Middle East And Africa Single Board Computer Market

Taille du marché en milliards USD

TCAC :

%

USD

171.91 Million

USD

223.54 Million

2024

2032

USD

171.91 Million

USD

223.54 Million

2024

2032

| 2025 –2032 | |

| USD 171.91 Million | |

| USD 223.54 Million | |

|

|

|

|

Segmentation du marché des ordinateurs monocartes au Moyen-Orient et en Afrique, type de processeur (architecture Arm, architecture X86, autres architectures), système d'exploitation (Windows, Linux, Android et autres), vitesse (2 à 4 GHz, 1,5 à 2 GHz, inférieure à 1,5 GHz et autres), type (système sur puce (SoC) et système sur module (SoM)), canal de distribution (ventes indirectes et ventes directes), connectivité (filaire et sans fil), application (automatisation industrielle, électronique grand public, soins de santé, automobile, éducation et recherche, télécommunications et autres) - Tendances et prévisions du secteur jusqu'en 2032

Analyse du marché des ordinateurs monocartes

Le marché des ordinateurs monocartes (SBC) est un secteur en pleine évolution qui se concentre sur le développement, la production et la distribution de systèmes informatiques compacts et entièrement intégrés sur un seul circuit imprimé. Ces ordinateurs sont conçus pour offrir une puissance de traitement, une connectivité et des fonctionnalités performantes pour un large éventail d'applications, notamment l'automatisation industrielle, l'IoT, la santé, l'aérospatiale et l'électronique grand public. Ce marché est porté par les avancées de l'IA, de l'edge computing et des systèmes embarqués, permettant le traitement des données en temps réel et des performances accrues dans des environnements à espace restreint. Face à la demande croissante de solutions informatiques basse consommation et hautes performances, le marché des SBC poursuit son expansion, favorisant l'innovation en matière de conception, de capacités matérielles et de personnalisations spécifiques aux applications pour répondre aux besoins changeants de l'industrie.

Taille du marché des ordinateurs monocartes

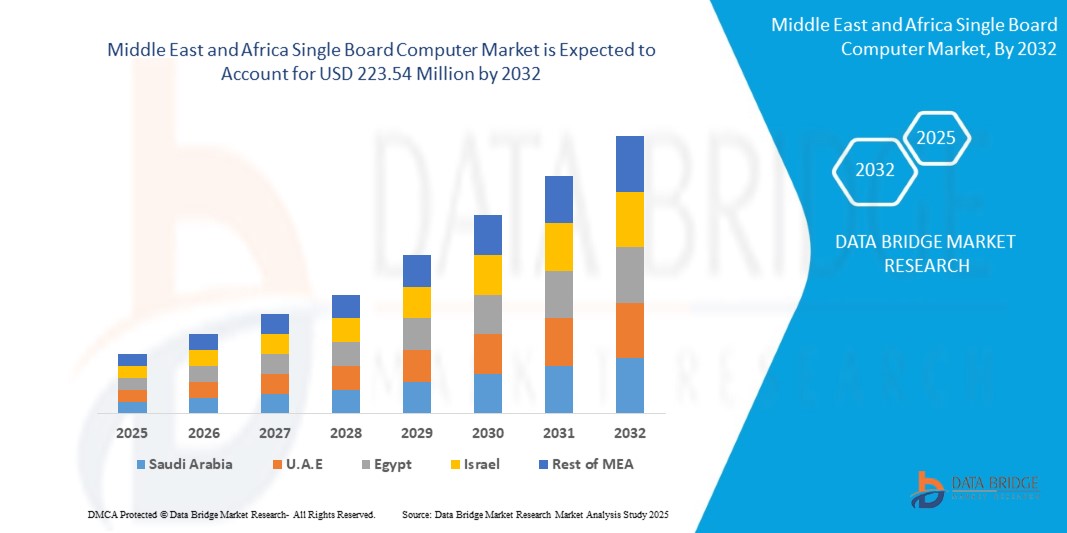

La taille du marché des ordinateurs monocartes au Moyen-Orient et en Afrique était évaluée à 171,91 millions USD en 2024 et devrait atteindre 223,54 millions USD d'ici 2032, avec un TCAC de 3,4 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE.

Tendances du marché des ordinateurs monocartes

« Demande croissante d'applications d'IA et de ML »

L'intégration croissante de l'intelligence artificielle (IA) et de l'apprentissage automatique (ML) dans divers secteurs a entraîné une demande croissante d'ordinateurs monocartes (SBC). Ces appareils compacts mais performants sont largement utilisés dans des applications telles que l'edge computing, la robotique, l'automatisation industrielle et le traitement de données en temps réel. Des secteurs comme la santé, l'automobile et les villes intelligentes dépendent des SBC pour alimenter les technologies basées sur l'IA, notamment la reconnaissance d'images, l'analyse prédictive et les systèmes autonomes. L'évolution constante de l'IA et du ML entraîne un besoin croissant de SBC offrant hautes performances, efficacité énergétique et évolutivité. Cette demande devrait stimuler l'expansion du marché, stimuler l'innovation et conduire au développement de solutions SBC plus avancées.

