North America Active Pharmaceutical Ingredient Api Market

Taille du marché en milliards USD

TCAC :

%

USD

70.77 Billion

USD

93.92 Billion

2024

2032

USD

70.77 Billion

USD

93.92 Billion

2024

2032

| 2025 –2032 | |

| USD 70.77 Billion | |

| USD 93.92 Billion | |

|

|

|

|

North America Active Pharmaceutical Ingredients (API) Market Segmentation, By Molecule (Small Molecule and Large Molecule), Type (Innovative Active Pharmaceutical Ingredients and Generic Innovative Active Pharmaceutical Ingredients), Type of Manufacturer (Captive API Manufacturer and Merchant API Manufacturer), Synthesis (Synthetic Active Pharmaceutical Ingredients and Biotech Active Pharmaceutical Ingredients), Chemical Synthesis (Acetaminophen, Artemisinin, Saxagliptin, Sodium Chloride, Ibuprofen, Losartan Potassium, Enoxaparin Sodium, Rufinamide, Naproxen, Tamoxifen, and Others), Type of Drug (Prescription Drugs and Over-the-Counter), Usage (Clinical and Research), Potency (Low-to-Moderate Potency Active Pharmaceutical Ingredients, and Potent-to-Highly Potent Active Pharmaceutical Ingredient), Therapeutic Application (Cardiology, CNS and Neurology, Oncology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology, and Other Therapeutic Application) - Industry Trends and Forecast to 2032

Active Pharmaceutical Ingredients (API) Market Size

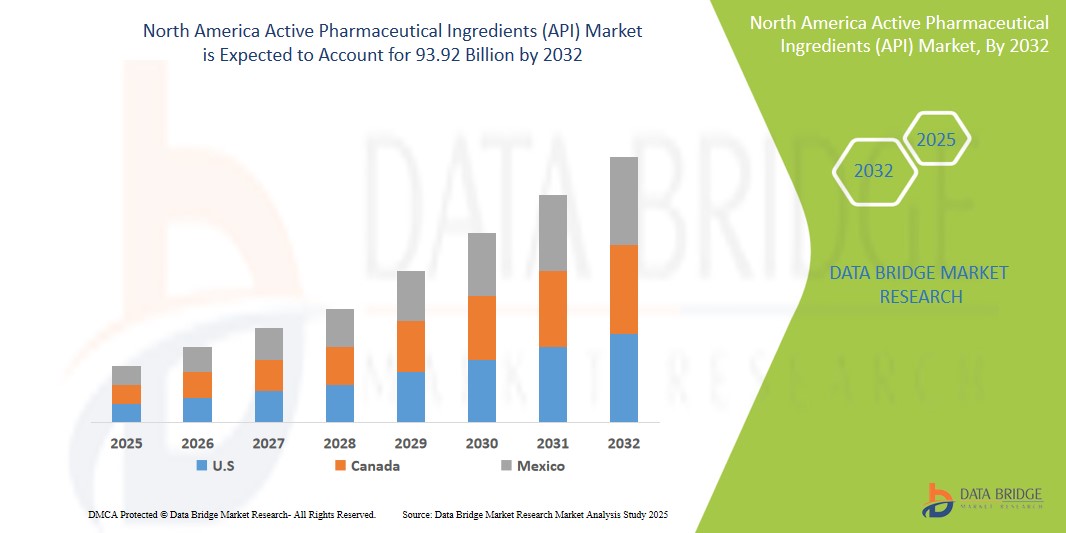

- The North America active pharmaceutical ingredients (API) market size was valued atUSD 70.77 billion in 2024 and is expected to reachUSD 93.92 billion by 2032, at aCAGR of 3.60%during the forecast period

- This growth is driven by factors such as the increasing prevalence of chronic diseases, advancements in biotechnology, strategic industry investments, government initiatives

Active Pharmaceutical Ingredients (API) Market Analysis

- Active pharmaceutical ingredients (API) are the biologically active ingredients in medications responsible for their therapeutic effects. They are the essence of pharmaceutical formulations, providing the desired medicinal properties

- APIs undergo stringent testing and regulation to ensure safety and efficacy. These substances are crucial in drug manufacturing, pivotal in developing various pharmaceutical products.

