Middle East Tobacco Products Market

Taille du marché en milliards USD

TCAC :

%

USD

46.55 Billion

USD

64.57 Billion

2024

2032

USD

46.55 Billion

USD

64.57 Billion

2024

2032

| 2025 –2032 | |

| USD 46.55 Billion | |

| USD 64.57 Billion | |

|

|

|

|

Segmentation du marché des produits du tabac au Moyen-Orient, par type de produit (cigarettes, cigares et cigarillos, cigarettes électroniques, tabac sans fumée, produits de nouvelle génération, tabac à rouler (ryo), tabac à narguilé/chicha, bidis, pipes et autres), type de tabac (Virginia, Burley, oriental, mixte et autres), saveur (aromatisée, classique et autres), gamme de prix (grand public, premium et luxe), tranche d'âge (génération Y (25-40 ans), génération X (41-56 ans) et baby-boomers (57-75 ans)), utilisateur final (hommes, femmes et unisexes), canal de distribution (détaillants hors magasin et détaillants en magasin) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des produits du tabac au Moyen-Orient

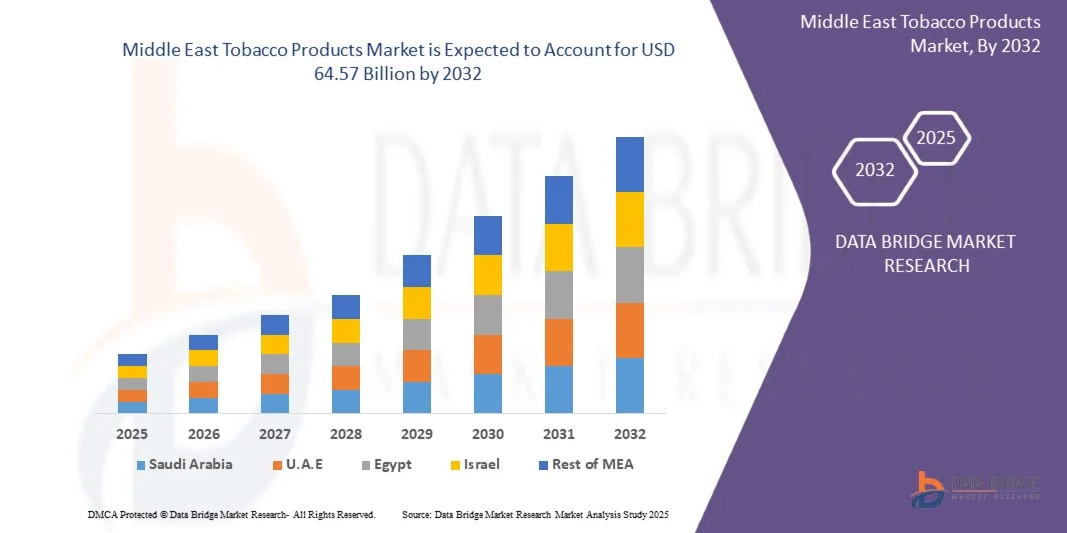

- La taille du marché des produits du tabac au Moyen-Orient était évaluée à 46,55 milliards USD en 2024 et devrait atteindre 64,57 milliards USD d'ici 2032 , à un TCAC de 4,21 % au cours de la période de prévision.

- La croissance est tirée par la forte demande de produits du tabac haut de gamme et à risque réduit, la hausse de la consommation dans les économies émergentes et la diversification croissante des produits dans des catégories telles que les cigarettes, les cigares, le tabac sans fumée et les alternatives de nouvelle génération telles que les cigarettes électroniques et les dispositifs de tabac chauffé.

- L'intégration de technologies innovantes telles que la surveillance de la chaîne d'approvisionnement par l'IoT, les systèmes de production économes en énergie et durables et les solutions d'emballage avancées pour la sécurité, la traçabilité et l'attrait de la marque propulse davantage l'expansion du marché, en particulier dans les segments du tabac haut de gamme et durable.

Analyse du marché des produits du tabac au Moyen-Orient

- Les produits du tabac désignent les produits de consommation fabriqués commercialement à partir de la plante de tabac, notamment les cigarettes, les cigares, le tabac à rouler, le tabac sans fumée et les alternatives de nouvelle génération comme les cigarettes électroniques et les produits à base de tabac chauffé. Ces produits sont largement consommés dans toutes les régions, en raison de facteurs tels que les habitudes culturelles, l'acceptation sociale, l'accessibilité financière et la demande croissante de produits à risque réduit chez les consommateurs soucieux de leur santé.

- La demande croissante de produits du tabac en Europe est alimentée par la jeunesse croissante de la population, la hausse des revenus disponibles et les préférences culturelles en matière de tabagisme. Les consommateurs se tournent également vers les cigarettes haut de gamme, les produits aromatisés et les nouvelles alternatives à risque réduit. Les innovations en matière de conception, de conditionnement et de distribution des produits, ainsi que les évolutions réglementaires et la montée du commerce illicite, influencent la dynamique du marché. De plus, l'urbanisation croissante de la région et la modernisation des infrastructures de vente au détail stimulent l'accessibilité et la consommation.

