Middle East And Africa Soil Health Market

Taille du marché en milliards USD

TCAC :

%

USD

1.11 Billion

USD

2.38 Billion

2025

2033

USD

1.11 Billion

USD

2.38 Billion

2025

2033

| 2026 –2033 | |

| USD 1.11 Billion | |

| USD 2.38 Billion | |

|

|

|

|

Segmentation du marché de la santé des sols au Moyen-Orient et en Afrique, par type (produits d'amélioration des sols et produits de test et de surveillance), par type de sol (sols alluviaux, sols rouges, limons, sols noirs, sols arides, sols sableux, sols limoneux, sols argileux, sols jaunes, sols latéritiques, sols salins/alcalins, sols tourbeux, sols crayeux, autres), par technologie (gestion conventionnelle des sols, gestion intégrée de la fertilité des sols (GIFS), gestion de précision de la santé des sols, pratiques d'agriculture régénératrice, autres), par application (sols cultivés et non cultivés), par utilisateur final (agriculteurs et producteurs, entreprises agroalimentaires, entreprises d'aménagement paysager et de foresterie, organismes gouvernementaux et de réglementation, instituts de recherche, universités, autres), par canal de distribution (ventes directes, marché de l'après-vente) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché de la santé des sols au Moyen-Orient et en Afrique

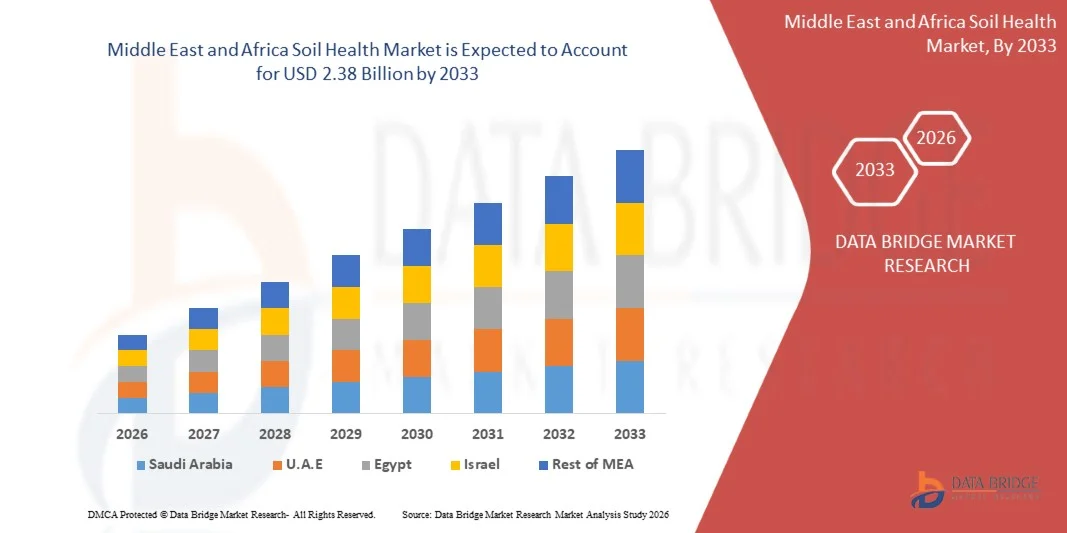

- Le marché de la santé des sols au Moyen-Orient et en Afrique devrait atteindre 2,38 milliards de dollars américains d'ici 2033, contre 1,11 milliard de dollars américains en 2025, avec un taux de croissance annuel composé (TCAC) de 5,5 % sur la période de prévision allant de 2026 à 2033.

- Le marché de la santé des sols au Moyen-Orient et en Afrique connaît une croissance soutenue, portée par l'utilisation croissante de solutions pour la santé des sols dans des secteurs tels que l'agriculture, l'horticulture, l'aménagement paysager et la foresterie. Ces solutions sont appréciées pour leur capacité à améliorer la fertilité des sols, à optimiser la rétention des nutriments et à favoriser des pratiques de gestion durable des terres.

- Les progrès constants réalisés dans les technologies d'amendement des sols, les techniques de formulation et l'efficacité des produits, conjugués à l'amélioration des normes de qualité, favorisent une adoption plus large des produits innovants pour la santé des sols dans des applications performantes, notamment l'amélioration de la productivité des cultures, la dépollution des sols et l'agriculture de précision. Il en résulte une amélioration de la qualité des sols, des rendements agricoles et une durabilité environnementale à long terme.

- Des cadres réglementaires favorables promouvant des intrants agricoles écologiques et peu toxiques, associés à des exigences accrues en matière de conformité environnementale, encouragent les parties prenantes à adopter des solutions pour la santé des sols comme alternatives plus sûres, durables et respectueuses de l'environnement aux pratiques traditionnelles.

Analyse du marché de la santé des sols au Moyen-Orient et en Afrique

- Le marché des produits de santé des sols au Moyen-Orient et en Afrique dessert un large éventail de secteurs, notamment le textile, le papier, les résines, la pharmacie, les cosmétiques et le traitement de l'eau. La demande est principalement tirée par ses excellentes propriétés de réticulation et son rôle d'intermédiaire essentiel dans les formulations chimiques de spécialité et de haute performance.

- Le marché des produits de santé des sols au Moyen-Orient et en Afrique s'adresse à des secteurs similaires, tels que le textile, le papier, les résines, la pharmacie, les cosmétiques et le traitement de l'eau. Son adoption est favorisée par ses propriétés fonctionnelles performantes et son rôle d'intermédiaire dans les applications chimiques de spécialité et de haute performance.

- En 2025, le segment des produits d'amélioration des sols devrait dominer le marché de la santé des sols avec une part de 89,04 %, grâce à son utilisation intensive dans la production de résines, d'adhésifs et de produits chimiques pour le traitement du papier. Ce segment bénéficie d'une forte demande dans les opérations industrielles à grande échelle et d'une rentabilité élevée pour la production en vrac, ce qui en fait un choix privilégié par rapport aux autres catégories de produits.

- L'Afrique du Sud devrait dominer le marché de la santé des sols au Moyen-Orient et en Afrique avec une part de 21,67 % en 2026, grâce à une industrialisation rapide, une forte demande des industries textile et papetière, une infrastructure de production chimique bien établie et des applications croissantes dans les revêtements, les adhésifs et les produits chimiques de spécialité, renforçant ainsi sa position de principal contributeur à la croissance du marché régional.

- Le marché saoudien devrait connaître une croissance annuelle composée d'environ 10,9 % entre 2026 et 2033, portée par la demande croissante des secteurs du textile et de l'agrochimie et par l'utilisation accrue de résines et de revêtements pour applications industrielles. L'accélération de l'industrialisation et du développement urbain dans la région stimulera davantage la croissance du marché.

- L'adoption croissante de technologies de pointe, telles que les systèmes de surveillance des sols basés sur l'IA, l'irrigation automatisée et l'analyse des nutriments en temps réel, améliore l'efficacité opérationnelle et soutient la croissance du marché dans les applications agricoles commerciales et industrielles.

- Des politiques gouvernementales favorables, le développement des infrastructures et les investissements dans des initiatives d'agriculture durable stimulent davantage la croissance du marché, encouragent l'adoption de solutions avancées pour la santé des sols et renforcent les perspectives de croissance à long terme du secteur.

