Global Track And Trace Solutions Market

Taille du marché en milliards USD

TCAC :

%

USD

5.88 Billion

USD

24.46 Billion

2024

2032

USD

5.88 Billion

USD

24.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.88 Billion | |

| USD 24.46 Billion | |

|

|

|

|

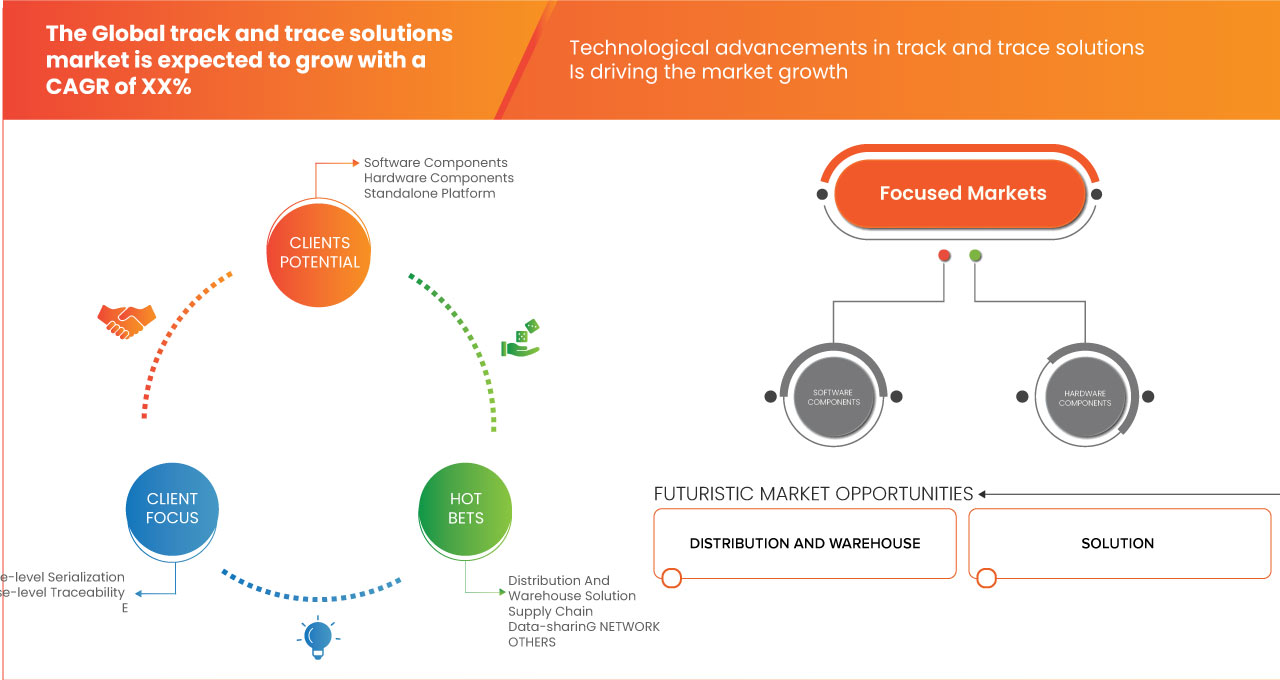

Global Track And Trace Solutions Market, By Product (Software Components, Hardware Components, and Standalone Platform), Solution (Line and Site-Level Serialization, Cloud Enterprise-Level Traceability, Distribution and Warehouse Solution, Supply Chain Data-Sharing Network, and Others), Application (Serialization, Printing, Labeling and Packaging Inspection, Aggregation, Tracking, Tracing, and Reporting), Technology (2D Barcodes, Radiofrequency Identification (RFID), and Linear/1D Barcodes), End User (Pharmaceutical and Biopharmaceutical Companies, Consumer Packaged Goods, Luxury Goods, Food and Beverage, Medical Device Companies, Contract Manufacturing Organizations, Repackagers, Cosmetics Companies, and Others), Distribution Channel (Direct Sales and Third Party Distributors) - Industry Trends and Forecast to 2032