Portée du rapport et segmentation du marché des ordinateurs monocartes

|

Attributs |

Informations clés sur le marché des ordinateurs monocartes |

|

Segments couverts |

|

|

Pays couverts |

Émirats arabes unis, Oman, Bahreïn, Koweït, Qatar, Arabie saoudite, Afrique du Sud, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

Qualcomm Technologies, Inc. (France), Intel Corporation (États-Unis), EMERSON ELECTRIC CO (États-Unis), ASUSTeK Computer Inc. (Taïwan), Kontron (Allemagne), Mercury Systems, Inc. (États-Unis), AAEON Technology Inc. (Taïwan), Axiomtek Co., Ltd. (Taïwan), Arduino (Italie), American Portwell Technology, Inc. (États-Unis), IEI Integration Corp. (Taïwan), Arm Limited (ou ses filiales) (Royaume-Uni), Advantech Co., Ltd. (Taïwan), RASPBERRY PI FOUNDATION (Royaume-Uni), Curtiss-Wright Corporation (États-Unis), Abaco Systems (États-Unis), ADLINK Technology Inc. (Taïwan), Core Avionics & Industrial Inc. (États-Unis), Eurotech SpA, Technologic Systems, Inc (États-Unis) et Gateworks Corporation (États-Unis), Eurotech SpA (Italie), Beagleboard.Org Foundation (États-Unis) et ARBOR Technology Corp (Taïwan) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie par des experts, une analyse d'import/export, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché des ordinateurs monocartes

Un ordinateur monocarte est un système informatique compact et autonome dont tous les composants essentiels, notamment le processeur (CPU), la mémoire (RAM), le stockage, les interfaces d'entrée/sortie et la gestion de l'alimentation, sont intégrés sur un seul circuit imprimé. Les SBC fonctionnent comme des unités autonomes, sans nécessiter de cartes d'extension ni de périphériques supplémentaires. Ils sont largement utilisés dans les systèmes embarqués, l'automatisation industrielle, la robotique, les objets connectés et les projets éducatifs grâce à leur petite taille, leur faible consommation d'énergie et leur rentabilité. Parmi les exemples les plus connus, citons le Raspberry Pi, le Beagle Bone et le Jetson Nano, couramment utilisés pour des applications allant de l'informatique de base et du prototypage à l'informatique de pointe et à l'automatisation alimentée par l'IA. Leur polyvalence les rend indispensables dans les secteurs exigeant des solutions informatiques efficaces, fiables et évolutives.

Dynamique du marché des ordinateurs monocartes

Conducteurs

- Soutien gouvernemental aux villes intelligentes et à la transformation numérique

L'importance croissante accordée aux initiatives de villes intelligentes et à la transformation numérique alimente la demande d'ordinateurs monocartes (SBC). Ces solutions informatiques compactes et économiques jouent un rôle crucial dans l'IoT, l'automatisation et les applications pilotées par l'IA, qui font partie intégrante des infrastructures urbaines modernes et des écosystèmes numériques. À mesure que les villes adoptent des systèmes de circulation intelligents, des réseaux intelligents et des services publics connectés, les SBC fournissent la puissance de calcul et la connectivité nécessaires. De plus, l'augmentation des financements et des incitations politiques en faveur du développement urbain axé sur la technologie accélère l'adoption des SBC dans tous les secteurs, renforçant ainsi leur rôle dans un paysage numérique en constante évolution.

Par exemple,

Selon un article de blog publié par Invest India, l'Inde a lancé en septembre 2024 un programme de développement de 12 nouvelles villes industrielles intelligentes dans le cadre du NICDP, avec un investissement de 329 431 millions de dollars. Ces villes sont conçues pour stimuler la croissance économique, attirer les investissements du Moyen-Orient et d'Afrique et créer des millions d'emplois grâce à des infrastructures de pointe et une connectivité fluide. L'accent mis par le gouvernement sur les réseaux électriques intelligents, les énergies renouvelables et la gestion durable des déchets s'inscrit dans ses objectifs plus larges de transformation numérique. Cette initiative soutient la croissance des industries axées sur l'automatisation, l'IA et l'IoT, bénéficiant directement au marché des ordinateurs monocartes (SBC). En favorisant l'innovation et la fabrication intelligente, l'Inde crée un écosystème solide pour l'adoption des SBC dans l'automatisation industrielle et le développement urbain.