Portée du rapport et segmentation du marché de la santé des sols au Moyen-Orient et en Afrique

|

Attributs |

Aperçu du marché de la santé des sols au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie d'experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTEL. |

Tendances du marché de la santé des sols

« Intégration aux écosystèmes de l’agriculture intelligente, de la gestion des sols et de l’agriculture de précision »

- Les solutions pour la santé des sols sont de plus en plus intégrées aux systèmes agricoles intelligents, favorisant la productivité des cultures, l'optimisation des nutriments et une gestion durable des terres. Ces solutions permettent un suivi régulier des sols, une application précise des amendements et une prise de décision fondée sur les données, conformément aux principes de l'Industrie 4.0 en agriculture.

- Dans les installations de traitement et de stockage des sols, les amendements et les conditionneurs de sol contribuent à la rétention d'humidité, à la stabilisation des nutriments et à l'amélioration de la structure du sol, améliorant ainsi l'efficacité de la manutention, la durabilité du stockage et la fiabilité des applications en aval.

- L'adoption croissante de produits pour la santé des sols dans les équipements agricoles de précision, les systèmes d'irrigation contrôlés et les plateformes automatisées de surveillance des champs contribue à une meilleure efficacité agricole à grande échelle en améliorant l'apport de nutriments, en réduisant le gaspillage et en favorisant la durabilité des sols à long terme dans toutes les opérations agricoles.

Par exemple,

- En janvier 2025, les technologies avancées d'amendement des sols étaient de plus en plus intégrées aux systèmes automatisés d'irrigation et de surveillance des parcelles. Ces systèmes, associés à des capteurs de nutriments du sol en temps réel et à des plateformes d'analyse numérique, ont permis d'améliorer l'efficacité opérationnelle, la régularité et la durabilité des exploitations agricoles, soulignant ainsi le rôle des solutions pour la santé des sols dans les écosystèmes agricoles de nouvelle génération.

- Les évolutions récentes du secteur témoignent d'une adoption croissante des amendements de sol spécialisés, des inoculants microbiens et des produits à base d'acides humiques dans les applications agricoles à haut rendement et d'agriculture de précision. La mécanisation croissante, les pratiques agricoles fondées sur les données et les exigences de durabilité renforcent l'importance grandissante des solutions pour la santé des sols au-delà des applications agricoles traditionnelles.

Dynamique du marché de la santé des sols

Conducteur

« Modernisation agricole croissante et exigences accrues en matière de solutions pour les sols axées sur la performance »

- Le secteur agricole du Moyen-Orient et de l'Afrique connaît une adoption accélérée des solutions avancées pour la santé des sols, sous l'impulsion d'exigences de performance de plus en plus complexes dans les domaines des cultures, de l'horticulture, de l'aménagement paysager et de la foresterie. Les agriculteurs et les entreprises agroalimentaires privilégient ces solutions pour leur capacité à améliorer la structure du sol, la rétention des nutriments, la capacité de stockage de l'eau et la fertilité à long terme. À mesure que les pratiques agricoles évoluent vers une efficacité accrue, des rendements plus constants et une durabilité renforcée, la demande d'amendements de sol favorisant un apport optimal de nutriments, de meilleures performances des cultures et des pratiques respectueuses de l'environnement s'accroît.

- Le rôle croissant des produits pour la santé des sols dans les initiatives de modernisation agricole a créé un environnement propice à l'innovation, favorisant les progrès en matière de formulation, de polyvalence d'application et de compatibilité avec les équipements d'agriculture de précision. Face à cette évolution dictée par la demande, les fabricants investissent dans le développement de solutions pour les sols personnalisées, adaptées à des types de cultures, des conditions pédologiques et des zones climatiques spécifiques, notamment des amendements à base d'acides humiques, des biostimulants et des engrais améliorant les performances.

- Ces innovations sont largement motivées par les besoins opérationnels de l'agriculture moderne, qui exige des solutions pour la santé des sols adaptables et performantes dans diverses conditions de terrain et sous différentes réglementations. À mesure que les exploitations agricoles et les entreprises agroalimentaires intègrent de plus en plus de produits de pointe pour la santé des sols dans leurs pratiques d'irrigation, de fertilisation et de gestion des terres, cette dynamique influence non seulement les stratégies d'investissement des fournisseurs, mais renforce également le rôle essentiel des solutions pour la santé des sols en tant que facteur clé d'une production agricole durable, à haut rendement et axée sur la qualité.

Par exemple,

- En septembre 2023, les rapports agricoles ont mis en évidence l'adoption accrue d'amendements de sol humiques et microbiens dans les opérations horticoles et de grandes cultures avancées visant à améliorer la structure du sol, la disponibilité des nutriments et la rétention d'eau tout en respectant des normes environnementales plus strictes.

- En février 2024, des données régionales indiquaient que les exploitations agricoles à travers l'Europe avaient intensifié l'utilisation de biostimulants et d'amendements de sol riches en nutriments pour soutenir des pratiques de production durables et réduire leur dépendance aux engrais chimiques conventionnels ayant un impact environnemental plus important.

- En février 2025, les développements au Moyen-Orient et en Afrique ont mis en évidence l'augmentation des investissements dans les produits spécialisés pour la santé des sols, notamment les acides humiques, les amendements organiques et les inoculants microbiens, afin de répondre à la demande croissante de l'agriculture à grande échelle, de l'agriculture de précision et des initiatives de gestion durable des terres.

- L'adoption croissante de solutions avancées pour la santé des sols dans le secteur agricole du Moyen-Orient et d'Afrique souligne leur importance grandissante en tant que produits multifonctionnels répondant aux exigences évolutives en matière de performance, d'efficacité et de durabilité. Alors que l'agriculture poursuit ses progrès vers des productions de meilleure qualité, un apport contrôlé en nutriments et une gestion optimisée des sols, les capacités fonctionnelles de ces solutions en font des atouts essentiels pour améliorer les rendements agricoles, la fertilité des sols et la productivité des terres à long terme.

Retenue/Défi

« Absence de cadres réglementaires harmonisés au Moyen-Orient et en Afrique pour les solutions de santé des sols »

- L’absence de réglementations harmonisées au Moyen-Orient et en Afrique régissant la fabrication, l’application et la manipulation des amendements de sol constitue un défi majeur pour le marché de la santé des sols dans cette région, car les exigences réglementaires diffèrent considérablement d’un pays et d’une région à l’autre.

- Les autorités réglementaires appliquent des normes variables concernant la composition des produits, les limites autorisées en ingrédients actifs, la conformité environnementale, l'étiquetage, le transport et la gestion des déchets. Cette fragmentation réglementaire oblige les fabricants de solutions pour la santé des sols et les utilisateurs agricoles en aval à adapter leurs formulations, leur documentation, leurs protocoles de sécurité et leurs stratégies de conformité à chaque marché, ce qui accroît la complexité opérationnelle, les coûts de mise en conformité et les délais d'adoption.

- De ce fait, les entreprises rencontrent des difficultés pour développer la fabrication et la distribution de produits pour la santé des sols au Moyen-Orient et en Afrique, notamment en ce qui concerne le commerce transfrontalier et les chaînes d'approvisionnement multinationales desservant les secteurs de l'agriculture, de l'horticulture, de l'aménagement paysager et de la foresterie.

Par exemple,

- Fin 2025, les autorités environnementales régionales d'Asie et d'Europe ont introduit des exigences de conformité différentes pour les amendements de sol, les amendements à base d'acide humique et les inoculants microbiens, avec des variations dans les composants actifs autorisés et les obligations de déclaration, illustrant des incohérences réglementaires qui compliquent les stratégies de production et d'exportation standardisées.

