Middle East And Africa Flame Retardant For Electronic Electrical And Appliances Market

Taille du marché en milliards USD

TCAC :

%

395,113.82 Thousand

506,893.99 Thousand

2024

2032

395,113.82 Thousand

506,893.99 Thousand

2024

2032

| 2025 –2032 | |

| Dollars américains 395,113.82 Thousand | |

| Dollars américains 506,893.99 Thousand | |

|

|

|

|

Marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique, par type (non halogéné et halogéné), plastique (PC, ABS, PP, PE, PS et autres), utilisation finale (électricité et électronique, appareils électroménagers et appareils professionnels) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des produits ignifuges pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique

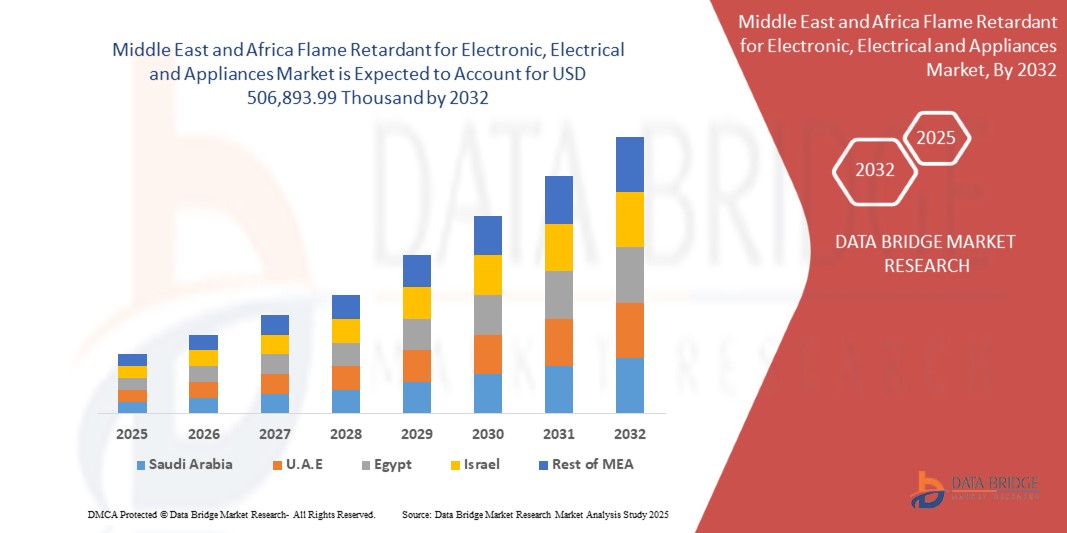

- La taille du marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique était évaluée à 395 113,82 milliers USD en 2024 et devrait atteindre 506 893,99 milliers USD d'ici 2032 , à un TCAC de 3,24 % au cours de la période de prévision.

- Cette croissance est tirée par des facteurs tels que la demande croissante d’électronique grand public et son utilisation croissante dans les applications industrielles et commerciales.

Analyse du marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique

- Les retardateurs de flamme pour composants électroniques, électriques et électroménagers sont utilisés pour réduire ou prévenir les risques d'incendie dans les composants électroniques, électriques et électroménagers. Ces substances sont essentielles pour améliorer la sécurité incendie de produits tels que les circuits imprimés, les câbles, les connecteurs et les boîtiers d'appareils électroménagers.

- La demande pour ces microscopes est considérablement stimulée par l'utilisation croissante dans les applications industrielles et commerciales et l'expansion des infrastructures électriques.

- L'Arabie saoudite devrait dominer le marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers en raison de sa base industrielle croissante, de la demande croissante de produits électroniques et de l'augmentation des activités de fabrication dans le pays.

- L'Arabie saoudite devrait être le pays connaissant la croissance la plus rapide sur le marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers au cours de la période de prévision en raison d'une industrialisation rapide, l'accent étant mis sur l'expansion de ses secteurs de fabrication d'électronique, d'électricité et d'appareils électroménagers.

- Le segment non halogéné devrait dominer le marché avec une part de marché de 61,14 % en raison des préoccupations environnementales croissantes, des réglementations plus strictes concernant l'utilisation de produits chimiques halogénés et de la demande croissante d'alternatives plus sûres et plus durables.

Portée du rapport et segmentation du marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers

|

Attributs |

Retardateur de flamme pour l'électronique, l'électricité et les appareils électroménagers - Principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique

« Progrès dans les microscopes opératoires et la visualisation 3D pour la chirurgie intraoculaire »

- Une tendance importante dans l’évolution des microscopes opératoires et des systèmes de visualisation 3D pour la chirurgie intraoculaire est l’intégration croissante d’optiques avancées et d’améliorations numériques.