Global Track and Trace Solutions Market Analysis

Tracking and tracing medications to enhance the accessibility of products in the prescription supply chain is not a novel phenomenon. In reality, the concept of serialization has been debated for more than 15 years. In 1999, after a study by the U.S. College of Medicine, President Bill Clinton put patient protection (including avoiding mistakes at the point of dispensing medicines) on the agenda of the federal government and proceeded to advocate for reform after his presidency. In 2003, the U.S. Food and Drug Administration (FDA) required barcoding at unit levels, and in the same year, the World Health Organization (WHO) released a study highlighting the scope of the counterfeit medication problem, claiming that 10% of medicines worldwide were counterfeit. A major shift in serialization took place around 2005 and the variety of countries started to set targets for adoption. However, after making several measures in protecting the supply chain, the challenge was less of a concern after the 2008 financial crisis.

As the world economy has changed, the focus has gradually moved. Turkey adopted serialization standards in 2010 and rules are in effect for other markets such as China, South Korea and India. With the EU Falsified Medicines Directive (FMD) coming into force in February 2019 and the U.S. adopting legislation as part of the Drug Supply Chain Security Act (DSCSA) in November 2017, more than 75% of global medicines are required to be protected by some form of monitor and trace regulations by 2019. The track and trace solutions market is of keen importance in various industries starting from pharmaceutical to medical devices and food and beverages among more.

The progress in demand of track and trace solutions in healthcare facilities is due to stringent laws formulated for serialization and labeling which leads to the lucrative growth of track and trace solutions in the market. The vast product portfolio with enormous options for almost all major industries such as food and beverage, cosmetic and medical devices among more further impels the growth of track and trace solutions in the global track and trace solutions market.

Global Track and Trace Solutions Market Size

Global track and trace solutions market size was valued at USD 5.88 Billion in 2024 and is projected to reach USD 24.46 Billion by 2032, with a CAGR of 19.5% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Global Track and Trace Solutions Market Trends

“Increased Demand For Supply Chain Transparency”

The demand for track and trace solutions is particularly strong due to the need for ensuring patient safety, product integrity, and regulatory compliance. Track and trace technologies help monitor the movement of pharmaceutical products, medical devices, and vaccines throughout the supply chain, minimizing the risk of counterfeit drugs and ensuring that products are stored and transported under proper conditions. Additionally, with the rising need for personalized medicine and greater healthcare accountability, these solutions enable healthcare providers to track products from production to end-use, ensuring they reach the right patients safely and efficiently. Regulatory bodies, such as the FDA, require stringent traceability measures, making track and trace systems an essential part of healthcare operations.

Report Scope and Global Track and Trace Solutions Market Segmentation

|

Attributes |

Global Track and Trace Solutions Market Market Insights |

|

Segments Covered |

|

|

Region Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Denmark, Poland, Sweden, Norway, Finland, Rest of Europe, China, Japan, India, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, New Zealand, Vietnam, Taiwan, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Qatar, Egypt, Kuwait, Bahrain, Oman, Rest of Middle East and Africa |

|

Key Market Players |

SAP SE(Germany), Zebra Technologies Corp.(U.S.), Videojet Technologies, Inc.(U.S.), METTLER TOLEDO(U.S.), Tracelink Inc.(U.S.), Siemens, Domino Printing Sciences plc(U.K.), Laetus GmbH(Germany), Xyntek Incorporated(U.S.), IBM Corporation(U.S.), WIPOTEC-OCS GmbH(Germany), 3Keys(Germany), ACG(India), NJM Packaging Inc.(U.S.), OPTEL GROUP(Canada), Systech(U.S.), Robert Bosch Manufacturing Solutions GmbH(Germany), ANTARES VISION S.p.A.(Italy), Uhlmann(Germany), SEA VISION S.r.l.(Italy), Jekson Vision(India), Kevision Systems(india), Arvato Systems, Grant-Soft Ltd.(Turkey), PharmaSecure Inc.(U.S.), Axyway(France) and SL Controls Ltd.(U.S.) |

|

Market Opportunities |

Expansion in Global Trade |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Track and Trace Solutions Market Definition

The method of identifying the present and historical position (and other information) of a particular object or property involves the storage and transportation of several kinds of items, monitoring and tracking or tracing. This definition can be followed by the estimation and recording of the location of cars and containers, for instance, recorded in a real-time database. This method leaves the challenge of drawing up a cohesive description of the corresponding progress notes. Track and trace stands for linking machines to IT and data sharing at all rates. This includes strong hardware suite device modules or stand-alone systems. The major goal of track and trace solutions is to decline the chain of counterfeit drugs and fake products across globe and to provide smooth flow and traceability of the goods at each and every point.