- L'Arabie saoudite a dominé le marché des produits du tabac au Moyen-Orient avec une part de marché de 51,28 % en 2024, grâce à son importante population de fumeurs, à ses monopoles d'État bien établis et à la culture du tabac soutenue par l'État. La forte base de consommateurs du pays, la forte prévalence du tabagisme et la croissance de sa population urbaine continuent de soutenir la demande.

- L'Arabie saoudite devrait connaître une croissance soutenue avec un TCAC de 4,81 % entre 2025 et 2032. Le marché du tabac en Arabie saoudite est principalement porté par la hausse de la consommation de cigarettes, notamment chez les jeunes et les adultes d'âge moyen, ainsi que par l'adoption croissante de produits à risque réduit tels que les cigarettes électroniques et le tabac chauffé. Le programme de diversification économique « Vision 2030 » du pays a également favorisé la modernisation des réseaux de distribution, les supermarchés, les hypermarchés et les commerces de proximité jouant un rôle prépondérant dans la distribution du tabac.

- Le segment des cigarettes a dominé le marché des produits du tabac au Moyen-Orient avec une part de marché de 79,01 % en 2024, en raison de leur prix abordable, de leur disponibilité généralisée et de leur forte acceptation culturelle par rapport aux autres catégories de tabac telles que les cigares, le tabac sans fumée et les alternatives de nouvelle génération.

Portée du rapport et segmentation du marché des produits du tabac au Moyen-Orient

|

Attributs |

Informations clés sur le marché des produits du tabac |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des produits du tabac au Moyen-Orient

« Croissance de la demande de produits du tabac dans les circuits de vente au détail et de distribution »

- La croissance rapide du commerce de détail organisé, des plateformes de commerce électronique et des magasins de proximité au Moyen-Orient stimule une forte demande de produits du tabac en améliorant l'accessibilité, la visibilité et la portée des consommateurs.

- Les formats de vente au détail modernes et les points de vente hors taxes élargissent la disponibilité des produits du tabac traditionnels et à risque réduit, répondant aux diverses préférences des consommateurs en termes de prix et de catégories de produits.

- En outre, l’adoption de solutions de distribution automatique innovantes, le suivi des stocks activé par l’IoT et les stratégies de distribution numérique créent des opportunités pour les fabricants de tabac de rationaliser les chaînes d’approvisionnement, d’améliorer la traçabilité et de renforcer la fidélité à la marque.

- Par exemple, en avril 2025, une importante société de tabac s'est associée à des chaînes de vente au détail du Moyen-Orient pour lancer des produits de tabac chauffé et des cigarettes électroniques de nouvelle génération, en exploitant les plateformes numériques et les réseaux de vente au détail pour améliorer l'engagement des consommateurs et accroître l'efficacité des ventes dans le monde entier.

- L'expansion croissante du commerce de détail organisé, des plateformes de commerce électronique et des canaux de distribution innovants améliore considérablement l'accessibilité et la visibilité des produits du tabac dans le monde entier. Grâce à l'intégration de solutions de chaîne d'approvisionnement numérique, à la gestion des stocks via l'IoT et à des stratégies de vente au détail intelligentes, les fabricants de tabac renforcent leur présence sur le marché et renforcent l'engagement des consommateurs. Les collaborations stratégiques avec les chaînes de distribution du Moyen-Orient et le déploiement de produits à risque réduit via des canaux modernes illustrent la transition du secteur vers l'efficacité, l'innovation et une clientèle diversifiée.

Dynamique du marché des produits du tabac au Moyen-Orient

Conducteur

« Demande croissante sur les marchés émergents comme le Moyen-Orient »

- En Arabie saoudite, l'urbanisation croissante, la hausse des revenus disponibles et la jeunesse de la population soutiennent, voire stimulent, la demande de produits du tabac, malgré les campagnes de santé publique en cours visant à réduire la consommation. Le tabagisme est culturellement normalisé depuis des décennies, notamment sous la forme de cigarettes et de chichas, qui restent ancrées socialement. Le marketing agressif de l'industrie et l'application progressive des mesures réglementaires contribuent également à la persistance des niveaux de consommation. Par conséquent, l'Arabie saoudite demeure l'un des marchés les plus importants du Moyen-Orient pour les produits du tabac, ce qui compromet les objectifs nationaux de santé et accentue la pression sur les initiatives de santé publique visant à freiner la consommation à long terme.

- Par exemple, en janvier 2025, l'État de la réduction des méfaits du tabac au Moyen-Orient et en Afrique (MEA) indiquait que la prévalence du tabagisme chez les adultes (15 ans et plus) de la région restait notable, certains pays enregistrant des baisses modérées grâce à des initiatives de santé publique et des campagnes de sensibilisation. Malgré ces baisses, le nombre absolu de fumeurs restait important, reflétant une demande soutenue dans toute la région. L'urbanisation, la hausse des revenus disponibles et l'acceptation culturelle des produits du tabac, notamment les cigarettes et la chicha, ont contribué à la persistance des niveaux de consommation, soulignant les défis persistants de la lutte antitabac et des stratégies de réduction des méfaits au Moyen-Orient et en Afrique.

