Middle East And Africa Inflation Device Market

Taille du marché en milliards USD

TCAC :

%

USD

34.70 Million

USD

42.94 Million

2025

2033

USD

34.70 Million

USD

42.94 Million

2025

2033

| 2026 –2033 | |

| USD 34.70 Million | |

| USD 42.94 Million | |

|

|

|

|

Segmentation du marché des dispositifs de gonflage au Moyen-Orient et en Afrique, par type (dispositifs de gonflage analogiques et numériques), capacité (dispositifs de gonflage de 20 ml, 25 ml, 30 ml et 60 ml), application (cardiologie interventionnelle, procédures vasculaires périphériques, radiologie interventionnelle, procédures urologiques, procédures gastro-intestinales et autres), pression (30 atm, 40 atm, 55 atm et autres), fonction (déploiement de stents et administration de fluides), utilisateur final (hôpitaux, laboratoires d'intervention et cliniques), canal de distribution (appels d'offres directs, ventes au détail et distributeurs tiers) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des dispositifs d'inflation au Moyen-Orient et en Afrique

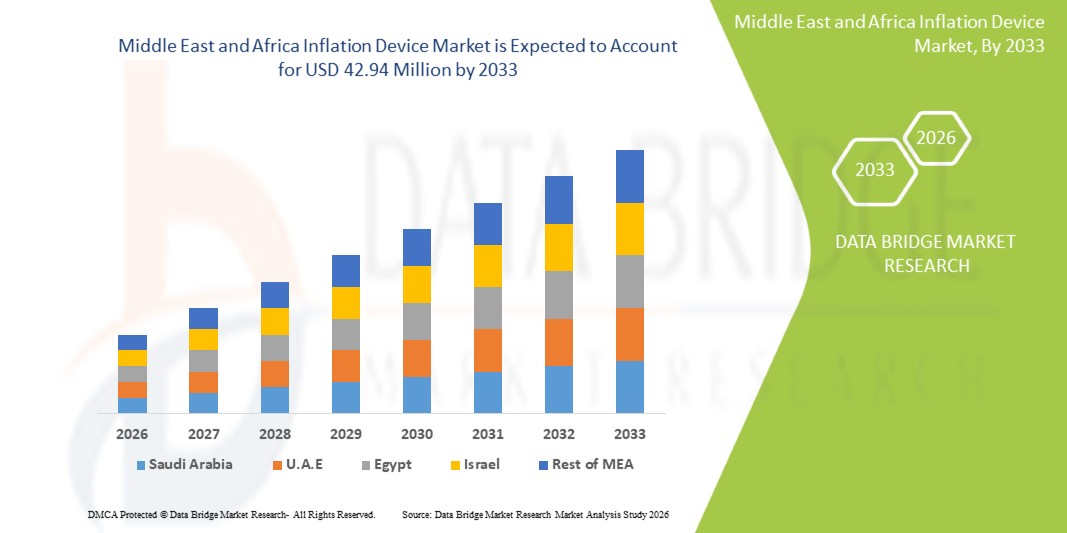

- Le marché des dispositifs de gonflage au Moyen-Orient et en Afrique était évalué à 34,70 millions de dollars américains en 2025 et devrait atteindre 42,94 millions de dollars américains d'ici 2033 , avec un TCAC de 2,70 % au cours de la période de prévision.

- La croissance du marché est principalement due à la prévalence croissante des maladies cardiovasculaires et vasculaires périphériques dans la région, ainsi qu'à l'augmentation des investissements dans les infrastructures médicales de pointe et les procédures interventionnelles.

- De plus, l'adoption croissante des traitements mini-invasifs et les progrès technologiques des dispositifs d'inflation aident les professionnels de santé à améliorer l'efficacité des interventions et les résultats pour les patients. Ces facteurs, conjugués à une meilleure connaissance des solutions médicales de pointe, alimentent la demande de dispositifs d'inflation dans les hôpitaux et les cliniques spécialisées, stimulant ainsi l'expansion du marché.