Global Track and Trace Solutions Market Dynamics

Drivers

- Stringent Regulations and Standards for the Implementation 0f Serialization

The arrival of mandatory serialization has completely transformed the pharmaceutical market. With both the United States Drug Supply Chain Security Act (DSCSA) and European Union Falsified Medicines Directive (FMD) now “live”, the supply chain of pharmaceuticals is forever linked to serialized products and data. Looking deeper, a successful serialization program involves far more than just placing serial numbers on packaging. Regulations vary from market to market and can often change, which means that the regulatory professionals need to be prepared to adjust procedures, processes, and filings to keep up. Since the law on the labeling and serialization of medicines is fairly recent, it is subject to greater global complexity and varies more often than other regulations. Moreover, as the supply chain for genuine pharmaceuticals has grown longer, this creates an opportunity for counterfeiters at every step in the supply chain. Hence, stringent regulations and standardization are made in order to protect the goods.

- In July 2024, according to the article published by Food and Drug Administration, the Drug Supply Chain Security Act (DSCSA) mandates the electronic identification and tracing of prescription drugs at the package level to prevent harmful drugs from entering the U.S. supply chain. This stringent regulation drives the need for advanced track and trace solutions to ensure compliance, protect patients, and enable quick responses to threats, thereby acting as a key driver for the global market

- In February 2022, according to the article published by USAID Global Health Supply Chain Program, China's State Food and Drug Administration has mandated serialization for 502 pharmaceutical drugs on the essential drug list, ensuring traceability and authenticity. This stringent regulation boosts the demand for track and trace solutions to comply with serialization requirements. As a result, it acts as a key driver for the global market, pushing for wider adoption of advanced tracking technologies

The issue of medicines and medication adulteration has been a global concern for decades. Fuelled by unsecured physical and cyber global supply chains, internet sales, and minimal penalties, the government believes and various pharmaceutical companies worldwide that the implementation of serialization could decrease and stop the issues related to counterfeiting. This makes the stringent regulations and standards for the implementation of serialization to act as a driver for the global track and trace solutions market.

- Rising Counterfeit Concerns

Rising concerns about counterfeit products have become a significant issue, particularly in the pharmaceutical and healthcare sectors, where the presence of fake drugs can have severe consequences on patient health and safety. Counterfeit medications not only compromise the integrity of the healthcare system but also increase risks of adverse effects, drug resistance, and treatment failures. In response to this growing threat, regulators and industry stakeholders are pushing for more stringent traceability and serialization measures. These measures help ensure the authenticity of products by enabling manufacturers, distributors, and retailers to track the movement of goods through the entire supply chain. Technologies such as RFID, barcoding, and blockchain are increasingly being deployed to combat counterfeiting, allowing products to be monitored and verified at each stage of the supply chain, from manufacturing to the end consumer. With the expansion of global trade and more complex supply chains, the risk of counterfeit products entering markets has become more pronounced, further driving the need for enhanced traceability systems. This heightened awareness of counterfeit risks acts as a key driver for the global track and trace solutions market, as businesses and governments seek robust systems to authenticate products, maintain regulatory compliance, and protect consumers from potentially harmful counterfeit goods.

For instance,

- In May 2024, according to the article published by Food and Drug Administration, Counterfeit medicines, which may contain incorrect, insufficient, or harmful ingredients, pose serious health risks while being falsely marketed as authentic. This growing concern over the safety and efficacy of pharmaceuticals is driving the adoption of track and trace solutions to ensure product authenticity. As a result, the rising concerns over counterfeit products act as a significant driver for the global track and trace solutions market

- In October 2024, according to the article published by Science Direct, Falsified and counterfeit medicines, particularly in international travel, pose a serious public health risk. With the rise in reported cases globally, concerns about the spread of counterfeit drugs have grown significantly. This has led to a greater need for traceability systems to ensure product authenticity. As a result, rising concerns over counterfeit medicines act as a key driver for the global track and trace solutions market

