Middle East And Africa Courier Market

Taille du marché en milliards USD

TCAC :

%

USD

26.83 Billion

USD

43.09 Billion

2025

2033

USD

26.83 Billion

USD

43.09 Billion

2025

2033

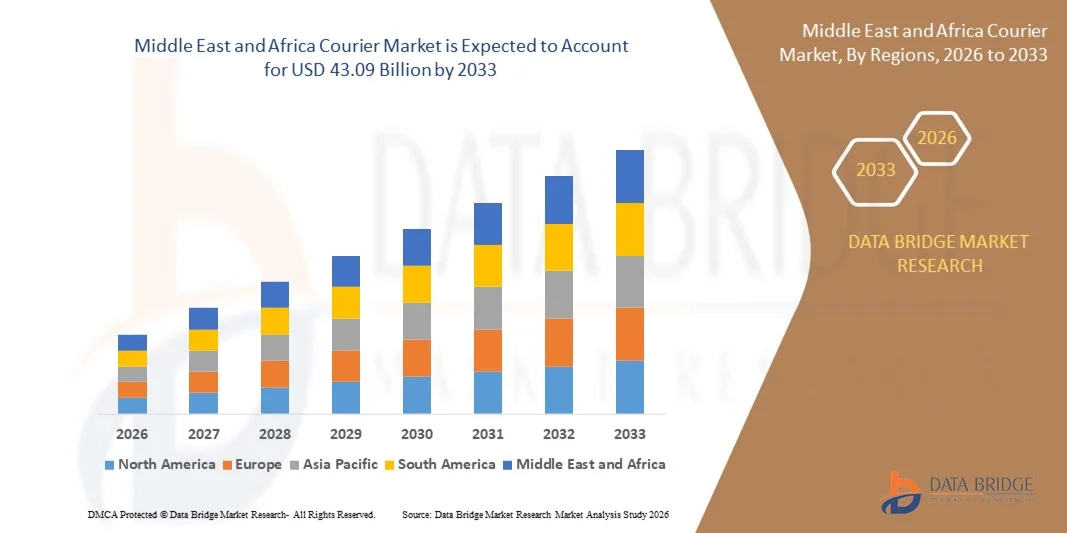

| 2026 –2033 | |

| USD 26.83 Billion | |

| USD 43.09 Billion | |

|

|

|

|

Middle East and Africa Courier Market Segmentation, By Type (Outbound and Inbound), Delivery Mode (Normal Delivery and Express Delivery), Customer Type (B2B (Business-To-Business), B2C (Business-To-Consumer) and Consumer-To-Consumer (C2C)), Destination (Domestic and International/Cross-Border), End User (Wholesale and Retail Trade (E-Commerce), Medical Courier, Manufacturing, Services (BFSI), Construction, Utilities, and Primary Industries) - Industry Trends and Forecast to 2033

Middle East and Africa Courier Market Size

- The Middle East and Africa courier market size was valued at USD 26.83 billion in 2025 and is expected to reach USD 43.09 billion by 2033, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce and online retail platforms, driving higher demand for fast, reliable, and technology-enabled delivery services across both urban and rural areas

- Furthermore, rising consumer expectations for same-day, next-day, and contactless deliveries, coupled with the adoption of advanced tracking, route optimization, and automated sorting technologies, are establishing courier services as essential components of modern commerce. These converging factors are accelerating the uptake of courier and logistics solutions, thereby significantly boosting the industry's growth

Middle East and Africa Courier Market Analysis

- Courier services, providing fast and reliable delivery of parcels, documents, and goods, are increasingly vital components of supply chain and e-commerce operations due to their efficiency, flexibility, and integration with digital platforms

- The escalating demand for courier services is primarily fueled by the growth of e-commerce, increasing urbanization, rising smartphone and internet penetration, and consumer preference for convenient, door-to-door delivery options

- Israel dominated the courier market in 2025, due to its advanced logistics infrastructure, high smartphone penetration, and growing e-commerce adoption