- La demande croissante en Arabie saoudite et dans d'autres pays clés de la région Moyen-Orient et Afrique (MOA) est un moteur important du marché des produits du tabac au Moyen-Orient et en Afrique. La région maintient un volume élevé de consommation de cigarettes en raison d'une acceptation culturelle bien ancrée, de l'urbanisation et de la croissance démographique. Bien que les chiffres exacts de production diffèrent de ceux de leaders mondiaux comme la Chine et l'Inde, la région MEA présente des tendances similaires de consommation importante de tabac, les zones urbaines et rurales affichant une prévalence importante du tabagisme. La faible application des restrictions d'âge, combinée à l'importance budgétaire des recettes du tabac pour les gouvernements, maintient l'importance économique des produits combustibles. Malgré les initiatives de santé publique visant à réduire le tabagisme, la demande reste forte, soutenue par les normes sociales, l'accessibilité financière et l'accessibilité, ce qui garantit que le marché des cigarettes de la région MEA continue de contribuer de manière significative aux recettes mondiales du tabac.

Retenue/Défi

« Réglementations strictes et taxes plus élevées »

- Une réglementation stricte et des taxes plus élevées sont devenues de puissants freins au marché des produits du tabac au Moyen-Orient. Partout dans le monde, les gouvernements ont de plus en plus recours à des hausses de droits d'accise, des lois sur les emballages neutres, des limitations de nicotine et des interdictions de publicité pour lutter contre le tabagisme et réduire sa prévalence. Ces mesures augmentent les prix, restreignent la disponibilité et érodent la visibilité des marques, ce qui a pour effet direct de réduire la consommation et les ventes.

- La sensibilisation croissante à la santé et les vastes campagnes antitabac se sont révélées être de redoutables freins au marché des produits du tabac au Moyen-Orient. Grâce à des messages médiatiques percutants, des initiatives nationales d'aide au sevrage tabagique, des interventions ciblant les jeunes et une éducation sanitaire réglementaire, de nombreux gouvernements et organismes de santé publique réduisent la demande, perturbent l'acceptation sociale et encouragent l'arrêt du tabac. Ces efforts modifient la perception et les normes du public, rendant le tabac moins attrayant et socialement acceptable, ce qui, à terme, freine la consommation. Vous trouverez ci-dessous des exemples concrets actualisés (2021-2025) issus de sources officielles qui illustrent comment la sensibilisation et le plaidoyer en faveur de la santé transforment le paysage de la consommation de tabac.

- Dans de nombreuses économies développées, la baisse soutenue de la prévalence du tabagisme, portée par des mesures de santé publique globales, une sensibilisation accrue et des contraintes réglementaires, transforme profondément le paysage du tabac au Moyen-Orient. Face à l'érosion de la consommation de tabac combustible conventionnel, les fabricants de tabac sont confrontés à une diminution de leur clientèle et à une baisse de leurs revenus, ce qui souligne l'urgence d'innover ou de se tourner vers des produits alternatifs. Cette tendance non seulement exacerbe la concurrence et perturbe les trajectoires de croissance, mais amplifie également les pressions réglementaires et limite l'accès aux marchés traditionnels.

- Par exemple, en mars 2025, le Bureau régional de l'Organisation mondiale de la Santé (OMS) pour la Méditerranée orientale a signalé que la prévalence du tabagisme en Arabie saoudite restait élevée, à environ 21 % chez les adultes, la consommation de chicha et de cigarettes étant particulièrement populaire dans les centres urbains comme Riyad et Djeddah. Les campagnes de santé publique ciblant les jeunes et les femmes ont eu un impact modeste, tandis que l'acceptation culturelle et les normes sociales ont continué de soutenir une demande soutenue. Le rapport a souligné que la faible application de la réglementation antitabac, conjuguée à la croissance des revenus disponibles, contribue à la résilience du marché des cigarettes et de la chicha dans la région MEA.

- La baisse constante de la consommation de tabac dans les économies développées représente un défi majeur pour l'industrie du tabac au Moyen-Orient, comme en témoignent les taux de tabagisme historiquement bas dans des pays comme les États-Unis, le Royaume-Uni, le Japon et les Pays-Bas. Sous l'effet de campagnes de santé publique vigoureuses, d'une réglementation plus stricte et d'une sensibilisation croissante à la santé, notamment après la COVID-19, les produits du tabac combustibles traditionnels perdent rapidement des parts de marché. Si cette tendance marque une victoire en matière de santé publique, elle contraint également les fabricants de tabac à faire face à une demande de plus en plus faible.

Portée du marché des produits du tabac au Moyen-Orient

Le marché est segmenté en fonction du type de produit, du type de tabac, de la saveur, de la gamme de prix, de la tranche d'âge, de l'utilisateur final et du canal de distribution.

