North America Automated Container Terminal Market

Taille du marché en milliards USD

TCAC :

%

USD

1.82 Billion

USD

3.07 Billion

2025

2033

USD

1.82 Billion

USD

3.07 Billion

2025

2033

| 2026 –2033 | |

| USD 1.82 Billion | |

| USD 3.07 Billion | |

|

|

|

|

Segmentation des terminaux à conteneurs automatisés en Amérique du Nord, par degré d'automatisation (terminaux semi-automatisés, terminaux entièrement automatisés), type de projet (projets de rénovation, projets de construction), offre (équipements, logiciels, services), utilisateur final (public, privé), canal de distribution (direct et indirect) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des terminaux à conteneurs automatisés en Amérique du Nord

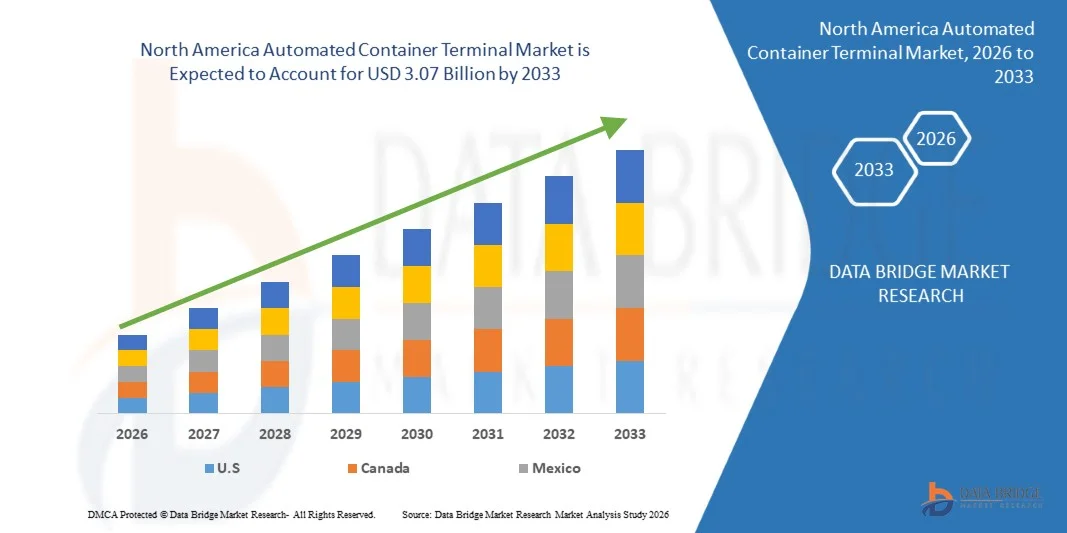

- Le marché nord-américain des terminaux à conteneurs automatisés était évalué à 1,82 milliard de dollars américains en 2025 et devrait atteindre 3,07 milliards de dollars américains d'ici 2033.

- Au cours de la période prévisionnelle allant de 2026 à 2033, le marché devrait croître à un TCAC de 6,8 %, principalement en raison du besoin d'une efficacité opérationnelle et d'une capacité portuaire accrues.

- La croissance du marché nord-américain des terminaux à conteneurs automatisés est stimulée par des facteurs tels que l'augmentation des volumes d'échanges commerciaux en Amérique du Nord, la demande croissante d'équipements de manutention de conteneurs haute performance, les progrès technologiques en matière d'automatisation et d'intelligence artificielle, ainsi que l'expansion des secteurs de la fabrication et du transport dans le monde entier.

Analyse du marché des terminaux à conteneurs automatisés en Amérique du Nord

- Les terminaux à conteneurs automatisés sont des installations portuaires modernes qui utilisent des technologies et des logiciels automatisés pour la manutention des conteneurs, minimisant ainsi le travail manuel, optimisant le débit et améliorant la sécurité et la prévisibilité des opérations de fret. Ils jouent un rôle crucial dans la chaîne d'approvisionnement nord-américaine, au service des compagnies maritimes, des autorités portuaires et des réseaux logistiques, en permettant des rotations de navires plus rapides et une gestion optimisée des terminaux.

