser leurs opérations financières et à rester compétitives, l’investissement initial nécessaire pour de tels logiciels peut en dissuader plus d’un, en particulier lorsque des frais de personnalisation et d’intégration supplémentaires sont inclus.

For SMEs, the large initial expenditure necessary to acquire and deploy complex tax and accounting software is frequently a substantial barrier. These systems, which are built to perform complicated financial activities, are often quite expensive. Furthermore, modification to fit individual company demands, as well as connection with current enterprise resource planning (ERP) or customer relationship management (CRM) systems, might increase expenses. For many smaller organizations, these costs might be prohibitively expensive, restricting their capacity to implement complex solutions and impeding their development potential. This difficulty is especially acute for businesses with limited resources, which may choose less expensive, off-the-shelf solutions over extensive, custom-built systems.

For instance,

In May 2024, according to an article published by Attract Group, ERP software development costs, ranging from USD 25,000 to USD 350,000, play a crucial role in modern business efficiency by streamlining operations. These costs are shaped by factors such as complexity, customization, deployment models, and integration requirements. In contrast, ERP systems provide long-term operational advantages, but their high development and implementation expenses present challenges, particularly for small and medium-sized enterprises (SMEs). The significant initial investments, along with ongoing costs for customization, integration, maintenance, upgrades, and licensing, create financial hurdles. These barriers are a notable restraint for the adoption of advanced tax and accounting software, especially among budget-sensitive businesses.

- Cybersecurity and Data Privacy Concerns Hinder Adoption of Tax and Accounting Software

As firms digitize their financial operations, cybersecurity concerns have become a major impediment to the use of modern tax and accounting software. Businesses face increased risks of data breaches, cyberattacks, and privacy violations as they rely more heavily on digital platforms to manage sensitive financial data. These issues frequently prevent businesses from completely adopting digital financial management systems.

In addition, the rising digitalization of financial data, although providing speed and convenience, raises severe issues about data privacy and security. Businesses must safeguard sensitive financial information, such as tax records, employee payroll data, and other secret information, against potential cyber-attacks. Data breaches and cyberattacks may result in significant financial losses, reputational harm, and legal ramifications for companies that fail to comply with data security requirements. As a result, businesses may be hesitant to use tax and accounting software that does not fulfill high security standards, limiting the widespread adoption of digital financial solutions. Furthermore, the absence of proper security measures, such as encryption and safe authentication procedures, might erode trust in the software.

For instance,

- In March 2024, according to an article published by the Association of International Certified Professional Accountants, the growing challenges faced by CPAs and businesses in protecting client data are exacerbated by increasing cybersecurity threats, regulatory changes, and evolving privacy standards. These concerns, including the complexity of maintaining compliance with global data privacy laws and the risks of cyberattacks, highlight the restraint "Cybersecurity and data privacy concerns hinder adoption of tax and accounting software" in the Tax IT Software Market, as firms hesitate to adopt new technologies due to fears of data breaches, compliance costs, and maintaining trust

Global Tax IT Software Market Scope

The tax IT software market is segmented six notable segments on the basis of offering, tax type, deployment mode, organization size, revenue model, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Software

- Services

- Type

- Training and Consulting

- Support

Tax Type

- Income Tax

- Corporate Tax

- Property Tax

- Others

Deployment Mode

- Cloud

- On-Premises

Organization Size

- Large Enterprises

- Small-and Medium-Sized Enterprises

Revenue Model

- Subscription Based

- One-Time Purchase

Industry

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Manufacturing

- Retail and Consumer Goods

- Healthcare

- Media and Entertainment

- Energy and Utilities

- Others

Global Tax IT Software Market Regional Analysis

The tax IT software market is segmented six notable segments on the basis of country, offering, tax type, deployment mode, organization size, revenue model, and industry.

The countries covered in the tax IT software market report as U.S., Canada, and Mexico, U.K., Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Belgium, Turkey, Luxembourg, and rest of Europe, China, Japan, India, South Korea, Australia & New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan, Vietnam, and rest of Asia-Pacific, Brazil, Argentina, and rest of South America and U.A.E, Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East and Africa.

