Middle East And Africa Plastic Compounding Market

Taille du marché en milliards USD

TCAC :

%

USD

10.48 Billion

USD

14.98 Billion

2024

2032

USD

10.48 Billion

USD

14.98 Billion

2024

2032

| 2025 –2032 | |

| USD 10.48 Billion | |

| USD 14.98 Billion | |

|

|

|

|

Segmentation du marché des composés plastiques au Moyen-Orient et en Afrique, par type de polymère (thermoplastiques, thermodurcissables, plastiques techniques, bioplastiques et autres), type de charge (charges minérales, renforts, additifs et autres), procédé de fabrication (extrusion, compactage/pressage, malaxage/mélange Banbury, mélange par moulage par injection et autres), propriétés (résistance, durabilité, flexibilité, résistance aux chocs, rigidité et autres), applications (aérospatiale et défense, emballage, électricité et électronique, énergie et électricité, bâtiment et construction, automobile, dispositifs médicaux, ameublement et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des composés plastiques au Moyen-Orient et en Afrique

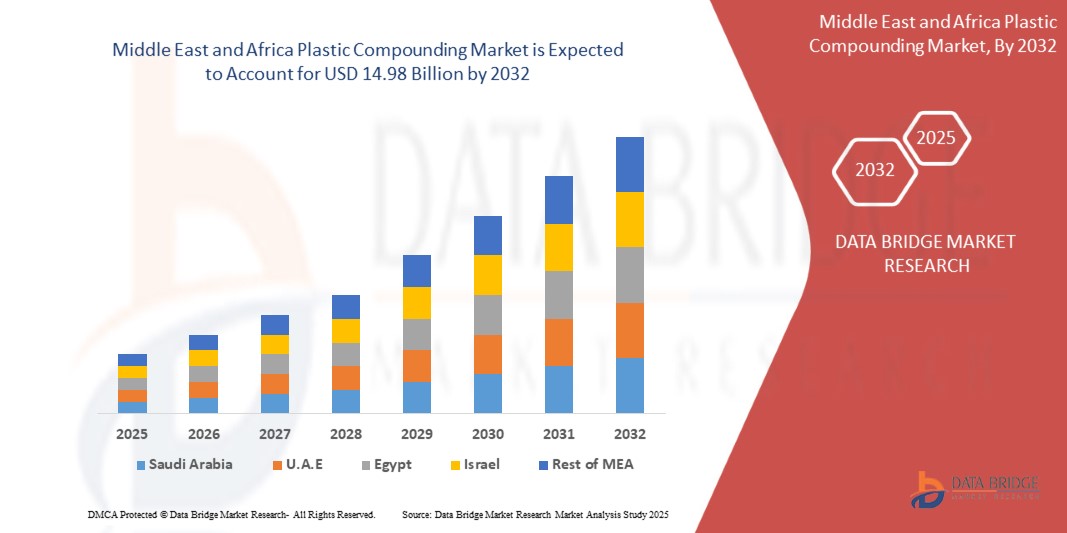

- La taille du marché des composés plastiques au Moyen-Orient et en Afrique était évaluée à 10,48 milliards USD en 2024 et devrait atteindre 14,98 milliards USD d'ici 2032 , à un TCAC de 4,61 % au cours de la période de prévision d'ici 2032. L'évolution vers des composés plastiques recyclables et biodégradables est due aux réglementations environnementales, aux progrès des technologies de compoundage améliorant les performances des produits et la rentabilité, ainsi qu'aux politiques et initiatives gouvernementales de soutien promouvant l'utilisation des plastiques dans diverses industries.

- En outre, le marché devrait connaître une utilisation croissante des bioplastiques et des alternatives aux composés durables, une augmentation de l'adoption des véhicules électriques nécessitant des polymères avancés et une demande croissante de solutions plastiques recyclables et circulaires.

Analyse du marché des composés plastiques au Moyen-Orient et en Afrique

- L'augmentation mondiale du passage aux composés plastiques recyclables et biodégradables en raison des réglementations environnementales, des progrès des technologies de compoundage améliorant les performances des produits et la rentabilité

- Les facteurs clés comprennent l'augmentation mondiale du passage aux composés plastiques recyclables et biodégradables en raison des réglementations environnementales, les progrès des technologies de compoundage améliorant les performances des produits et la rentabilité, la demande croissante des secteurs de transmission d'énergie et l'augmentation des investissements dans la modernisation du réseau et les infrastructures transfrontalières.

- L'Arabie saoudite domine le marché des composés plastiques au Moyen-Orient et en Afrique, détenant la plus grande part de revenus de 24,38 % en 2024, attribuée à sa vaste base de population, à la prévalence croissante du prolapsus des organes pelviens (POP) et de l'incontinence urinaire (IU), à l'augmentation des dépenses de santé et à l'adoption rapide de dispositifs médicaux innovants dans les villes de niveau 1 et de niveau 2.