- L'une des technologies clés des terminaux à conteneurs automatisés est l'utilisation de grues de stockage automatisées (ASC), qui stockent et récupèrent les conteneurs de manière autonome sur le parc, optimisant ainsi l'utilisation de l'espace et réduisant les temps de manutention. L'essor des porte-conteneurs de plus grande taille stimule également le développement de logiciels spécialisés et de véhicules à guidage automatique (AGV) conçus pour coordonner les mouvements complexes des conteneurs entre le quai et la zone de stockage. Dans les opérations du terminal, cette automatisation est essentielle pour le traitement des conteneurs aux portes d'embarquement, la planification des navires et la maintenance des équipements, garantissant ainsi des performances constantes et des coûts d'exploitation réduits.

- Les États-Unis devraient dominer le marché nord-américain des terminaux à conteneurs automatisés, avec une part de revenus de 77,66 % en 2026, grâce à d'importants investissements dans l'automatisation portuaire, les infrastructures numériques et les systèmes logistiques intelligents. De grands ports comme Los Angeles, Long Beach et New York/New Jersey ont adopté des grues de stockage automatisées, des véhicules à guidage automatique (AGV) et des systèmes d'exploitation de terminaux (TOS) avancés afin d'améliorer la productivité et de réduire la congestion. Par ailleurs, le soutien important des initiatives fédérales et étatiques visant à renforcer la résilience et la durabilité de la chaîne d'approvisionnement, conjugué à la présence d'opérateurs portuaires mondiaux clés tels qu'APM Terminals, SSA Marine et DP World, a consolidé la position des États-Unis en tant que leader du développement des terminaux à conteneurs automatisés en Amérique du Nord.

- Les États-Unis devraient connaître la croissance la plus rapide du marché nord-américain des terminaux à conteneurs automatisés au cours de la période de prévision, avec un TCAC de 7,1 %. Cette croissance est alimentée par l'augmentation des investissements dans l'automatisation et la numérisation des ports, la hausse des volumes d'échanges de conteneurs et l'importance accrue accordée à l'amélioration de l'efficacité de la chaîne d'approvisionnement. La modernisation des principaux ports tels que Los Angeles, Long Beach et New York/New Jersey, grâce à l'adoption de systèmes d'exploitation de terminaux (TOS) basés sur l'IA, de véhicules autonomes et de grues télécommandées, stimule l'expansion du marché.

- En 2026, le segment des terminaux semi-automatisés devrait dominer le marché avec une part de marché de 54,50 % grâce à son équilibre optimal entre investissement et avantages opérationnels, offrant une voie de transition à moindre risque pour les ports existants, des gains de productivité importants et une plus grande flexibilité opérationnelle par rapport aux systèmes entièrement automatisés.

Portée du rapport et segmentation du marché des terminaux à conteneurs automatisés en Amérique du Nord

|

Attributs |

Aperçu du marché des terminaux à conteneurs automatisés en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include industry analysis & futuristic scenario, penetration and growth prospect mapping, competitor key pricing strategies (prominent players), technology analysis, company profiling, competitive analysis. |

North America Automated Container Terminal Market Trends

“Expansion of automated terminals in emerging markets”

- The rapid growth in trade volumes and the increasing demand for efficient port operations in emerging markets are creating a significant opportunity for ACT market players. By developing greenfield and brownfield automated container terminals, these regions can enhance port efficiency, accommodate larger vessels, and strengthen their integration into global supply chains.

- Expansion into emerging markets enables equipment manufacturers, software vendors, and service integrators to leverage first-mover advantages, deploy modern automation technologies, and achieve greater operational scalability. Investments in advanced cranes, Automated Guided Vehicles (AGVs), Terminal Operating Systems (TOS), and digital logistics platforms are transforming ports into modern, efficient hubs capable of handling surging container traffic while reducing costs and dwell times.

