Middle East And Africa Biological Buffers Market

Taille du marché en milliards USD

TCAC :

%

USD

28.79 Million

USD

50.41 Million

2024

2032

USD

28.79 Million

USD

50.41 Million

2024

2032

| 2025 –2032 | |

| USD 28.79 Million | |

| USD 50.41 Million | |

|

|

|

|

Segmentation du marché des tampons biologiques au Moyen-Orient et en Afrique, par type de tampon (tampons de marchandises et autres tampons à base de sel), formulation (poudre et liquide), application (produits pharmaceutiques et biopharmaceutiques, culture cellulaire et biologie moléculaire, applications cliniques et diagnostiques, et applications chimiques et industrielles, autres), utilisateur final (sociétés pharmaceutiques et biopharmaceutiques, sociétés de biotechnologie, instituts de recherche et universitaires, laboratoires de diagnostic, organismes de recherche sous contrat (CRO) et CMO) - Tendances et prévisions du secteur jusqu'en 2035

Analyse et taille du marché des tampons biologiques au Moyen-Orient et en Afrique

Le marché des tampons biologiques au Moyen-Orient et en Afrique est axé sur la production, la distribution et la vente de tampons biologiques. Ces solutions contiennent un acide faible et sa base conjuguée (ou une base faible et son acide conjugué) et sont utilisées pour maintenir un pH stable en laboratoire et en milieu biomédical. Ce marché englobe une large gamme de tampons biologiques, notamment les tampons phosphate, les tampons Tris, les tampons HEPES et autres, destinés à diverses applications dans des domaines tels que la recherche en sciences de la vie, les biotechnologies, l'industrie pharmaceutique et le diagnostic, entre autres.