- U.S. is expected to dominate the active pharmaceutical ingredients (API) market with 91.3% due to rising prevalence of cardiovascular, genetic, and other chronic diseases aided with growing research in field of drug development

- Canada is expected to be the fastest growing region in the active pharmaceutical ingredients (API) market during the forecast period due to increasing healthcare investments and technological advancements

- The synthetic active pharmaceutical ingredients segment is expected to dominate the market with a market share with 72.5% due to high demand for generic drugs

Report Scope and Active Pharmaceutical Ingredients (API) Market Segmentation

|

Attributes |

Active Pharmaceutical Ingredients (API) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Active Pharmaceutical Ingredients (API) Market Trends

“Integration of Artificial Intelligence (AI) in API Development”

- Pharmaceutical companies are leveraging AI to accelerate the discovery of novel APIs. AI algorithms analyze vast datasets to predict molecular behavior, identify potential drug candidates, and optimize synthesis routes, significantly reducing development timelines

- AI technologies are being employed to monitor equipment health in real-time, predicting maintenance needs before failures occur. This proactive approach minimizes downtime, enhances production efficiency, and ensures consistent API quality

- AI-powered systems are automating quality control processes by analyzing production data to detect anomalies and ensure compliance with stringent regulatory standards. This automation reduces human error and ensures high-quality API output

- AI is being utilized to optimize supply chain logistics, predicting demand fluctuations and adjusting production schedules accordingly. This leads to cost savings and ensures the timely availability of APIs

- AI models are identifying existing drugs that could be repurposed for new therapeutic indications, expanding the utility of APIs and accelerating the availability of treatments

Active Pharmaceutical Ingredients (API) Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases”

- A significant driver of the North American API market is the increasing prevalence of chronic diseases

- Conditions such as diabetes, cardiovascular diseases, and cancer are on the rise, leading to a higher demand for medications that require active pharmaceutical ingredients

- For instance, the Centers for Disease Control and Prevention (CDC) reports that chronic diseases are the leading cause of death and disability in the U.S., accounting for a significant portion of healthcare expenditures

- This surge in chronic conditions necessitates a consistent and reliable supply of APIs to meet the treatment needs of the population

- As a result, pharmaceutical companies are investing heavily in API production to ensure the availability of essential medications

Opportunity

“Growing Emphasis on Personalized Medicine”

- The growing emphasis on personalized medicine presents a significant opportunity for the North American API market

- Personalized medicine involves tailoring medical treatment to individual characteristics, needs, and preferences of patients, which often requires specialized APIs

- This approach is gaining traction due to advancements in genomics and biotechnology, enabling the development of targeted therapies that are more effective and have fewer side effects

- Pharmaceutical companies are increasingly focusing on developing APIs that cater to these personalized treatments, thereby opening new avenues for growth in the API market

- Additionally, the rise of digital therapeutics and the integration of artificial intelligence in drug development are further driving the demand for specialized APIs

Restraint/Challenge

“Stringent Regulatory Requirements Imposed by Authorities”

- One of the primary challenges facing the North American API market is the stringent regulatory requirements imposed by authorities such as the U.S. Food and Drug Administration (FDA) and Health Canada

- Compliance with these regulations increases the cost and complexity of API manufacturing, posing challenges for smaller manufacturers

- For Instance, the FDA's Current Good Manufacturing Practice (CGMP) regulations require manufacturers to establish robust quality control systems, conduct regular inspections, and maintain detailed documentation, all of which can be resource-intensive

- These stringent standards, while ensuring the safety and efficacy of APIs, can be burdensome for smaller companies with limited resources

- Furthermore, the expiration of patents for blockbuster drugs reduces the demand for their APIs, affecting the revenue of API manufacturers

- This combination of regulatory challenges and market dynamics necessitates strategic planning and investment from API manufacturers to maintain competitiveness in the evolving market landscape

Active Pharmaceutical Ingredients (API) Market Scope

The market is segmented on the basis of molecule, type, type of manufacturer, synthesis, chemical synthesis, type of drug, usage, potency, and therapeutic application.