- In July 2025, according to the Times of India, Vizhinjam International Seaport (India) commenced operations using AI-based port operations and automated cranes, trained India’s first female automated crane operators, and handled over 830,000 containers in its first year

- In September 2025, Reuters reported that the Colombo West International Terminal (Sri Lanka), operated by a consortium led by Adani Group, expanded its fully automated terminal capacity to handle up to 3.2 million containers annually, ahead of schedule, strengthening regional logistics capabilities

- Thus, the expansion of automated terminals in emerging markets is establishing these regions as key growth drivers for the ACT market. By implementing advanced automation technologies, emerging-market ports are modernizing infrastructure, reducing operational bottlenecks, and improving global competitiveness, paving the way for sustained industry growth.

North America Automated Container Terminal Market Dynamics

Driver

“The surge in international trade has led to higher container throughput”

- The continuous expansion of global trade has significantly increased the volume of containerized cargo moving across international borders, thereby driving demand for efficient, automated container-handling solutions. As seaborne trade remains the backbone of global commerce, ports worldwide are under growing pressure to enhance throughput capacity, reduce vessel turnaround time, and improve overall terminal efficiency. Automated Container Terminals (ACTs) have emerged as a vital solution to address these operational demands by leveraging robotics, AI, and advanced logistics technologies.

- Rising globalization, coupled with the growth of e-commerce and cross-border supply chains, is further accelerating the need for automation in port operations. Automated cranes, driverless vehicles, and digital port management systems are increasingly being deployed to handle large container volumes with precision and minimal human intervention.

- In October 2024, according to the United Nations Conference on Trade and Development (UNCTAD, 2024), global maritime trade volumes grew by 2.4% in 2023, with containerized trade accounting for over 60% of seaborne cargo, emphasizing the critical need for automated port infrastructure

- In November 2024, A report by Hamburg Port Consulting highlights that automation and digitalisation are becoming essential to modern port operations, as rising cargo volumes demand higher efficiency

- In addition, the increasing complexity of global logistics networks and the expansion of free trade zones are compelling ports to adopt next-generation automated systems to remain competitive. Automation not only supports higher container throughput but also ensures greater operational accuracy, sustainability, and adaptability to fluctuating trade demands. As international maritime trade continues to surge, automation technologies such as AGVs, automated stacking cranes, and digital twin-based monitoring systems are becoming indispensable for optimizing performance and reducing operational bottlenecks.

- Thus, the surge in international trade volumes and the growing need for efficient container handling are propelling the adoption of automated container terminals globally, solidifying automation as a key pillar for future-ready, resilient, and high-performing port operations.

Restraint/Challenge

“High upfront investment and installation costs”

- Despite the growing adoption of automation technologies across global ports, the high upfront investment and installation costs remain a significant restraining factor in the North America Automated Container Terminal Market. Developing fully or semi-automated terminals requires substantial capital for advanced machinery, such as Automated Guided Vehicles (AGVs), Automated Stacking Cranes (ASCs), and sophisticated Terminal Operating Systems (TOS), as well as for integrating supporting digital infrastructure and energy systems. These expenses often exceed hundreds of millions of dollars, posing a major restraint, particularly for medium- and small-scale ports with limited budgets or uncertain cargo throughput.

- Moreover, automation projects typically involve complex retrofitting and long installation timelines, which can disrupt ongoing operations and extend Return-On-Investment (ROI) periods. While automation promises long-term operational efficiency and labor savings, the high initial Capital Expenditure (CAPEX) and integration risks often deter terminal operators from adopting full-scale automation solutions. Consequently, many ports opt for phased or hybrid automation models instead of complete overhauls.

- In January 2024, Port Technology International reported that 62% of terminal professionals identified high initial investment requirements as the primary barrier to automation deployment in container terminals

- In June 2023, PortEconomics highlighted that automation retrofits in existing terminals often face complex integration issues, further increasing project costs and limiting flexibility post-installation.

- Thus, while terminal automation promises long-term benefits such as enhanced productivity, labor optimization, and sustainability, the significant upfront financial burden and complex installation processes remain key restraints for market growth. Overcoming these challenges will depend on adopting innovative financing mechanisms, phased automation models, and increased public–private collaboration to make automation financially viable for ports of all sizes in the coming years.