Taille du marché des tampons biologiques au Moyen-Orient et en Afrique

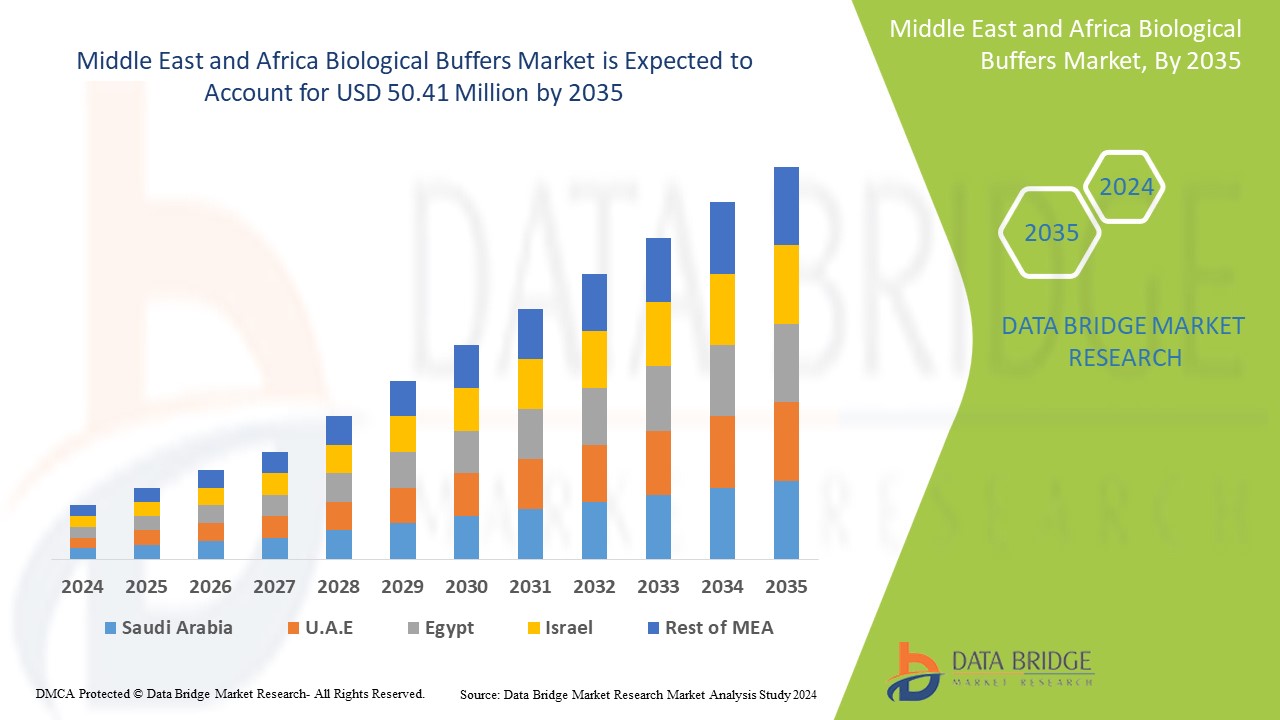

Data Bridge Market Research analyse que le marché des tampons biologiques au Moyen-Orient et en Afrique devrait atteindre 50,41 millions USD d'ici 2035, contre 28,79 millions USD en 2024, avec un TCAC substantiel de 5,3 % au cours de la période de prévision de 2025 à 2035. En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE.

Tendances du marché des tampons biologiques

« Adoption croissante des technologies basées sur l'IA »

Le marché des tampons biologiques connaît une évolution significative vers des solutions basées sur l'IA. Alors que les laboratoires et les entreprises biopharmaceutiques privilégient la précision, l'efficacité et la conformité réglementaire, l'intelligence artificielle et l'apprentissage automatique sont intégrés aux processus de formulation et de contrôle qualité des tampons. Ces technologies permettent d'optimiser la stabilisation du pH, d'améliorer les prévisions de performance des tampons et de rationaliser les flux de production. De plus, le besoin croissant de surveillance en temps réel et d'ajustements automatisés dans des secteurs comme le développement de médicaments, la recherche clinique et les bioprocédés stimule la demande. Face au durcissement des normes réglementaires et à l'accélération de la transformation numérique, les solutions de tampons biologiques basées sur l'IA sont en passe de devenir la norme du secteur.

Portée du rapport et segmentation du marché des tampons biologiques

|

Attributs |

Informations clés sur le marché des tampons biologiques |

|

Segments couverts |

|

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Koweït, Israël, reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

F. Hoffmann-La Roche Ltd (Suisse), Bio-Rad Laboratories, Inc. (États-Unis), Thermo Fisher Scientific Inc. (États-Unis), Takara Bio Inc. (Japon) et Merck KGaA (Allemagne), entre autres |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse d'import/export, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché des tampons biologiques

Les tampons biologiques sont des solutions contenant un acide faible et sa base conjuguée (ou une base faible et son acide conjugué) qui résistent aux variations de pH lors de l'ajout d'un acide ou d'une base. Ils sont essentiels dans les systèmes biologiques et les laboratoires pour maintenir un pH stable, car les enzymes et autres biomolécules sont très sensibles aux fluctuations de pH. Les tampons biologiques courants comprennent le phosphate, le Tris et l'HEPES, chacun ayant une plage de tampons spécifique adaptée à différentes applications.

Dynamique du marché des tampons biologiques au Moyen-Orient et en Afrique

Cette section vise à comprendre les moteurs, les avantages, les opportunités, les contraintes et les défis du marché. Tous ces éléments sont détaillés ci-dessous :

Conducteurs

- Prévalence croissante des maladies chroniques

La prévalence croissante des maladies chroniques, telles que le diabète, le cancer et les maladies cardiovasculaires, est un moteur important du marché des tampons biologiques au Moyen-Orient et en Afrique. Cette croissance nécessite des efforts accrus en recherche et développement pour comprendre les mécanismes des maladies, développer des outils de diagnostic et formuler des traitements efficaces. Les tampons biologiques jouent un rôle crucial dans ces efforts, car ils fournissent les environnements de pH stables indispensables à la réalisation d'expériences et de tests précis dans divers domaines, notamment la culture cellulaire, la découverte de médicaments et l'analyse des protéines.