Concerns about counterfeit products, especially in the pharmaceutical and healthcare industries, have become a major issue due to the potential harm fake drugs can cause to patients. Counterfeit medications can lead to ineffective treatments and health risks, prompting increased demand for traceability solutions. By using technologies such as RFID, barcodes, and blockchain, companies can track products throughout the supply chain to ensure authenticity. As global supply chains grow more complex, the risk of counterfeit goods entering the market increases, driving the need for stronger tracking systems. This demand for secure and reliable traceability solutions acts as a major driver for the global track and trace solution market

Opportunities

- Growth In The E-Commerce Sector

The rapid growth of the E-commerce sector presents a substantial opportunity for the global track and trace solutions market due to the increasing complexity and scale of online retail operations. As more consumers shift to online shopping, businesses are required to ensure that their logistics and supply chain processes are efficient and transparent. Track and trace solutions facilitate real-time monitoring of inventory levels, shipment status, and delivery processes, enabling companies to provide accurate information to customers regarding their orders. This heightened level of transparency boosts customer confidence and enhances the overall shopping experience, making E-commerce companies more competitive in a crowded marketplace.

For instance,

- In July 2024, according to an article, ‘Impact of E-commerce on Logistics: Adapting to Demand’, published in the marketplace digest, implementing advanced tracking and visibility solutions enhances tracking and visibility solutions are critical for meeting e-commerce demands. Real-time tracking technology enables carriers to provide accurate delivery estimates and updates, improving transparency and customer trust

- En avril 2023, selon un article intitulé « Identification des avantages, des défis et des voies dans les industries du commerce électronique », publié dans ScienceDirect : Un modèle intégré de prise de décision en deux phases, le secteur du commerce électronique a connu une croissance significative au cours de la dernière décennie, car il se concentre sur la commodité et l'accessibilité, ce qui a entraîné une augmentation des achats en ligne avec un plus grand nombre de consommateurs qui l'optent

De plus, avec l’essor du commerce électronique, les risques de vol, de fraude et de contrefaçon augmentent, ce qui nécessite des systèmes de suivi et de traçabilité robustes capables d’atténuer ces défis. La mise en œuvre de technologies avancées telles que la RFID, la blockchain et les systèmes de suivi automatisés permet aux entreprises de commerce électronique de maintenir l’intégrité de leurs produits de l’entrepôt à la livraison. Ces solutions permettent en outre aux entreprises de se conformer aux exigences réglementaires et aux normes du secteur liées à la responsabilité et à la sécurité des produits. À mesure que le commerce électronique continue de se développer, la demande de solutions de suivi et de traçabilité fiables va augmenter, créant des opportunités de marché importantes pour les fournisseurs de ces technologies.

- Expansion du commerce mondial

L’expansion du commerce mondial crée une opportunité considérable pour le marché mondial des solutions de suivi et de traçabilité, stimulée par la complexité croissante des chaînes d’approvisionnement qui traversent les frontières internationales. Les entreprises s’appuyant de plus en plus sur des réseaux mondiaux pour s’approvisionner en matériaux et distribuer leurs produits, le besoin de systèmes de suivi efficaces devient primordial. Les solutions de suivi et de traçabilité permettent aux entreprises de surveiller les expéditions en temps réel, garantissant ainsi la transparence et l’efficacité tout au long du processus logistique. Cette capacité améliore l’efficacité opérationnelle et aide les organisations à se conformer aux réglementations et normes internationales, ce qui renforce la confiance entre les partenaires et les clients. À mesure que le commerce mondial continue de se développer, la demande de technologies de suivi sophistiquées capables de gérer diverses exigences réglementaires et d’offrir une visibilité sur plusieurs juridictions est susceptible d’augmenter.

Par exemple,

- En mai 2024, selon un article publié dans le Forum économique mondial, on s’attend à ce que le commerce mondial de biens et de services augmente de 2,3 % cette année et de 3,3 % en 2025, soit plus du double de la croissance de 1 % observée en 2023.

