Marché de la gestion de flotte au Moyen-Orient et en Afrique, par offre (solution et services), type de location (en location et sans location), mode de transport (automobile, marine, matériel roulant et avion), type de véhicule (moteurs à combustion interne et véhicule électrique ), matériel (dispositifs de suivi GPS, caméras de tableau de bord, balises de suivi Bluetooth, enregistreurs de données et autres), taille de la flotte (petites flottes (1 à 5 véhicules), flottes moyennes (5 à 20 véhicules) et grandes flottes et flottes d'entreprise (20 à 50 véhicules et plus), portée de communication (communication à courte portée et communication à longue portée), modèle de déploiement (sur site, cloud et hybride), technologie (GNSS, systèmes cellulaires, échange de données informatisé (EDI), télédétection, méthodes informatiques et prise de décision, RFID et autres), fonction (surveillance du comportement du conducteur, consommation de carburant, gestion des actifs, plainte ELD, gestion des itinéraires, mises à jour de maintenance des véhicules, calendrier de livraison, prévention des accidents, véhicule en temps réel Localisation, applications mobiles et autres, opérations (privées et commerciales), type d'entreprise (petites et grandes entreprises), utilisateur final (automobile, transport et logistique, vente au détail, fabrication, alimentation et boissons, énergie et services publics, exploitation minière, gouvernement, soins de santé, agriculture, construction et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la gestion de flotte au Moyen-Orient et en Afrique

Les principaux facteurs qui devraient stimuler la croissance du marché de la gestion de flotte au cours de la période de prévision sont l'essor de plusieurs applications industrielles, notamment l'aérospatiale, l'acier, l'énergie, la chimie et d'autres. En outre, la résistance accrue aux variations de charge est l'avantage de la gestion de flotte, ce qui devrait encore propulser la croissance du marché de la gestion de flotte.

Data Bridge Market Research estime que le marché de la gestion de flotte au Moyen-Orient et en Afrique devrait atteindre la valeur de 3 773 529,91 milliers de dollars d'ici 2030, à un TCAC de 8,6 % au cours de la période de prévision. Le rapport sur le marché de la gestion de flotte couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 – 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Offre (solution et services), type de location (en location et sans location), mode de transport (automobile, marine, matériel roulant et aéronefs), type de véhicule (moteurs à combustion interne et véhicule électrique), matériel (dispositifs de suivi GPS, caméras de tableau de bord, balises de suivi Bluetooth, enregistreurs de données et autres), taille de la flotte (petites flottes (1 à 5 véhicules), flottes moyennes (5 à 20 véhicules) et flottes de grande taille et d'entreprise (20 à 50 véhicules et plus), portée de communication (communication à courte portée et communication à longue portée), modèle de déploiement (sur site, cloud et hybride), technologie (GNSS, systèmes cellulaires, échange de données informatisé (EDI), télédétection, méthodes informatiques et prise de décision, RFID et autres), fonction (surveillance du comportement du conducteur, consommation de carburant, gestion des actifs, plainte ELD, gestion des itinéraires, mises à jour de maintenance des véhicules, calendrier de livraison, prévention des accidents, localisation des véhicules en temps réel, applications mobiles et autres), Opérations (privées et commerciales), type d'entreprise (petites et grandes entreprises), utilisateur final (automobile, transport et logistique, vente au détail, fabrication, alimentation et boissons, énergie et services publics, exploitation minière, gouvernement, soins de santé, agriculture, construction et autres) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Israël, Égypte, Afrique du Sud et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

TRAXALL, Donlen LeasePlan, Enterprise Holdings, Emkay, Chevin Fleet Solutions, Deutsche Leasing AG, BERGSTROM AUTOMOTIVE, TÜV SÜD, Motive Technologies, Inc., ALD Automotive, VEL'CO, Avrios, Element Fleet Management Corp., Rarestep, Inc., OviDrive BV, FleetCompany GmbH, Sixt Leasing (acquis par Hyundai Capital Bank Europe GmbH), Fleetcare Pty Ltd., Capital Lease Group, Wilmar Inc., Wheels, NEXTRAQ, LLC, Avis Budget Group et Zeemac Vehicle Acquisition & Fleet Services, entre autres |

Définition du marché

La gestion de flotte désigne les processus et pratiques impliqués dans la gestion de la flotte de véhicules d'une entreprise. La gestion de flotte comprend les voitures, les camions, les fourgonnettes et autres véhicules utilisés à des fins professionnelles. Elle implique également de nombreuses pratiques, telles que l'acquisition de véhicules, la maintenance, la gestion du carburant, la gestion des conducteurs, la sécurité et la conformité. L'objectif de la gestion de flotte est d'optimiser l'utilisation des véhicules de l'entreprise pour améliorer l'efficacité, réduire les coûts et renforcer la sécurité. Une gestion de flotte efficace peut aider les entreprises à augmenter la productivité, à réduire les temps d'arrêt et à prolonger la durée de vie utile de leurs véhicules. Elle peut également contribuer à améliorer le comportement des conducteurs, à réduire les accidents et à garantir le respect des réglementations et des politiques. La gestion de flotte est utilisée dans divers secteurs, notamment le transport, la logistique, les services de livraison et la construction. Les technologies avancées, telles que le suivi GPS et la télématique, ont rendu la gestion de flotte plus efficace et efficiente ces dernières années.