Par exemple,

- En janvier 2024, selon un article publié dans le NCBI, les maladies chroniques telles que le diabète, les maladies cardiaques, les accidents vasculaires cérébraux et le cancer contribuent depuis longtemps et continuent de contribuer de manière significative aux taux mondiaux de morbidité et de mortalité. Non seulement ces maladies affectent des millions de vies, mais elles pèsent également lourdement sur les systèmes de santé du monde entier. L'impact financier de la prise en charge des maladies chroniques devrait augmenter considérablement, leur coût mondial étant estimé à 47 000 milliards de dollars d'ici 2030. Ce chiffre alarmant met en évidence le fardeau croissant des maladies chroniques, qui nécessitent des soins médicaux continus, des traitements de pointe et des ressources de santé importantes.

- En juillet 2024, selon les données publiées par l'OMS, on estimait que 39,9 millions [36,1–44,6 millions] de personnes vivaient avec le VIH à la fin de 2023, dont 1,4 million [1,1–1,7 million] d'enfants (0–14 ans) et 38,6 [34,9–43,1 millions] d'adultes (15 ans et plus). 1,3 million [1,0–1,7 million] de personnes ont contracté le VIH en 2023. 120 000 [83 000–170 000] enfants ont contracté le VIH en 2023. 1,2 million [950 000–1,5 million] d'adultes ont contracté le VIH en 2023.

La prévalence de ces maladies varie selon le lieu : environ 17 % des personnes âgées en milieu rural et 29 % en milieu urbain sont touchées par des maladies chroniques. Parmi ces affections, l'hypertension et le diabète sont particulièrement répandus, représentant ensemble environ 68 % de l'ensemble des maladies chroniques chez les personnes âgées. Cela souligne l'urgence d'interventions de santé ciblées et de stratégies de prise en charge pour faire face au fardeau croissant des maladies chroniques au sein de la population vieillissante de l'Inde.

- Adoption accrue des techniques Western BLOT et Elisa

Les techniques de Western Blot et d'Elisa sont fondamentales pour la recherche et le diagnostic en sciences de la vie, permettant la détection et la quantification de protéines et d'autres biomolécules. Avec l'expansion des efforts de recherche, notamment dans des domaines comme la découverte de médicaments, le diagnostic des maladies et l'identification de biomarqueurs, la demande pour ces techniques augmente, ce qui accroît le besoin de tampons fiables et de haute qualité, essentiels à des performances d'analyse optimales.

Par exemple,

- En avril 2023, un article publié dans la Bibliothèque nationale de médecine souligne l'utilisation croissante de la méthode ELISA (dosage immuno-enzymatique) en raison de sa polyvalence, de sa sensibilité et de sa spécificité pour la détection et la quantification des substances biologiques. Cette adoption croissante est due à son applicabilité au diagnostic médical, à la sécurité alimentaire et à la recherche. La capacité de la méthode ELISA à détecter un large éventail d'antigènes et d'anticorps, associée aux progrès de l'automatisation et du multiplexage, en fait une méthode privilégiée en milieu clinique et en laboratoire. La simplicité, la reproductibilité et la rentabilité de ce test contribuent également à son utilisation croissante.

- En avril 2021, selon un article publié dans la revue IUBMB Journals, le Western Blot (WB), également appelé immunoblot, est une méthode fondamentale fréquemment employée par les biologistes pour étudier divers aspects des biomolécules protéiques. Au-delà de la recherche, il est largement utilisé dans le diagnostic des maladies grâce à sa capacité à détecter directement les protéines, ce qui en fait un outil diagnostique très efficace et couramment utilisé en milieu clinique. Sa polyvalence et sa fiabilité ont conduit à son adoption généralisée dans les laboratoires de biologie, s'imposant comme l'une des techniques les plus essentielles pour la recherche et les applications cliniques.