- Ces innovations améliorent la précision chirurgicale en offrant une visualisation haute définition et en temps réel des structures intraoculaires, améliorant ainsi la précision des procédures délicates.

- Par exemple, les systèmes de visualisation 3D modernes offrent une perception de la profondeur supérieure, permettant aux chirurgiens de naviguer dans l’anatomie intraoculaire complexe avec plus de clarté, ce qui est particulièrement bénéfique pour les chirurgies vitréo-rétiniennes et les procédures mini-invasives du glaucome.

- Ces avancées transforment la chirurgie intraoculaire, améliorent les résultats des patients et stimulent la demande de microscopes chirurgicaux de nouvelle génération dotés de capacités de visualisation de pointe.

Dynamique du marché des retardateurs de flamme pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique

Conducteur

« Demande croissante en électronique grand public »

- La demande d'appareils électroniques tels que les smartphones, les tablettes, les ordinateurs portables, les téléviseurs et les appareils électroménagers intelligents a considérablement augmenté.

- Ces appareils nécessitent un assemblage complexe de composants, de cartes de circuits imprimés (PCB), de connecteurs, de boîtiers et de fils, qui doivent tous être conformes à des normes de sécurité incendie strictes pour prévenir les incendies électriques et améliorer la sécurité de l'utilisateur final.

- Dans les marchés émergents, l’augmentation des revenus disponibles et la pénétration croissante d’Internet entraînent des taux d’adoption plus élevés de l’électronique personnelle

Par exemple,

- En juillet 2023, conformément au ministère de l'Écologie, les fabricants ont ajouté des retardateurs de flamme aux boîtiers en plastique des appareils électroniques, tels que les téléviseurs et les ordinateurs, afin de respecter les normes d'inflammabilité et de réduire les risques d'incendie. Cette pratique permet d'éviter la propagation des flammes en cas de dysfonctionnement interne.

- L'essor du secteur de l'électronique grand public accélère considérablement la demande mondiale de retardateurs de flamme. À mesure que les appareils deviennent plus intégrés, compacts et répandus, le besoin de matériaux ignifuges avancés, sûrs et durables ne fera que croître, positionnant le marché des retardateurs de flamme comme un moteur essentiel de la sécurité et de l'innovation dans l'électronique.

Opportunité

« Innovation technologique dans les centres de données et les infrastructures 5G »

- Le déploiement de la technologie 5G et l'expansion des centres de données stimulent la demande de matériaux ignifuges hautes performances dans le secteur électrique et électronique (E&E).

- Le nombre croissant de centres de données, qui abritent des serveurs et des équipements électriques de grande capacité, amplifie le besoin de matériaux ignifuges.

- Avec la densité accrue des composants dans les centres de données modernes, le risque d'incendies électriques augmente, ce qui rend les câbles et les circuits imprimés ignifuges essentiels pour la sécurité incendie et la conformité réglementaire.

Par exemple,

- En août 2024, l'Union internationale des télécommunications (UIT) a souligné la nécessité de matériaux ignifuges pour la construction des stations de base et des équipements 5G. La technologie 5G nécessitant des infrastructures plus denses et des composants électriques plus puissants, l'utilisation de câbles et de circuits imprimés ignifuges devient essentielle pour prévenir les risques d'incendie dans les environnements à forte densité. Cette exigence de normes de sécurité entraîne une demande accrue de matériaux ignifuges pour les infrastructures 5G.

- Pour répondre aux exigences des réseaux 5G et des centres de données, les fabricants se tournent vers des matériaux ignifuges avancés, notamment des solutions sans halogène et à faible toxicité. Ces innovations améliorent la sécurité incendie tout en minimisant l'impact environnemental. Avec la croissance continue des infrastructures 5G et des centres de données, la demande de composants ignifuges va augmenter, offrant ainsi d'importantes opportunités pour le marché des matériaux ignifuges.

Retenue/Défi

« Défis du recyclage dus à la contamination et aux limitations de traitement »

- L'utilisation croissante de matériaux ignifuges dans diverses industries a entraîné des défis importants dans le recyclage de ces matériaux, notamment en raison de la contamination et des limites des capacités de traitement.

- Des produits chimiques ignifuges, tels que les composés bromés et chlorés, sont souvent ajoutés aux plastiques, aux textiles et aux composants électroniques pour réduire leur inflammabilité. Cependant, ces substances compliquent le processus de recyclage en raison de leurs propriétés chimiques.

