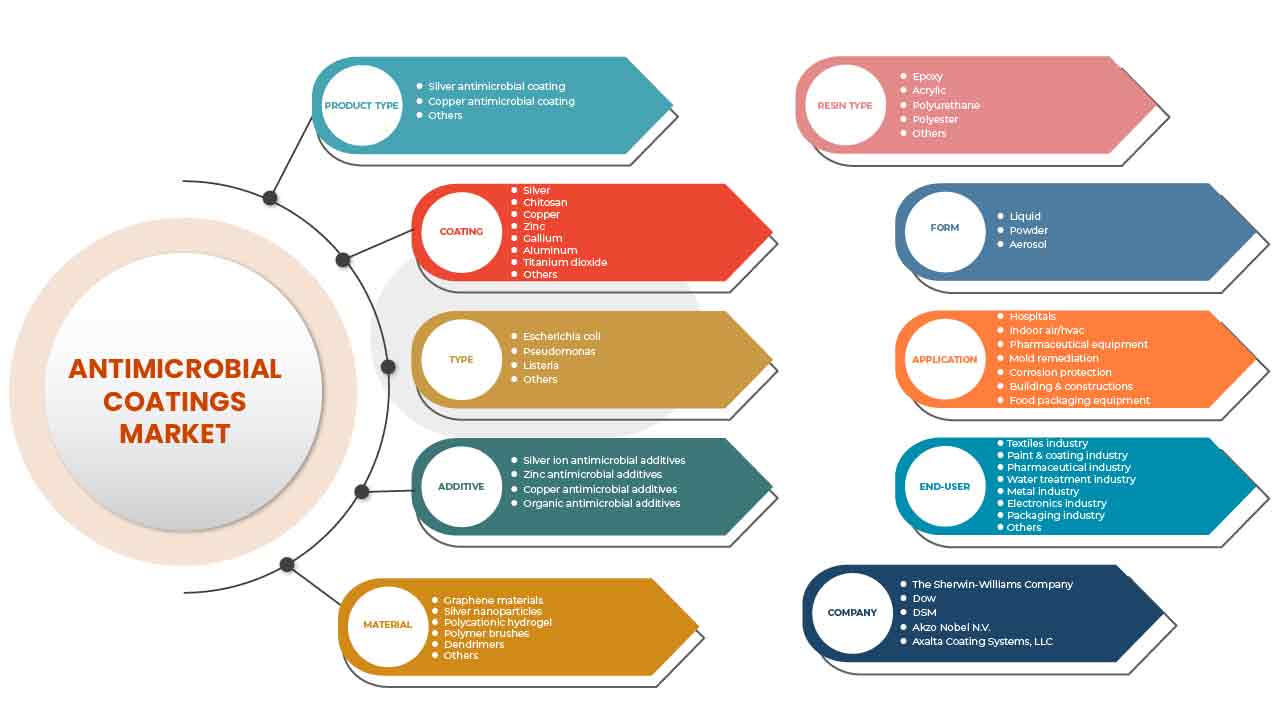

Middle East and Africa Antimicrobial Coatings Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Construction and Food Packaging Equipment), End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) Industry Trends and Forecast to 2029.