Opportunités

- Augmentation du financement public-privé dans la recherche biomédicale

Grâce à l'augmentation des ressources financières allouées à la recherche et au développement scientifiques, les entreprises ont la possibilité d'investir dans des formulations et des technologies innovantes améliorant les performances des tampons de blocage. Ce financement soutient la création de solutions personnalisées adaptées à des applications spécifiques, améliorant la spécificité et réduisant le bruit de fond des analyses. De plus, il favorise la collaboration avec les instituts de recherche, ce qui conduit à des avancées technologiques majeures dans le domaine des tampons. L'augmentation des investissements facilite le développement de produits respectueux de l'environnement et durables, répondant ainsi à la demande croissante des consommateurs pour des solutions éco-responsables. Globalement, exploiter cette tendance de financement propulse les avancées sur le marché des tampons de blocage et renforce la compétitivité dans un environnement en constante évolution.

Par exemple,

- En mai 2021, selon un article publié dans le NCBI, l'augmentation du financement public-privé de la recherche biomédicale, conjuguée à l'application croissante des techniques de Western blot et à l'essor des innovations produits, crée un environnement favorable à la croissance. Cette tendance représente une opportunité significative pour le marché des tampons de blocage de se développer et d'évoluer.

- En mars 2023, selon un article publié dans le NCBI, Target 2035, une fédération internationale de scientifiques biomédicaux, s'appuie sur des principes ouverts pour créer des outils pharmacologiques pour chaque protéine humaine, essentiels à l'étude de la santé et de la maladie. Grâce à l'apport de connaissances et de réactifs par les entreprises pharmaceutiques, cette initiative offre une précieuse opportunité de croissance et d'innovation pour le marché des tampons de blocage.

La récente augmentation des financements publics-privés offre une opportunité considérable pour le marché des tampons de blocage. Un soutien financier accru à la recherche scientifique permet aux entreprises d'investir dans des formulations innovantes améliorant les performances des tampons. Ce financement encourage le développement de solutions personnalisées, renforce la spécificité et favorise la collaboration avec les instituts de recherche, favorisant ainsi le développement de produits respectueux de l'environnement. Cette tendance positionne le marché des tampons de blocage vers une croissance significative.

- Méthodes d'analyse pour la sécurité alimentaire et les tests environnementaux

Industries such as food safety and environmental testing increasingly rely on precise analytical methods, where high-quality blocking buffers play a critical role in minimizing background noise and enhancing assay sensitivity. As regulatory standards become more stringent, the demand for effective blocking solutions in these sectors is set to rise. By developing specialized buffers tailored to the unique requirements of food safety testing—such as allergen detection and pathogen identification—and environmental monitoring—such as pollutant analysis—manufacturers may tap into a growing market. This targeted approach not only addresses specific industry needs but also helps establish a competitive advantage. Companies that innovate and offer customizable solutions for these niche applications may position themselves for significant growth within the broader blocking buffer market.

For instance,

- In September 2021, according to the article published in Springer Nature, the use of Enzyme-Linked Immunosorbent Assay (ELISA) techniques in food analysis highlights a significant opportunity for the blocking buffer market. Their sensitivity and specificity allow for the detection of various components, including pesticides and toxins. This versatility creates a valuable opportunity for specialized blocking buffers tailored to food safety applications

- In May 2020, according to the article published in Science Direct, the prevalence of chemical contamination in food presents a significant opportunity for the blocking buffer market. The competitive enzyme-linked immunosorbent assay (Cp-ELISA) is widely used for detecting these contaminants due to its high throughput and low cost, highlighting the need for effective blocking buffers to enhance assay performance