- En mai 2025, les organismes de réglementation nationaux et locaux des marchés émergents ont appliqué des restrictions plus strictes en matière de manutention, de stockage et de transport, allant au-delà des directives centrales existantes, ce qui a entraîné des perturbations opérationnelles temporaires pour les fabricants et les distributeurs de solutions pour la santé des sols, qui ont été tenus d'obtenir des approbations supplémentaires et de modifier leurs flux de travail logistiques pendant la période d'application.

- L’absence de cadres réglementaires harmonisés au Moyen-Orient et en Afrique continue de constituer un défi structurel pour le marché de la santé des sols, limitant la facilité de normalisation de la production, de la distribution et du commerce transfrontalier, et augmentant le besoin de stratégies de conformité spécifiques à chaque région.

Étendue du marché de la santé des sols

Le marché de la santé des sols au Moyen-Orient et en Afrique est segmenté en six catégories selon le type de produit, le type de sol, la technologie, l'application, l'utilisateur final et le canal de distribution.

• Par type

En fonction du type de produit, le marché est segmenté en produits d'amélioration des sols et produits de test et de surveillance.

En 2026, le segment des produits d'amélioration des sols devrait dominer le marché de la santé des sols au Moyen-Orient et en Afrique, représentant la part la plus élevée (89,04 %), grâce à son intégration poussée dans un large éventail d'applications agricoles et horticoles. Cette domination s'explique principalement par l'utilisation intensive d'amendements de sol industriels, de produits à base d'acides humiques et de biostimulants dans la production végétale, l'agriculture de précision, l'aménagement paysager et la réhabilitation des terres, domaines où une application continue à grande échelle est essentielle au maintien de la fertilité des sols, de l'équilibre des nutriments et du rendement des cultures. Leur capacité à assurer une rétention fiable des nutriments, une bonne capacité de rétention d'eau et des propriétés d'amélioration des sols à l'échelle de la parcelle en fait un choix privilégié pour les agriculteurs et les entreprises agroalimentaires gérant des exploitations à haut rendement.

Par ailleurs, la position dominante du segment des produits de test et de surveillance sur le marché est renforcée par leur rentabilité et leur disponibilité en grandes quantités, ce qui correspond parfaitement aux stratégies d'approvisionnement des grands exploitants agricoles cherchant à optimiser leurs coûts opérationnels sans compromettre la productivité des sols ni les rendements des cultures. Alors que les secteurs agricole et horticole continuent de se développer rapidement dans les économies développées et émergentes, la demande de solutions standardisées et à grande échelle pour la santé des sols devrait rester soutenue.

Cette demande soutenue, combinée à la polyvalence et à la compatibilité des produits d'amélioration des sols avec divers types de sols, cycles de culture et conditions climatiques, positionne le segment de qualité industrielle comme le principal contributeur aux revenus du marché de la santé des sols au Moyen-Orient et en Afrique en 2026.

Par type de sol

En fonction du type de sol, le marché est segmenté en sols alluviaux, sols rouges, limons, sols noirs, sols arides, sols sableux, sols limoneux, sols argileux, sols jaunes, sols latéritiques, sols salins/alcalins, sols tourbeux, sols crayeux et autres.

En 2026, le segment des sols alluviaux devrait dominer le marché de la santé des sols au Moyen-Orient et en Afrique, représentant la part la plus importante (15,85 %). Cette domination s'explique par les performances supérieures et la fiabilité fonctionnelle accrue des sols alluviaux dans les applications agricoles et de gestion des terres les plus avancées. Les solutions de santé des sols adaptées aux sols alluviaux améliorent la rétention des nutriments, la capacité de rétention d'eau et la stabilisation de la structure du sol, ce qui les rend particulièrement adaptées aux applications où un conditionnement précis du sol et des rendements agricoles constants sont essentiels. Ces propriétés favorisent considérablement leur adoption dans l'agriculture de précision, l'horticulture à haute valeur ajoutée, la production de cultures spécialisées et les projets de réhabilitation des terres, où l'optimisation des performances du sol se traduit directement par une amélioration des rendements, une durabilité accrue et une utilisation plus efficace des ressources.

Par ailleurs, la position dominante du segment des sols alluviaux sur le marché est renforcée par sa qualité constante et sa conformité aux normes réglementaires et agronomiques les plus strictes. Les agriculteurs et les entreprises agroalimentaires privilégient de plus en plus les solutions de traitement des sols alluviaux sur mesure afin de répondre aux exigences changeantes en matière de sécurité des sols, de protection de l'environnement et de transparence des processus. Alors que les pratiques agricoles évoluent vers une culture performante et à forte valeur ajoutée, la demande de solutions de haute qualité pour la santé des sols alluviaux devrait rester soutenue, consolidant ainsi la position dominante de ce segment sur le marché de la santé des sols au Moyen-Orient et en Afrique en 2026.

Par la technologie

En fonction de la technologie, le marché est segmenté en gestion conventionnelle des sols, gestion intégrée de la fertilité des sols (ISFM), gestion de précision de la santé des sols, pratiques d'agriculture régénératrice et autres.

En 2026, le segment de la gestion conventionnelle des sols devrait dominer le marché de la santé des sols au Moyen-Orient et en Afrique, représentant la part la plus importante (32,11 %). Cette domination s'explique par son efficacité opérationnelle supérieure et sa parfaite adéquation aux exigences modernes de l'agriculture et de la gestion des terres. Cette approche de gestion permet une meilleure répartition des nutriments, un amendement du sol homogène et des rendements prévisibles, ce qui la rend particulièrement adaptée aux applications exigeant des solutions d'amélioration des sols fiables et standardisées. Comparées aux pratiques traditionnelles ou ponctuelles, les techniques de gestion conventionnelle structurées offrent un cadre contrôlé pour le traitement des sols, favorisant une culture stable à grande échelle, une variabilité réduite et des performances optimales au champ.

De plus, la position dominante du segment des pratiques agricoles régénératrices sur le marché est renforcée par une sécurité opérationnelle accrue, une rentabilité optimisée et le respect des normes environnementales et de durabilité, autant d'éléments devenus essentiels pour les fournisseurs de solutions pour les sols. Cette approche réduit la dépendance aux intrants chimiques dangereux, limite l'impact environnemental et permet de se conformer aux réglementations régionales strictes. Face à la demande croissante de solutions pour la santé des sols au Moyen-Orient et en Afrique, dans les secteurs des cultures, de l'horticulture, de l'aménagement paysager et de l'agriculture de précision, les agriculteurs et les entreprises agroalimentaires adoptent de plus en plus cette méthode évolutive et durable, consolidant ainsi sa position de leader sur le marché d'ici 2026.

Sur demande

En fonction de l'application, le marché est segmenté en sols cultivés et sols non cultivés. Les sols cultivés sont ensuite subdivisés en fonction de l'application : céréales, oléagineux et légumineuses, fruits et légumes, cultures commerciales, cultures de plantation et autres.

En 2026, le segment des terreaux devrait dominer le marché, représentant la part la plus importante (70,13 %), grâce à sa polyvalence et à ses avantages pratiques pour une vaste gamme d'applications agricoles et d'aménagement du territoire. Les terreaux sont largement plébiscités pour leur facilité d'utilisation, leurs caractéristiques de stockage sûres et leur aptitude à une application précise, ce qui les rend particulièrement adaptés aux exigences de la production végétale, de l'horticulture et des cultures spécialisées à haute valeur ajoutée, où une utilisation contrôlée et la prévention de la contamination sont essentielles.