North America dominates the global tax IT software market due to its advanced technological infrastructure, higher adoption rates of automation, and stringent tax regulations across industries. Additionally, the region is home to major players in the software market, ensuring rapid innovation and deployment of solutions tailored to diverse tax needs .

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Tax It Software Market Share

Tax IT software market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global tax IT software market .

Global Tax IT Software Market Leaders Operating in the Market are:

- Microsoft (U.S.)

- ADP, Inc. (U.S.)

- Yayoi Co., Ltd. (Japan)

- Wolters Kluwer N.V (Netherland)

- Stripe (U.S.)

- SAP (U.S.)

- Thomson Reuters (U.S.)

- Oracle (U.S.)

- NTT data (Japan)

- QUICKBOOKS (INTUIT INC.) (U.S.)

- SAGE GROUP PLC (U.K.)

- Vertex (U.S.)

- TKC Corporation (Japan)

- SOVOS Compliance, LLC (U.S.)

- Avalara (U.S.)

- Money Forward, Inc.(Japan)

- freee K.K (Japan)

- TaxDiva (India)

- Esker (France)

- PCA Corporation (Japan)

- Epicor Software Corporation (U.S.)

Latest Developments in Global Tax IT Software Market

- In September 2024, Wolters Kluwer has partnered with OneTeam Services Group to enhance CCH Integrator. The collaboration will expand tax compliance, data management, and collaborative workflows, improving efficiency for tax firms and corporations across multiple tax domains

- In October, ADP has acquired Workforce Software, a leading provider of workforce management solutions for global enterprises. This acquisition expands ADP's offerings, enhancing global workforce management capabilities and driving future innovation to meet evolving business needs.

- In June, Stripe appears to be signaling preparations for an IPO, despite non-committal statements from its co-founders. Actions such as publishing financial performance reports and conducting tender offers have fueled speculation. These developments drive Stripe to enhance transparency and financial reporting, bolstering trust in its Tax and Accounting Software solutions and aligning with its mission to help businesses streamline compliance, potentially attracting a broader user base.

- En juin, Avalara a renforcé sa présence en Inde pour soutenir les ambitions d'exportation du pays en fournissant des solutions de conformité fiscale basées sur le cloud qui simplifient les processus fiscaux transfrontaliers. Cette initiative renforce la position d'Avalara sur le marché des logiciels fiscaux et comptables en élargissant sa présence dans une région en pleine croissance, en s'adressant à des secteurs divers et en démontrant sa compétence dans l'automatisation de la conformité fiscale indirecte à l'échelle mondiale.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