North America Automated Container Terminal Market Scope

The market is segmented on the basis of degree of automation, project type, offering, end user, and distribution channel.

- By Degree of Automation

On the basis of Degree of Automation, the North America Automated Container Terminal Market is segmented into Semi-Automated Terminals and Fully Automated Terminals. In 2026, the Semi-Automated Terminals segment is expected to dominate the market with a 54.50% market share, driven by their cost-effectiveness, operational flexibility, and compatibility with existing port infrastructure. Key factors supporting this dominance include ease of integration, gradual automation upgrades, high productivity, and improved safety, which together make semi-automated solutions the preferred choice over fully automated terminals across the region.

- By Project Type

On the basis of Project Type, the North America Automated Container Terminal Market is segmented into Brownfield and Greenfield. In 2026, the Brownfield segment is expected to dominate with a 61.74% market share, driven by the modernization of existing ports, established infrastructure, and cost-effective automation upgrades. Growing investments in advanced equipment, safety enhancements, and operational efficiency further reinforce its market leadership over Greenfield projects.

The Greenfield segment is the fastest-growing segment in the North America Automated Container Terminal Market, with a CAGR of 7.3%, driven by the development of new ports, increasing trade volumes, and rising demand for state-of-the-art automated infrastructure. Greenfield projects allow designing terminals with fully integrated automation systems, advanced equipment, and smart port technologies from the ground up. Additionally, investments in AI-based terminal management, IoT-enabled monitoring, and sustainable operations are accelerating adoption and driving rapid growth in this segment.

- By Offering

On the basis of Offering, the North America Automated Container Terminal Market is segmented into Equipment, Software, Services. In 2026, the Equipment segment is expected to dominate the market with 5519% market share, driven by the high demand for automated cranes, guided vehicles, and essential terminal machinery. Strong port infrastructure, government support, and rising trade volumes in the region, along with investments in smart and sustainable port technologies, reinforce the segment’s leading position.

Software is the fastest-growing segment with a CAGR of 7.6% in the North America Automated Container Terminal Market driven by its ease of integration, cost-effectiveness, and ability to optimize terminal operations. Automation software enables real-time monitoring, predictive maintenance, and efficient resource allocation without the need for extensive physical upgrades, improving overall terminal productivity. Increasing adoption of digital terminal management systems, growing awareness of smart port benefits, and advancements in AI and IoT technologies are further driving the rapid growth of this segment.

- By End User

On the basis of end user, the market is segmented into public and private. In 2026, the public segment is expected to dominate the market with 59.84% market share, driven by the government-led port authorities, large-scale infrastructure investments, national trade facilitation initiatives, modernization of strategic ports, adoption of automation to improve efficiency and safety, long-term funding stability, and policy support aimed at enhancing global connectivity and economic growth.

Le secteur privé est le segment qui connaît la croissance la plus rapide sur le marché, avec un TCAC de 7,2 %, grâce à la hausse des concessions de terminaux privés, des partenariats public-privé, de la demande d'efficacité opérationnelle, d'une prise de décision plus rapide, de l'accent mis sur le retour sur investissement, de l'adoption de technologies d'automatisation avancées, de la pression concurrentielle visant à réduire les coûts, à améliorer le débit et à offrir une plus grande fiabilité de service.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en canal direct et canal indirect. En 2026, le segment du canal direct devrait dominer le marché avec une part de 69,08 %, grâce aux relations étroites entre les opérateurs de terminaux et les fournisseurs de solutions d'automatisation, aux exigences d'intégration de systèmes personnalisés, à la réduction des coûts d'approvisionnement, au support technique direct, aux contrats de service à long terme et à la nécessité d'une mise en œuvre fluide de solutions d'automatisation complexes et à forte valeur ajoutée.