- Expansion des applications dans les soins de santé et les dispositifs médicaux

The growing adoption of Single Board Computers (SBCs) in healthcare and medical devices is driving market expansion. These compact, high-performance systems support medical imaging, patient monitoring, and diagnostic equipment, enhancing efficiency and real-time data processing. SBCs enable AI-driven analysis, wearable health tech, and telemedicine applications, improving patient care. Their cost-effectiveness and integration with IoT further boost demand in hospitals and research labs. As healthcare technology advances, SBCs play a crucial role in innovation and medical automation.

For instance,

In February 2025, Kontron launched the 3.5"-SBC-AML/ADN single board computer to support AI-enabled healthcare systems. Powered by IntelUSD AtomUSD , N-Series, and Core i3 N-Series processors, it delivered 4K 60fps output and AI acceleration within a low power range of 6W to 15W. It featured DDR5 memory, 2.5GbE LAN, and USB 3.2 for low-latency real-time performance. The board-to-board connector allowed expansion for specialized medical applications. With industrial-grade variants and TPM 2.0 security, it ensured reliability and protection against environmental and cyber threats, enhancing SBC use in healthcare.

- Rising Demand for AI and ML Applications

The growing integration of artificial intelligence (AI) and machine learning (ML) in various industries has significantly boosted the demand for Single Board Computers (SBCs). These compact yet powerful computing solutions are increasingly used in edge computing, robotics, automation, and real-time data processing. Industries such as healthcare, automotive, and smart cities rely on SBCs to support AI-driven applications such as image recognition, predictive analytics, and autonomous systems. As AI and ML continue to advance, the need for high-performance, energy-efficient SBCs is expected to rise, driving market expansion and innovation.

For instance,

In October 2024, according to the blog published by the Mouser Electronics, Inc., single board computers (SBCs) such as the Raspberry Pi played a key role in bringing AI to the industrial automation edge. AI and machine learning (ML) applications expanded beyond large enterprises, integrating into industries through Industry 5.0 and the Industrial Internet of Things (IIoT). Edge computing improved industrial automation by enabling real-time data processing, reducing latency, and minimizing reliance on cloud infrastructure. Raspberry Pi introduced the Hailo-8L AI Kit, enhancing AI capabilities for industrial automation. This advancement boosted the demand for high-performance SBCs, driving growth in the Middle East and Africa market.

Opportunities

- Rising Use in Gaming and Retro Computing

The rising use of Single Board Computers (SBCs) in gaming and retro computing has created a significant market opportunity. Enthusiasts and developers increasingly turn to SBCs for building compact gaming consoles, emulation systems, and DIY arcade machines. The affordability, energy efficiency, and flexibility of SBCs make them ideal for running classic games and customized gaming platforms. With growing interest in nostalgia-driven gaming and the demand for cost-effective, versatile computing solutions, the SBC market is poised to benefit from this expanding segment.

For instance,

In June 2022, Ibase Technology launched the IB956 single-board computer, designed for gaming applications. Equipped with 11th Gen Intel Core/Celeron processors, the board supported four displays through multiple interfaces, enhancing gaming experiences. Its efficient heat dissipation system improved performance and reliability. This development aligned with the growing demand for SBCs in gaming and retro computing, offering a powerful and versatile solution for enthusiasts and developers.

- Development of SBCs with Neural Processing Units (NPUs)

The development of single-board computers (SBCs) with neural processing units (NPUs) presents a strong opportunity for the market. As AI-driven applications, including machine learning, computer vision, and edge computing, continue to grow, SBCs equipped with NPUs offer enhanced processing power and efficiency. These advanced boards enable faster AI inference, lower power consumption, and improved real-time decision-making, making them ideal for robotics, automation, and AI-powered gaming. With increasing demand for intelligent computing solutions, the integration of NPUs in SBCs positions the market for significant expansion and innovation.

For instance,

In April, 2024, Radxa launched the ROCK 5C and ROCK 5C Lite, two single-board computers (SBCs) featuring integrated neural processing units (NPUs). Built around the Rockchip RK3588S2 and RK3582 chipsets, these SBCs provided AI acceleration with up to six TOPS of performance, enabling efficient machine learning applications. The boards supported up to 32GB of LPDDR4x memory, HDMI 2.1 for 8K video output, and various connectivity options, including USB, Ethernet, and Wi-Fi 6. With their compact design and enhanced AI capabilities, these SBCs highlighted the growing demand for NPUs in the market, offering new opportunities for AI-driven applications and development.

- Advancements in low-Power SBCs

Advancements in low-power SBCs present a significant opportunity for the market, enabling energy-efficient computing solutions for a wide range of applications. These SBCs reduce operational costs and extend battery life, making them ideal for IoT, edge computing, and embedded systems. Their compact size and optimized power consumption attract developers seeking sustainable and cost-effective alternatives. As industries shift towards greener technology, demand for low-power SBCs continues to rise, opening new possibilities in smart devices, automation, and AI-driven applications. This trend drives innovation and expands the market reach for energy-efficient computing solutions.