Market Analysis and Insights

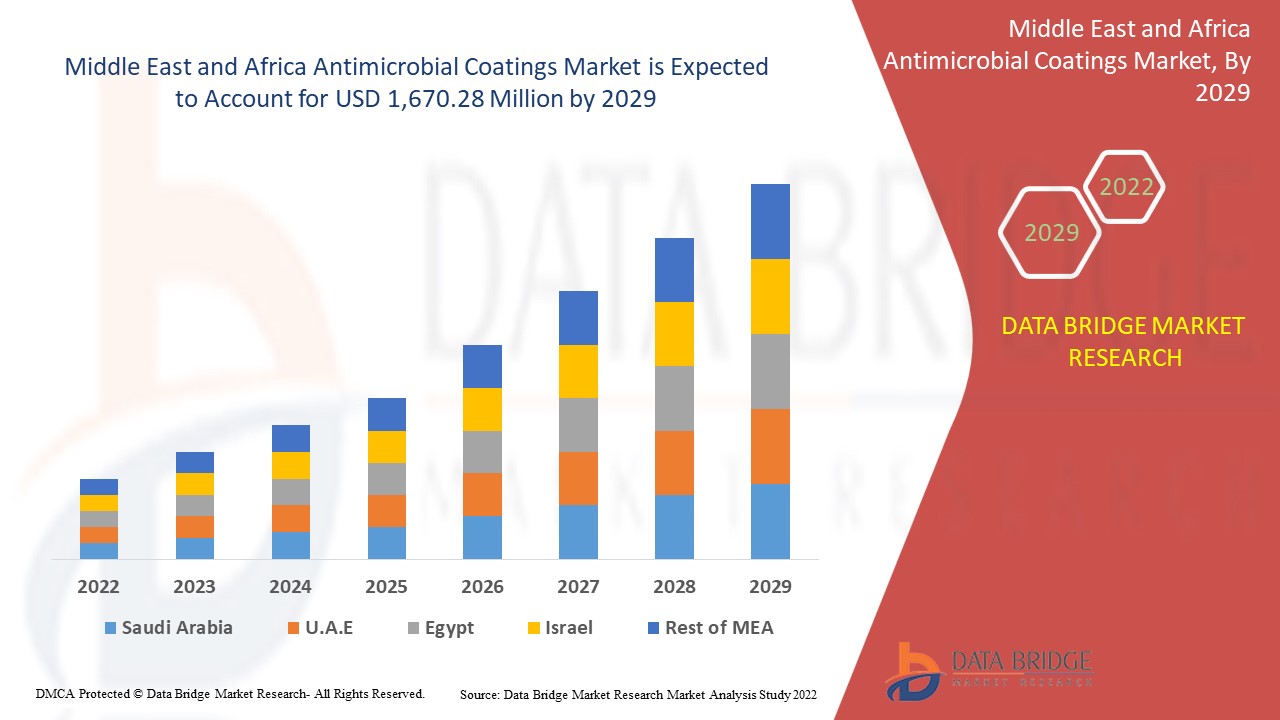

Middle East and Africa antimicrobial coatings market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 13.1% in the forecast period of 2022 to 2029 and is expected to reach USD 1,670.28 million by 2029. The major factor driving the growth of the Middle East and Africa antimicrobial coatings market is the growing demand for heating, ventilation, and air conditioning to improve indoor air quality.

Antimicrobial coatings assist in maintaining the quality of applied surfaces by preventing the growth of microorganisms such as fungi, parasites, and bacteria. The usage of these antimicrobial coatings provides improved cleanliness and hygiene as they end the requirement of frequent cleaning. As a result, antimicrobial coatings are more cost-effective and offer lasting protection against pathogens. These coatings are generally applied on walls, vents, counters, and door handles. Moreover, as these coatings help sterilize medical tools, surgical masks, gloves, and clothing, they find vast applications in clinics, hospitals, and healthcare centers.

The application of antimicrobial coatings improves the durability and appearance of the applied surface and aids in shielding the surface from the attack of microbes. As a result, these coatings are widely used to eliminate the germination of pathogens that can cause infectious diseases such as Ebola, influenza, mumps, measles, chickenpox, and rubella.

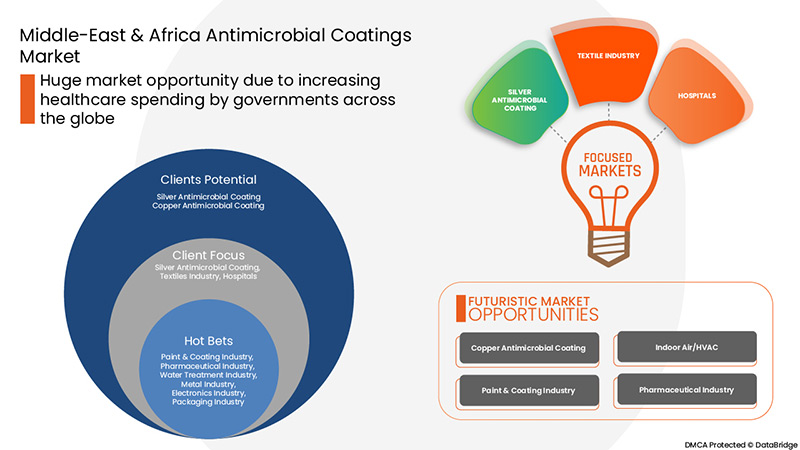

Growing demand for heating, ventilation, and air conditioning to improve indoor air quality and rising awareness regarding healthcare-associated infections (HCAI) are expected to boost market antimicrobial coatings demand. With the increasing consumption of antimicrobial coatings globally, major companies are expanding their production capacities in different countries to strengthen their presence of these products in the market.