Analyse régionale du marché des terminaux à conteneurs automatisés en Amérique du Nord

- Les États-Unis devraient dominer le marché nord-américain des terminaux à conteneurs automatisés en 2026, avec une part de revenus de 77,66 %, grâce à d'importants investissements dans l'automatisation portuaire, les infrastructures numériques et les systèmes logistiques intelligents. Les principaux ports, tels que Los Angeles, Long Beach et New York/New Jersey, ont adopté des grues de stockage automatisées, des véhicules à guidage automatique (AGV) et des systèmes d'exploitation de terminaux (TOS) avancés afin d'améliorer la productivité et de réduire la congestion. Par ailleurs, le soutien important des initiatives fédérales et étatiques visant à renforcer la résilience et la durabilité de la chaîne d'approvisionnement, conjugué à la présence d'opérateurs portuaires mondiaux clés comme APM Terminals, SSA Marine et DP World, a consolidé la position des États-Unis en tant que leader du développement des terminaux à conteneurs automatisés en Amérique du Nord.

- Les États-Unis devraient connaître la croissance la plus rapide du marché nord-américain des terminaux à conteneurs automatisés au cours de la période de prévision, avec un TCAC de 7,1 %. Cette croissance est alimentée par l'augmentation des investissements dans l'automatisation et la numérisation des ports, la hausse des volumes d'échanges de conteneurs et l'importance accrue accordée à l'amélioration de l'efficacité de la chaîne d'approvisionnement. La modernisation des principaux ports tels que Los Angeles, Long Beach et New York/New Jersey, grâce à l'adoption de systèmes d'exploitation de terminaux (TOS) basés sur l'IA, de véhicules autonomes et de grues télécommandées, contribue à l'expansion du marché.

- De plus, un financement fédéral important pour la modernisation des infrastructures, l'accent mis sur la réduction de la dépendance à la main-d'œuvre et des émissions, ainsi que des partenariats avec des leaders technologiques mondiaux comme ABB, Siemens et Konecranes, contribuent à la croissance rapide du marché des terminaux à conteneurs automatisés en Amérique du Nord.

Aperçu du marché des terminaux à conteneurs automatisés au Canada et en Amérique du Nord

Le marché des terminaux à conteneurs automatisés du Canada et de l'Amérique du Nord joue un rôle prépondérant dans la région, porté par la croissance des volumes d'échanges commerciaux, la modernisation des ports et l'adoption de l'automatisation. Des ports clés comme Vancouver, Prince Rupert et Montréal intègrent des systèmes d'exploitation de terminaux avancés et des équipements automatisés afin d'accroître leur efficacité. Le soutien gouvernemental important au développement portuaire intelligent et durable, conjugué aux investissements de grands opérateurs tels que DP World et GCT Global Container Terminals, continue de renforcer la position du Canada sur le marché régional.

Aperçu du marché des terminaux à conteneurs automatisés au Mexique et en Amérique du Nord

Le marché des terminaux à conteneurs automatisés du Mexique et d'Amérique du Nord devrait connaître une croissance soutenue, portée par l'augmentation des investissements dans les infrastructures portuaires, la hausse du commerce de conteneurs avec les États-Unis et l'Amérique latine, et la volonté du gouvernement de moderniser les réseaux logistiques et de transport. Des ports clés comme Manzanillo, Lázaro Cárdenas et Veracruz adoptent des technologies d'automatisation et des systèmes numériques pour améliorer leur efficacité opérationnelle. Par ailleurs, les collaborations avec des opérateurs de terminaux et des fournisseurs de technologies internationaux contribuent également à l'expansion de ce marché au Mexique.

Les principaux acteurs du marché sont :

- TOTAL SOFT BANK LTD. (Corée du Sud)

- INFORM SOFTWARE (États-Unis)

- Logstar ERP (Inde)

- infyz.com (Inde)

- Tideworks (États-Unis)

- Loginno Logistic Innovation ltd. (Israël)

- Services de grues mondiaux FZE (Émirats arabes unis)

- STARCOMM SYSTEMS (Royaume-Uni)

- Kalmar Corporation (Finlande)

- Cargotec Corporation (Finlande)

- Konecranes Plc (Finlande)

- Shanghai Zhenhua Heavy Industries Co., Ltd. (États-Unis)

- Groupe LIEBHERR (Suisse)

- ABB Ltd. (Suisse)

- HAPAG LLOYD (États-Unis)