- La présence de retardateurs de flamme peut contaminer les matériaux recyclés, les rendant impropres à la réutilisation dans de nouveaux produits. Le processus de recyclage implique généralement le broyage, la fusion et le remoulage des matériaux. Cependant, la présence de retardateurs de flamme peut libérer des fumées toxiques ou provoquer des réactions chimiques indésirables lors de ces étapes, rendant les matériaux dangereux pour les produits de consommation.

Par exemple,

- En mai 2024, un rapport de l'Agence suédoise de protection de l'environnement a abordé l'inquiétude croissante suscitée par la présence de produits chimiques ignifuges dans les textiles et les produits plastiques. L'agence a souligné que l'utilisation de ces produits chimiques dans les biens de consommation créait des obstacles au recyclage des déchets post-consommation, notamment dans les vêtements et les emballages plastiques. Le défi est particulièrement important dans l'industrie textile, où les taux de recyclage sont faibles et où la présence de retardateurs de flamme complique encore davantage le processus.

- Par conséquent, pour garantir la durabilité, les innovations dans les retardateurs de flamme plus sûrs et recyclables et les technologies de recyclage améliorées sont essentielles pour atténuer les risques environnementaux et sanitaires.

Portée du marché des produits ignifuges pour l'électronique, l'électricité et les appareils électroménagers au Moyen-Orient et en Afrique

Le marché est segmenté en fonction de l'application, du type de produit, de la technologie, du type de grossissement, de l'utilisateur final et du canal de distribution.

|

Segmentation |

Sous-segmentation |

|

Par type |

|

|

Par plastique |

|

|

Par utilisation finale |

|

En 2025, le segment des non-halogénés devrait dominer le marché avec la plus grande part de marché.

The non-halogenated segment is expected to dominate the Flame retardant for electronic, electrical and appliances market with the largest share of 61.14% in 2025 due to its excellent thermal stability, high impact resistance, and optical clarity, making it an ideal choice for electronic, electrical and appliances applications.

The PC is expected to account for the largest share during the forecast period in plastic segment

In 2025, the PC segment is expected to dominate the market with the largest market share of 36.92% due to its excellent thermal stability, high impact resistance, and optical clarity, making it an ideal choice for electronic, electrical and appliances applications.

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Regional Analysis

“Saudi-Arabia Holds the Largest Share in the Flame retardant for electronic, electrical and appliances Market”

- Saudi-Arabia dominates the Flame retardant for electronic, electrical and appliances market, driven by rapid industrialization, a high concentration of electronics and electrical manufacturing, and strong demand for consumer electronics

- The Saudi-Arabia holds a significant share due to its robust electronics and appliance manufacturing base, favorable government policies, and increasing domestic consumption

- The country benefits from well-established supply chains, availability of raw materials, and the presence of leading Middle East and Africa manufacturers

- In addition, the Increasing awareness regarding fire safety regulations and the need for flame retardant materials in household and industrial electronic products further fuels market expansion

“Saudi-Arabia is Projected to Register the Highest CAGR in the Flame retardant for electronic, electrical and appliances Market”

- The Saudi-Arabia country is expected to witness the highest growth rate in the Flame retardant for electronic, electrical and appliances market, driven by continuous growth in consumer electronics, increasing adoption of electric and smart appliances, and rising urbanization

- The country is seeing a surge in demand for innovative and high-performance materials, particularly in electronics and appliance manufacturing, as domestic consumption continues to rise

- Additionally, the need for lightweight, durable, and thermally resistant components in electronics and appliances will further fuel the market growth in Saudi Arabia

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF (Germany)

- Clariant (Germany)

- DIC CORPORATION (Japan)

- LANXESS (Germany)

- Plastibends (India)

- Albemarle Corporation (U.S.)

- Ampacet Corporation (U.S.)

- Nouryo (Netherlands)

- Gabriel-Chemie GmbH (Austria)

- Blendcolours (India)

- Americhem (U.S.)

- Tosaf Compounds Ltd (Israel)

Latest Developments in Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market

- In January 2025, BASF's advanced flame-retardant grade of Ultramid T6000 polyphthalamide (PPA) was adopted for terminal block applications, replacing non-FR materials to improve safety in inverter and motor systems of Electric Vehicles (EVs). It supports electrical safety enhancement in electric vehicles, making it a functional upgrade with direct implications for thermal protection, reliability, and compliance in automotive electrical systems.

- In July 2022, BASF and THOR GmbH combined their expertise in non-halogenated flame retardant additives to offer a comprehensive solution that improved sustainability and performance in select plastic compounds while meeting strict fire safety standards.