Dynamique du marché de la gestion de flotte au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande en logistique en raison du secteur du commerce électronique

La gestion de flotte est une pratique qui permet aux organisations de gérer et de coordonner les véhicules de livraison pour atteindre une efficacité optimale et réduire les coûts. La pratique de la gestion de flotte est utilisée pour surveiller et enregistrer les coursiers et le personnel de livraison. Elle nécessite un système de technologies qui permettent au gestionnaire de flotte de coordonner plus facilement les activités, de la gestion du carburant à la planification des itinéraires, et peut être facilement gérée à l'aide d'un logiciel de gestion de flotte. L'expansion de l'industrie du commerce électronique a eu un impact significatif sur l'industrie de la logistique. La logistique a été considérée comme l'épine dorsale de l'industrie du commerce électronique car elle affecte immédiatement les opérations planifiées, les entrepôts et les organisations du réseau de production. Ils dépendront progressivement de la réévaluation pour faire face aux demandes croissantes liées au développement de la partie commerciale sur Internet. Adopter cette voie, que ce soit pour le transport du dernier kilomètre ou pour la satisfaction des demandes, leur permettra de garantir un transport prévisible, fiable, productif et sans ratés. Ainsi, cela peut être un facteur important dans la gestion et l'expansion de la pression due à la croissance attendue de l'industrie du commerce électronique.

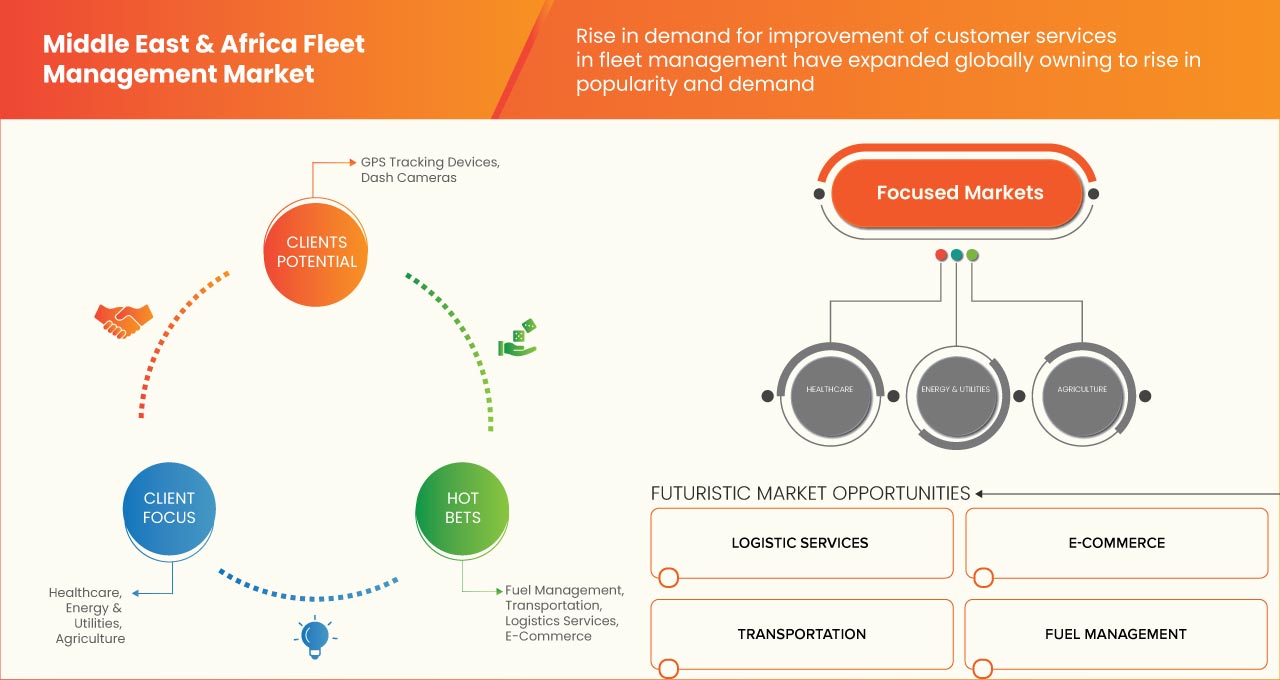

- Augmentation de la demande d'amélioration des services à la clientèle

Les clients sont aujourd'hui plus intelligents et ont des attentes plus élevées que jamais. La satisfaction et le bonheur des clients font partie des considérations les plus importantes pour toute entreprise. Quel que soit le secteur d'activité, les clients mécontents ne resteront pas clients longtemps, il est donc important de les garder heureux et de se sentir valorisés. Cela est également vrai pour la logistique et la gestion de flotte, où la fidélisation des clients est la clé du succès à long terme. L'amélioration des services et de la satisfaction des clients grâce à une meilleure performance de gestion de flotte est un facteur clé qui devrait stimuler le marché de la gestion de flotte au Moyen-Orient et en Afrique. Sur le marché concurrentiel d'aujourd'hui, les entreprises reconnaissent l'importance de la satisfaction des clients et utilisent des technologies avancées dans les solutions de gestion de flotte pour optimiser leurs opérations et améliorer l'expérience client

Opportunités

- Hausse de la demande de véhicules utilitaires

Les véhicules utilitaires sont des véhicules conçus et utilisés pour transporter des marchandises ou des passagers. Ces véhicules comprennent des camions, des fourgonnettes, des bus et des véhicules similaires utilisés à des fins commerciales. Le marché des véhicules utilitaires est un élément crucial de l'industrie automobile du Moyen-Orient et de l'Afrique et a connu une croissance significative au cours des dernières décennies. L'augmentation de la demande de véhicules utilitaires peut être attribuée à plusieurs facteurs, notamment la croissance de l'industrie du commerce électronique, l'urbanisation croissante et le besoin de systèmes de transport efficaces. Comme de plus en plus d'entreprises dépendent des véhicules utilitaires pour leurs besoins de transport, la demande de services et de logiciels de gestion de flotte devrait également augmenter. L'une des raisons de l'augmentation de la demande de véhicules utilitaires est la croissance de l'industrie du commerce électronique. La demande de services de transport a augmenté avec le nombre croissant de plateformes d'achat en ligne. En conséquence, l'utilisation de véhicules utilitaires est devenue plus courante et la gestion de flotte est devenue plus critique.