- Terminal APM (Pays-Bas)

- BECKHOFF AUTOMATION GMBH & CO. KG (États-Unis)

- Künz GmbH (Autriche)

- CyberLogitec Co., Ltd. (Corée)

- Camco Technologies NV (Belgique)

- IDENTEC SOLUTIONS AG (Autriche)

- ORBCOMM Inc. (États-Unis)

- ORBITA PORTS & TERMINALS acquis par TMEIC PORT TECHNOLOGIES, SL (Japon)

- PACECO Corp. (États-Unis)

Dernières évolutions concernant les terminaux à conteneurs automatisés en Amérique du Nord

- En octobre 2025, Hapag-Lloyd et DP World ont renouvelé leur partenariat de longue date au port de Santos, au Brésil. Cette prolongation garantit leur collaboration pour les dix prochaines années et prévoit un important agrandissement du terminal, avec un allongement des quais et une augmentation de la capacité de manutention annuelle. Hapag-Lloyd pourra ainsi accueillir des navires plus grands et proposer de nouveaux services à ses clients.

- En septembre 2025, Hiab Corporation a signé un partenariat avec Forterra afin d'accélérer le développement de solutions de transport et de manutention autonomes. L'objectif est d'améliorer les capacités d'autonomie, renforçant ainsi la durabilité et la sécurité des flux logistiques.

- In September 2025, Liebherr and TPT entered into a 10-year strategic partnership agreement aimed at modernizing and enhancing efficiency across South Africa’s port operations. The agreement includes the supply of four large STS cranes for the Port of Durban and 48 rubber-tyred gantry (RTG) cranes for the Durban and Cape Town terminals, along with a 20-year asset management program to ensure long-term reliability of the equipment.

- In November 2024, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) entered into a strategic cooperation agreement with Cavotec SA, marking a significant step toward advancing sustainability and innovation in port and terminal infrastructure North Americaly. This partnership combines ZPMC’s expertise in manufacturing heavy-duty port equipment with Cavotec’s specialized technologies in automation and electrification. Together, they aim to develop cutting-edge solutions that improve the efficiency and environmental performance of ports, such as reducing emissions through electrified equipment and enhancing operational automation. By leveraging the strengths of both companies, the collaboration seeks to support the North America maritime industry’s transition toward greener, smarter, and more sustainable port operations.

- In December 2024, Konecranes completed the acquisition of Rotterdam-based Peinemann Port Services BV and Peinemann Container Handling BV after receiving approval from the Dutch competition authority. The acquisition, valued at an undisclosed amount, added approximately 100 employees and strengthened Konecranes' position in the Netherlands, particularly in the Rotterdam area.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 COMPETITOR KEY PRICING STRATEGIES (PROMINENT PLAYERS)

4.4 TECHNOLOGY ANALYSIS – NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

4.5 COMPANY PROFILING

4.5.1 HAPAG-LLOYD AG

4.5.1.1 LIST OF ACQUISITION

4.5.1.2 SHAREHOLDING PATTERN

4.5.1.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.1.4 BUSINESS MODEL

4.5.1.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.1.5.1 COMPANY CUSTOMER SEGMENTS

4.5.1.5.2 COMPANY VALUE PROPOSITIONS

4.5.1.5.3 COMPANY CHANNELS

4.5.1.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.1.5.5 COMPANY REVENUE STREAMS

4.5.1.5.6 COMPANY KEY RESOURCES

4.5.1.5.7 COMPANY KEY ACTIVITIES

4.5.1.5.8 COMPANY KEY PARTNERS

4.5.1.5.9 COMPANY A COST STRUCTURE

4.5.1.5.10 COMPANY SWOT ANALYSIS

4.5.2 KONECRANES

4.5.2.1 LIST OF ACQUISITION

4.5.2.2 SHAREHOLDING PATTERN

4.5.2.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.2.4 BUSINESS MODEL

4.5.2.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.2.5.1 COMPANY CUSTOMER SEGMENTS

4.5.2.5.2 COMPANY VALUE PROPOSITIONS

4.5.2.5.3 COMPANY CHANNELS

4.5.2.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.2.5.5 COMPANY REVENUE STREAMS