De plus, la position dominante du segment des amendements pour sols agricoles est renforcée par leur large disponibilité et leur production économique, permettant une distribution et un approvisionnement fluides sur les marchés développés comme émergents. Les agriculteurs et les entreprises agroalimentaires s'appuient de plus en plus sur des formats standardisés de produits pour sols qui simplifient le stockage, le transport et la conformité réglementaire, tout en garantissant la qualité et la performance des produits. Face à la demande croissante du secteur agricole pour des solutions de santé des sols pratiques, fiables et performantes, le segment des amendements pour sols agricoles devrait conserver sa position de leader sur le marché de la santé des sols au Moyen-Orient et en Afrique en 2026.

Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en agriculteurs et producteurs, entreprises agroalimentaires, entreprises d'aménagement paysager et de foresterie, organismes gouvernementaux et de réglementation, instituts de recherche, universités et autres.

En 2026, le segment des agriculteurs et des producteurs devrait dominer le marché, représentant la part la plus importante (53,26 %), grâce à son utilisation généralisée pour améliorer la fertilité des sols, la productivité des cultures et les performances des exploitations. Les solutions avancées pour la santé des sols jouent un rôle crucial dans l'amélioration de la rétention des nutriments, de la capacité de rétention d'eau et de la stabilité de la structure du sol, ce qui les rend essentielles à de nombreuses chaînes de valeur agricoles et horticoles.

Par ailleurs, le segment des entreprises agroalimentaires, qui connaît la croissance la plus rapide, est soutenu par la forte demande en amendements de sol spécialisés, biostimulants et produits à base d'acides humiques, notamment pour l'agriculture de précision, la production de cultures à haute valeur ajoutée et les exploitations agricoles à grande échelle. Ces solutions pour la santé des sols améliorent leurs performances tout en permettant des pratiques culturales efficaces, rentables et durables. Alors que le secteur agricole continue de privilégier l'optimisation des rendements, la durabilité des sols et la fiabilité opérationnelle, ce segment devrait demeurer un moteur de croissance essentiel du marché de la santé des sols au Moyen-Orient et en Afrique en 2026.

Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en ventes directes et marché de l'après-vente.

En 2026, le segment des ventes directes devrait dominer le marché, représentant la part la plus importante (70,01 %), grâce à son utilisation généralisée dans la production végétale, l'horticulture et l'amélioration des sols. Les solutions pour la santé des sols de ce segment jouent un rôle crucial dans l'amélioration de la fertilité des sols, la rétention des nutriments et la résilience des cultures, ce qui en fait un choix privilégié pour les exploitations agricoles à grande échelle et les environnements agricoles à haut rendement.

De plus, le segment de l'après-vente, qui connaît la croissance la plus rapide, est renforcé par l'efficacité, la stabilité et la compatibilité supérieures des amendements de sol de pointe avec les pratiques et équipements agricoles existants, garantissant ainsi des performances constantes quelles que soient les conditions climatiques et pédologiques. Face à une demande croissante de solutions fiables, performantes et durables pour la santé des sols dans de nombreux secteurs agricoles, ce segment devrait maintenir une forte adoption et conserver sa position de leader sur le marché en 2026.

Analyse régionale du marché de la santé des sols

- En 2025, l'Afrique du Sud représentait la plus grande part du marché de la santé des sols au Moyen-Orient et en Afrique, avec 21,67 % de la demande totale. Ce marché, dont la croissance annuelle composée (TCAC) est estimée à 9,8 %, est porté par la modernisation rapide de l'agriculture, le développement des cultures à haute valeur ajoutée, l'adoption croissante des techniques d'agriculture de précision et la demande grandissante de solutions d'amélioration des sols pour diverses applications agricoles.

- Le pays bénéficie de l'amélioration de ses infrastructures agricoles, de politiques gouvernementales favorables et d'investissements croissants dans des pratiques agricoles durables et des technologies de pointe en matière de gestion des sols. Le développement des applications finales dans la production végétale, l'horticulture, la réhabilitation des terres et l'agriculture spécialisée continue de soutenir une forte pénétration du marché et un potentiel de croissance à long terme au Moyen-Orient et en Afrique.

Analyse du marché de la santé des sols en Arabie saoudite

Le marché sud-africain des produits d'amélioration des sols est en pleine expansion, porté par une production agricole à grande échelle, l'adoption généralisée des techniques d'agriculture de précision et les initiatives gouvernementales favorables à une gestion durable des sols. Les progrès technologiques en matière de surveillance des sols, de biostimulants et d'amendements à base d'acides humiques, associés à une production rentable de solutions pour la santé des sols, positionnent l'Afrique du Sud comme un pôle majeur au Moyen-Orient et en Afrique pour les produits d'amélioration des sols, avec un fort potentiel de croissance.

Analyse du marché de la santé des sols en Arabie saoudite

Le marché saoudien de la santé des sols connaît une forte croissance, soutenue par l'expansion de la production agricole, l'adoption croissante de produits d'amendement et de biostimulants, et le recours accru à des solutions de gestion des sols avancées dans l'agriculture à haute valeur ajoutée. Les programmes gouvernementaux promouvant une agriculture durable, l'amélioration de la fertilité des sols et l'enrichissement des sols à l'échelle industrielle continuent de dynamiser ce marché.

Analyse du marché égyptien de la santé des sols :

Le marché égyptien de la santé des sols est un contributeur majeur au Moyen-Orient et en Afrique, grâce à des infrastructures agricoles bien établies, des pratiques de gestion des sols avancées et une utilisation croissante de biostimulants, d’acides humiques et de solutions microbiennes pour les sols. L’intégration poussée des technologies d’agriculture de précision, l’optimisation des processus et les amendements de sol respectueux de l’environnement continuent de soutenir la croissance et l’innovation du marché.

Part de marché de la santé des sols

Le secteur de la santé des sols est principalement dirigé par des entreprises bien établies, notamment :

- BASF (Allemagne)

- Bayer AG (Allemagne)

- Corteva (États-Unis)

- Mosaïque Arabie Saoudite (Arabie Saoudite)

- UPL (Arabie saoudite)

- FMC Corporation (États-Unis)

- Syngenta Crop Protection AG (Suisse)

- EarthOptics (États-Unis)

- Miraterra Technologies Corporation (États-Unis)

- Soil Scout Oy (Finlande)

- Stevens Water Monitoring Systems Inc. (États-Unis)

- MÈTRE (É.-U.)

- Campbell Scientific, Inc. (États-Unis)

- Sentek Technologies (Australie)

- Tecsoil, Inc. (États-Unis, estimation ; à vérifier)

- Nutrien Ag Solutions, Inc. (Canada)

- ICL (Israël)

- CropX Inc. (Israël)

- AgroCares (Pays-Bas)

- Soilwiz Ltd (Royaume-Uni/Europe)

- Growindigo / Indigo Ag (États-Unis)

- Engrais Langley (Royaume-Uni)

- Humintech (Allemagne)

- Coromandel International Ltd. (Arabie saoudite)

- Evonik (Allemagne)

- ADM (Archer Daniels Midland Company) (États-Unis)

- HUMA GRO (États-Unis)

- La société Scotts LLC (États-Unis)

Dernières évolutions du marché de la santé des sols au Moyen-Orient et en Afrique

- En octobre 2025, Multichem Specialities Private Limited a été reconnue parmi les 10 meilleurs distributeurs de produits chimiques de spécialité de 2025 par le magazine Industry Outlook, soulignant ainsi son engagement envers la qualité, l'innovation et un service fiable dans le secteur des produits chimiques de spécialité. En juillet 2025, l'entreprise a également organisé une collecte de sang en collaboration avec le Breach Candy Hospital Trust, mobilisant ses employés et la communauté pour soutenir les initiatives de santé publique.