- In February 2020, according to the article published in Springer Nature, The monitoring of pharmaceuticals in aquatic environments using enzyme-linked immunosorbent assay (ELISA) techniques creates a valuable opportunity for the blocking buffer market. As the demand for accurate detection of contaminants grows, effective blocking buffers become essential for improving assay sensitivity and reliability in environmental testing

The rising geriatric population is a key driver in the Middle East and Africa biological buffers market, as older adults are more susceptible to various eye conditions that can lead to corneal damage and the need for transplants. Age-related eye diseases, such as Fuchs' endothelial dystrophy, bullous keratopathy, and other degenerative corneal disorders, become more prevalent with advancing age, significantly increasing the demand for Biological Bufferss. Also, older adults are more likely to experience complications from cataract surgery or develop chronic conditions like diabetes, which can further contribute to corneal deterioration. As the Middle East and Africa population ages, the number of individuals requiring biological bufferss is expected to rise, particularly in regions with rapidly aging demographics. This trend is further fueled by increased awareness about the availability and success rates of Biological Bufferss, as well as advancements in surgical techniques that offer better outcomes and faster recovery times for older patients. As a result, the growing geriatric population is a major factor driving the expansion of the Middle East and Africa biological buffers market, highlighting the need for accessible and effective treatment options for age-related corneal diseases.

Restraint/Challenge

- Alternative Technologies and Approaches for Inhibiting Biological Buffers

The biological buffer market faces substantial challenges due to the rise of alternative methodologies and advanced techniques, such as label-free detection and microfluidics, which allow for precise interactions without the need for traditional blocking buffers, thereby reducing background noise. Innovations in immunoassays, including multiplexing, improve specificity and further lessen dependence on conventional blocking strategies. Moreover, the application of nanotechnology for targeted binding complicates the traditional role of biological buffers. As these alternatives gain traction, offering cost-effective solutions, they may introduce background noise in sensitive assays, creating a dual challenge. As these methods become more widely accepted in research and clinical applications, the market is under pressure to innovate and adapt, potentially shifting demand and altering the competitive landscape.

For instance,

- In July 2021, according to the article published in Springer Nature Limited, Cell-free gene expression (CFE) offers an alternative to traditional cell-based methods for protein synthesis and labeling in structural biology and proteomics. This innovative approach enhances specificity and reduces non-specific interactions, presenting a challenge in the blocking buffer market as demand shifts towards more efficient methodologies

- In March 2024, according to the article published in MDPI, the synthesis of fully synthetic copolymers based on pHPMA or poly(2-oxazoline), designed to suppress non-specific interactions. These copolymers could serve as potential replacements for BSA or other proteins in diagnostic assays, presenting a significant challenge in the blocking buffer market

- In August 2023, according to the article published in MDPI, the enhanced immunoblotting process by simplifying gel preparation, optimizing the electrophoresis buffer, and substituting methanol with ethanol to improve safety. These modifications boost efficiency nearly four-fold, allowing even low-quality antibodies to be visualized effectively. This innovation presents a challenge in the blocking buffer market.

Biological Buffers Market Scope

The Middle East and Africa biological buffers market is categorized into four notable segments based on buffers type, formulation, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Buffers Type

- Goods Buffers

- Tris Buffers

- Tris (Tris(Hydroxymethyl)Aminomethane)

- Tris NA

- Tris-HCL

- Hepes Buffers

- Hepes

- Hepes NA

- Mops Buffers

- Mops

- Mops NA

- Mes Buffers

- MES

- MES NA

- Bis-Tris Buffers

- BIS-TRIS

- Bis-TRIS HCL

- Others

- Tris Buffers

- Other Salt-Based Buffers

- Phosphate Buffers

- Phosphate Buffered Saline (PBS)