- Par type de produit

Sur la base du type de produit, le marché des produits du tabac au Moyen-Orient est segmenté en cigarettes, cigares et cigarillos, cigarettes électroniques, tabac sans fumée, produits de nouvelle génération, tabac à rouler, tabac à narguilé/chicha, bidis, pipes, etc. Les cigarettes devraient détenir la part la plus élevée du marché mondial en 2025, avec 79,05 %, reflétant leur large disponibilité, leurs habitudes de consommation profondément ancrées et leur domination dans les économies matures comme en développement. Les cigarettes représentent la part dominante du segment des produits sur le marché mondial des produits du tabac. Cette position est soutenue par des modes de consommation de longue date et une forte pénétration du commerce de détail qui garantissent une large disponibilité dans les circuits urbains et ruraux.

Les produits de nouvelle génération devraient connaître la croissance la plus rapide, avec un taux de croissance annuel composé (TCAC) de 4,83 % sur la période de prévision, en raison de la tendance croissante des consommateurs à privilégier des alternatives moins risquées. La sensibilisation croissante aux effets du tabagisme traditionnel sur la santé, l'essor des innovations produits comme les cigarettes électroniques et le tabac chauffé, ainsi que les réglementations gouvernementales favorables aux produits de réduction des risques, contribuent également à l'essor rapide de ce segment à l'échelle mondiale.

- Par type de tabac

Le marché des produits du tabac est segmenté selon le type de tabac : Virginia, Burley, Oriental, Mixte et autres. En 2025, le segment Virginia devrait dominer le marché, représentant 57,86 % de la part de marché totale. Il devrait également connaître la croissance la plus rapide, avec un taux de croissance annuel composé (TCAC) de 4,44 % sur la période de prévision. La forte croissance et la domination du segment Virginia sur le marché sont tirées par sa forte consommation, tant dans les régions émergentes que développées. De plus, des facteurs tels que la présence de marques bien établies, la large disponibilité en magasin et la préférence des consommateurs pour son goût et sa qualité uniques contribuent à son expansion continue et à sa prédominance au sein de l'industrie du tabac au Moyen-Orient.

- Par saveur

En fonction des arômes, le marché des produits du tabac est segmenté en produits aromatisés, classiques et autres. En 2025, le segment des produits aromatisés devrait dominer le marché, détenant 73,69 % du marché total. Il devrait également connaître la croissance la plus rapide, avec un taux de croissance annuel composé (TCAC) de 4,28 % sur la période de prévision. Cette croissance est portée par la demande croissante des jeunes adultes, plus attirés par des saveurs variées et innovantes. De plus, les innovations produits croissantes et les stratégies marketing agressives mises en œuvre par les fabricants de tabac alimentent son expansion. Ces facteurs contribuent à la position dominante du segment des produits aromatisés et à sa croissance soutenue sur le marché des produits du tabac au Moyen-Orient .

- Par gamme de prix

Sur la base de la fourchette de prix, le marché des produits du tabac au Moyen-Orient est classé en segments de masse, premium et luxe. Le segment de masse détient la part la plus élevée (61,89 %), grâce à son accessibilité et à sa consommation généralisée, en particulier dans les économies en développement où une grande partie de la population est sensible aux prix. Le segment de masse continue de dominer le marché du tabac en termes de volume. Sa force repose sur son accessibilité, sa large accessibilité et des habitudes de consommation bien ancrées, en particulier dans les régions sensibles aux prix. La production à grande échelle et la distribution au détail extensive permettent à ces produits de maintenir une forte pénétration dans les économies développées et émergentes. En 2025, le segment de masse devrait connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC de 4,38 %, grâce à son accessibilité et à sa consommation généralisée dans les économies en développement. Tandis que les segments premium et luxe devraient connaître une croissance grâce à la hausse des revenus disponibles et à la demande liée au style de vie.

- Par groupe d'âge

Sur la base des tranches d'âge, le marché des produits du tabac est segmenté en deux groupes : la génération X (41-56 ans), la génération Y (25-40 ans) et la génération du baby-boom (57-75 ans). En 2025, la génération X devrait dominer le marché avec une part de marché de 44,01 %. Cette domination s'explique par des revenus disponibles relativement plus élevés, des habitudes de consommation bien ancrées et une forte préférence pour les produits innovants. De plus, son intérêt croissant pour les produits du tabac aromatisés, premium et alternatifs, notamment les cigarettes électroniques et les dispositifs de tabac chauffé, stimule la croissance du segment, faisant d'elle une clientèle essentielle pour les acteurs du marché mondial.

La génération Y (25-40 ans) devrait connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC de 4,47 %. Cette croissance est tirée par leur plus grande acceptation de produits innovants tels que les cigarettes électroniques et le tabac chauffé, l'augmentation de leur revenu disponible et la tendance au tabagisme social. De plus, des stratégies marketing agressives, des offres de produits haut de gamme et des modes de consommation axés sur le mode de vie stimulent encore davantage le tabagisme dans cette tranche d'âge.

Par utilisateur final

Sur la base de l'utilisateur final, le marché des produits du tabac est segmenté en hommes, femmes et unisexe. En 2025, le segment masculin devrait dominer le marché, représentant 69,01 % de la part de marché totale. Il devrait également être le segment à la croissance la plus rapide, avec un taux de croissance annuel composé (TCAC) de 4,32 % au cours de la période de prévision. La croissance de ce segment est tirée par des campagnes marketing ciblées spécifiquement destinées aux consommateurs masculins, ainsi que par l'acceptation croissante des alternatives au tabac telles que les cigarettes électroniques et les produits de tabac chauffé. De plus, l'évolution des modes de vie et la sensibilisation accrue aux différentes options de produits contribuent à des taux d'adoption plus élevés, renforçant la position du segment et alimentant son expansion sur le marché des produits du tabac .

