Global Trade Surveillance Market

Taille du marché en milliards USD

TCAC :

%

USD

902.21 Million

USD

2,866.36 Million

2022

2030

USD

902.21 Million

USD

2,866.36 Million

2022

2030

| 2023 –2030 | |

| USD 902.21 Million | |

| USD 2,866.36 Million | |

|

|

|

|

Global Trade Surveillance Market, By Components (Solution and Services), Deployment Model (Cloud, On Premises and Hybrid), Organization Size (Large Enterprises, Small and Medium Sized Enterprises (SMES)), Vertical (Capital Markets and Banking Financial Services and Insurance (BFSI)) - Industry Trends and Forecast to 2030.

Trade Surveillance Market Analysis and Size

The global trade surveillance market is segmented on the basis of component, deployment model, organization size, vertical. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

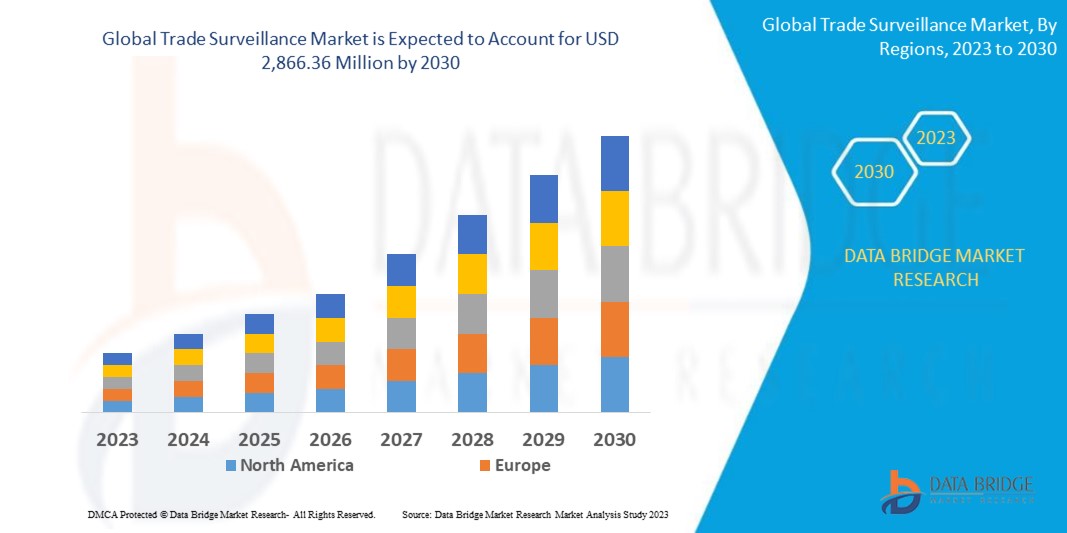

Data Bridge Market Research analyses that the global trade surveillance market which was USD 902.21 million in 2022, is expected to reach USD 2,866.36 million by 2030, and is expected to undergo a CAGR of 13.9% during the forecast period 2023-2030. This indicates the market value. “Solution” dominates the component segment of the global trade surveillance market due to solutions can collect and store large amounts of data from a variety of sources, including trading platforms, market data providers, and news outlets. This data can then be used to identify potential violations of trading rules and regulations. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Trade Surveillance Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Components (Solution and Services), Deployment Model (Cloud, On Premises and Hybrid), Organization Size (Large Enterprises, Small and Medium Sized Enterprises (SMES)), Vertical (Capital Markets and Banking Financial Services and Insurance (BFSI)) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa |

|

Market Players Covered |

NICE Actimize (U.S.), Nasdaq, Inc. (U.S.), FIS (U.S.), FISERV (U.S.), Software AG (Germany), IPC Systems, Inc. (U.S.), Scila AB (Sweden), Ancoa Software Ltd. (U.K.), B-Next (Italy), Cinnober Financial Technology (Sweden), OneMarketData, LLC (U.S.), Thomson Reuters (Canada), Smarsh (U.S.), Aquis Technologies (U.K.), Eventus Systems, Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

The industry that focuses on providing tools, technologies, and solutions for monitoring, analyzing, and detecting potential misconduct and regulatory violations in trading activities across financial markets. It encompasses a range of activities and systems designed to ensure compliance with regulations, maintain market integrity, and prevent activities such as market manipulation, insider trading, fraud, and other illicit practices.

Trade surveillance involves the systematic monitoring of trade-related data, including trade orders, transactions, communications, and market data, to identify suspicious or anomalous patterns that may indicate market abuse or non-compliance with regulatory requirements. Market participants, including financial institutions, regulatory bodies, exchanges, and trading platforms, utilize trade surveillance solutions to enforce regulatory compliance, mitigate risks, protect market integrity, and maintain investor confidence.

Global Trade Surveillance Market Dynamics

Drivers

- Technological Advancements and Data Analytics Capabilities

The rapid advancements in technology, particularly in areas such as artificial intelligence (AI), machine learning (ML), big data analytics, and natural language processing (NLP), have significantly enhanced trade surveillance capabilities. These technologies enable the analysis of vast volumes of trading data in real-time, allowing for the identification of complex patterns and anomalies that may indicate market abuse. The increasing adoption of advanced technologies in trade surveillance solutions drives market growth and provides more accurate and efficient surveillance capabilities.