- Sodium Phosphate

- Potassium Phosphate

- Acetate Buffers

- Sodium Acetate

- Potassium Acetate

- Citrate Buffers

- Sodium Citrate

- Citric Acid

- Amino Acid Buffers

- Glycine Buffer

- Histidine Buffer

- Phosphate Buffers

Formulation

- Powder

- Liquid

Application

- Pharmaceutical & Biopharmaceuticals

- Drug Development

- Vaccine Formulation

- Biologics Manufacturing

- Cell Culture & Molecular Biology

- PCR & Electrophoresis

- Cell Culture Media Preparation

- DNA & RNA Isolation

- Protein Purification

- Clinical & Diagnostic Applications

- In-Vitro Diagnostics (IVD)

- Clinical Testing Kits

- Chemical & Industrial Applications

- Biotechnology Research

- Food & Beverage Processing

- Others

End User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Research & Academic Institutes

- Diagnostic Laboratories

- Contract Research Organizations (CROS) & CMOS

Biological Buffers Market Regional Analysis

Biological buffers market is analyzed, and market size insights and trends are provided by based on buffer type, formulation, application, and end user.

The countries covered in this market report are South Africa, Saudi Arabia, U.A.E., Egypt, Kuwait, Israel, rest of Middle East and Africa.

South Africa is expected to dominate the market due to high R&D spending, key market player presence, advanced infrastructure, a strong healthcare system, and stringent regulations.

South Africa is expected to be the fastest growing market due to its increasing healthcare spending, expanding pharmaceutical industry with a developing healthcare infrastructure and a rising prevalence.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Biological Buffers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Biological Buffers Market Leaders operating in the market are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bio-Rad Laboratories, Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- Takara Bio Inc. (Japan), Merck KGaA (Germany),

- Avantor, Inc. (U.S.)

- Advancion Corporation (U.S.)

- Santa Cruz Biotechnology Inc. (U.S.)

- MP Biomedicals (U.S.)

- Promega Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

- QIAGEN (Germany)

- HiMedia Laboratories (India)

- Cayman Chemical (U.S.)

- Biosynth (Switzerland)

- SERVA Electrophoresis GmbH (Germany)

- FUJIFILM Wako Pure Chemical Corporation (Japan)

- Reagecon Diagnostics Ltd (Ireland)

- GoldBio (U.S.)

- nacalai.com (Japan)

- HOPAX (Taiwan)

Latest Developments in Biological Buffers Market

- In February 2024, Roche entered into collaboration agreement with PathAI to expand digital pathology capabilities for companion diagnostics. The collaboration provides Roche with PathAI’s advanced AI technology for improving companion diagnostics. It ensures exclusive, tailored solutions and accelerates algorithm development while allowing Roche to continue developing its own diagnostics

- In July 2024, Roche announced the successful acquisition of LumiraDx’s Point of Care technology, following the necessary antitrust and regulatory approvals. This integration enhanced Roche’s diagnostics portfolio with a user-friendly platform that consolidates various immunoassay and clinical chemistry tests. The acquisition aimed to improve access to diagnostic testing, particularly in primary care and underserved regions, aligning with Roche's commitment to decentralised healthcare solutions

- En juillet 2023, Bio-Rad et QIAGEN ont annoncé un accord de règlement de brevets et de licences croisées mettant fin à des litiges en cours concernant des technologies spécifiques. Ce partenariat permet aux deux entreprises d'enrichir leurs portefeuilles de produits et d'accélérer l'innovation dans le secteur des sciences de la vie, bénéficiant ainsi à leurs clients en leur offrant un accès plus large à des technologies de pointe et à des solutions améliorées en recherche et en diagnostic.

- En mai 2023, Thermo Fisher et BRIN se sont associés pour améliorer les capacités de recherche en Indonésie, en se concentrant sur l'avancement de l'innovation scientifique et de la collaboration dans les sciences de la vie, la biotechnologie et les études environnementales pour les chercheurs locaux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFER MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE U.S.