- Par canal de distribution

En fonction du canal de distribution, le marché des produits du tabac est segmenté entre détaillants en magasin et détaillants hors magasin. En 2025, le segment des détaillants en magasin devrait dominer le marché avec une part de marché significative de 84,79 %. Ce canal devrait également connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC de 4,24 %. La position forte des détaillants en magasin repose sur leur grande accessibilité, la disponibilité immédiate de leurs produits et la confiance durable des consommateurs. Leur présence étendue en zones urbaines et rurales en fait le choix privilégié d'une large clientèle. Par ailleurs, les points de vente traditionnels tels que les commerces de proximité, les supermarchés et les boutiques spécialisées continuent de jouer un rôle crucial pour améliorer l'expérience client et garantir la visibilité des produits.

Analyse régionale du marché des produits du tabac au Moyen-Orient

- L'Arabie saoudite a dominé le marché des produits du tabac au Moyen-Orient avec une part de marché de 51,28 % en 2024, grâce à son importante population de fumeurs, à ses monopoles d'État bien établis et à la culture du tabac soutenue par l'État. La forte base de consommateurs du pays, la forte prévalence du tabagisme et la croissance de sa population urbaine continuent de soutenir la demande.

- L'Arabie saoudite devrait connaître une croissance robuste avec un TCAC de 4,81 % de 2025 à 2032. Le marché du tabac en Arabie saoudite est principalement propulsé par la consommation croissante de cigarettes, en particulier chez les jeunes et les adultes d'âge moyen, associée à l'adoption croissante de produits à risque réduit tels que les cigarettes électroniques et le tabac chauffé.

Aperçu du marché des produits du tabac en Arabie saoudite

Le marché des produits du tabac en Arabie saoudite était évalué à 23 872 836,25 milliers de dollars américains en 2024 et devrait atteindre 34 689 428,31 milliers de dollars américains d'ici 2032, avec un TCAC de 4,81 %. L'Arabie saoudite est sur le point d'enregistrer une croissance significative sur le marché des produits du tabac, tirée par la hausse de la consommation de tabac, une population jeune et croissante, et des investissements croissants des fabricants de tabac régionaux. L'expansion du marché est également soutenue par la demande croissante de produits du tabac haut de gamme et aromatisés, la popularité croissante des alternatives à risque réduit et les initiatives gouvernementales qui favorisent la culture et la production locales et le soutien réglementaire de l'industrie. Ces facteurs collectivement positionnent l'Arabie saoudite comme un marché de croissance clé dans la région du Moyen-Orient.

Aperçu du marché des produits du tabac à Bahreïn

Le marché bahreïni des produits du tabac connaît un essor rapide, porté par une demande croissante de produits haut de gamme et à risque réduit, ainsi que par la popularité soutenue des cigarettes traditionnelles dans de nombreuses régions. Parmi les principaux moteurs de croissance figurent la hausse de la consommation dans les économies émergentes, l'adoption croissante du tabac chauffé et des cigarettes électroniques pour des raisons de santé, et les innovations constantes en matière de produits, telles que les variantes aromatisées, les formats compacts et les emballages durables. Le vieillissement de la population et les préoccupations sanitaires accrues accélèrent l'adoption de produits de nouvelle génération, tandis que les secteurs florissants de la vente au détail, du tourisme et de l'hôtellerie-restauration à l'échelle mondiale stimulent l'expansion du marché grâce à des canaux de distribution diversifiés et modernisés.

Part de marché des produits du tabac au Moyen-Orient

Le marché des produits du tabac au Moyen-Orient est principalement dirigé par des entreprises bien établies, notamment :

- Philip Morris Products SA (Suisse)

- Imperial Brands plc (Royaume-Uni)

- British American Tobacco plc (Royaume-Uni)

- JTI SA (Suisse)

- PT Djarum (Indonésie)

- KT&G (Corée du Sud)

- Pyxus International, Inc. (États-Unis)

- Scandinavian Tobacco Group A/S (Danemark)

- Compagnie de l'Est SAE (Égypte)

- Godfrey Phillips India Ltd. (Inde)

- T. Akiyama & Co. (Japon)

- Villiger Söhne AG (Suisse)

- Joya de Nicaragua SA (Nicaragua)

- Panafrican Tobacco Group Holding Ltd. (Rwanda)

Derniers développements sur le marché des produits du tabac au Moyen-Orient

- En juin 2025, un important fabricant de tabac du Moyen-Orient a étendu son réseau de distribution dans la région en ouvrant de nouvelles installations de fabrication et de conditionnement en Arabie saoudite et aux Émirats arabes unis. Cette initiative vise à renforcer les chaînes d'approvisionnement locales et à répondre à la demande croissante de produits du tabac traditionnels et à risque réduit. Cette initiative renforce la domination régionale de l'entreprise et soutient la croissance de sa clientèle au Moyen-Orient.