- Saudi Arabia is expected to be the fastest growing country in the courier market during the forecast period due to rapid e-commerce growth, government-backed logistics investments, and rising consumer preference for reliable delivery services

- Outbound segment dominated the market with a market share of 61.3% in 2025, due to the high volume of shipments sent by businesses, e-commerce platforms, manufacturers, and service providers to end customers. Growth in online retail, cross-border trade, and direct-to-consumer business models continues to fuel outbound parcel movement globally. Courier companies focus heavily on outbound logistics optimization to ensure timely delivery, cost efficiency, and customer satisfaction

Report Scope and Courier Market Segmentation

|

Attributes |

Courier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Courier Market Trends

Increasing Shift Toward Digitalized, High-Speed, and Technology-Driven Courier Services

- A significant trend in the courier market is the growing shift toward technology-enabled, high-speed delivery solutions, driven by the rapid expansion of e-commerce, online retail, and increasing consumer expectations for fast and reliable service. Companies are investing heavily in digital platforms, automation, and tracking systems to streamline operations and improve customer experience across urban and semi-urban areas

- For instance, DHL has implemented automated sorting centers and advanced route optimization software to enhance delivery speed and reduce operational inefficiencies. These technology-driven solutions strengthen service reliability and allow real-time monitoring of parcels from dispatch to delivery

- The adoption of AI-powered logistics platforms is rising, enabling predictive delivery times, route optimization, and enhanced last-mile connectivity. This positions courier services as essential enablers of efficient supply chain operations and customer satisfaction

- The healthcare and pharmaceutical sectors are increasingly relying on courier services for timely delivery of critical medicines, vaccines, and laboratory samples. Companies such as FedEx and UPS provide temperature-controlled and priority delivery solutions that ensure safe and prompt transportation

- Retailers are expanding their use of digitalized courier networks to support same-day and next-day delivery models, leveraging tracking systems, mobile applications, and automated dispatch to meet rising consumer demand. This trend is accelerating market adoption of technology-integrated delivery services

- The market is witnessing strong growth in international express and cross-border logistics services, where digital platforms, customs clearance automation, and integrated tracking solutions are critical. Rising global trade, online shopping across borders, and demand for fast international shipping reinforce the overall transition toward digitalized, technology-driven courier services

Middle East and Africa Courier Market Dynamics

Driver

Rapid E-Commerce Growth and Rising Demand for Fast Delivery

- The rapid expansion of e-commerce platforms, increased online shopping penetration, and rising consumer expectations for timely deliveries are driving strong demand for courier services. Technology-enabled solutions, real-time tracking, and flexible delivery options are creating opportunities for market growth

- For instance, Amazon Logistics leverages sophisticated AI, robotics, and predictive analytics to manage high-volume deliveries and provide fast, reliable last-mile services. These capabilities enable the company to meet growing demand for same-day and next-day deliveries across multiple regions

- Rising urbanization, increased smartphone and internet usage, and consumer preference for convenience further accelerate courier adoption. Businesses across sectors are increasingly relying on digitalized logistics networks to ensure timely delivery and operational efficiency

- The growing importance of supply chain reliability, particularly for high-value and perishable goods, reinforces the need for advanced courier services. Companies are integrating cloud-based tracking, automated sorting, and route optimization to maintain performance and customer trust

- The expansion of e-commerce marketplaces and direct-to-consumer models is intensifying the demand for scalable, tech-driven courier solutions. This sustained reliance on high-speed, reliable delivery services positions the market for continued growth

Restraint/Challenge

High Operational Costs and Infrastructure Constraints

- The courier market faces challenges due to the high cost of infrastructure, vehicle fleets, automated sorting centers, and technology investments required to meet rising delivery demand. These factors increase overall operational expenses and limit profit margins for providers

- For instance, Blue Dart and FedEx encounter significant costs associated with last-mile delivery, warehouse automation, and integration of digital tracking systems. Maintaining service quality while controlling costs remains a key operational challenge

- Limited logistics infrastructure in semi-urban and rural regions poses delivery bottlenecks, impacting speed and efficiency. Expansion into these areas requires significant investment in transportation networks and technology-enabled delivery systems

- Rising fuel costs, labor shortages, and fluctuating maintenance expenses further contribute to operational challenges for courier providers. Balancing cost management with service reliability is critical for sustaining market competitiveness

- The market continues to face constraints in scaling high-speed, technology-driven delivery networks while maintaining affordability and efficiency. These challenges collectively require innovative solutions, partnerships, and infrastructure investments to meet growing consumer expectations

Middle East and Africa Courier Market Scope

The market is segmented on the basis of type, delivery mode, customer type, destination, and end user.