- Growing Complexity and Globalization of Financial Markets

Financial markets have become increasingly complex, with a wide range of trading instruments, asset classes, and trading venues. Moreover, globalization has led to interconnectedness between markets, making it necessary to monitor cross-border trading activities effectively. The need to monitor and analyze trading data across multiple markets, instruments, and jurisdictions drives the demand for comprehensive trade surveillance solutions that can handle diverse data sources, detect irregularities, and provide holistic surveillance capabilities.

- Increasing Instances of Market Manipulation and Insider Trading

The occurrence of market manipulation, insider trading, and other illicit activities in financial markets has raised concerns about market integrity and investor protection. These instances highlight the need for robust trade surveillance systems that can effectively detect and prevent such misconduct. The growing awareness of these issues and the desire to maintain a fair and transparent market environment drive the adoption of trade surveillance solutions to mitigate risks and safeguard the interests of investors.

Opportunity

- Increasing Regulatory Scrutiny and Compliance Requirements

Regulatory bodies across the globe are placing greater emphasis on market surveillance and enforcement of regulations to maintain market integrity. Financial institutions are facing stricter compliance requirements to prevent market abuse, insider trading, and other illicit activities.

Restraints/ Challenges

- Complexity of Regulatory Landscape

The regulatory landscape for financial markets is complex and continuously evolving. Financial institutions must navigate through a multitude of regulations and requirements imposed by various regulatory bodies across different jurisdictions. This complexity poses challenges for trade surveillance solution providers in developing systems that can effectively adapt to and comply with diverse regulatory frameworks. Keeping pace with regulatory changes and ensuring accurate interpretation and implementation of regulations can be demanding, impacting the development and deployment of trade surveillance solutions.

- Data Volume and Complexity

The increasing volume and complexity of trading data pose significant challenges for trade surveillance systems. With the advent of electronic trading, algorithmic trading, and high-frequency trading, vast amounts of data are generated in real-time, making it challenging to effectively capture, process, and analyze this data. Moreover, the data comes from various sources, including multiple trading venues, which further adds to the complexity. Trade surveillance solution providers need to develop robust infrastructure and advanced algorithms to handle and analyze this massive volume of data accurately and efficiently.

This global trade surveillance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the trade surveillance market contact the Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In September 2022, FIS launched Worldpay for Platforms, a software-as-a-service (SaaS) solution that enables small-to-medium-sized businesses (SMBs) to access embedded payments and finance solutions through software providers. This innovative offering combines FIS's global merchant and banking capabilities with embedded payments technology acquired through Payrix, empowering software companies to onboard merchants quickly and provide access to the payment capabilities of Worldpay from FIS, one of the world's largest payment processors. The platform allows SMBs to accept global payments, manage subscriptions, issue refunds, access customized payment offerings, and receive tailored support, revolutionizing the way businesses handle financial transactions and compete in the market

- In November 2019, Nasdaq launched artificial intelligence (AI) technology for surveillance patterns on The Nasdaq Stock Market, enhancing its market surveillance functionality. The AI system, developed in collaboration with Nasdaq's Market Technology business and Machine Intelligence Lab, improves detection of malicious activity through deep learning, transfer learning, and human-in-the-loop learning. Nasdaq plans to expand the technology to other exchanges and regulators globally, aiming to revolutionize market surveillance and maintain the integrity of capital markets by leveraging AI technology

The Global Trade Surveillance Market Scope

The global trade surveillance market is segmented on the basis of component, deployment model, organization size and vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

Deployment Model

- Cloud

- On Premises

- Hybrid

Organization Size

- Large Enterprises

- Small and Medium Sized Enterprises (SMES)

Vertical

- Capital Markets

- Banking Financial Services

- Insurance (BFSI)

The Global Trade Surveillance Market Region Analysis/Insights

The global trade surveillance market is analyzed and market size insights and trends are provided by region, component, deployment model, organization size, and vertical as referenced above.

The regions covered in the global trade surveillance market are North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. The countries covered in the global trade surveillance market report are U.S., Canada, Mexico, Brazil, Argentina, the Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa.

Europe dominates the global trade surveillance market because Europe has some of the strictest regulations in the world governing financial markets. This has led to a demand for robust trade surveillance systems that can help financial institutions to comply with these regulations.

Asia-Pacific is the fastest-growing country in the global trade surveillance market due to due to the increasing expansion of the banking and insurance industries in Asia-Pacific nations like India, China, Singapore, South Korea, and Japan.

The region section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global Trade Surveillance Market Share Analysis

The global trade surveillance market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the global trade surveillance market.

Some of the major players operating in the global trade surveillance market are:

- NICE Actimize (U S)

- Nasdaq, Inc. (U.S.)

- FIS (U.S.)

- FISERV (U.S.)

- Software AG (Germany)

- IPC Systems, Inc. (U.S.)

- Scila AB (Sweden)

- Ancoa Software Ltd. (U.K.)

- B-Next (Italy)

- Cinnober Financial Technology (Sweden)

- OneMarketData, LLC (U.S.)

- Thomson Reuters (Canada)

- Smarsh (U.S.)

- Aquis Technologies (U.K.)

- Eventus Systems, Inc. (U.S.)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.