|

Segmentation |

Sub-Segmentation |

|

By Molecule |

|

|

By Type |

|

|

By Type of Manufacturer |

|

|

By Synthesis |

|

|

By Chemical Synthesis |

|

|

By Type of Drug |

|

|

By Usage |

|

|

By Potency |

|

|

By Therapeutic Application |

|

In 2025, The Synthetic Active Pharmaceutical Ingredients is projected to dominate the market with a largest share in synthesis segment

The synthetic active pharmaceutical ingredients segment is expected to dominate the Active Pharmaceutical Ingredients (API) market with the largest share with 72.5% in 2025 due to high demand for generic drugs. APIs used to develop generic drugs contribute to high revenue for synthetic and chemical API manufacturing companies. This is creating a wide opportunity for CDMOs. An increase in outsourcing trend for improving profitability by reducing the cost of production is creating new growth avenues for the market.

The captive API manufacturer is expected to account for the largest share during the forecast period in type of manufacturer market

In 2025, the captive API manufacturer segment is expected to dominate the market with the largest market share with 51.7% due to the Numerous companies are investing in solving challenges and developing new chemical ways for in-house production of APIs. This aids in reducing costs and the risk of contamination. Protein synthesis and artificial intelligence are expected to accelerate development with greater control over the process.

Active Pharmaceutical Ingredients (API) Market Regional Analysis

“U.S. Holds the Largest Share in the Active Pharmaceutical Ingredients (API) Market”

- The U.S. holds a dominant position in the North American Active Pharmaceutical Ingredients (API) market, accounting for 91.3% of the regional market share

- This dominance is attributed to the presence of major pharmaceutical companies such as AbbVie Inc., Pfizer Inc., and Viatris Inc., which contribute significantly to API production and innovation

- The U.S. benefits from advanced manufacturing infrastructure, robust research and development capabilities, and a well-established regulatory framework, ensuring high-quality API production

- The prevalence of chronic diseases, including cardiovascular conditions and diabetes, drives the demand for APIs, further solidifying the U.S.'s leading role in the market

- Government initiatives and investments in pharmaceutical manufacturing, such as Eli Lilly's investment in Indiana, underscore the strategic importance of API production in the U.S.

“Canada is Projected to Register the Highest CAGR in the Active Pharmaceutical Ingredients (API) Market”

- Canada is projected to experience the highest growth rate in the North American API market

- The Canadian government's support for pharmaceutical innovation and manufacturing, including initiatives to enhance biosimilar production, fosters a conducive environment for API market expansion

- Collaborations between global pharmaceutical companies and Canadian firms, such as Viatris's partnership with Biocon to launch oncology biosimilars, contribute to the growth of the API sector

- Canada's strategic focus on high-value manufacturing areas, including complex and highly potent APIs, gene therapies, and biologics, positions it for significant market growth

- The increasing prevalence of chronic diseases in Canada, coupled with a growing aging population, drives the demand for APIs, supporting the market's rapid expansion

Active Pharmaceutical Ingredients (API) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dr. Reddy’s Laboratories Ltd.(India)

- Sun Pharmaceutical Industries Ltd.(India)

- Teva Pharmaceutical Industries Ltd.(Israel)

- Cipla Inc.(India)

- AbbVie Inc.(U.S.)

- Aurobindo Pharma (India)

- Sandoz International GmbH (Novartis AG) (Switzerland)

- Viatris Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- STADA Arzneimittel AG (Germany)

- Lonza (Switzerland)

- Curia (U.S.)

- Pfizer Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Merck KGaA (Germany)

- Catalent, Inc. (U.S.)

Latest Developments in North America Active Pharmaceutical Ingredients (API) Market

- In October 2023, Cambrex announced the completion of its USD 38 million small molecule API manufacturing facility. This investment doubled the size of the company’s manufacturing facility and enhanced its ability to acquire more customers to meet their evolving needs.

- In August 2023, BARDA and Regeneron entered into an agreement wherein the former will support the latter in developing an antibody therapy to prevent SARS-CoV-2. This contract is worth USD 326 million and is anticipated to drive the market with production of novel vaccines in the coming years.

- In April 2023, Eli Lilly announced an investment of USD 1.6 billion in U.S.-based LEAP Innovation Park. This brings the total investment to USD 3.7 billion to manufacture complex APIs for products such as genetic medicine.

- In April 2022, Geocann entered into a strategic partnership with Averix Bio for supplying API phytocannabinoid ingredients.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.