- L'Arabie saoudite devrait être le pays connaissant la croissance la plus rapide sur le marché au cours de la période de prévision, grâce à son adoption généralisée d'un compoundage efficace et continu et à la demande croissante de composés plastiques de haute qualité dans diverses industries.

- Le segment des thermoplastiques devrait dominer le marché du compoundage plastique au Moyen-Orient et en Afrique, avec une part de marché de 63,58 % en 2025, en raison de son adoption généralisée pour un compoundage efficace et continu et de la demande croissante de composés plastiques de haute qualité dans diverses industries.

Portée du rapport et segmentation du marché des composés plastiques au Moyen-Orient et en Afrique

|

Attributs |

Informations clés sur le marché des composés plastiques au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des composés plastiques au Moyen-Orient et en Afrique

Demande croissante de plastiques haute performance

- La demande en composés plastiques haute performance connaît une croissance rapide, portée par l'urbanisation croissante, l'activité industrielle et l'essor des véhicules électriques et des infrastructures intelligentes. Les composés plastiques avancés répondent à ces défis en offrant une durabilité, une efficacité énergétique et des performances produit améliorées.

- Alors que les pays se concentrent sur la réduction des émissions de carbone et l'amélioration de la stabilité du réseau, on observe une tendance croissante à la modernisation des infrastructures électriques grâce à l'utilisation de composés plastiques innovants. Cette transition est essentielle pour répondre à la demande croissante d'électricité tout en favorisant des systèmes de transport plus propres et plus efficaces.

- Les principaux acteurs de l'industrie tels que Covestro, LyondellBasell et BASF augmentent considérablement leurs efforts de R&D pour développer des composés plastiques de nouvelle génération plus durables, flexibles et performants, stimulant ainsi davantage l'innovation et la croissance du marché.

- Les progrès technologiques en matière de compoundage plastique, caractérisés par une stabilité thermique, une isolation électrique et une résistance mécanique améliorées, stimulent la croissance du marché. Les principaux fabricants développent activement des composés spécialisés pour soutenir l'intégration à grande échelle des énergies renouvelables et améliorer les infrastructures énergétiques interrégionales, favorisant ainsi l'expansion du marché mondial du compoundage plastique au Moyen-Orient et en Afrique.

Dynamique du marché des composés plastiques au Moyen-Orient et en Afrique

Conducteur

Transition vers des composés plastiques recyclables et biodégradables en raison des réglementations environnementales

- La demande mondiale croissante de matériaux durables, portée par des réglementations environnementales strictes, une sensibilisation croissante des consommateurs et les objectifs de développement durable des entreprises, exerce une pression considérable sur les méthodes traditionnelles de production de plastique. Pour relever ce défi, de nombreux fabricants accélèrent leurs investissements dans des composés plastiques recyclables et biodégradables afin de réduire leur impact environnemental et de soutenir les initiatives d'économie circulaire. Ces développements créent des solutions de matériaux plus écologiques, plus performantes et tournées vers l'avenir, à l'instar des technologies écoénergétiques qui optimisent l'utilisation des ressources.

- Par exemple, en 2024, plusieurs grandes entreprises chimiques ont annoncé des projets d'envergure visant à accroître leurs capacités de production de plastiques biodégradables, afin de répondre à la demande croissante des secteurs de l'emballage, de l'automobile et des biens de consommation. Ces initiatives visent à réduire les déchets plastiques, à améliorer la recyclabilité et à se conformer aux cadres réglementaires mondiaux tels que le Plan d'action de l'UE pour l'économie circulaire.

- Ces investissements transforment non seulement les formulations de matériaux, mais favorisent également une adoption plus large des plastiques durables dans tous les secteurs. Des acteurs majeurs tels que BASF, Covestro et LyondellBasell investissent massivement dans la R&D pour développer des composés plastiques biosourcés et recyclables de nouvelle génération, garantissant ainsi des performances et un respect de l'environnement accrus.

- De plus, l'engagement continu des gouvernements, des entreprises privées et des organismes de réglementation joue un rôle essentiel dans la promotion des plastiques recyclables et biodégradables, un élément essentiel des efforts mondiaux en matière de développement durable. Ces initiatives font des composés plastiques écologiques un élément clé de l'économie circulaire et un moteur de croissance majeur sur le marché mondial des composés plastiques au Moyen-Orient et en Afrique.

Retenue/Défi

Volatilité des prix des matières premières, en particulier des matières premières à base de pétrole comme le polypropylène et le polyéthylène

- La volatilité des prix des matières premières, notamment celles issues du pétrole comme le polypropylène et le polyéthylène, demeure un frein important au marché du compoundage plastique au Moyen-Orient et en Afrique. Les fluctuations de prix impactent les coûts de production et la rentabilité, créant une incertitude pour les fabricants comme pour les utilisateurs finaux.