- En février 2024, Multichem Specialities Private Limited a participé à Vitafoods Saudi Arabia, renforçant ainsi sa présence dans le segment des nutraceutiques et des ingrédients de spécialité tout en dialoguant avec ses clients et partenaires pour présenter son portefeuille croissant de solutions chimiques.

- En octobre 2024, Otto Chemie Pvt. Ltd. a élargi sa gamme de produits chimiques et réactifs de laboratoire de haute pureté, renforçant ainsi sa présence dans les secteurs pharmaceutique, de la recherche et industriel. L'entreprise a également consolidé son réseau de distribution et ses capacités logistiques afin de répondre à la demande croissante en Arabie saoudite et sur les marchés internationaux.

- En juillet 2024, Otto Chemie Pvt. Ltd. a organisé une campagne de don de sang et de sensibilisation à la santé en collaboration avec des hôpitaux locaux, témoignant de l'engagement de l'entreprise envers le bien-être de la communauté et ses initiatives de responsabilité sociale.

- En mars 2025, Oxford Lab Fine Chem LLP a mis en œuvre des solutions d'emballage écologiques et optimisé ses pratiques de gestion des déchets dans ses processus de production et de distribution, renforçant ainsi l'engagement de l'entreprise en faveur d'une fabrication chimique durable et responsable.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS – MODERATE

4.1.1.1 Capital Requirement – Moderate

4.1.1.2 Product Knowledge – Moderate to High

4.1.1.3 Technical Knowledge – High

4.1.1.4 Customer Relationship – High

4.1.1.5 Access to Application and Technology – Moderate

4.1.2 THREAT OF SUBSTITUTES – MODERATE

4.1.2.1 Cost – High

4.1.2.2 Performance – Moderate

4.1.2.3 Availability – High

4.1.2.4 Technical Knowledge – Low to Moderate

4.1.2.5 Durability – Low

4.1.3 BARGAINING POWER OF BUYERS – MODERATE TO HIGH

4.1.3.1 Number of Buyers Relative to Suppliers – High

4.1.3.2 Product Differentiation – Moderate

4.1.3.3 Threat of Forward Integration – Low

4.1.3.4 Buyer Volume – High

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.4.1 Supplier Concentration – Moderate to High

4.1.4.2 Buyer Switching Cost to Other Suppliers – Moderate

4.1.4.3 Threat of Backward Integration – Low to Moderate

4.1.5 COMPETITIVE RIVALRY WITHIN THE INDUSTRY – HIGH

4.1.5.1 Industry Concentration – Moderate

4.1.5.2 Industry Growth Rate – High

4.1.5.3 Product Differentiation – Moderate

4.1.6 STRATEGIC SUMMARY

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 GROUP 1: LARGE COMMERCIAL & CORPORATE FARMING OPERATIONS

4.3.2 GROUP 2: PROGRESSIVE MEDIUM-TO-LARGE FARMERS AND AGRIBUSINESS CLIENTS

4.3.3 GROUP 3: COST-CONSCIOUS COMMERCIAL FARMERS

4.3.4 GROUP 4: SMALLHOLDER AND TRADITIONAL FARMERS

4.3.5 GROUP 5: INPUT-DEPENDENT AND SUBSIDY-ORIENTED BUYERS

4.3.6 GROUP 6: SPECIALIZED, HIGH-VALUE CROP GROWERS AND INNOVATORS

4.3.7 STRATEGIC INSIGHT

4.4 COMPANY PRODUCTION CAPACITY ANALYSIS

4.5 PRICING ANALYSIS

4.5.1 PRICES OF NITROGEN-FIXING BACTERIA

4.5.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.2.1 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 VALUE CHAIN ANALYSIS – MIDDLE EAST AND AFRICA SOIL HEALTH MARKET

4.7.1 RAW MATERIAL SOURCING & INPUT GENERATION

4.7.2 PROCESSING & FORMULATION

4.7.3 QUALITY CONTROL, CERTIFICATION & REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION & SUPPLY CHAIN LOGISTICS

4.7.5 APPLICATION, TESTING & MONITORING (END USE)

4.7.6 FEEDBACK LOOP & VALUE REINFORCEMENT

4.7.7 VALUE CHAIN INSIGHT

4.8 SUPPLY CHAIN ANALYSIS – MIDDLE EAST AND AFRICA SOIL HEALTH MARKET

4.8.1 CORE SUPPLY-CHAIN STAGES (FLOW + KEY ACTORS)

4.8.1.1 Raw-material sourcing

4.8.1.2 Processing & formulation

4.8.1.3 Quality control & compliance

4.8.1.4 Distribution & logistics

4.8.1.5 Retail & advisory

4.8.1.6 End use & monitoring

4.8.2 KEY CONSTRAINTS & BOTTLENECKS

4.8.2.1 Logistics & last-mile delivery

4.8.2.2 Cold-chain & shelf-life for biologicals

4.8.2.3 Raw-material seasonality & feedstock quality —

4.8.2.4 Regulatory fragmentation

4.8.2.5 Concentration & geopolitical exposure in mineral supply

4.8.3 OPERATIONAL & COMMERCIAL RISKS

4.8.4 ENABLERS

4.8.4.1 Public programmes & procurement

4.8.4.2 Digital platforms & logistics aggregation

4.8.4.3 Circular-economy feedstock integration

4.8.4.4 Harmonized standards & MRV

4.8.5 STRATEGIC OPPORTUNITIES

4.8.6 PRACTICAL RECOMMENDATIONS (FOR SUPPLIERS, INVESTORS, POLICY MAKERS)

4.9 RAW MATERIAL COVERAGE

4.9.1 ORGANIC AND BIOMASS-DERIVED RAW MATERIALS

4.9.1.1 Livestock Manure: Reactive Organic–Mineral Complexes

4.9.2 CROP RESIDUES AND GREEN BIOMASS

4.9.3 COMPOST FEEDSTOCKS AND STABILIZED ORGANIC MATTER

4.9.4 THERMOCHEMICAL CARBON MATERIALS

4.9.5 MINERAL AND GEOLOGICAL RAW MATERIALS

4.9.6 GYPSUM AND SULFUR MINERALS

4.9.7 PHOSPHATE ROCK AND SILICATE MINERALS

4.9.8 HUMIC SUBSTANCES AND CARBON EXTRACTS

4.9.8.1 Leonardite, Lignite, and Peat Resources

4.9.9 MICROBIAL AND BIOLOGICAL RAW MATERIALS

4.9.9.1 Microbial Biomass and Fermentation Inputs

4.9.10 CARRIER AND STABILIZATION MATERIALS

4.9.11 MARINE AND AQUATIC BIOMASS RESOURCES

4.9.11.1 Seaweed and Algal Feedstocks

4.9.12 RAW MATERIALS FOR SOIL TESTING AND DIGITAL MONITORING

4.9.12.1 Chemical and Biological Analytical Inputs

4.9.13 ELECTRONIC AND SENSOR MATERIALS

4.9.14 STRATEGIC IMPLICATIONS AND CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 TECHNOLOGICAL ADVANCEMENTS IN RAW MATERIAL SOURCING AND CHARACTERIZATION