For instance,

In February 2025, Kontron launched the 3.5"-SBC-AML/ADN, a new low-power single-board computer designed for AI-enabled applications in automation, healthcare, smart cities, and smart retail. The board featured Intel® Atom® x7000RE/x7000E, Intel® N-Series, and Intel® Core™ i3 N-Series processors, integrating AI acceleration and UHD Graphics for enhanced AI inference performance. It supported 4K 60fps output, DDR5 memory, high-bandwidth 2.5GbE LAN, and USB 3.2 Gen 2 for optimized system responsiveness. The board also included industrial-grade variants, a wide voltage input range, and TPM 2.0 security, offering improved durability and protection. These advancements in low-power SBCs created new opportunities in the market for real-time, AI-driven applications.

Restraints/Challenges

- Higher Costs of AI and Industrial-Grade SBCs

The high costs of AI and industrial-grade SBCs act as a major restraint on market growth. Expensive hardware limits accessibility for startups and small businesses, slowing innovation and adoption. Many industries hesitate to invest in costly SBCs, especially when cheaper alternatives exist. The steep pricing also reduces demand in price-sensitive regions, restricting Middle East and Africa market expansion. As a result, the high cost barrier hampers widespread deployment and scalability in various applications

For instance,

The high costs of AI and industrial-grade SBCs, such as NVIDIA's USD 20,535 A100 GPU and Seeed Studio's USD 1,800 Jetson AGX Xavier Kit, create significant barriers to market expansion. These premium prices limit adoption, especially for startups and smaller enterprises with constrained budgets. Industries seeking cost-effective solutions may turn to lower-end alternatives, slowing the adoption of advanced AI-driven computing. High upfront investments discourage widespread deployment in emerging markets, restricting innovation. As a result, the steep pricing of these SBCs negatively impacts market growth and scalability.

- Supply Chain Disruptions and Semiconductor Shortages

Supply chain disruptions and semiconductor shortages are major restraints on the Single Board Computer (SBC) market. Limited availability of key components, including processors and memory chips, has led to production delays and increased costs for manufacturers. Logistics challenges, geopolitical tensions, and fluctuating raw material prices further impact supply stability. These issues slow innovation, extend lead times, and create uncertainty for businesses relying on SBCs for healthcare, automation, and AI-driven applications. Without a stable supply chain, market growth faces constraints, forcing companies to seek alternative sourcing strategies and redesign products to mitigate risks.

For instance,

In January 2023, according to a blog published by Everstream Analytics, rising China-Taiwan tensions posed a major threat to Middle East and Africa supply chains, particularly in semiconductor manufacturing. Increased military incursions, regulatory conflicts, and potential trade restrictions heightened the risk of disruptions in Taiwan’s semiconductor exports. Any escalation, including cyberattacks, naval blockades, or full-scale conflict, could significantly damage infrastructure and reduce Middle East and Africa economic output by an estimated USD 2.7 trillion in the first year. The semiconductor shortage resulting from such instability would severely impact industries reliant on Single Board Computers (SBCs), leading to delays, higher costs, and reduced production capacity worldwide.

- E-Waste Concerns and Environmental Impact

E-waste concerns and environmental impact pose a significant challenge to the Middle East and Africa Single Board Computer (SBC) Market as the rapid advancement of technology leads to frequent hardware upgrades and short product life cycles. Many SBCs become obsolete within a few years, contributing to electronic waste (e-waste). Improper disposal of SBCs can result in toxic material leakage, including lead, mercury, and cadmium, which harm the environment and human health. In addition, recycling SBC components is difficult due to the compact, soldered nature of circuit boards. As governments impose stricter e-waste regulations, manufacturers must adopt sustainable materials, eco-friendly designs, and recycling programs to minimize environmental impact.

For instance,

En 2024, la production de déchets électroniques au Moyen-Orient et en Afrique a atteint 62 milliards de kg, mais seulement 13 milliards de kg (21 %) ont été correctement collectés et recyclés, ce qui met en évidence un déficit considérable en matière de gestion des déchets électroniques. Parmi les petits équipements informatiques, dont les ordinateurs monocartes (SBC), seul 1 milliard de kg sur 4,6 milliards de kg (22 %) a été recyclé. Ce faible taux de recyclage soulève de graves préoccupations environnementales, car les SBC contribuent à l'augmentation des déchets électroniques en raison de leur cycle de vie court, de leur obsolescence rapide et de la difficulté de recycler leurs composants PCB complexes. Pour relever ce défi, l'industrie des SBC doit privilégier les matériaux durables, les conceptions modulaires et de meilleurs systèmes d'élimination des déchets électroniques afin de réduire son empreinte environnementale.