Contraintes/Défis

- Efficacité réduite en matière de connectivité

Le secteur de la logistique et du transport a considérablement évolué ces dernières années. Des concepts tels que la numérisation, l'émergence du big data et la connectivité ont été introduits et de nombreuses flottes utilisent désormais des versions précoces de ces nouvelles technologies. Dans de nombreux cas, elles modifient la façon dont les gestionnaires de flotte opèrent au quotidien. La connectivité est l'un des concepts les plus importants et les plus efficaces. C'est là qu'un gestionnaire de flotte peut avoir une vue d'ensemble de l'ensemble de la flotte et rester en contact avec les conducteurs, les camions et les remorques grâce à des processus automatisés qui fournissent des données exploitables à partir des appareils embarqués. Grâce aux appareils télématiques et aux solutions logicielles connectées, les problèmes de flotte peuvent être signalés aux véhicules mineurs dès qu'ils surviennent, ce qui leur permet de résoudre les problèmes plus tôt et de les traiter avant que les pannes ne surviennent. Cela donne la flexibilité d'effectuer des réparations courantes ou des entretiens programmés à l'avance, ce qui permet aux camions de rester sur la route plus souvent et de passer plus de temps à livrer des marchandises

- Guidage inapproprié pour activer l'itinéraire

Un système de suivi de véhicule peut être défini comme une partie d'un système de gestion de flotte, qui permet à l'opérateur de la flotte de connaître la position du véhicule tout au long du trajet du véhicule en fonction du temps. En plus d'utiliser les données générées par le système de suivi de véhicule pour faire respecter l'horaire des bus, ces données fournissent également des informations importantes pour la prise de décision. Le système facilite le calcul de la distance exacte parcourue dans un laps de temps donné, le calcul de la vitesse du bus à un endroit donné, l'analyse du temps mis par le véhicule pour parcourir une certaine distance. Il devient un outil très puissant dans le cas des agences d'exploitation.

Impact de la pandémie de COVID-19 sur le marché de la gestion de flotte au Moyen-Orient et en Afrique

La COVID-19 a eu un impact négatif sur le marché de la gestion de flotte en raison des réglementations et des règles de confinement dans les usines de fabrication.

La pandémie de COVID-19 a eu un impact négatif sur le marché de la gestion de flotte. Cependant, l'adoption croissante de la gestion de flotte dans le secteur de l'aviation a aidé le marché à croître après la pandémie. En outre, la croissance a été élevée depuis l'ouverture du marché après la COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur.

Les constructeurs automobiles prennent diverses décisions stratégiques pour rebondir après la crise du COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans la gestion de flotte. Grâce à cela, les entreprises apporteront des technologies avancées sur le marché. En outre, les initiatives gouvernementales visant à utiliser la technologie d'automatisation ont conduit à la croissance du marché.

Développement récent

- En octobre 2022, Chevin Fleet Solutions a annoncé que la société avait lancé de nouvelles applications, « FleetWave Technician » et « FleetWave Driver », pour ses produits logiciels de gestion de flotte.

- En février 2022, Element Fleet Management Corp. a annoncé que la société avait lancé Arc by Element, une offre de flotte de véhicules électriques (VE) de bout en bout pour aider les clients à naviguer et à simplifier la transition complexe des véhicules à moteur à combustion interne (ICE) vers les VE.

Portée du marché de la gestion de flotte au Moyen-Orient et en Afrique

Le marché de la gestion de flotte au Moyen-Orient et en Afrique est segmenté en fonction de l'offre, du type de location, du mode de transport, du type de véhicule, du matériel, de la taille de la flotte, de la portée de communication, du modèle de déploiement, de la technologie, des fonctions, des opérations, du type d'entreprise et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solution

- Services

Sur la base de l’offre, le marché est segmenté en solutions et services.

Type de bail

- En location

- Sans bail

En fonction du type de bail, le marché est segmenté en bail et sans bail.

Mode de transport

- Automobile

- Marin

- Matériel roulant

- Aéronef

Sur la base du mode de transport, le marché est segmenté en automobile, marine, matériel roulant et aéronautique.

Type de véhicule

- Moteurs à combustion interne (ICE)

- Véhicule électrique

Sur la base du type de véhicule, le marché est segmenté en moteurs à combustion interne (ICE) et véhicules électriques.

Matériel

- Dispositifs de suivi GPS

- Caméras embarquées

- Balises de suivi Bluetooth (balises BLE)

- Enregistreurs de données

- Autres

Sur la base du matériel, le marché est segmenté en appareils de suivi GPS, caméras de tableau de bord, balises de suivi Bluetooth (balises BLE), enregistreurs de données et autres.