- By Type

On the basis of type, the courier market is segmented into Outbound and Inbound services. The Outbound segment dominated the market with an estimated 61.3% share in 2025, driven by the high volume of shipments sent by businesses, e-commerce platforms, manufacturers, and service providers to end customers. Growth in online retail, cross-border trade, and direct-to-consumer business models continues to fuel outbound parcel movement globally. Courier companies focus heavily on outbound logistics optimization to ensure timely delivery, cost efficiency, and customer satisfaction.

The Inbound segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising return shipments, reverse logistics, supplier deliveries, and inbound inventory replenishment. Increasing focus on efficient supply chain management and inventory optimization is accelerating demand for inbound courier services.

- By Delivery Mode

Based on delivery mode, the courier market is segmented into Normal Delivery and Express Delivery. The Normal Delivery segment held the largest market share of 54.8% in 2025, owing to its cost-effectiveness and widespread usage for non-urgent shipments across retail, manufacturing, and service sectors. Businesses continue to rely on standard delivery options to manage logistics costs while ensuring reliable service.

The Express Delivery segment is projected to register the fastest growth rate during 2026–2033, driven by rising consumer demand for same-day, next-day, and time-definite deliveries. Expansion of e-commerce, food delivery, healthcare logistics, and premium services is significantly boosting adoption of express courier solutions.

- By Customer Type

On the basis of customer type, the courier market is segmented into B2B (Business-to-Business), B2C (Business-to-Consumer), and Consumer-to-Consumer (C2C). The B2B segment dominated the market with a 46.5% share in 2025, supported by high shipment volumes across manufacturing, wholesale trade, pharmaceuticals, BFSI, and industrial supply chains. Reliable, scheduled, and contract-based courier services continue to drive strong B2B demand.

The B2C segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid expansion of e-commerce, digital marketplaces, and direct-to-consumer brands. Increasing consumer expectations for fast, trackable, and flexible delivery options are accelerating growth in B2C courier services.

- By Destination

Based on destination, the courier market is segmented into Domestic and International/Cross-Border deliveries. The Domestic segment accounted for the largest market share of 63.9% in 2025, driven by high intra-country parcel volumes, urban deliveries, and expansion of national e-commerce and retail networks. Efficient last-mile infrastructure and local courier networks support strong domestic demand.

The International/Cross-Border segment is anticipated to grow at the fastest CAGR from 2026 to 2033, supported by increasing global trade, cross-border e-commerce, and international shipping of documents and parcels. Improvements in customs processing, digital documentation, and international logistics networks are accelerating cross-border courier growth.

- By End User

On the basis of end user, the courier market is segmented into Wholesale and Retail Trade (E-Commerce), Medical Courier, Manufacturing, Services (BFSI), Construction, Utilities, and Primary Industries. The Wholesale and Retail Trade (E-Commerce) segment dominated the market with a 49.2% share in 2025, driven by massive parcel volumes generated by online shopping platforms, omnichannel retail, and digital marketplaces. Continuous growth in online consumer spending supports sustained demand.

The Medical Courier segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by rising demand for time-sensitive delivery of pharmaceuticals, diagnostic samples, medical equipment, and healthcare supplies. Increasing focus on healthcare logistics reliability and compliance is strengthening adoption.