De plus, l’essor du commerce électronique et de la vente au détail en ligne a encore accéléré la demande de solutions de suivi et de traçabilité, car les consommateurs s’attendent à des livraisons rapides et à une transparence concernant leurs commandes. Avec de grandes quantités de marchandises transportées à travers le monde, les entreprises ont besoin de systèmes robustes pour suivre avec précision leurs stocks et leurs expéditions. Cette demande a stimulé l’innovation sur le marché du suivi et de la traçabilité, encourageant le développement de technologies avancées telles que la blockchain, l’IoT et l’intelligence artificielle. Ces innovations améliorent les capacités des solutions de suivi et de traçabilité et offrent la possibilité de se différencier sur un marché encombré. Alors que le commerce mondial continue de croître et d’évoluer, le marché des solutions de suivi et de traçabilité est prêt à capitaliser sur cette tendance, en fournissant des outils essentiels qui aident les entreprises à naviguer dans les complexités de la gestion moderne de la chaîne d’approvisionnement tout en répondant aux exigences des consommateurs en matière de transparence et de responsabilité.

Contraintes/Défis

- Risques associés à la contamination des échantillons

Les problèmes de sécurité et de confidentialité des données représentent un défi majeur pour le marché des solutions de suivi et de traçabilité en Asie-Pacifique, car ces systèmes impliquent souvent la collecte, le stockage et la transmission d'informations sensibles. Il peut s'agir de données personnelles, de détails sur les produits et d'informations sur la chaîne d'approvisionnement qui, s'ils ne sont pas correctement protégés, présentent des risques pour les consommateurs et les entreprises. Les failles de sécurité des données peuvent entraîner des pertes financières, des atteintes à la réputation et des conséquences juridiques, en particulier à la lumière de réglementations de plus en plus strictes telles que le RGPD en Asie-Pacifique et diverses lois sur la protection des données en Asie-Pacifique. Lorsque les organisations mettent en œuvre des technologies de suivi et de traçabilité, elles doivent garantir des mesures de sécurité robustes, ce qui peut augmenter les coûts et compliquer le processus de déploiement, ce qui peut dissuader les entreprises d'adopter ces solutions.

Par exemple,

- En août 2024, selon un article intitulé « Principaux défis liés à la mise en œuvre de solutions de suivi et de traçabilité dans la gestion de la chaîne logistique », publié par Shriram Veritech Solutions Pvt. Ltd., avec la mise en œuvre de solutions de suivi et de traçabilité, les entreprises traitent une grande quantité de données sensibles, notamment des informations exclusives, des informations sur les clients et un suivi de localisation en temps réel. Les systèmes de suivi et de traçabilité sont vulnérables aux cyberattaques.

De plus, la sensibilisation des consommateurs à la confidentialité des données est de plus en plus importante, ce qui conduit à une surveillance accrue des entreprises qui traitent des informations personnelles. Les entreprises sont sous pression pour démontrer leur conformité aux réglementations en matière de protection des données et pour établir une relation de confiance avec leurs clients. Si les entreprises ne peuvent pas garantir en toute confiance aux parties prenantes leur capacité à protéger les données, elles risquent de perdre des parts de marché et de faire face à la réaction négative des consommateurs. Ce climat d’inquiétude peut limiter la volonté des entreprises d’investir pleinement dans des solutions avancées de suivi et de traçabilité qui peuvent nécessiter une gestion et un traitement approfondis des données. Par conséquent, le marché pourrait connaître une croissance plus lente à mesure que les entreprises s’adaptent à ces complexités, cherchant à équilibrer les avantages des capacités de suivi améliorées avec l’impératif de préserver la confidentialité et la sécurité des données.

- Dommages aux étiquettes de suivi pendant la livraison

Les étiquettes de suivi endommagées pendant la livraison ont un impact considérable sur l’efficacité des solutions de suivi et de traçabilité sur le marché mondial. Lorsque des étiquettes de suivi, telles que des étiquettes RFID ou des codes-barres, sont endommagées pendant le transport, cela entraîne des inexactitudes dans les données, une perte de visibilité du produit et des retards dans le suivi. Cela compromet la fiabilité des opérations de la chaîne d’approvisionnement, en particulier dans les secteurs qui dépendent de la précision et de la conformité des mouvements des produits. Dans le secteur pharmaceutique, par exemple, les étiquettes endommagées perturbent les processus de traçabilité critiques, augmentant le risque de contrefaçon et de non-conformité réglementaire. De tels problèmes entraînent des inefficacités, des coûts opérationnels plus élevés et une baisse de la confiance des clients, ce qui constitue un frein important au marché mondial des solutions de suivi et de traçabilité.