Taille de la flotte

- Petites flottes (1 à 5 véhicules)

- Flottes moyennes (5 à 20 véhicules)

- Flottes de véhicules de grande taille et d'entreprise (20 à 50 véhicules et plus)

Sur la base de la taille de la flotte, le marché est segmenté en petites flottes (1 à 5 véhicules), flottes moyennes (5 à 20 véhicules) et grandes flottes et flottes d'entreprise (20 à 50 véhicules et plus).

Portée de communication

- Communication à courte portée

- Communication à longue distance

On the basis of communication range, the market is segmented into short-range communication and long-range communication.

Deployment Model

- On-Premise

- Cloud

- Hybrid

On the basis of deployment model, the market is segmented into on premise, cloud, and hybrid.

Technology

- GNSS

- Cellular Systems

- Electronic Data Interchange (EDI)

- Remote Sensing

- Computational Methods

- Decision-Making

- RFID

- Others

On the basis of technology, the market is segmented into GNSS, Cellular systems, electronic data interchange (EDI), remote sensing, computational methods, decision-making, RFID, and others.

Function

- Monitoring Driver Behaviour

- Fuel Consumption

- Asset Management

- ELD Complaint

- Route Management

- Vehicle Maintenance Updates

- Delivery Schedule

- Accident Prevention

- Real-Time Vehicle Location

- Mobile Apps

- Others

On the basis of function, the market is segmented into monitoring driver behaviour, fuel consumption, asset management, ELD complaint, route management, vehicle maintenance updates, delivery schedule, accident prevention, real-time vehicle location, mobile apps, and others.

Operations

- Private

- Commercial

On the basis of operations, the market is segmented into private and commercial.

Business Type

- Small Businesses

- Large Businesses

On the basis of business type, the market is segmented into small businesses and large businesses.

End User

- Automotive

- Transportation & Logistics

- Retail

- Manufacturing

- Food & Beverages

- Energy & Utilities

- Mining

- Government

- Healthcare

- Agriculture

- Construction

- Others

On the basis of end user, the market is segmented into automotive, transportation & logistics, retail, manufacturing, food & beverages, energy & utilities, mining, government, healthcare, agriculture, construction, and others. All automotive, transportation & logistics, retail, manufacturing, food & beverages, energy & utilities, mining, government, healthcare, agriculture, and construction.

Middle East and Africa Fleet Management Market Regional Analysis/Insights

Middle East and Africa fleet management market is analysed, and market size insights and trends are provided by offering, lease type, mode of transport, vehicle type, hardware, fleet size, communication range, deployment model, technology, functions, operations, business type, and end user as referenced above.

The countries covered in the fleet management market report are Saudi Arabia, U.A.E., Israel, Egypt, South Africa and the Rest of the Middle East and Africa.

Saudi Arabia dominates in the Middle East and Africa region due to the rising adoption of automation in manufacturing and industrial robotics.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Fleet Management Market Share Analysis

Middle East and Africa fleet management market competitive landscape provide details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the fleet management market.

Some of the major players operating in the Middle East and Africa fleet management market are TRAXALL, Donlen LeasePlan, Enterprise Holdings, Emkay, Chevin Fleet Solutions, Deutsche Leasing AG, BERGSTROM AUTOMOTIVE, TÜV SÜD, Motive Technologies, Inc., ALD Automotive, VEL’CO, Avrios, Element Fleet Management Corp., Rarestep, Inc., OviDrive B.V., FleetCompany GmbH, Sixt Leasing (Acquired by Hyundai Capital Bank Europe GmbH) , Fleetcare Pty Ltd., Capital Lease Group, Wilmar Inc., Wheels, NEXTRAQ, LLC, Avis Budget Group, and Zeemac Vehicle Acquisition & Fleet Services among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS MODEL

4.2 REGULATORY LANDSCAPE

4.3 TOP WINNING STRATEGIES

4.4 COMPANY CAR POLICY

4.4.1 BENEFITS OF CAR POLICY CENTRALIZATION

4.4.2 CORPORATE POLICIES ON THE USAGE OF COMPANY CARS

4.5 FLEET MANAGEMENT PROFIT ALLOCATION ALONG THE VALUE CHAIN

4.6 BRAND COMPARATIVE ANALYSIS

4.6.1 TRAXALL

4.6.2 LEASEPLAN

4.6.3 ENTERPRISE HOLDINGS

4.6.4 ELEMENT FLEET MANAGEMENT

4.6.5 WHEELS

4.7 DISRUPTIVE TECHNOLOGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR THE LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISE IN DEMAND FOR IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASE IN DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 LOWER EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DEMAND FOR UTILITY VEHICLES