4.5.2.5.6 COMPANY KEY RESOURCES

4.5.2.5.7 COMPANY KEY ACTIVITIES

4.5.2.5.8 COMPANY KEY PARTNERS

4.5.2.5.9 COMPANY A COST STRUCTURE

4.5.2.5.10 COMPANY SWOT ANALYSIS

4.6 COMPETITIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT

5.1.2 PROLIFERATION OF AUTOMATION, ROBOTICS, AND AI IN PORT OPERATIONS

5.1.3 SUSTAINABILITY INITIATIVES PROMOTING ENERGY-EFFICIENT AND LOW-EMISSION TERMINALS

5.1.4 RISING GOVERNMENT INVESTMENTS AND INCENTIVES FOR SMART PORT INITIATIVES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT INVESTMENT AND INSTALLATION COSTS

5.2.2 COMPLIANCE WITH STRINGENT REGIONAL REGULATIONS AND SAFETY STANDARDS

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF AUTOMATED TERMINALS IN EMERGING MARKETS

5.3.2 INTEGRATION WITH SMART LOGISTICS SOLUTIONS AND PORT COMMUNITY SYSTEMS

5.3.3 GROWING ADOPTION OF ELECTRIC AND HYBRID AUTOMATED EQUIPMENT FOR SUSTAINABILITY

5.4 CHALLENGES

5.4.1 CYBERSECURITY RISKS ASSOCIATED WITH DIGITAL PORT INFRASTRUCTURE

5.4.2 SYSTEM INTEROPERABILITY WITH LEGACY EQUIPMENT AND MULTI-VENDOR SOLUTIONS

6 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION

6.1 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

6.1.1 SEMI-AUTOMATED TERMINALS

6.1.2 FULLY AUTOMATED TERMINALS

7 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

7.1 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

7.1.1 BROWNFIELD PROJECTS

7.1.1.1 BROWNFIELD PROJECTS, BY TYPE

7.1.1.1.1 END-TO-END BROWNFIELD PROJECTS TERMINAL AUTOMATION

7.1.1.1.2 YARD-ONLY AUTOMATION RETROFITS

7.1.1.1.3 LANDSIDE / GATE AUTOMATION UPGRADES

7.1.1.1.4 QUAY CRANE AUTOMATION RETROFITS

7.1.2 GREENFIELD PROJECTS

7.1.2.1 GREENFIELD PROJECTS, BY TYPE

7.1.2.1.1 FULLY AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.2 SEMI-AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.3 PHASED GREENFIELD PROJECTS AUTOMATION