- En juillet 2025, un important fabricant de tabac du Moyen-Orient a présenté une innovation de produit avancée en lançant des appareils à tabac chauffé haut de gamme intégrés à des conceptions respectueuses de l'environnement et à des systèmes de refroidissement intelligents sur les principaux marchés urbains, soulignant l'adoption croissante de solutions de tabac de nouvelle génération et la forte préférence des consommateurs pour des alternatives à risque réduit dans la région.

- En avril 2025, un autre acteur du Moyen-Orient a étendu sa présence en introduisant un portefeuille diversifié de cigarettes, de cigares et de cigarettes électroniques haut de gamme dans les centres urbains d'Égypte et du Qatar, ciblant les consommateurs de la classe moyenne et renforçant sa présence sur le marché régional des produits du tabac.

- En août 2024, une importante entreprise de tabac du Moyen-Orient a intensifié ses activités en déployant des bâtonnets de tabac chauffé aromatisés et des plateformes de distribution basées sur l'IA en Arabie saoudite et à Bahreïn pour un ciblage efficace des consommateurs. Cette initiative renforce sa domination régionale et démontre sa capacité à proposer des solutions innovantes à grande échelle sur les marchés en pleine évolution du Moyen-Orient.

- En juillet 2024, un important cigarettier du Moyen-Orient a conclu des partenariats stratégiques avec des distributeurs et des détaillants des Émirats arabes unis et d'Oman afin de soutenir le déploiement de produits à risque réduit dans les centres urbains. Cette collaboration met l'accent sur une intégration intelligente des points de vente, des emballages durables et une plus grande portée auprès des consommateurs, renforçant ainsi le leadership de l'entreprise au Moyen-Orient.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING CONSUMER PURCHASING DECISIONS IN THE MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET

4.2 CONSUMER BUYING BEHAVIOR FOR MIDDLE EAST AND AFRICA TOBACCO PRODUCTS

4.2.1 HEALTH PERCEPTIONS AND SAFETY AWARENESS

4.2.2 PRICE SENSITIVITY AND VALUE PERCEPTION

4.2.3 BRAND LOYALTY AND MARKETING INFLUENCE

4.2.4 REGULATORY ENVIRONMENT AND COMPLIANCE

4.2.5 SOCIAL NORMS, CULTURE, AND ETHICAL CONCERNS

4.2.6 SUMMARY TABLE: EXPANDED CONSUMER DRIVERS

4.3 PRODUCT ADOPTION SCENARIO IN THE MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET

4.4 PORTER’S FIVE FORCES

4.4.1 COMPETITIVE RIVALRY – HIGH

4.4.2 THREAT OF NEW ENTRANTS – LOW TO MODERATE

4.4.3 BARGAINING POWER OF BUYERS – MODERATE TO HIGH

4.4.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.4.5 THREAT OF SUBSTITUTES – HIGH

4.5 BRAND OUTLOOK

4.6 IMPACT OF ECONOMIC SLOWDOWN ON THE MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 THE MIDDLE EAST AND AFRICA TOBACCO SUPPLY CHAIN ANALYSIS

4.9 PRICING ANALYSIS OF TOBACCO PRODUCTS IN THE MIDDLE EAST AND AFRICA MARKET

4.1 IMPORT EXPORT ANALYSIS

4.10.1 IMPORT SCENARIO

4.10.2 EXPORT SCENARIO

4.11 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN EMERGING MARKETS SUCH AS ASIA-PACIFIC

6.1.2 BRAND LOYALTY & STRONG DISTRIBUTION NETWORKS

6.1.3 RISING YOUTH AND FEMALE CONSUMER BASE

6.1.4 TAX REVENUE RELIANCE OF GOVERNMENTS

6.2 CHALLENGES

6.2.1 STRICT REGULATIONS & HIGHER TAXES

6.2.2 RISING HEALTH AWARENESS AND ANTI-SMOKING CAMPAIGNS

6.3 OPPORTUNITIES

6.3.1 GROWTH OF NEXT-GENERATION PRODUCTS (NGP)

6.3.2 PREMIUMIZATION TRENDS OF TOBACCO CONSUMPTION

6.3.3 E-COMMERCE AND DIRECT-TO-CONSUMER CHANNELS

6.4 CHALLENGES

6.4.1 DECREASING TOBACCO CONSUMPTION IN DEVELOPED ECONOMIES

6.4.2 PUBLIC AND POLITICAL SCRUTINY

7 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CIGARETTES

7.3 CIGAR & CIGARILLOS

7.4 E-CIGARETTES

7.5 SMOKELESS TOBACCO

7.6 NEXT GENERATION PRODUCTS

7.7 ROLL-YOUR-OWN (RYO) TOBACCO

7.8 HOOKAH/SHISHA TOBACCO

7.9 BIDIS

7.1 PIPES

7.11 OTHERS

8 MIDDLE EAST AND AFRICA TOBACCO PRODUCT MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 GENERATION X (41–56 YEARS)