Analyse du marché des dispositifs de gonflage au Moyen-Orient et en Afrique

- Les dispositifs de gonflage, qui permettent de contrôler la pression lors des angioplasties par ballonnet et autres interventions, deviennent des éléments essentiels des interventions cardiovasculaires, vasculaires périphériques et urologiques modernes grâce à leur précision, leur sécurité et leur facilité d'utilisation.

- La demande croissante de dispositifs de gonflage est principalement due à la prévalence croissante des maladies cardiovasculaires, à la sensibilisation accrue aux procédures mini-invasives et aux investissements continus dans les infrastructures de soins de santé de pointe dans toute la région.

- L’Arabie saoudite a dominé le marché des dispositifs d’inflation au Moyen-Orient et en Afrique avec la plus grande part de revenus (38,1 %) en 2025, grâce à des dépenses de santé élevées, des initiatives gouvernementales visant à améliorer les services de cardiologie interventionnelle et la présence de distributeurs clés et d’entreprises régionales de dispositifs médicaux, avec une adoption importante dans les hôpitaux privés et publics.

- Les Émirats arabes unis devraient connaître la croissance la plus rapide sur le marché des dispositifs d'inflation au cours de la période de prévision, grâce à un meilleur accès aux soins de santé, à la multiplication des centres spécialisés en cardiologie et en radiologie interventionnelle, et aux collaborations avec des fabricants internationaux de dispositifs visant à améliorer les capacités procédurales.

- Les dispositifs de gonflage numériques ont dominé le marché avec une part de 55,2 % en 2025, grâce à leur contrôle précis de la pression, leurs capacités de surveillance en temps réel, leur intégration avec les systèmes de cathéters avancés et la préférence croissante des hôpitaux et des laboratoires d'intervention pour les solutions technologiquement avancées.

Portée du rapport et segmentation du marché des dispositifs de gonflage au Moyen-Orient et en Afrique

|

Attributs |

Principaux enseignements du marché des dispositifs de gonflage au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des dispositifs de gonflage au Moyen-Orient et en Afrique

« Adoption des dispositifs numériques et connectés de surveillance de l’inflation »

- Une tendance importante et croissante sur le marché des dispositifs de gonflage au Moyen-Orient et en Afrique est le passage progressif des dispositifs analogiques aux dispositifs numériques dotés de fonctions avancées de surveillance de la pression et de connectivité, améliorant ainsi la précision et la sécurité des procédures.

- Par exemple, les systèmes de gonflage numérique de Merit Medical permettent aux cliniciens de surveiller et de contrôler à distance le gonflage des ballonnets, améliorant ainsi l'efficacité des procédures et réduisant les risques lors des interventions.

- Les dispositifs de gonflage numériques intègrent de plus en plus l'enregistrement des données et les systèmes d'information hospitaliers, permettant ainsi l'enregistrement en temps réel des paramètres de la procédure et facilitant l'analyse post-opératoire.

- L'adoption d'appareils connectés favorise également la maintenance prédictive et le dépannage à distance, réduisant ainsi les temps d'arrêt des équipements et les interruptions de service dans les hôpitaux et les laboratoires d'intervention.

- L'amélioration de la compatibilité avec les plateformes multi-procédures est une autre tendance, permettant l'utilisation d'un seul dispositif pour les interventions en cardiologie interventionnelle, en chirurgie vasculaire périphérique et en urologie, ce qui accroît la flexibilité opérationnelle.

- Les fabricants s'attachent également à concevoir des dispositifs ergonomiques et à améliorer leur facilité d'utilisation afin de réduire la fatigue des cliniciens et les erreurs de procédure lors d'interventions longues ou complexes.

- Cette tendance vers des dispositifs de gonflage intelligents, connectés et surveillés numériquement redéfinit les attentes des utilisateurs en cardiologie interventionnelle et dans d'autres procédures mini-invasives.

