North America Biopsy Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

1.80 Billion

USD

3.60 Billion

2024

2032

USD

1.80 Billion

USD

3.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.80 Billion | |

| USD 3.60 Billion | |

|

|

|

|

North America Biopsy Devices Market Segmentation, By Product (Needle-Based Biopsy Instruments, Procedure Trays, Localization Wires and other Products), Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy and Other Applications), Guidance Technique (Ultrasound-Guided Biopsy, Stereotactic-Guided Biopsy, MRI-Guided Biopsy and Other Guidance Techniques), End User (Hospitals, Academic and Research Institutes, Diagnostic and Imaging Centers) – Industry Trends and Forecast to 2032

North America Biopsy Devices Market Size

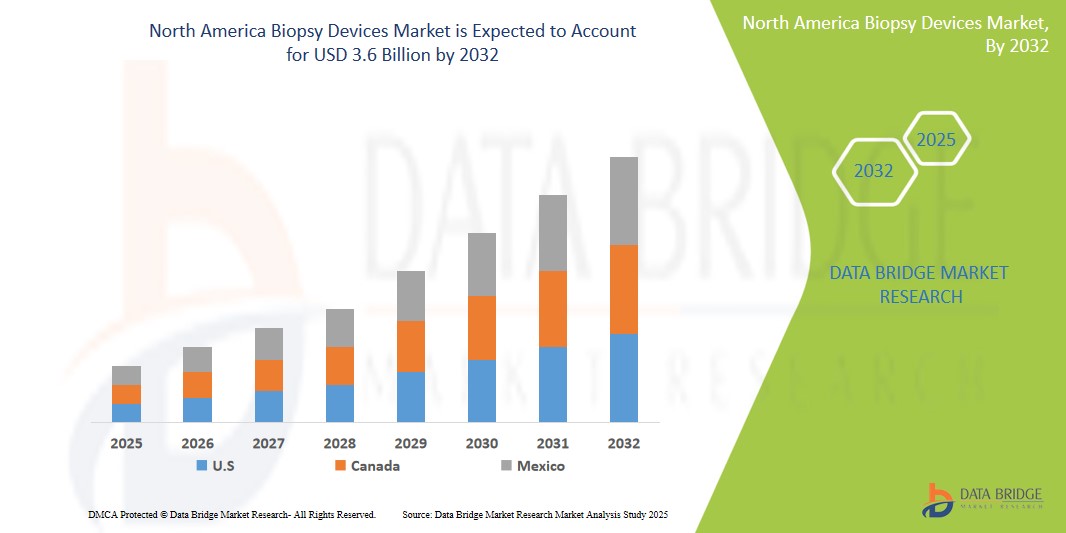

- The North America Biopsy Devices Market was valued atUSD1.8 Billion in 2024 and is expected to reachUSD3.6 Billion by 2032

- Drivers of the North America Biopsy Devices Market include the rising prevalence of cancer and other chronic diseases, which necessitate accurate diagnostic tools for early detection and treatment. Additionally, advancements in biopsy technologies, such as minimally invasive techniques and imaging guidance, are enhancing procedural efficiency and patient outcomes. The increasing emphasis on personalized medicine and the growing number of diagnostic and outpatient procedures further propel market growth.

North America Biopsy Devices Market Analysis

- The North America Biopsy Devices Market is experiencing robust growth due to the rising incidence of cancer and an increasing focus on early diagnosis and intervention. The aging population and a greater awareness of health issues contribute to the demand for advanced biopsy technologies.

- Innovations in biopsy techniques, including image-guided biopsies and minimally invasive procedures, are driving the market. These advancements improve accuracy, reduce patient discomfort, and shorten recovery times, making them more appealing to healthcare providers and patients alike.

- Favorable regulatory environments and reimbursement policies in the U.S. and Canada support the adoption of biopsy devices. This environment encourages manufacturers to develop and market advanced diagnostic tools, further boosting market growth.

- The market features several major players, including companies like Bard, Hologic, and Devicor Medical Products, which are continually innovating and expanding their product offerings. Competitive strategies often involve mergers, acquisitions, and partnerships to enhance market presence and technological capabilities.

Report Scope andNorth America Biopsy Devices MarketSegmentation

|

Attributes |

North America Biopsy Devices MarketInsights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Biopsy Devices MarketTrends

“Growing Adoption of Image-Guided Biopsy Techniques”

- Image-guided biopsy techniques, such as ultrasound, CT, and MRI-guided procedures, enhance the accuracy of sample collection, allowing for more precise targeting of lesions. This precision is crucial for effective diagnosis, particularly in complex cases, leading to better patient outcomes.

- Patients and healthcare providers increasingly favor minimally invasive techniques that reduce recovery time and postoperative complications. Image-guided biopsies fulfill this demand, offering safer alternatives to traditional surgical biopsies with shorter hospital stays and quicker return to daily activities.

- Continuous advancements in imaging technologies are facilitating the integration of high-resolution imaging with biopsy devices, enabling more effective and streamlined procedures. As these technologies evolve, their application in biopsy devices is expected to become even more widespread, driving market growth and innovation.

North America Biopsy Devices Market Dynamics

Driver

“Increasing Incidence of Cancer”

- The incidence of various types of cancer, including breast, lung, and prostate cancer, is increasing in North America due to factors such as an aging population, lifestyle changes, and environmental exposures. This rise in cancer cases boosts the demand for diagnostic devices, including biopsy devices, which are essential for accurate diagnosis and treatment planning.