- En outre, la dépendance aux marchés du pétrole brut expose l’industrie du compoundage aux tensions géopolitiques, aux perturbations de la chaîne d’approvisionnement et aux changements de politiques commerciales, ce qui peut entraîner des pics de prix soudains ou des pénuries.

- Par exemple, début 2025, les fluctuations des prix mondiaux du pétrole brut ont entraîné une variation de plus de 20 % des prix du polypropylène en quelques mois, affectant directement les coûts des intrants des fabricants de composés plastiques et obligeant à des ajustements dans les stratégies de prix.

- De plus, les matières premières alternatives telles que les matières premières d'origine biologique, bien que prometteuses, sont actuellement limitées par des coûts plus élevés et des problèmes d'évolutivité, ce qui empêche une atténuation complète de la volatilité des prix du pétrole.

- Cette instabilité des prix pose des défis pour la planification et l'investissement à long terme dans le secteur du compoundage plastique, en particulier pour les petits fabricants et les régions à la résilience financière plus faible. Malgré les efforts déployés pour diversifier les sources de matières premières et améliorer la flexibilité de la chaîne d'approvisionnement, la volatilité des prix des matières premières demeure un obstacle majeur à une croissance stable.

Portée du marché des composés plastiques au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de polymère, du type de charge, du processus de fabrication, des propriétés et de l'application.

- Type de polymère

Selon le type de polymère, le marché est segmenté en thermoplastiques, thermodurcissables, plastiques techniques, bioplastiques, etc. En 2025, le segment des thermoplastiques devrait dominer le marché avec une part de marché de 63,58 %, avec un TCAC de 4,22 % sur la période 2025-2032, porté par la demande croissante de matériaux légers et durables dans tous les secteurs et par l'intérêt croissant pour les composés plastiques recyclables et durables.

- Type de remplissage

Selon le type de charge, le marché est segmenté en charges minérales, renforts, additifs et autres. En 2025, le segment des charges minérales devrait dominer le marché avec une part de marché de 50,75 %, avec un TCAC de 5,24 % sur la période de prévision (2025-2032), porté par la demande croissante de matériaux aux propriétés améliorées, la rentabilité et l'adoption croissante de ces matériaux dans diverses applications industrielles.

- Processus de fabrication

En fonction du procédé de fabrication, le marché est segmenté en extrusion, compactage/pressage, malaxage/mélange Banbury, compoundage par moulage par injection, etc. En 2025, le segment de l'extrusion devrait dominer le marché avec une part de marché de 47,19 %, avec un TCAC de 4,90 % sur la période 2025-2032, grâce à son adoption généralisée pour un compoundage efficace et continu et à la demande croissante de composés plastiques de haute qualité dans divers secteurs.

- Propriétés

Sur la base de leurs propriétés, le marché est segmenté en résistance, durabilité, flexibilité, résistance aux chocs, rigidité, etc. En 2025, le segment de la résistance devrait dominer le marché avec une part de marché de 32,03 %, avec un TCAC de 5,10 % sur la période de prévision (2025-2032), porté par la demande croissante de composés plastiques durables et hautes performances dans les secteurs de l'automobile, de la construction et des biens de consommation.

- Application

En fonction des applications, le marché est segmenté en secteurs tels que l'aérospatiale et la défense, l'emballage, l'électricité et l'électronique, l'énergie, le bâtiment et la construction, l'automobile, les dispositifs médicaux et l'ameublement. En 2025, le segment automobile devrait dominer le marché avec une part de marché de 30,83 %, avec un TCAC de 3,67 % sur la période de prévision (2025-2032), porté par la demande croissante de composés plastiques légers, durables et recyclables, afin d'améliorer l'efficacité énergétique et de respecter les réglementations environnementales strictes.

Analyse régionale du marché des composés plastiques au Moyen-Orient et en Afrique

- Le marché des composés plastiques au Moyen-Orient et en Afrique devrait atteindre 14,98 milliards USD d'ici 2032, contre 10,48 milliards USD en 2024, avec un TCAC de 4,61 % au cours de la période de prévision de 2025 à 2032.

- Le Moyen-Orient et l'Afrique consacrent une part importante de leur PIB à la fabrication et au développement industriel, garantissant ainsi un financement solide pour les matériaux avancés et les technologies innovantes de compoundage plastique. À l'inverse, les marchés émergents augmentent leurs investissements dans le compoundage plastique, portés par l'industrialisation et l'urbanisation croissantes, ainsi que par la demande croissante de matériaux durables et performants. La disponibilité de financements publics et privés joue un rôle crucial dans l'expansion des capacités de production et l'adoption de composés plastiques avancés à l'échelle mondiale.