- In May 2022, BASF expanded its Polyphthalamide (PPA) portfolio with various flame-retardant grades offering high thermal stability, excellent electrical insulation, and low water uptake. These halogen-free materials featured RTI values above 140°C, improved color stability, and enabled safer, more reliable applications across e-mobility, electronics, appliances, and power connectors.

- In October 2023, Clariant inaugurated a new USD 66.78 million Exolit OP flame retardant plant in Daya Bay, China. Aimed at meeting Asia’s demand for sustainable fire protection, the facility enhances local supply capabilities. A second production line is under construction, set to launch in 2024

- In September 2022, Gabriel-Chemie introduced a new series of halogen-free flame retardant masterbatches for the electrical conduits and tubes market, emphasizing the company's commitment to sustainability. These masterbatches comply with flame retardant standard EN 61386, halogen-free standard EN 50642, and low smoke standard IEC 61304-2. Benefits include reduced toxic gas emissions during fires, enhanced recyclability, and minimized corrosion of electronic equipment and machinery

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.4.1 OVERVIEW OF FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES PRICES

4.4.2 FACTORS INFLUENCING PRICING TRENDS

4.4.3 PRICE VOLATILITY AND MARKET OUTLOOK

4.4.4 CONCLUSION

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 RAW MATERIAL COVERAGE

4.8.1 SUPPLY CHAIN CONSIDERATIONS:

4.8.2 ENVIRONMENTAL AND REGULATORY TRENDS:

4.8.3 CONCLUSION:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TARIFFS AND THEIR IMPACT ON MARKET

4.10.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION

4.10.4.4 PRICE PITCHING AND POSITION OF MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.7 REGULATORY INCLINATION

4.10.7.1 GEOPOLITICAL SITUATION

4.10.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.10.7.2.1 FREE TRADE AGREEMENTS

4.10.7.2.2 ALLIANCE ESTABLISHMENTS

4.10.7.3 STATUS ACCREDITATION (INCLUDING MFN)

4.10.7.4 DOMESTIC COURSE OF CORRECTION

4.10.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.10.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.11.1 DEVELOPMENT OF HALOGEN-FREE FLAME RETARDANTS

4.11.2 ECO-FRIENDLY AND SUSTAINABLE FORMULATIONS

4.11.3 NANO-TECHNOLOGY INTEGRATION

4.11.4 SYNERGISTIC ADDITIVE SYSTEMS

4.11.5 SMART AND REACTIVE FLAME RETARDANTS

4.12 WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE) REGULATIONS

4.12.1 RESTRICTION OF HAZARDOUS FLAME RETARDANTS

4.12.2 DESIGN FOR RECYCLING AND ECO-FRIENDLY MATERIALS

4.12.3 EXTENDED PRODUCER RESPONSIBILITY (EPR)

4.12.4 TRANSPARENCY AND MATERIAL DOCUMENTATION

4.12.5 CONCLUSION

4.13 FLAME RETARDANT DATA TABLE

4.14 REQUIREMENT

4.15 DATA SOURCING ANALYSIS

4.15.1 PRIMARY SOURCING

4.15.2 SECONDARY SOURCING

4.15.2.1 CHEMICAL INDUSTRIES

4.15.2.2 SCIENTIFIC RESEARCH

4.15.2.3 ARTICLES & LITERATURE REVIEW

4.15.2.4 AMONG OTHERS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CONSUMER ELECTRONICS

6.1.2 EXPANSION OF ELECTRICAL INFRASTRUCTURE

6.1.3 RISING USE IN INDUSTRIAL AND COMMERCIAL APPLICATIONS

6.2 RESTRAINTS

6.2.1 COMPLEXITY OF MANUFACTURING PROCESS

6.2.2 DEPENDENCY ON RAW MATERIALS FROM SPECIFIC REGIONS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATION IN DATA CENTERS AND 5G INFRASTRUCTURE

6.3.2 ADVANCEMENTS IN ECO-FRIENDLY FLAME RETARDANTS

6.4 CHALLENGES

6.4.1 RECYCLING CHALLENGES DUE TO CONTAMINATION AND PROCESSING LIMITATIONS

6.4.2 HEALTH HAZARDS AND ENVIRONMENTAL TOXICITY

7 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-HALOGENATED

7.3 HALOGENATED

8 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC

8.1 OVERVIEW

8.2 PC

8.3 ABS

8.4 PP

8.5 PE

8.6 PS

8.7 OTHERS

9 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE

9.1 OVERVIEW

9.2 ELECTRICAL AND ELECTRONICS

9.3 HOUSEHOLD APPLIANCES

9.4 PROFESSIONAL APPLIANCES

10 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 SAUDI ARABIA

10.1.2 U.A.E.

10.1.3 SOUTH AFRICA

10.1.4 EGYPT

10.1.5 QATAR

10.1.6 KUWAIT

10.1.7 OMAN

10.1.8 ISRAEL

10.1.9 BAHRAIN

10.1.10 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ALBEMARLE CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 BASF