The major restraint which may impact the market is stringent regulations associated with antimicrobial coatings. Also, the emission of active ingredients into the environment is a restraining factor for the Middle East and Africa antimicrobial coatings market.

Middle East and Africa antimicrobial coatings market report provide details of market share, new developments, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), By Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), By Type (Escherichia Coli, Pseudomonas, Listeria, Others), By Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), By Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), By Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), By Form (Liquid, Powder, Aerosol), By Application (Hospitals, Indoor Air/HVAC, Pharmaceutical Equipment, Mold Remediation, Corrosion Protection, Building & Equipment, and Food & Packaging Equipment), By End-Users (Pharmaceutical Industry, Paint and Coating Industry, Packaging Industry, Textiles Industry, Electronics Industry, Metal Industry, Water Treatment Industry, and Others) |

|

Countries Covered |

South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the Rest of the Middle East and Africa |

|

Market Players Covered |

Axalta Coating Systems, LLC, Akzo Nobel N.V., PPG Industries Inc., DSM, Dow, DuPont, Flowcrete, Kastus Technologies Company Limited, Nano Care Deutschland AG, SANITIZED AG, among others |

Market Definition

Les revêtements antimicrobiens sont des revêtements résistants aux microbes qui comprennent des agents antimicrobiens empêchant les impuretés microbiennes. Ils sont largement utilisés dans les secteurs de la construction, de l'alimentation et de la santé. Ils sont appliqués sur les portes, les panneaux de verre, les murs, les portes, les tentes CVC, les comptoirs, etc. Le revêtement antimicrobien est une application d'un agent chimique sur la surface qui peut arrêter la croissance des micro-organismes pathogènes. En dehors de cela, le revêtement antimicrobien contribue à augmenter la durabilité de la surface, l'apparence, la résistance à la corrosion, etc. Ces revêtements sont utilisés pour les dispositifs médicaux afin de détruire ou d'inhiber la croissance des micro-organismes et de protéger les humains contre l'infection par des maladies infectieuses. Le revêtement antimicrobien est connu pour être une arme puissante contre les infections liées aux soins de santé. Le revêtement antimicrobien présente un revêtement antimicrobien viable très efficace et des modifications précisément dosées et délivrées directement à partir de la surface du dispositif médical. Le revêtement antimicrobien se concentre sur la réduction de l'accumulation sur les dispositifs biomédicaux en modifiant les caractéristiques interfaciales.

Dynamique du marché des revêtements antimicrobiens au Moyen-Orient et en Afrique

Conducteurs

- Demande croissante de chauffage, de ventilation et de climatisation pour améliorer la qualité de l'air intérieur

La qualité de l'air intérieur suscite une prise de conscience et une préoccupation croissantes en raison de la propagation accrue des maladies transmises par l'air. Ainsi, la demande accrue de chauffage, de ventilation et de climatisation pour améliorer la qualité de l'air intérieur devrait stimuler le marché des revêtements antimicrobiens au Moyen-Orient et en Afrique.

- Sensibilisation accrue aux infections associées aux soins de santé (IAS)

L’augmentation du nombre et des cas d’infections associées aux soins de santé dans la région et l’augmentation des coûts des soins de santé avec l’augmentation des cas d’infections devraient agir comme des moteurs pour le marché des revêtements antimicrobiens au Moyen-Orient et en Afrique.

- Forte demande de la part de l'industrie des dispositifs médicaux

La capacité des revêtements antimicrobiens à prévenir et à contrôler la croissance des agents pathogènes dans le secteur de la santé fait augmenter la demande de l'industrie des dispositifs médicaux. Ainsi, la demande considérablement croissante de l'industrie des dispositifs médicaux devrait agir comme un moteur pour le marché des revêtements antimicrobiens au Moyen-Orient et en Afrique. De plus, le nombre d'établissements de santé au Moyen-Orient et dans les pays africains a augmenté, ce qui stimulera encore la demande de dispositifs médicaux, contribuant ainsi à la croissance du marché.