- Au Moyen-Orient et en Afrique, les technologies avancées de compoundage plastique sont largement adoptées et intégrées à diverses applications industrielles, soutenant des secteurs tels que l'automobile, l'aérospatiale et l'électronique. À l'inverse, les marchés émergents dotés d'infrastructures de production en développement connaissent une croissance rapide de la demande en composés plastiques spécialisés, tirée par l'expansion de leurs bases industrielles et les besoins croissants des secteurs de la santé, de l'automobile et de l'emballage. La centralisation ou la privatisation de ces systèmes de santé et industriels entraîne souvent une augmentation des investissements dans les technologies de pointe de compoundage plastique, favorisant ainsi la croissance et l'accessibilité du marché.

Aperçu du marché des composés plastiques en Arabie saoudite, au Moyen-Orient et en Afrique

L'Arabie saoudite devrait enregistrer un TCAC de 5,86 % de 2025 à 2032 dans la région Moyen-Orient et Afrique, grâce à la demande croissante de propriétés matérielles améliorées, à la rentabilité et à l'adoption croissante dans diverses applications industrielles.

Aperçu du marché des composés plastiques en Égypte, au Moyen-Orient et en Afrique

L'Égypte devrait enregistrer un TCAC de 4,51 % entre 2025 et 2032, grâce à la demande croissante de matériaux légers et durables dans tous les secteurs et à l'accent croissant mis sur les composés plastiques recyclables et durables.

Part de marché des composés plastiques au Moyen-Orient et en Afrique

Le marché des composés plastiques au Moyen-Orient et en Afrique est principalement dirigé par des entreprises bien établies, notamment :

- LyondellBasell Industries Holdings BV (États-Unis)

- BASF (Allemagne)

- Dow (États-Unis)

- SABIC (Arabie saoudite)

- Covestro AG (Allemagne)

- LANXESS (Allemagne)

- Celanese Corporation (États-Unis)

- Borealis GmbH (Autriche)

- Mitsubishi Chemical Group Corporation (Japon)

- DuPont (États-Unis)

- Avient Corporation (États-Unis)

- Syensqo (Belgique)

- Arkema (France)

- Trinseo (États-Unis)

- KANEKA CORPORATION (Japon)

- TORAY INDUSTRIES, INC. (Japon)

- SCG (Thaïlande)

- CLARIANT (Suisse)

Derniers développements sur le marché des composés plastiques au Moyen-Orient et en Afrique

- En juin 2025, Envalior, en collaboration avec SENTImotion et le groupe Frencken, a annoncé une innovation produit : un nouveau concept de boîte de vitesses pour bras robotisés, utilisant le plastique technique Stanyl PA46. Ce développement permet de concevoir des boîtes de vitesses 50 % plus légères et 50 % plus économiques que les alternatives métalliques, favorisant ainsi la production à grande échelle de robots légers et économes en énergie. Cette innovation bénéficie significativement à Envalior en élargissant sa présence dans les secteurs de la robotique et de la mobilité, ouvrant ainsi de nouvelles perspectives de croissance dans l'automatisation grand public et industrielle.

- En mai 2024, Envalior a annoncé sa participation à la conférence SKZ « Plastics in E&E Applications », où elle a présenté ses innovations produits, notamment des composés durables de polyamide 6 et un nouveau PBT ignifuge sans halogène (par exemple, le Pocan BFN4221Z). Ce développement vise à élargir le portefeuille de plastiques techniques d'Envalior avec une proportion accrue de matières premières durables, permettant ainsi à ses clients de réduire leur empreinte carbone et leur dépendance aux combustibles fossiles. Les matériaux mis en avant offrent des performances mécaniques et une ignifugation améliorées, permettant à Envalior de mieux répondre à la demande croissante des secteurs de l'électromobilité, tels que l'électromobilité, la 5G et les systèmes autonomes, tout en renforçant son leadership dans les thermoplastiques durables.

- En juillet 2025, Arkema a lancé Zenimid, une nouvelle marque pour sa gamme de polyimides ultra-hautes performances, marquant ainsi un développement produit stratégique. Cette innovation enrichit le portefeuille de matériaux de spécialités d'Arkema en répondant aux besoins de secteurs à forte demande tels que l'aéronautique, l'électronique et l'automobile. Doté d'une résistance thermique, mécanique et chimique exceptionnelle, Zenimid accompagne la croissance de l'entreprise dans les applications avancées. Ce lancement renforce la position d'Arkema sur le marché des polymères hautes performances.

- En juin 2025, Trinseo a dévoilé LIGOS A9615, un nouvel adhésif acrylique conçu pour le segment des étiquettes à usage général (GPL). Lancé le 9 juin 2025, il cible les étiquettes de film sur le marché de l'Asie du Sud-Est. Ce lancement stratégique renforce la force de Trinseo en matière d'innovation adhésive. Parmi les principaux avantages de ce produit, on peut citer son excellente résistance au vieillissement, son enlevabilité propre et sa capacité de repositionnement, ainsi que sa résistance aux plastifiants, permettant une adhérence fiable même sur les surfaces PVC courbes, courantes dans les applications de biens de consommation et d'emballage.