4.10.2 MANUFACTURING-CENTRIC TECHNOLOGICAL ADVANCEMENTS

4.10.3 MATERIAL ENGINEERING IN ORGANIC–MINERAL AND CARBON-BASED INPUTS

4.10.4 EXTRACTION AND REFINEMENT OF HUMIC SUBSTANCES

4.10.5 QUALITY CONTROL, AUTOMATION, AND DIGITAL MANUFACTURING INTEGRATION

4.10.6 PACKAGING, STABILITY, AND LOGISTICS TECHNOLOGIES

4.10.7 SMART LOGISTICS AND TRACEABILITY SYSTEMS

4.10.8 CUSTOMER DELIVERY, PRECISION APPLICATION, AND FEEDBACK LOOPS

4.10.9 DATA-ENABLED ADVISORY AND CONTINUOUS IMPROVEMENT

4.10.10 STRATEGIC IMPLICATIONS AND CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 RAW MATERIAL GOVERNANCE AS THE FIRST FILTER OF VENDOR CREDIBILITY

4.11.2 MANUFACTURING DEPTH AND PROCESS ENGINEERING CAPABILITY

4.11.3 SCIENTIFIC VALIDATION AS A MEASURE OF TECHNICAL INTEGRITY

4.11.4 REGULATORY READINESS AND STEWARDSHIP DISCIPLINE

4.11.5 SUPPLY CHAIN RESILIENCE AND SCALABILITY

4.11.6 DIGITAL CAPABILITY, DATA INTEGRITY, AND VALUE EXPANSION

4.11.7 FINANCIAL STRENGTH, UNIT ECONOMICS, AND CAPITAL EFFICIENCY

4.11.8 STRATEGIC ALIGNMENT AND LONG-TERM PARTNERSHIP VALUE

4.11.9 CONCLUSION: VENDOR SELECTION AS A LONG-TERM VALUE SAFEGUARD

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.1.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.1.2 VENDOR SELECTION CRITERIA DYNAMICS

5.1.3 IMPACT ON SUPPLY CHAIN

5.1.3.1 RAW MATERIAL PROCUREMENT

5.1.3.2 MANUFACTURING AND PRODUCTION

5.1.3.3 LOGISTICS AND DISTRIBUTION

5.1.3.4 PRICE PITCHING AND MARKET POSITIONING

5.1.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.1.4.1 SUPPLY CHAIN OPTIMIZATION

5.1.4.2 JOINT VENTURE ESTABLISHMENTS

5.1.5 MPACT ON PRICES

5.1.6 REGULATORY INCLINATION

5.1.7 GEOPOLITICAL SITUATION

5.1.8 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.1.8.1 FREE TRADE AGREEMENTS

5.1.9 ALLIANCES ESTABLISHMENTS

5.1.9.1 STATUS ACCREDITATION (INCLUDING MFTN)

5.1.9.2 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.1.9.3 SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 REGULATORY FRAMEWORK COVERAGE – MACRO & MICRO ANALYSIS

6.1.1 PRODUCT CODES – CLASSIFICATION LOGIC & COMPLIANCE CONSEQUENCES

6.1.2 CERTIFIED STANDARDS – MARKET ACCESS & QUALITY CONTROL

6.1.3 SAFETY STANDARDS – OPERATIONAL RISK MANAGEMENT

6.1.3.1 MATERIAL HANDLING & STORAGE – DETAILED ANALYSIS

6.1.3.2 TRANSPORT & PRECAUTIONS – REGULATORY DEPTH

6.1.3.3 HAZARD IDENTIFICATION – RISK DISCLOSURE & LIABILITY

6.1.4 REGULATORY ENFORCEMENT & MONITORING

6.1.5 REGULATORY IMPACT ON COST STRUCTURE

6.1.6 REGULATORY TRENDS & FUTURE OUTLOOK

6.1.7 STRATEGIC IMPLICATIONS FOR MARKET PARTICIPANTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING ADOPTION OF REGENERATIVE AGRICULTURE AND SUSTAINABLE FARMING PRACTICES