Middle East and Africa Courier Market Regional Analysis

- Israel dominated the courier market with the largest revenue share in 2025, driven by its advanced logistics infrastructure, high smartphone penetration, and growing e-commerce adoption

- Robust government initiatives supporting digital commerce, investment in smart logistics hubs, and streamlined customs regulations reinforce Israel’s leadership in the regional market

- The presence of leading domestic courier providers, collaborations with global e-commerce platforms, and the deployment of technology-driven delivery solutions continue to consolidate Israel’s dominant position during the forecast period. Expanding urbanization, rising demand for same-day and next-day deliveries, and adoption of automated sorting and tracking systems further strengthen market penetration across major cities

Saudi Arabia Courier Market Insight

Saudi Arabia is projected to register the fastest CAGR in the Middle East & Africa courier market during 2026–2033, fueled by rapid e-commerce growth, government-backed logistics investments, and rising consumer preference for reliable delivery services. Growing urban populations, increasing smartphone and internet penetration, and expanding retail networks are accelerating courier adoption. The demand for cost-effective, technology-enabled, and same-day delivery solutions is particularly strong among young online shoppers. Partnerships between domestic logistics providers and global courier companies are enhancing service coverage and operational efficiency. Government initiatives such as Vision 2030 and support for digital commerce ensure Saudi Arabia’s emergence as the fastest-growing market in the region.

U.A.E. Courier Market Insight

The U.A.E. market is anticipated to grow steadily from 2026 to 2033, supported by its advanced infrastructure, thriving e-commerce sector, and strong logistics ecosystem. U.A.E. consumers increasingly prefer premium and technology-driven courier services offering real-time tracking, secure delivery, and flexible time slots. Rising investments in automated warehouses, smart sorting centers, and last-mile delivery solutions are enhancing service efficiency. Collaborations between U.A.E.-based courier companies and global logistics providers are reinforcing market growth. The country’s strategic location, business-friendly policies, and focus on innovation underpin its strong regional positioning.

Middle East and Africa Courier Market Share

The courier industry is primarily led by well-established companies, including:

- FedEx (U.S.)

- Deutsche Post AG (Germany)

- United Parcel Service of America, Inc. (UPS) (U.S.)

- SF Express (China)

- Royal Mail Group Limited (U.K.)

- Yamato Transport Co., Ltd. (Japan)

- Koninklijke PostNL (Netherlands)

- Aramex (U.A.E.)

- Singapore Post Limited (Singapore)

- Sagawa Express Co., Ltd. (Japan)

- Qantas Airways Limited (Australia)

- Allied Express (Australia)

- Unique Air Express (India)

- Gati-Kintetsu Express Private Limited (India)

- DTDC Express Limited (India)

- Hermes Europe GmbH (Germany)

- GO! Express & Logistics (Deutschland) GmbH (Germany)

- GEODIS (France)

- Delhivery Pvt Ltd (India)

- LaserShip Inc (U.S.)

Latest Developments in Middle East and Africa Courier Market

- In June 2025, JD.com launched its first self-operated international express service to strengthen its global logistics presence and compete directly with established courier leaders. This move reflects JD.com’s ambition to expand cross-border delivery capabilities and enhance control over international supply chains

- In May 2025, DHL eCommerce U.K. merged with Evri to create a large-scale delivery network handling over one billion parcels annually across the country. This merger highlights industry consolidation aimed at improving last-mile efficiency, delivery speed, and nationwide coverage

- In February 2024, Emirates Post Group, rebranded as 7X, introduced EMX as a new subsidiary focused on transforming the courier, express, and parcel industry in the U.A.E. through advanced technologies and customer-centric logistics solutions. This initiative underscores the group’s strategy to modernize CEP services and strengthen regional competitiveness

- In May 2023, Interroll launched its High Performance Conveyor Platform designed specifically for courier, express, and parcel operations, featuring intelligent diverter modules and high-throughput sorting capabilities. This development demonstrates the growing importance of automation and efficiency in large-scale parcel handling environments

- In November 2022, DHL Express opened a fully automated digital service point at Dubai Digital Park, marking the first such facility in the Middle East and within DHL’s global network. This launch set a new benchmark for automated customer service and reinforced DHL’s leadership in logistics innovation

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.