8.3 MILLENNIALS (25–40 YEARS)

8.4 BABY BOOMERS (57–75 YEARS)

9 MIDDLE EAST AND AFRICA TOBACCO PRODUCT MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MASS

9.3 PREMIUM

9.4 LUXURY

10 MIDDLE EAST AND AFRICA TOBACCO PRODUCT MARKET, BY FLAVOR

10.1 OVERVIEW

10.2 FLAVORED

10.3 REGULAR

10.4 OTHERS

11 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY END-USER

11.1 OVERVIEW

11.2 MEN

11.3 WOMEN

11.4 UNISEX

12 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE

12.1 OVERVIEW

12.2 VIRGINIA

12.3 BURLEY

12.4 ORIENTAL

12.5 MIXED

12.6 OTHERS

13 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE-BASED RETAILERS

13.3 TABLE 2 MIDDLE EAST AND AFRICA STORE BAESD RETAILERS IN TOBACCO PRODUCT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

13.4 NON-STORE RETAILERS

14 MIDDLE EAST AND AFRICA TOBACCO PRODUCT MARKET, BY REGION

14.1 MIDDLE EAST

14.1.1 SAUDI ARABIA

14.1.2 BAHRAIN

14.1.3 OMAN

14.1.4 REST OF MIDDLE EAST

14.2 AFRICA

14.2.1 SOUTH AFRICA

14.2.2 NIGERIA

14.2.3 MOROCCO

14.2.4 KENYA

14.2.5 TANZANIA

14.2.6 MOZAMBIQUE

14.2.7 ÔTE D’IVOIRE

14.2.8 ANGOLA

14.2.9 CAMEROON

14.2.10 SENEGAL

14.2.11 LIBYA

14.2.12 CONGO

14.2.13 REST OF AFRICA

15 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 PHILIP MORRIS PRODUCTS S.A.

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATES

17.2 IMPERIAL BRANDS PLC

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVEOPMENT

17.3 BRITISH AMERICAN TOBACCO P.L.C

17.3.1 COMPANY SNAPSHOT

17.3.2 RECENT FINANCIALS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 JTI SA

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 PT DJARUM

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 CREMO CIGARS

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 EASTERN COMPANY S.A.E

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 GODFREY PHILLIPS INDIA LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 JOYA DE NICARAGUA, S.A

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 KT&G CORP.

17.10.1 COMPANY SNAPSHOT

17.10.2 RECENT FINANCIALS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 PANAFRICAN TOBACCO GROUP HOLDING

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PYXUS INTERNATIONAL, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 SCANDINAVIAN TOBACCO GROUP A/S

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 AKIYAMA SANGYO CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 VILLIGER SÖHNE AG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICING ANALYSIS IN THE MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET

TABLE 2 REGULATORY COVERAGE

TABLE 3 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 5 MIDDLE EAST AND AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA CIGAR & CIGARILLOS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ROLL-YOUR-OWN (RYO) TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 38 MIDDLE EAST AND AFRICA HOOKAH/SHISHA TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BIDIS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PIPES IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA OTHERS TOBACCO IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA GENERATION X (41–56 YEARS) IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 44 MIDDLE EAST AND AFRICA MILLENNIALS (25–40 YEARS) IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA BABY BOOMERS (57–75 YEARS) IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA MASS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA PREMIUM IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND

TABLE 49 MIDDLE EAST AND AFRICA LUXURY IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY FLAVOR 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA REGULAR IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN TOBACCO PRODUCTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA MEN IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA WOMEN IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA UNISEX IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA VIRGINIA IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA BURLEY IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA ORIENTAL IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA MIXED IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA OTHERS IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA TOBACCO PRODUCT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA STORE BAESD RETAILERS IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN TOBACCO PRODUCT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN TOBACCO PRODUCT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 76 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 78 MIDDLE EAST CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 121 SAUDI ARABIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SAUDI ARABIA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 147 SAUDI ARABIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SAUDI ARABIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 159 SAUDI ARABIA TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SAUDI ARABIA NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 BAHRAIN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 BAHRAIN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 164 BAHRAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 BAHRAIN HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 BAHRAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 167 BAHRAIN FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 BAHRAIN MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 BAHRAIN SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 BAHRAIN FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 BAHRAIN AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 BAHRAIN ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 BAHRAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 174 BAHRAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 175 BAHRAIN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 176 BAHRAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 BAHRAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 178 BAHRAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 BAHRAIN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 180 BAHRAIN FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 BAHRAIN FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 BAHRAIN MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 BAHRAIN AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 BAHRAIN SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 BAHRAIN ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 BAHRAIN SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BAHRAIN NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 BAHRAIN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 BAHRAIN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 190 BAHRAIN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 191 BAHRAIN TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 BAHRAIN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 193 BAHRAIN FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BAHRAIN FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 BAHRAIN MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 BAHRAIN SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BAHRAIN AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BAHRAIN ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 BAHRAIN TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 200 BAHRAIN TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 201 BAHRAIN TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 202 BAHRAIN TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 203 BAHRAIN STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BAHRAIN NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 OMAN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 OMAN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 207 OMAN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 OMAN HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 OMAN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 210 OMAN FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 OMAN MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 OMAN SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 OMAN FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 OMAN AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 OMAN ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 218 OMAN CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 219 OMAN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 OMAN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 221 OMAN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 OMAN E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 223 OMAN FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 OMAN FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 OMAN MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 OMAN AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 OMAN SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 OMAN ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 OMAN SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 OMAN NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 OMAN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 OMAN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 233 OMAN SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 234 OMAN TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 OMAN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 236 OMAN FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 OMAN FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 OMAN MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 OMAN SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 OMAN AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 OMAN ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 OMAN TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 243 OMAN TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 244 OMAN TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 245 OMAN TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 246 OMAN STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 OMAN NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 REST OF MIDDLE EAST TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 REST OF MIDDLE EAST TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 250 AFRICA TOBACCO PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 251 AFRICA TOBACCO PRODUCTS MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 252 AFRICA