Ce rapport de marché détaille les évolutions récentes, la réglementation commerciale, l'analyse des importations et exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs nationaux et locaux, l'analyse des opportunités de revenus émergents, l'évolution de la réglementation, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination du marché, les homologations et lancements de produits, les expansions géographiques et les innovations technologiques. Pour plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée et à stimuler votre croissance.

Portée du marché des ordinateurs monocartes

Le marché est segmenté en sept segments clés, basés sur le type de processeur, le système d'exploitation, la vitesse, le type, le canal de distribution, la connectivité et l'application. La croissance de ces segments vous permettra d'analyser les segments à faible croissance des secteurs et de fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, les aidant ainsi à prendre des décisions stratégiques pour identifier les applications clés du marché.

Type de processeur

- Architecture du bras

- Architecture X86

- Autres architectures

- Système opérateur

- Windows

- Linux

- Androïde

- Autres

Vitesse

- En dessous de 1,5 GHz

- 1,5 à 2 GHz

- 2 à 4 GHz

- Au-dessus de 4 GHz

Taper

- Système sur puce (SOC)

- Système sur module (Som)

- processeur

- Mémoire embarquée

- Interfaces de carte porteuse

- Système opérateur

- Circuits intégrés de gestion de l'alimentation

- Autres

Canal de distribution

- Ventes directes

- Ventes indirectes

Type de connectivité

- Câblé

- Ethernet

- USB

- Ports série (Rs-232/Rs-485)

- Autres

- Sans fil

- Wi-Fi

- Bluetooth

- Cellulaire (3g/4g/5g)

- Autres

Application

- Automatisation industrielle

- Robotique

- Contrôle des processus

- Vision artificielle

- Par type de processeur

- Architecture du bras

- Architecture X86

- Autres architectures

- Par type de processeur

- Électronique grand public

- Ordinateurs personnels

- Consoles de jeux

- Domotique

- Par type de processeur

- Architecture du bras

- Architecture X86

- Par type de processeur

- soins de santé

- Dispositifs médicaux

- Équipement de diagnostic

- Systèmes de surveillance des patients

- Par type de processeur

- Architecture du bras

- Architecture X86

- Autres architectures

- Par type de processeur

- Automobile

- Systèmes d'infodivertissement

- Systèmes avancés d'aide à la conduite (Adas)

- Contrôle des véhicules électriques (VE)

- Par type de processeur

- Architecture du bras

- Architecture X86

- Autres architectures

- Par type de processeur

- Éducation et recherche

- Kits d'apprentissage

- Prototypage et développement

- Par type de processeur

- Architecture du bras

- Architecture X86

- Autres architectures

- Par type de processeur

- Télécommunications

- Équipement de réseau

- Passerelles IoT

- Par type de processeur

- Architecture du bras

- Architecture X86

- Autres architectures

- Par type de processeur

- Autres

Analyse régionale du marché des ordinateurs monocartes

The Middle East and Africa single board computer market is segmented into seven notable segments based on the processor type, operating system, speed, type, distribution channel, connectivity, and application.

The countries covered in the market are Oman, Bahrain, Kuwait, Qatar, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East and Africa.

Saudi Arabia is the fastest growing and is expected to dominate the Middle East & Africa Single Board Computer Market due to its its strong manufacturing ecosystem, rapid industrial automation, and increasing adoption of IoT and AI-driven applications. The region is home to major SBC manufacturers, semiconductor companies, and consumer electronics giants, driving innovation and production scalability.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Single Board Computer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Single Board Computer Market Leaders Operating in the Market Are:

- Qualcomm Technologies, Inc.(France)

- Intel Corporation (U.S.)

- EMERSON ELECTRIC CO (U.S.)

- ASUSTeK Computer Inc.(Taiwan)

- Kontron (Germany)

- Mercury Systems, Inc.,(U.S.)

- AAEON Technology Inc.(Taiwan)

- Axiomtek Co., Ltd.(Taiwan)

- Arduino (Italy)

- American Portwell Technology, Inc.(U.S.)

- IEI Integration Corp.(Taiwan)

- Arm Limited (or its affiliates) (U.K.)

- Advantech Co., Ltd. (Taiwan)

- RASPBERRY PI FOUNDATION (U.K.)

- Curtiss-Wright Corporation (U.S.)

- Abaco Systems (U.S.)

- ADLINK Technology Inc.(Taiwan)

- Core Avionics & Industrial Inc. (U.S.)

- Eurotech S.p.A., Technologic Systems, Inc (U.S.)

- Gateworks Corporation(U.S.)

- Eurotech S.p.A.(Italy)

- Beagleboard.Org Foundation (U.S.)