- En février 2025, Trinseo a annoncé le 27 février 2025 le lancement du premier produit de résine de polystyrène recyclé par dissolution (rPS) transparent au Moyen-Orient et en Afrique, spécifiquement approuvé pour le contact alimentaire direct et officiellement conforme au règlement UE 2022/1616. Cette étape réglementaire fait suite à des tests approfondis, notamment un « Challenge Test » mené avec l'Institut Fraunhofer pour valider l'efficacité de la décontamination et la conformité de la résine finale aux normes de sécurité alimentaire. Produite dans l'usine Trinseo de Schkopau et contenant environ 30 % de contenu recyclé, la nouvelle résine rPS offre une réduction de l'empreinte carbone d'environ 18 % par rapport au polystyrène vierge. Pour Trinseo, ce développement représente une avancée stratégique en matière de développement durable, permettant à l'entreprise de répondre à la demande croissante de solutions de matériaux circulaires et de soutenir les objectifs de contenu recyclé de ses clients.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.2.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.2.1.1 JOINT VENTURES

4.2.1.2 MERGERS AND ACQUISITIONS

4.2.1.3 LICENSING AND PARTNERSHIP

4.2.1.4 TECHNOLOGY COLLABORATIONS

4.2.1.5 STRATEGIC DIVESTMENTS

4.2.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.2.3 STAGE OF DEVELOPMENT

4.2.4 TIMELINES AND MILESTONES

4.2.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.2.6 RISK ASSESSMENT AND MITIGATION

4.2.7 FUTURE OUTLOOK

4.3 VALUE CHAIN ANALYSIS

4.4 IMPORT EXPORT SCENARIO

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CONSUMER BUYING BEHAVIOUR

4.8 DATA BASE OF COMPOUNDERS & THE EQUIPMENT THEY HAVE IN USE

4.9 PATENT ANALYSIS

4.9.1 PATENT QUALITY AND STRENGTH

4.9.2 PATENT FAMILIES

4.9.3 LICENSING AND COLLABORATIONS

4.9.4 REGION PATENT LANDSCAPE

4.9.5 IP STRATEGY AND MANAGEMENT

4.1 RAW MATERIAL COVERAGE

4.11 SUPPLY CHAIN ANALYSIS OF THE MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIOS

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS (LSPS)

4.12 TECHNOLOGICAL ADVANCEMENTS IN THE MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET

4.12.1 AI AND DIGITAL PROCESS OPTIMIZATION

4.12.2 ADVANCED EXTRUSION AND MATERIAL HANDLING TECHNOLOGIES

4.12.3 BIO-BASED AND FUNCTIONALIZED POLYMER COMPOUNDS

4.12.4 SMART AND RESPONSIVE COMPOUNDING SOLUTIONS

4.12.5 AUTOMATION AND INDUSTRY 4.0 IN COMPOUNDING OPERATIONS

4.12.6 SUSTAINABILITY AND CIRCULAR ECONOMY INNOVATIONS

4.12.7 DIGITAL CUSTOMER ENGAGEMENT AND FORMULATION PLATFORMS

4.13 VENDOR SELECTION CRITERIA

4.14 COMPANY EVALUATION QUADRANT

4.15 PRICING ANALYSIS

5 ROLE OF TARIFFS IN THE MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET

5.1 TARIFF LANDSCAPE: DUTIES ON POLYMERS, ADDITIVES, AND MACHINERY

5.2 IMPACT OF TARIFFS ON COST STRUCTURES AND SUPPLY CHAIN DYNAMICS

5.3 INFLUENCE OF TRADE AGREEMENTS AND REGULATORY POLICIES

5.4 MARKET TRENDS AMPLIFYING TARIFF IMPACTS

5.5 COMPETITIVE IMPLICATIONS FOR INDUSTRY PARTICIPANTS

5.6 CHALLENGES AND OPPORTUNITIES ARISING FROM TARIFFS

5.7 KEY COMPANIES AND TARIFF STRATEGY SNAPSHOT

6 REGULATION COVERAGE: MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 SHIFT TOWARDS RECYCLABLE AND BIODEGRADABLE PLASTIC COMPOUNDS DUE TO ENVIRONMENTAL REGULATIONS

7.1.2 ADVANCEMENTS IN COMPOUNDING TECHNOLOGIES IMPROVING PRODUCT PERFORMANCE AND COST-EFFICIENCY

7.1.3 DEVELOPMENT OF NANOCOMPOSITE PLASTICS OFFERING SUPERIOR MECHANICAL AND BARRIER PROPERTIES

7.1.4 INCREASED USE OF COMPOUNDED PLASTICS IN MEDICAL DEVICES DUE TO BIOCOMPATIBILITY AND STERILIZATION COMPATIBILITY

7.2 RESTRAINTS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES, ESPECIALLY PETROLEUM-BASED FEEDSTOCKS LIKE POLYPROPYLENE AND POLYETHYLENE