4.2 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2.1 INDUSTRY ANALYSIS

4.2.2 FUTURISTIC SCENARIO

4.2.3 COMPETITIVE LANDSCAPE

4.3 PENETRATION AND GROWTH PROSPECT MAPPING

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES

5.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

5.1.3 GROWING NEED FOR STREAMLINING ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

5.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

5.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

5.3.2 RISING GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

5.4 CHALLENGES

5.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

5.4.2 CHALLENGES IN INTEGRATING LEGACY SYSTEMS FOR BUSINESSES GLOBALLY

6 GLOBAL TAX IT SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.3 SERVICES

6.3.1 SERVICE, BY TYPE

6.4 TRAINING AND CONSULTING

6.5 SUPPORT

7 GLOBAL TAX IT SOFTWARE MARKET, BY TAX TYPE

7.1 OVERVIEW

7.2 INCOME TAX

7.3 CORPORATE TAX

7.4 PROPERTY TAX

7.5 OTHERS

8 GLOBAL TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISES

9 GLOBAL TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10 GLOBAL TAX IT SOFTWARE MARKET, BY REVENUE MODEL

10.1 OVERVIEW

10.2 SUBSCRIPTION-BASED

10.3 ONE-TIME PURCHASE

11 GLOBAL TAX IT SOFTWARE MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.3 IT AND TELECOMMUNICATIONS

11.4 MANUFACTURING

11.5 RETAIL AND CONSUMER GOODS

11.6 HEALTHCARE

11.7 MEDIA AND ENTERTAINMENT

11.8 ENERGY AND UTILITIES

11.9 OTHERS

12 GLOBAL TAX IT SOFTWARE MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 INDIA

12.3.4 SOUTH KOREA

12.3.5 AUSTRALIA

12.3.6 INDONESIA

12.3.7 THAILAND

12.3.8 MALAYSIA

12.3.9 SINGAPORE

12.3.10 PHILIPPINES

12.3.11 REST OF ASIA-PACIFIC

12.4 EUROPE

12.4.1 U.K

12.4.2 FRANCE

12.4.3 NETHERLANDS

12.4.4 GERMANY

12.4.5 SPAIN

12.4.6 BELGIUM

12.4.7 ITALY

12.4.8 RUSSIA

12.4.9 TURKEY

12.4.10 SWITZERLAND

12.4.11 REST OF EUROPE

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SAUDI ARABIA

12.6.2 U.A.E

12.6.3 SOUTH AFRICA

12.6.4 EGYPT

12.6.5 ISRAEL

12.6.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL TAX IT SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ADP,INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 YAYOI CO., LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WOLTERS KLUWER N.V.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 STRIPE, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 SERVICE PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AVALARA, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 EPICOR SOFTWARE CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ESKER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SOLUTION PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 FREEE KK

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 INTUIT INC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MONEY FORWARD, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 NTT DATA GROUP CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SERVICE PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 ORACLE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PCA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 SAGE GROUP PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SAP SE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SOVOS COMPLIANCE, LLC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TAXDIVA

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THOMSON REUTERS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 SERVICE PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TKC CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 VERTEX, INC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SERVICE PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATIONS AND STANDARDS FOR GLOBAL TAX IT SOFTWARE MARKET

TABLE 2 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 3 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