- La demande en dispositifs de gonflage numériques et intelligents croît rapidement dans les hôpitaux et les cliniques spécialisées, les prestataires de soins de santé privilégiant la sécurité des patients, l'efficacité opérationnelle et les informations procédurales basées sur les données.

Dynamique du marché des dispositifs anti-inflation au Moyen-Orient et en Afrique

Conducteur

« Augmentation de la prévalence des maladies cardiovasculaires et des investissements dans les soins de santé »

- La prévalence croissante des maladies cardiovasculaires et vasculaires périphériques, associée à l'augmentation des investissements dans les infrastructures de soins de santé de pointe, est un facteur clé de la demande d'appareils de gonflage dans la région.

- Par exemple, en mars 2025, Boston Scientific a étendu sa présence en Arabie saoudite avec des solutions de cardiologie interventionnelle avancées, renforçant ainsi l'accès à des dispositifs de gonflage de pointe pour les hôpitaux et les centres cardiaques.

- Avec l'augmentation du nombre de patients subissant des interventions mini-invasives, les hôpitaux ont de plus en plus besoin de dispositifs de gonflage fiables offrant un contrôle précis de la pression, une surveillance adéquate et des fonctions de sécurité.

- De plus, les initiatives gouvernementales dans des pays comme les Émirats arabes unis et l'Arabie saoudite visant à améliorer les soins cardiaques et les infrastructures interventionnelles favorisent l'adoption de dispositifs technologiquement avancés.

- La demande de dispositifs de gonflage conviviaux, précis et sûrs est également soutenue par une prise de conscience croissante des cliniciens quant à la réduction des complications procédurales et à l'amélioration des résultats pour les patients.

- La collaboration croissante entre les hôpitaux et les fabricants mondiaux de dispositifs médicaux facilite davantage l'accès aux systèmes de gonflage avancés, stimulant ainsi la croissance du marché dans les secteurs de la santé publique et privée.

- La multiplication des programmes de formation et des ateliers proposés par les fabricants de dispositifs médicaux aux professionnels de santé contribue à renforcer la confiance dans l'utilisation des dispositifs de gonflage avancés et encourage leur adoption.

- L'intérêt croissant pour les interventions mini-invasives dans les villes secondaires et les pôles de soins de santé émergents élargit le marché potentiel au-delà des grands hôpitaux métropolitains.

Retenue/Défi

« Coûts élevés et exigences de conformité réglementaire »

- Le coût relativement élevé des dispositifs de gonflage numérique avancés et les exigences strictes en matière de conformité réglementaire constituent des obstacles importants à leur adoption plus large au Moyen-Orient et en Afrique.

- Par exemple, les petits hôpitaux et cliniques de certaines régions peuvent hésiter à investir dans des dispositifs de surveillance de l'inflation des primes en raison de contraintes budgétaires, ce qui limite la pénétration du marché.

- Le respect des réglementations locales relatives aux dispositifs médicaux et la nécessité d'obtenir des certifications auprès des autorités sanitaires peuvent retarder le lancement des produits et augmenter les coûts opérationnels pour les fabricants et les distributeurs.

- De plus, les exigences de formation des cliniciens pour utiliser correctement les dispositifs de gonflage avancés peuvent constituer un obstacle dans les hôpitaux disposant d'un personnel limité ou d'une expertise limitée en matière de procédures interventionnelles.

- Bien que les prix de certains appareils de mesure d'inflation analogiques de base soient plus bas, le surcoût des systèmes numériques ou connectés demeure un obstacle, notamment pour les marchés émergents de la région.

- Le dépassement de ces défis grâce à l'optimisation des coûts, au soutien réglementaire et aux programmes de formation des cliniciens sera essentiel pour assurer l'adoption et la croissance durables des dispositifs de gonflage dans la région.

- La capacité de production locale limitée et la dépendance aux importations peuvent allonger les délais et augmenter les coûts d'approvisionnement pour les hôpitaux, ce qui nuit à l'accès rapide aux dispositifs médicaux.