8 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING

8.1 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

8.1.1 EQUIPMENT

8.1.1.1 EQUIPMENT, BY TYPE

8.1.1.1.1 AUTOMATED & REMOTE-CONTROLLED CRANES

8.1.1.1.2 AUTOMATED HORIZONTAL TRANSPORT

8.1.1.1.3 GATE & LANDSIDE AUTOMATION EQUIPMENT

8.1.1.1.4 OTHERS

8.1.2 SOFTWARE

8.1.2.1 SOFTWARE, BY TYPE

8.1.2.1.1 EQUIPMENT CONTROL SYSTEMS (ECS) & FLEET MANAGEMENT

8.1.2.1.2 TERMINAL OPERATING SYSTEMS (TOS)

8.1.2.1.3 AUTOMATION & ORCHESTRATION PLATFORMS

8.1.2.1.4 DIGITAL TWIN & SIMULATION TOOLS

8.1.2.1.5 GATE & COMMUNITY PLATFORMS

8.1.2.1.6 OTHERS

8.1.3 SERVICES

8.1.3.1 SERVICE, BY TYPE

8.1.3.1.1 PROFESSIONAL SERVICES

8.1.3.1.2 MANAGED SERVICES

9 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER

9.1 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

9.1.1 PUBLIC

9.1.1.1 PUBLIC, BY APPLICATION

9.1.1.1.1 PORT INFRASTRUCTURE MODERNIZATION

9.1.1.1.2 TRADE FACILITATION & CUSTOMS AUTOMATION

9.1.1.1.3 SAFETY & COMPLIANCE AUTOMATION

9.1.1.1.4 SMART NATIONAL LOGISTICS CORRIDORS

9.1.1.1.5 PUBLIC–PRIVATE PARTNERSHIP (PPP) CO-MANAGED TERMINALS

9.1.1.1.6 OTHERS

9.1.2 PRIVATE

9.1.2.1 PRIVATE, BY APPLICATION

9.1.2.1.1 HIGH-VOLUME AUTOMATED CONTAINER HANDLING

9.1.2.1.2 AUTOMATED LOGISTICS & INTERMODAL HUBS

9.1.2.1.3 CARRIER-OWNED SMART TERMINALS

9.1.2.1.4 SUBSCRIPTION & MANAGED TERMINAL AUTOMATION SERVICES

10 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL

10.1 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

10.1.1 DIRECT CHANNEL

10.1.2 INDIRECT CHANNEL

10.1.2.1 INDIRECT CHANNEL, BY TYPE

10.1.2.1.1 SYSTEM INTEGRATORS

10.1.2.1.2 VALUE-ADDED RESELLERS (VAR)

10.1.2.1.3 OTHERS

11 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIEBHERR

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 BECKHOFF AUTOMATION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 SHANGHAI ZHENHUA HEAVY INDUSTRIES CO., LTD.

14.3.1 COMPANY SNAPSHOTS

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 KONECRANES

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 KALMAR CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 APM TERMINALS

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CAMCO TECHNOLOGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 CLT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HIAB CORPORATION (SUBSIDIARY OF CARGOTEC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 HAPAG-LLOYD AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 INFYZ.COM.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INFORM SOFTWARE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 IDENTEC SOLUTIONS AG

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 KÜNZ GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LOGSTAR ERP.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 LOGINNO LOGISTIC INNOVATION LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 ORBCOMM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PACECO CORP.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 STARCOM GPS NORTH AMERICA SOLUTIONS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 ECENT DEVELOPMENT

14.21 TMEIC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 TIDEWORKS.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 TOTAL SOFT BANK LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.24 WCS CONSULTANCY

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 INDUSTRY ANALYSIS AND FUTURISTIC SCENARIO OF THE NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET

TABLE 2 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 3 NORTH AMERICA SEMI-AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA FULLY AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA DIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 USD THOUSAND

TABLE 43 U.S. AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 44 U.S. AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 U.S. BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 U.S. GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 U.S. AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 48 U.S. EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 U.S. SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 U.S. SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 U.S. PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 U.S. AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 53 U.S. PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 54 U.S. PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 U.S. AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 56 U.S. INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 USD THOUSAND

TABLE 58 CANADA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 59 CANADA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 CANADA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 CANADA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 CANADA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 63 CANADA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 CANADA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 CANADA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 CANADA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 CANADA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 68 CANADA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 69 CANADA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 70 CANADA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 71 CANADA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 USD THOUSAND

TABLE 73 MEXICO AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 74 MEXICO AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MEXICO BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 MEXICO GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MEXICO AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 78 MEXICO EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MEXICO SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MEXICO SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MEXICO PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 MEXICO AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 83 MEXICO PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 84 MEXICO PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 85 MEXICO AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 86 MEXICO INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET

FIGURE 2 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: MULTIVARIATE MODELLING

FIGURE 7 SWOT ANALYSIS

FIGURE 8 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 TWO SEGMENTS COMPRISE THE NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

FIGURE 15 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT. IT IS EXPECTED TO DRIVE THE NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 SEMI-AUTOMATED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET IN 2025 AND 2033

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET

FIGURE 18 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: BY DEGREE OF AUTOMATION, 2025

FIGURE 19 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: BY PROJECT TYPE, 2025

FIGURE 20 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: BY OFFERING, 2025

FIGURE 21 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: BY END USER, 2025

FIGURE 22 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 23 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: SNAPSHOT (2025)

FIGURE 24 NORTH AMERICA AUTOMATED CONTAINER TERMINAL MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.