- Early and accurate detection of cancer significantly improves treatment outcomes and increases survival rates. As healthcare providers emphasize preventive care and early diagnosis, the demand for biopsy devices that facilitate timely and effective cancer detection has surged, driving market growth.

- Continuous innovation in biopsy technology, including the development of less invasive and more precise methods, enhances the appeal of biopsy devices. These advancements not only improve diagnostic capabilities but also encourage healthcare providers to adopt biopsies as a standard practice in cancer diagnosis, further fueling market demand.

Opportunity

“Expanding Applications of Biopsy Devices in Oncology”

- The rising prevalence of various cancers, particularly breast, lung, and colorectal cancers, presents a significant opportunity for the biopsy devices market. Early and accurate diagnostic techniques, including biopsies, are essential for effective treatment planning and management, leading to greater demand for advanced biopsy solutions.

- As the focus on personalized medicine grows, there is an increasing need for precise tumor characterization through biopsy techniques. This enables tailored treatments based on the specific genetic and molecular profile of a patient’s cancer, expanding the role of biopsy devices in oncology and enhancing their market potential.

- The ongoing development of novel biopsy technologies, such as liquid biopsies and advanced imaging-guided procedures, offers new avenues for market growth. These innovations provide less invasive options for obtaining tissue samples and enhance diagnostic accuracy, making biopsy devices more appealing to both providers and patients.

Restraint/Challenge

“Regulatory and Reimbursement Issues”

- The process for obtaining regulatory approval for new biopsy devices in North America can be lengthy and complex. Manufacturers must navigate through rigorous standards set by organizations like the FDA, which can delay the introduction of innovative products to the market and increase development costs.

- Securing reimbursement from insurance providers for biopsy procedures can be challenging. Variability in coverage policies and reimbursement rates across different insurers can deter healthcare providers from adopting newer biopsy technologies, limiting their market potential.

- High costs associated with advanced biopsy devices may restrict their accessibility, especially in lower-resource healthcare settings. Hospitals and clinics may be hesitant to invest in expensive technologies without assurance of adequate reimbursement, further complicating market penetration.

North America Biopsy Devices Market Scope

The market is segmented on the basis of type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

Needle-Based Biopsy Instruments, Procedure Trays, Localization Wires and other Products |

|

ByApplication |

Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy and Other Applications |

|

ByGuidance Technique |

Ultrasound-Guided Biopsy, Stereotactic-Guided Biopsy, MRI-Guided Biopsy and Other Guidance Techniques |

|

By End User |

Hospitals, Academic and Research Institutes, Diagnostic and Imaging Centers) |

North America Biopsy Devices Market Analysis

“U.S. is the Dominant with around 38% market share in the North America Biopsy Devices Market”

- The United States boasts a highly developed healthcare system with sophisticated medical facilities and advanced technological capabilities. This infrastructure supports the adoption of cutting-edge biopsy devices, making the U.S. a leader in the market. Hospitals and clinics in the U.S. are equipped with the latest imaging technologies and biopsy tools, which enhances the precision and efficiency of diagnostic procedures.

- The U.S. is home to a large number of medical device manufacturers and biotech companies that heavily invest in research and development. This commitment leads to continuous innovation in biopsy technology, including the development of minimally invasive techniques and advanced imaging-guided devices. The financial resources available for R&D contribute to the growth and dominance of the U.S. in the biopsy market.

- The U.S. healthcare system offers a relatively robust reimbursement framework for biopsy procedures, facilitating greater access to these services for patients. Insurance companies and government programs often cover advanced diagnostic procedures, encouraging healthcare providers to adopt the latest biopsy technologies. This support creates a conducive environment for market expansion and places the U.S. at the forefront of the North American Biopsy Devices Market.

“U.S. is Projected to Register the Highest Growth Ratein theNorth America Biopsy Devices Market”

- The U.S. is home to a robust ecosystem of research and development in the healthcare sector, leading to significant innovations in biopsy devices. Continuous advancements in imaging technologies and minimally invasive techniques are driving the adoption of sophisticated biopsy solutions, thus fueling market growth.

- The rising prevalence of cancer and other chronic diseases in the U.S. has led to a higher demand for diagnostic procedures, including biopsies. As early detection of cancer becomes a priority in healthcare, the need for advanced biopsy devices is expected to rise, contributing to the market’s growth in the region.

North America Biopsy Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD (Becton, Dickinson and Company)

- Hologic, Inc.

- Danaher Corporation ( (including brands like Leica Biosystems)

- Argon Medical Devices (

- Cook Medical

- AbbVie Inc. (Allergan)

- Bayer AGss

- The Cooper Companies, Inc.

- DKT International

- EUROGINE S.L.

- Pregna International Limited

- Prosan International BV

- SMB Corporation of India

- Melbea AG

- OCON Medical Ltd.

- Mylan N.V. (Viatris)

- Teva Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- Pfizer Inc.

- HLL Lifecare Limited

Latest Developments in North America Biopsy Devices Market

- In 2024, Hologic, Inc. launched its Breast Biopsy Suite, integrating advanced imaging and biopsy tools for more precise diagnostics.

- In 2023, BD (Becton, Dickinson and Company) introduced a next-generation core biopsy needle with enhanced tissue sample accuracy.

- In 2023, Argon Medical Devices released a new vacuum-assisted biopsy system for minimally invasive procedures.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.