7.2.2 COMPLEX RECYCLING PROCESSES AND LACK OF PROPER INFRASTRUCTURE FOR PLASTIC COMPOUND WASTE MANAGEMENT

7.3 OPPORTUNITIES

7.3.1 GROWING USE OF BIOPLASTICS AND SUSTAINABLE COMPOUND ALTERNATIVES

7.3.2 SURGE IN ELECTRIC VEHICLE ADOPTION REQUIRING ADVANCED POLYMERS

7.3.3 INCREASING DEMAND FOR RECYCLABLE AND CIRCULAR PLASTIC SOLUTIONS

7.4 CHALLENGES

7.4.1 PERFORMANCE LIMITATIONS OF SUSTAINABLE ALTERNATIVES

7.4.2 REGULATORY AND STANDARDS FRAGMENTATION ACROSS REGIONS

8 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE

8.1 OVERVIEW

8.2 THERMOPLASTICS

8.2.1 THERMOPLASTICS, BY TYPE

8.2.2 POLYETHYLENE (PE), BY TYPE

8.3 ENGINEERING PLASTICS

8.3.1 ENGINEERING PLASTICS, BY TYPE

8.4 THERMOSETTING PLASTICS

8.4.1 THERMOSETTING PLASTICS, BY TYPE

8.5 BIOPLASTICS

8.5.1 BIOPLASTICS, BY TYPE

8.6 OTHERS

9 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE

9.1 OVERVIEW

9.2 MINERAL FILLERS

9.2.1 MINERAL FILLERS, BY TYPE

9.3 REINFORCEMENTS

9.3.1 REINFORCEMENTS, BY TYPE

9.4 ADDITIVES

9.4.1 ADDITIVES, BY TYPE

9.5 OTHERS

10 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS

10.1 OVERVIEW

10.2 EXTRUSION

10.2.1 EXTRUSION, BY TYPE

10.2.2 EXTRUSION, BY PELLETIZING SYSTEM

10.3 INJECTION MOLDING BASED COMPOUNDING

10.3.1 INJECTION MOLDING BASED COMPOUNDING, BY PELLETIZING SYSTEM

10.4 COMPACTION/PRESSING

10.4.1 COMPACTION/PRESSING, BY PELLETIZING SYSTEM

10.5 KNEADER/BANBURY MIXING

10.5.1 KNEADER/BANBURY MIXING, BY PELLETIZING SYSTEM

10.6 OTHERS

11 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES

11.1 OVERVIEW

11.2 RESISTANCE

11.3 DURABILITY

11.4 FLEXIBILITY

11.5 IMPACT RESISTANCE

11.6 RIGIDITY

11.7 OTHERS

12 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AUTOMOTIVE

12.2.1 AUTOMOTIVE, BY CATEGORY

12.2.1.1 INTERIOR COMPONENTS, BY TYPE

12.2.1.2 EXTERIOR BODY PARTS, BY TYPE

12.2.1.3 UNDER-THE-HOOD APPLICATIONS, BY TYPE

12.3 PACKAGING

12.3.1 PACKAGING, BY CATEGORY

12.3.1.1 FOOD & BEVERAGE PACKAGING, BY TYPE

12.3.1.2 INDUSTRIAL PACKAGING, BY TYPE

12.3.1.3 CONSUMER GOODS PACKAGING, BY TYPE

12.4 BUILDING & CONSTRUCTION

12.4.1 BUILDING & CONSTRUCTION, BY CATEGORY

12.5 ELECTRICAL & ELECTRONICS

12.5.1 ELECTRICAL & ELECTRONICS, BY CATEGORY

12.6 MEDICAL DEVICES

12.6.1 MEDICAL DEVICES, BY CATEGORY

12.7 FURNITURE

12.7.1 FURNITURE, BY CATEGORY

12.8 ENERGY AND POWER

12.8.1 ENERGY & POWER, BY CATEGORY

12.9 AEROSPACE AND DEFENSE

12.9.1 AEROSPACE AND DEFENSE, BY CATEGORY

12.1 OTHERS

13 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET BY COUNTRIES

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 EGYPT

13.1.3 U.A.E.

13.1.4 SOUTH AFRICA

13.1.5 ISRAEL

13.1.6 KUWAIT

13.1.7 OMAN

13.1.8 QATAR

13.1.9 BAHRAIN

13.1.10 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SABIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 DOW

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DUPONT

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ARKEMA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASAHI KASEI CORP.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AVIENT CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 BOREALIS GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BASF

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 CLEANESE CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 CHIMEI

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 CLARIANT

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 COVESTRO AG

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 DAICEL CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 ENSINGER GMBH

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 ENVALIOR

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 INEOS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 KANEKA CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 KINGFA SCI.&TECH. CO.,LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 LANXESS

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 BUSINESS PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 LG CHEM

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 MITSUBISHI CHEMICAL GROUP CORPORATION.