TABLE 4 TECHNOLOGY MATRIX

TABLE 5 COMPARATIVE ANALYSIS

TABLE 6 THE OVERALL ERP IMPLEMENTATION PRICING

TABLE 7 GLOBAL TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL SOFTWARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL SERVICES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL INCOME TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL CORPORATE TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL PROPERTY TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL CLOUD IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL ON-PREMISE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL LARGE ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL SMALL AND MEDIUM-SIZED ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL SUBSCRIPTION BASED IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL ONE-TIME PURCHASE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI), BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL IT AND TELECOMMUNICATIONS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL MANUFACTURING IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL RETAIL AND CONSUMER GOODS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL HEALTHCARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL MEDIA AND ENTERTAINMENT IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL ENERGY AND UTILITIES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 51 CANADA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 57 MEXICO TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MEXICO TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 72 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 73 JAPAN SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 76 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 77 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 78 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 INDIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 INDIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 90 INDIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 91 INDIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 92 INDIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH KOREA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH KOREA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH KOREA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH KOREA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH KOREA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH KOREA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH KOREA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 100 AUSTRALIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 101 AUSTRALIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 AUSTRALIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 AUSTRALIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 104 AUSTRALIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 105 AUSTRALIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 106 AUSTRALIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 107 INDONESIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 108 INDONESIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 INDONESIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 INDONESIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 111 INDONESIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 112 INDONESIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 113 INDONESIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 114 THAILAND TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 115 THAILAND SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 THAILAND TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 THAILAND TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 118 THAILAND TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 119 THAILAND TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 120 THAILAND TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 121 MALAYSIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 122 MALAYSIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MALAYSIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MALAYSIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 125 MALAYSIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 126 MALAYSIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 127 MALAYSIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 128 SINGAPORE TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 129 SINGAPORE SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SINGAPORE TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SINGAPORE TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 132 SINGAPORE TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 133 SINGAPORE TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 134 SINGAPORE TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 135 PHILIPPINES TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 136 PHILIPPINES SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 PHILIPPINES TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 PHILIPPINES TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 139 PHILIPPINES TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 140 PHILIPPINES TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 141 PHILIPPINES TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 142 REST OF ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 143 EUROPE TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 144 EUROPE TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 145 EUROPE SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 EUROPE TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 EUROPE TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 148 EUROPE TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 149 EUROPE TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 150 EUROPE TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 152 U.K. SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.K. TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 156 U.K. TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 157 U.K. TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 158 FRANCE TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 159 FRANCE SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 FRANCE TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 FRANCE TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 162 FRANCE TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 163 FRANCE TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 164 FRANCE TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 165 NETHERLANDS TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 166 NETHERLANDS SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 NETHERLANDS TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 NETHERLANDS TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 169 NETHERLANDS TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 170 NETHERLANDS TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 171 NETHERLANDS TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 172 GERMANY TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 173 GERMANY SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 GERMANY TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 GERMANY TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 176 GERMANY TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 GERMANY TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 178 GERMANY TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 179 SPAIN TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 180 SPAIN SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SPAIN TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SPAIN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 183 SPAIN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 184 SPAIN TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 185 SPAIN TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 186 BELGIUM TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 187 BELGIUM SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 BELGIUM TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 BELGIUM TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 190 BELGIUM TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 191 BELGIUM TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 192 BELGIUM TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 193 ITALY TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 194 ITALY SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 ITALY TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 ITALY TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 197 ITALY TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 198 ITALY TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 199 ITALY TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 200 RUSSIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 201 RUSSIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 RUSSIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 RUSSIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 204 RUSSIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 205 RUSSIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 206 RUSSIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 207 TURKEY TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 208 TURKEY SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 TURKEY TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 TURKEY TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 211 TURKEY TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 212 TURKEY TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 213 TURKEY TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 214 SWITZERLAND TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 215 SWITZERLAND SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SWITZERLAND TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SWITZERLAND TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 218 SWITZERLAND TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 219 SWITZERLAND TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 220 SWITZERLAND TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 221 REST OF EUROPE TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 222 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 223 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 224 SOUTH AMERICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 227 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 228 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 229 SOUTH AMERICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 230 BRAZIL TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 231 BRAZIL SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 BRAZIL TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 BRAZIL TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 234 BRAZIL TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 235 BRAZIL TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 236 BRAZIL TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 237 ARGENTINA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 238 ARGENTINA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 ARGENTINA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 ARGENTINA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 241 ARGENTINA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 242 ARGENTINA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 243 ARGENTINA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 244 REST OF SOUTH AMERICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 245 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 246 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 247 MIDDLE EAST AND AFRICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 250 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 251 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 252 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 253 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 254 SAUDI ARABIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 257 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 258 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 259 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 260 U.A.E. TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 261 U.A.E. SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 U.A.E. TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 U.A.E. TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 264 U.A.E. TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 265 U.A.E. TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 266 U.A.E. TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 267 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 268 SOUTH AFRICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 271 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 272 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 273 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 275 EGYPT SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 EGYPT TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 278 EGYPT TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 279 EGYPT TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 280 EGYPT TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 281 ISRAEL TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 282 ISRAEL SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 ISRAEL TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 ISRAEL TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 285 ISRAEL TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 286 ISRAEL TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 287 ISRAEL TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 288 REST OF MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 GLOBAL TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL TAX IT SOFTWARE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 GLOBAL TAX IT SOFTWARE MARKET: OFFERING TIMELINE CURVE

FIGURE 10 GLOBAL TAX IT SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 12 GLOBAL TAX IT SOFTWARE MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE GLOBAL TAX IT SOFTWARE MARKET:

FIGURE 14 GLOBAL TAX IT SOFTWARE MARKET: STRATEGIC DECISIONS

FIGURE 15 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES IS EXPECTED TO DRIVE THE GLOBAL TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 17 NORTH AMERICA IS EXPECTED TO DOMINATE AND FASTEST GROWING REGION IN THE GLOBAL TAX IT SOFTWARE MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 18 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR TAX IT SOFTWARE MANUFACTURERS IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL TAX IT SOFTWARE MARKET

FIGURE 20 GLOBAL TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 21 GLOBAL TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 22 GLOBAL TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 23 GLOBAL TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 24 GLOBAL TAX IT SOFTWARE MARKET: BY REVENUE MODEL, 2024

FIGURE 25 GLOBAL TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 26 GLOBAL TAX IT SOFTWARE MARKET: SNAPSHOT (2024)

FIGURE 27 GLOBAL TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

FIGURE 28 NORTH AMERICA TAX IT SOFTWARE MARKET: COMPANY SHARE 2024(%)

FIGURE 29 EUROPE TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

FIGURE 30 ASIA-PACIFIC TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.