- La variabilité des infrastructures et des procédures de préparation d'un pays à l'autre peut entraver une adoption uniforme, certains hôpitaux pouvant manquer d'équipements de soutien ou de personnel formé pour utiliser pleinement les dispositifs de gonflage avancés.

Portée du marché des dispositifs d'inflation au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, de la capacité, de l'application, de la pression, de la fonction, de l'utilisateur final et du canal de distribution.

- Par type

Le marché est segmenté, selon le type de dispositif, en dispositifs de gonflage analogiques et numériques. En 2025, le segment des dispositifs numériques dominait le marché avec une part de revenus de 55,2 %, grâce à un contrôle précis de la pression, des capacités de surveillance en temps réel et une intégration avec les systèmes de cathéters avancés. Les hôpitaux et les laboratoires d'intervention privilégient les dispositifs numériques pour une sécurité procédurale accrue, un enregistrement précis de la pression et la possibilité de stocker et de transférer les données procédurales pour une analyse postopératoire. Les dispositifs numériques réduisent les erreurs humaines lors d'interventions complexes, ce qui en fait un choix privilégié dans les centres de cardiologie et de radiologie à forte activité. La sensibilisation croissante aux procédures mini-invasives et la préférence pour les solutions technologiquement avancées favorisent leur adoption. Les fabricants se concentrent également sur la surveillance logicielle et la maintenance prédictive afin d'améliorer l'efficacité opérationnelle.

Le segment des dispositifs de gonflage analogiques devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à son coût inférieur, sa conception simplifiée et sa facilité d'entretien. Les petits hôpitaux et cliniques d'Afrique et des marchés émergents du Moyen-Orient adoptent les dispositifs analogiques comme solutions économiques, tout en opérant une transition progressive vers les systèmes numériques. Les dispositifs analogiques offrent une fiabilité pour les interventions de routine et nécessitent une formation minimale pour les cliniciens. Les budgets limités et les exigences d'infrastructure moindres rendent les dispositifs analogiques attractifs dans les villes secondaires et les petits établissements de santé. La facilité de réparation et la faible dépendance au support technique contribuent également à leur adoption. Leur compatibilité avec les cathéters à ballonnet existants garantit une demande soutenue dans les environnements aux ressources limitées.

- Par capacité

En fonction de leur capacité, les dispositifs de gonflage sont segmentés en quatre catégories : 20 ml, 25 ml, 30 ml et 60 ml. Le segment des dispositifs de 30 ml dominait le marché avec une part de 40 % en 2025, grâce à sa polyvalence en cardiologie interventionnelle, en chirurgie vasculaire périphérique et en urologie. Les cliniciens privilégient cette capacité pour sa compatibilité avec les cathéters à ballonnet couramment utilisés et sa facilité de manipulation lors des procédures diagnostiques et thérapeutiques. L’équilibre entre volume et précision de gonflage le rend adapté à une utilisation fréquente dans les hôpitaux et les laboratoires d’intervention. Il est largement utilisé dans les établissements de santé publics et privés d’Arabie saoudite et des Émirats arabes unis. Les hôpitaux privilégient cette capacité pour réduire les complications procédurales et obtenir un gonflage précis. La forte demande dans les centres de cardiologie et de chirurgie vasculaire renforce encore sa position dominante sur le marché.

Le segment des dispositifs de 60 ml devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison de la multiplication des interventions complexes nécessitant des volumes de gonflage plus importants, comme la pose de stents lors d'interventions vasculaires périphériques. Le développement des infrastructures de soins cardiaques aux Émirats arabes unis, en Arabie saoudite et sur certains marchés africains favorise l'adoption de dispositifs de plus grande capacité. La sensibilisation croissante aux procédures mini-invasives et la nécessité d'une plus grande efficacité opératoire stimulent la demande. Les progrès technologiques réalisés dans le domaine des dispositifs de grand volume, notamment l'amélioration du suivi de la pression, contribuent également à cette adoption. Enfin, la complexité accrue des interventions dans les centres de soins tertiaires alimente la croissance de ce segment.