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 MITSUI CHEMICALS, INC

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 RTP COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SCG

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 SYENSQO

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 TEKNOR APEX

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TORAY INDUSTRIES, INC.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENT

16.29 TRINSEO

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 SOLUTION PORTFOLIO

16.29.4 RECENT DEVELOPMENTS

16.3 WASHINGTON PENN

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 STAGES OF VALUE CHAIN

TABLE 2 BRAND OUTLOOK: MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET

TABLE 3 CONSUMER BUYING BEHAVIOUR

TABLE 4 MIDDLE EAST AND AFRICA PLAYERS IN PLASTIC COMPOUNDING

TABLE 5 NUMBER OF PATENTS PER YEAR

TABLE 6 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 7 TOP PATENT APPLICANTS

TABLE 8 TARIFF EXPOSURE AND STRATEGIC RESPONSE BY COMPANY TYPE

TABLE 9 TARIFF EXPOSURE AND STRATEGIC RESPONSE OF KEY PLAYERS

TABLE 10 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 12 MIDDLE EAST AND AFRICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 14 MIDDLE EAST AND AFRICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND )

TABLE 17 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 18 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 21 MIDDLE EAST AND AFRICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 24 MIDDLE EAST AND AFRICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 27 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY FILTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 37 MIDDLE EAST AND AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 39 MIDDLE EAST AND AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 43 MIDDLE EAST AND AFRICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 46 MIDDLE EAST AND AFRICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 49 MIDDLE EAST AND AFRICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 52 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA RESISTANCE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA DURABILITY IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FLEXIBILITY IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA IMPACT RESISTANCE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA RIGIDITY IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 61 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 63 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 69 MIDDLE EAST AND AFRICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 75 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 78 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 81 MIDDLE EAST AND AFRICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 84 MIDDLE EAST AND AFRICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 87 MIDDLE EAST AND AFRICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 90 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA OTHERS IN PLASTIC COMPOUNDING MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 93 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 95 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 97 MIDDLE EAST AND AFRICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 108 MIDDLE EAST AND AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 116 MIDDLE EAST AND AFRICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 132 SAUDI ARABIA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 143 SAUDI ARABIA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 147 SAUDI ARABIA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 149 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 151 SAUDI ARABIA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SAUDI ARABIA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 161 SAUDI ARABIA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 162 SAUDI ARABIA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 163 SAUDI ARABIA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 164 SAUDI ARABIA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 167 EGYPT THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 EGYPT REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 178 EGYPT EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 EGYPT EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 180 EGYPT INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 181 EGYPT COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 182 EGYPT KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 183 EGYPT PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 186 EGYPT AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 EGYPT EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 EGYPT UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 EGYPT PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 191 EGYPT FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 EGYPT INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 EGYPT CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 EGYPT BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 195 EGYPT ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 196 EGYPT MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 197 EGYPT FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 198 EGYPT ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 EGYPT AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 200 U.A.E. PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 U.A.E. PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 202 U.A.E. THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 U.A.E. POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 U.A.E. ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 U.A.E. THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E. BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 U.A.E. PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 U.A.E. MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 U.A.E. REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E. ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E. PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E. PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 213 U.A.E. EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E. EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E. INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E. COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E. KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E. PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E. PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E. PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 221 U.A.E. AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 222 U.A.E. INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 U.A.E. EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 U.A.E. UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 U.A.E. PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 226 U.A.E. FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 U.A.E. INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 U.A.E. CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 U.A.E. BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 230 U.A.E. ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 231 U.A.E. MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 232 U.A.E. FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 233 U.A.E. ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 234 U.A.E. AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 237 SOUTH AFRICA THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH AFRICA POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH AFRICA ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH AFRICA THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH AFRICA BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH AFRICA MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SOUTH AFRICA REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SOUTH AFRICA ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 247 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 248 SOUTH AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SOUTH AFRICA EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 250 SOUTH AFRICA INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 251 SOUTH AFRICA COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 252 SOUTH AFRICA KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 253 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 254 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 255 SOUTH AFRICA PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 256 SOUTH AFRICA AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 257 SOUTH AFRICA INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 SOUTH AFRICA EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 SOUTH AFRICA UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SOUTH AFRICA PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 261 SOUTH AFRICA FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SOUTH AFRICA INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SOUTH AFRICA CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SOUTH AFRICA BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 265 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 266 SOUTH AFRICA MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 267 SOUTH AFRICA FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 268 SOUTH AFRICA ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 269 SOUTH AFRICA AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 270 ISRAEL PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 ISRAEL PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 272 ISRAEL THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 ISRAEL POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 ISRAEL ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 ISRAEL THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 ISRAEL BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 ISRAEL PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 ISRAEL MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 ISRAEL REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 ISRAEL ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 ISRAEL PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 282 ISRAEL PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 283 ISRAEL EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 ISRAEL EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 285 ISRAEL INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 286 ISRAEL COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 287 ISRAEL KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 288 ISRAEL PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 289 ISRAEL PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 290 ISRAEL PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 291 ISRAEL AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 292 ISRAEL INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 ISRAEL EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 ISRAEL UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 ISRAEL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 296 ISRAEL FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 ISRAEL INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 ISRAEL CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 ISRAEL BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 300 ISRAEL ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 301 ISRAEL MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 302 ISRAEL FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 303 ISRAEL ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 304 ISRAEL AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 305 KUWAIT PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 KUWAIT PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 307 KUWAIT THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 KUWAIT POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 KUWAIT ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 KUWAIT THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 KUWAIT BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 KUWAIT PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 KUWAIT MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 KUWAIT REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 KUWAIT ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 KUWAIT PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 317 KUWAIT PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 318 KUWAIT EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 KUWAIT EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 320 KUWAIT INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 321 KUWAIT COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 322 KUWAIT KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 323 KUWAIT PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 324 KUWAIT PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 325 KUWAIT PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 326 KUWAIT AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 327 KUWAIT INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 KUWAIT EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 KUWAIT UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 KUWAIT PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 331 KUWAIT FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 KUWAIT INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 KUWAIT CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 KUWAIT BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 335 KUWAIT ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 336 KUWAIT MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 337 KUWAIT FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 338 KUWAIT ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 339 KUWAIT AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 340 OMAN PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 OMAN PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 342 OMAN THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 OMAN POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 OMAN ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 OMAN THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 OMAN BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 OMAN PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 OMAN MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 OMAN REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 OMAN ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 OMAN PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 352 OMAN PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 353 OMAN EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 OMAN EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 355 OMAN INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 356 OMAN COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 357 OMAN KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 358 OMAN PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 359 OMAN PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 360 OMAN PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 361 OMAN AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 362 OMAN INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 OMAN EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 OMAN UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 OMAN PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 366 OMAN FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 OMAN INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 OMAN CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 OMAN BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 370 OMAN ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 371 OMAN MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 372 OMAN FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 373 OMAN ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 374 OMAN AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 375 QATAR PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 QATAR PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 377 ATAR THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 QATAR POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 QATAR ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 QATAR THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 QATAR BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 QATAR PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 QATAR MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 QATAR REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 QATAR ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 QATAR PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 387 QATAR PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (KILO TONS)