Par exemple,

- En août 2024, selon l'article publié par encstorge.com, les étiquettes RFID sont vulnérables aux dommages pendant la livraison, causés par des facteurs tels que l'eau, la chaleur excessive, les produits chimiques ou la rupture physique de la puce ou des lignes d'antenne. Il est essentiel de comprendre ces risques pour optimiser les performances RFID dans différents environnements. De tels dommages perturbent les systèmes de suivi et de traçabilité, ce qui entraîne des inexactitudes et des inefficacités, qui constituent un frein important à la croissance du marché mondial

- En août 2023, selon l'article publié par Lexicon Tech Solutions, les codes-barres peuvent être endommagés pendant la livraison en raison de l'exposition à l'humidité, aux huiles ou aux surfaces rugueuses, ce qui entraîne des problèmes tels que des taches ou des déchirures. Ces dommages rendent le code-barres illisible, perturbant le processus de suivi. De tels problèmes d'intégrité des codes-barres peuvent entraîner des retards, des inexactitudes et des inefficacités dans les chaînes d'approvisionnement, ce qui constitue un frein important au marché mondial des solutions de suivi et de traçabilité.

Les étiquettes de suivi endommagées pendant la livraison nuisent à l'efficacité des systèmes de suivi et de traçabilité sur le marché mondial. Les étiquettes RFID ou les codes-barres endommagés entraînent des erreurs de suivi, une perte de visibilité et des retards, ce qui affecte la précision de la chaîne d'approvisionnement. Dans des secteurs tels que celui des produits pharmaceutiques, cela perturbe la conformité et la traçabilité, ce qui entraîne des inefficacités, des coûts plus élevés et une perte de confiance, ce qui freine la croissance du marché.

Portée du marché mondial des solutions de suivi et de traçabilité

Le marché est segmenté en fonction du produit, de la solution, de l'application, de la technologie, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Composants logiciels

- Directeur d'usine

- Contrôleur de ligne

- Gestionnaire d'entreprise et de réseau

- Suivi des lots

- Suivi des dossiers

- Responsable d'entrepôt et d'expédition

- Suivi des palettes

- Autres

- Composants matériels

- Impression et marquage

- Scanner de codes-barres

- Surveillance et vérification

- Étiqueteuse

- Trieuse pondérale

- Lecteur RFID

- Autres

- Plateforme autonome

Solution

- Sérialisation au niveau de la ligne et du site

- Traçabilité du cloud au niveau de l'entreprise

- Solution de distribution et d'entreposage

- Réseau de partage de données sur la chaîne d'approvisionnement

- Autres

Application

- Sérialisation

- Sérialisation des cartons

- Sérialisation des bouteilles

- Sérialisation des dispositifs médicaux

- Sérialisation des flacons et des ampoules

- Sérialisation des blisters

- Impression

- Inspection de l'étiquetage et de l'emballage

- Agrégation

- Agrégation de bundles

- Agrégation de cas

- Agrégation de palettes

- Suivi

- Tracé

- Rapports

Technologie

- Codes-barres 2D

- Identification par radiofréquence (RFID)

- Codes à barres linéaires/1D

Utilisateur final

- Sociétés pharmaceutiques et biopharmaceutiques

- Biens de consommation emballés

- Produits de luxe

- Alimentation et boissons

- Entreprises de dispositifs médicaux

- Entreprises de fabrication sous contrat

- Reconditionneurs

- Entreprises de cosmétiques

- Autres

Canal de distribution

- Vente directe

- Distributeurs tiers

Analyse régionale du marché mondial des solutions de suivi et de traçabilité

Le marché est analysé et des informations sur la taille et les tendances du marché sont fournies en fonction du pays, du produit, de la solution, de l'application, de la technologie, de l'utilisateur final et du canal de distribution comme référencé ci-dessus.