- Sur demande

En fonction de l'application, le marché est segmenté en cardiologie interventionnelle, interventions vasculaires périphériques, radiologie interventionnelle, interventions urologiques, interventions gastro-intestinales et autres. Le segment de la cardiologie interventionnelle dominait le marché avec une part de 50 % en 2025, en raison de la forte prévalence des maladies cardiovasculaires dans la région. Les hôpitaux privilégient les dispositifs permettant un contrôle précis de la pression pour l'angioplastie par ballonnet et la pose de stents, garantissant ainsi la sécurité des patients. Les initiatives gouvernementales visant à améliorer les soins cardiaques et l'augmentation des investissements dans le secteur de la santé en Arabie saoudite et aux Émirats arabes unis favorisent également l'adoption de ces dispositifs. Les hôpitaux bénéficient des dispositifs numériques permettant l'enregistrement des données, la surveillance des interventions et la réduction des risques de complications. La préférence des cliniciens pour des dispositifs fiables dans les centres de cardiologie à forte activité renforce la position dominante du marché. L'utilisation généralisée dans les hôpitaux privés et publics consolide la position de leader de ce segment.

Le segment des interventions vasculaires périphériques devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à l'adoption croissante des techniques mini-invasives et à une meilleure prise en charge des artériopathies périphériques. Les dispositifs de gonflage avancés utilisés pour ces interventions gagnent en popularité dans les hôpitaux et cliniques spécialisés. La demande croissante de pose précise de stents et d'angioplasties par ballonnet dans les artères périphériques stimule cette croissance. Le développement des centres de soins vasculaires dans les villes et les agglomérations contribue à une adoption rapide. Les campagnes de sensibilisation et le soutien gouvernemental aux interventions de pointe favorisent également l'expansion du marché.

- Par pression

En fonction de la pression, le marché est segmenté en 30 atm, 40 atm, 55 atm et autres. Le segment 40 atm dominait le marché en 2025, générant la plus grande part de revenus, car la plupart des interventions de routine nécessitent cette pression pour un gonflage sûr et efficace du ballonnet. Les dispositifs de cette catégorie offrent aux cliniciens un contrôle optimal et des marges de sécurité maximales, ce qui explique leur utilisation standard dans les hôpitaux et les laboratoires d'intervention. Leur adoption est particulièrement forte en Arabie saoudite et aux Émirats arabes unis, grâce à leurs infrastructures de pointe en cardiologie et en radiologie. Les dispositifs 40 atm offrent un équilibre optimal entre sécurité et efficacité procédurale, aussi bien pour les interventions complexes que pour les interventions fréquentes. Leur compatibilité avec les cathéters à ballonnet courants garantit leur large utilisation. Les cliniciens privilégient ces dispositifs pour leurs performances prévisibles et fiables lors des interventions.

Le segment des dispositifs à 55 atm devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, portée par la multiplication des interventions complexes nécessitant des pressions de gonflage plus élevées, notamment pour la pose de stents et les interventions vasculaires périphériques. La prévalence croissante des pathologies cardiovasculaires avancées soutient la demande. Les hôpitaux pratiquant des interventions complexes privilégient les dispositifs à haute pression pour plus de précision. Les progrès technologiques réalisés sur les dispositifs à 55 atm, notamment la surveillance numérique, améliorent la sécurité des interventions. Leur adoption progresse dans les centres spécialisés en cardiologie et en chirurgie vasculaire du Moyen-Orient et d'Afrique.

- Par fonction

En fonction de leur fonction, le marché est segmenté en déploiement de stents et administration de fluides. Le segment du déploiement de stents dominait le marché avec une part de 52 % en 2025, porté par l'augmentation des interventions cardiovasculaires et l'exigence cruciale de précision dans la pose des stents. Les hôpitaux et les centres de cardiologie spécialisés privilégient les dispositifs numériques permettant un déploiement contrôlé et une surveillance en temps réel. L'augmentation du volume d'interventions en cardiologie interventionnelle favorise également leur adoption. Les dispositifs numériques de déploiement de stents réduisent les risques et améliorent les résultats pour les patients. Leur compatibilité avec les systèmes de cathéters avancés renforce leur position de leader sur le marché. La large familiarité des cliniciens avec ces dispositifs garantit une demande soutenue.