5.3.2 RISE IN THE TREND OF MIDDLE EAST & AFRICAIZATION

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.4 INCREASE IN DATA-DRIVEN MODELS IN MOBILITY

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISE IN CYBER THREATS

6 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE

6.1 OVERVIEW

6.2 SHORT RANGE COMMUNICATION

6.3 LONG RANGE COMMUNICATION

7 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

7.4 HYBRID

8 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 GNSS

8.3 CELLULAR SYSTEMS

8.4 LECTRONIC DATA INTERCHANGE (EDI)

8.5 REMOTE SENSING

8.6 COMPUTATIONAL METHOD & DECISION MAKING

8.7 RFID

8.8 OTHERS

9 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS

9.1 OVERVIEW

9.2 ASSET MANAGEMENT

9.3 ROUTE MANAGEMENT

9.4 FUEL CONSUMPTION

9.5 REAL TIME VEHICLE LOCATION

9.6 DELIVERY SCHEDULE

9.7 ACCIDENT PREVENTION

9.8 MOBILE APPS

9.9 MONITORING DRIVER BEHAVIOR

9.1 VEHICLE MAINTENANCE UPDATES

9.11 ELD COMPLIANCE

9.12 OTHERS

10 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 PRIVATE

11 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

11.1 OVERVIEW

11.2 LARGE BUSINESS

11.2.1 FLORIST & GIFT DELIVERY BUSINESS

11.2.2 CATERING & FOOD DELIVERING COMPANY

11.2.3 CLEANING SERVICE COMPANY

11.2.4 ELECTRICIAN/PLUMBING/HVAC COMPANY

11.2.5 LANDSCAPING BUSINESS

11.3 SMALL BUSINESS

11.3.1 RENTAL CAR/TRUCK COMPANY

11.3.2 MOVING COMPANY

11.3.3 TAXI COMPANY

11.3.4 DELIVERY COMPANY

11.3.5 LONG HAUL SEMI-TRUCK COMPANY

12 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

12.1 OVERVIEW

12.2 INTERNAL COMBUSTION ENGINE

12.3 ELECTRIC VEHICLE

13 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OFFERING

13.1 OVERVIEW

13.2 SOLUTIONS

13.2.1 ETA PREDICTIONS

13.2.1.1 STREAMLINED ROUTES

13.2.1.2 DETAILED LOCATION DATA

13.2.1.3 BREAKDOWN NOTIFICATION

13.2.2 OPERATIONS MANAGEMENT

13.2.2.1 FLEET TRACKING & GEO-FENCING

13.2.2.2 ROUTING & SCHEDULING

13.2.2.3 REAL & IDLE TIME MONITORING

13.2.3 PERFORMANCE MANAGEMENT

13.2.3.1 DRIVER MANAGEMENT

13.2.3.1.1 TRACKING

13.2.3.1.2 ROADSIDE/EMERGENCY ASSISTANCE FOR DRIVERS

13.2.3.1.3 MONITORING OF MISUSE (HARD BRAKING)

13.2.3.2 FLEET MANAGEMENT & TRACKING

13.2.3.2.1 REAL TIME ROUTING

13.2.3.2.2 SPEED/IDLING REAL TIME FEEDBACK

13.2.3.2.3 ENGINE DATA VIA ON-BOARD SENSORS

13.2.4 VEHICLE MAINTENANCE & DIAGNOSTICS

13.2.5 SAFETY & COMPLIANCE MANAGEMENT

13.2.6 RISK MANAGEMENT

13.2.7 CONTRACT MANAGEMENT

13.2.7.1 FUEL MANAGEMENT

13.2.7.2 ACCIDENT MANAGEMENT

13.2.7.3 ADMINISTRATIVE COST

13.2.7.4 LONG TERM CONTRACT

13.2.7.5 SHORT TERM CONTRACT

13.3 SERVICES

13.3.1 PROFESSIONAL SERVICES

13.3.1.1 SUPPORT & MAINTENANCE

13.3.1.2 IMPLEMENTATION

13.3.1.3 CONSULTING

13.3.2 MANAGED SERVICES

14 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE

14.1 OVERVIEW

14.2 ON-LEASE

14.3 WITHOUT LEASE

14.3.1 OPEN ENDED

14.3.2 CLOSE ENDED

15 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE

15.1 OVERVIEW

15.2 GPS TRACKING DEVICES

15.3 DASH CAMERAS

15.4 BLUETOOTH TRACKING TAGS

15.5 DATA LOGGERS

15.6 OTHERS

16 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE

16.1 OVERVIEW

16.2 SMALL FLEETS (1-5 VEHICLES)

16.3 MEDIUM FLEETS (5-20 VEHICLES)

16.4 LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES)

17 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

17.1 OVERVIEW

17.1.1 AUTOMOTIVE

17.1.2 LIGHT DUTY VEHICLE

17.1.2.1 PASSENGER CARS

17.1.2.2 VANS

17.1.3 MEDIUM & HEAVY VEHICLE

17.1.3.1 TRUCKS

17.1.3.2 TRAILERS

17.1.3.3 FORKLIFTS

17.1.3.4 SPECIALIST VEHICLES

17.1.4 MARINE

17.1.5 ROLLING STOCK

17.1.6 AIRCRAFT

18 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY END USER

18.1 OVERVIEW

18.2 AUTOMOTIVE

18.2.1 SOLUTIONS

18.2.1.1 ETA PREDICTIONS

18.2.1.2 OPERATIONS MANAGEMENT

18.2.1.3 PERFORMANCE MANAGEMENT

18.2.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.2.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.2.1.6 RISK MANAGEMENT

18.2.1.7 CONTRACT MANAGEMENT

18.2.2 SERVICES

18.2.2.1 PROFESSIONAL SERVICES

18.2.2.2 MANAGED SERVICES

18.3 TRANSPORTATION & LOGISTICS

18.3.1 SOLUTIONS

18.3.1.1 ETA PREDICTIONS

18.3.1.2 OPERATIONS MANAGEMENT

18.3.1.3 PERFORMANCE MANAGEMENT

18.3.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.3.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.3.1.6 RISK MANAGEMENT