Les pays couverts sur le marché sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, la Suisse, la Russie, la Turquie, la Belgique, les Pays-Bas, le Danemark, la Pologne, la Suède, la Norvège, la Finlande, le reste de l'Europe, la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, Singapour, l'Indonésie, la Thaïlande, la Malaisie, les Philippines, la Nouvelle-Zélande, le Vietnam, Taïwan, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, le Qatar, l'Égypte, le Koweït, Bahreïn, Oman et le reste du Moyen-Orient et de l'Afrique.

L’Amérique du Nord devrait dominer le marché en raison des progrès technologiques dans la région ainsi que de la présence d’acteurs majeurs des solutions de suivi et de traçabilité dans la région.

La région Asie-Pacifique devrait connaître la croissance la plus rapide sur le marché mondial du suivi et de la traçabilité en raison de l'industrialisation rapide, de la croissance du commerce électronique, des exigences réglementaires strictes et des préoccupations croissantes concernant les produits contrefaits. En outre, l'expansion des secteurs pharmaceutique et de la santé, ainsi que les avancées technologiques, stimulent la demande de solutions efficaces de visibilité de la chaîne d'approvisionnement.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché des solutions mondiales de suivi et de traçabilité

Le paysage concurrentiel du marché fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders mondiaux du marché des solutions de suivi et de traçabilité opérant sur le marché sont :

- SAP SE (Allemagne)

- Zebra Technologies Corp. (États-Unis)

- Videojet Technologies, Inc. (États-Unis)

- METTLER TOLEDO (États-Unis)

- Tracelink Inc. (États-Unis)

- Siemens (Allemagne)

- Domino Printing Sciences plc (Royaume-Uni)

- Laetus GmbH (Allemagne)

- Xyntek Incorporated (États-Unis)

- IBM Corporation (États-Unis)

- WIPOTEC-OCS GmbH (Allemagne)

- 3Keys (Allemagne)

- ACG (Inde)

- NJM Packaging Inc. (États-Unis)

- GROUPE OPTEL (Canada)

- Systech (Inde)

- Robert Bosch Manufacturing Solutions GmbH (Allemagne)

- ANTARES VISION SpA (Italie)

- Uhlmann (Inde)

- SEA VISION Srl (Italie)

- Jekson Vision (Inde)

- Systèmes Kevision (Inde)

- Arvato Systems (Allemagne)

- Grant-Soft Ltd. (Turquie)

- PharmaSecure Inc. (États-Unis)

- Axyway (France)

- SL Controls Ltd. (États-Unis)

Derniers développements sur le marché mondial des solutions de suivi et de traçabilité

- En mai 2024, Videojet a lancé le laser CO2 3350 de 30 watts, conçu pour fournir un marquage permanent de haute qualité pour une variété de matériaux. Cette solution laser avancée améliore l'efficacité opérationnelle et réduit les temps d'arrêt grâce à ses performances fiables et à grande vitesse. Elle est particulièrement adaptée aux industries nécessitant un marquage de précision, comme l'alimentation, les boissons et les produits pharmaceutiques

- En mai 2019, METTLER TOLEDO a ouvert à Barcelone son nouveau centre de test d'inspection de produits pour les transformateurs alimentaires et pharmaceutiques du Moyen-Orient et d'Afrique. Ce nouveau centre de test ouvert par l'entreprise renforce sa crédibilité sur le marché, ce qui entraîne une augmentation de la demande et des ventes de ses produits à l'avenir.

- En février 2020, ACG a lancé une plateforme de marque innovante basée sur la blockchain. Cette nouvelle plateforme introduite par l'entreprise augmentera sa demande sur le marché

- En novembre 2019, ACG a présenté la série NXT, des machines prêtes pour l'avenir qui offriront une expérience utilisateur intelligente à nos clients. Dans le cadre de la série NXT, les machines incluses sont Protab 300 NXT, Protab 700 NXT, BMax NXT, KartonX NXT, Verishield CS18 NXT au PMEC 2019. Ces nouveaux produits lancés par ACG augmenteront la demande pour ses produits sur le marché

- En juillet 2020, Axyway a reçu la désignation AWS Healthcare Competency et la désignation AWS Life Sciences Competency d'Amazon Web Services (AWS) pour ses solutions utilisées dans de nombreux secteurs. Cette reconnaissance reçue par l'entreprise va renforcer sa crédibilité sur le marché