Opportunités

- Utilisation croissante dans de nouvelles applications clés

Face à l'inquiétude et à la sensibilisation croissantes concernant la sécurité et l'hygiène dans le monde entier, de nombreux fabricants, tels que les fabricants de textiles, de biens de consommation et d'électronique, se concentrent sur le développement de produits antimicrobiens et antibactériens. Cela permet de se conformer aux préférences changeantes des consommateurs et à la demande du marché pour les produits à revêtement antimicrobien, offrant ainsi une opportunité lucrative pour la croissance du marché des revêtements antimicrobiens au Moyen-Orient et en Afrique.

- Progrès technologiques dans le domaine des revêtements antimicrobiens

Le développement rapide de la technologie des revêtements antimicrobiens, associé à la demande croissante de produits de revêtements antimicrobiens avancés dans différentes industries, devrait créer une opportunité pour le marché des revêtements antimicrobiens au cours de la période de prévision.

Contraintes/Défis

- Émission de principes actifs dans l'environnement

L'utilisation croissante de revêtements antimicrobiens doit être soumise à une analyse des risques et des avantages. Les revêtements antimicrobiens sont utilisés pour prévenir les infections chez les êtres humains. Cependant, l'utilisation de revêtements antimicrobiens peut entraîner des risques pour la santé à long terme. Les revêtements antimicrobiens libèrent des principes actifs tels que le zinc, l'argent et le cuivre. Ces principes actifs pénètrent lentement dans les plans d'eau et peuvent nuire à l'écosystème. De plus, ces principes actifs libérés sont consommés par les animaux marins tels que les poissons, les crustacés, les algues et bien d'autres. Les êtres humains finissent par consommer ces animaux dans leur alimentation et, par conséquent, nuisent à la santé humaine.

Ainsi, les effets néfastes des revêtements antimicrobiens sur l’environnement, associés à un manque de sensibilisation et d’informations concernant la minimisation de leurs effets néfastes sur l’environnement, peuvent restreindre le marché des revêtements antimicrobiens au Moyen-Orient et en Afrique.

- Inquiétudes croissantes concernant la toxicité des nanoparticules

Une exposition prolongée à la toxicité des nanoparticules libérées par les revêtements antimicrobiens peut entraîner de graves problèmes de santé, ce qui suscite des inquiétudes et peut constituer un défi à la croissance du marché des revêtements antimicrobiens au Moyen-Orient et en Afrique.

- Coût élevé des produits et perturbations de la chaîne d'approvisionnement en raison de la pandémie de COVID-19

L’épidémie de COVID-19 devrait constituer un défi pour la croissance du marché des revêtements antimicrobiens au Moyen-Orient et en Afrique au cours de la période de prévision. Cependant, avec l’assouplissement du confinement et les campagnes de vaccination menées dans divers pays, le flux de travail a commencé à augmenter, aidant ainsi les acteurs du marché à faire leur retour. En outre, les réglementations gouvernementales et le soutien concernant la croissance de l’économie et l’essor des startups pourraient faire augmenter la demande pour le marché des revêtements antimicrobiens au Moyen-Orient et en Afrique au cours de la période de prévision.

Développement récent

- En novembre 2021, DuPont a conclu un accord définitif pour acquérir Rogers Corporation (« Rogers ») pour 5,2 milliards USD. DuPont a annoncé une série d'actions faisant progresser sa stratégie en tant qu'entreprise multi-industrielle de premier plan axée sur des activités à forte croissance et à marge élevée, leaders du marché, dotées de caractéristiques technologiques et financières complémentaires. Ce développement aidera DuPont à développer ses activités avec l'aide de Rogers Corporation.

Portée du marché des revêtements antimicrobiens au Moyen-Orient et en Afrique

Le marché des revêtements antimicrobiens du Moyen-Orient et de l’Afrique est classé en fonction du type de produit, du revêtement, du type, du matériau, de l’additif, du type de résine, de la forme, de l’application et des utilisateurs finaux.