18.3.1.7 CONTRACT MANAGEMENT

18.3.2 SERVICES

18.3.2.1 PROFESSIONAL SERVICES

18.3.2.2 MANAGED SERVICES

18.4 RETAIL

18.4.1 SOLUTIONS

18.4.1.1 ETA PREDICTIONS

18.4.1.2 OPERATIONS MANAGEMENT

18.4.1.3 PERFORMANCE MANAGEMENT

18.4.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.4.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.4.1.6 RISK MANAGEMENT

18.4.1.7 CONTRACT MANAGEMENT

18.4.2 SERVICES

18.4.2.1 PROFESSIONAL SERVICES

18.4.2.2 MANAGED SERVICES

18.5 MANUFACTURING

18.5.1 SOLUTIONS

18.5.1.1 ETA PREDICTIONS

18.5.1.2 OPERATIONS MANAGEMENT

18.5.1.3 PERFORMANCE MANAGEMENT

18.5.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.5.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.5.1.6 RISK MANAGEMENT

18.5.1.7 CONTRACT MANAGEMENT

18.5.2 SERVICES

18.5.2.1 PROFESSIONAL SERVICES

18.5.2.2 MANAGED SERVICES

18.6 FOOD & BEVERAGES

18.6.1 SOLUTIONS

18.6.1.1 ETA PREDICTIONS

18.6.1.2 OPERATIONS MANAGEMENT

18.6.1.3 PERFORMANCE MANAGEMENT

18.6.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.6.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.6.1.6 RISK MANAGEMENT

18.6.1.7 CONTRACT MANAGEMENT

18.6.2 SERVICES

18.6.2.1 PROFESSIONAL SERVICES

18.6.2.2 MANAGED SERVICES

18.7 ENERGY & UTILITIES

18.7.1 SOLUTIONS

18.7.1.1 ETA PREDICTIONS

18.7.1.2 OPERATIONS MANAGEMENT

18.7.1.3 PERFORMANCE MANAGEMENT

18.7.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.7.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.7.1.6 RISK MANAGEMENT

18.7.1.7 CONTRACT MANAGEMENT

18.7.2 SERVICES

18.7.2.1 PROFESSIONAL SERVICES

18.7.2.2 MANAGED SERVICES

18.8 MINING

18.8.1 SOLUTIONS

18.8.1.1 ETA PREDICTIONS

18.8.1.2 OPERATIONS MANAGEMENT

18.8.1.3 PERFORMANCE MANAGEMENT

18.8.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.8.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.8.1.6 RISK MANAGEMENT

18.8.1.7 CONTRACT MANAGEMENT

18.8.2 SERVICES

18.8.2.1 PROFESSIONAL SERVICES

18.8.2.2 MANAGED SERVICES

18.9 GOVERNMENT

18.9.1 SOLUTIONS

18.9.1.1 ETA PREDICTIONS

18.9.1.2 OPERATIONS MANAGEMENT

18.9.1.3 PERFORMANCE MANAGEMENT

18.9.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.9.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.9.1.6 RISK MANAGEMENT

18.9.1.7 CONTRACT MANAGEMENT

18.9.2 SERVICES

18.9.2.1 PROFESSIONAL SERVICES

18.9.2.2 MANAGED SERVICES

18.1 HEALTHCARE

18.10.1 SOLUTIONS

18.10.1.1 ETA PREDICTIONS

18.10.1.2 OPERATIONS MANAGEMENT

18.10.1.3 PERFORMANCE MANAGEMENT

18.10.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.10.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.10.1.6 RISK MANAGEMENT

18.10.1.7 CONTRACT MANAGEMENT

18.10.2 SERVICES

18.10.2.1 PROFESSIONAL SERVICES

18.10.2.2 MANAGED SERVICES

18.11 AGRICULTURE

18.11.1 SOLUTIONS

18.11.1.1 ETA PREDICTIONS

18.11.1.2 OPERATIONS MANAGEMENT

18.11.1.3 PERFORMANCE MANAGEMENT

18.11.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.11.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.11.1.6 RISK MANAGEMENT

18.11.1.7 CONTRACT MANAGEMENT

18.11.2 SERVICES

18.11.2.1 PROFESSIONAL SERVICES

18.11.2.2 MANAGED SERVICES

18.12 CONSTRUCTION

18.12.1 SOLUTIONS

18.12.1.1 ETA PREDICTIONS

18.12.1.2 OPERATIONS MANAGEMENT

18.12.1.3 PERFORMANCE MANAGEMENT

18.12.1.4 VEHICLE MAINTENANCE & DIAGNOSTICS

18.12.1.5 SAFETY & COMPLIANCE MANAGEMENT

18.12.1.6 RISK MANAGEMENT

18.12.1.7 CONTRACT MANAGEMENT

18.12.2 SERVICES

18.12.2.1 PROFESSIONAL SERVICES

18.12.2.2 MANAGED SERVICES

18.13 OTHERS

19 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY REGION

19.1 MIDDLE EAST AND AFRICA

19.1.1 SAUDI ARABIA

19.1.2 SOUTH AFRICA

19.1.3 EGYPT

19.1.4 ISRAEL

19.1.5 REST OF MIDDLE EAST AND AFRICA

20 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 ENTERPRISE HOLDINGS

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 SOLUTION PORTFOLIO

22.1.4 RECENT DEVELOPMENTS

22.2 AVIS BUDGET GROUP

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 COMPANY SHARE ANALYSIS

22.2.4 SOLUTION PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 DEUTSCHE LEASING AG

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 SOLUTION PORTFOLIO

22.3.5 RECENT DEVELOPMENT

22.4 ALD AUTOMOTIVE

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 SOLUTION PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 LEASEPLAN