7.1.2 INCREASING DEPLOYMENT OF PRECISION SOIL MONITORING AND DIGITAL AGRICULTURE TECHNOLOGIES

7.1.3 GOVERNMENT POLICIES AND CONSUMER DEMAND SUPPORTING SUSTAINABLE FOOD SYSTEMS

7.2 RESTRAINTS

7.2.1 HIGH COST AND LIMITED ACCESS TO COMPREHENSIVE SOIL TESTING AND MONITORING INFRASTRUCTURE

7.2.2 LIMITED FARMER AWARENESS AND TECHNICAL CAPACITY TO INTERPRET SOIL HEALTH DATA

7.3 OPPORTUNITIES

7.3.1 EMERGENCE OF SOIL CARBON AND CLIMATE FINANCE PROGRAMS CREATING NEW REVENUE STREAMS

7.3.2 GROWING NEED FOR MONITORING, REPORTING, AND VERIFICATION (MRV) SYSTEMS FOR SOIL HEALTH

7.3.3 EXPANSION OF BIO-BASED AND NATURE-BASED SOIL AMENDMENTS

7.4 CHALLENGES

7.4.1 LACK OF STANDARDIZATION AND REGULATORY CONSENSUS IN SOIL HEALTH AND SOIL CARBON MEASUREMENT

7.4.2 SCIENTIFIC VARIABILITY AND INCONSISTENT FIELD PERFORMANCE OF BIOLOGICAL SOIL SOLUTIONS

8 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOIL ENHANCEMENT PRODUCTS

8.3 TESTING & MONITORING PRODUCTS

8.4 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 SOIL AMENDMENTS

8.4.2 SOIL FERTILITY ENHANCERS

8.4.3 BIOLOGICALS / MICROBIAL SOLUTIONS

8.4.4 SOIL CONDITIONERS

8.4.5 PEAT

8.4.6 OTHERS

8.5 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

8.6 MIDDLE EAST AND AFRICA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 ORGANIC AMENDMENTS

8.6.2 INORGANIC AMENDMENTS

8.7 MIDDLE EAST AND AFRICA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 MANURE

8.7.2 COMPOST

8.7.3 GREEN MANURE

8.7.4 BIOCHAR

8.7.5 OTHERS

8.8 MIDDLE EAST AND AFRICA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 LIME

8.8.2 GYPSUM

8.8.3 MINERAL ADDITIVES

8.8.4 OTHERS

8.9 MIDDLE EAST AND AFRICA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 BIOFERTILIZERS

8.9.2 ORGANIC-MINERAL FERTILIZERS

8.1 MIDDLE EAST AND AFRICA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 NITROGEN-FIXING BACTERIA

8.10.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

8.10.3 POTASH-MOBILIZING MICROORGANISMS

8.11 MIDDLE EAST AND AFRICA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 NPK-ENRICHED ORGANIC FERTILIZERS

8.11.2 COMPOST-BASED MINERAL FORTIFIED PRODUCTS

8.11.3 HUMIC ACID AND NPK BLENDS

8.12 MIDDLE EAST AND AFRICA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 COMPOST + NPK BLENDS

8.12.2 BIO-ORGANIC NPK GRANULES / PELLETS

8.12.3 LIQUID ORGANIC + NPK FORMULATIONS

8.12.4 SLOW-RELEASE / CONTROLLED RELEASE ORGANIC-MINERAL NPKS

8.12.5 SPECIALTY / CROP-SPECIFIC ENRICHED ORGANIC NPKS

8.13 MIDDLE EAST AND AFRICA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 BIO-COMPOST + MINERAL BLENDS

8.13.2 GRANULATED COMPOST-BASED FERTILIZERS

8.13.3 VERMICOMPOST FORTIFIED WITH MINERALS

8.13.4 CO-COMPOSTED MINERAL + WASTE BLENDS

8.13.5 LIQUID COMPOST EXTRACTS FORTIFIED WITH NUTRIENTS

8.14 MIDDLE EAST AND AFRICA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 HUMIC + NPK SOLID BLENDS

8.14.2 LIQUID HUMIC + NPK FORMULATIONS

8.14.3 POTASSIUM HUMATE ENRICHED BLENDS

8.14.4 HIGH HUMIC FRACTION BLENDS

8.14.5 HUMIC + FULVIC + MINERAL BLENDS

8.15 MIDDLE EAST AND AFRICA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 TRICHODERMA

8.15.2 BACILLUS SPECIES

8.15.3 MYCORRHIZAL FUNGI

8.15.4 RHIZOBIA

8.15.5 OTHERS

8.16 MIDDLE EAST AND AFRICA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 HUMIC ACID

8.16.2 SEAWEED EXTRACTS

8.16.3 FULVIC ACID

8.16.4 POTASSIUM HUMATE ENRICHED BLENDS

8.16.5 HUMIC + FULVIC + MINERAL BLENDS

8.16.6 HIGH HUMIC FRACTION BLENDS

8.16.7 LIQUID HUMIC + NPK FORMULATIONS

8.17 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

8.19 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.19.1 SOIL TESTING KITS

8.19.2 LABORATORY ANALYTICAL SOLUTIONS (BIOLOGICAL ANALYSIS)

8.19.3 DIGITAL AND REMOTE MONITORING

8.2 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.21 MIDDLE EAST AND AFRICA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 PH KITS

8.21.2 NUTRIENT TEST KITS

8.22 MIDDLE EAST AND AFRICA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 IOT SENSORS

8.22.2 REMOTE SENSING & DRONES

8.22.3 GIS & MAPPING TOOLS

8.23 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

9 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY SOIL TYPE

9.1 OVERVIEW

9.2 ALLUVIAL SOILS

9.3 RED SOILS

9.4 LOAMS

9.5 BLACK SOILS

9.6 ARID SOILS

9.7 SANDY SOILS

9.8 SILT SOILS

9.9 CLAY SOILS

9.1 YELLOW SOILS

9.11 LATERITE SOILS

9.12 SALINE/ALKALINE SOILS

9.13 PEAT SOILS

9.14 CHALKY SOILS

9.15 OTHERS

9.16 MIDDLE EAST AND AFRICA ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.16.1 ASIA-PACIFIC

9.16.2 NORTH AMERICA

9.16.3 EUROPE

9.16.4 SOUTH AMERICA

9.16.5 MIDDLE EAST & AFRICA

9.17 MIDDLE EAST AND AFRICA RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.17.1 ASIA-PACIFIC

9.17.2 NORTH AMERICA

9.17.3 EUROPE

9.17.4 SOUTH AMERICA

9.17.5 MIDDLE EAST & AFRICA

9.18 MIDDLE EAST AND AFRICA LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.18.1 ASIA-PACIFIC

9.18.2 NORTH AMERICA

9.18.3 EUROPE

9.18.4 SOUTH AMERICA

9.18.5 MIDDLE EAST & AFRICA

9.19 MIDDLE EAST AND AFRICA BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.19.1 ASIA-PACIFIC

9.19.2 NORTH AMERICA

9.19.3 EUROPE

9.19.4 SOUTH AMERICA

9.19.5 MIDDLE EAST & AFRICA

9.2 MIDDLE EAST AND AFRICA ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.20.1 ASIA-PACIFIC

9.20.2 NORTH AMERICA

9.20.3 EUROPE

9.20.4 SOUTH AMERICA

9.20.5 MIDDLE EAST & AFRICA

9.21 MIDDLE EAST AND AFRICA SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.21.1 ASIA-PACIFIC

9.21.2 NORTH AMERICA

9.21.3 EUROPE

9.21.4 SOUTH AMERICA

9.21.5 MIDDLE EAST & AFRICA

9.22 MIDDLE EAST AND AFRICA SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.22.1 ASIA-PACIFIC

9.22.2 NORTH AMERICA

9.22.3 EUROPE

9.22.4 SOUTH AMERICA

9.22.5 MIDDLE EAST & AFRICA

9.23 MIDDLE EAST AND AFRICA CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.23.1 ASIA-PACIFIC

9.23.2 NORTH AMERICA

9.23.3 EUROPE

9.23.4 SOUTH AMERICA

9.23.5 MIDDLE EAST & AFRICA

9.24 MIDDLE EAST AND AFRICA YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.24.1 ASIA-PACIFIC

9.24.2 NORTH AMERICA

9.24.3 EUROPE

9.24.4 SOUTH AMERICA

9.24.5 MIDDLE EAST & AFRICA

9.25 MIDDLE EAST AND AFRICA LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.25.1 ASIA-PACIFIC

9.25.2 NORTH AMERICA

9.25.3 EUROPE

9.25.4 SOUTH AMERICA

9.25.5 MIDDLE EAST & AFRICA

9.26 MIDDLE EAST AND AFRICA SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.26.1 ASIA-PACIFIC

9.26.2 NORTH AMERICA

9.26.3 EUROPE

9.26.4 SOUTH AMERICA

9.26.5 MIDDLE EAST & AFRICA

9.27 MIDDLE EAST AND AFRICA PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.27.1 ASIA-PACIFIC

9.27.2 NORTH AMERICA

9.27.3 EUROPE

9.27.4 SOUTH AMERICA

9.27.5 MIDDLE EAST & AFRICA

9.28 MIDDLE EAST AND AFRICA CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.28.1 ASIA-PACIFIC

9.28.2 NORTH AMERICA

9.28.3 EUROPE

9.28.4 SOUTH AMERICA

9.28.5 MIDDLE EAST & AFRICA

9.29 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.29.1 ASIA-PACIFIC

9.29.2 NORTH AMERICA

9.29.3 EUROPE

9.29.4 SOUTH AMERICA

9.29.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CONVENTIONAL SOIL MANAGEMENT

10.3 INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM)

10.4 PRECISION SOIL HEALTH MANAGEMENT

10.5 REGENERATIVE AGRICULTURE PRACTICES

10.6 OTHERS

10.7 MIDDLE EAST AND AFRICA CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 MIDDLE EAST AND AFRICA INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.9.1 REMOTE SENSING & DRONES