- ARBOR Technology Corp (Taiwan)

Latest Developments in Single Board Computer Market

- En juillet 2023, Axiomtek, leader reconnu des solutions informatiques industrielles au Moyen-Orient et en Afrique, a annoncé le lancement du SHB160, un ordinateur monocarte (SBC) PICMG 1.3 de taille standard conçu pour offrir des performances de calcul élevées et une grande fiabilité. Équipé d'un processeur Intel Core™ i7/i5/i3, Pentium® ou Celeron® de 13e/12e génération (LGA1700) et du chipset Intel R680E/H610E, le SHB160 a été lancé pour répondre aux exigences croissantes des applications industrielles et AIoT.

- En avril 2024, la division Solutions de Défense de Curtiss-Wright a annoncé l'élargissement de sa gamme d'ordinateurs monocarte (SBC) certifiés DO-254 avec le lancement de sa première conception basée sur l'architecture Intel®. Le nouveau module processeur V3-1222 est le premier du secteur embarqué à intégrer le processeur Intel Core de 13e génération pour l'avionique. Ce module est compatible avec le package de preuves de navigabilité Intel et est hébergé sur une carte VPX 3U robuste conçue pour les applications certifiées DO-254 DAL (Design Assurance Level) A.

- En février 2025, Eurotech, fournisseur leader de solutions d'informatique de pointe, s'est associé à AxxonSoft, acteur innovant du Moyen-Orient et de l'Afrique dans le domaine des logiciels de gestion vidéo, afin de proposer des solutions intégrées avancées pour la vidéosurveillance haute performance et l'analyse basée sur l'IA. Cette collaboration associe le système de gestion vidéo intelligent d'AxxonSoft au matériel d'intelligence artificielle de pointe d'Eurotech, certifié en cybersécurité et de qualité industrielle, garantissant ainsi des performances et une évolutivité supérieures en matière de surveillance en temps réel.

- En décembre 2024, IEI, leader de l'informatique IA de pointe au Moyen-Orient et en Afrique, a présenté le POCi-W22/24C-RPL, une gamme de PC médicaux intelligents de nouvelle génération conçue pour les applications médicales pilotées par l'IA. Équipé de processeurs Intel Core i7/i5 de 13e génération, il dispose de deux emplacements M.2 pour un stockage optimisé et un traitement des données plus rapide, optimisant ainsi les flux de travail et améliorant l'efficacité des professionnels de santé dans un contexte de transformation numérique à l'échelle du secteur.

- En décembre 2024, IEI a annoncé le lancement de ses dernières cartes mères industrielles hautes performances, équipées de processeurs AMD Ryzen™ et EPYC™ pour une puissance de calcul et une efficacité exceptionnelles. Conçues pour les applications industrielles, ces cartes mères offrent des capacités de traitement avancées, une fiabilité et une évolutivité optimales, répondant aux besoins des secteurs exigeant des performances robustes pour l'automatisation, l'edge computing et les solutions basées sur l'IA.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PROCESSOR TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 EVOLUTION OF THE CUSTOMER SEGMENT FOR SINGLE BOARD COMPUTER

4.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.5 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.6 TECHNOLOGY ANALYSIS OF THE MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET

4.7 COMPANY COMPARATIVE ANALYSIS

4.8 COMPANY SERVICE PLATFORM MATRIX FOR MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET

4.9 USE CASE AND ITS ANALYSIS

4.1 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GOVERNMENT SUPPORT FOR SMART CITIES AND DIGITAL TRANSFORMATION

5.1.2 EXPANDING APPLICATIONS IN HEALTHCARE AND MEDICAL DEVICES

5.1.3 RISING DEMAND FOR AI AND ML APPLICATIONS

5.1.4 ADVANCEMENTS IN ARM-BASED AND RISC-V ARCHITECTURES

5.2 RESTRAINTS

5.2.1 HIGHER COSTS OF AI AND INDUSTRIAL-GRADE SBCS

5.2.2 SUPPLY CHAIN DISRUPTIONS AND SEMICONDUCTOR SHORTAGES

5.3 OPPORTUNITIES

5.3.1 RISING USE IN GAMING AND RETRO COMPUTING

5.3.2 DEVELOPMENT OF SBCS WITH NEURAL PROCESSING UNITS (NPUS)

5.3.3 ADVANCEMENTS IN LOW-POWER SINGLE BOARD COMPUTERS (SBCS)

5.4 CHALLENGES

5.4.1 E-WASTE CONCERNS AND ENVIRONMENTAL IMPACT

5.4.2 LIMITED MEMORY AND STORAGE EXPANSION OPTIONS

6 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE

6.1 OVERVIEW

6.2 ARM ARCHITECTURE

6.3 X86 ARCHITECTURE

6.4 OTHER ARCHITECTURE

7 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 ANDROID

7.5 OTHERS

8 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY SPEED

8.1 OVERVIEW

8.2 2 TO 4 GHZ

8.3 1.5 TO 2 GHZ

8.4 BELOW 1.5 GHZ

8.5 OTHERS

9 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY TYPE

9.1 OVERVIEW

9.2 SYSTEM-ON-CHIP (SOC)

9.3 SYSTEM-ON-MODULE (SOM)

9.3.1 CPU

9.3.2 ON BOARD MEMORY

9.3.3 CARRIER BOARD INTERFACES

9.3.4 OPERATING SYSTEM

9.3.5 POWER MANAGEMENT ICS

9.3.6 OTHERS

10 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 INDIRECT SALES

10.3 DIRECT SALES

11 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY

11.1 OVERVIEW

11.2 WIRED

11.2.1 ETHERNET

11.2.2 USB

11.2.3 SERIAL PORTS

11.2.4 OTHERS

11.3 WIRELESS

11.3.1 WIFI

11.3.2 BLUETOOTH

11.3.3 CELLULAR

11.3.4 OTHERS

12 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 INDUSTRIAL AUTOMATION

12.2.1 BY TYPE

12.2.1.1 Process Control

12.2.1.2 Robotics

12.2.1.3 Machine Vision

12.2.2 BY PROCESSOR TYPE

12.2.2.1 Arm Architecture

12.2.2.2 X86 Architecture

12.2.2.3 Other Architectures

12.3 CONSUMER ELECTRONICS

12.3.1 BY TYPE

12.3.1.1 Home Automation

12.3.1.2 Gaming Consoles

12.3.1.3 Personal Computers

12.3.2 BY PROCESSOR TYPE

12.3.2.1 Arm Architecture

12.3.2.2 X86 Architecture

12.3.2.3 Other Architectures

12.4 HEALTH CARE

12.4.1 BY TYPE

12.4.1.1 Patient Monitoring System

12.4.1.2 Diagnostic Equipment

12.4.1.3 Medical Device

12.4.2 BY PROCESSOR TYPE

12.4.2.1 Arm Architecture

12.4.2.2 X86 Architecture

12.4.2.3 Other Architectures

12.5 AUTOMOTIVE

12.5.1 BY TYPE

12.5.1.1 Advanced Driver-Assistance System

12.5.1.2 Electric Vehicle Control

12.5.1.3 Infotainment System

12.5.2 BY PROCESSOR TYPE

12.5.2.1 Arm Architecture

12.5.2.2 X86 Architecture

12.5.2.3 Other Architectures

12.6 EDUCATION AND RESEARCH

12.6.1 BY TYPE

12.6.1.1 Learning Kits

12.6.1.2 Medical Device

12.6.2 BY PROCESSOR TYPE

12.6.2.1 Arm Architecture

12.6.2.2 X86 Architecture

12.6.2.3 Other Architectures

12.7 TELECOMUNICATIONS

12.7.1 BY TYPE

12.7.1.1 Networking Equipment

12.7.1.2 IOT Gateways

12.7.2 BY PROCESSOR TYPE

12.7.2.1 Arm Architecture

12.7.2.2 X86 Architecture

12.7.2.3 Other Architectures

12.8 OTHERS

13 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 SOUTH AFRICA

13.1.3 U.A.E

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 QATAR

13.1.7 KUWAIT

13.1.8 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 QUALCOMM TECHNOLOGIES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 INTEL CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 EMERSON ELECTRIC CO.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 ASUSTEK COMPUTER INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 KONTRON

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AAEON TECHNOLOGY INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ABACO SYSTEMS (ACQUIRED BY AMETEK, INC.)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ADLINK TECHNOLOGY INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ADVANTECH CO., LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 AMERICAN PORTWELL TECHNOLOGY, INC. (SUBSIDIARY OF PORTWELL INC.)

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 ARBOR TECHNOLOGY CORP.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ARDUINO

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ARM LIMITED

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 AXIOMTEK CO., LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 BEAGLEBOARD.ORG FOUNDATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 CORE AVIONICS & INDUSTRIAL INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 CURTISS-WRIGHT CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT/NEWS

16.18 EUROTECH S.P.A.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 GATEWORKS CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 IEI INTEGRATION CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MERCURY SYSTEMS, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

16.22 RASPBERRY PI LTD (SUBSIDIARY OF RASPBERRY PI FOUNDATION)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TECHNOLOGIC SYSTEMS, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 COMPANY SERVICE PLATFORM MATRIX

TABLE 4 USE CASE ANALYSIS

TABLE 5 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET

TABLE 6 TOP 12 SMART CITIES IN THE U.S.