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 SOLUTION PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AVRIOS

22.6.1 COMPANY SNAPSHOT

22.6.2 SOLUTION PORTFOLIO

22.6.3 RECENT DEVELOPMENT

22.7 BERGSTROM AUTOMOTIVE

22.7.1 COMPANY SNAPSHOT

22.7.2 SOLUTION PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CAPITAL LEASE GROUP

22.8.1 COMPANY SNAPSHOT

22.8.2 SOLUTION PORTFOLIO

22.8.3 RECENT DEVELOPMENTS

22.9 CHEVIN FLEET SOLUTIONS

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS

22.1 DONLEN

22.10.1 COMPANY SNAPSHOT

22.10.2 SOLUTION PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 ELEMENT FLEET MANAGEMENT CORP.

22.11.1 COMPANY SNAPSHOT

22.11.2 REVENUE ANALYSIS

22.11.3 SOLUTION PORTFOLIO

22.11.4 RECENT DEVELOPMENT

22.12 EMKAY

22.12.1 COMPANY SNAPSHOT

22.12.2 SOLUTION PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 FLEETCARE PTY LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 SOLUTION PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 FLEETCOMPANY GMBH

22.14.1 COMPANY SNAPSHOT

22.14.2 SOLUTION PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 MOTIVE TECHNOLOGIES, INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 NEXTRAQ, LLC

22.16.1 COMPANY SNAPSHOT

22.16.2 SOLUTION PORTFOLIO

22.16.3 RECENT DEVELOPMENTS

22.17 OVIDRIVE B.V.

22.17.1 COMPANY SNAPSHOT

22.17.2 SOLUTION PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 RARESTEP, INC.

22.18.1 COMPANY SNAPSHOT

22.18.2 SOLUTION PORTFOLIO

22.18.3 RECENT DEVELOPMENTS

22.19 SIXT LEASING

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 SOLUTION PORTFOLIO

22.19.4 RECENT DEVELOPMENT

22.2 TRAXALL

22.20.1 COMPANY SNAPSHOT

22.20.2 SOLUTION PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 TÜV SÜD

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 SOLUTION PORTFOLIO

22.21.4 RECENT DEVELOPMENT

22.22 VELCO

22.22.1 COMPANY SNAPSHOT

22.22.2 SOLUTION PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 WHEELS

22.23.1 COMPANY SNAPSHOT

22.23.2 SOLUTION PORTFOLIO

22.23.3 RECENT DEVELOPMENTS

22.24 WILMAR INC.

22.24.1 COMPANY SNAPSHOT

22.24.2 SOLUTION PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

22.25 ZEEMAC VEHICLE ACQUISITION & FLEET SERVICES

22.25.1 COMPANY SNAPSHOT

22.25.2 SOLUTION PORTFOLIO

22.25.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

Liste des tableaux

TABLE 1 VARIOUS REGULATORY STANDARDS RELATED TO FLEET MANAGEMENT

TABLE 2 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA SHORT RANGE COMMUNICATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LONG RANGE COMMUNICATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA ON-PREMISE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CLOUD IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA HYBRID IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA GNSS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA CELLULAR SYSTEMS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA ELECTRONIC DATA INTERCHANGE (EDI) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA REMOTE SENSING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA COMPUTATIONAL METHOD & DECISION MAKING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RFID IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA ASSET MANAGEMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA ROUTE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA FUEL CONSUMPTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA REAL TIME VEHICLE LOCATION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA DELIVERY SCHEDULE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ACCIDENT PREVENTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA MOBILE APPS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MONITORING DRIVER BEHAVIOR IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA VEHICLE MAINTENANCE UPDATES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA ELD COMPLIANCE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA COMMERCIAL IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA PRIVATE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA INTERNAL COMBUSTION ENGINE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA ON-LEASE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA GPS TRACKING DEVICES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA DASH CAMERAS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA BLUETOOTH TRACKING TAGS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA DATA LOGGERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA SMALL FLEETS (1-5 VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA MEDIUM FLEETS (5-20 VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA LARGE & ENTERPRISE FLEETS (20-50+ VEHICLES) IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA MARINE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA ROLLING STOCK IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA AIRCRAFT STOCK IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND )

TABLE 79 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 81 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 MIDDLE EAST & AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 MIDDLE EAST & AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 89 MIDDLE EAST & AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 93 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 97 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 98 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MIDDLE EAST & AFRICA MINING IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 101 MIDDLE EAST & AFRICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 MIDDLE EAST & AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 105 MIDDLE EAST & AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 MIDDLE EAST & AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 109 MIDDLE EAST & AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MIDDLE EAST & AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 113 MIDDLE EAST & AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 MIDDLE EAST & AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 117 MIDDLE EAST & AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 MIDDLE EAST & AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MIDDLE EAST & AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MIDDLE EAST & AFRICA OTHERS IN FLEET MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 MIDDLE EAST AND AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 MIDDLE EAST AND AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 MIDDLE EAST AND AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 MIDDLE EAST AND AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 MIDDLE EAST AND AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 SAUDI ARABIA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 SAUDI ARABIA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 SAUDI ARABIA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 SAUDI ARABIA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 SAUDI ARABIA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 SAUDI ARABIA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 192 SAUDI ARABIA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 193 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 SAUDI ARABIA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 SAUDI ARABIA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 198 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 199 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 200 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 201 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 202 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 203 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 204 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 SAUDI ARABIA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 SAUDI ARABIA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 209 SAUDI ARABIA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 210 SAUDI ARABIA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 SAUDI ARABIA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 213 SAUDI ARABIA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 214 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 216 SAUDI ARABIA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 217 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 218 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 SAUDI ARABIA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 220 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SAUDI ARABIA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 223 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 SAUDI ARABIA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 226 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 227 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 228 SAUDI ARABIA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 229 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 SAUDI ARABIA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 232 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 234 SAUDI ARABIA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 235 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 SAUDI ARABIA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 238 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 SAUDI ARABIA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 241 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 SAUDI ARABIA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 244 SAUDI ARABIA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 245 SAUDI ARABIA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 246 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 247 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 SOUTH AFRICA ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 SOUTH AFRICA OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 250 SOUTH AFRICA PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 251 SOUTH AFRICA DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 252 SOUTH AFRICA FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 SOUTH AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AFRICA CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 255 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AFRICA PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 257 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AFRICA WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 260 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 261 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 262 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 263 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 264 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 265 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 266 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 SOUTH AFRICA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 SOUTH AFRICA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 271 SOUTH AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 272 SOUTH AFRICA LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 SOUTH AFRICA MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 274 SOUTH AFRICA FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 275 SOUTH AFRICA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 276 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 SOUTH AFRICA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 279 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 280 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 281 SOUTH AFRICA RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 282 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 283 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 SOUTH AFRICA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 285 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 286 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 SOUTH AFRICA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 288 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 290 SOUTH AFRICA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 291 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 292 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 SOUTH AFRICA MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 294 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 SOUTH AFRICA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 297 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 SOUTH AFRICA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 300 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 301 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 SOUTH AFRICA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 303 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 304 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 SOUTH AFRICA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 306 SOUTH AFRICA SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 SOUTH AFRICA SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 308 EGYPT FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 309 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 310 EGYPT ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 EGYPT OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 312 EGYPT PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 313 EGYPT DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 EGYPT FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 EGYPT CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 316 EGYPT CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 317 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 EGYPT PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 319 EGYPT FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 EGYPT WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 321 EGYPT FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 322 EGYPT FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 323 EGYPT FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 324 EGYPT FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 325 EGYPT FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 326 EGYPT FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 327 EGYPT FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 328 EGYPT FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 EGYPT LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 330 EGYPT SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 331 EGYPT FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 EGYPT FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 333 EGYPT AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 EGYPT LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 335 EGYPT MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 336 EGYPT FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 337 EGYPT AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 338 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 339 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 340 EGYPT TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 341 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 342 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 343 EGYPT RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 344 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 345 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 346 EGYPT MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 347 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 348 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 349 EGYPT FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 350 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 351 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 352 EGYPT ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 353 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 354 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 355 EGYPT MINING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 356 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 357 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 358 EGYPT GOVERNMENT IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 359 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 360 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 361 EGYPT HEALTHCARE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 362 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 363 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 364 EGYPT AGRICULTURE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 365 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 366 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 367 EGYPT CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 368 EGYPT SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 369 EGYPT SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 370 ISRAEL FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 371 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 372 ISRAEL ETA PREDICTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 373 ISRAEL OPERATIONS MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 374 ISRAEL PERFORMANCE MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 375 ISRAEL DRIVER MANAGEMENT IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 376 ISRAEL FLEET MANAGEMENT & TRACKING IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 377 ISRAEL CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY STRUCTURE, 2021-2030 (USD THOUSAND)

TABLE 378 ISRAEL CONTRACT MANAGEMENT IN FLEET MANAGEMENT MARKET, BY MODEL, 2021-2030 (USD THOUSAND)

TABLE 379 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 380 ISRAEL PROFESSIONAL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 381 ISRAEL FLEET MANAGEMENT MARKET, BY LEASE TYPE, 2021-2030 (USD THOUSAND)

TABLE 382 ISRAEL WITHOUT LEASE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 383 ISRAEL FLEET MANAGEMENT MARKET, BY HARDWARE, 2021-2030 (USD THOUSAND)

TABLE 384 ISRAEL FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2021-2030 (USD THOUSAND)

TABLE 385 ISRAEL FLEET MANAGEMENT MARKET, BY COMMUNICATION RANGE, 2021-2030 (USD THOUSAND)

TABLE 386 ISRAEL FLEET MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 387 ISRAEL FLEET MANAGEMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 388 ISRAEL FLEET MANAGEMENT MARKET, BY FUNCTIONS, 2021-2030 (USD THOUSAND)

TABLE 389 ISRAEL FLEET MANAGEMENT MARKET, BY OPERATIONS, 2021-2030 (USD THOUSAND)

TABLE 390 ISRAEL FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2021-2030 (USD THOUSAND)

TABLE 391 ISRAEL LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 392 ISRAEL SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 393 ISRAEL FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 394 ISRAEL FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2021-2030 (USD THOUSAND)

TABLE 395 ISRAEL AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 396 ISRAEL LIGHT DUTY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 397 ISRAEL MEDIUM & HEAVY VEHICLE IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 398 ISRAEL FLEET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 399 ISRAEL AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 400 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 401 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 402 ISRAEL TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 403 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 404 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 405 ISRAEL RETAIL IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 406 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 407 ISRAEL SERVICES IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 408 ISRAEL MANUFACTURING IN FLEET MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 409 ISRAEL SOLUTIONS IN FLEET MANAGEMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)