5.2 REGULATORY SUBMISSIONS

5.3 INTERNATIONAL HARMONIZATION

5.4 EUROPE REGULATORY SCENARIO

5.5 REGULATORY SUBMISSIONS

5.6 INTERNATIONAL HARMONIZATION

5.7 JAPAN REGULATORY SCENARIO

5.8 REGULATORY SUBMISSIONS

5.9 INTERNATIONAL HARMONIZATION

5.1 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT

6.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS

6.2 RESTRAINTS

6.2.1 LIMITED SHELF LIFE OF BLOCKING BUFFERS

6.2.2 POTENTIAL OF CONTAMINATION OR BATCH INCONSISTENCIES FOR BIOLOGICAL BUFFERS

6.3 OPPORTUNITY

6.3.1 INCREASE IN PUBLIC-PRIVATE FUNDING IN BIOMEDICAL RESEARCH

6.3.2 ANALYTICAL METHODS FOR FOOD SAFETY AND ENVIRONMENTAL TESTING.

6.3.3 DIAGNOSTIC AND CLINICAL APPLICATIONS USE BLOCKING BUFFERS.

6.4 CHALLENGES

6.4.1 ALTERNATIVE TECHNOLOGIES AND APPROACHES FOR INHIBITING BIOLOGICAL BUFFERS.

6.4.2 DISRUPTIONS IN THE SUPPLY CHAIN OF BIOLOGICAL BUFFERS.

7 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE

7.1 OVERVIEW

7.2 GOODS BUFFERS

7.2.1 TRIS BUFFERS

7.2.2 HEPES BUFFERS

7.2.3 MOPS BUFFERS

7.2.4 MES BUFFERS

7.2.5 BIS-TRIS BUFFERS

7.3 OTHER SALT-BASED BUFFERS

7.3.1 PHOSPHATE BUFFERS

7.3.2 ACETATE BUFFERS

7.3.3 CITRATE BUFFERS

7.3.4 AMINO ACID BUFFERS

8 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PHARMACEUTICAL & BIOPHARMACEUTICALS

9.3 CELL CULTURE & MOLECULAR BIOLOGY

9.4 CLINICAL & DIAGNOSTIC APPLICATIONS

9.5 CHEMICAL & INDUSTRIAL APPLICATIONS

9.6 OTHERS

10 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

10.3 BIOTECHNOLOGY COMPANIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 DIAGNOSTIC LABORATORIES

10.6 CONTRACT RESEARCH ORGANIZATIONS (CROS) & CMOS

11 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 UAE

11.1.4 EGYPT

11.1.5 KUWAIT

11.1.6 ISRAEL

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT

14 COMPANY PROFILES

14.1 F. HOFFMANN-LA ROCHE LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 BIO-RAD LABORATORIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 THERMO FISHER SCIENTIFIC, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 TAKARA BIO INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 MERCK KGAA, DARMSTADT, GERMANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ADVANCION CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BECKMAN COULTER

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 BIOSYNTH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FUJIFILM WAKO PURE CHEMICAL CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GOLDBIO

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HOPAX

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HIMEDIA LABORATORIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MP BIOMEDICALS.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NACALAI TESQUE, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PROMEGA CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 REAGECON DIAGNOSTICS LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SANTA CRUZ BIOTECHNOLOGY INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 SERVA ELECTROPHORESIS GMBH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 TEVA PHARMACEUTICALS USA, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND