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 WEIFANG MINGRUN CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 DIC CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 CLARIANT

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 INDUSTRIES PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 AMERICHEM

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMPACET CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BLENDCOLOURS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 CROMEX S/A

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DONGGUAN JIEFU FLAME RETARDANT MATERIAL CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 DOVER CHEMICAL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 GABRIEL-CHEMIE GESELLSCHAFT M.B.H.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 GREEN VIEW TECHNOLOGY AND DEVELOPMENT CO., LTD

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 KANDUI INDUSTRIES PRIVATE LIMITED

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LANXESS

13.15.1 COMPANY SNAPSHOT

13.15.2 RECENT FINANCIALS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 NOURYON

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 PLASTIBLENDS

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SHANDONG HAIWANG CHEMICAL CO., LTD

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 TOSAF COMPOUNDS LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 SOLUTION PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 XINOMER AG

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA -HALOGENATED

TABLE 2 MIDDLE EAST AND AFRICA -NON_HALOGENATED

TABLE 3 MIDDLE EAST AND AFRICA -HALOGENATED

TABLE 4 MIDDLE EAST AND AFRICA -NON_HALOGENATED

TABLE 5 MIDDLE EAST AND AFRICA -HALOGENATED

TABLE 6 MIDDLE EAST AND AFRICA -NON_HALOGENATED

TABLE 7 REGULATORY COVERAGE

TABLE 8 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 10 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PC IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA ABS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PP IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA PE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA OTHERS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 40 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 59 SAUDI ARABIA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 U.A.E. NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.A.E. PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.A.E. CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.A.E. HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.A.E. BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 82 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E. ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E. ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.A.E. ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.A.E. ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.A.E. HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 U.A.E. HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.A.E. PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 U.A.E. PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 93 SOUTH AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AFRICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 110 EGYPT NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 EGYPT ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 EGYPT ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 EGYPT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 EGYPT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 EGYPT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 EGYPT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 127 QATAR NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 QATAR PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 QATAR CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 QATAR HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 QATAR BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 133 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 134 QATAR ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 QATAR ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 QATAR ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 QATAR ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 QATAR HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 QATAR HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 QATAR PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 QATAR PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 KUWAIT NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 KUWAIT PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 KUWAIT CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 KUWAIT HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 KUWAIT BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 150 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 151 KUWAIT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 152 KUWAIT ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 KUWAIT ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 KUWAIT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 KUWAIT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 KUWAIT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 KUWAIT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 KUWAIT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 161 OMAN NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 OMAN PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 OMAN CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 OMAN HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 OMAN BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 167 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 168 OMAN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 OMAN ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 OMAN ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 OMAN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 OMAN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 173 OMAN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 OMAN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 OMAN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 178 ISRAEL NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ISRAEL PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 ISRAEL CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 ISRAEL HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ISRAEL BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 184 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 185 ISRAEL ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 ISRAEL ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 ISRAEL ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ISRAEL ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 ISRAEL HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 190 ISRAEL HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 ISRAEL PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 192 ISRAEL PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 195 BAHRAIN NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 BAHRAIN PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BAHRAIN CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BAHRAIN HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 BAHRAIN BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 201 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 202 BAHRAIN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 BAHRAIN ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BAHRAIN ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 BAHRAIN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 BAHRAIN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 207 BAHRAIN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 BAHRAIN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 209 BAHRAIN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 REST OF MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 REST OF MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 2 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET END USE COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FOR CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE NON-HALOGENATED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 24 TOTAL NUMBER OF MOBILE PHONES SOLD WORLDWIDE EACH YEAR

FIGURE 25 TOP STATES FOR UTILITY- AND SMALL-SCALE SOLAR (COMBINED) CAPACITY AND GENERATION IN 2023

FIGURE 26 MIDDLE EAST AND AFRICA MOTOR VEHICLE SALES BY COUNTRY IN 2021

FIGURE 27 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY TYPE, 2024

FIGURE 28 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY PLASTIC, 2024

FIGURE 29 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY END USE, 2024

FIGURE 30 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: SNAPSHOT (2024)

FIGURE 31 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.