Le segment de l'administration de fluides devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, en raison de son utilisation croissante dans les interventions urologiques et gastro-entérologiques exigeant une administration précise des fluides et une pression contrôlée. Les hôpitaux et les cliniques adoptent des dispositifs permettant une gestion précise des fluides. La hausse des interventions mini-invasives en chirurgie vasculaire périphérique et en urologie stimule la demande. L'intégration de la surveillance numérique améliore la sécurité et l'efficacité des procédures. Cette croissance est soutenue par l'expansion des hôpitaux secondaires et des cliniques spécialisées. L'importance accrue accordée à la sécurité des patients et à la précision des procédures favorise l'adoption de ces dispositifs.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, laboratoires interventionnels et cliniques. Le segment des hôpitaux dominait le marché avec une part de 60 % en 2025, grâce à un volume élevé de patients, des infrastructures de pointe et une forte demande en dispositifs de gonflage fiables et performants. Les hôpitaux ont besoin de dispositifs pour les interventions de cardiologie interventionnelle, de radiologie et d'urologie, avec un contrôle précis de la pression. Les hôpitaux de pointe d'Arabie saoudite et des Émirats arabes unis privilégient les dispositifs numériques pour une efficacité opérationnelle optimale. L'adoption à grande échelle dans les hôpitaux publics et privés renforce la position dominante des hôpitaux sur le marché. L'intégration aux systèmes d'information hospitaliers améliore l'enregistrement des données et le suivi des procédures. La préférence pour des dispositifs fiables et sûrs favorise leur adoption par les hôpitaux.

Le segment des laboratoires interventionnels devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à l'expansion des laboratoires spécialisés aux Émirats arabes unis et en Arabie saoudite. Cette expansion vise à répondre à la demande croissante de procédures mini-invasives nécessitant une surveillance avancée. Elle est soutenue par l'augmentation des investissements dans les laboratoires de cardiologie et de chirurgie vasculaire. L'adoption de dispositifs numériques pour un contrôle précis de la pression contribue également à cette croissance. La sensibilisation accrue des cliniciens à la sécurité et à la précision des procédures favorise l'expansion du segment. L'émergence de laboratoires interventionnels dans les villes secondaires contribue également à la croissance rapide de ce segment. Enfin, l'accent mis sur l'amélioration de l'efficacité opérationnelle renforce l'adoption de ces technologies.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en appels d'offres directs, ventes au détail et distributeurs tiers. En 2025, le segment des appels d'offres directs dominait le marché avec une part de 50 %, grâce aux stratégies d'achat des hôpitaux et aux appels d'offres publics dans le secteur de la santé, garantissant l'accès à des dispositifs de gonflage de haute qualité. Les hôpitaux privilégient l'achat direct pour bénéficier d'un support, d'un service et d'une maintenance assurés. Les appels d'offres de grande envergure en Arabie saoudite et aux Émirats arabes unis renforcent la position dominante de ce segment. Les dispositifs acquis par appel d'offres direct sont souvent numériques, ce qui garantit des fonctionnalités avancées et une sécurité optimale. Les initiatives gouvernementales en faveur des services de cardiologie et d'intervention favorisent l'adoption de ce mode d'achat. L'appel d'offres direct garantit la conformité aux normes réglementaires et l'assurance qualité.

Le segment des distributeurs tiers devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à une pénétration accrue dans les petites cliniques et les hôpitaux des marchés émergents de la santé en Afrique. Ces distributeurs offrent un accès aux dispositifs de gonflage analogiques et numériques, avec un support localisé. Le développement des infrastructures de santé dans les villes secondaires favorise l'adoption de ces dispositifs. La flexibilité offerte par les distributeurs en matière d'approvisionnement et de maintenance les rend attractifs pour les petites structures. L'expansion des réseaux de distribution régionaux renforce la croissance du marché. La demande croissante de procédures mini-invasives dans les cliniques et les petits hôpitaux soutient également cette croissance.