TABLE 6 MIDDLE EAST AND AFRICA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWDER IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA LIQUID IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION,2018-2035 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA BIOTECHNOLOGY COMPANIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA RESEARCH & ACADEMIC INSTITUTES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DIAGNOSTIC LABORATORIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CONTRACT RESEARCH ORGANIZATIONS (CROS) IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY COUNTRY, 2018-2035 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 54 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 55 SOUTH AFRICA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 56 SOUTH AFRICA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 57 SOUTH AFRICA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 58 SOUTH AFRICA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 59 SOUTH AFRICA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 60 SOUTH AFRICA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 61 SOUTH AFRICA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 62 SOUTH AFRICA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 63 SOUTH AFRICA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 64 SOUTH AFRICA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 65 SOUTH AFRICA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 66 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 67 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 68 SOUTH AFRICA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 69 SOUTH AFRICA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 70 SOUTH AFRICA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 71 SOUTH AFRICA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 72 SOUTH AFRICA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 73 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 74 SAUDI ARABIA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 75 SAUDI ARABIA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 76 SAUDI ARABIA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 77 SAUDI ARABIA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 78 SAUDI ARABIA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 79 SAUDI ARABIA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 80 SAUDI ARABIA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 81 SAUDI ARABIA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 82 SAUDI ARABIA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 83 SAUDI ARABIA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 84 SAUDI ARABIA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 85 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 86 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 87 SAUDI ARABIA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 88 SAUDI ARABIA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 89 SAUDI ARABIA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 90 SAUDI ARABIA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 91 SAUDI ARABIA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 92 UAE BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 93 UAE GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 94 UAE TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 95 UAE HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 96 UAE MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 97 UAE MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 98 UAE BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 99 UAE OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 100 UAE PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 101 UAE ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 102 UAE CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 103 UAE AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 104 UAE BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 105 UAE BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 106 UAE PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 107 UAE CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 108 UAE CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 109 UAE CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 110 UAE BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 111 EGYPT BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 112 EGYPT GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 113 EGYPT TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 114 EGYPT HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 115 EGYPT MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 116 EGYPT MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 117 EGYPT BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 118 EGYPT OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 119 EGYPT PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 120 EGYPT ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 121 EGYPT CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 122 EGYPT AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 123 EGYPT BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 124 EGYPT BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 125 EGYPT PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 126 EGYPT CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 127 EGYPT CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 128 EGYPT CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 129 EGYPT BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 130 KUWAIT BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 131 KUWAIT GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 132 KUWAIT TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 133 KUWAIT HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 134 KUWAIT MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 135 KUWAIT MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 136 KUWAIT BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 137 KUWAIT OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 138 KUWAIT PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 139 KUWAIT ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 140 KUWAIT CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 141 KUWAIT AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 142 KUWAIT BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 143 KUWAIT BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 144 KUWAIT PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 145 KUWAIT CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 146 KUWAIT CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 147 KUWAIT CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 148 KUWAIT BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 149 ISRAEL BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 150 ISRAEL GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 151 ISRAEL TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 152 ISRAEL HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 153 ISRAEL MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 154 ISRAEL MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 155 ISRAEL BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 156 ISRAEL OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 157 ISRAEL PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 158 ISRAEL ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 159 ISRAEL CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 160 ISRAEL AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 161 ISRAEL BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 162 ISRAEL BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 163 ISRAEL PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 164 ISRAEL CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 165 ISRAEL CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 166 ISRAEL CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 167 ISRAEL BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 168 REST OF MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: SEGMENTATION

FIGURE 11 RISING PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET GROWTH IN THE FORECAST PERIOD OF 2025 TO 2035

FIGURE 12 GOODS BUFFERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET IN THE FORECAST PERIOD OF 2025 & 2035

FIGURE 13 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 DROC

FIGURE 16 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, 2024

FIGURE 17 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, 2025-2035 (USD THOUSAND)

FIGURE 18 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, CAGR (2025-2035)

FIGURE 19 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, LIFELINE CURVE

FIGURE 20 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, 2024

FIGURE 21 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, 2025-2035 (USD THOUSAND)

FIGURE 22 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, CAGR (2025-2035)

FIGURE 23 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 24 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, 2025-2035 (USD THOUSAND)

FIGURE 26 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, CAGR (2025-2035)

FIGURE 27 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, 2024

FIGURE 29 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, 2025-2035 (USD THOUSAND)

FIGURE 30 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, CAGR (2025-2035)

FIGURE 31 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: SNAPSHOT (2024)

FIGURE 33 MIDDLE EAST AND AFRICA BIOLOGICAL BUFFERS MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.