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 GLOBAL TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN GLOBAL SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN GLOBAL TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 GLOBAL TRACK AND TRACE SOLUTIONS MARKET

13.1 GLOBAL

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 FRANCE

13.3.4 ITALY

13.3.5 SWITZERLAND

13.3.6 SPAIN

13.3.7 NETHERLANDS

13.3.8 BELGIUM

13.3.9 TURKEY

13.3.10 RUSSIA

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 INDIA

13.4.4 SOUTH KOREA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 THAILAND

13.4.8 MALAYSIA

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 SAUDI ARABIA

13.6.3 U.A.E.

13.6.4 ISRAEL

13.6.5 EGYPT

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 GLOBAL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 GLOBAL RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 GLOBAL THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 102 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 103 U.K. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 106 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 U.K. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 110 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 U.K. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 113 FRANCE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 116 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 122 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 123 ITALY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 124 ITALY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 125 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 126 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 ITALY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 ITALY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 130 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 ITALY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 132 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 133 SWITZERLAND SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 134 SWITZERLAND HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 135 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 136 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 SWITZERLAND SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 SWITZERLAND AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 140 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 141 SWITZERLAND TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 143 SPAIN SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 144 SPAIN HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 145 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 146 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 SPAIN SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 SPAIN AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 150 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 SPAIN TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 152 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 153 NETHERLANDS SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 154 NETHERLANDS HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 155 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 156 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 NETHERLANDS SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 NETHERLANDS AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 159 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 160 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 161 NETHERLANDS TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 163 BELGIUM SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 164 BELGIUM HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 165 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 166 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 BELGIUM SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 BELGIUM AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 170 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 BELGIUM TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 173 TURKEY SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 174 TURKEY HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 175 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 176 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 177 TURKEY SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 TURKEY AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 179 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 180 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 181 TURKEY TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 182 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 183 RUSSIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 184 RUSSIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 185 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 186 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 RUSSIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 188 RUSSIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 189 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 190 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 191 RUSSIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 192 REST OF EUROPE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 193 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 194 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 195 ASIA-PACIFIC SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 196 ASIA-PACIFIC HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 197 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 204 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 205 CHINA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 206 CHINA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 207 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 215 JAPAN SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 216 JAPAN HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 217 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 218 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 219 JAPAN SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 JAPAN AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 222 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 223 JAPAN TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 225 INDIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 226 INDIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 227 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 228 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 229 INDIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 INDIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 232 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 233 INDIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH KOREA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH KOREA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 246 AUSTRALIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 247 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 248 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 AUSTRALIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 250 AUSTRALIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 251 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 252 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 253 AUSTRALIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 255 SINGAPORE SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 256 SINGAPORE HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 257 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 258 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 259 SINGAPORE SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 260 SINGAPORE AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 261 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 262 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 263 SINGAPORE TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 264 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 265 THAILAND SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 266 THAILAND HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 267 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 268 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 269 THAILAND SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 270 THAILAND AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 271 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 272 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 273 THAILAND TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 275 MALAYSIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 276 MALAYSIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 277 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 278 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 279 MALAYSIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 280 MALAYSIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 281 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 282 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 283 MALAYSIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 295 PHILIPPINES SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 296 PHILIPPINES HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 297 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 298 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 299 PHILIPPINES SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 300 PHILIPPINES AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 301 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 302 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 303 PHILIPPINES TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 304 REST OF ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 305 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 306 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 307 SOUTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 308 SOUTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 309 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 310 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 SOUTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 312 SOUTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 313 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 314 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 315 SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 316 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 317 BRAZIL SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 318 BRAZIL HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 319 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 320 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 321 BRAZIL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 322 BRAZIL AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 323 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 324 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 325 BRAZIL TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 326 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 327 ARGENTINA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 328 ARGENTINA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 329 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 330 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 331 ARGENTINA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 332 ARGENTINA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 333 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 334 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 335 ARGENTINA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 336 REST OF SOUTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 337 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 338 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 339 MIDDLE EAST AND AFRICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 340 MIDDLE EAST AND AFRICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 341 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 342 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 343 MIDDLE EAST AND AFRICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 344 MIDDLE EAST AND AFRICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 345 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 346 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 347 MIDDLE EAST AND AFRICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)