Type de produit

- Revêtements antimicrobiens à base d'argent

- Revêtements antimicrobiens en cuivre

- Autres

Sur la base du type de produit, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en revêtements antimicrobiens en argent, revêtements antimicrobiens en cuivre et autres.

Revêtement

- Argent

- Chitosane

- Cuivre

- Zinc

- Gallium

- Aluminium

- Dioxyde de titane

- Autres

Sur la base du revêtement, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en argent, chitosane, cuivre, zinc, gallium, aluminium, dioxyde de titane et autres.

Taper

- Escherichia coli

- Pseudomonas

- Listeria

- Autres

Sur la base du type, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en Escherichia coli, pseudomonas, listeria et autres.

Additif

- Additifs antimicrobiens à base d'ions d'argent

- Additifs antimicrobiens à base de zinc

- Additifs antimicrobiens à base de cuivre

- Additifs antimicrobiens biologiques

Sur la base des additifs, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en additifs antimicrobiens aux ions argent, additifs antimicrobiens au zinc, additifs antimicrobiens au cuivre et additifs antimicrobiens organiques.

Matériel

- Matériaux à base de graphène

- Hydrogel polycationique

- Nanoparticules d'argent

- Brosses en polymère

- Dendrimères

- Autres

Sur la base du matériau, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en matériaux à base de graphène, nanoparticules d'argent, hydrogel polycationique, brosses polymères, dendrimères et autres.

Type de résine

- Acrylique

- Polyester

- Polyuréthane

- Époxy

- Autres

Sur la base du type de résine, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en époxy, acrylique, polyuréthane, polyesters et autres.

Formulaire

- Liquide

- Aérosol

- Poudre

Sur la base de la forme, le marché des revêtements antimicrobiens du Moyen-Orient et de l’Afrique est segmenté en liquide, aérosol et poudre.

Application

- Hôpitaux

- Air intérieur/CVC

- Equipements pharmaceutiques

- Traitement des moisissures

- Protection contre la corrosion

- Bâtiment et construction

- Équipement d'emballage alimentaire

- Autres

Sur la base de l'application, le marché des revêtements antimicrobiens du Moyen-Orient et de l'Afrique est segmenté en hôpitaux, air intérieur/CVC, équipements pharmaceutiques, assainissement des moisissures, protection contre la corrosion, bâtiment et construction, équipements d'emballage alimentaire et autres.

Utilisateurs finaux

- Industrie pharmaceutique

- Industrie de la peinture et des revêtements

- Industrie de l'emballage

- Industrie textile

- Industrie électronique

- Industrie métallurgique

- Industrie du traitement de l'eau

- Autres

On the basis of end-users, Middle East and Africa antimicrobial coatings market is segmented into the pharmaceutical industry, paint and coating industry, packaging industry, textiles industry, electronics industry, metal industry, water treatment industry, and others.

Middle East and Africa Antimicrobial Coatings Regional Analysis/Insights

Middle East and Africa antimicrobial coatings market is categorized based on product type, coating, type, material, additive, resin type, form, application, and end-users.

The Middle East and Africa antimicrobial coatings market is further segmented into South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the Rest of the Middle East and Africa.

United Arab Emirates is expected to dominate the Middle East and Africa antimicrobial coatings market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to growing of the construction and renovation activities and the increase in the standards of living in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of the Middle East and African brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Antimicrobial Coatings Market Share Analysis

The Middle East and Africa antimicrobial coatings market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Middle East and Africa antimicrobial coatings market.