TABLE 388 QATAR EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 QATAR EXTRUSION IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 390 QATAR INJECTION MOLDING BASED COMPOUNDING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 391 QATAR COMPACTION/PRESSING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 392 QATAR KNEADER/BANBURY MIXING IN PLASTIC COMPOUNDING MARKET, BY PELLETIZING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 393 QATAR PLASTIC COMPOUNDING MARKET, BY PROPERTIES, 2018-2032 (USD THOUSAND)

TABLE 394 QATAR PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 395 QATAR PLASTIC COMPOUNDING MARKET, BY APPLICATION, 2018-2032 (KILO TONS)

TABLE 396 QATAR AUTOMOTIVE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 397 QATAR INTERIOR COMPONENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 QATAR EXTERIOR BODY PARTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 QATAR UNDER-THE-HOOD APPLICATIONS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 QATAR PACKAGING IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 401 QATAR FOOD & BEVERAGE PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 QATAR INDUSTRIAL PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 QATAR CONSUMER GOODS PACKAGING IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 QATAR BUILDING & CONSTRUCTION IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 405 QATAR ELECTRICAL & ELECTRONICS IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 406 QATAR MEDICAL DEVICES IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 407 QATAR FURNITURE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 408 QATAR ENERGY AND POWER IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 409 QATAR AEROSPACE AND DEFENSE IN PLASTIC COMPOUNDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 410 BAHRAIN PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 BAHRAIN PLASTIC COMPOUNDING MARKET, BY POLYMER TYPE, 2018-2032 (KILO TONS)

TABLE 412 BAHRAIN THERMOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 BAHRAIN POLYETHYLENE (PE) IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 BAHRAIN ENGINEERING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 BAHRAIN THERMOSETTING PLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 BAHRAIN BIOPLASTICS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 BAHRAIN PLASTIC COMPOUNDING MARKET, BY FILLER TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 BAHRAIN MINERAL FILLERS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 BAHRAIN REINFORCEMENTS IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 BAHRAIN ADDITIVES IN PLASTIC COMPOUNDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 BAHRAIN PLASTIC COMPOUNDING MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)