Analyse régionale du marché des dispositifs de gonflage au Moyen-Orient et en Afrique

- L’Arabie saoudite a dominé le marché des dispositifs d’inflation au Moyen-Orient et en Afrique avec la plus grande part de revenus (38,1 %) en 2025, grâce à des dépenses de santé élevées, des initiatives gouvernementales visant à améliorer les services de cardiologie interventionnelle et la présence de distributeurs clés et d’entreprises régionales de dispositifs médicaux, avec une adoption importante dans les hôpitaux privés et publics.

- Les hôpitaux et les laboratoires d'intervention de la région apprécient particulièrement la précision, la surveillance en temps réel et les fonctionnalités de sécurité offertes par les dispositifs de gonflage numériques, qui améliorent l'efficacité des procédures et les résultats pour les patients.

- Cette adoption généralisée est également soutenue par des initiatives gouvernementales visant à améliorer les soins cardiaques, une forte présence de distributeurs clés et d'entreprises régionales de dispositifs médicaux, ainsi que par une sensibilisation croissante des cliniciens aux avantages des dispositifs de gonflage avancés, ce qui en fait le choix privilégié des hôpitaux et des cliniques spécialisées.

Analyse du marché des dispositifs de gonflage en Arabie saoudite

Le marché saoudien des dispositifs de gonflage a généré 38,1 % des revenus en 2025 au Moyen-Orient et en Afrique, porté par la prévalence croissante des maladies cardiovasculaires et vasculaires périphériques et par l'augmentation des investissements dans les infrastructures de santé de pointe. Les hôpitaux et les laboratoires d'intervention privilégient les dispositifs de gonflage numériques pour leur précision, leur surveillance en temps réel et leurs caractéristiques de sécurité, qui améliorent l'efficacité des procédures et les résultats pour les patients. Les initiatives gouvernementales visant à améliorer les soins cardiaques et l'adoption croissante des procédures mini-invasives stimulent davantage la croissance du marché. Par ailleurs, la présence de distributeurs clés et d'entreprises régionales de dispositifs médicaux garantit une large disponibilité et un service après-vente performant, favorisant ainsi l'expansion du marché.

Analyse du marché des dispositifs de gonflage aux Émirats arabes unis

Le marché des dispositifs de gonflage aux Émirats arabes unis devrait connaître la croissance annuelle composée la plus rapide au cours de la période de prévision, portée par un meilleur accès aux soins de santé, la multiplication des centres spécialisés en cardiologie et en médecine vasculaire, et le développement des collaborations avec les fabricants internationaux de dispositifs. Les hôpitaux et les cliniques des Émirats arabes unis adoptent rapidement les dispositifs de gonflage numériques afin d'améliorer la précision et l'efficacité des interventions. Les initiatives gouvernementales promouvant les soins interventionnels de pointe, conjuguées à une sensibilisation accrue des cliniciens aux procédures mini-invasives, favorisent également cette adoption. La disponibilité d'infrastructures hospitalières modernes et d'un personnel médical hautement qualifié contribue à la croissance dynamique de ce marché.

Analyse du marché des dispositifs de gonflage en Afrique du Sud

Le marché sud-africain des dispositifs de gonflage connaît une croissance soutenue, portée par l'augmentation des dépenses de santé et la prévalence croissante des maladies cardiovasculaires et vasculaires périphériques. Les hôpitaux et les laboratoires d'intervention adoptent des dispositifs de gonflage analogiques et numériques afin de répondre efficacement aux exigences des procédures. Le développement des infrastructures de santé publiques et privées, conjugué aux initiatives visant à améliorer l'accès aux interventions de pointe, soutient la croissance du marché. La sensibilisation croissante aux techniques mini-invasives et le nombre croissant de centres de cardiologie spécialisés contribuent également à cette croissance.