TABLE 253 AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 255 AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 AFRICA HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 258 AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 265 AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 266 AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 267 AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 269 AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 271 AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 AFRICA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 AFRICA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 281 AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 282 AFRICA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 AFRICA TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 284 AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 AFRICA TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 291 AFRICA TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 292 AFRICA TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 293 AFRICA TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 AFRICA STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 AFRICA NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 298 SOUTH AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SOUTH AFRICA HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SOUTH AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 301 SOUTH AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SOUTH AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 SOUTH AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SOUTH AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SOUTH AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SOUTH AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SOUTH AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 308 SOUTH AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 309 SOUTH AFRICA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 310 SOUTH AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SOUTH AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 312 SOUTH AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 SOUTH AFRICA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 314 SOUTH AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 SOUTH AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 SOUTH AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 SOUTH AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SOUTH AFRICA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AFRICA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 SOUTH AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 324 SOUTH AFRICA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 327 SOUTH AFRICA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SOUTH AFRICA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 SOUTH AFRICA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 SOUTH AFRICA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 SOUTH AFRICA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 SOUTH AFRICA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 334 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 335 SOUTH AFRICA TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 336 NIGERIA TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 337 NIGERIA STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 NIGERIA NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 NIGERIA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 NIGERIA TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 341 NIGERIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 NIGERIA HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 NIGERIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 344 NIGERIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 NIGERIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 NIGERIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 NIGERIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 NIGERIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 NIGERIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 NIGERIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 351 NIGERIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 352 NIGERIA CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 353 NIGERIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 NIGERIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 355 NIGERIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 NIGERIA E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 357 NIGERIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 NIGERIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 NIGERIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 NIGERIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 NIGERIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 NIGERIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 NIGERIA SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 NIGERIA NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 NIGERIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 NIGERIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 367 NIGERIA SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 368 NIGERIA TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 NIGERIA TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 370 NIGERIA FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 NIGERIA FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 NIGERIA MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 NIGERIA SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 NIGERIA AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 NIGERIA ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 NIGERIA TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 377 NIGERIA TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 378 NIGERIA TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 379 NIGERIA TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 380 NIGERIA STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 NIGERIA NON STORE RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 MOROCCO TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 MOROCCO TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 384 MOROCCO CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 MOROCCO HERBAL CIGARETTES IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 MOROCCO CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 387 MOROCCO FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 MOROCCO MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 MOROCCO SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 MOROCCO FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 MOROCCO AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 MOROCCO ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 MOROCCO CIGARETTES IN TOBACCO PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 394 MOROCCO CIGARETTES IN TOBACCO PRODUCTS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 395 MOROCCO CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LENGTH, 2018-2032 (USD THOUSAND)

TABLE 396 MOROCCO E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 MOROCCO E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY VAPING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 398 MOROCCO E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY LIQUID TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 MOROCCO E-CIGARETTES IN TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 400 MOROCCO FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 MOROCCO FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 MOROCCO MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 MOROCCO AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 MOROCCO SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 MOROCCO ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 MOROCCO SMOKELESS TOBACCO IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 MOROCCO NEXT GENERATION PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 MOROCCO SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 MOROCCO SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY NICOTINE CONTENT, 2018-2032 (USD THOUSAND)

TABLE 410 MOROCCO SNUS PRODUCTS IN TOBACCO PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 411 MOROCCO TOBACCO PRODUCTS MARKET, BY TOBACCO TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 MOROCCO TOBACCO PRODUCTS MARKET, BY FLAVOR, 2018-2032 (USD THOUSAND)

TABLE 413 MOROCCO FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 MOROCCO FRUIT IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 MOROCCO MENTHOL IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 MOROCCO SPICED FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 MOROCCO AROMATIC FLAVORED IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 MOROCCO ALCOHOL INSPIRED FLAVORS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 MOROCCO TOBACCO PRODUCTS MARKET, BY PRICE RANGE, 2018-2032 (USD THOUSAND)

TABLE 420 MOROCCO TOBACCO PRODUCTS MARKET, BY AGE-GROUP, 2018-2032 (USD THOUSAND)

TABLE 421 MOROCCO TOBACCO PRODUCTS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 422 MOROCCO TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 423 MOROCCO STORE BASED RETAILERS IN TOBACCO PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)