Some of the prominent participants operating in the Middle East and Africa antimicrobial coatings market are Axalta Coating Systems, LLC, Akzo Nobel N.V., PPG Industries Inc., DSM, Dow, DuPont, Flowcrete, Kastus Technologies Company Limited, Nano Care Deutschland AG, SANITIZED AG, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY

5.1.2 RISING AWARENESS REGARDING HEALTHCARE ASSOCIATED INFECTIONS (HCAI)

5.1.3 SIGNIFICANT DEMAND FROM THE MEDICAL DEVICE INDUSTRY

5.1.4 INCREASING ADOPTION ACROSS VARIOUS INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 EMISSION OF ACTIVE INGREDIENTS INTO THE ENVIRONMENT

5.2.2 STRINGENT REGULATIONS ASSOCIATED WITH ANTIMICROBIAL COATINGS

5.3 OPPORTUNITIES

5.3.1 RISING USAGE ACROSS KEY NOVEL APPLICATIONS

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN ANTIMICROBIAL COATINGS

5.3.3 INCREASING HEALTHCARE SPENDING BY GOVERNMENTS ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INCREASING CONCERNS REGARDING THE TOXICITY OF NANOPARTICLES

5.4.2 HIGH COST OF PRODUCTS AND SUPPLY CHAIN DISRUPTIONS DUE TO COVID-19 PANDEMIC

6 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATINGS

6.3 COPPER ANTIMICROBIAL COATINGS

6.4 OTHERS

7 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 NON-FOULING POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 HOSPITALS

13.3 INDOOR AIR/HVAC

13.4 PHARMACEUTICAL EQUIPMENT

13.5 MOLD REMEDIATION

13.6 CORROSION PROTECTION

13.7 BUILDING & CONSTRUCTIONS

13.8 FOOD PACKAGING EQUIPMENT

13.9 OTHERS

14 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY END USER

14.1 OVERVIEW

14.2 TEXTILES INDUSTRY

14.2.1 SILVER ANTIMICROBIAL COATING

14.2.2 COPPER ANTIMICROBIAL COATING

14.2.3 OTHERS

14.3 PAINT & COATING INDUSTRY

14.3.1 SILVER ANTIMICROBIAL COATING

14.3.2 COPPER ANTIMICROBIAL COATING

14.3.3 OTHERS

14.4 PHARMACEUTICAL INDUSTRY

14.4.1 SILVER ANTIMICROBIAL COATING

14.4.2 COPPER ANTIMICROBIAL COATING

14.4.3 OTHERS

14.5 WATER TREATMENT INDUSTRY

14.5.1 SILVER ANTIMICROBIAL COATING

14.5.2 COPPER ANTIMICROBIAL COATING

14.5.3 OTHERS

14.6 METAL INDUSTRY

14.6.1 SILVER ANTIMICROBIAL COATING

14.6.2 COPPER ANTIMICROBIAL COATING

14.6.3 OTHERS

14.7 ELECTRONICS INDUSTRY

14.7.1 SILVER ANTIMICROBIAL COATING

14.7.2 COPPER ANTIMICROBIAL COATING

14.7.3 OTHERS

14.8 PACKAGING INDUSTRY

14.8.1 SILVER ANTIMICROBIAL COATING

14.8.2 COPPER ANTIMICROBIAL COATING

14.8.3 OTHERS

14.9 OTHERS

14.9.1 SILVER ANTIMICROBIAL COATING

14.9.2 COPPER ANTIMICROBIAL COATING

14.9.3 OTHERS

15 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 UNITED ARAB EMIRATES

15.1.2 SAUDI ARABIA

15.1.3 SOUTH AFRICA

15.1.4 ISRAEL

15.1.5 EGYPT

15.1.6 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16.2 MERGERS & ACQUISITIONS

16.3 EXPANSIONS

16.4 NEW PRODUCT DEVELOPMENTS

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 THE SHERWIN-WILLIAMS COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATES

18.2 DOW

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATES

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATE

18.4 AKZO NOBEL N.V.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATES

18.5 AXALTA COATING SYSTEMS, LLC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATES

18.6 AEREUS TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT UPDATES

18.7 ARXADA AG

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT UPDATES

18.8 BURKE INDUSTRIAL COATINGS

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT UPDATE

18.9 DUPONT

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATE

18.1 FIBERLOCK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT UPDATES

18.11 FLOWCRETE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT UPDATE

18.12 GBNEUHAUS GMBH

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT UPDATE

18.13 LINETEC

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT UPDATE

18.14 KASTUS TECHNOLOGIES COMPANY LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT UPDATE

18.15 KATILAC COATINGS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT UPDATE

18.16 MICROBAN INTERNATIONAL

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT UPDATE

18.17 NANO CARE DEUTSCHLAND AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT UPDATE

18.18 SANITIZED AG

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT UPDATES

18.19 SPECIALTY COATING SYSTEMS INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT UPDATES

18.2 PPG INDUSTRIES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 3 MIDDLE EAST & AFRICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SILVER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 5 MIDDLE EAST & AFRICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA COPPER ANTIMICROBIAL COATINGS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (KILO TONNES)