10.9.2 VARIABLE RATE TECHNOLOGY (VRT)

10.9.3 GPS & GIS MAPPING

10.1 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST & AFRICA

10.11 MIDDLE EAST AND AFRICA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.11.1 GPS & GIS MAPPING

10.11.2 VARIABLE RATE TECHNOLOGY (VRT)

10.11.3 REMOTE SENSING & DRONES

10.12 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 SOUTH AMERICA

10.13.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CROP SOIL

11.3 NON-CROP SOIL

11.4 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.4.1 CEREALS & GRAINS

11.4.2 OILSEEDS & PULSES

11.4.3 FRUITS & VEGETABLES

11.4.4 COMMERCIAL CROPS

11.4.5 PLANTATION CROPS

11.4.6 OTHERS

11.5 MIDDLE EAST AND AFRICA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 CORN

11.5.2 WHEAT

11.5.3 RICE

11.5.4 BARLEY

11.5.5 OATS

11.5.6 OTHERS

11.6 MIDDLE EAST AND AFRICA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 SOYBEAN

11.6.2 RAPESEED/CANOLA

11.6.3 SUNFLOWER

11.6.4 CHICKPEAS

11.6.5 GROUNDNUT

11.6.6 LENTILS

11.6.7 OTHERS

11.7 MIDDLE EAST AND AFRICA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.7.1 FRUIT CROPS

11.7.2 ROOT CROPS

11.7.3 LEAFY GREENS

11.7.4 NIGHTSHADES

11.7.5 CUCURBITS

11.7.6 OTHERS

11.8 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 SUGARCANE

11.8.2 COTTON

11.8.3 COFFEE

11.8.4 COCOA

11.8.5 TEA

11.8.6 TOBACCO

11.8.7 OTHERS

11.9 MIDDLE EAST AND AFRICA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 PALM OIL

11.9.2 RUBBER

11.9.3 COCONUT

11.9.4 OTHERS

11.1 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 TURF & LANDSCAPING

11.11.2 FORESTRY

11.11.3 SOIL RECLAMATION & RESTORATION

11.11.4 OTHERS

11.12 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY END-USER

12.1 OVERVIEW

12.2 FARMERS & GROWERS

12.3 AGRIBUSINESS COMPANIES

12.4 LANDSCAPING & FORESTRY COMPANIES

12.5 GOVERNMENT & REGULATORY BODIES

12.6 RESEARCH INSTITUTES

12.7 UNIVERSITIES

12.8 OTHERS

12.9 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.9.1 SOIL AMENDMENTS

12.9.2 SOIL FERTILITY ENHANCERS

12.9.3 SOIL CONDITIONERS

12.9.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.9.5 TESTING & MONITORING PRODUCTS

12.9.6 PEAT

12.9.7 OTHERS

12.1 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 NORTH AMERICA

12.10.3 EUROPE

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.11.1 SOIL AMENDMENTS

12.11.2 SOIL FERTILITY ENHANCERS

12.11.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.11.4 SOIL CONDITIONERS

12.11.5 TESTING & MONITORING PRODUCTS

12.11.6 PEAT

12.11.7 OTHERS

12.12 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 NORTH AMERICA

12.12.3 EUROPE

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

12.13 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.13.1 SOIL AMENDMENTS

12.13.2 SOIL CONDITIONERS

12.13.3 PEAT

12.13.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.13.5 SOIL FERTILITY ENHANCERS

12.13.6 TESTING & MONITORING PRODUCTS

12.13.7 OTHERS

12.14 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 SOUTH AMERICA

12.14.5 MIDDLE EAST & AFRICA

12.15 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.15.1 SOIL AMENDMENTS

12.15.2 TESTING & MONITORING PRODUCTS

12.15.3 SOIL CONDITIONERS

12.15.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.15.5 SOIL FERTILITY ENHANCERS

12.15.6 PEAT

12.15.7 OTHERS

12.16 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 SOUTH AMERICA

12.16.5 MIDDLE EAST & AFRICA

12.17 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.17.1 TESTING & MONITORING PRODUCTS

12.17.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.17.3 SOIL AMENDMENTS

12.17.4 SOIL FERTILITY ENHANCERS

12.17.5 SOIL CONDITIONERS

12.17.6 PEAT

12.17.7 OTHERS

12.18 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 SOUTH AMERICA

12.18.5 MIDDLE EAST & AFRICA

12.19 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.19.1 TESTING & MONITORING PRODUCTS

12.19.2 SOIL AMENDMENTS

12.19.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.19.4 SOIL FERTILITY ENHANCERS

12.19.5 SOIL CONDITIONERS

12.19.6 PEAT

12.19.7 OTHERS

12.2 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.20.1 ASIA-PACIFIC

12.20.2 NORTH AMERICA

12.20.3 EUROPE

12.20.4 SOUTH AMERICA

12.20.5 MIDDLE EAST & AFRICA

12.21 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.21.1 TESTING & MONITORING PRODUCTS

12.21.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.21.3 SOIL AMENDMENTS

12.21.4 SOIL CONDITIONERS

12.21.5 SOIL FERTILITY ENHANCERS

12.21.6 PEAT

12.21.7 OTHERS

12.22 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.22.1 ASIA-PACIFIC

12.22.2 NORTH AMERICA

12.22.3 EUROPE

12.22.4 SOUTH AMERICA

12.22.5 MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT SALES

13.3 AFTERMARKET

13.4 MIDDLE EAST AND AFRICA DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 MIDDLE EAST AND AFRICA AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 EGYPT

14.1.4 UNITED ARAB EMIRATES

14.1.5 ISRAEL

14.1.6 KUWAIT

14.1.7 QATAR

14.1.8 OMAN

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 MANUFACTURER COMPANY PROFILE

17.1 BASF

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BAYER AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CORTEVA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 SYNGENTA

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 NUTRIEN AG SOLUTIONS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ADM

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 AGROCARES

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CAMPBELL SCIENTIFIC, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 COROMANDEL INTERNATIONAL LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 CROPX INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 EARTHOPTICS.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 EVONIK

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 FMC CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 INDIGO AG, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVEOPMENT

17.15 HUMA GRO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 HUMINTECH

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 ICL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 METER GROUP.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MIRATERRA TECHNOLOGIES CORPORATION

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 MOSAIC INDIA

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PLANTBIOTIX

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SENTEK TECHNOLOGIES.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 SOIL SCOUT.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 SOILWIZ LT

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 STEVENS WATER MONITORING SYSTEMS INC.

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SUNPALM AUSTRALIA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 TECSOIL, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 THE SCOTTS COMPANY LLC

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 UPL

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENT

17.3 UTKARSH AGROCHEM PVT LTD

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 DISTRIBUTOR COMPANY PROFILE

18.1 CALIFORNIA AG SOLUTIONS

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 ENLIGHTENED SOIL CORP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 GETDISTRIBUTORS.COM

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 ORGANIC DISTRIBUTORS, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 SEACOLE

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 BRAND OUTLOOK BY PRODUCT CATEGORY

TABLE 2 CONSUMER PREFERENCES BY DECISION PARAMETER

TABLE 3 ESTIMATED OUTPUT

TABLE 4 EFFECTIVE TARIFF BURDEN (NOT JUST NOMINAL)

TABLE 5 PRODUCT-LEVEL IMPORT DEPENDENCY

TABLE 6 WEIGHTED DECISION MATRIX (INDICATIVE)

TABLE 7 MANUFACTURING ECONOMICS

TABLE 8 PRICE SEGMENTATION

TABLE 9 COST STACK CONTRIBUTION

TABLE 10 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 13 MIDDLE EAST AND AFRICA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 28 MIDDLE EAST AND AFRICA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 32 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET FOR SOIL ENHANCEMENT PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (TONS)

TABLE 88 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 89 MIDDLE EAST AND AFRICA

TABLE 90 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 93 MIDDLE EAST AND AFRICA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 106 MIDDLE EAST AND AFRICA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)