Analyse du marché égyptien des dispositifs de gonflage

Le marché égyptien des dispositifs de gonflage devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période de prévision, portée par l'augmentation de l'incidence des maladies cardiovasculaires et le développement des services de soins interventionnels. Les hôpitaux et les cliniques investissent de plus en plus dans les dispositifs de gonflage numériques pour un meilleur contrôle des procédures et une sécurité accrue des patients. Le soutien gouvernemental à la modernisation des infrastructures hospitalières et à l'amélioration de l'accès aux interventions cardiovasculaires de pointe stimule davantage la demande. L'adoption de ces dispositifs est également favorisée par les programmes de formation et les ateliers organisés par les fabricants pour familiariser les cliniciens avec ces dispositifs avancés. La croissance de la population urbaine et les projets de modernisation du système de santé renforcent l'expansion du marché.

Part de marché des dispositifs de gonflage au Moyen-Orient et en Afrique

Le secteur des dispositifs de gonflage au Moyen-Orient et en Afrique est principalement dominé par des entreprises bien établies, notamment :

- Merit Medical Systems, Inc. (États-Unis)

- Boston Scientific Corporation (États-Unis)

- Medtronic (Irlande)

- Cook (États-Unis)

- B. Braun SE (Allemagne)

- Terumo Corporation (Japon)

- Teleflex Incorporated (États-Unis)

- Abbott (États-Unis)

- Cardinal Health (États-Unis)

- AngioDynamics, Inc. (États-Unis)

- Argon Medical Devices, Inc. (États-Unis)

- Lepu Medical Technology Co., Ltd. (Chine)

- Vygon SA (France)

- ICU Medical, Inc. (États-Unis)

- Ortus Medi-Tech (Chine)

- Dispositifs médicaux St. Stone (Inde)

- Angiomed GmbH (Allemagne)

- Sinomed Medical (Chine)

- Zylox-Tonbridge (liste Chine/Royaume-Uni)

- Hunan VST BioTechnology Co., Ltd. (Chine)

Quels sont les développements récents sur le marché des dispositifs de surveillance de l'inflation au Moyen-Orient et en Afrique ?

- En janvier 2025, Burjeel Holdings, un important fournisseur de soins de santé privés aux Émirats arabes unis et à Oman, a annoncé l'expansion de son réseau d'établissements, notamment la création de nouveaux centres spécialisés et l'augmentation de ses capacités chirurgicales et interventionnelles, témoignant d'une demande croissante en dispositifs interventionnels de pointe dans la région.

- En mai 2024, Merit Medical Systems a lancé son dispositif de gonflage basixSKY, un nouveau dispositif de gonflage analogique conçu pour les angioplasties par ballonnet et les procédures de pose de stent, offrant un gonflage rapide, une préparation à une main et une manipulation simplifiée.

- En février 2024, Zylox-Tonbridge a reçu les autorisations de mise sur le marché du ministère de la Santé et de la Prévention des Émirats arabes unis pour cinq de ses produits vasculaires interventionnels, dont le cathéter à ballonnet PTA à revêtement médicamenteux ZENFluxion et le cathéter à ballonnet PTA ZENFlow HP, marquant ainsi la première entrée réglementaire de la société dans la région du Golfe.

- En novembre 2022, Merit Medical a lancé le dispositif de gonflage BasixAlpha, un dispositif ergonomique permettant une préparation à une main et un gonflage rapide, destiné à améliorer le débit des procédures d'angioplastie.

- En janvier 2022, Medtronic a fait l'acquisition d'Affera, une entreprise de technologies cardiaques spécialisée dans les systèmes de cartographie, de navigation et d'ablation. Cette acquisition témoigne de l'engagement accru de Medtronic à développer son offre en matière d'interventions cardiovasculaires, ce qui peut stimuler la demande de dispositifs de soutien, notamment les systèmes de gonflage, sur les marchés du Moyen-Orient et d'Afrique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.