TABLE 9 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SILVER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CHITOSAN IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA TITANIUM DIOXIDE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ALUMINUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COPPER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA ZINC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA GALLIUM IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ESCHERICHIA COLI IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PSEUDOMONAS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA LISTERIA IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA GRAPHENE MATERIALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SILVER NANOPARTICLES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DENDRIMERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA EPOXY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ACRYLIC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA POLYURETHANE IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA POLYESTER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA LIQUID IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA POWDER IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA AEROSOL IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA HOSPITALS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDOOR AIR/HVAC IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA PHARMACEUTICAL EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MOLD REMEDIATION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA CORROSION PROTECTION IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA BUILDING & CONSTRUCTIONS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA FOOD PACKAGING EQUIPMENT IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA PAINT & COATING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY COUNTRY, 2020-2029 (KILO TONNES)

TABLE 74 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 76 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 95 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 96 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 98 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATES POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 UNITED ARAB EMIRATES ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 UNITED ARAB EMIRATES TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 UNITED ARAB EMIRATES PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 UNITED ARAB EMIRATES PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 UNITED ARAB EMIRATES WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 UNITED ARAB EMIRATES METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 UNITED ARAB EMIRATES ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 UNITED ARAB EMIRATES PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 UNITED ARAB EMIRATES OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 114 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 115 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 117 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 118 SAUDI ARABIA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 133 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 SOUTH AFRICA ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 SOUTH AFRICA TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 SOUTH AFRICA OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 151 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 152 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 153 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 155 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 156 ISRAEL POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 157 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 158 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 159 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 ISRAEL ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 ISRAEL TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 ISRAEL PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 ISRAEL PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 ISRAEL WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 ISRAEL METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 166 ISRAEL ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 167 ISRAEL PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 ISRAEL OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 EGYPT ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 EGYPT ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

TABLE 171 EGYPT ANTIMICROBIAL COATINGS MARKET, BY COATINGS, 2020-2029 (USD MILLION)

TABLE 172 EGYPT ANTIMICROBIAL COATINGS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 EGYPT ANTIMICROBIAL COATINGS MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 174 EGYPT ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 175 EGYPT POLYMER BRUSHES IN ANTIMICROBIAL COATINGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 176 EGYPT ANTIMICROBIAL COATINGS MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 177 EGYPT ANTIMICROBIAL COATINGS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 178 EGYPT ANTIMICROBIAL COATINGS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 179 EGYPT ANTIMICROBIAL COATINGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 180 EGYPT TEXTILES INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 EGYPT PAINT & COATINGS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 182 EGYPT PHARMACEUTICAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 183 EGYPT WATER TREATMENT INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 EGYPT METAL INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 EGYPT ELECTRONICS INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 EGYPT PACKAGING INDUSTRY IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 EGYPT OTHERS IN ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 188 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 189 REST OF MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONNES)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR HEATING, VENTILATION, AND AIR CONDITIONING TO IMPROVE INDOOR AIR QUALITY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SILVER ANTIMICROBIAL COATINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET

FIGURE 18 RELATIVE CONTRIBUTIONS TO U.S. HEALTH EXPENDITURES, 2020

FIGURE 19 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY COATINGS, 2021

FIGURE 21 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY TYPE, 2021

FIGURE 22 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY ADDITIVE, 2021

FIGURE 23 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY MATERIAL, 2021

FIGURE 24 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY RESIN TYPE, 2021

FIGURE 25 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY FORM, 2021

FIGURE 26 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET: SNAPSHOT (2021)

FIGURE 29 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021)

FIGURE 30 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA ANTIMICROBIAL COATINGS MARKET: BY PRODUCT TYPE (2022 - 2029)

FIGURE 33 MIDDLE EAST & AFRICA ANTIMICROBIAL COATINGS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.