TABLE 7 SINGLE BOARD COMPUTER (SBC) PRICE IN USD

TABLE 8 SUPPLY CHAIN DISRUPTIONS AND SEMICONDUCTOR SHORTAGES

TABLE 9 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA ARM ARCHITECTURE IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA X86 ARCHITECTURE IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA OTHER ARCHITECTURES IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA WINDOWS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA LINUX IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA ANDROID IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA OTHERS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY SPEED 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA 2 TO 4 GHZ IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA 1.5 TO 2 GHZ IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA BELOW 1.5 GHZ IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SYSTEM-ON-CHIP (SOC) IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA INDIRECT SALES IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA DIRECT SALES IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA WIRED IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA OTHERS IN SINGLE BOARD COMPUTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 80 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 81 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 84 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 85 SAUDI ARABIA WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SAUDI ARABIA WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SAUDI ARABIA SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SAUDI ARABIA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SAUDI ARABIA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SAUDI ARABIA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SAUDI ARABIA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SAUDI ARABIA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SAUDI ARABIA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SAUDI ARABIA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH AFRICA WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH AFRICA SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH AFRICA INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH AFRICA CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SOUTH AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 SOUTH AFRICA HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SOUTH AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SOUTH AFRICA AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SOUTH AFRICA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH AFRICA EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SOUTH AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH AFRICA TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 U.A.E SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 U.A.E SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 124 U.A.E SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 125 U.A.E SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.A.E SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.A.E SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 U.A.E SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 129 U.A.E WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.A.E WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.A.E SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 U.A.E INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.A.E INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.A.E CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.A.E CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.A.E HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.A.E HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.A.E AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.A.E AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.A.E EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.A.E EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.A.E TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.A.E TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 ISRAEL SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 ISRAEL SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 146 ISRAEL SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 147 ISRAEL SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 ISRAEL SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 ISRAEL SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 150 ISRAEL SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 151 ISRAEL WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 ISRAEL WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 ISRAEL SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 154 ISRAEL INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ISRAEL INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 ISRAEL CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 ISRAEL CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 ISRAEL HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 ISRAEL HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 ISRAEL AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 ISRAEL AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 ISRAEL EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 ISRAEL EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ISRAEL TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ISRAEL TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 EGYPT WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 EGYPT CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 EGYPT CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 EGYPT HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 EGYPT HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 EGYPT AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 EGYPT AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 EGYPT TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 QATAR SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 QATAR SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 190 QATAR SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 191 QATAR SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 QATAR SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 QATAR SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 QATAR SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 QATAR WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 QATAR SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 198 QATAR INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 QATAR INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 QATAR CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 QATAR CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 QATAR HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 QATAR HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 QATAR AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 QATAR AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 QATAR EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 QATAR EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 QATAR TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 QATAR TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 KUWAIT SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 KUWAIT SINGLE BOARD COMPUTER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 212 KUWAIT SINGLE BOARD COMPUTER MARKET, BY SPEED, 2018-2032 (USD THOUSAND)

TABLE 213 KUWAIT SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 KUWAIT SYSTEM-ON-MODULE (SOM) IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 KUWAIT SINGLE BOARD COMPUTER MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 216 KUWAIT SINGLE BOARD COMPUTER MARKET, BY CONNECTIVITY, 2018-2032 (USD THOUSAND)

TABLE 217 KUWAIT WIRED IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 KUWAIT WIRELESS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 KUWAIT SINGLE BOARD COMPUTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 KUWAIT INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 KUWAIT INDUSTRIAL AUTOMATION IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 KUWAIT CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 KUWAIT CONSUMER ELECTRONICS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 KUWAIT HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 KUWAIT HEALTH CARE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 KUWAIT AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 KUWAIT AUTOMOTIVE IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 KUWAIT EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 KUWAIT EDUCATION AND RESEARCH IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 KUWAIT TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 KUWAIT TELECOMMUNICATIONS IN SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 REST OF MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: PROCESSOR TYPE TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: SEGMENTATION

FIGURE 13 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET, BY PROCESSOR TYPE (2024)

FIGURE 14 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 RISING DEMAND FOR AI AND ML APPLICATIONS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 PROCESSOR TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET IN 2025 & 2032

FIGURE 19 (USD BILLION) JAPAN FUND FOR ASEAN SMART CITIES

FIGURE 20 TOTAL E-WASTE GENERATED AND RECYCLED

FIGURE 21 SMALL IT EQUIPMENT

FIGURE 22 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY PROCESSOR TYPE, 2024

FIGURE 23 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY OPERATING SYSTEM, 2024

FIGURE 24 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY SPEED, 2024

FIGURE 25 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY TYPE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 27 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY CONNECTIVITY, 2024

FIGURE 28 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: BY APPLICATION, 2024

FIGURE 29 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: SNAPSHOT (2024)

FIGURE 30 MIDDLE EAST AND AFRICA SINGLE BOARD COMPUTER MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.